insurers

advertisement

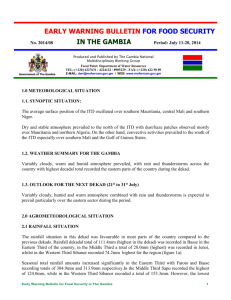

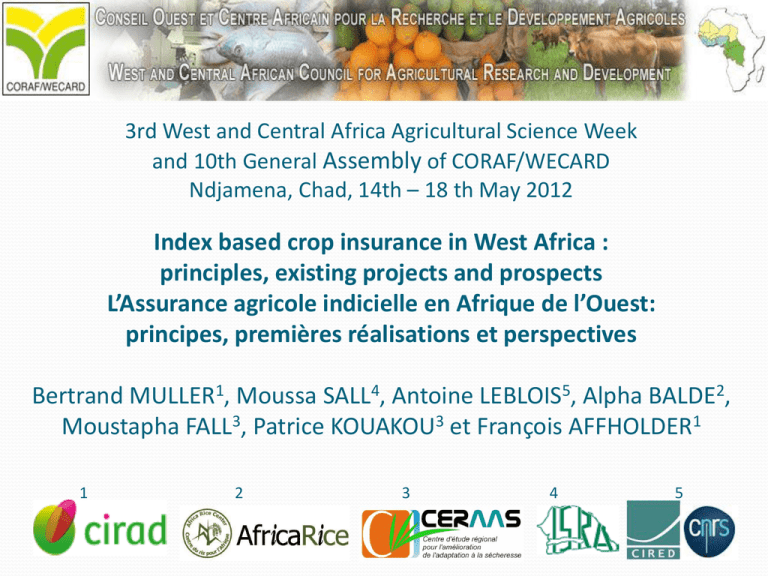

3rd West and Central Africa Agricultural Science Week and 10th General Assembly of CORAF/WECARD Ndjamena, Chad, 14th – 18 th May 2012 Index based crop insurance in West Africa : principles, existing projects and prospects L’Assurance agricole indicielle en Afrique de l’Ouest: principes, premières réalisations et perspectives Bertrand MULLER1, Moussa SALL4, Antoine LEBLOIS5, Alpha BALDE2, Moustapha FALL3, Patrice KOUAKOU3 et François AFFHOLDER1 1 2 3 4 5 Introduction : constraints/risks limit productions Crop productions are limited by constraints and risks Many constraints(problems) and risks can be controlled or prevented: good practices, inputs, organization … But residual risks: rainfall variability (droughts) massive locusts and birds attacks extremes temperatures, winds, floodings And those risks are generally extremely covariant : affect numerous people at the same time 2 Quelea Quelea Introduction : constraints/risks limit productions Soudanian (600-1200mm) and Sahelian (200-500mm) areas: very important rainfall spatio-temporal variability Spatially, inter-annual and intra (seasonal) annual Very variable (uncertain) start, dry-spells/droughts Sharp decrease in 1970 -> 1990 : 1st sign of CChange Increasing since 15 years … Pluviométrie annuelle de Bambey (1923-2010) 1100 1923-2010 1923-1969 1970-1979 2000-2010 1000 Pluviométries 2007 - Dept. Diourbel - 26 postes (AMMA DMN-CERAAS-CIRAD) 900 Pluviométrie annuelle (mm) 600 550 Pluviométrie (mm) 500 450 400 350 : : : : 586,5 667,5 465,8 593,7 mm mm mm mm 800 700 600 500 300 400 250 300 2007 2003 1999 1995 1991 1987 1983 1979 1975 Années 1971 1967 1963 1959 1955 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 1951 8 1947 7 1943 5 6 1939 4 1935 3 1931 2 1927 1 1923 200 3 Introduction : constraints/risks limit productions Risks and economic conditions affect productivity WA farmers are used to climate variability and CChange : aim at securing medium/low yields and don’t want to loose investments in bad years : “risk aversion” (pertinent) Risk aversion reinforced by economic conditions : low prices, markets, organizations “value chains”, etc.. => extensive systems : low productivities => food dependency (some exceptions : irrigated rice ..) But African population will increase by 2,5 – 3 And Asian production seems to not increase more … Agricultural productivities must increase to feed Africa Under climate change with probably more climate variability 4 Introduction : constraints/risks limit productions Agricultural (crops, animals) insurances appear as a possible tools to cope with residual risks by paying indemnities in case of low productions (losses) May secure part of farmers incomes May secure credit programs : more sustainable Mays allow access to credit for much more farmers May generate credit rate decrease May contribute to a virtuous circle conducing to more investments (inputs, works) and productivity increase Also considered as an adaptation tool to CC and CV Interest of backers : many money is coming Very ”fashion” theme for many stakeholders … and a new market for (re-)insurers Just starting in West Africa but 10 years in Asia, S.Am., E.Af. 5 Insurance and index based insurance principles Insurance is a service : the insurer pays compensations in case of bad production / losses due to one(some) problem(s) (residual ones) the insured farmer must pay an annual premium nobody know when compensations (payouts) will come .. Premium prices depend on: compensations/payouts : statistical average (on time and space) service management costs : same for credit and all services but insurance specificity is losses evaluation commercial margin : same for credit and all services re-insurance costs : to allow the insurer to be able to compensate simultaneously numerous customers if necessary … that is often the case in agriculture since risks are extremely covariant 6 Insurance and index based insurance principles Damages/losses evaluation is difficult/costly, particularly in South Countries where fields are small, disseminated, heterogeneous, etc.. risk of conflicts and “moral hazard” Index based insurances (since early 2000s) No direct damages/losses evaluation (at fields) Damages/losses indirectly assessed through the value of an index (indicator) related to some measurements For instance measures of temperature in one reference site => reduced cost Allow to insure several farmers of an area at the same time, and/or to have group contract => reduced cost Additional ways to decrease costs Management linked with credit Mobile phones technologies (sms) for contracts and payments 7 Insurance and index based insurance principles Calibrated to protect investments and then credit systems : not for production/profit losses: would be too costly considering markets and risks frequencies (1 year out of 5-10) “Real insurance” (private sector) is a priori reserved to “intensive (using inputs) and market linked productions” because farmers (or other stakeholder) have to pay premium Cotton, peanut, maize, rice, vegetables … But could be partially subsided by Governments/Backers -> PPP Index system can be used also for “social protection system” Aggregated (average) yields index : “all-risks insurance” Specific index allow to link losses to only one specific risk (whatever the other problems) Climate index : on temperature, rainfall measurements Satellite data index : NDVI, biomass, ET%... 8 Insurance and index based insurance principles Main problem: “basic risk” i.e. risk that index values and thus payouts aren’t correctly linked to damages Depend on kind and quality of index On spatial variability of reference observed factor .. On variability of other conditions: soils, sowing dates, varieties Development of insurance requires efforts (time, money) to explain and convince farmers and others stakeholders: difficult to install “confidence” (trust) since there is no “insurance culture” and because of “commercial” aspects … Also some initial investments in technologies : secured raingauges, satellite data, yields controls … 9 Insurance based on aggregated yields Payouts depend on average yield compared to a reference yield level that is a fraction of the mean inter-annual yield Requires a very good and confident “yields measurements Moyenne historique Seuil protection 80% Indemnisations 80% Seuil protection 30% Indemnisations 30% 300 400 200 200 100 0 - pluies rendements Lin. rendements 20 06 Rdts moyens 600 20 04 2000 2002 2004 2006 400 20 02 1992 1994 1996 1998 800 500 20 00 1986 1988 1990 1 000 19 98 200 0 1 200 600 19 96 800 600 400 700 19 86 1 200 1 000 Evolutions rendements arachide et pluies Diourbel rendements (Kg/Ha) 800 cumuls annuels (mm) rendements et indemnisations (Kg/Ha) Exemple fonctionnement assurance sur rendements agrégés 1 600 1 400 19 94 19 92 19 90 19 88 system” : cotton, sugarcane, vegetable Quite expensive Difficult now with national statistics : spatial cover and “quality” .. Better if also some control of practices at farmers fields Problem if bad yields due to human factor such as bad fertilizer for instance … or decrease in tendency Lin. pluies 10 Rainfall index based insurance Based on rainfalls = “drought insurance” : most frequent Many kinds of rainfall index: Simple : total rainfall amounts but don’t perform well Most complex : simulated yield (or stress index) by crop model Intermediate (IRI, World Bank) and most used since it is quite good and easy to explain to farmers and insurers : composite index based on rainfall amounts on different phases of crop cycles Whatever the index : its parameters must be precisely defined based on agro-climato-economical analysis Attention to pure statistical index as “payout if observed value reach percentile x%” : not recommended payouts not calibrated according to crop status induces differences in protection level between areas 11 Rainfall index based insurance Composite index: Simulation of a “virtual crop cycle” that starts within a recommended sowing period according to a reference rainfall value (20 mm) Fixed cycle and fixed phases (2 to 4) considered for insurance “Trigger/Strike” and “Exit” reference rainfalls values for each phase to pilot payouts according to rainfalls during the phases Déficit Pl. (mm) PHASE 1 Semis et installation Déficit Pl. (mm) PHASE 2 Croissance et Floraison Déficit Pl. (mm) PHASE 3 Développement Fruits Calendrier Cultural Démarrage Période Indemnités = min (Coût prod. Total ; Somme paiements phases 1 + 2 + 3) 12 Rainfall index based insurance Several parameters in the contract Peanut 90 Fonctionnement contrat arachide qualité Paoscoto-Nioro First Dekad of Sowing Window Last Dekad of Sowing Window Sowing Trigger for Contract (mm) Dekadal Cap (mm) Phase 1 Start (dekad) Phase 1 End (dekad) Phase 2 Start (dekad) Phase 2 End (dekad) Phase 3 Start (dekad) Phase 3 End (dekad) Phase 1 Trigger (mm) (/4mm) Phase 1 Exit (mm) Phase 2 Trigger (mm) (/5mm) Phase 2 Exit (mm) Phase 3 Trigger (mm) (/4,5mm) Phase 3 Exit (mm) Total Insured Production Costs (FCFA) Insured Prod. Costs Phase 1 (FCFA) Insured Prod. Costs Phase 2 (FCFA) Insured Prod. Costs Phase 3 (FCFA) 19 21 20 80 2 2 3 5 6 8 10 0 120 60 80 30 100000 70000 100000 100000 Indemnisations (FCFA/Ha) Contract Parameters 180 000 1,00 160 000 0,90 140 000 0,80 0,70 120 000 0,60 100 000 0,50 80 000 0,40 60 000 0,30 40 000 0,20 20 000 0,10 Indemnité phase 1 0,00 Indemnité phase 2 Indemnité phase 3 Année Série4 RDT Stat Nioro Main problems : potential “basic risks” due to Rainfall spatial variability No good time synchronization between contract functioning 13 and farmers crops INDEX RDT Nioro How to improve “rainfall” index based insurance Favorable environment promoting homogeneity and adequate practices limiting insured risks (sowing date, variety) and other problems (diseases, etc..) Index are calibrated and perform well for “good practices” Losses due to other factors are not considered Mathematical solutions to partially limit basic risks: Use of majored dekadal (10 days) rainfall amounts Index related to several raingauges 14 How to improve “rainfall” index based insurance Most recommended : use of geospacialized data from satellites : pixelised rainfalls or relative evapotranspirations ET% (or mix), controlled/calibrated using some ground observations But researches are required to assess accuracy of those methods and of their pertinence for crop insurance Agrhymet - EARS project IFAD/WFP/AFD project Will be required also for extension/upscaling EARS figure Already on-going pilot projects in Mali, Burkina and Benin by PlaNet Guarantee and EARS, using 3km x 3km Meteosat info 15 How to improve “rainfall” index based insurance Other points to consider to improve insurance systems in the future “Personalized” contract considering sowing date (within sowing window): info transmitted by mobile phones “Sophisticated index”: simulated yield (or ET%) by crop model : more accurate and will allow to consider also overrained period and/or integer other factors (Temp) Because farmers who invest need precision / quality : in focus groups and meetings they ask very pertinent questions about index functioning And since technologies allow (will allow) to do it 16 Index based insurances experiences in West Africa Up to now only in Burkina Faso and Mali : on cotton and maize, less than 1000 farmers in 2011 ; PlaNet Guarantee / GIIF / EARS 20.000 farmers expected in 2012 … Pilots will be implemented in 2012 in Senegal on maize and peanut : PG/GIIF+WorldBank+Cirad : 1000 farmers (??) Pilots will be implemented in 2012 in Bénin on maize ; PG/GIIF Different studies : Ghana (GTZ), Bénin (WB), Cameroun, BOAD 17 What we can learn from experiences USA : fully subsided (EU : prices are subsided ..) India : different programs sustained by Government which subsides premium : more than 20 million farmers Positive for credit and allow government to help small farmers Malawi, other projects: strong investments GRET (2011) : “insurance programs could be economically profitable but require at the beginning many investments from Governments or Backers” feasibility studies (experts) equipments/technologies explanation/information, capacity building … Subsides generally required for small farmers 18 What we can learn from experiences When there is no subside (Mali, BF) : strategies consist in proposing very cheap products to launch insurance culture : but they poorly protect farmers … is that pertinent? Subsides may also contribute to create equity between areas Senegal : subsides higher for Northern region in order to have same premium and protection everywhere Better to consider insurance in agricultural policy Basic risk is a problem IFAD/WFP (2010) : “The future largely depends on how the industry will be able to expand the technology frontier” (satellite and communications technologies) 19 Conclusions Insurance could contribute to enhance productivity by securing credit (at least) Index based insurances are quite cheap and thus allow providing insurance to much more farmers Major technical issues to be addressed to reduce basis risk and improve quality of insurance products : satellite and mobile phone technologies and crop models also Satellite technology also necessary for extension Insurance development requires expensive investments at the beginning, including eventual premium subsides Subsides/other mechanisms are also required for equity Insurance must be considered in agricultural policy Government must also regulate the sector (legal issues) Recommendations Let be optimistic : crop markets and agricultural policies in Africa will allow insurance development .. Researchers must work on technical issues and also on economical and policy ones what are the adequate Private-Public-Partnership ? how to integer agricultural insurances and index based insurances in global food security management system?? Researchers and development stakeholders must participate to insurance projects / feasibility studies to technically help them to ensure transparency, equity and balance between development and commercial issues to capitalize experiences in order to advise Governments Thank you very much Bertrand Muller bertrand.muller@cirad.fr With Moussa SALL (ISRA-BAME), Antoine LEBLOIS (CNRS-CIRED), Alpha BALDE (AfricaRice), Moustapha FALL (ISRA-CERAAS), Patrice KOUAKOU (ISRA-CERAAS) et François AFFHOLDER (CIRAD) « l’assurance agricole est un sujet trop sérieux pour être confiée aux seuls assureurs, ré-assureurs et acteurs du crédit et de la micro-finance »