Bundling as a Structural Issue: Community Colleges

advertisement

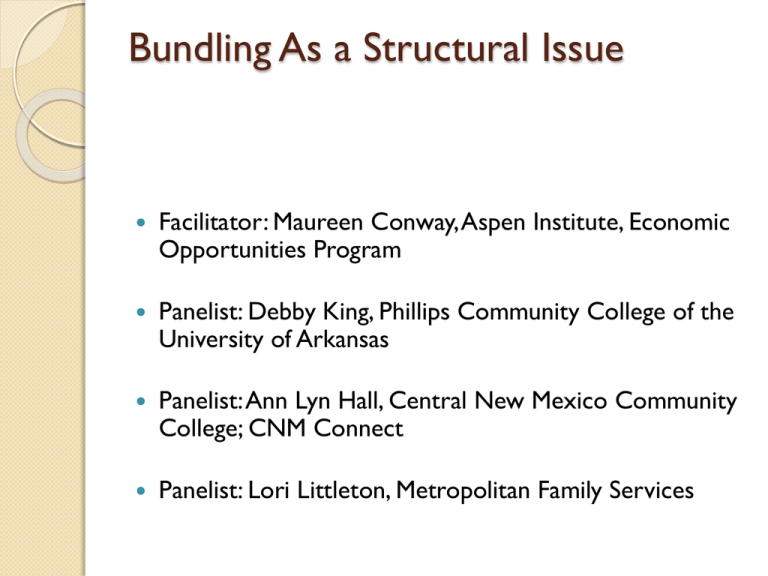

Bundling As a Structural Issue Facilitator: Maureen Conway, Aspen Institute, Economic Opportunities Program Panelist: Debby King, Phillips Community College of the University of Arkansas Panelist: Ann Lyn Hall, Central New Mexico Community College; CNM Connect Panelist: Lori Littleton, Metropolitan Family Services Career Pathways Center for Working Families Debby King, Ed.D. Vice Chancellor for Instruction Who We Are Three campuses – DeWitt, Helena, Stuttgart Enrollment: 2100 Average student – 26 years old and female 87% of first-time students require remediation in one or more courses Approximately 85% of students are Pell eligible What We Do Implemented the Career Pathways model to increase the number served Provide extensive employment education opportunities offered Provide Financial Education Program as part of a supplemental curriculum offered to all students enrolled in Basic Writing II and Freshman English I Target Population We Serve TANF- eligible adults Adults who fall at or below 250% of the federal poverty level Any student requesting services All students enrolled in Basic Writing II, EH 123 and enrolled in Freshman English I Initiatives and Programs to Support the Center for Working Families Annie E. Casey Foundation in partnership with MDC, Inc. Arkansas Career Pathways Achieving the Dream Initiative Student Support Services PCCUA Funding Center for Working Families Partners Arkansas Workforce Center in Phillips County Arkansas Department of Human Services Arkansas Department of Workforce Services Mid Delta Community Services Arkansas Department of Career Education – Adult Education Section Arkansas Department of Rehabilitation Services Southern Bancorp Financial Services Phillips County Health Department Employment/Education Services Individual Career Plan Kuder Career Exploration Employability Skills Arkansas Career Readiness Certificate Job Referrals Degree and Certificate Pathways Basic Skills Development using PLATO and KeyTrain Tutoring Income and Work Supports Access to public benefits such as food stamps, TANF, child care, and housing Referrals to assistance agencies Tax assistance Financial Aid workshops and brochures Scholarship information Financial Services and Literacy Financial literacy classes and workshops One-on-one financial coaching and counseling Referrals to financial services for loans and savings programs IDA ACTIVITIES Workshops: financial aid, conflict resolution, social risk taking, income tax preparation Resource Fair – 20-25 community and college supporters (100-150 participants) Testing for Career Readiness Certificates Financial literacy curriculum developed Financial literacy curriculum implemented in Student Success I & II classes Bundled Services Goals 80% - two out of three core services 50% - three core services 2012-13 Outcomes Received Services – 577 2 of 3 Core Services – 337 (58%)If SS is included it exceeds (91%) 3 Core Services – 277 (46%) Students receiving services in the fall who enrolled in the Spring – 404 (70%) Number completing a degree or certificate – 48 (many in two yr. programs) Number placed in jobs – 50 Data Collection and Tracking The Career Pathways database, Datatel, and Excel spreadsheets. This method of tracking is time consuming and not flexible enough so that information can be shared across services, staff, and partner organizations. Central New Mexico Community College CNM Connect Ann Lyn Hall Staffing Lori Littleton, MS Program Supervisor Who we are Metropolitan Family Service is a non-profit agency that has been the engine of change that empowers Chicago-area families to reach their greatest potential and positively impact their communities since 1857- 156 years of Fiscal Stewardship. ◦ Metro has more than 800 full-and part-time professional staff ◦ Served more than 53,000 families and individuals as diverse as the communities in which they live, with 81% being part of the working poor and lower-middle class in FY12 Metropolitan’s Service Areas: 4E’s ◦ Education – Child/Youth Development and Parent Development Program ◦ Economic Stability – Center for Working Families (CWF), Family Works, Young Fathers Program and Employee Assistance Program ◦ Emotional wellness – Counseling, Mental Health, Violence Prevention and Intervention and Older Adult Services ◦ Empowerment- Legal Aid and the Jane Addams Domestic Violence Court Advocacy Program [ Client Demographics • Race: 94.4 % of our current client population are African-American. • Income: 91.5% of the population we serve income fall below the Federal poverty line; and 40% of this population is homeless • Age: 24.8 % (14-24); 27.5% (25-34); 35% (35-54) and 1.9% (55 & over) • Gender: 60.8% Female; 39.2% Male • Education: Of the clients enrolled in CWF over 18 years of age, • 21.0% have no High School Diploma or GED education. • 28.0% of our clients have a high School diploma or GED. • 50% of clients have some College. • Unemployment Rate in Illinois: As of July, 2013 the unemployment rate is 9.2% Metropolitan Family Services Client Flow Chart Orie ntation (Pr ogr am Ove r vie w ) 2 hour s Financial Coaching 1-2 hour s M eet one on one wi th a fi na nci a l coa ch to ga i n fi na nci a l pea ce thr ough budgeti ng a nd debt ma na gement Incom e Suppor t 1-2 hour s M eet one on one wi th a speci a l i st to deter mi ne i ncome r el a ted el i gi bi lity Job Re adine s s Tr aining 4 days /Total of 16hr s P r epa r a tion for Empl oyment Sea r ch Fi na nci a l Li tera cy Resume Bui l di ng, Job Appl i ca ti ons, Inter vi ewi ng Sk i l l s a nd Ca r eer Expl or a ti on Em ploym e nt Scr e e ning Em ploym e nt and Education Se r vice s M eet one on one wi th a n Empl oyment Speci a l i st for j ob scr eeni ng a nd ma tchi ng ba sed on sk i l l sets. Job Seek er s wi l l r ema i n i n thi s pha se unti l pl a cement Job Place m e nt Job Club ` P a r ti ci pa te i n a wor k shop r el a ted to feedba ck , suppor t a nd empl oyment r etenti on Core Services Financial Literacy Services – One-on-one financial coaching, group financial literacy ◦ Workshops. CWF financial coaches: review credit reports and scores; help clients ◦ Create plans to establish or build credit; assist in development of personal budgets and ◦ Creation of plans to address debt; and support clients as they save money and make ◦ Strong connections to mainstream financial institutions Core Services Continue Income Support Services– Assistance accessing all benefits to which clients are ◦ Entitled such as Food Stamps, child care subsidies, utilities assistance and subsidized housing ◦ All CWF services are provided free of charge. Employment Services – Job readiness training, job placement assistance, job retention ◦ Support, career advancement services, and enhanced access to education and training ◦ Opportunities through Kennedy-King College and the City Colleges of Chicago. Core Service Continue Family Net Center ◦ Technology resources are available in the onsite Family Net Center (FNC). The FNC ◦ provides computer training, an open access resource room and is a community-based hub ◦ for technology learning, education access and information sharing. Metropolitan Family Service Bundling Services Outcome Report Period- June, 2011- October, 2013 Client Enrolled in CWF Services since enrollment- 937 ◦ Total Percent of people who got exactly 1/3 services 173 (16%) ◦ Total Percent of people who got exactly 2/3 services 310 (30.1%) ◦ Total Percent of people who got exactly 3/3 services 547 (53.1%) Resources and Contacts Presenter Contacts Maureen Conway, Aspen Institute, Economic Opportunities Program maureen.conway@aspeninst.org Ann Lyn Hall, Central New Mexico Community College; CNM Connect ahall@cnm.edu Lori Littleton, Metropolitan Family Services CWFLittletL@metrofamily.org Debby King, Phillips Community College of the Univ. of Arkansas dking@pccua.edu Other Resources MDC Executive Summary: http://www.mdcinc.org/sites/default/files/resources/CWF%20Clearing%20the%20Financial%20Barriers%20to% 20Student%20Success%20-%20Executive%20Summary.pdf Bundled Services: http://www.aecf.org/~/media/Pubs/Topics/Economic%20Security/Family%20Economic%20Supports/AnIntegratedApproachtoFost eringFamilyEconomic/Report%201%2012%2009.pdf CLASP Toolkit: http://www.clasp.org/issues/pages?type=work_supports&id=0007