Personal Finance 101 - Bessie B. Moore Center for Economic

Personal Finance 101

Dr. Rita Littrell

Bessie B. Moore Center for Economic Education

What can you do with money?

Spend it

Save it

Invest it

Share it

Cosby Show Economics Lesson http://www.youtube.com/watch?v=nFY0HBk

Um8o

Spending

Make good decisions

Use a budget

Research products

Compare prices

Consider the opportunity cost

Keep receipts & warranties

Return faulty items

Use credit wisely

Consumer Credit

A loan – spending money you have not earned

Two types:

Closed End Credit -- Ex: Auto Loans, Mortgage

Loans

Open End Credit -- Ex: Credit Cards

Interest is the cost of credit

Credit Cards

Make Sure You Know All The Terms and Conditions

Beware of “Store Credit Cards” & Their High Interest

Rates

Avoid Getting Too Many Credit Cards

Beware of the Minimum Monthly Payment Trap

Home Equity Line of Credit

Building Your Credit Rating

Credit Bureaus – Collect Credit Information About

You

Three Main Credit Bureaus in U.S.

Equifax

Experian

TransUnion

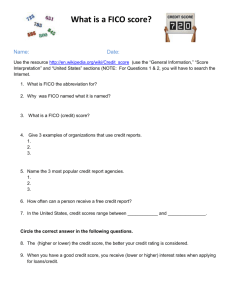

Your Credit (FICO) Score

Building Your FICO Score

Fair Isaac Company credit score

FICO scores:

Are your credit rating

Range from 300 – 850, higher is better

Most lenders base approval on FICO

Higher scores result in lower interest rates

Free Credit Report: https://www.annualcreditreport.com/cra/index.jsp

FICO Scores Based On

FICO scores are based on your rating in:

Payment history – 35%

Amount owed – 30%

Length of credit history – 15%

New credit – 10%

Types of credit used – 10% http://www.myfico.com/CreditEducation/WhatsInYourScore.aspx

How a Good FICO Score Can Help

36 month auto loan

FICO score

720-850

690-719

660-689

620-659

590-619

500-589

In Arkansas on

Sept. 26 th , 2008

6.0%

7.07%

8.00%

10.23%

12.95% n/a

APR

For a loan of

$25,000

Monthly payment

$761

$773

$783

$809

$842

$0

Fico Help Center

Credit Counseling Services

If You Are Having A Problem Paying A

Bill, You Can…

1. Contact the Creditor

2. Contact A Nonprofit Financial

3. Counseling Program

Credit Counseling of Arkansas

Credit Counseling of Arkansas

CCOA Is a Local NonProfit Org.

1. Provides Educational Services

2. Debt Counseling Services

3. Supported By Contributions From Banks,

Merchants, etc.

4. Service May Be Free or There May Be a Small

Charge

Beware of Predatory Counseling Organizations

Saving

Consuming less than you earn.

Ways to save:

Saving Account

Certificate of Deposit

Savings Bond

Rainy day or to invest

Sharing

Contributions of philanthropic organizations

1. Walton Family Foundation

2. Wal-Mart Foundation

3. Winthrop Rockefeller Foundation

4. Winthrop Rockefeller Trust

5. Walton Family Charitable Support Foundation

6. Charles A. Frueauff Foundation,

7. Arkansas Community Foundation

8. Ross Foundation

9. Harvey and Bernice Jones Center for Families

10. Murphy Foundation

11. Windgate Charitable Foundation

Arkansas Philanthropy

Between 1997 & 2004, AR ranked among top 7 states in individual charitable contributions while being among the five least wealthy

National or International nonprofits groups

Heifer International – LR – eliminate starvation by enabling low-income people to feed themselves on a sustained basis

Potluck Food Rescue for Arkansas – redirects otherwise wasted food to low-income Arkansans

AR Foodbank Network & AR Rice Depot – work to relieve hunger and malnutrition

Investing

Options for Investing

Open a Savings Account

Invest in the Stock Market

Buy Bonds

Invest in a Mutual Fund

First step is to determine short and long term financial goals.

Fundamentals of Investing

1. How Much Money Do You Want to Accumulate?

2. How Long Will It Take?

3. How Much Risk Are You Willing to Assume?

4. Are Your Goals Reasonable?

5. Are You Willing to Make the Necessary Sacrifices?

6. What Are the Consequences If You Don’t Reach Your

Goals?

Before Investing

Get Your Financial House In Order

Make Sure You Have Adequate Insurance

Start an Emergency Fund

Balance Your Budget

Use These Options

1. Employer Sponsored Retirement Plans

2. Employer Savings Plans

3. Gifts, Inheritances or Windfalls

Save – Even If It Is a Small Amount!

( www.dinkytown.net

)

Stocks

Ownership in a company

Buy Stock for:

1. Dividends

2. Price Appreciation

Level of Risk

Mutual Funds

Stocks in several companies

Professionally managed

Wide variety of funds

Less risk due to diversification

But You Can Lose Money Too!!

Bonds – a loan

Corporate Bonds – not insured by

Federal Government

US Government Bonds – Treasury Bills,

Bonds & Notes (terms vary)

Municipal Bonds – issued by state and local governments – Fed tax exemptions & that state

Bureau of Public Debt - US Dept of Treasury

For ratings – Moody’s Investor Service -

Standard and Poor’s Corp

Financial Institutions

Use financial institutions to:

protect your money

help you manage your money – checks, debit cards

savings, checking and other accounts

to help your money work for you

for financial advice

Stock Market

New York Stock Exchange (NYSE)

American Stock Exchange (AMEX)

Nasdaq (Nat’l Assn of

Securities Dealers

Automated Quotation)

List of up and coming companies from Fast

Company!

Influences on the Market

• War

• Emotions

• Politics

• Economy

• Natural Disasters

What influences the price of a stock

• Conditions in the Industry

• Changes in Technology

• Competition

• Health of the Company

• Supply and Demand

The Arkansas 20

Reading a Stock Table

What Does it Mean?

Reading a Mutual Fund Table

Understanding the Mutual Fund Table

Reading a Bond Table

Understanding the Bond Table

Three Rules for Building Wealth

1. Start early.

Give money time to grow.

2. Buy and hold.

Keep you money invested.

3. Diversify.

Don’t put your eggs in one basket.

Use the Magic of Compounding

Compound Interest Calculator

Buy & Hold

1. Spend less than you receive.

Earn more by improving your formal education or job skills.

Spend less by using a budget to keep track of where your money is going.

2. Become connected to financial institutions?

Open and maintain accounts at mainstream financial institutions.

3. Manage your credit responsibly?

Limit the number of credit cards you have.

Limit the number of purchases to what you can pay off each monthly.

Apply for loans only when you are confident you can repay with your current income.

Stock-Market Roller Coaster

If you hold long enough, the ups are greater than the downs.

Diversify

Don’t put all your eggs in one basket!

Costs & Benefits of Saving & Investing

• Saving accounts: provide small but steady return

• Certificates of deposit: very safe, but instant access is penalized

• Bonds: lending money to a corporation or government, with a promise of higher returns than those offered by bank savings accounts and CDs

• Stocks: part ownership in a company, offering higher risks and potentially higher returns than some other investments

• Real estate: the risks and benefits of being a landlord