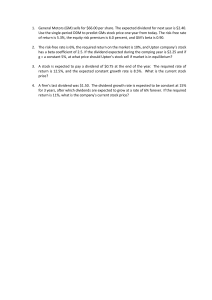

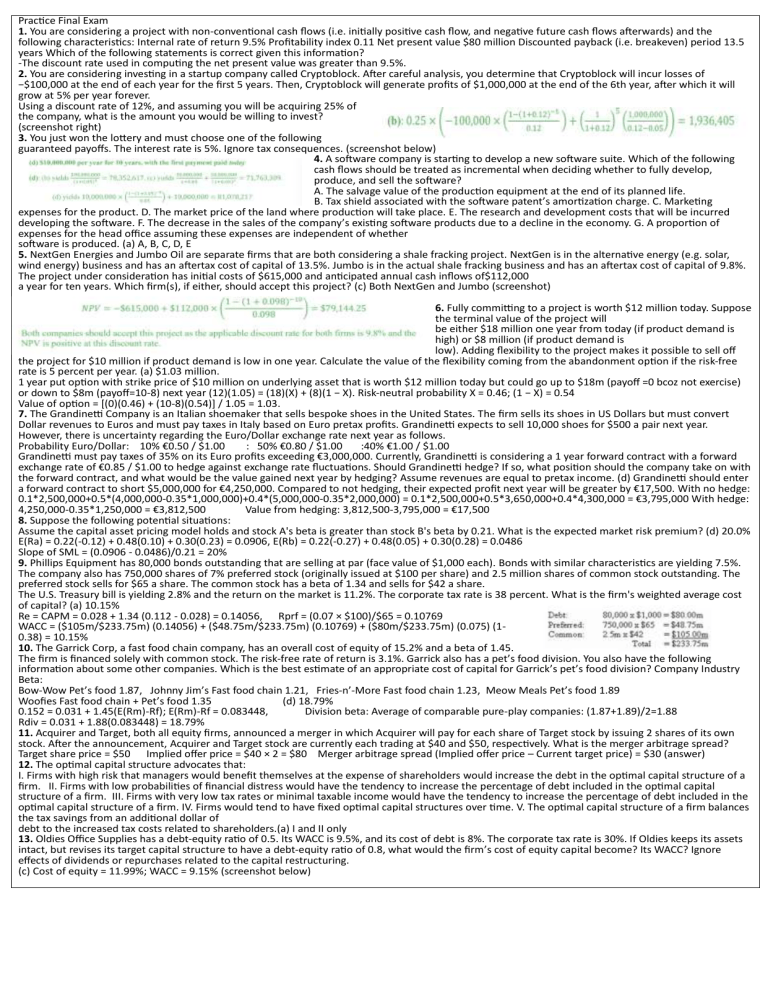

Practice Final Exam 1. You are considering a project with non-conventional cash flows (i.e. initially positive cash flow, and negative future cash flows afterwards) and the following characteristics: Internal rate of return 9.5% Profitability index 0.11 Net present value $80 million Discounted payback (i.e. breakeven) period 13.5 years Which of the following statements is correct given this information? -The discount rate used in computing the net present value was greater than 9.5%. 2. You are considering investing in a startup company called Cryptoblock. After careful analysis, you determine that Cryptoblock will incur losses of −$100,000 at the end of each year for the first 5 years. Then, Cryptoblock will generate profits of $1,000,000 at the end of the 6th year, after which it will grow at 5% per year forever. Using a discount rate of 12%, and assuming you will be acquiring 25% of the company, what is the amount you would be willing to invest? (screenshot right) 3. You just won the lottery and must choose one of the following guaranteed payoffs. The interest rate is 5%. Ignore tax consequences. (screenshot below) 4. A software company is starting to develop a new software suite. Which of the following cash flows should be treated as incremental when deciding whether to fully develop, produce, and sell the software? A. The salvage value of the production equipment at the end of its planned life. B. Tax shield associated with the software patent’s amortization charge. C. Marketing expenses for the product. D. The market price of the land where production will take place. E. The research and development costs that will be incurred developing the software. F. The decrease in the sales of the company’s existing software products due to a decline in the economy. G. A proportion of expenses for the head office assuming these expenses are independent of whether software is produced. (a) A, B, C, D, E 5. NextGen Energies and Jumbo Oil are separate firms that are both considering a shale fracking project. NextGen is in the alternative energy (e.g. solar, wind energy) business and has an aftertax cost of capital of 13.5%. Jumbo is in the actual shale fracking business and has an aftertax cost of capital of 9.8%. The project under consideration has initial costs of $615,000 and anticipated annual cash inflows of$112,000 a year for ten years. Which firm(s), if either, should accept this project? (c) Both NextGen and Jumbo (screenshot) 6. Fully committing to a project is worth $12 million today. Suppose the terminal value of the project will be either $18 million one year from today (if product demand is high) or $8 million (if product demand is low). Adding flexibility to the project makes it possible to sell off the project for $10 million if product demand is low in one year. Calculate the value of the flexibility coming from the abandonment option if the risk-free rate is 5 percent per year. (a) $1.03 million. 1 year put option with strike price of $10 million on underlying asset that is worth $12 million today but could go up to $18m (payoff =0 bcoz not exercise) or down to $8m (payoff=10-8) next year (12)(1.05) = (18)(X) + (8)(1 − X). Risk-neutral probability X = 0.46; (1 − X) = 0.54 Value of option = [(0)(0.46) + (10-8)(0.54)] / 1.05 = 1.03. 7. The Grandinetti Company is an Italian shoemaker that sells bespoke shoes in the United States. The firm sells its shoes in US Dollars but must convert Dollar revenues to Euros and must pay taxes in Italy based on Euro pretax profits. Grandinetti expects to sell 10,000 shoes for $500 a pair next year. However, there is uncertainty regarding the Euro/Dollar exchange rate next year as follows. Probability Euro/Dollar: 10% €0.50 / $1.00 : 50% €0.80 / $1.00 :40% €1.00 / $1.00 Grandinetti must pay taxes of 35% on its Euro profits exceeding €3,000,000. Currently, Grandinetti is considering a 1 year forward contract with a forward exchange rate of €0.85 / $1.00 to hedge against exchange rate fluctuations. Should Grandinetti hedge? If so, what position should the company take on with the forward contract, and what would be the value gained next year by hedging? Assume revenues are equal to pretax income. (d) Grandinetti should enter a forward contract to short $5,000,000 for €4,250,000. Compared to not hedging, their expected profit next year will be greater by €17,500. With no hedge: 0.1*2,500,000+0.5*(4,000,000-0.35*1,000,000)+0.4*(5,000,000-0.35*2,000,000) = 0.1*2,500,000+0.5*3,650,000+0.4*4,300,000 = €3,795,000 With hedge: 4,250,000-0.35*1,250,000 = €3,812,500 Value from hedging: 3,812,500-3,795,000 = €17,500 8. Suppose the following potential situations: Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21. What is the expected market risk premium? (d) 20.0% E(Ra) = 0.22(-0.12) + 0.48(0.10) + 0.30(0.23) = 0.0906, E(Rb) = 0.22(-0.27) + 0.48(0.05) + 0.30(0.28) = 0.0486 Slope of SML = (0.0906 - 0.0486)/0.21 = 20% 9. Phillips Equipment has 80,000 bonds outstanding that are selling at par (face value of $1,000 each). Bonds with similar characteristics are yielding 7.5%. The company also has 750,000 shares of 7% preferred stock (originally issued at $100 per share) and 2.5 million shares of common stock outstanding. The preferred stock sells for $65 a share. The common stock has a beta of 1.34 and sells for $42 a share. The U.S. Treasury bill is yielding 2.8% and the return on the market is 11.2%. The corporate tax rate is 38 percent. What is the firm's weighted average cost of capital? (a) 10.15% Re = CAPM = 0.028 + 1.34 (0.112 - 0.028) = 0.14056, Rprf = (0.07 × $100)/$65 = 0.10769 WACC = ($105m/$233.75m) (0.14056) + ($48.75m/$233.75m) (0.10769) + ($80m/$233.75m) (0.075) (10.38) = 10.15% 10. The Garrick Corp, a fast food chain company, has an overall cost of equity of 15.2% and a beta of 1.45. The firm is financed solely with common stock. The risk-free rate of return is 3.1%. Garrick also has a pet’s food division. You also have the following information about some other companies. Which is the best estimate of an appropriate cost of capital for Garrick’s pet’s food division? Company Industry Beta: Bow-Wow Pet’s food 1.87, Johnny Jim’s Fast food chain 1.21, Fries-n’-More Fast food chain 1.23, Meow Meals Pet’s food 1.89 Woofies Fast food chain + Pet’s food 1.35 (d) 18.79% 0.152 = 0.031 + 1.45(E(Rm)-Rf); E(Rm)-Rf = 0.083448, Division beta: Average of comparable pure-play companies: (1.87+1.89)/2=1.88 Rdiv = 0.031 + 1.88(0.083448) = 18.79% 11. Acquirer and Target, both all equity firms, announced a merger in which Acquirer will pay for each share of Target stock by issuing 2 shares of its own stock. After the announcement, Acquirer and Target stock are currently each trading at $40 and $50, respectively. What is the merger arbitrage spread? Target share price = $50 Implied offer price = $40 × 2 = $80 Merger arbitrage spread (Implied offer price – Current target price) = $30 (answer) 12. The optimal capital structure advocates that: I. Firms with high risk that managers would benefit themselves at the expense of shareholders would increase the debt in the optimal capital structure of a firm. II. Firms with low probabilities of financial distress would have the tendency to increase the percentage of debt included in the optimal capital structure of a firm. III. Firms with very low tax rates or minimal taxable income would have the tendency to increase the percentage of debt included in the optimal capital structure of a firm. IV. Firms would tend to have fixed optimal capital structures over time. V. The optimal capital structure of a firm balances the tax savings from an additional dollar of debt to the increased tax costs related to shareholders.(a) I and II only 13. Oldies Office Supplies has a debt-equity ratio of 0.5. Its WACC is 9.5%, and its cost of debt is 8%. The corporate tax rate is 30%. If Oldies keeps its assets intact, but revises its target capital structure to have a debt-equity ratio of 0.8, what would the firm’s cost of equity capital become? Its WACC? Ignore effects of dividends or repurchases related to the capital restructuring. (c) Cost of equity = 11.99%; WACC = 9.15% (screenshot below) 14. Montgomery Corp is currently worth $30 million as a company, but has $50 million of debt. There is a potential project that costs $60 million that would require shareholders to provide an additional $30 million to invest in. In one year, the project will yield $99 million or $55 million with 50% probability each. If the investment is not made, the firm will file for bankruptcy today. Suppose a 10% discount rate. The shareholders will the investment because they stand to . The investment is for the firm and for the debtholders. (Ignore taxes and bankruptcy costs) (d) disapprove; lose $5.45 million; good; good If no investment, NPV to debtholders = 30 NPV to shareholders = 0 If invest, NPV to firm = -60 + (0.5*99 + 0.5*55) / 1.1 = +10 NPV to shareholders = -30 + (0.5*(99-50) + 0.5*(55-50)) / 1.1 = -5.45 NPV to debtholders = -30 + (0.5*50 + 0.5*50) / 1.1 = +15.45 15. Which of the following are true? I. Existing shareholders of privately held companies dislike IPOs because they are forced to exit their positions at underpriced valuations. II. IPO underpricing indicates that buying and selling newly listed stocks during the first day of trading can be a profitable strategy. III. SEO rights offers could potentially mitigate SEO announcement stock price drops by alleviating the adverse selection problem. IV. A callable bond is usually priced below an otherwise identical straight bond, whereas a convertible bond is typically priced above an otherwise identical straight bond. (b) III and IV Note: II: Silly Cathy got it wrong by investing on day 1 in class eg. III: the definition of rights offer. Reduce adverse selection/ lemon; IV: Key here is who has/ owns the option? 16. The Gator Consulting Group needs to decide how to allocate its 30 consultants to potential projects this year. It is considering the following contracts: NPV Use of Consultants, A $6 million 15, B $3 million 18, C $4.5 million 12, D $0.2 million 3 (b) First invest in A, then in C and D A: PI = NPV/Use of consultants = 0.4 B: PI = NPV/Use of consultants = 0.17 C: PI = NPV/Use of consultants = 0.38 D: PI = NPV/Use of consultants = 0.07 We have limited resources (# of consultants): According to the profitability index rule, first invest in A, then in C. The next highest is B, but there are not enough consultants left. We use the remaining 3 on D. 17. You own 1,000 shares of stock in Avondale Corporation. You will receive a $0.8 per share dividend in one year. In two years, Avondale will pay a special dividend of $40 per share. The required return on Avondale stock is 14 percent. You have a preference for smoothing out your income year after year. What will your dividend income be this year if you use homemade dividends to create two equal annual dividend payments out of Avondale’s scheduled dividends? (Ignore taxes and any dividends beyond the second year. Suppose you could purchase and sell stock in share increments) (c) $19,118 Method 1: P0 = ($0.80/1.14) + ($40/1.142) = $31.48, $31.48 = (D/1.14) + (D/1.142 ); D = $19.118 Dividend income = 1,000 × $19.118 = $19,118 Method 2: To receive $X in total in the first year, sell shares worth $X − ($0.8 × 1,000) in one year. Share price in one year = $40/1.14 = $35.09 Number of shares sold = ($X − $800) / $35.09 Dividends received in the second year = (1,000 − ($X − $800) / $35.09) × $40 = $X (1,000 + $800/$35.09) × $40 = $X × (1 + $40/$35.09) $X = $19,118 → Same in quiz 2. Think about $X dollar per share that makes $0.8 in year one and $40 in year two. 18. Which of the following are true about merger arbitrage strategies? I. An investor speculating that the merger will succeed will short shares of the target company and long shares of the acquirer. II. The merger arbitrage spread is the gap between the fundamental value of the target company and its current share price. III. The merger arbitrage spread will narrow down as the merger comes closer to completion. IV. The merger arbitrage spread will generally widen when there is news that target company’s management will exercise golden parachutes. (c) III and IV only Note: Make sure you understand the merger arbitrage strategy (Module 7). Then what is the golden parachutes defense? What other ‘defense’ weapons are out there? 19. Which of the following case studies touches the payout policies? (a) Wm. Wrigley Jr 20. Simons Inc. has $250 million in cash and $90 million in annual interest expenses. If its cash falls short of its debt obligations, Simons will be deemed financially distressed, in which case the firm will suffer a value loss of $150 million. The firm has an investment option which initially costs $50 million. The project will yield uncertain cash flows one year later: $150 million with 30% probability, $100 million with 60% probability, and a loss of -$150 million with 10% probability. Assuming a discount rate of 10%, what is the maximum amount that Simons could payout immediately as a special dividend? Find a best estimate, ignoring taxes. (a) $110 million NPV of project: -50 + (150*0.3 + 100*0.6 – (150+150)*0.1)/1.1 = $18.18 million Even after incorporating distress costs stemming from the bad case of the investment outcome, NPV is still positive, so we want to set aside $50M for investment. We also want to set aside the annual debt obligation of $90M. Then, maximum available for dividend = 250 - 50 - 90 = $110M Quiz #2 1. S.L. Moffatt, Inc. has paid a quarterly dividend of $1.20 per share for the last ten quarters. Which one of the following is most apt to cause the firm to reduce the amount of its next dividend payment? (c) Loss of a major customer which lowers the firm's outlook for the next several years 2. Which one of the following statements related to stock repurchases is correct? (c) A firm may spend more cash over the course of a year on stock repurchases than it does on cash dividends. 3. Steve owns 3,000 shares of NOP, Inc. stock, which he purchased six years ago at a price of $22 a share. Today, these shares are selling for $68 each. Assume the current tax laws are such that Steve is subject to a tax rate of 25 percent on both his dividend income and his capital gains. From Steve's point of view, a stock repurchase: (Ignore costs and capital market imperfections, other than taxes) (b) is more desirable than a cash dividend. Repurchase is at least as good as dividends since you can pay tax later (defer), while taxes on dividends are immediately happening. 4. On July 7, you purchased 500 shares of Wagoneer, Inc. stock for $21 a share. On August 1, you sold 200 shares of this stock for $28 a share. You sold an additional 100 shares on August 17 at a price of $25 a share. The company declared a $0.95 per share dividend on August 4 to holders of record as of Wednesday, August 15. This dividend is payable on September 1. How much dividend income will you receive on September 1 as a result of your ownership of Wagoneer stock? (c) $285 Dividend received = $0.95 × (500 – 200 on Aug 1) = $285 5. Al owns 800 shares of The Good Life Co. The company recently issued a statement that it will pay a dividend per share of $0.55 this year and a $0.60 per share dividend next year. Al does not want any dividend income this year but does want as much dividend income as possible next year. Al expects Good Life stock to earn 9 percent per year. If Al configures his preferred payout scheme on his own, what will Al's total homemade dividend be next year? (Ignore taxes and any dividends beyond next year. Suppose Al could purchase and sell stock in share increments) (d) $959.60 Method 1: Homemade dividend income for next year = [($0.55 × 1.09) + $0.60] × 800 = $959.60 Method 2: Dividends received in year 1 = $0.55 × 800 = $440, Price of stock in year 1 = $0.6/1.09 = $0.5505, Number of shares to reinvest in year 1 using year 1 dividends = $440/$0.5505 = 799.2734 Dividends in year 2 = (800 + 799.2734) × $0.6 = $959.56 6. The Green Fiddle has declared a $5 per share dividend. Suppose capital gains are not taxed, but dividends are taxed at 15 percent. IRS regulations require that taxes be withheld at the time the dividend is paid. Green Fiddle stock sells for $71.50 per share, and the stock is about to go ex-dividend. What will the ex-dividend price be? (a) $67.25 Ex-dividend price = $71.50 - [$5 × (1 - 0.15)] = $67.25 7. You own 1,000 shares of stock in Avondale Corporation. You will receive a $0.8 per share dividend in one year. In two years, Avondale will pay a special dividend of $40 per share. The required return on Avondale stock is 14 percent. You have a preference for smoothing out your income year after year. What will your dividend income be this year if you use homemade dividends to create two equal annual dividend payments out of Avondale’s scheduled dividends? (Ignore taxes and any dividends beyond the second year. Suppose you could purchase and sell stock in share increments) (c) $19,118 Method 1: P0 = ($0.80/1.14) + ($40/1.142) = $31.48, $31.48 = (D/1.14) + (D/1.142); D = $19.118, Dividend income = 1,000 × $19.118 = $19,118 Method 2:, To receive $X in total in the first year, sell shares worth $X − ($0.8 × 1,000) in one year. Share price in one year = $40/1.14 = $35.09 Number of shares sold = ($X − $800) / $35.09 Dividends received in the second year = (1,000 − ($X − $800) / $35.09) × $40 = $X (1,000 + $800/$35.09) × $40 = $X × (1 + $40/$35.09) $X = $19,118 8. You own 1,500 shares of stock in The Kim Corporation. You will receive a $0.80 per share dividend in one year. In two years, Kim will pay a special dividend of $35 per share. The required return on Kim stock is 16 percent. You only want $200 of investment income in year one, and want to postpone the rest of the income to be received in the second year. You aim to accomplish this configuration by using homemade dividends. What will your investment income amount be in year two? (Ignore taxes and any dividends beyond the second year. Suppose you could purchase and sell stock in share increments) (b) $53,660, Dividends received in one year = 1,500 × $0.80 = $1,200 (Used to give yourself dividends or buy shares) Price of stock in one year = $35/1.16 = $30.1724, Number of shares you purchased = ($1,200 - $200)/$30.1724 = 33.142857 shares (Keep $200 in dividends, spend $1k to buy more shares) Dividend in year two = $35 × (1,500 + 33.142857) = $53,660 Another (probably easier) way: The present value of dividends = 1,500 x ($0.8/1.16 + $35/1.16^2) = $200/1.16 + $X/1.16^2 9. Credo company, with 2 million shares outstanding, is for the first time considering a payout in regular cash dividends of $0.25 per share starting in 1 year. Credo currently has $2 million in cash. The firm also pays annual interest of $150,000 on its debt and aims to maintain enough cash to cover it at any – – time. A stock analyst forecasts the following years’ uncertain future cash flows of Credo company as follows.Scenario Probability FCF in 1 year FCF in 2 years FCF in 3 years Recession 10% -$2,500,000 -$3,250,000 -$4,550,000 Stable 60% $800,000 $1,000,000 $920,000 Boom 30% $1,500,000 $1,250,000 $1,750,000 Which of the following statements are true? Ignore taxes. I. Credo will be able to cover both its dividend and debt payments through its cash holdings and internally generated expected cash inflows in the next three years. II. The market will react negatively to the dividend announcement because Credo will not be able to commit to the dividend over the next three years without costly external financing. III. To preserve investment capacity, it could be prudent for Credo to conduct a flexible buyback program instead of the regular dividend program. IV. Although the probability of a recession is low, the impact of a recession on free cash flow is large enough for expected financial distress costs to render the dividend program unsustainable. (b) I and III only Expected FCF are $680,000, $650,000, and $622,000 in the next 3 years. After dividends and interest payments, the firm’s cash holdings, initially $2M, will evolve into $2,030,000, $2,030,000, and $2,002,000 in the next three years. 10. Benning Corp is an all-equity company with a stable dividend stream. Historically it has paid out $0.5 per share every year, and the market expects the company will maintain this payout policy in perpetuity. Benning’s baseline strategy is to meet this market expectation. The historical average T-bill rate is 2% and the average S&P 500 return is 8%. Benning’s management uses the CAPM to estimate its cost of capital, and internally estimates its stock’s true beta to be 0.75. The stock is currently trading on the market at $5.5 per share. In order to maximize shareholder value, Benning’s management should: (Assume the firm has enough funds) (b) repurchase its stock in addition to maintaining the dividend payments According to management, the stock price should be $0.5/(2%+0.75*(8%-2%))=$7.7, so the market is currently underpricing the stock. The management should exploit this and repurchase the underpriced stock to maximize shareholder value, in addition to maintaining the dividend payments to minimize an adverse signaling effect. 11. Which of the following takeover defenses talks about rights offering that gives the target shareholders rights to buy target shares at deep discounts when certain conditions are met. (c) Poison pills 12. ABC Corp and XYZ Corp are both firms based in the US, where it is stipulated that dividends and capital gains are both taxed at 20%. Below is a snapshot of each company’s shareholder base. ABC Corp XYZ Corp Shareholder Ownership Shareholder Ownership Individuals 40% ABC Corp 60% Foreign entities 10% Endowment funds 20% Long-term investors 50% Pension funds 20% To optimize the effect of taxes on shareholder value, ABC Corp should should (d) repurchase shares; pay dividends and XYZ Corp Investors of ABC either have a dividend tax disadvantage or are indifferent. Investors of XYZ either enjoy a dividend tax break or are indifferent. 13. Dividends are taxed at 30%, and there are no capital gains taxes. The Palm Court Restaurants company has stock currently trading at $50 per share, and has declared a dividend of $2 per share. The vast majority of the company’s shareholders and market participants who trade the stock are domestic individual investors with brokerage accounts to whom the tax code applies. You, on the other hand, have a retirement account where you can self-direct your investments exempt from this tax. You are considering what a friend describes as a “dividend capture” strategy, where you buy a stock before the exdividend day (i.e. cum-dividend) and subsequently sell it on or after the ex-dividend day, thus capturing the dividend. Your friend says this will be profitable because usually the stock price drop on the ex- dividend day is less than the dividend amount you will capture. Your friend is if you execute the strategy on your account because your aftertax profit will be . (c) correct; retirement; $0.6 per share The ex-dividend price drop will be 2*(1-0.3) =$1.4, which is less than the dividend amount. If you do the trade on your personal brokerage account, your aftertax dividend proceed will be $1.4, and your capital loss will be $1.4. Thus your aftertax profit will be zero. If you do the trade on your retirement account, your aftertax dividend proceed will be $2.0, and your capital loss will be $1.4. Thus your aftertax profit will be $0.6. 14. Which of the following is not a common reason for failed mergers? (c) Underpricing 15. Which one of the following is true about the acquisition price in a merger agreement? (c) Upon announcement of a merger agreement, the target stock price usually rises substantially. 16. Which of the following are true about merger arbitrage strategies? I. An investor speculating that the merger will succeed will long shares of the target company and short shares of the acquirer. II. The merger arbitrage spread is the gap between the current target share price and the per share offer price. III. The merger arbitrage spread will narrow down as the merger comes closer to completion. IV. The merger arbitrage spread will generally widen when there is unexpected news that makes the merger’s success unlikely. (d) All of above 17. Nora & Joe Co. and Bob & Pop Co. are all equity firms each trading at $7.5 and $12.5 per share, with 10 million and 2 million shares outstanding, respectively. Nora & Joe aims to acquire Bob & Pop afterwhich it believes there will be synergistic increases in profits of $1 million each year in perpetuity. Nora & Joe plans to pay for the acquisition with newly issued stock. What is the maximum number of shares Nora & Joe should be willing to offer to purchase each share of Bob & Pop (i.e. the stock exchange ratio)? Assume a discount rate of 10%. Ignore taxes and the effects of issuance on stock prices. (c) 2.33 shares A: Pre-merger acquirer value T: Pre-merger target value S: Synergy value Na: Number of outstanding shares of acquirer Nt: Number of outstanding shares of target X: Number of acquirer stock to be issued for a stock acquisition (A+T+S)/(Na+X) > A/Na Notice here the question asks the exchange ratio (not x). x/Nt < ((T+S)/A)*(Na/Nt) = 2.33 shares 18. Acquirer Corp and Target Inc have announced a merger agreement in which Acquirer will pay for each share of Target stock by issuing 0.9 shares of its own stock. Right before the merger announcement, Acquirer and Target stock were each trading at $10.5 and $7.5, with 10 million and 3 million shares outstanding, respectively. Both firms are all-equity. May is a junior investment banker at FinExperts & Co and is conducting a valuation of Target to ensure her client, Acquirer, is paying a reasonable price in the deal. May believes Target’s pre-merger stock price well reflects its standalone value. She estimates that the merger and subsequent managerial shake-up will result in a reduction in Target’s annual costs ranging between $1 million and $2 million in perpetuity. Given an estimated discount rate of 10%, how should May advise on the reasonableness of the merger agreement? (c) Good deal for Acquirer as they are paying an offer price below the possible range of postmerge. Target values inclusive of synergies Synergy values = $1 million/0.1 to $2 million/0.1 = $10 million to $20 million, Post-merger target value range = $32.5 million to $42.5 million, Post-merger target per-share value range = $10.83, ($32.5M/3M) to $14.17 ($42.5M/3M) Implied offer price per target share = 0.9 × $10.5 = $9.45 19. Beyers Corp and Eona Inc, both all-equity firms, have announced a merger agreement in which Beyers will pay for each share of Eona stock by issuing 0.75 shares of its own stock. After the merger has been announced, Beyer and Eona stock are currently each trading at $12.25 and $7.75, respectively. The merger arbitrage spread is currently , indicating uncertainty regarding the eventual merger outcome. When such uncertainty is resolved, the spread will . (d) $1.44 ; diminish Target share price = $7.75, Implied offer price = $12.25 × 0.75 = $9.19, Merger arbitrage spread (gap between the above two) = $1.44 20. Which of the following are true? I. Angel investors are typically professional investors who have an excellent understanding of the startup’s operation. II. Just like a traditional IPO, Amplitude’s direct listing is also subject to lockup provisions. III. In Wm. Wrigley Jr’s case, Blanka Dobrynin hopes to do a levered recapitalization and payout. IV. The EPS (earnings per share) for a firm would be different after different payout methods (dividends vs. share repurchases). (b) III and IV Formulas: 1. ROA: ROA = ROA + (ROA - rd) × (DE) × (1 - Tax Rate) 2. M&M2: If M&M2, no taxes. Financial Metrics: 1. Unlevered Cost of Capital (CoC): Unlevered CoC = EBIT × (1 - Tax Rate) / Value of Equity 2. Value of Equity (VE): VE = Number of Shares × Market Price per Share 3. Annual Interest Tax Shield: Annual Interest Tax Shield = Bond Issue Outstanding × Coupon × Tax Rate 4. Weighted Average Cost of Capital (WACC): WACC = (1 - Tax Rate) × (Debt × rd) + (Preferred Stock × rp) + (Equity × re) 5. Ex-Dividend Price: Ex-Dividend Price = Stock Price - [Per Share Dividend × (1 - Dividend Tax)] A falling underlying security value decreases a call option's worth. Forward contract buyers, starting with no position, have an upward-sloping linear payoff. Option rights favour buyers; forwards entail obligations. Initiating an option contract is costlier than a forward. Diversifying acquisitions, with low transaction costs, often add little value. Target stock prices commonly surge upon a merger agreement announcement. In a tender offer, the acquirer pays a marked-up price, channelling synergy gains to target shareholders. Firms with entrenched management typically deploy takeover defense mechanisms. CAPM Formula: 𝐸(𝑅𝑖 ) − 𝑅𝑓 = 𝛽𝑖 [𝐸(𝑅𝑚 ) − 𝑅𝑓 ] 𝐸(𝑅𝑖 ): Expected, or required, return on stock 𝑖 𝐸(𝑅𝑚 ): Expected return on market 𝑅𝑓 : The risk-free rate Stock’s risk premium on LHS, 𝐸(𝑅𝑖 ) − 𝑅𝑓 , depends on 2 things Its beta (risk loading, or amount of risk): High beta = High systematic risk – – The market premium (price of risk), 𝐸(𝑅𝑚 ) − 𝑅𝑓 , Suppose the return on short-term government bonds (perceived to be riskless) is 6%. The expected rate of return required by the market for a portfolio with a beta of 1 is 15%. According to the CAPM, What is the expected rate of return on the market portfolio? 15% What would you consider as the expected rate of return on a stock with a 𝛽 of 0? 6% Suppose you consider buying a share at $40. The stock is expected to pay $3 in dividends next year and to then sell for $41. The stock’s risk has been evaluated by 𝛽 = −0.5. According to the CAPM, is the stock overpriced or underpriced? 41+3 − 1 = 10% > 6% + (−0.5)(15% − 6%) = 1.5% It lies above SML (CAPM): Underpriced! 40 Assume the equity beta for Julia’s Live Forever biotech company is 0.55. The yield on 10-year Treasuries is 3%, and you estimate the market risk premium to be 6%. Estimate her cost of equity using the CAPM approach. 𝑟𝐸 = 𝑅𝑓 + 𝛽(𝑹𝒎 − 𝑹𝒇 ) = 0.03 + 0.55 × 𝟎. 𝟎𝟔 = 6.3% Suppose Stephanie’s revolutionary Fintech Platform firm has debt with a face value of $10 million, trading at 95% of par. It also has book equity of $10 million, and 1 million shares of common stock trading at $30 per share. What weights should Steph use in calculating the WACC? use market value! MV of debt: 95% of $10 million = $9.5 million, MV of equity: $30 × 1 million = $30 million. Weights: Debt: 9.5/(9.5+30) = 24.1% Equity: 30/(9.5+30) = 75.9% Normal” yield curve: Moderately upward sloping, Generally, longer-term loans are considered riskier, Longer-term: Higher likelihood of default, higher likelihood of inflation “Steep” yield curve: Steep upward sloping, Indicates that interest rates are expected to rise in the future, Generally, coming out of a recession (i.e., expecting high money demand) Inverted yield curve: Downward sloping, Indicates that interest rates are expected to drop, Generally, prior to recessions (i.e., expecting low money demand)Systematic risk: Common risk, diversification can’t help, Idiosyncratic risk: Firm specific, diversifiable risk Risk premium/WACC A portfolio is invested 35% each in Stock A and Stock B and 30% in Stock C. What is the expected risk premium on the portfolio if the expected T-bill rate is 3.3%? E(Rp) Boom = 0.35(0.42) + 0.35(0.35) + 0.30(0.65) = 0.4645 (sum of weighted returns of ABC in Boom). E(Rp) Normal = 0.35(0.31) + 0.35(0.18) + 0.30(0.04) = 0.1835 (…in Normal). E(Rp) Bust = 0.35(0.17) + 0.35(-0.17) + 0.30(-0.64) = -0.192 (…in Bust) Then the probability of state of economy comes in E(Rp total) = 0.45(0.4645) + 0.50(0.1835) + 0.05(-0.192) = 0.2912 Risk premium? = return on the risky asset (the market portfolio under the CAPM, but here, this particular portfolio which consists of stock A, B, and C) – riskfree rate (T-bill here) so Expected risk premium = 0.2912 - 0.033 = 25.82% Growing perpetuity?: 𝑃0 = 𝐷𝑖𝑣1 𝑟𝐸 −𝑔 Rearrange to get: 𝑟𝐸 = 𝐷𝑖𝑣1 𝑃0 + 𝑔 For preferred stock, 𝑔 = 0 Cost of preferred stock = 𝑟𝑝𝑓𝑑 = 𝐷𝑖𝑣𝑝𝑓𝑑 𝑃𝑝𝑓𝑑 Cathy’s Bakery has a 5% one-year bond issued at par of $1,000. But there is a 20% chance the company will go into bankruptcy and only pay $500. What is the bond’s value and YTM? $940 $50+$1,000 In 1 year: $1,050 × 0.8 + $500 × 0.2 = $940 𝑃𝑉 𝑜𝑓 𝑏𝑜𝑛𝑑 = = $895, $895 = 𝑌𝑇𝑀 = 17.3% 1.05 1+𝑌𝑇𝑀 Longer term rates reflect expectations of future interest rates: Forward rates: Compound with one-period interest rate r1 and forward rate r12 (1-yr forward rate): Instead, compound with a fixed two-period interest rate r2 (1+𝑟2 )2 $1 × (1 + 𝑟1 )(1 + 𝑟1,2 ) = $1 × (1 + 𝑟2 )2 = (1 + 𝑟1,2 ) = Suppose for Veerakit’s Elephant Tower 2-year bond: 1-year rate is 𝑟1 = 5% and the 1+𝑟1 (1+𝑟2 )2 2-year rate is 𝑟2 = 6%. 1-year forward rate, i.e. 𝑟1,2 ? (1 + 𝑟1,2 ) = 1+𝑟1 = (1.06)2 1.05 = 1.0701 Given a corporate tax rate of 𝑇𝐶 , 𝑟𝐷∗ = 𝑟𝐷 (1 − 𝑇𝐶 ) Assume the expected return on Target’s equity is 11.5%, and the firm has a yield to maturity on its debt of 6%. Debt accounts for 18% and equity for 82% of Target’s total market value. If its tax rate is 35%, what is an estimate of this firm’s WACC? 𝑟𝑤𝑎𝑐𝑐 = 𝑟𝐸 𝐸% + 𝑟𝐷 (1 − 𝑇𝐶 )𝐷% = 0.115 × 0.82 + 0.06 × (1 − 0.35) × 0.18 = 10.1%. Microsoft’s future CFO Zachary is evaluating the possibility of manufacturing and selling electric cars. Assume that Microsoft has no debt. Microsoft’s beta is 1.25. Electric cars would be a new line of business for Microsoft. Tesla is a well-known producer of electric cars, which is its sole business. Tesla’s beta is known to be 0.65. Assuming that the risk-free rate is 3% and the market risk premium is 6%, how would he estimate the cost of capital for Microsoft’s potential investment in this electric car area?Using CAPM, 𝑟 𝑚𝑠 = 3% + 1.25 × 6% = 10.5%𝑟 𝑡𝑒𝑠𝑙𝑎 = 3% + 0.65 × 6% = 6.9%. GE has two divisions. Julia and Agustin are the division heads. Julia’s division manufactures consumer goods. The average beta of firms that only produce consumer goods is 1.0. Agustin’s division produces gas turbines. The average beta of firms that do this alone is 1.5. The two divisions each constitute 50% of the firm. The firm has no debt. The risk-free rate is 5% and the market risk premium is estimated to be 8%. What is the firm’s cost of capital 𝛽𝑐𝑜𝑚𝑝𝑎𝑛𝑦 = 0.5 × 1.0 + 0.5 × 1.5 = 1.25 𝑈𝑠𝑖𝑛𝑔 𝐶𝐴𝑃𝑀, 𝑟 = 𝑅𝑓 + 𝛽𝑐𝑜𝑚𝑝𝑎𝑛𝑦 ∗ 𝑚𝑎𝑟𝑘𝑒𝑡 𝑟𝑖𝑠𝑘 𝑝𝑟𝑒𝑚 = 5% + 1.25 × 8% = 15% -Which one of the following is represented by the slope of the security market line: Market risk premium -You want your portfolio beta to be 0.90. Currently, your portfolio consists of $4,000 invested in stock A with a beta of 1.47 and $3,000 in stock B with a beta of 0.54. You have another $9,000 to invest and want to divide it between an asset with a beta of 1.74 and a risk-free asset. How much should you invest in the risk-free asset? Beta of Portfolio = 0.90 = ($4,000/$16,000)(1.47) + ($3,000/$16,000)(0.54) + (x/$16,000)(1.74) + (($9,000 - x)/$16,000)(0) x=$3,965.52 Investment in risk-free asset = $9,000 - $3,965.52 = $5,034.48 -The risk-free rate of return is 3.9% and the market risk premium is 6.2%. What is the expected rate of return on a stock with a beta of 1.21? E(R) = 0.039 + (1.21 × 0.062) = 11.40% - The common stock of Jensen Shipping has an expected return of 14.7%. The return on the market is 10.8% and the risk-free rate of return is 3.8%. What is the beta of stock? E(R) = 0.147 = 0.038 + β (0.108 - 0.038) β = 1.56 - The common stock of United Industries has a beta of 1.34 and an expected return of 14.29%. The riskfree rate of return is 3.7%. What is the expected market risk premium? E(R) = 0.1429 = 0.037 + 1.34 (E(Rm)-Rf), E(Rm)-Rf = 7.90% - The common stock of Alpha Manufacturers has a beta of 1.14 and a potential return of 15.26% that you believe could be earned (not indicated by the CAPM). The risk-free rate of return is 4.3% and the market rate of return is 12.01%. Which one of the following statements is true given this information? E(R) = 0.043 + 1.14 (0.1201 - 0.043) = 13.09%, underpriced. -Which one of the following stocks is correctly priced if the risk-free rate of return is 3.7% and the market risk premium is 8.8%? (Your belief of potential future returns, not CAPM returns, are shown) E(Ra) = 0.037 + (0.64 × 0.088) = 0.0933, E(Rb) = 0.037 + (0.97 × 0.088) = 0.1224, E(Rc) = 0.037 + (1.22 × 0.088) = 0.1444 Stock C is correctly priced, E(Rd) = 0.037 + (1.37 × 0.088) = 0.1576 -Suppose you observe the following situation: pete corp, beta 0.8, ER 0.12, repete corp beta 1.1 ER 0.16 Assume these securities are correctly priced. Based on the CAPM, what is the return on the market? Ra=0.12=Rf+(Rm-Rf)*0.8 Rb=0.16=Rf+(RmRf)*1.1, 2 unknowns (Rm and Rf) with 2 equations, solve for Rf and Rm: Rf=1.33% and Rm=14.67% -Suppose the following potential situations: Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21. What is the expected market risk premium (=slope of the SML!!)? The slope is the key. E(Ra) = 0.22(-0.12) + 0.48(0.10) + 0.30(0.23) = 0.0906 E(Rb) = 0.22(-0.27) + 0.48(0.05) + 0.30(0.28) = 0.0486 Slope = delta or change of (Y is Er)/delta or change of (X is beta). Slope of SML = (0.0906 - 0.0486)/0.21 = 20% -Phillips Equipment has 80,000 bonds outstanding that are selling at par (face value of $1,000 each) Bonds with similar characteristics are yielding 7.5%. The company also has 750,000 shares of 7% preferred stock (originally issued at $100 per share) and 2.5 million shares of common stock outstanding. The preferred stock sells for $65 a share. The common stock has a beta of 1.34 and sells for $42 a share. The U.S. Treasury bill is yielding 2.8% and the return on the market is 11.2%. The corporate tax rate is 38 percent. What is the firm's weighted average cost of capital?Cost of equity: Re = 0.028 + 1.34 (0.112