education plan - Home | OMBD

EDUCATION PLAN

Retail Mass Market

Broker Distribution

February 2014

An Investment in their Future

EDUCATION PLAN

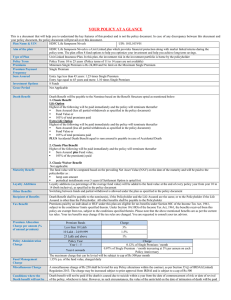

The Education Plan is designed to provide an affordable vehicle for long-term savings to provide a tax-free cash lump sum, to enable provision to be made for the child’s higher education.

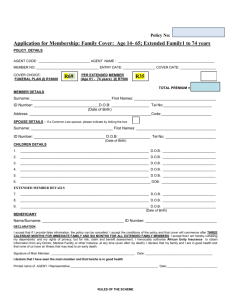

Minimum Premium:

Minimum Term:

Maximum Term:

API:

R155 years R175.00 (with premium waiver benefit)

10 years

Lesser of 20 years or NRA – age

Automatic Premium Increase (API) is effective each year on the 1st July. The client can switch off the API in any given year, if the client is unable to pay the increased premium for that particular year. The premium escalation will automatically revert back for the policy in the following year.

Proposer’s Risk: On death or disability of policyholder within the first ten years, a lump sum equal to the balance of the ten years’ premiums will be paid into the policy - to ensure funds are still available to the child on maturity, as previously planned.

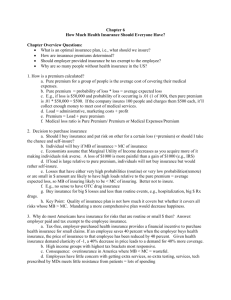

Withdrawal Option first 5 years

Monthly Premiums

Withdrawal Option after 5-year interval

Savings

Savings term (min. 10yrs)

1

F2014 SAVINGS BENEFIT RANGE

Maturity lump sum

(where no tax is due)

PRODUCT FEATURES AND BENEFITS

Surrenders:

Paid-ups:

Death/Disability:*

(Policyholder)

The Plan has a surrender value available immediately

The Plan has a paid-up value available

Withdrawals: One part-withdrawal will be available within the first 5 years of the policy term, and then at 5-yearly intervals thereafter. The period between any partwithdrawals must also be at least 5 years

Premium Holiday Benefit: The Premium Holiday allows for up to six premiums to be skipped, during the term of the policy. This benefit is available again to the client, on payment of the skipped premiums

Waiting Periods:* The Education Plan carries the normal six months waiting period, from application date, in respect of death or disability from causes other than accidental

For death or disablement as a result of an accident, no waiting period will apply

In the event of the policyholder’s death or disability within the first 10 years (but after the waiting period for non-accidental causes), the policy will be made paid-up and a lump sum benefit equivalent to the balance of the outstanding premiums for the first 10 years will be added to the client’s fund - which will become payable at the end of the selected policy term.

* Only applicable to the Premium Waiver Benefit

2

F2014 SAVINGS BENEFIT RANGE

24 HOUR FAMILY SUPPORT SERVICES

Access to the following Family Support Services* from independent service providers:

Health support*: Telephone access to health advisers for assistance with health queries

Trauma, assault and HIV treatment*: Assistance and treatment following assault (e.g. rape, hijacking, child abuse), accidental exposure to HIV or other kinds of trauma

Emergency medical response*:

Legal support*:

Advice, emergency treatment and transportation to an appropriate medical facility

Free telephone advice and assistance on legal matters, help with legal documents

Important note:

*Family Support Services - Certain terms and conditions apply to the facilitation of this access. For a copy of these, call 0860 00 1919.

Old Mutual facilitates access to independent Family Support Service providers. Such access is not offered as a benefit under your insurance policy and may be varied or cancelled at any time. The service providers provide services directly to you on terms agreed between you and the service providers. Old Mutual does not accept any liability arising from the services rendered by the service providers.

3

F2014 SAVINGS BENEFIT RANGE

Old Mutual is a Licensed Financial Service Provider