Today's Lecture - #15 Interest Sensitive and Variable Life

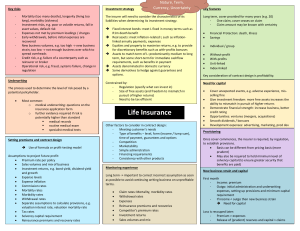

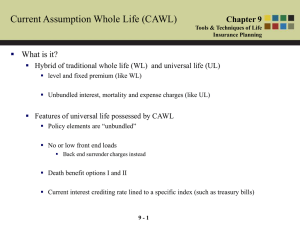

advertisement

Today’s Lecture - #15 Interest Sensitive and Variable Life Why buy life insurance? Offset the financial loss of death Tax sheltered investment program New types of life insurance for investment Universal life Current assumption whole life Variable life Variable universal life Universal Life Combination of: Tax advantage of whole life Low cost of protection of term Flexible premiums Straightforward expenses Current mortality charges Current interest rates Universal Life Features Death benefit options Type A - Level death benefit Type B - Increasing death benefit Premium payments Maximum based on IRS rules Minimum to keep coverage in force Mortality charges Current Maximum Universal Life Features Expense charges Front-end Surrender Investment returns Current Indexed New money rate Portfolio rate Guaranteed level Universal Life Flow of Funds Premium + Cash value from prior period - Expenses - Mortality charges - Withdrawals or loans = Amount subject to investment + Investment return = Cash value at end of period Universal Life Flow of Funds Example A 30 year old policyholder has had a Type B (Increasing Death Benefit) Universal Life policy for $100,000 in force for 5 years. The mortality charge is $1.30 per $1000 of coverage. Expenses are 10% of premiums. The policy earns a 7% rate of return this year. The cash value at the beginning of the period is $3000. The policyholder pays a $500 premium this year. Universal Life Flow of Funds Example 500 + 3000 50 - 130 0 = 3320 + 232 = 3552 Premiums Prior cash value Expenses (.10x500) Mortality charge (100x1.30) Withdrawals or loans Amount subject to investment Investment return (3320x.07) Ending cash value Current Assumption Whole Life Cross between whole life and universal Regular premium payments Premiums can change based on: Mortality experience Investment experience Expenses Vanishing premium provisions Variable Life Level premiums Cash value invested in separate account Stocks Bonds Real Estate If investment performance exceeds assumed return, cash value and death benefit increase If investment performance is below assumed return, cash value decreases No guaranteed return Minimum death benefit Variable Universal Life All the features of universal life except the guaranteed minimum return Variety of investment choices Stocks Bonds Real Estate Gold International funds Life Insurance - Example Which of the following life insurance policies have flexible premiums? I Universal life II Current assumption whole life III Variable life IV Variable universal life A) C) E) I and III I, III and IV None of the above B) D) I and IV I, II, III and IV Summary Should you buy life insurance? If someone would suffer a financial loss at your death - Yes What type of life insurance should you buy? If all you need is death protection - Term If you want a tax sheltered investment plan - Cash value life What Type of Cash Value Life? If you want guarantees - Whole Life If you will accept some risk Current assumption whole life If you are willing to take investment risk Variable or variable universal If you want premium flexibility Universal or variable universal Buying Life Insurance – Example 1 Which type of life insurance would be best for a young couple with a newborn baby who are on a limited budget but need a lot of protection during her childhood? A) Yearly renewable term B) 20 year level term C) 20 pay whole life D) Straight life E) Decreasing term Buying Life Insurance – Example 2 Which type of life insurance would be best for a 35 year old single person without any dependents who wants to save for retirement? A) Universal life B) Variable life C) Whole life paid up at 65 D) 30 year endowment E) None of the above Buying Life Insurance – Example 3 Which type of life insurance would be best for a 50 year old couple without any children who want a life insurance policy that offers tax sheltered savings? A) Front-end-loaded term B) 20 year level term C) Current assumption whole life D) Variable life E) None of the above