Loan Nguyen

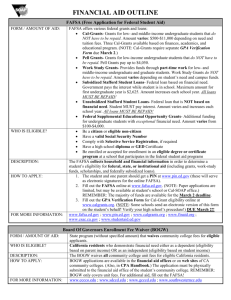

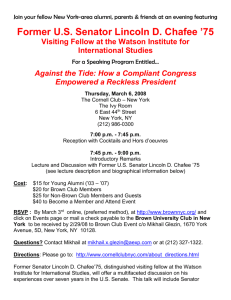

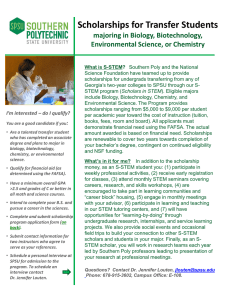

advertisement

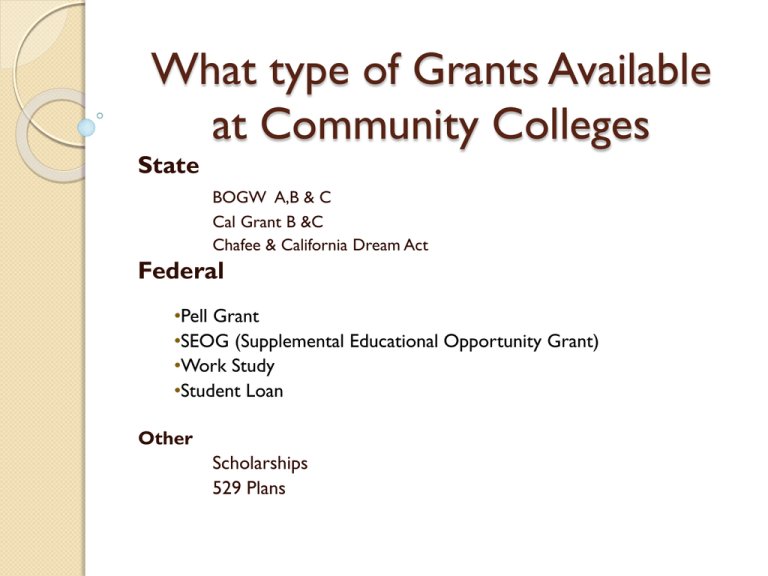

What type of Grants Available at Community Colleges State BOGW A,B & C Cal Grant B &C Chafee & California Dream Act Federal •Pell Grant •SEOG (Supplemental Educational Opportunity Grant) •Work Study •Student Loan Other Scholarships 529 Plans Board of Governors Fee Waiver for Community College California state residents Covers the cost of tuition Covers tuition fee for three semesterssummer, fall, spring Three types: A, B & C BOGW - A & B (Paper Application) BOGW-A: For students and/or a student's parent who are currently receiving some form of public assistance (AFDC, TANF, CalWORKs, SSI, and General Relief). Proof of cash benefits for the current or previous month must be provided at the time of application to be considered for a BOG A. BOGW-B: Student has to meet the income standards listed in the Total Family Income table*. Students should be prepared to show previous federal tax return(s) or other income verification. BOGW fee waiver application available at: http://extranet.cccco.edu/Divisions/StudentServices/Fin ancialAid/BOGFeeWaiverProgram.aspx Board of Governors Fee Waiver BOGFW-B 2014-2015 Income Standards* Family Size 2013 Income 1 $17,235 2 $23,265 3 $29,295 4 $35,325 5 $41,355 6 $47,385 7 $53,415 8 $59,445 Each Additional Family Member $6,030 BOGW – C (Must Completed FAFSA Application) Must have a minimum Unmet Need of $1,104 is required. Unmet Need = The difference between the college costs and the Expected Family Contribution (EFC) is the student’s remaining need as demonstrated below: Cost of Education - Expected Family Contribution (EFC) = Student’s Financial Need Cost of Education (Example) Away From Home At Home <1/2 Time Non-Resident Non-Resident (at home) Tuition $1,104.00 $1,104.00 $1,1104.00 $6,216.00 $6,216.00 Student Fee $4.00 $4.00 $4.00 $4.00 $4.00 $36.00 $36.00 $36.00 $36.00 $36.00 $1,746.00 $1,746.00 $1,746.00 $1,746.00 $1,746.00 Room & Board $11,493.00 $4,599.00 $0.00 $11,493.00 $4,599.00 Transportation $1,278.00 $1,278.00 $1,278.00 $1,278.00 $1,278.00 Personal Expense $3,132.00 $3,132.00 $0.00 $3,132.00 $3,132.00 Total $18,793.00 $11,899.00 $4,168.00 $23,950.00 $17,011.00 Health Fee Books &Supplies Who is California Dream Act Application for ? Students who meet the requirements of AB540: Attend a California high school for at least three years, Graduate from a California high school or pass the California High School Proficiency Examination(CHSPE), or obtain a Certificate of General Education Development (GED), Enroll in an accredited and qualifying California college or university, and If applicable, complete an affidavit to legalize immigration status as soon as student is eligible AB 540 students may include: Undocumented students Students who are U.S. citizens, but who are not residents of California Usually dependent students whose parents are not residents of California California Higher Education Institutions are responsible to certify student AB 540 eligibility How AB540 Students Apply for BOGW? For BOGW: A & B application available at: http://extranet.cccco.edu/Divisions/St udentServices/FinancialAid/BOGFee WaiverProgram.aspx For BOGW: C Application available at: www.caldreamact.org Types of Cal-Grants from Community College Cal Grant B Entitlement and Competitive Awards provide a living allowance and tuition and fee assistance to very low-income students. Students attending community college can only receive the living allowance portion of Cal Grant B. Meet the income and asset ceilings Must have at least $700 in financial need Maximum Award $1,473 (year) GPA minimum 2.00 Cal Grant C Assists with books, tools and equipment for occupational or vocational programs. Maximum Award $547 (year) General Requirements for Cal Grants Including CA Dream Act Be a resident of California or be AB540 eligible Be a U.S. citizen, permanent resident or eligible non-citizen or be AB 540 eligible Attend an eligible California school Meet Selective Service requirements Not be in default on a student loan Not have earned a bachelor’s degree Maintain satisfactory academic progress Be enrolled at least half-time GPA Verification Graduating High School seniors must have GPA verification data submitted by their High School. Inquire at your home HS concerning the paper GPA verification form. Most student will not need to submit a paper form. CCC transmits eligible GPA’s electronically to the Student Aid Commission. Reestablished GPAs may be submitted for Community College competitive Cal Grant B awards once a student has completed 16 degree applicable credits. GPA Verifications due by: March 2, 2014 and September 2, 2014 (only for students attending a community college) For more information on Cal-grant, please visit http://www.csac.ca.gov WebGrants for Students (WGS) www.webgrants4students.org Provide students online access to California assistance and more. Access available after the FAFSA is filed Check application and award status Verify and update e-mail and mailing address View payment history Simulate Cal Grant status at eligible California schools Request a leave of absence Self-certify high school graduation Select links to other financial aid information sites Chafee Grant The California Chafee Grant program provides up to $5,000 annually to current and former foster youth for college or vocational training at any accredited college in the U.S., based on available funding To be eligible, foster youth must have been in California foster care on their 16th birthday and not have reached their 22nd birthday before July 1, 2014 Foster youth are encouraged to apply during their senior year of high school To apply, the foster youth must complete: 1. 2014-2015 FAFSA 2. California Chafee Grant Program Application To apply go to: www.chafee.csac.ca.gov AB540 students may also be eligible Federal Financial Aid (Pell Grant) Grants from the federal government to assist students cover the cost of educational expenses Based on Financial need. Beginning in Fall 2012, students are now limited to 12 semesters or 600% of Pell grant eligibility during their lifetime. Students can check their remaining Lifetime Eligibility used at NSLDS.ed.gov Maximum Award $5,730 (year) for 2014-15 To apply: Complete Free Application for Federal Student Aid Application available online at http://www.fafsa.ed.gov/ Federal Financial Aid (SEOG Grant) Based on financial need. Complete FAFSA application as early as January 1st of each academic year Amounts vary depending upon Home College enrollment and the amount of funding available at that College. Because funds are limited, students who apply early and are eligible for the Pell Grant receive first priority consideration for the SEOG grant. Federal Work Study (FWS) FWS is employment financed primarily with federal funds. Students who apply for financial aid, demonstrate financial need for FWS and indicate they will accept work will be considered for Work Study The amount a student may earn depends on the amount of the student’s award which is determined by the College Financial Aid Office based on the funds available at the College Students must be enrolled at least ½ time There are also some off-campus jobs available with non profit organizations Student Loans Two types of loans: ◦ Subsidized Loan – interest is paid by federal government while attending college $3,500 1st year $4,500 2nd year ◦ Unsubsidized Loan – no interest subsidy $6,000 for independent students $2,000 for dependent students At community colleges, student loans are not automatically included in the student’s award letter ◦ Students will need to submit a request Colleges may require additional steps, for example: ◦ Financial literacy – online or in-person ◦ In-person or group workshops Scholarships At community colleges, scholarships may be administered by Financial Aid Office or college Foundation. Students are encouraged to visit the college’s scholarship website for college specific scholarships. Students should compile a portfolio of reference letters from counselors/teachers as well as personal statement that details various clubs, volunteer activities, community services, awards and commendations earned by the students for Civic activities. Scholarship awards are included in the student’s award letter ◦ Affects the student’s financial need ◦ Example: Scholarships continue… Cost of Attendance $18,000 EFC 0_________ Financial Need $18,000 Pell Grant $5,000 Federal Work-Study $4,000 Scholarship $6,000_____ Unmet financial need $3,000 Free scholarship search engines: From LOCAL organizations such as Unions, hospitals, local lodges such as Lions or Elks, local business organizations. Business Women‘s organization such as Soroptimists International…etc. Connecting students and parents to scholarships notifications that come through your office. ◦ Fast Web www.fastweb.com ◦ Wired Scholar www.wiredscholar.com ◦ College Board http://apps.collegeboard.com/cbsearch_ss/welcome.jsp 529 Plans A plan operated by a State educational institution In California contact www.SCHOLARSHARE.com Earnings not subject to Federal/State tax May be purchased by parent/grandparent Designated beneficiary use for qualifying education expenses such as tuition, fees books (including cost of computer technology) Contributions to a 529 Plan are NOT deductible Another reference www.collegesavings.org When/What To Apply Apply for Federal/State Grants beginning January 1, 2014, for use in the Fall of 2014 Apply for Fee Waiver (BOG) if attending a CA Community College Apply for institutional aid and college scholarships such as UC Grants and State University Grants if attending a CA State College or University Questions and Answers Thank you!