Professor Miranda - Melbourne Law School

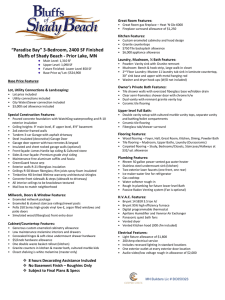

advertisement

Melbourne JD Sample law class College Scholarships Key dates for 2013 admission Round 1 Register for LSAT By 25 May 2012 Sit LSAT 24 June 2012 Submit Application 13 July 2012 http://www.law.unimelb.edu.au/jd Our Students – Profiles Future Law: the network for Aspiring Law Students Future Law is a network that offers members exciting opportunities to: •Attend sample law classes •Attend LSAT preparation and other information sessions •Meet other future law students •Interact with current law students and academic staff •Receive ‘Future Law’ newsletters Register online: www.futurelaw.unimelb.edu.au Our Students – Profiles Can you deduct your educational expenses from your tax? And if not – why not? 30 April 2012 Professor Miranda Stewart Law School Our Students – Profiles Tax law in the JD • An upper year option • Second or third year in your JD degree • After you have done some of the “core” general law subjects • Taxation Law and Policy • Taxation of Business Enterprises • Legal research in Taxation • Masters subject in Taxation Our Students – Profiles Who says you have to pay tax? Sec 4-10 (1) You must pay income tax for each financial year (2) Your income tax is worked out by reference to your taxable income for the income year (3) Work out your income tax for the financial year as follows: Income Tax = (Taxable Income * Rate) – Tax Offsets (rebates) Our Students – Profiles How much tax must you pay? • The income tax is levied by the federal government • The tax law is contained in various statutes enacted by Parliament, including: INCOME TAX ASSESSMENT ACT 1997 (Cth) Sec 4-1: Income tax is payable by each individual and company, and by some other entities. Our Students – Profiles What is your taxable income? Sec 4-15 Taxable income = Assessable income – Deductions Our Students – Profiles Marginal tax rates for 2011-12 (year ended 30 June 2012) Taxable income 0 – $6,000 Rate 0% Tax on this income Nil $6,001 – $37,000 15% 15c for each $1 over $6,000 $37,001 – $80,000 30% $4,650 plus 30c for each $1 over $37,000 $80,001 – $180,000 37% $17,550 plus 37c for each $1 over $80,000 $180,001 and over 45% $54,550 plus 45c for each $1 over $180,000 • Plus Medicare Levy 1.5% • Low-income tax offset refunds tax for low income earners • Rates are revised following the carbon emissions scheme for 2012-13: large tax-free threshold of $18,000 approx. Our Students – Profiles What is income? Sec 6-5 Your assessable income includes income according to ordinary concepts, which is called ordinary income. • This is a “judicial” concept of income – determined in its ordinary meaning, as set out by judges in cases • Ordinary income “must be determined in accordance with the ordinary concepts and usages of mankind” Scott v Federal Commissioner of Taxation (1935) 35 SR (NSW) 215 at 219 (Chief Justice Jordan) Our Students – Profiles What kind of income might you have while studying? • • • • Employment income, eg salary? Youth allowance? Business income? Investment income (“trust funds”, dividends, interest, rents)? • Gifts or support from family? Our Students – Profiles What are allowable deductions? Sec 8-1 (1) You can deduct from your assessable income any loss or outgoing to the extent that: (a) it is incurred in gaining or producing your assessable income; or (b) it is necessarily incurred in carrying on a business for the purpose of gaining or producing your assessable income. (2) However, you cannot deduct a loss or outgoing to the extent that: (a) it is a loss or outgoing of capital, or of a capital nature; or (b) it is a loss or outgoing of a private or domestic nature; or (c) it is incurred in relation to gaining or producing your exempt income; or (d) a provision of this Act prevents you from deducting it. Our Students – Profiles What kind of education expenses might you seek to claim? • • • • • • • Fees, eg University services fee Text books and materials Computer, printer etc Materials for practical training/internships Lab equipment Clothes/uniforms Transport What is the argument that these expenses are deductible? Our Students – Profiles Anstis case • A full time student undertaking a teaching degree at Australian Catholic University • In her tax return for the year ended 30 June 2006, she declared: • $14,946 wages (sales assistant) • $3,622 youth allowance • She claimed as a deduction $920: • Textbooks and stationary • Student administration fee • Supplies for children during teaching rounds • Travel expenses to schools • Computer - depreciation Our Students – Profiles Anstis case By CLANCY YEATES, 18 December 2010, p. 5 The Age: Students win cash back on old tax “HUNDREDS of thousands of current and former students will receive partial tax refunds, after the Australian Tax Office said it would change previous assessments to comply with a landmark High Court ruling. The Tax Office yesterday said it would amend its assessment for all full-time students who received Youth Allowance and paid tax between the 2006-07 and 2009-10 financial years. The ATO will automatically deduct an extra $550 a year from eligible taxpayers' incomes, providing an average refund of $90 for each year.” Our Students – Profiles Why did the Commissioner of Tax oppose the claim in Anstis? • • • • Tax Ruling TR 98/9 http:/law.ato.gov.au Commissioner’s view of the tax law Self-education expenses are deductible where they have a relevant connection to the taxpayer's current income-earning activities. Deductible if: • Taxpayer's income-earning activities are based on the exercise of a skill or some specific knowledge and the subject of self-education enables her to maintain or improve that skill or knowledge. • The study objectively leads to, or is likely to lead to, an increase in a taxpayer's income from current incomeearning activities in the future. Our Students – Profiles • Study to enable a taxpayer to get employment, to obtain new employment or to open up a new income-earning activity (whether in business or in the taxpayer's current employment) is considered non-deductible • Includes studies relating to a particular profession, occupation or field of employment in which the taxpayer is not yet engaged • Commissioner took the view that education expenses could not be deducted against Youth Allowance or similar payments, while studying full time, because the expenses are incurred at a point too soon to be incurred “in gaining or producing assessable income” Our Students – Profiles • Earlier cases formed the basis for the Commissioner’s tax ruling TR 98/9 • Federal Commissioner of Taxation v Finn (1961) 106 CLR 60 • Federal Commissioner of Taxation v. Hatchett (1971) 71 ATC 4184 , Menzies J, High Court • Federal Commissioner of Taxation v Studdert (1991) 91 ATC 5006 Our Students – Profiles What did the High Court have to consider? 1. Is youth allowance assessable income? 2. Are the self-education expenses incurred "in gaining or producing” assessable income? 3. Is the deduction nonetheless to be disallowed as being of a "private" nature? Our Students – Profiles What are the Youth Allowance rules? • Social Security Act 1991 (Cth), Section 540: Requires a Youth Allowance recipient to: • (i) satisfy "the activity test“ • (ii) be of "youth allowance age" as defined in ss 543-543B; and • (iii) be an "Australian resident" as defined in s 7(2). • “Activity test”: You are "undertaking full-time study". • enrolled in an approved course of education at an educational institution; and • undertaking in the particular semester at least three-quarters of the normal amount of full-time study for the course; and • in the Secretary's opinion, “making satisfactory progress towards completing the course” based on guidelines set by the Minister • Basically, requires completion of the course within the standard minimum length of the course Our Students – Profiles Youth Allowance is assessable “ordinary income” “The character of a receipt in the hands of the taxpayer is determined having regard to the totality of the circumstances. That a receipt is periodical is a characteristic tending to show that it is received as income.” “Youth allowance payments enable recipients to rely upon them for regular expenditure, and recipients can expect to receive those payments but only so long as they satisfy the various requirements of the social security legislation. It follows that such amounts are income according to ordinary concepts.” Referred to earlier cases, including Keily v Commissioner of Taxation, White J (1983) 32 SASR 494 at 495 (about the age pension). Our Students – Profiles Youth Allowance is also a “rebatable benefit” • Although it is included in assessable income, tax on the benefit itself is refunded (“rebated”) to the beneficiary • S 160AAA of Income Tax Assessment Act 1936 • Government assistance payments that are taxable in law are in effect tax-free due to the rebate. • If you have no other income except your taxable government assistance payment, then the beneficiary rebate extinguishes the tax liability. • If you also have other income, eg, employment income, you still have the tax on their government assistance payment extinguished by the rebate, but are taxed on any other assessable income at your marginal tax rate. • We will come back to the significance of this later… Our Students – Profiles Education expenses were deductible! • “The respondent's desire to obtain a degree, whether to enable her to become a teacher or for some other reason, cannot deny the circumstance that expenses occasioned by her enrolment, full-time study and satisfactory progress in that degree were incurred by her as a recipient of youth allowance” • “The prospect of the future employment of the respondent as a teacher was not the basis on which her education expenses have been held to be deductible. Rather, the question is whether the occasion of her expenses was productive of her "passive income", in the form of youth allowance” • The outgoings did not lose their connection with the "position" she held as a recipient of youth allowance simply because she might have been studying for reasons other than enjoying an entitlement to youth allowance. Our Students – Profiles Education expenses were not disallowed because private • Ms Anstis was not "paid to undertake [study]" but that was not required for the deductions to be allowable. • The assessable Youth Allowance was gained or produced by her entitlement to that payment consequent on the determination by the Secretary that she qualified for the payment. • The notion of "gaining or producing" income within the meaning of s 8-1(1)(a) is wider than those activities which may be said to earn income, in its ordinary meaning. • To "gain" means not only to "earn or obtain (a living)" but to "obtain, secure or acquire" or to "receive". Our Students – Profiles The legal effect of Anstis decision • Taxation Ruling TR 98/9 is now wrong as it is not in accordance with the law established by the High Court • The High Court decision establishes that the law allows a tax deduction for education expenses against Youth Allowance • The ATO must respond in accordance with law • Decision Impact Statement issued • The ATO takes steps to amend its Ruling • The ATO adopts an administrative approach to assist students: automatic $550 deduction for all years from 2006 to 2011 Our Students – Profiles The policy consequences of Anstis decision Assistant Treasurer, the Hon Bill Shorten MP, 17 December 2010 The Government will not amend the tax law retrospectively to deny deductions against Youth Allowance for prior years following the High Court decision in Commissioner of Taxation v Anstis. “The Government will not be playing Christmas Grinch for those taxpayers that can benefit from the Tax Office's decision to allow an automatic deduction and for those taxpayers that can substantiate their claims," he said. In terms of deductibility against youth allowance for the current and future income years, this will be considered by the Government in the New Year. Our Students – Profiles The policy consequences of Anstis decision • In May 2011 Budget, the government announced that it would legislate to deny deductions against all government assistance payments for individuals from 1 July 2011 • Budget Paper No. 2 Revenue Measures • Education expenses will not deductible against Youth Allowance from 1 July 2011 onwards • But can be deducting by amending assessments for years 2006 to 30 June 2011 Our Students – Profiles The Government’s view of the decision The High Court decision represented a departure from the principle that study expenses unrelated to employment are not deductible. The decision means that individuals in like circumstances (such as students with the same income) have different tax obligations depending on the type of government assistance payment they receive, or whether they receive any government assistance payments at all. In that sense, the decision has long-term implications for the integrity of basic tax principles; involves a costs to revenue; and introduces additional horizontal inequities into the tax system. Our Students – Profiles Exposure Draft legislation released • Available from Treasury website, www.treasury.gov.au • http://www.treasury.gov.au/contentitem.asp?NavId=&Conte ntID=2296 • Proposed new s 26-19 Rebatable benefits (1) You cannot deduct under this Act a loss or outgoing to the extent 15 that the loss or outgoing is incurred in gaining or producing a rebatable benefit … • Still not introduced into the Parliament as a Bill, or enacted in legislative form www.law.unimelb.edu.au