GLOBALIZATION

advertisement

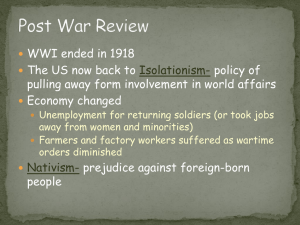

GLOBALIZATION Joe Smith started the day early having set his alarm clock (MADE IN JAPAN) for 6 a.m. While his coffeepot (MADE IN CHINA) was perking, he shaved with his electric razor (MADE IN HONG KONG). He put on a dress shirt (MADE IN SRI LANKA), designer jeans (MADE IN SINGAPORE) and tennis shoes (MADE IN KOREA). After cooking his breakfast in his new electric skillet (MADE IN INDIA) he sat down with his calculator (MADE IN MEXICO) to see how much he could spend today. After setting his watch (MADE IN TAIWAN ) to the radio (MADE IN INDIA) he got in his car (MADE IN GERMANY) filled it with GAS from Saudi Arabia and continued his search for a good paying AMERICAN JOB. At the end of yet another discouraging and fruitless day checking his computer (MADE IN MALAYASIA), Joe decide to relax for a while. He put on his sandals (MADE IN BRAZIL) poured himself a glass of wine (MADE IN FRANCE) and turned on his TV (MADE IN INDONESIA), and then wondered why he can't find a good paying job in America..... Actually this is a good thing. We get more choices, lower prices, & because more is bought, more jobs are created. APPARENTLY, SOME PEOPLE THINK SO!! SWEATSHOP LABOR AND BELOW SUBSISTENCE WAGES ARE WHAT MOST PEOPLE ENVISION Globalization can be defined as: •Widening and deepening of international flows of trade, finance and information in a single, integrated local market. •Increasing linkages between the world's people as natural and artificial barriers fall. •Transformation of the world into a global village, as borders disappear, distances shrink and time shortens. Impact of Globalization The Good News… •Increased market access e.g. trade flows increased 12-fold in the past 50 years as a result of the removal of natural and artificial barriers. •Increased access to capital. •The General Agreements on Tariff and Trade (GATT) is expected to increase global income by an estimated US $ 212 - US $ 510 billion - from trade and efficiency gains and higher rates of return on capital. •Increased movement of people due to tourism and migration. •Greater access to information and increased long distance communication The Disturbing News… •Gains are not equally distributed between countries. •Gains are not equally distributed within countries. •Financial volatility because of a globally integrated market. •Contagion and threat of worldwide recession. •More human insecurity such as crime (trafficking in drugs, weapons, women, international syndicates), spread of diseases such as HIV/AIDS, and loss of cultural identity. The world is becoming a smaller place. What happens in Tokyo affects what happens in New York and Dallas, Texas. There is over $12 trillion in world trade. Volume of Trade The importance of trade has grown. Exports as % of GDP Panama 80% Belgium 87% Netherlands 71% Kuwait 55% Norway 45% Canada 38% [If we sneeze, Canada catches a cold] South Korea 44% Germany 40% China 35%[1/3 bought by U.S.] United Kingdom 26% Spain 25% Italy 27% France 26% Mexico 25% [80% of Mexico’s exports are sold to U.S.] Japan 13% United States 11% [$1.6 trillion in 2007] World 25% 2008 In 2007, we had a trade deficit in goods of $815 billion. We had a trade surplus in services of $104 billion. ($711) 16% 322 313 200 249 211 180 180 160 160 140 140 120 120 100 137 148 95 80 100 60 80 66 60 40 20 Deficit 0 Canada 60 of 20 0 57 40 $256 Canada Mexico China Japan Germany Mexico China 50 50 Germany UK Japan 32 Korea EXPORTS UK 45 38 Korea Taiwan 42 France IMPORTS 26 Taiwan 25 33 27 Singapore Netherlands France After a series of product recalls, from pet food to tires, American regulators are paying more attention to goods exported to the U.S. from China. 10 million toys including “Big Bird” were recalled because of “lead” or magnets that tear the intestines when swallowed by children. Who Buys Chinese Goods? The U.S. accounts for 1/5 of all Chinese export destinations, 2007. 1.5 mil imported toy trains were made using lead paint. 450,000 tires were recalled because of tire separation problems. $56 billion In goods from U.S. to China More than 60 billion cans of cat and dog food were recalled. FDA ordered recall after a poisonous ingredient was found in toothpaste. 675,000 Barbie doll accessories KEEP THE MONEY AT HOME Point: When I buy a coat in England, I have the coat and England has the money. But when I buy a coat in America, I have the coat and America has the money. America is more wealthy because it has both the coat and the money. Abe Lincoln Counterpoint: Money is not wealth in and of itself, it merely facilitates trade. If America sends dollars to England, England will eventually use those dollars to buy American goods. If we don’t buy goods from other countries, then other countries will not be able to buy goods from us. Point: Protecting businesses from foreign competition preserves American jobs. Counterpoint: Few are helped by protective policies, but they are more visible and more vocal than the many who are hurt. Protecting jobs in import competing industries raises prices to consumers and costs jobs in industries that use imported inputs. America and consumers pay dearly each time protectionist measures “save” jobs. Industry Textiles Dairy Products Sugar Peanuts Meat Non-rubber footwear Orange Juice Canned Tuna Yearly Loss To Economy From Barriers $15,850 billion 1,630 million Employment Loss If Barriers Were Removed 71,639 2,378 657 million 74 million 2,040 397 322,059 187,223 928 1,377 190,733 123,456 609 390 635,103 257,640 177 million 170 million 307 million 100 million Annual Cost Per Job Saved $221,258 685,233 Point: If we trade freely with low wage countries, U.S. businesses will flee to those countries and U.S. wages will plummet. Counterpoint: Low wages, combined with low productivity, will result in high unit costs. High wages in the U.S. result from the high productivity of American workers, aided by the availability of raw materials, massive capital equipment, sophisticated management, and elaborate infrastructure. GLOBALIZATION LEADS TO LOWER FERTILITY RATES WHICH LEADS TO MORE OPPORTUNITY FOR GROWTH AND DEVELOPMENT, ESPECIALLY FOR WOMEN WHAT IS THE GLOBAL ECONOMY? AN INTERNATIONAL MARKETPLACE (IN A VERY BROAD SENSE) Trade in Goods Trade in Services Outsourcing Vacation Trade in Labor Final and intermediate goods Immigration … … legal and illegal Trade in Capital Foreign direct investment Financial flows: stocks, bonds, currencies ECONOMIC BACKGROUND: WHY ARE ECONOMISTS IN FAVOR OF FREE TRADE? Should Wisconsin grow oranges? Should Florida make cheese? No and No! Wisconsin should specialize in cheese Florida should specialize in orange production Then trade cheese for oranges ECON LINGO: OPPORTUNITY COST How much orange production does WI give up to produce one more unit of cheese? Very little, because oranges don’t grow well in WI. How much cheese production does WI give up to produce one more unit of oranges? A lot! Wisconsin Florida Cheese production Low opportunity cost High opportunity cost Orange production High opportunity cost Low opportunity cost MORE ECON LINGO: COMPARATIVE ADVANTAGE The country with the lower opportunity cost in producing one good has a comparative advantage in that good. • Wisconsin has a comparative advantage in cheese production => specialize in cheese • Florida in orange production => specialize in oranges Wisconsin Florida Cheese production Low Comparative opportunity advantage cost High opportunity cost Orange production High opportunity cost Low Comparative opportunity advantage cost U.S. TRADE FLOWS (EXPORTS + IMPORTS OF GOODS AND SERVICES) AS % OF GDP Recessions in yellow More trade is associated with economic expansion Trade expanded 3 times faster than GDP, since 1950 DOES THE TRADE DEFICIT CAUSE UNEMPLOYMENT? Most of the expansion in the trade deficit occurred during the roaring 1990s! Unemployment drops Since 2000 Trade deficit expands Before 2000 U.S. MANUFACTURING OUTPUT HURT BY IMPORTS? Manufacturing output expands despite imports 1990s: Surge in imports and manufacturing output Since 2000: Both recovering 2000-2002: Manufacturing drops, imports slow LOSS OF MANUFACTURING JOBS: ONLY IN THE U.S.? Manufacturing jobs: 1993 normalized to 100 3m jobs lost in the U.S. It’s a worldwide phenomenon! THE U.S. FINANCIAL SECTOR IN A GLOBAL ECONOMY. SOME FACTS: Int’l financial flows are the flip side of the trade deficit: Countries that have a trade surplus with the U.S. are net purchasers of our assets. There is a trend toward more international financial integration. This has coincided with less volatility in U.S. GDP. 1980: U.S. is a net creditor 800 16000 700 $365b more assets 600 100 0 4000 112% of GDP 200 6000 92% of GDP 300 12000 (IN $B) 8000 14% of GDP 400 14000 $2,546b more liabilities: accumulated trade deficits! 10000 U.S. INTERNATIONAL INVESTMENT POSITION 27% of GDP 500 Notice the difference in scale! 2005: U.S. is a net debtor 2000 0 Assets Direct Investment Banks Liabilities Portfolio Other Sectors Assets Direct Investment Banks Liabilities Portfolio Other Sectors GDP GDP has growth become (quarterly less volatilerates, sinceannualized) the mid 1980s. Some economists argue that international has 2 timesdiversification standard deviation 20% been a contributing factor around the mean 15% 10% 5% 0% -5% -10% -15% 1950 1960 1970 1980 1990 2000 LABOR MOVEMENTS: IMMIGRATION Historical perspective of immigration Who are the immigrants? Why does immigration work? History of (legal) immigrantion: Percent of total population Immigration is high compared to mid-1900s, (10Y moving average) but low compared to pre WW-I era!!! 1.2% A lot of immigrants came in the late 1800s, early 1900s 1.0% Currently about 1m immigrants per year (0.3% of total population) Drops after 1914 0.8% 0.6% Peak demand for IT workers in the mid 1990s 0.4% Drops again during the Great Depression 0.2% 0.0% 1860 1880 1900 1920 1940 1960 1980 2000 Do immigrants assimilate or do they present a burden on society and the economy for generations? Who are the immigrants? What’s their age? What's their education? How much money do they make? Age Distribution of Working Age Population by Citizenship Status (2004) Immigrants are young compared to the overall population! 70% 60% 50% 40% 30% 20% 10% 0% All Citizens 15-39 40-64 Non-citizens 65+ Educational Attainment by Citizenship Status (2004) 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Native Naturalized Less than HS Some college or associate degree Advanced degree Non-Citizens High school graduate Bachelor's degree Educational Attainment by Citizenship Status (2004) Large fraction of uneducated individuals among immigrants 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Native Naturalized Less than HS Some college or associate degree Advanced degree Non-Citizens High school graduate Bachelor's degree Income Distribution of Immigrants by Generation (2004) First generation immigrants have low income (they are younger, less educated), … … but consequent generations catch up! 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% first generation $24,999 and less second generation 25,000 to 49,999 third generation and higher All native 50,000 to 74,999 75,000 and above SUMMARY ON IMMIGRATION Large flow of immigrants, though not as large as in the 1800s and early 1900s Immigrants tend to be young: They help alleviate impending problems of baby boomer’s retirement (but can’t solve the problem either) Immigrants become more economically like the native population over time Immigration helps the economy balance growth in labor demand with supply POST-TEST Since 1975 U.S. exports and imports have A. declined as a percentage of U.S. GDP. B. more than doubled as a percentage of U.S. GDP. C. have increased as a percentage of overall world trade. D. remained virtually constant as a percentage of U.S. GDP. Which statement is true about the distribution of income among immigrants throughout the generations? A. Second generation immigrants remain less affluent than the native population. B. The longer immigrants are here the more likely they are in higher income brackets. C. The percentage of the immigrant population mired in the lowest quartile tends not to change while the other quartiles rebalance. D. Immigrants never catch up to the income levels of native citizens no matter how many generations are measured. According to the law of comparative advantage, a country should A. specialize and export goods with the highest opportunity cost. B. specialize and export goods with the lowest opportunity cost. C. specialize and export goods with the highest production cost. D. specialize and export goods with the lowest production cost. In the last twenty years, the global trend has been greater financial integration and an increase in international financial transactions. As a result, A. there has been greater instability in the U.S. economy during that time. B. U.S. private investors now hold almost half of their investment portfolios in foreign stocks. C. foreign investors have significantly reduced their buying of U.S. assets. D. the U.S. GDP has experienced far less volatility compared to the preceding twenty-five years. The number of legal immigrants as a percentage of the total U.S. population A. is currently at its highest level since the beginning of the 20th century. B. has continually increased since the economy began to recover in 2001. C. experienced its lowest level after the Great Depression. D. declined in the 1990s as the U.S. labor market approached full employment.