Presentation Sept 20, 2011 (*)

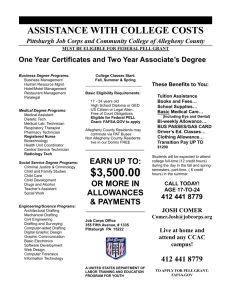

advertisement

D1407: Enrollment Management: A Game of Trade-Offs, Compromises, and Occasional Victories Paul Hamborg, Enrollment Research Associates, TX Bambi Burgard, Kansas City Art Institute, MO Christopher Ellertson, Trinity University, TX Michael Thorp, Millsaps College, MS Change in Consumer Behavior From 2000 to 2008: • The household savings rate dipped below zero • Median family income stagnated • The consumer price index increased 27% • Private college tuition increased 57% Since 2008: • Willingness and ability to borrow has decreased dramatically • Current income is now the primary source for paying for college Family Financial Circumstances Family 1: Family 2: Family 3: Family 4: $6,000 EFC $13,000 EFC $22,000 EFC $36,000 EFC Annual Wages $70,000 $100,000 $135,000 $175,000 Monthly Net Income $4,270 $5,873 $7,605 $9,500 Housing Costs $2,255 $2,695 $3,179 $3,600 $575 $950 $1,550 $1,550 General Expenses $1,485 $2,160 $2,735 $2,835 Total Expenses $4,315 $5,805 $7,464 $7,985 -$45 $68 $141 $1,515 Transportation Costs Net Income/Loss What Happened in 2009? A Study of 902 Private Colleges 2008 2009 Change Students 454,969 458,831 3,862 0.85% increase Average Tuition $24,122 $25,177 $1,055 4.37% increase 38.6% 41.3% 2.7% $14,397 $14,497 $38 Discount Net Revenue Changes to the FAFSA in 2009 As part of the American Recovery and Reinvestment Act passed on February 17, 2009, the Department of Education dramatically increased eligibility for federal Pell Grants This goal was achieved in several important ways: • Expanding Pell to a year-round program where students can draw grants for summer study • Expanding eligibility for Pell by adjusting the underlying formulas that determine a student’s Expected Family Contribution • A slight increase in the maximum Pell award and in the EFC cut-off value What Happened in 2009? A Study of 902 Private Colleges Pell grants Percent with Pell Pell Amount Student Cost 2008 2009 Change 106,797 133,811 27,014 23.5% 29.2% 5.7% 25.2% increase $366,258,257 $543,099,737 $176,841,480 48.3% increase $11,750 $11,398 -$352 3.0% decrease Merit Scholarships Versus Need-Based Aid • Most merit-based scholarships contribute toward meeting student need as defined by the FAFSA • We have a valid and reliable measure of academic profile, while we do not have a valid and reliable measure of need • Actual need versus perceived need has become a more significant issue 11 Year Average: 640.2 Millsaps College Enrollment Results, 2009 - 2011 2009 2010 2011 282 214 228 Tuition $26,240 $27,814 $29,482 Net Revenue Per Student $5,934 $8,064 $10,323 Discount Rate 77.4% 71.0% 65.3% Average ACT 25.4 26.5 26.4 One-Year Retention Rate 76% 88% - New Students Year Discount Rate 2007 48% 2008 51% 2009 50% 2010 52% 2011 53% Question 1 Enrollment management has become increasingly data driven over the past decade. How have each of you integrated data-driven decision making into your admissions and financial aid operations? Question 2 Approaches to conducting search and managing prospect and inquiry pools has been evolving rapidly over the past few years. What tactics are each of you taking to increase the number of applicants who have a strong likelihood of attending your institution? Question 3 All Presidents, especially new ones, want it all: more students, more revenue, lower discount, and higher quality students. How do you educate them, and the rest of the campus community, on the realities of enrollment management in 2011?