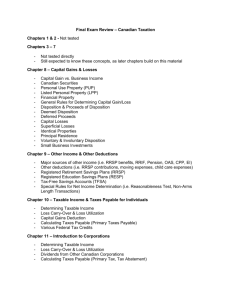

FNCE10002 Principles of Finance Semester 1, 2023 Department of Finance Teaching Note 3 An Introduction to the Taxation System in Australia* Asjeet S. Lamba, Ph.D., CFA Head, Department of Finance Faculty of Business and Economics University of Melbourne, Victoria 3010 asjeet@unimelb.edu.au Outline 1. An introduction to personal and capital gains taxes in Australia 1.1. Personal taxes 1.2. Capital gains taxes 2 2. Taxation of dividends under a classical tax system 8 3. Taxation of dividends under the imputation system 9 4. Suggested answers to practice problems 12 5. References and further reading 14 * This teaching note has been prepared for students enrolled in FNCE10002 Principles of Finance. This material is copyrighted by Asjeet S. Lamba and reproduced under license by the University of Melbourne (© 2000-23). This document was last revised in April 2023. It incorporates previous revisions by Howard Chan (Jan 2017) and Rob Brown (Nov 2022) which are gratefully acknowledged. Please email me if you find any typos and/or errors. Teaching Note 3: An Introduction to the Taxation System in Australia 1 FNCE10002 Principles of Finance Semester 1, 2023 This teaching note provides an introduction to the taxation system in Australia. Section 1 provides an introduction to the currently prevailing personal and capital gains tax systems in Australia, while sections 2 and 3 examine the taxation of dividends under the classical and imputation tax systems, respectively. Note that the focus of section 1 of this teaching note is on individuals who are Australian residents. Different rules apply to non-residents, Australian corporations and other resident entities which are not covered in this teaching note. At the end of this note you should be able to: ▪ ▪ Calculate the personal taxes for individuals using the appropriate tax rate regime Calculate the capital gains taxes for individuals using the method appropriate for the type of capital gains realized Examine the taxation of dividends under a classical tax system and its implications for corporations and individual shareholders Examine the taxation of dividends under the imputation tax system and its implications for corporations and individual shareholders ▪ ▪ 1. An Introduction to Personal and Capital Gains Taxes in Australia 1.1. Personal taxes In Australia, while corporations are taxed at a flat rate of 30%, individuals are taxed on a progressive basis with the tax rate increasing with income levels. For individuals, the tax year spans the period of July 1 through to June 30 of the following year. The 2022-23 tax rate schedule for individuals is given the following table.1 Table 1: Personal Income Tax Rates: 2022-23* Taxable Income $0 – $18,200 $18,201 – $45,000 $45,001 – $120,000 $120,001 – $180,000 $180,001 and over * Taxes Payable $0 19¢ for each $1 over $18,200 $5,092 + 32.5¢ for each $1 over $45,000 $29,467 + 37¢ for each $1 over $120,000 $51,667 + 45¢ for each $1 over $180,000 Source: Australian Tax Office, www.ato.gov.au/rates/individual-income-tax-rates. The taxes paid by individuals are based on taxable income which is equal to the individual’s assessable income minus any allowable deductions. Assessable income includes items such as salary and wages, investment income, realized capital gains, etc. while typical deductions include those related to work, managing investments, etc. Donations to approved charities are also allowed as deductions. The following example illustrates how taxes are calculated for individuals. Example 1: Personal taxes Josephine King, your second best friend, has asked you for some help with her taxes for the current tax year. You have figured out her taxable income for the year to be $95,000. Ignoring the Medicare levy, calculate Jo’s tax liability using the tax schedule given above. What are her average and marginal tax rates and how are these related to each other? 1 There is also a Medicare levy which is ignored in the examples in this teaching note. Teaching Note 3: An Introduction to the Taxation System in Australia 2 FNCE10002 Principles of Finance Semester 1, 2023 Solution Based on the 2022-23 tax schedule, Jo’s taxable income lies in the $45,001 – $120,000 range. So, on the first $45,000 Jo’s tax liability is $5,092 and on the remaining $50,000 she will pay taxes at 32.5%. That is: Tax payable on the first $45,000 = $5,092. Tax payable on the remaining $50,000 = 0.325 × 50,000 = $16,250. Total tax payable = $5,092 + $16,250 = $21,342. Jo’s average tax rate is the amount of tax paid divided by her taxable income. That is: Average tax rate = $21,342/$95,000 = 22.5%. The marginal tax rate is the tax rate applicable to the last dollar of taxable income and will be higher than the average tax rate. Here, Jo’s marginal tax rate is 32.5% because the last dollar of her taxable income is taxed at 32.5¢. 1.2. Capital gains taxes For individuals, a capital gains tax (CGT) is the tax paid on the net capital gains realized in a particular tax year.2 A net capital gain is defined as the total capital gain realized during the tax year minus the total capital loss realized in that year and any unapplied net capital losses from earlier years. Note that if an individual’s total capital loss in a tax year is more than the total capital gain, the difference is a net capital loss for that tax year. Such a loss can be carried forward to future years where it can be deducted against future, realized capital gains. In other words, one cannot deduct capital losses (or a net capital loss) from taxable income. There is also no time restriction on how long one can carry forward a net capital loss. Typically, a capital gain or loss is realized if a CGT event occurs. As shown in the examples below, for most CGT events an individual’s capital gain is the difference between the total capital proceeds and the cost base of the asset on which the capital gain is realized. Conversely, an individual makes a capital loss if the reduced cost base of the asset is greater than the total capital proceeds. Note that as the capital gains tax regime was introduced on September 20, 1985 any realized capital gain or capital loss on an asset acquired before September 20, 1985 is disregarded, and no capital gains taxes are payable on such asset sales. According to the Australian Tax Office (ATO), there are three methods that can be used to calculate the capital gain on an asset, which are: ▪ ▪ ▪ The “other” method The indexation method The discount method Each of these methods is described below, starting with the simplest one, the “other” method. 2 Different rules apply to corporations and other entities and these are not covered here. For details see the ATO’s Guide to Capital Gains Tax 2022, available at: https://www.ato.gov.au/Forms/Guide-to-capital-gains-tax-2022/. Teaching Note 3: An Introduction to the Taxation System in Australia 3 FNCE10002 Principles of Finance Semester 1, 2023 1.2.1. The “other” method This method is used to calculate the capital gain if an asset has been purchased and sold within a 12-month period. In such cases, the indexation and discount methods do not apply. The method is simple to use as it involves subtracting the asset’s cost base from the capital proceeds received upon its sale, as illustrated in the following example. Example 2: Calculating capital gains using the “other” method Your friend purchased a property for $200,000 on November 20, 2022. He paid a stamp duty of $5,000 on December 10, 2022 and his solicitor’s fees of $2,000 a week later. He sold the property on April 10, 2023 for $250,000 on which he incurred costs of $2,000 in solicitor’s fees and $4,000 in agent’s commission. Calculate your friend’s taxable capital gain on the sale of the property. Solution Since your friend bought and sold the property within 12 months he must use the “other” method to calculate the capital gain; that is, the full amount of the net capital gain is taxable. His total cost base is as follows. Cost of property Stamp duty on purchase of property Solicitor’s fees for purchase of property Solicitor’s fees for sale of property Agent’s commission on sale of property Total cost base $200,000 $5,000 $2,000 $2,000 $4,000 $213,000 The capital gain on the sale of the property is as follows. Capital proceeds Less: Cost base Capital gain $250,000 $213,000 $37,000 The whole of the $37,000 is included in his taxable income. 1.2.2. The indexation method For individuals, the indexation method is used to calculate the capital gain under the following conditions: ▪ A CGT event occurred to an asset acquired between September 20, 1985 and September 21, 1999, and ▪ The asset was owned for 12 months or more. Under this method, the cost base of the asset is increased by an indexation factor where the indexation factor is calculated using the relevant consumer price index (CPI) shown in the following table. Teaching Note 3: An Introduction to the Taxation System in Australia 4 FNCE10002 Principles of Finance Semester 1, 2023 Table 3: Consumer Price Index for the Indexation Method* Year 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 31 March 67.8 67.0 67.1 66.2 63.8 61.5 60.6 59.9 58.9 56.2 51.7 48.4 45.3 41.4 – Quarter Ending 30 June 30 September 68.1 68.7 67.4 67.5 66.9 66.6 66.7 66.9 64.7 65.5 61.9 62.3 60.8 61.1 59.7 59.8 59.0 59.3 57.1 57.5 53.0 54.2 49.3 50.2 46.0 46.8 42.1 43.2 – 39.7 31 December N/A** 67.8 66.8 67.0 66.0 62.8 61.2 60.1 59.9 59.0 55.2 51.2 47.6 44.4 40.5 Source: Australian Tax Office, 2022, https://www.ato.gov.au/rates/consumer-price-index. If the indexation method is used to calculate the capital gains the indexation factor is based on increases in the CPI up to September 1999 only as indexation was frozen on September 30, 1999. * ** If the CGT event occurred before September 21, 1999, the indexation factor used is: Indexation Factor = CPI for quarter when CGT event occurred . CPI for quarter in which expenditure was incurred Clearly, the higher this factor (that is, the higher the inflation adjustment required) the higher the cost base and the lower the net capital gain. The indexation of the asset cost base was frozen on September 21, 1999. So, for CGT events on or after September 21, 1999, the indexation factor is the CPI for the September 1999 quarter (which is 68.7, as highlighted in the table above), divided by the CPI for the quarter in which you incurred costs relating to the asset, and rounded to three decimal places. That is, the indexation factor for CGT events on or after September 21, 1999 is: Indexation Factor = CPI for quarter ending Sep 30, 1999 (= 68.7) . CPI for quarter in which expenditure was incurred 1.2.3. The discount method For individuals, the discount method is used to calculate the capital gain under the following conditions: ▪ The CGT event occurred on or after September 21, 1999, ▪ The asset was acquired at least 12 months before the CGT event, and ▪ The indexation method is not used to calculate the capital gain. Teaching Note 3: An Introduction to the Taxation System in Australia 5 FNCE10002 Principles of Finance Semester 1, 2023 Note that in verifying whether an asset was acquired at least 12 months before the CGT event both the acquisition and CGT event days are excluded from the month count. Also note that for assets acquired after September 21, 1999 only the discount method can be used to calculate the capital gain. Example 3: Choosing the indexation or discount method You sold 1,000 shares of LMB Ltd in July 2022 for $25,000, which were purchased in February 1995 for $18,000. The acquisition cost included stamp duty and brokerage while there was no brokerage on the sale. You had no other capital gains or capital losses in 2022-23 and no net capital losses carried forward from previous years. Which method should you use to calculate your capital gains? How does your answer change if the shares were purchased in February 1990? How does your answer change if the shares were purchased in February 1990 and if you had $2,500 in net capital losses carried forward from previous years? Solution As you owned the shares for more than 12 months and they were purchased after September 20, 1985 but before September 21, 1999 you can use the indexation method or the discount method to calculate your capital gains and choose the method that gives the best outcome. The calculations are as follows. Capital proceeds from sale Less: Cost base of shares Capital gain Less: CGT discount (50%) Taxable net capital gain Indexation method $25,000 $19,386* $5,614 -$5,614 Discount method $25,000 $18,000 $7,000 $3,500 $3,500 Note that the indexation factor is 68.7/63.8 = 1.077. So, Acquisition cost × Indexation factor = $18,000 × 1.077 = $19,386. * As the discount method provides you with a lower taxable net capital gain this method would be used in this case. If the shares were purchased in February 1990 the indexation factor becomes: 68.7/56.2 = 1.222. The cost base of the shares under the indexation method is: $18,000(1.222) = $21,996. Capital proceeds from sale Less: Cost base of shares Capital gain Less: CGT discount (at 50%) Taxable net capital gain Indexation method $25,000 $21,996* $3,004 -$3,004 Discount method $25,000 $18,000 $7,000 $3,500 $3,500 Note that the indexation factor is 68.7/56.2 = 1.222. So, Acquisition cost × Indexation factor = $18,000 × 1.222 = $21,996. * As the indexation method now provides you with a lower taxable net capital gain this method would be used in this case. This is because the inflation-adjusted cost base of the shares has risen substantially resulting in a lower taxable net capital gain. Teaching Note 3: An Introduction to the Taxation System in Australia 6 FNCE10002 Principles of Finance Semester 1, 2023 The capital gain calculations with a $2,500 in net capital losses carried forward from previous years are as follows. Capital proceeds from sale Less: Cost base of shares Capital gain Less: Capital losses from previous years Adjusted capital gain Less: CGT discount (at 50%) Taxable net capital gain Indexation method $25,000 $21,996* $3,004 $2,500 $504 -$504 Discount method $25,000 $18,000 $7,000 $2,500 $4,500 $2,250 $2,250 Note that the indexation factor is 68.7/56.2 = 1.222. So, Acquisition cost × Indexation factor = $18,000 × 1.222 = $21,996. * In this case you would use the indexation method as well because it results in a lower net capital gain.3 The following table provides a summary of the three methods used to calculate capital gains and the differences across these methods. In choosing between the indexation and discount methods an individual will use the method that results in the lower net taxable capital gains, as illustrated in the example above. Table 4: Summary of Methods for Calculating Taxable Capital Gains* Description of method When to use the method How to calculate capital gains * 3 Indexation method Allows an individual to increase the cost base by applying an indexation factor based on CPI up to September 1999 Use for an asset owned for 12 months or more if it produces a better result than the discount method. Applies to assets acquired between September 20, 1985 and September 21, 1999 Apply the relevant indexation factor then subtract the indexed cost base from the capital proceeds (see example 3 above) Discount method Allows an individual to halve the capital gain “Other” method Simplest method of subtracting the cost base from capital proceeds Use for an asset owned for 12 months or more if it produces a better result than the indexation method Use when an asset is purchased and sold within 12 months (that is, when the indexation and discount methods do not apply) Subtract the cost base from the capital proceeds, deduct any capital losses, then reduce by the relevant discount percentage (see example 3 above) Subtract the cost base from the capital proceeds (see example 2 above) Source: Adapted from Personal Investors Guide to Capital Gains Tax 2012, Australian Tax Office, Table 1. Note that applying one method to calculate the capital gains on a whole parcel of shares acquired before September 1999 may not be the best option if there are capital losses from previous years. In such cases, an even better option may be to apply the indexation method to sufficient shares to absorb the capital loss and then apply the discount method to any remaining shares. Such situations are not covered in this teaching note. Teaching Note 3: An Introduction to the Taxation System in Australia 7 FNCE10002 Principles of Finance 2. Semester 1, 2023 Taxation of Dividends Under a Classical Tax System The “classical” tax system is the tax system under which dividends are paid to shareholders from the after-corporate-tax earnings of firms. Taxes on these dividends are then payable at the shareholder’s level via personal taxes. This system is in operation in several countries, including the US. It was the system that was applicable to taxpayers in Australia until 1987 when it was replaced by the “imputation” system, which is discussed in the following section. Under the classical tax system earnings at the firm level are essentially taxed twice: first, at the firm level via corporate taxes on earnings and next at the shareholder level via personal taxes on dividends received. The following example illustrates the double taxation of earnings under the classical tax system. ABL Ltd had the following net income during 2022-23. Assume that it pays out all its after-tax earnings as dividends to its shareholders and the applicable company tax rate is 30%. Net operating income Interest expense Taxable income Tax payable (at 30%) Net income $2,000,000 $400,000 $1,600,000 $480,000 $1,120,000 You are an Australian resident who owns 1% of the shares of ABL which implies that you receive a dividend of $11,200 (= 0.01 × $1,120,000). Assume that your other taxable income is high enough to put you in the 45% marginal tax rate bracket.4 Your after-tax income related to this dividend would be as follows. Dividend received Tax payable on dividend (at 45%) Dividend income after tax $11,200 $5,040 $6,160 Under the classical tax system your “share” of the total taxes paid by the firm is $4,800 (= 0.01 × $480,000) while at the personal level the total tax payable is $5,040. So, the effective tax rate under the classical tax system is: Effective tax rate = ($4800 + $5040)/$16000 = 61.5%. Note that the $16,000 in the above calculation is your “share” of the firm’s taxable income (= 0.01 × $1,600,000). So, under the classical tax system the shareholder has effectively been taxed twice, as follows: Dividend income after tax = $16000(1 – tc)(1 – tp) = $16000(1 – 0.30)(1 – 0.45) = $6,160. Here tc is the corporate tax rate of 30% and tp is the shareholder’s personal marginal tax rate of 45%. 4 $180,000 may sound like a lot right now but remember that you’ll soon be a Melbourne Uni graduate and reaching that income threshold won’t take too long! Teaching Note 3: An Introduction to the Taxation System in Australia 8 FNCE10002 Principles of Finance 3. Semester 1, 2023 Taxation of Dividends Under the Imputation System In Australia, dividends paid to shareholders from earnings on which taxes have been paid at the corporate level are taxed under an “imputation” system. It is called an imputation system because the tax paid by a firm are imputed (or attributed) to shareholders. The tax paid by the firm is allocated to shareholders via “franking credits” or “imputation credits” attached to the dividends paid. These franking credits can be used by shareholders to fully (or partly) offset tax payable on the dividends. So, under the imputation system taxes paid at the firm and individual levels are treated in an integrated manner. A typical dividend payment statement is shown below. Figure 1: Example of a Dividend Statement Source: You and Your Shares 2022, Australian Tax Office, p. 6. In the above example, the shareholder has received an unfranked dividend of $200 and a franked dividend of $700. Unfranked dividends are dividends paid from earnings on which no corporate tax is paid in Australia.5 As a result, unfranked dividends are taxed as part of the shareholder’s ordinary income while the franked dividend has associated with it an imputation (or franking) credit, which, in our example, is $300. This amount is calculated using the following expression: Franking credit = Div[tc/(1 – tc)], where tc is the corporate tax rate, currently at 25% or 30%, depending on the company’s aggregate turnover.6 In our example, assuming the company tax rate is 30%, the franking credit is: Franking credit = $700(0.3)/(1 – 0.3) = $300. For tax purposes this franking credit is considered both as (imputed) personal income and the tax already paid by the shareholder. Assuming that the shareholder has other taxable income which 5 6 An example of this would be foreign earnings earned by an Australian firm. The aggregate turnover threshold is $50 million and firms with an aggregate turnover less that this amount are taxed at 25% while those with a turnover above this amount are taxed at 30%. This teaching note assumes a 30% marginal corporate tax rate. Teaching Note 3: An Introduction to the Taxation System in Australia 9 FNCE10002 Principles of Finance Semester 1, 2023 puts her in the 45% marginal tax bracket, the tax payable on the franked dividend is calculated as follows: Franked dividend received Franking credit1 Grossed-up dividend2 Tax liability (at 45%) Less: Franking credit1 Tax payable on dividend 1 2 $700 $300 $1,000 $450 $300 $150 Row 1 Row 2 Row 3 = Row 1 + Row 2 Row 4 = 0.45 × Row 3 Row 5 = Row 2 Row 6 = Row 4 – Row 5 Franking credit = Div[tc/(1 – tc)] = $700(0.30)/(1 – 0.30) = $300. Grossed-up dividend = Div + Div[tc/(1 – tc)] = Div/(1 – tc) = $700/(1 – 0.30) = $1,000. We return to our example of ABL Ltd and now assume that the company pays all of its after-tax earnings as franked dividends to shareholders. Net operating income Interest expense Taxable income Tax payable (at 30%) Net income $2,000,000 $400,000 $1,600,000 $480,000 $1,120,000 As a shareholder you own 1% of the firm and receive $11,200 in franked dividends. Again, assume that your other taxable income is high enough to put you in the 45% marginal tax rate bracket. The tax payable on these dividends is calculated as follows. Dividend received Franking credit1 Grossed-up dividend2 Tax liability (at 45%) Less: Franking credit1 Tax payable on dividend Dividend income after tax 1 2 $11,200 $4,800 $16,000 $7,200 $4,800 $2,400 $8,800 Row 1 Row 2 Row 3 = Row 1 + Row 2 Row 4 = 0.45 × Row 3 Row 5 = Row 2 Row 6 = Row 4 – Row 5 Row 1 – Row 6 Franking credit = Div[tc/(1 – tc)] = $11,200(0.30)/(1 – 0.30) = $4,800. Grossed-up dividend = Div + Div[tc/(1 – tc)] = Div/(1 – tc) = $11,200/(1 – 0.30) = $16,000. Under the imputation system your share of the total taxes paid by the firm is $4,800 (= 0.01 × $480,000) while at the personal level the total tax payable is $2,400. Thus, the effective tax rate under the imputation tax system is: Effective tax rate = ($4800 + $2400)/$16000 = 45%. Again, note that the $16,000 in the above calculation is your “share” of the firm’s taxable income (= 0.01 × $1,600,000). So, under the imputation tax system the shareholder is effectively taxed at the shareholder’s marginal personal tax rate, as follows: Dividend income after tax = $16000(1 – tp) = $16000(1 – 0.45) = $8,800. Teaching Note 3: An Introduction to the Taxation System in Australia 10 FNCE10002 Principles of Finance Semester 1, 2023 Now consider two other shareholders who are in the 30% and 15% marginal tax brackets, respectively and who receive the same franked dividend as you.7 The tax payable by the shareholder in the 30% marginal tax bracket is as follows. Dividend received Franking credit1 Grossed-up dividend2 Tax liability (at 30%) Less: Franking credit1 Tax payable on dividend Dividend income after tax 1 2 $11,200 $4,800 $16,000 $4,800 $4,800 $0 $11,200 Row 1 Row 2 Row 3 = Row 1 + Row 2 Row 4 = 0.30 × Row 3 Row 5 = Row 2 Row 6 = Row 4 – Row 5 Row 1 – Row 6 Franking credit = Div[tc/(1 – tc)] = 11200(0.30)/(1 – 0.30) = $4,800. Grossed-up dividend = Div + Div[tc/(1 – tc)] = Div/(1 – tc) = 11200/(1 – 0.30) = $16,000. This shareholder has no tax payable on the dividend and the effective tax rate for this shareholder is: Effective tax rate = ($4800 + 0)/$16000 = 30%. The implication is that if the shareholder’s marginal tax rate is equal to the corporate tax rate a fully franked dividend is effectively tax-free to an Australian resident. In this case, we have: Dividend income after tax = $16000(1 – tp) = $16000(1 – 0.30) = $11,200. Finally, consider the shareholder who is in the 15% marginal tax bracket whose tax payable is shown in the following table. Dividend received Franking credit1 Grossed-up dividend2 Tax liability (at 15%) Less: Franking credit1 Tax payable on dividend Dividend income after tax 1 2 $11,200 $4,800 $16,000 $2,400 $4,800 –$2,400 $13,600 Row 1 Row 2 Row 3 = Row 1 + Row 2 Row 4 = 0.15 × Row 3 Row 5 = Row 2 Row 6 = Row 4 – Row 5 Row 1 – Row 6 Franking credit = Div[tc/(1 – tc)] = $11,200(0.30)/(1 – 0.30) = $4,800. Grossed-up dividend = Div + Div[tc/(1 – tc)] = Div/(1 – tc) = $11,200/(1 – 0.30) = $16,000. This shareholder has a negative tax payable; that is, a tax refund is forthcoming on this dividend. The effective tax rate for this shareholder is: Effective tax rate = ($4800 – $2400)/$16000 = 15%. In this case, we have: Dividend income after tax = $16000(1 – tp) = $16000(1 – 0.15) = $13,600. 7 Note that there is no 30% personal tax bracket and this rate has been chosen to illustrate the case where the company and the shareholder have the same marginal tax rate. Superannuation funds have a marginal tax rate of 15%. Teaching Note 3: An Introduction to the Taxation System in Australia 11 FNCE10002 Principles of Finance Semester 1, 2023 The implication is that if the shareholder’s marginal tax rate is less than the corporate tax rate a fully franked dividend will result in negative tax payable, which reduces the tax payable on other income, or is refunded if no other tax is payable. Overall, the above analysis shows that the imputation tax system eliminates the double taxation of corporate earnings where each shareholder’s franked dividend income is effectively taxed at that shareholder’s marginal personal tax rate.8 Practice Problem 1 Blaine Ennis’s income for the 2022-23 tax year was $87,000, excluding dividends and share transactions. He received a fully franked dividend of $0.60 per share on his holding of 5,000 shares in ABC Ltd and an unfranked dividend of $0.10 per share on his holding of 8,000 shares in XYZ Ltd. The company tax rate paid by ABC Ltd is 30%. During the year, he sold half of his holding of ABC’s shares for $6.40 per share. He had purchased these shares for $6.00 per share in December 2002. Use the tax table in this teaching note to calculate Blaine’s taxable income, tax liability and tax payable for 2022-23. What are his average and marginal tax rates? Show all your calculations. Practice Problem 2 Sienna Feld owns $500,000 in 10 percent bonds of Festivus Ltd as well as 20,000 of its ordinary shares. In the past year, Festivus Ltd paid the stipulated interest on its bonds and a dividend of $2.00 per share. The firm’s tax rate is 30 percent. Assume that Sienna’s other taxable income is high enough so that the interest and dividend are taxed at the highest marginal tax rate of 45%. Calculate her taxable income, tax liability and tax payable on this interest and dividend income assuming that: (a) the dividend is unfranked and (b) the dividend is fully franked. How do your answers change if Sienna has no other taxable income? Show all your calculations. 4. Suggested answers to practice problems Practice Problem 1 The taxable income, tax liability and tax payable are as follows. Base taxable income Franked dividend Franking credit1 Unfranked dividend Taxable capital gain2 Taxable income Tax liability3 Tax payable4 5000 × $0.60 $3000 × [0.30/(1 – 0.30)] 8000 × $0.10 0.50 × [$6.40 – $6.00] × 2500 $5092 + 0.325 × ($92,585.71 – $45,000.00) $20,557.36 – $1285.71 $87,000.00 $3,000.00 $1,285.71 $800.00 $500.00 $92,585.71 $20,557.36 $19,271.65 Franking credit = Div[tc/(1 – tc)]. The discount method is the one available for calculating the taxable capital gain. 3 The tax liability is calculated using the tax table in this teaching note. 4 Tax payable = Tax liability – Franking credit. 1 2 8 Note that this analysis assumes that the firm pays all of its after-tax earnings as dividends and that the dividends paid are fully (or 100%) franked. If this is not the case, the overall effect may be different. Such cases are not considered in this teaching note. Teaching Note 3: An Introduction to the Taxation System in Australia 12 FNCE10002 Principles of Finance Semester 1, 2023 Average tax rate = $19,271.65/$92,585.71 = 20.8%. Marginal tax rate = 32.5%. Practice Problem 2 Assuming that Sienna has other taxable income so that the interest and dividends are taxed at her marginal rate of 45% we have the following tax payable. a) If the dividend is unfranked the tax payable on the interest and dividends is as follows. Interest income Dividend income Taxable income Tax payable b) $500,000 × 0.10 20,000 × $2.00 $50,000.00 $40,000.00 $90,000.00 $40,500.00 $90,000 × 0.45 If the dividend is fully franked the tax payable on the interest and dividends is as follows. Interest income Dividend income Franking credit1 Taxable income Tax liability Tax payable2 1 2 $500,000 × 0.10 20,000 × $2.00 $40,000 × 0.30/(1 − 0.30) $107,142.86 × 0.45 $48,214.29 − $17,142.86 $50,000.00 $40,000.00 $17,142.86 $107,142.86 $48,214.29 $31,071.43 Franking credit = Div[tc/(1 – tc)]. Tax payable = Tax liability – Franking credit. If Sienna has no other taxable income we can use the tax table to calculate the tax payable, as below. a) If the dividend is unfranked then the tax payable on the interest and dividends is as follows. The taxable income from the calculation in part (a) above is $90,000. Taxable income Tax liability on first $45,0001 Tax liability on remaining $45,0001 Tax payable 1 b) $45,000 × 0.325 $90,000.00 $5,092.00 $14,625.00 $19,717.00 The tax liability is calculated using the tax table for 2022-23. If the dividend is fully franked then the tax payable on the interest and dividends is calculated as follows. The taxable income from the calculation in part (b) above is $107,142.86. Taxable income Tax liability on first $45,0001 Tax liability on remaining $62,142.861 $62,142.86 × 0.325 Total tax liability $5,092.00 + $20,196.43 2 Tax payable $25,288.43 − $17,142.86 1 2 $107,142.86 $5,092.00 $20,196.43 $25,288.43 $10,132.00 The tax liability is calculated using the tax table in this teaching note. Tax payable = Tax liability – Franking credit. Teaching Note 3: An Introduction to the Taxation System in Australia 13 FNCE10002 Principles of Finance 5. Semester 1, 2023 References and further reading Australian Tax Office, Guide to Capital Gains Tax 2022. Available at: https://www.ato.gov.au/Forms/Guide-to-capital-gains-tax-2022/ Australian Tax Office, You and Your Shares 2022. Available at: https://www.ato.gov.au/Forms/You-and-your-shares-2022/ Teaching Note 3: An Introduction to the Taxation System in Australia 14