Koepsel.Retail_ci_08

advertisement

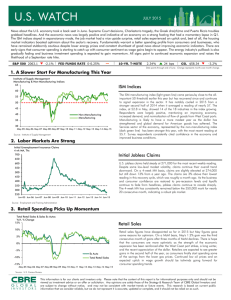

WCAI Year In Review Symposium December 2, 2013 Retail Market Overview Milwaukee, WI 2013 Ross L. Koepsel, CCIM Partner Commercial Property Associates, Inc. 1000 N. Water St. Suite 160 Milwaukee, WI 53202 (414) 271-3298 (414) 271-3789 fax rkoepsel@cpa-wi.com • • • • Retail-focused brokerage Founded in 1989 10 brokers plus support staff Landlord/buyer/developer representation, Tenant/seller representation, site selection, investment sales, excess property disposition, distressed assets, sale/leasebacks, subleases, ground leases, etc. • Retailers represented include: Men’s Wearhouse, AutoZone, Dollar Tree, rue 21, Firehouse Subs, Verizon, Heartland Dental, Caribou Coffee, Fresh Thyme Farmer’s Market, and many more Major Factors Currently Affecting Retail • • • • • Employment Interest Rates Consumer confidence/decreased consumer demand Housing Inflation CCIM Quarterly Market Trends Report • Projected net absorption of approximately 12 million square feet nationwide. • Third quarter national vacancy rate fell 10 basis points to 10.6% Retail Research Market Report • Local economy to add 10,000 jobs in 2013, adding 1.2% to payrolls year over, while net jobs created remains relatively even compared to 2012 • Approximately 650,000 sf of new retail space will be delivered at year end 2013. This is a decrease of 850,000 sf of new product compared to 2012 • Local vacancy rates will fall 70 basis points to 7.8% as strong national net absorption rates are also witnessed closer to home • Area retail asking rents will swing slightly in favor of Landlords, adjusting up 0.4% from 2012 Recent Retailer Activity in Southeastern Wisconsin • • • • • • • • • • • • • • • • Nordstrom, Nordstrom Rack Sak’s Off Fifth Wal-Mart Neighborhood Market Meijer Hobby Lobby Ashley Furniture Ulta DSW Shoes Gordman’s Bed Bath & Beyond Dick’s Sporting Goods Big Lots Planet Fitness Dollar Tree TJX Cos Woodman’s Retail Development in Southeastern Wisconsin Under Construction • Mayfair Collection • Drexel Town Square • Wal-Mart SWC Moorland Rd. and Greenfield Ave. New Berlin – breaking ground soon 152,000 sf Proposed • Ruby Farms/Plaza 173/The Corners in Brookfield • Grafton – north of Costco • Oconomowoc Wal-Mart/Sam’s Club • Phase 3 Shops at Fox River in Waukesha Largest Lease Deals in 2013 • Hobby Lobby Crossroads SC Menomonee Falls 62,000 sf • Ashley Furniture 4771 S. 27th St. Greenfield 56,785 sf • Big Lots 5415 Washington Ave. Racine 39,060 sf • Value Village Badger Plaza Racine 26,041 sf • Jo-Ann Fabrics North Northpointe SC Menomonee Falls 18,157 sf Largest Deliveries of Space in 2013 • Woodman’s 1600 E. Main St. Waukesha 230,000 sf • Wal-Mart 4140 W. Greenfield Ave. West Milwaukee 100,000 sf • Wal-Mart 5301 S. 76th St. Greendale 92,000 sf • Wal-Mart 222 N. Chicago Ave. South Milwaukee 48,978 sf • TJ Maxx 1160 W. Sunset Dr. Waukesha 24,000 sf Cap Rates, etc. • Retail cap rates in the area compressed to 8.04% in 2013 from 8.94% in 2012 • In first 6 months of 2013, 32 sale transactions over 15,000 sf occurred vs. 25 during the first 6 months of 2012 • Price on a psf basis rose from $81.50/sf to $93.17/sf Retail Property Sales • 3 Wal-Mart anchored properties purchased by Inland Real Estate JV (Wauwatosa, Menomonee Falls, and Milwaukee) • Sale of combined 174,500 sf for $24,200,000 • 9/12/2013 • Nagawaukee Center in Delafield purchased by Ramco-Gershenson Properties Trust from Told Development Co. for $22,650,000 on 4/18/2013 • The 105,921 sf acquisition achieved $213.84/sf • 8% cap • Washington Square SC Sheboygan sold for $19,000,000 • $128.18/sf, GLA of center 147,086 sf • Sold on 12/26/2012 to Piggly Wiggly by Tom Schafer • Pick N Save center 1751 N. Mayfair Rd. Wauwatosa acquired for $16,185,484 • 7.55% cap rate equates to $234.67/sf (68,970 sf) • Sold 12/21/2012 to Cole Real Estate Investments by West Development Partners • East Pointe Marketplace downtown Milwaukee $15,235,000 or $264.04/sf • 57,700 sf sold 11/2/2012 • Sold by Mandel Group Inc. to Westwood Financial Corp • Originally developed 1994 • Cole Credit Property Trust IV, Inc. purchased the Pick N Save 2625 S. Business Dr. in Sheboygan (southside) $14,122,000. • Sold 9/6/2012 for $201.74/sf (70,000 sf) • Cap rate of 7.73% • Built 2012 – developed by Continental Properties • Shoppes at Wyndham Village 7780 S. Lover’s Lane in Franklin sold 11/26/13 for $12,800,000 • Sale encompassed the Pick N Save and 3 buildings totaling 96,269 sf • Purchaser was Cloverleaf Group from Northfield, IL • Sold by Starwood Capital Group • Ascendant Holdings LLC purchased West Bend Corporate Center from Ripp Properties on 9/25/2012 for $11,475,000 • Property size 127,992 which equates to $89.65/sf • 9.66% cap • Developed in 1998 by Continental Properties • Meadowbrook Marketplace sold for $10,300,000 on 11/19/2012 • GLA of center 104,526 sf, built in 1999 • $98.54/sf • 9% cap • 104,526 sf, 92% leased at time of sale • Sold by Styza Properties to a property investment group from Singapore (Meadowbrook Marketplace LLC) • Pick N Save at 2931 S. Chicago Ave. in South Milwaukee was sold 11/11/13 for $7,558,000 • Cole Real Estate Investments Inc. purchased from Alexander & Bishop of Oshkosh, WI • 58,730 sf big box anchors Grant Park Plaza 2014 Forecast • Retail leasing and sales activity will continue to increase • Net absorption should continue to increase slowly even with new construction deliveries • Rents for grade A properties will continue to strengthen • Demand and cap rates for single tenant net leased assets will remain steady due to low inventory • Cap rates for multi-tenant retail should compress an additional 25 to 50 basis points due to increased demand Have a Happy and Prosperous 2014 Thank you!!