Federal Tax Credits - Environmental Business Council of New

advertisement

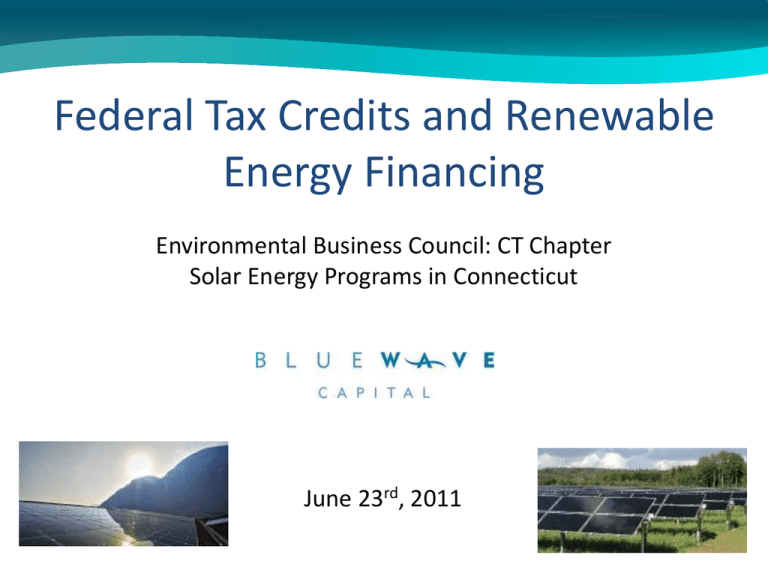

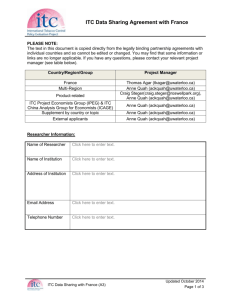

Federal Tax Credits and Renewable Energy Financing Environmental Business Council: CT Chapter Solar Energy Programs in Connecticut June 23rd, 2011 Federal Tax Credits • Renewable energy projects have historically been supported through the US tax code, primarily through: – – – • • • • The production tax credit (“PTC”) in Section 45, The investment tax credit (“ITC”) in Sections 25D and 48, and Accelerated tax depreciation in Section 168 (“MACRS”) Historically, renewable energy developers had two options in order to monetize the favorable tax benefits granted through the tax code: either 1.) offset eligible corporate income, or 2.) utilize tax equity to monetize the PTC, ITC, and MACRS (typically used by developers that don’t manufacture taxable income) Through the end of 2011, developers have been presented a third option, 3.) utilize 1603 Treasury Grants to monetize PTC and ITC Recently, developers have also successfully utilized the New Markets Tax Credit as another source of tax credits to be used in the renewable energy sector. However, developers still need to utilize either 1.) eligible corporate income, or 2.) tax equity to monetize the MACRS 1603 Grant and Investment in Renewables • Prior to PTC and ITC extensions in 2007‐2008, annual wind and solar installations fluctuated considerably, reflecting inconsistent policy • The introduction of the 1603 Treasury Grant in 2009 had an immediate impact on the U.S. clean energy market • We estimate that over $7 billion of 1603 Treasury Grants have been awarded since 2009, and $5 billion more could be committed during the remainder of 2011. Type Wind Solar Geothermal Other Total Number of Projects 244 2,185 35 145 2,609 Source: U.S. Department of the Treasury $ $ $ $ $ Total Amount Awarded ($) 5,614,938,702.00 936,009,351.00 268,124,199.00 183,458,288.00 7,002,530,540.00 $ $ $ $ $ $ per Project 23,012,044 428,380 7,660,691 1,265,230 2,683,990 Investment Tax Credit After years of instability ITC is extended for more than one or two years • Based on the cost of qualifying equipment – Generally 30% of tax basis – Credit is claimed entirely in the year in which property is placed in service • To qualify for ITC, solar facility must be placed in service by taxpayer before January 1, 2017 (i.e., no later than December 31, 2016) • Nonrefundable but can be carried back one year and forward 20 years • Basis of property reduced by 50% of ITC • Recapture if disposed of within 5 years • No cutback for subsidized financing Section 1603 Grant in Lieu of ITC A much needed shot of adrenaline for the industry • Developer can elect to receive cash grant in lieu of ITC • ITC eligibility requirements for apply • Project generally must be: – Placed in service in 2009, 2010 or 2011, or – Construction must begin before 2012 and project must be placed in service by credit termination date • Application due no later than September 30, 2012 • Grant generally operates in the same manner as ITC – 30% of tax basis of qualifying property – Subject to recapture if sold to disqualified person within 5 years – Generally not included in recipient’s taxable income (but may be subject to state tax) – Basis reduced by 50% of grant amount MACRS (Accelerated Depreciation) Almost as valuable as the ITC but harder to monetize • The level of acceleration in the depreciation of qualified assets depends on type: – Wind and solar qualify for 5-year MACRS – Others generally qualify for 7-year MACRS • Bonus Depreciation: – For projects placed in service after September 8, 2010 and before January 1, 2012, 100% bonus depreciation in first year – For projects placed in service in 2012, 50% bonus depreciation in first year New Markets Tax Credit Not a silver bullet but can be a helpful tool • In the existence since 2000 with over $3 billion in credits awarded – 39% tax credit – Does not reduce cost basis for depreciation – Can be combined with other Federal tax credits • Previously NMTC has been mostly used for commercial real estate and manufacturing • NMTC is now being considered as a source of low cost capital for renewable facilities • Fairly complex structure, with high transaction costs, and a long lead time Impact of Federal Tax Credits: Combined with State-level incentives, provides attractive rates, but multiple stakeholders and regulatory frameworks add complexity $0.45 $0.40 $0.35 $0.30 $0.25 $0.20 $0.15 $0.10 $0.05 $Northeast US Energy Ontario, CA Germany State Incen ves (SRECs) Federal Incen ves Italy Impact of Federal Tax Credits: Complexity of incentives comes with a price. While resource adjusted rates in US are similar to FIT markets, complicated regulatory framework has limited industry growth. Impact of Federal Tax Credits: How much will really be left after after 1603 Grant expires? 10.00 9.00 8.00 $ Billions 7.00 6.00 5.00 4.00 3.00 2.00 1.00 2005 2006 2007 2008 2009 Tax Equity 2010 Treasury Grant 2011 2012 2013 2014 Tax Equity Players: Which of them will stick around post 1603? Financing Solar Projects: Tax Equity is the building block, what happens when 1603 goes away? John DeVillars BlueWave Capital, LLC Tel. 617.470.7297 Email. jdevillars@bluewave-capital.com Eric Graber Lopez BlueWave Capital, LLC Tel. 617.401.7681 Email. egraberlopez@bluewave-capital.com

![Cost of $10 Billion Stimulus Easier to T[...]](http://s3.studylib.net/store/data/007765701_2-a2dca74a6ce9324c137e97ec4bf0e1de-300x300.png)