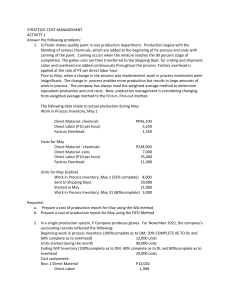

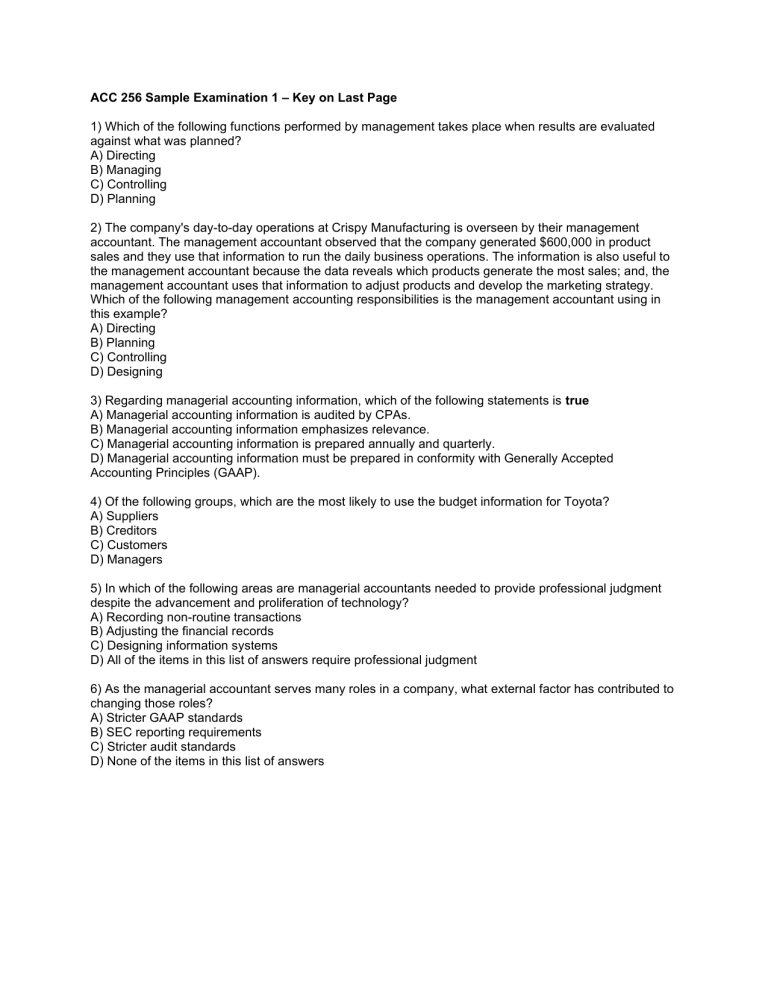

ACC 256 Sample Examination 1 – Key on Last Page 1) Which of the following functions performed by management takes place when results are evaluated against what was planned? A) Directing B) Managing C) Controlling D) Planning 2) The company's day-to-day operations at Crispy Manufacturing is overseen by their management accountant. The management accountant observed that the company generated $600,000 in product sales and they use that information to run the daily business operations. The information is also useful to the management accountant because the data reveals which products generate the most sales; and, the management accountant uses that information to adjust products and develop the marketing strategy. Which of the following management accounting responsibilities is the management accountant using in this example? A) Directing B) Planning C) Controlling D) Designing 3) Regarding managerial accounting information, which of the following statements is true A) Managerial accounting information is audited by CPAs. B) Managerial accounting information emphasizes relevance. C) Managerial accounting information is prepared annually and quarterly. D) Managerial accounting information must be prepared in conformity with Generally Accepted Accounting Principles (GAAP). 4) Of the following groups, which are the most likely to use the budget information for Toyota? A) Suppliers B) Creditors C) Customers D) Managers 5) In which of the following areas are managerial accountants needed to provide professional judgment despite the advancement and proliferation of technology? A) Recording non-routine transactions B) Adjusting the financial records C) Designing information systems D) All of the items in this list of answers require professional judgment 6) As the managerial accountant serves many roles in a company, what external factor has contributed to changing those roles? A) Stricter GAAP standards B) SEC reporting requirements C) Stricter audit standards D) None of the items in this list of answers 7) At Snow Day Manufacturing, two employees perform the following tasks as indicated in the following: Employee A Roles and Responsibilities Raise capital by issuing stocks & bonds Reports to CFO Employee B Roles and Responsibilities General financial accounting Tax preparation General managerial accounting Reports to CFO Which of the following is the role of Employee A and Employee B? A) CFO; CEO B) Managerial Accountant; Financial Accountant C) Treasurer; Controller D) Audit Committee; Cross-Functional Team 8) The Institute of Management Accountants prescribes ethical standards that includes A) Competence, Confidentiality, Perseverance, and Credibility. B) Competence, Objectivity, Credibility, and Honesty. C) Competence, Confidence, Integrity, and Credibility. D) None of the items in this list of answers 9) The manager of The Chipped Teacup ships out pre-ordered merchandise during the last week of December in order to ensure a profit and not in mid-January as the customer instructed. This early shipment could be a violation of which ethical standard? A) Confidentiality B) Integrity C) Competence D) Verifiability 10) With a focus on influencing a firm’s ability to survive and thrive in the long run, what three factors comprise the “triple bottom line? A) People, places, things B) Profit, people, planet C) Profit, people, place D) Planet, profit, place 11) Border Supply Company is considering opening a plant in Vietnam. The company anticipates gross profit of $3,500,000 from this new plant. It will cost $2,000,000 to set up the plant and $800,000 to train employees. An additional $160,000 will be spent to build relationships with the local suppliers. Do the benefits outweigh the costs or do the costs outweigh the benefits, and by how much? A) Costs outweigh benefits by $700,000. B) Benefits outweigh costs by $700,000. C) Costs outweigh benefits by $540,000. D) Benefits outweigh costs by $540,000. 12) All of the following are part of a company’s value chain except A) Reporting B) Design C) Purchase D) Research 13) Shamrock Farms provided the following expense information for April: Assembly-line workers' wages Plastic milk bottles Delivery expenses Caps for milk bottles Reconfiguring the assembly line Advertising campaign Salaries of research scientists Depreciation on factory equipment Salaries of salespeople Utilities for factory Customer toll-free order line $65,700 41,900 15,300 2,250 75,300 10,700 42,100 22,300 48,300 14,300 8,900 What is the total cost for the production category of the value chain? A) $221,750 B) $146,450 C) $109,850 D) $102,300 14) When determining the cost of a manufacturing product, how would a salesperson’s salary be classified? A) a direct cost B) an indirect cost C) a period cost D) None of the items in this list of answers 15) Which of the following is an example of indirect labor in a manufacturing plant? A) Chief financial officer B) Machine operators C) Salespersons D) None of the items in this list of answers 16) Java Deluxe manufacturers espresso coffee machines. Which of the following is an example of manufacturing overhead costs in its manufacturing factory? A) Wages of assembly line workers B) Wages of administrators in the corporate office C) Wages of factory supervisors D) Salaries of salespersons 17) When preparing the financial statements for a manufacturing company, where would period costs be presented? A) Under current assets on the balance sheet B) Under current liabilities on the balance sheet C) As operating expenses on the income statement in the period incurred D) As operating expenses on the income statement for a previous period 18) Which of the following is an example of a product cost for a manufacturing company? A) Depreciation on corporate office equipment B) Insurance on store building C) Sales salaries expenses D) None of the items in this list of answers 19) Manufacturing overhead for a company was $643,650; direct materials were $324,850; and direct labor was $124,900. What is the total amount of conversion costs? A) $1,093,400 B) $449,750 C) $968,500 D) $768,550 20) Lumberjack Company reports the following data for its first year of operation. Cost of goods manufactured Work in process inventory, beginning Work in process inventory, ending Direct materials used Direct Labor Manufacturing overhead Finished goods inventory, beginning Finished goods inventory, ending $304,600 0 72,500 90,750 123,400 162,950 0 110,800 What is the cost of goods sold? A) $110,800 B) $193,800 C) $304,600 D) $377,100 21) Mountain Sports sells ski and snowboarding equipment. The following information summarizes the company's operating expenses for 2020: Cost of goods sold Marketing Rent and utilities Salaries and wages $114,900 $9,000 $50,200 $65,800 If sales revenue in 2020 was $267,400, what is gross profit? A) $152,500 B) $27,700 C) $125,000 D) $142,400 22) Cambridge Manufacturing is deciding whether to purchase a new piece of equipment that can produce units more quickly than its current equipment. Which of the following costs would be relevant to its decision? A) The original purchase price of the current machinery B) The accumulative repairs costs of the current machinery over the years C) The cost of raw materials D) None of the items in this list of answers 23) Aspen Toy Company has fixed costs of $22,000 per month. If sales double from 3,000 to 6,000 units during the month, fixed costs in total will A) double. B) remain the same. C) be cut in half. D) None of the items in this list of answers 24) All Pro Manufacturing produces baseball gloves at a variable cost of $43 per glove. If 5,240 gloves are produced at a total variable cost of $225,320, the total variable cost at 4,180 gloves will be A) $225,320. B) $24. C) $179,740. D) $405,060. 25) An industry that would use a process costing system rather than a job-order costing system? A) Pepsi Cola B) Boeing Airplanes C) Centex Home Builders D) Smith, Attorney at Law 26) After a requisition of direct material, they flow directly into A) cost of goods sold account. B) finished goods inventory account. C) manufacturing overhead account. D) none of the items in this list of answers. 27) When examining the basic flow of inventory in a manufacturing company, which of the following is the last step in the job-costing process? A) Finished goods inventory B) Cost of goods sold C) Raw materials inventory D) Work in process inventory 28) Blane Products Manufacturing uses job costing. In June, material requisitions were $61,200 ($56,000 of these were direct materials), and raw material purchases were $76,700. The end of month balance in raw materials inventory was $41,300. What was the beginning raw materials inventory balance? A) $91,400 B) $62,000 C) $25,800 D) $40,500 29) Here are selected data for Creek Corporation: Cost of materials purchases on account Cost of materials requisitioned (includes $13320 of indirect) Direct labor costs incurred Manuf. overhead costs incurred, including indirect materials Cost of goods manufactured Cost of goods sold Beginning raw materials inventory Beginning work in process inventory Beginning finished goods inventory Predetermined overhead rate (as % of direct labor cost) What is the balance in work in process inventory at the end of the year? A) $19,910 B) $47,590 C) $55,600 D) $28,500 $72,900 $56,100 $81,300 $102,400 $228,100 $155,900 $18,900 $34,500 $37,500 110% 30) Bob Burgers allocates manufacturing overhead to jobs based on machine hours. The company has the following estimated costs for the upcoming year: Direct materials used Direct labor costs Wages of factory janitors Sales supervisor salary Utilities for factory Rent on factory building Advertising expense $52,800 $72,900 $42,100 $53,200 $18,900 $15,900 $7,980 The company estimates that 1,850 direct labor hours will be worked in the upcoming year, while 1,000 machine hours will be used during the year. The predetermined manufacturing overhead rate per machine hour will be A) $34.80. B) $138.08. C) $263.78. D) $76.90. 31) Fast Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year: Estimated direct labor cost Actual direct labor cost Estimated manufacturing overhead costs Actual manufacturing overhead costs Estimated direct labor hours Actual direct labor hours $591,000 $474,600 $434,200 $359,000 259,900 241,600 If Fast Company uses direct labor cost as the allocation base, what would the predetermined manufacturing overhead rate be? A) 70% B) 76% C) 91% D) 73% 32) Nadal Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year: Actual direct labor hours Estimated direct labor hours Actual manufacturing overhead costs Estimated manufacturing overhead costs Actual direct labor cost Estimated direct labor cost 235,000 251,000 $358,600 $408,800 $473,800 $508,300 If Nadal Company uses direct labor hours as the allocation base, what would the allocated manufacturing overhead be for the year? (Round intermediary calculations to the nearest cent and the final answer to the nearest dollar.) A) $336,050 B) $358,600 C) $409,130 D) $383,050 33) Benson Corporation charged Job 111 with $24,000 of direct materials and $22,600 of direct labor. Allocation for manufacturing overhead is 70% of direct labor costs. What is the total cost of Job 111? A) $62,420 B) $15,820 C) $78,240 D) None of the items on this list of answers 34) Astro Company manufactures custom engines for use in the lawn and garden equipment industry. The company allocates manufacturing overhead based on machine hours. Selected data for costs incurred for Job 799 are as follows: Direct materials used Direct labor hours worked Machine hours used Direct labor rate per hour Predetermined overhead rate based on machine hours $6,100 350 505 $20 $25 What is the total manufacturing cost of Job 799? A) $25,725 B) $7,000 C) $12,625 D) $6,955 35) A ___________ is the primary factor that causes a cost to be incurred. A) cost driver B) cost allocation C) materials requisition D) predetermined manufacturing overhead rate 36) If a job consists of a batch of identical units, how can managers find the unit cost? A) By tracing direct materials to each unit B) By multiplying the total job cost by the number of units in the job C) By dividing the total job cost by the number of units in the job D) By tracing direct labor to each unit 37) Manufacturing overhead has an overallocated balance of $7,800; raw materials inventory balance is $62,900; work in process inventory is $34,300; finished goods inventory is $25,600; and cost of goods sold is $135,500. After adjusting for the overallocated manufacturing overhead, what is cost of goods sold? A) $127,700 B) $97,200 C) $143,300 D) $135,500 38) When calculating a departmental overhead rate, what should the numerator be? A) Total estimated amount of the departmental allocation base B) Total estimated departmental overhead cost pool C) Total estimated amount of manufacturing overhead for the factory D) Actual quantity of the departmental allocation base used by the job 39) When broadly allocating indirect costs, cost distortion may result in A) overcosting of all products. B) undercosting of all products. C) accurate costing of all products. D) undercosting some products and overcosting other products. 40) Alpine Inc. allocates manufacturing overhead to each job using departmental overhead rates. Operations at Alpine are divided into a Grinding department and a Welding department. The Grinding department uses a departmental overhead rate of $50 per machine hour, while the Welding department uses a departmental overhead rate of $28 per direct labor hour. Job 923 used the following direct labor hours and machine hours in the two departments: Actual results Direct labor hours used Machine hours used Grinding Department 6 3 Welding Department 10 4 The cost of direct labor and the cost of the direct materials used by Job 923 is $280 and $170 respectively. How much manufacturing overhead would be allocated to Job 923 using the departmental overhead rates? A) $430 B) $612 C) $384 D) $580 41) Activities classified as non-value added are A) also called waste activities. B) activities that neither provide a competitive advantage of improve the customer’s image of the product. C) activities that could be removed from or reduced within a process with no ill effect on the end product or service. D) All of the items in this list of answers 42) Which of the following types of companies can benefit from using ABC? A) Manufacturing firms B) Merchandising firms C) Firms that provide services D) All types of companies can benefit from using ABC. 43) Which of the following is not considered to be part of the cost hierarchy frequently used when implementing ABC? A) production-level activity B) batch-level activity C) product-level activity D) unit-level activity 44) Using factory utilities would best be classified as which type of activity in the ABC cost hierarchy? A) unit-level B) batch-level C) facility-level D) product-level 45) Star Company manufactures large portable heaters and uses ABC to allocate all indirect manufacturing costs. Each portable heater requires $20 of direct labor and consists of 24 separate parts totaling $110 in direct materials. Each unit requires 6.0 machine hours to produce. Additional information follows: Activity Materials handling Machining Assembling Packaging Allocation Base Number of parts Machine hours Number of parts Number of finished units Cost Allocation Rate $1.75 per part $3.20 per machine hour $1.10 per part $4.00 per finished unit What is the total manufacturing cost of one portable heater? A) $221.60 B) $201.60 C) $111.60 D) $91.60 46) All of the following are characteristic of a lean company except A) arranging machines by function. B) reducing machine setup times. C) producing product in in small batches. D) training employees to operate more than one machine. 47) When companies implement a lean strategy and cross-train their employees the company will A) decrease morale. B) increase costs. C) restrict employee abilities. D) None of the items in this list of answers 48) All of the following would be considered non-value-added activities except the A) assembly of products. B) movement of parts from a warehouse. C) inspection of the product. D) None of the items in this list of answers. 49) When constructing a Cost of Quality report which of the following cost items should be listed as a prevention cost? A) Providing suppliers with technical support B) Warranty expenses for the repair of defective products C) Conducting quality inspections D) The cost of spoiled units 50) Consider a company that decreased investments in its prevention costs by reducing employee training. The company’s external failure costs would likely A) go up. B) go down. C) remain unchanged. D) None of the items in this list of answers Key 1. C 2. A 3. B 4. D 5. D 6. D 7. C 8 .D 9. B 10. B 11. D 12. A 13. B 14. C 15. D 16. C 17. C 18. D 19. D 20. B 21. A 22. D 23. B 24. C 25. A 26. D 27. B 28. C 29. A 30. D 31. D 32. D 33. A 34. A 35. A 36. C 37. A 38. B 39. D 40. A 41. D 42. D 43. A 44. C 45. A 46. A 47. D 48. A 49. A 50. A