Chapter - 1 - Learning Financial Management

advertisement

Venture Capital Financing By- Rahul Jain What Is Venture Capital? High Risk Capital Seeking 50%+ Annual Rates of Return Active Investors Who Will Step In and Make Changes to Protect Their Investment Experienced Investors Who Know How to Build Large Companies 2 Some Statistics 99%+ of All Startups Do Not Require Institutional Venture Capital VCs average initial investment is $3M+ Average Dilution from Initial VC Investment is 40%+ VCs look at over 100 business plans for every one they finance 3 Features of Venture Capital Equity Participation. Long-term Investments. Participation in Management. Venture capitalist combines the qualities of bankers, stock market investors and entrepreneur in one. 4 When Is VC Good Heavy R&D Component of the business Semi conductors Biotech Datacomm Equipment Very Large Opportunity Requiring A Lot of Working Capital Federal Express Amazon.com 5 When is VC Wrong For You Too Early – You Don’t Have Enough to Show Yet (Revenues, Product, Team) Too Small – You Only Need A Couple Million to Get Profitable Not Proprietary – Your Business Has No Barriers to Entry. It is Just An Execution Game. 6 When Is VC Wrong For You [continued] You Need to Move Fast Raising VC takes 3-6 months minimum You Are Dilution Sensitive You Need To Be In Control You Don’t Need It 7 Stages in Venture Financing Early Stage Financing Expansion Financing Acquisition/Buyout Financing 8 Venture Capital Investment Process Deal Origination Screening Evaluation Deal Structuring Post-investment activity Exit 9 Methods of Venture Financing Equity Conditional Loan Income Note Other Financing Methods 1. 2. 3. 4. 5. 6. 7. Participating Debentures Partially Convertible Debentures Cumulative Convertible Preference Shares Deferred Shares Convertible Loan Stock Special Ordinary Shares Preferred Ordinary Shares 10 Disinvestment Mechanisms Buybacks Initial Public Offerings Secondary Stock Markets 11 Entrepreneurs’ Role Entrepreneurs are drivers of innovations, of job creation and of economic development. Entrepreneurship should be advocated and supported by the entire business world. Entrepreneurs in developed economies consider the primary contribution of the venture capitalists to be other than financial. Assistance with recruitment, financial planning, strategic partnering and complex negotiations are important contributions of VCs. 12 Entrepreneurial Requirement To build entrepreneurial companies, there is need To develop service infrastructure. To reduce bureaucracy with regard to the creation of small businesses. To provide adequate incentives for entrepreneurs by reforming tax treatment of stock options and capital gains. To reform labour laws that takes into account the needs and limitations of small businesses. 13 Future Prospects of Venture Financing Rehabilitation of sick units. Assist small ancillary units to upgrade their technologies. Provide financial assistance to people coming out of universities etc. 14 Success of Venture Capital Entrepreneurial Tradition. Unregulated Economic Environment. Disinvestment Avenues. Fiscal Incentives. Broad Based Education. Venture Capital Managers. Promotion Efforts. Institute Industry Linkage. R&D Activities. 15 References Financial Management by I.M. Pandey 16

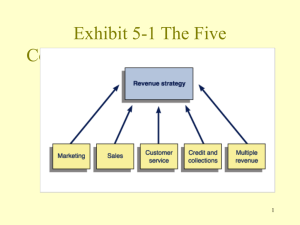

![[08]. Informal Risk Capital, Venture Capital and Going Public](http://s2.studylib.net/store/data/005328960_1-aef9a6c6e6610b4c0a3f3db1e76a505d-300x300.png)