Financial Aid Info - LMU - New Millennium Secondary School

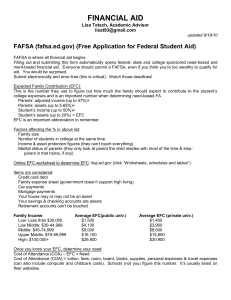

advertisement

2013-14 Financial Aid Workshop Why are you here? • Jobs of the future will require more skills than those provided by a high school education alone • Students who go to college have financial advantages – their life-time earnings are higher than those of high school graduates – they are less likely to be unemployed – their children are more likely to attend college Who wants a million dollars? What will be covered this evening? • Philosophy of Financial Aid • Financial Aid Administrators – what is our role? • Types & Sources of Financial Aid • How to Apply for Financial Aid • The Financial Aid Formula • College Expenses – what are the costs? • What is the Expected Family Contribution (EFC)? • Awarding Process & Comparing Awards • Tips Philosophy of Financial Aid • Providing access and information • Parents and students have the responsibility to pay for higher education expenses to the extent they are able • The aid application process should provide Financial Aid Office a consistent and equitable evaluation of a family’s financial circumstances for all that are applying • Allocation of finite resources Our Roles The Financial Aid Office’s Role… • Stewards of federal, state and institutional financial aid dollars • To administer federal, state and institutional financial assistance to students and their parents in an accurate, informative, timely and friendly manner Parent & Student’s Role… • To contribute to the application, awarding and financing process throughout student’s Undergraduate Education Funding Types • Need-Based Funding (must complete FAFSA) • Grants • Gift aid that does not need to be repaid • Based on household financials • Loans • Stafford Subsidized Loans • Government pays loan interest while attending • Work • A set amount that a student can earn by working on campus funded by the Federal Government or the college • How does “work” work? Benefits? Funding Types • Non-Need Based Funding • Merit/Academic Scholarships • Based on Admission Information • Separate Application/Interview Process? • Athletic Scholarships • Non-Need Based Loans (Stafford, PLUS, Private) • Stafford Unsubsidized Loans • Parent Loans • Alternative Educational Loans Four Primary Sources of Aid 1. Federal Programs (FAFSA Application) • • • Pell Grant Supplemental Grants Stafford Loans • • • Subsidized vs. Unsubsidized Perkins Loan Work Study Sources of aid – Cal Grant • All students who have earned a high school GPA of 3.0 or greater, demonstrate financial need, meet parental income and asset requirements, and file by March 2, 2013 will receive up to four years of – system-wide fees at UC ($12,192) and CSU ($5,970) campuses – as much as $9,084 at independent California colleges or universities – as much as $4,000 at California private career colleges Sources of aid – Cal Grant All students who have earned a high school GPA of 2.0 or greater, demonstrate financial need, meet parental income and asset requirements, and file by March 2, 2013 will receive up to four years of a $1,473 stipend for living expenses for up to four years at all California colleges and universities including the community colleges plus - system-wide fees at UC ($12,192) and CSU ($5,970) campuses for second through fourth years - as much as $9,084 at independent California colleges or universities for second through fourth years - as much as $4,000 at California private career colleges Sources of aid - Chafee The California Chafee Grant program provides up to $5,000 annually to current and former foster youth for college or vocational training at any accredited college in the U.S. To be eligible, the foster youth must have been in California foster care on his or her 16th birthday and not have reached his or her 22nd birthday before July 1, 2013 To apply, complete the: 2013-2014 FAFSA California Chafee Grant Program Application To learn more about the Chafee Grant, go to www.chafee.csac.ca.gov Sources of Aid 3. Institutional Programs • • • • Scholarships Grants Loans Work 4. Outside Resources • • • • • Community: Rotary, YMCA, Elks Parent’s Employer Web Sites: www.fastweb.com Time spent on searches… Worthwhile? Outside Scholarships can replace loans/work Resources for Parents • Parent Programs • Employer Reimbursement for Dependents • Federal Plus Loan Program • Payment Plans • Federal IRS Educational Tax Benefits Connecting Admissions & Financial Aid Process • Apply for Admission AND • Apply for Financial Aid • Don’t wait for an admission decision to apply for financial aid • Schools will prepare & send financial aid awards once student is admitted May 1, 2013 National College Decision Date How to Apply… • Free Application for Federal Student Aid (FAFSA) • http://www.fafsa.ed.gov • Required for Federal and State fund eligibility • January 1, 2013 – March 2, 2013 • FAFSA4caster for non-seniors • PIN Number required for E-Signature • Each school has their own deadlines! • February 1, 2013 priority deadline for LMU • Estimate Information if taxes are not complete Cash for College Participate in all college information sessions at your high school Attend a Cash for College FAFSA Workshop on Saturday, January 26, 2013 for help completing the FAFSA and the Cal Grant GPA Verification Form (both due by March 2, 2013) a chance to win one of many scholarships To find a location close to you, visit: www.lacashforcollege.org Cal Grant - How to Apply • Cal Grant G.P.A. Verification Form • Check the status of your Cal Grant at • https://mygrantinfo.csac.ca.gov • March 2, 2013 • New California law states that we must check income and assets annually. • How does your High School process Cal Grant GPA Verification Forms? Undocumented Students Undocumented and under-documented students, while not eligible for federal aid, may be eligible for state aid in California start inquiring in elementary and high school to see if it is possible for the student to become a permanent resident apply for all scholarships for which the student may be eligible check with colleges and universities to see if institutional financial aid is available watch for changes in federal and state laws regarding the eligibility of undocumented or under-documented students for more information: call (213) 629-2512 For a list of scholarships, go to www.maldef.org/assets/pdf/MALDEF_Scholarship_Resource_Guide. pdf and www.latinocollegedollars.org The Expected Family Contribution (EFC) • The Expected Family Contribution (EFC) is what the family is expected to pay according to the Federal Government and the information reported on the FAFSA. • The Federal Government offers limited resources, so the entire need is not always met. • Often the families do have to pay more than the estimated EFC. • Institutions may calculate their own EFC for allocating their own limited resources by collecting CSS Profile application information. Currently, the CSS Profile is not required by LMU. The Financial Aid Formula Cost of Attendance MINUS Expected Family Contribution (EFC) EQUALS Family Financial Aid Eligibility (Need) The Formula with Numbers! School Private UC CSU CC *Est. Cost/yr. $55,000 $30,000 $20,000 $15,000 **Est. Family Contribution/yr. $10,000 $10,000 $10,000 $10,000 ***Amount of “Need” for Fin. Aid $45,000 $20,000 $10,000 $5,000 *Cost for college includes: Room & board (whether living home or on/near campus), books, fees &/or tuition. Information based on estimates provided by State information and rounded up or down. **Estimated Family Contribution would be based on the information provided on the FAFSA &/or PROFILE. Amount used above is for demonstration purposes only. *** “Need” is the difference between the two numbers. The financial package would include one or more of these items: Grants, Scholarships, Loans, Work/Study Program. Packaging Financial Aid Awards Cost of Attendance $60,000 Expected Family Contribution $20,000 Financial Need $40,000 Example Financial Aid Package Stafford Loan LMU Loan Work Study Institutional Award(s) $ 5,500 $ 2,000 $ 3,000 $25,000 Total Awarded $35,500 Unmet Need $4,500 Net Price Calculator • New regulations state that every US school must have a standardized calculator to give families an idea how much it will cost to attend. • Different schools = different calculators – Some schools use a generic calculator – Some schools have broad ranges – Some schools use the lowest estimate • Output is only as accurate as the information entered Disbursing Awards • Full Time Enrollment • Accepting, Declining & Adjusting Awards • Entrance Counseling Requirements for Loan Programs • Completing Promissory Notes • Finding Employment/Completing Time Sheets • Satisfactory Academic Progress Tips Put all deadlines on the calendar!!! File taxes early Start a financial aid file • Make copies of all documents submitted for all four years Apply for a FAFSA PIN Apply Each and Every Year Tips If you send any documents through the mail, make sure to get a certificate of mailing Research outside agencies for scholarships Review Websites Use on-line “web services tool” provided by the school Notify Financial Aid Office of any changes in family circumstances Scholarship & Application Services Be Cautious Limit Dependency Do your Homework Manage Expectations • Consultants • Scholarships Refer to institutional resources on the web Contact Information • Charles Von Der Ahe Building Suite 270 • Email: finaid@lmu.edu • Phone: 310-338-2753 • Fax: 310-338-2793 Thank you! ANY QUESTIONS?