AGENDA - UniQure

advertisement

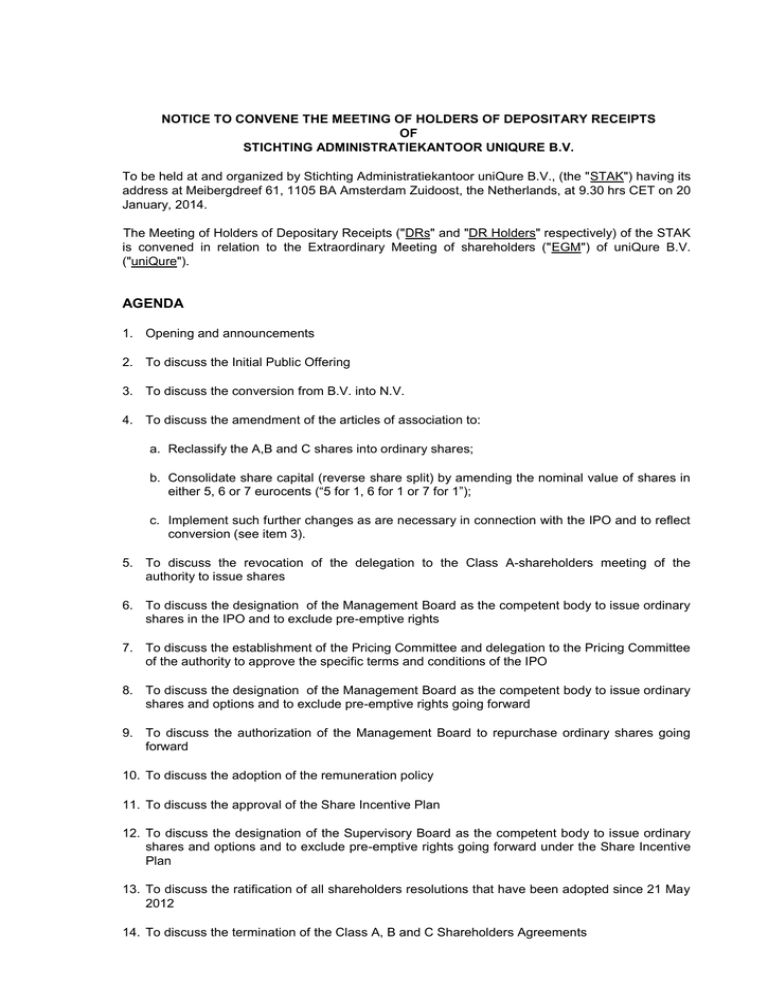

NOTICE TO CONVENE THE MEETING OF HOLDERS OF DEPOSITARY RECEIPTS

OF

STICHTING ADMINISTRATIEKANTOOR UNIQURE B.V.

To be held at and organized by Stichting Administratiekantoor uniQure B.V., (the "STAK") having its

address at Meibergdreef 61, 1105 BA Amsterdam Zuidoost, the Netherlands, at 9.30 hrs CET on 20

January, 2014.

The Meeting of Holders of Depositary Receipts ("DRs" and "DR Holders" respectively) of the STAK

is convened in relation to the Extraordinary Meeting of shareholders ("EGM") of uniQure B.V.

("uniQure").

AGENDA

1. Opening and announcements

2. To discuss the Initial Public Offering

3. To discuss the conversion from B.V. into N.V.

4. To discuss the amendment of the articles of association to:

a. Reclassify the A,B and C shares into ordinary shares;

b. Consolidate share capital (reverse share split) by amending the nominal value of shares in

either 5, 6 or 7 eurocents (“5 for 1, 6 for 1 or 7 for 1”);

c. Implement such further changes as are necessary in connection with the IPO and to reflect

conversion (see item 3).

5. To discuss the revocation of the delegation to the Class A-shareholders meeting of the

authority to issue shares

6. To discuss the designation of the Management Board as the competent body to issue ordinary

shares in the IPO and to exclude pre-emptive rights

7. To discuss the establishment of the Pricing Committee and delegation to the Pricing Committee

of the authority to approve the specific terms and conditions of the IPO

8. To discuss the designation of the Management Board as the competent body to issue ordinary

shares and options and to exclude pre-emptive rights going forward

9. To discuss the authorization of the Management Board to repurchase ordinary shares going

forward

10. To discuss the adoption of the remuneration policy

11. To discuss the approval of the Share Incentive Plan

12. To discuss the designation of the Supervisory Board as the competent body to issue ordinary

shares and options and to exclude pre-emptive rights going forward under the Share Incentive

Plan

13. To discuss the ratification of all shareholders resolutions that have been adopted since 21 May

2012

14. To discuss the termination of the Class A, B and C Shareholders Agreements

15. Any other business

16. Closing of the meeting

2

The explanatory notes to the agenda and other information are available for inspection as of the date

hereof. These items can be obtained free of charge at the STAK’s offices, Meibergdreef 61, 1105 BA

Amsterdam, the Netherlands and at the STAK's website (www.uniQure.com/investors). For DR Holders that

hold NPEX DRs (as defined below) the explanatory notes to the agenda and other information are also

available via the NPEX website (www.npex.nl) on a dedicated environment for DR Holders that hold NPEX

DRs.

Record Date and relevant register

For this meeting, those entitled to vote and/or attend the DR Holders’ Meeting are those who:

(i)

on 17 January 2014, after processing of all debit entries and transfers, are registered in

one of the designated (sub) registers (the "Record Date").

Designated as (sub)register for holders of depositary receipts traded through the

Nederlandsche Participatie Exchange ("NPEX DRs") and other depositary receipts ("NonTraded DRs") are respectively the administration/records of Stichting Bewaarbedrijf NPEX

and the administrations of the banks and brokers which are intermediaries according to the

Dutch Securities Giro Transactions Act (‘Wet giraal effectenverkeer’) with Euroclear

Nederland ("Intermediaries"), all as per the Record Date; and

(ii)

have duly registered for participation in the DR Holders’ Meeting.

Participation in the DR Holders' Meeting

The DR Holder who chooses to participate in the DR Holders’ Meeting may register via his bank in writing

until 17:00 hrs. CET on 17 January 2014, to Kempen & Co N.V., Beethovenstraat 300, 1077 WZ

Amsterdam, The Netherlands or via telefax: +31 20 348 9549 or email proxyvoting@kempen.nl, at which

application a confirmation must be submitted from the Intermediaries in whose administration that holder of

DRs is registered, that the DRs concerned were registered in the name of that holder on the Record Date.

The acknowledgement of receipt provided will be valid as an attendance card to the meeting. Kempen & Co

N.V. shall arrange for deposit of these applications at the STAK‘s office address.

Proxy and Instruction to Vote at DR Holders’ Meeting and EGM of uniQure

The DR Holder who chooses to have himself represented at the DR Holders’ Meeting and who chooses to

give instructions to the STAK how to vote in the EGM on the shares B in the capital of uniQure for which

DRs were issued must – in addition to the application requirements stated above – provide uniQure

with a proxy to that effect. DR Holders are required to use a form, which either can be obtained from 17

January 2014 via Kempen & Co N.V., fax number: +31 20 348 9549 or e-mail: proxyvoting@kempen.nl or

can be downloaded from the STAK’s website (www.uniQure.com/investors). The completed form, duly

completed by the DR holder, must have been received by Kempen & Co N.V. by 17.00 CET on 17 January

2014 ultimately.

Receipt of proxy forms and voting instruction forms can be rejected after this time deadline.

Persons entitled to attend the DR Holders’ meeting may be asked for identification prior to being admitted

by means of a valid identity document, such as a passport or driver’s license.

3

Explanatory notes to the agenda for the Meeting of Holders of Depositary Receipts ("DRs" and "DR

Holders" respectively) of the STAK in relation to the Extraordinary General Meeting of shareholders

("EGM") of uniQure B.V. ("uniQure") to be held on 20 January 2014.

These explanatory notes and other information are available for inspection as of the date hereof. These

items can be obtained free of charge at the STAK's office address and at the STAK's website

(www.uniqure.com/investors).

_____________________________________________________________________________________

General

The items 2 through and including 14 are all subject to the IPO effectively taking place at the envisaged

closing date (the "Closing Date") with the exception of items 5, 7, and 13.

Agenda item 2: Initial Public Offering

It is proposed that the Company makes a public offering and issues ordinary shares in the capital

of the Company in the IPO. It is proposed that the Company will take any necessary actions to

have the ordinary shares listed on NASDAQ (the "Listing") and that a registration statement,

including a prospectus related to the IPO, be filed with the United States Securities and Exchange

Commission . In relation to the IPO it is proposed that an underwriting agreement be entered into

by the Company and a group of underwriters including Jefferies and Leerink Swann (the

"Underwriters").

In connection therewith, it is proposed that the IPO and the Listing are approved all within and

subject to the terms and conditions set forth under 6 and 7 below.

Agenda item 3: Conversion from B.V. into N.V.

Given the envisaged IPO, it is proposed to convert ('omzetten'), the Company from a 'besloten

vennootschap met beperkte aansprakelijkheid' ("BV") into a 'naamloze vennootschap' ("NV")

since the NV legal form is the appropriate form for a listed company.

In connection therewith, it is further proposed to amend the articles of association of the Company

integrally in accordance with the draft presented and explained under item 4 of the Agenda.

The conversion will be effective as per the Closing Date.

Agenda item 4: Amendment of the articles of association

It is proposed that in connection with the conversion ('omzetting') of the Company from a B.V. into

an N.V., the articles be integrally amended and revised in accordance with the draft submitted to

the EGM. As part of the amendment of the articles, the current different classes of shares (Class

A, Class B and Class C) will be reclassified into ordinary shares as per the Closing Date.

The articles as amended in accordance with this proposal are hereafter referred to as the New

Articles.

It is further proposed that the Pricing Committee to be installed pursuant to item 7 of the agenda

be authorised to decide on the definitive nominal value of each share by opting either 0.06 euro

each or 0.07 euro instead of the proposed 0.05 euro as indicated in the draft and consequently on

the final ratio of the reverse share split (5:1, 6:1 or 7:1).

Finally it is proposed to authorise each member of the Management Board and each (deputy)

civil-law notary or notarial employee of Holdinga Matthijssen Kraak in Amsterdam to sign and

execute the deed of conversion and amendment.

The amendment of the articles of association will be effective as per the Closing Date.

4

Agenda item 5: Revocation of delegation to issue shares

To date the authority to issue new Class A and Class B shares as well as the authority to exclude

or limit the pre-emptive rights of shareholders in respect thereto has been designated to the Class

A Meeting. As the different classes of shares will be reclassified into one single class of ordinary

shares per the Closing Date, whilst it is also proposed that the Management Board will be

designated as the competent body to issue the new ordinary shares and exclude and limit preemptive rights of shareholders pursuant to items 6 and 8 of the Agenda, it is proposed to revoke

the current authority of the Class A Meeting. Pursuant to Dutch law the present authorities will

vest again in the General Meeting as a result of the proposed revocation.

Agenda item 6: Designation of Management Board as the competent body to issue

ordinary shares in the IPO

It is proposed that the Management Board is hereby designated as the competent body to issue

and sell in the IPO such number of ordinary shares, including ordinary shares to cover overallotments, if any, as necessary to raise an amount of up to USD 75 million, and to exclude preemptive rights in connection therewith, on such further terms and conditions as approved and

confirmed by the Pricing Committee in accordance with the delegation under 7 of the agenda.

Agenda item 7: Establishment of Pricing Committee and delegation

It is further proposed that a pricing committee is installed comprised of Ferdinand Verdonck

(chairman), Sander Slootweg, Sander van Deventer, Jörn Aldag, Piers Morgan, Philip AstleySparke and Edwin de Graaf (the "Pricing Committee") and that the general meeting of

shareholders delegates to the Pricing Committee the authority, acting by majority vote (by

meeting, telephone conference call or written action in lieu of a meeting) for and in the name of

the Company, to approve the specific terms and conditions of the IPO, including, without

limitation, the maximum aggregate offering price of the ordinary shares to be sold, the actual

number of ordinary shares to be sold, the per ordinary share price at which the ordinary shares

shall be offered to the public, and the per ordinary share price at which the ordinary shares shall

be sold to the Underwriters pursuant to the Underwriting Agreement and to determine the

definitive nominal value of each share and so the final ratio of the reverse share split.

Agenda item 8: Designation of Management Board as the competent body to issue

ordinary shares going forward

It is proposed that the Management Board is hereby designated as the competent body to issue

ordinary shares and to grant rights to subscribe for ordinary shares for a term of 18 months with

effect from the Closing Date and to limit or exclude pre-emptive rights in connection therewith.

The power of the Management Board will include, for the period after the Closing Date, a

maximum of 19.9% of the total issued and outstanding ordinary share capital at the time of

issuance.

It is acknowledged that pursuant to the New Articles a resolution of the Management Board to

issue ordinary shares or to limit or exclude pre-emptive rights of existing shareholders with

respect thereto will be subject to the approval of the Supervisory Board.

This designation will allow the Management Board to be flexible and react quickly, if and when

deemed appropriate, without prior approval from the shareholders. The designation can be used

for any and all purposes, subject to statutory limitation and with the exception of awards under the

2014 Plan (see under 11 below).

5

Agenda item 9: Authorization of Management Board to repurchase ordinary shares going

forward

It is proposed that the Management Board is hereby authorized with effect from the Closing Date

to resolve on the acquisition by the Company of its own fully paid-up ordinary shares, for a

maximum of 10% of the issued share capital immediately following the Closing Date, within the

limits of Dutch law and the New Articles through a purchase on the stock exchange or otherwise

for a term of 18 months against a repurchase price between, on the one hand, the nominal value

of the ordinary shares concerned and, on the other hand, an amount of 110% of the highest price

of the ordinary shares officially quoted on any of the official stock markets the Company is listed

on any of 30 banking days preceding the date the repurchase is effected or proposed. It is

acknowledged that pursuant to the New Articles a Management Board resolution to repurchase

ordinary shares will be subject to the approval of the Supervisory Board.

Agenda item 10: Adoption of the Remuneration Policy

It is proposed that the general meeting of shareholders adopts the remuneration policy for the

Management Board as presented to the EGM and as approved by the Supervisory Board upon

recommendation of its Remuneration Committee. This proposed policy has been developed in

view of external market developments, taking into account the principles and best practice

provisions of the Dutch Corporate Governance Code. The Supervisory Board seeks to achieve

three broad goals in connection with the Remuneration Policy and decisions regarding individual

compensation of the members of the Management Board:

to enable uniQure to attract, motivate an retain executives who are capable of leading the

Company in achieving its business objectives.

to create a performance-oriented environment for the Company’s executives.

to provide members of the Management Board with an equity interest in the Company so as

to link a portion of their remuneration with the long-term performance of uniQure’s ordinary

shares and to align their interest with those of the shareholders.

Agenda item 11: Approval of Share Incentive Plan

It is proposed that the general meeting of shareholders approves the 2014 Share Incentive Plan

(the “2014 Plan”), in the form presented to the EGM pursuant to which the Company may grant

incentive share options, non-statutory share options, share appreciation rights, restricted share

awards, restricted share units and other share-based or cash-based awards for the purchase of

such number of shares as is equal to 15 percent of the fully diluted number of ordinary shares as

of the Closing Date.

The purpose of the 2014 Plan is to enable the Company to attract, retain and motivate members

of the Management Board, the Supervisory Board, employees and other individuals having

business relationships with the Company and to reward such persons for their loyalty and

commitment.

Agenda item 12: Designation of the Supervisory Board as the competent body to issue

ordinary shares and options and to exclude pre-emptive rights going forward under the

Share Incentive Plan

It is proposed that the Supervisory Board is hereby designated as the competent body to issue

ordinary shares and to grant rights to subscribe for ordinary shares under the 2014 Plan for the

duration of the 2014 Plan with effect from the Closing Date, and to limit or exclude pre-emptive

rights in connection therewith. This authority is limited to such number of ordinary shares as is

equal to 15 percent of the fully diluted number of ordinary shares as of the Closing Date. It is

further proposed to the general meeting of shareholders to approve that this maximum number of

ordinary shares be reserved for issuance under and pursuant to the 2014 Plan.

6

Agenda item 13: Ratification of all shareholders resolutions that have been adopted since

21 May 2012

It is proposed that the general meeting of shareholders, to the extent necessary, adopts,

approves, ratifies and confirms all actions taken and things done by the shareholders, supervisory

directors and managing directors of the Company since 21 May 2012, as the same appear of

record or were taken or done, whether or not in the usual course of business through the present

date, whether or not in accordance with the articles as then currently in effect, whether or not

evidenced by records contained in the minute books of the Company, whether or not taken or

done at a meeting that was properly called or held at a proper time and place or with a proper

quorum, whether or not taken or done by the holders of the requisite number of shares or by the

requisite number of directors and whether or not the directors were properly elected and qualified.

Agenda item 14: Termination of Class A, Class B and Class C Shareholders Agreements

It is proposed to terminate each of the Class A, Class B and Class C Shareholders Agreements in

respect of the Company, effective upon the Closing Date.

7

Stichting Administratiekantoor uniQure B.V.

Proxy / Voting instruction DR Holders Meeting

The undersigned:

_______________________________(full name),

a company / private person residing at

_______________________________(place of residence),

acting in his/its capacity as holder of _______________________________depositary receipts issued for

shares b in the capital of uniQure B.V., having its address at Meibergdreef 61, 1105 BA Amsterdam

Zuidoost, the Netherlands ("uniQure").

Hereby grants full proxy and power of attorney to:

[ ] each member of the Board of Stichting Administratiekantoor uniQure B.V. ("STAK"), having its address

at Meibergdreef 61, 1105 BA Amsterdam Zuid Oost, the Netherlands, or

[ ] ____________________________________________________ (full name proxyholder)

(Please tick the relevant box, and if the proxy and power of attorney is granted to someone else than the

STAK's Board members, please clearly print the full name of the proxyholder on the above line).

to represent the undersigned, with the right of substitution, in the DR Holders’ Meeting of the STAK, which

will be held on 20 January 2014 at 9.30 hrs in Amsterdam and to vote on behalf of the undersigned in any

and all matters that will be proposed to the depositary receipt holders of the STAK, with all powers which

the undersigned would possess and would be able to execute if personally present at said meeting, and to

resolve on any and all matters which the proxyholder may deem necessary and appropriate, subject to and

in accordance with the instructions below acknowledging that no matter is scheduled for voting but rather

for discussion purposes only.

Signed in: _______________________________________ (Place) on:______________ 2014.

By:

Title:

8

STICHTING ADMINISTRATIEKANTOOR UNIQURE B.V.

Voting instruction EGM

The undersigned:

_______________________________(full name),

a company / private person residing at

_______________________________(place of residence),

acting in his/its capacity as holder of _______________________________depositary receipts issued for

shares b in the capital of uniQure B.V., having its address at Meibergdreef 61, 1105 BA Amsterdam

Zuidoost, the Netherlands ("uniQure").

Hereby instructs:

[ ] each member of the Executive Board of Stichting Administratiekantoor uniQure B.V. ("STAK"), having

its address at Meibergdreef 61, 1105 BA Amsterdam Zuidoost, the Netherlands,

to vote on behalf of the undersigned in any and all matters that will be proposed to the shareholders of

uniQure in the EGM of Shareholders of uniQure to be held on 20 January 2014, and to resolve on any and

all matters which the STAK may deem necessary and appropriate, subject to and in accordance with the

instructions below.

9

Direction for voting on the following matters:

Resolution to make a public offering and issue ordinary

shares in the capital of the company in the IPO (agenda

item 2)

Resolution to convert the company from a BV into a NV

(agenda item 3)

Resolution to amend and revise

the articles of

association in accordance with the draft submitted to the

EGM (agenda item 4)

Resolution to revoke the delegation to issue shares

(agenda item 5)

Resolution to designate the management board as the

competent body to issue ordinary shares in the IPO

(agenda item 6)

Resolution to establish the pricing committee and

delegation (agenda item 7)

Resolution to designate the management board as the

competent body to issue ordinary shares going forward

(agenda item 8)

Resolution to authorise the management board to

repurchase ordinary shares going forward (agenda item

9)

Resolution to adopt the remuneration policy (agenda

item 10)

Resolution to approve the share incentive plan (agenda

item 11)

Resolution to designate the supervisory board as the

competent body to issue ordinary shares and options

and to exclude pre-emptive rights going forward under

the share incentive plan (agenda item 12)

Resolution to ratify all shareholders resolutions that have

been adopted since 21 May 2012 (agenda item 13)

In favour

Against

Abstain

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

Signed in: _______________________________________ (Place) on:_______ 2014.

By:

Title:

10