Shareholders’ Equity:

Capital

Chapter 11

McGraw-Hill/Irwin

Copyright © 2010 by The McGraw-Hill Companies, Inc. All rights reserved.

Corporations

An entity created

by law.

Existence is

separate from

owners.

Ownership

can be

Privately, or

Closely Held

Has rights and

privileges.

Publicly Held

11-2

Advantages of Incorporation

Limited personal

liability for

shareholders

Transferability of

ownership

Professional

management

Continuity of

existence

11-3

Disadvantages of Incorporation

Heavy taxation

Greater regulation

Cost of formation

Separation of

ownership and

management

11-4

Formation of a Corporation

• Each corporation is formed

according to the laws of

the place or country where

it is located.

The costs

associated with

incorporation are

usually expensed

immediately.

• The application for

corporate status is

supported by the

Memorandum and Articles

of Incorporation.

11-5

Rights of Shareholders

Voting (in person

or by proxy).

Rights

Shareholders

Proportionate

distribution of

dividends.

Proportionate

distribution of

assets in a

liquidation.

11-6

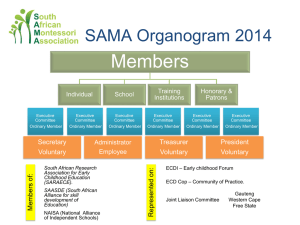

Rights of Shareholders

Corporate Organization Chart

Ultimate

control

Shareholders

Shareholders

usually meet

once a year.

Board of Directors

President

Secretary

Treasurer

Controller

Other Vice

Presidents

11-7

Functions of the Corporate

Officers

Corporate Organization Chart

Contractual and legal

representation

Custodian of

funds

Shareholders

Board of Directors

Chief

Accountant

President

Secretary

Treasurer

Controller

Other Vice

Presidents

11-8

Publicly Owned Corporations Face

Different Rules

By law, publicly owned corporations must:

Prepare financial statements in accordance with

relevant accounting standards, e.g. IFRS.

Have their financial statement audited by an

independent CPA.

Comply with relevant rules and regulations.

Submit financial information for relevant authority

for review.

11-9

Shareholder Records in a

Corporation

Shareholder ledgers are often maintained by a

share transfer agent or share registrar.

Shareholders usually meet once a year.

Each unit of ownership is called a share.

Share certificates serve as proof that a

shareholder has purchased shares.

When the share is sold, the shareholder signs a

transfer endorsement on the back of the share

certificate.

11-10

Shareholders’ Equity of a

Corporation

Shareholders' equity is

increased in two ways.

Contributions by

investors in exchange

for share.

Retention of profits

earned by the

corporation.

Paid Capital

Retained Earnings

11-11

Authorization and Issuance

of Share Capital

Authorized

Shares

The maximum

number of

shares that can

be sold to the

public.

11-12

Authorization and Issuance

of Share Capital

Authorized

Shares

Usually

shares are

sold

through an

underwriter.

Issued

shares are

authorized

shares that

have been

sold.

Unissued

shares are

authorized

shares that

never have

been sold.

11-13

Authorization and Issuance

of Share Capital

Outstanding shares are

issued shares that are

owned by

shareholders.

Authorized

Shares

Issued

Shares

Outstanding

Shares

Treasury

Shares

Unissued

Shares

Treasury shares are

issued shares that

have been reacquired

by the corporation.

11-14

Shareholders’ Equity

• Par value is an arbitrary amount assigned

to each share when it is authorized.

• Market price is the amount that each

share will sell for in the market.

11-15

Shareholders’ Equity

Ordinary share can be issued in three forms:

Par Value

Ordinary

Share

No-Par

Ordinary

Share

Stated Value

Ordinary

Share

Let’s examine this

form of share.

All proceeds

credited to

Ordinary Share

Capital

Treated like par

value ordinary

share

11-16

Issuance of Par Value Share

Record:

1. The cash received.

2. The number of shares issued × the par value

per share in the Ordinary Share account.

3. The remainder is assigned to Share Premium

(or Additional Paid-in Capital).

Assume a corporation issues 10,000 shares

of its $2 par value share for $25 per share.

11-17

Issuance of Par Value Share

Assume a corporation issues 10,000 shares

of its $2 par value share for $25 per share.

Description

Cash

Ordinary Share

Share Premium

Debit

Credit

250,000

20,000

230,000

10,000 × $2 = $20,000

11-18

Issuance of Par Value Share

Shareholders' Equity with Ordinary Share

Shareholders' Equity

Contributed capital:

Ordinary share - $2 par value; 50,000 shares

authorized; 10,000 shares issued and

outstanding

Share premium

Retained earnings

Total shareholders' equity

$

20,000

230,000

65,000

$ 315,000

11-19

Preference Share

A separate class of share, typically having

priority over ordinary shares in . . .

Dividend distributions (rate is usually stated).

Distribution of assets in case of liquidation.

Specific characteristics (say redeemable) can

affect its presentation in the balance sheet as

liabilities (IAS 32).

Other Features Include:

Cumulative

dividend

rights.

Usually

callable by

the company.

Normally has

no voting

rights.

11-20

Cumulative Preference Share

Cumulative

Dividends in

arrears must be

paid before

dividends may be

paid on ordinary

share.

Vs.

Noncumulative

Undeclared

dividends from

current and prior

years do not have

to be paid in future

years.

11-21

Share Preferred as to Dividends

Example: Consider the following partial

Statement of Shareholders’ Equity.

Ordinary shares, $50 par value; 4,000 shares

authorized, issued and outstanding

Preference shares, 9%, $100 par value; 1,000

shares authorized, issued and outstanding

Total contributed capital

$ 200,000

100,000

$ 300,000

During 2008, the directors declare cash

dividends of $5,000. In 2009, the directors

declare cash dividends of $42,000.

11-22

Share Preferred as to Dividends

Preferred

If Preference

Share

Noncumulative:

Preferred Stock

is is

Noncumulative:

Year 2008 $5,000 dividends declared

$

Year 2009

Step 1: Current preference

dividend

$

preferred dividend

Step 2: Remainder to ordinary

commonshareholders

shareholders

If Preference

Share

Cumulative:

Preferred Stock

is is

Cumulative:

Year 2008 $5,000 dividends declared

$

Year 2009

Step 1: Dividends in arrears

$

Step 2: Current preference

dividend

preferred dividend

Step 3: Remainder to ordinary

commonshareholders

shareholders

Totals

$

5,000

Common

$

-

$

33,000

$

-

$

$

29,000

29,000

9,000

5,000

4,000

9,000

13,000

11-23

Other Features of Preference

Share

I just converted 100 shares

of preference share into

1,000 ordinary shares and

ended up with a higher

dividend yield!

Gee, I can’t do

that with MY

preference share!

Some preference

share is

convertible into

ordinary shares.

11-24

Preference Share

Shareholders' Equity with Ordinary and Preference Share

Shareholders' Equity

Contributed Capital:

Preference Share - $100 par value; 1,000 shares

authorized; 50 shares issued and

outstanding

$

5,000

Ordinary Shares - $10 par value; 50,000 shares

authorized; 30,000 shares issued and

outstanding

300,000

Share Premium

1,000

Retained Earnings

65,000

Total Shareholders' Equity

$

371,000

11-25

Market Value

Accounting by

the issuer.

Ordinary share is

carried at original issue

price.

Accounting by

the investor.

Investments in

marketable securities

are carried at market

value.

11-26

Market Price of Preference Share

Factors affecting market price of preference share:

• Dividend rate

• Risk

• Level of interest rates

The return based on the

market value is called the

“dividend yield.”

11-27

Market Price of Ordinary Share

Factors affecting

market price of

ordinary share:

Investors’

expectations of

future profitability.

Changes in

market value

have no impact

on the books

of the issuer.

Risk

that this level

of profitability will

not be achieved.

11-28

Book Value per Share

of Ordinary Share

Preference share and preference

dividends in arrears are deducted

from total shareholders’ equity.

Total Shareholders’ Equity

Number of Ordinary Shares Outstanding

Book Value ≠ Market Value

11-29

Share Splits

Companies use

share splits to

reduce market

price.

Outstanding

shares increase,

but par value is

decreased

proportionately.

Ice Cream Parlor

Share Splits

Now

Available

11-30

Share Split

Assume a corporation has 5,000 shares

of $1 par value ordinary share

outstanding before a 2–for–1 share split.

Ordinary Shares

Before Split

5,000

After Split

10,000 Increase

Par Value per Share

$

1.00

$

Total Par Value

$

5,000

$

0.50 Decrease

No

5,000 Change

11-31

Treasury Share

Treasury

shares are

issued

shares that

have been

reacquired

by the

corporation.

When share is reacquired, the corporation

records the treasury share at cost.

11-32

Recording Purchases of

Treasury Share

Riley Corporation reacquires 3,000 shares

of its ordinary share at $55 per share.

Prepare the journal entry to record the

purchase of treasury share.

Description

Description

Treasury Share

Stock

Cash

Debit

Debit

Credit

Credit

165,000

165,000

3,000 shares × $55 = $165,000

11-33

Recording Purchases of

Treasury Share

Riley Corporation reissued 1,000 shares of

the treasury share originally purchased for

$55 per share. The shares were reissued at

$75 per share.

1,000 shares × $75 = $75,000

Description

Cash

Treasury Share

Share Premium: Treasury Share

Debit

Credit

75,000

55,000

20,000

1,000 shares × $55 cost = $55,000

11-34

Shareholders’ Equity Presentation

Shareholders' Equity

Contributed capital:

Preference Share - $100 par value; 1,000 shares

authorized; 50 shares issued & outstanding

Ordinary Share - $10 par value; 50,000 shares

authorized; 30,000 shares issued and

outstanding

Share Premium

Retained earnings

Subtotal

Less: Treasury share

Total Shareholders' equity

$

$

$

5,000

300,000

21,000

65,000

391,000

110,000

281,000

11-35

Share Buyback Programs

Some corporations have buyback programs, in which

they repurchase large amounts of their own ordinary

share. As a result of these programs, treasury share

has become a material item in the balance sheet of

many corporations.

Share option plans are an important part of employee

compensation for many companies. Treasury share

purchases are an effective means by which the

company can have available the shares needed to

satisfy the requirement of share option plans to issue

the shares to employees.

11-36

Financial Analysis and

Decision Making

Return on

Total Assets =

Return on Ordinary

Shareholders’ Equity =

Profit

Average Total Assets

Profit – Preference Dividends

Average Ordinary Shareholders’ Equity

11-37

End of Chapter 11

11-38