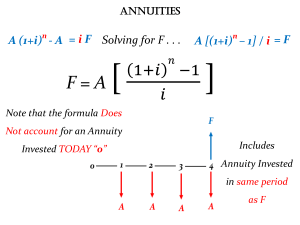

Time Value of Money INTEREST term used in business cost of using money over time interest expense = borrower / debtor interest income = lender / creditor Time Value of Money – term used by economist 3 Factors: 1. Principal 2. Interest Rate 3. Time Period 2 Concepts: a. Future Value b. Present Value FUTURE VALUE: compounds money forward in time to determine its worth in the future Compounding is the process of determining future value when compound interest is applied. Can Be Computed Using: A. Simple Interest (interest paid or earned on the initial principal only) B. Compound Interest (interest paid on both the principal and the amount of interest accumulated in prior periods) Simple Interest: A. ABC Corporation deposits P 10,000 in a bank at 10% interest in a year. How much is the future value of the principal at the end of year 1? Interest (I) = Principal (P) x Rate (R) x Time (T) Future Value (FV) = Principal (P) + Interest (I) Principal Interest FV = P 10,000 = P 1,000 (10,000 x 10%) = P 11,000 Simple Interest: B. ABC Corporation deposits P 10,000 in a bank at 10% interest in a year. How much is the future value of the principal after 6 months? Interest (I) = Principal (P) x Rate (R) x Time (T) Future Value (FV) = Principal (P) + Interest (I) Principal Interest FV = P 10,000 =P 500 (10,000 x 10% x 6/12 ) = P 10,500 Simple Interest: C. ABC Corporation deposits P 10,000 in a bank at 10% interest for 5 years. How much is the future value of the money after 5 years? Interest (I) = Principal (P) x Rate (R) x Time (T) Future Value (FV) = Principal (P) + Interest (I) Principal Interest FV = P 10,000 = P 5,000 (10,000 x 10% x 5 ) = P 15,000 Compound Interest: A. ABC Corporation deposits P 10,000 in a bank compounded annually at 10% interest. How much is the future value of the principal at the end of year 2? Year Amount Compound Interest Future Value 1 10,000 1,000 11,000 2 11,000 1,100 12,100 Total interest 2,100 Compound Interest: B. ABC Corporation deposits P 10,000 in a bank compounded annually at 10% interest. How much is the future value of the principal after 5 years? Year Amount Compound Interest Future Value 1 10,000 1,000 11,000 2 11,000 1,100 12,100 3 12,100 1,210 13,310 4 13,310 1,331 14,641 5 14,641 1,464.10 16,105.10 6,105.10 Compound Interest: B. ABC Corporation deposits P 10,000 in a bank compounded annually at 10% interest. How much is the future value of the principal after 5 years? Alternative Solution: FV= PV (1 + i )n = 10,000 (1 + .10)5 = 10,000 (1.61051*) = 16,105.10 where: FV PV i n = future value = initial principal = interest rate = period * 1.61051 is referred to as FVIF (future value interest factor) EXERCISE: CAE Corporation borrowed P 20,000 in a bank at 12% interest. Using simple interest method, 1. How much is the interest after 3 years? 2. What is the FV of the principal after 8 years? CAE Corporation borrowed P 20,000 in a bank compounded annually at 12% interest. Using compound interest method, 1. How much is the interest after 3 years? 2. What is the FV of the principal after 6 months? 3. What is the FV of the principal after 10 years if it is compounded quarterly? Future Value (With Intra-period Compounding) Intra-period Compounding - compounding that occurs more than once in a year Examples: FV monthly, quarterly, semi-annually = PV (1 + i/m)m*n Where: m refers to the number of times interest is compounded in a year Example: A. ABC Corporation is contemplating to deposit P 10,000 to BPI that pays 10 percent interest compounded annually. However, the financial manager of ABC Corporation decided to deposit the money at BDO that pays 10 percent interest compounded semi-annually. Questions: 1. What is the FV of P 10,000 should ABC Corporation opted to deposit it at BPI after 1 year? 2. What is the FV of P 10,000 at BDO after 1 year ? 3. Was the decision of ABC Corporation to deposit the money at BDO right? By how much was the difference in future values? Solution: A. FV = PV (1+ i) 1 = 10,000 ( 1.10)1 = 11,000 B. FV = PV (1+ i/m) nm = 10,000 ( 1 + (.10/2)2*1 = 10,000 (1 + .05)2 = 10,000 (1.1025) = 11,025 C. YES BPI = 11,000 BDO = 11,025 25 difference Nominal Rate: is also known as stated rate Effective Rate: is also called - APR (annual percentage rate) is the true interest rate arises because of the frequency of compounding in a year Nominal Rate = Effective Rate if compounding of interest happens once in a year Example: ABC deposits P 10,000 at BDO that pays a 10 percent interest rate compounded semi-annually APR = (1 +i/m) m - 1 = (1 + .10/2)2 -1 = (1 + .05)2 -1 = 1.1025 – 1 = .1025 or 10.25% Checking: Principal Interest FV = 10,000 = 1,025 (10,000 x .1025) = 11,025 SUMMARY EXERCISES: 1. If you invest P 12,000 today, how much will you have a. in 6 years at 7 percent (ordinary interest) b. in 15 years at 12 percent (compounded annually) c. In 25 years at 10 percent (compounded semi-annually) 2. If a bank pays 12 percent nominal interest rate, what is the effective interest rate assuming quarterly compounding ? Future Value of a Stream of Payments Stream of Payments - compounding of a series or stream of payments A. Stream of Unequal Payments How: Compute the FV of each payment at a specified future date and then summing all FVs FV = ϵ PV (1 +i) n-t where t refers to the no. of periods in which interest is earned / accrued Example: A. A firm plans to deposit P 2,000 today and P 1,500 on the second year at BPI. The bank pays 10 percent interest compounded annually. The FV of the account at the end of four years is? FV = 2,000 (1+.10)4 + 1,500 (1+.10)3 = 2,000 (1.4641) + 1,500 (1.331) = 2,928.20 + 1,996.50 = 4,924.70 Example: B. A firm plans to deposit P 10,000 on the first year, P 8,000 on the second year and P 5,000 on the third year at BDO. The bank pays 8 percent interest compounded annually. No future deposits or withdrawals are made. The FV of the account at the end of 5 years is? FV = 10,000 (1+.08)5 + 8,000 (1+.08)4 + 5,000 (1+.08)3 = 10,000 (1.4693) + 8,000 (1.3605) + 5,000 (1.2597) = 14,693 + 10,884 + 6,298.5 = 31,875.50 Future Value of a Stream of Payments A. Stream of Equal Payments Annuity (Fixed Annuity) – a stream of equal payments made at regular time intervals 2 Types: 1. Ordinary Annuity (Deferred Annuity) – one in which payments or receipts occur at the END OF EACH PERIOD 2. Annuity Due – one in which payments or receipts occur at the BEGINNING OF EACH PERIOD Future Value of a Stream of Payments 1. Ordinary Annuity (Deferred Annuity) FVOA FVIFAin = A (FVIFAin) = (1+i)n -1 i where FVOA - means future value of ordinary annuity A - means the amount of the fixed annuity payment FVIFAin - future value interest factor of an ordinary annuity Example: A. ABC Corporation deposits P 10,000 at the end of each year for the next 3 consecutive years in a bank paying 10 percent interest compounded annually. No future deposits or withdrawals are made. The FV of the account at the end of the 3rd year is? FVOA = A (FVIFAin) = 10,000 (3.310) = 33,100 Future Value of a Stream of Payments 1. Annuity Due FVAD = A (FVIFADin) FVIFADin = (1+i)n -1 x (1 +i) i where FVAD - means future value of annuity due A - means the amount of the fixed annuity payment FVIFADin - future value interest factor of an annuitydue Example: B. ABC Corporation deposits P 10,000 at the beginning of each year for 3 consecutive years with a bank paying 10 percent interest compounded annually. No future deposits or withdrawals are made. The FV of the account at the end of the 3rd year is? FVAD = A (FVIFADin) = 10,000 (3.641) = 36,410 Comparing FV of ordinary annuity and annuity due: 33,100 36,410 Ordinary Annuity Annuity Due Analysis: The future value for the annuity due is greater than the ordinary annuity because each deposit made one year earlier earns interest one year longer Present Value: discounts money that will be received in the future back in time to see what it is worth in the present the current value of a future amount of money or series of payments, evaluated at an appropriate discount rate Discount Rate: sometimes called the required rate of return the rate of interest that is used to find present values Discounting: the process of determining the present value of a future amount Present Value: PV = FV (1 + i) n or PV = FV (1+i) -n Example: XYZ expects to receive P 10,000 one year from now. What is the present value of this amount if the discount rate is 10 percent? PV = FV (1 + i) n = 10,000 (1+.10)1 = 9,090.91 or PV = FV (1+i) -n = 10,000 (1+.10)-1 = 10,000 (.9091**) = 9,090.91 * PVIF Present Value of Stream of Payments: Stream of Unequal Payments How: Compute the PV of an unequal or mixed, stream of payments separately and then add altogether PV = ϵ FV (PVIFin) PVIFin = 1 (1+i)n Example: XYZ expects to receive payments of P 10,000, 11,500 and P 20,000 at the end of one, two and three years respectively. The present value of this stream of payments discounted at 10 percent PV = ϵ FV (PVIFin) = 10,000 (.909) + 11,500 (.826) + 20,000 (.751) = 9,090 + 9,499 + 15,020 = 33,609 Present Value of Stream of Payments: Stream of Equal Payments A. Ordinary Annuity PVOA = A (PVIFAin) PVIFAin = 1 – _1_ __(1+i)n i Example: XYZ Corporation expects to receive P 10,000 at year-end for the next 3 years. The PV of this annuity discounted at 10 percent is? The PVIFAin is 2.487. PVOA = 10,000 (2.487) = 24,870 Present Value of Stream of Payments: Stream of Equal Payments B. Annuity Due PVAD = A (PVIFADin) PVIFADin = 1 – _1_ (1+i) __(1+i)n i Example: XYZ Corporation expects to receive P 10,000 at the beginning of the year for the next 3 years . The PV of this annuity discounted at 10 percent is? The PVIFADin is 2.7355 PVAD = 10,000 (2.7355) = 27,355 Present Value of a Perpetuity: Perpetuity * is an annuity with an infinite life, that is the payments continue indefinitely PV of perpetuity = A nnuity Discount rate Example: JBT Corporation wants to deposit an amount of money that will allow it to withdraw P 1,500 indefinitely at the end of each year without reducing the amount of the initial deposit. If the bank guarantees to pay the firm by 10 percent interest on its deposits , the amount to be deposited NOW is? \ PV of perpetuity = 1,500 .10 = 15,000 EXERCISE; The Billy Playhouse wants P 10,000 at the end of each year for the next 6 years. How much must be deposited today at 10% to yield this annuity? What amount must be deposited now in order to withdraw P 2,000 at the beginning of each year for 5 years if the interest rate is 12% compounded annually? ABC Company wants to deposit an amount of money that will allow it to withdraw P 2,000 indefinitely at the end of each year without decreasing the amount of the original deposit. If the bank guarantees to pay the firm 5 percent interest , the amount to be deposited NOW is? Thank you!