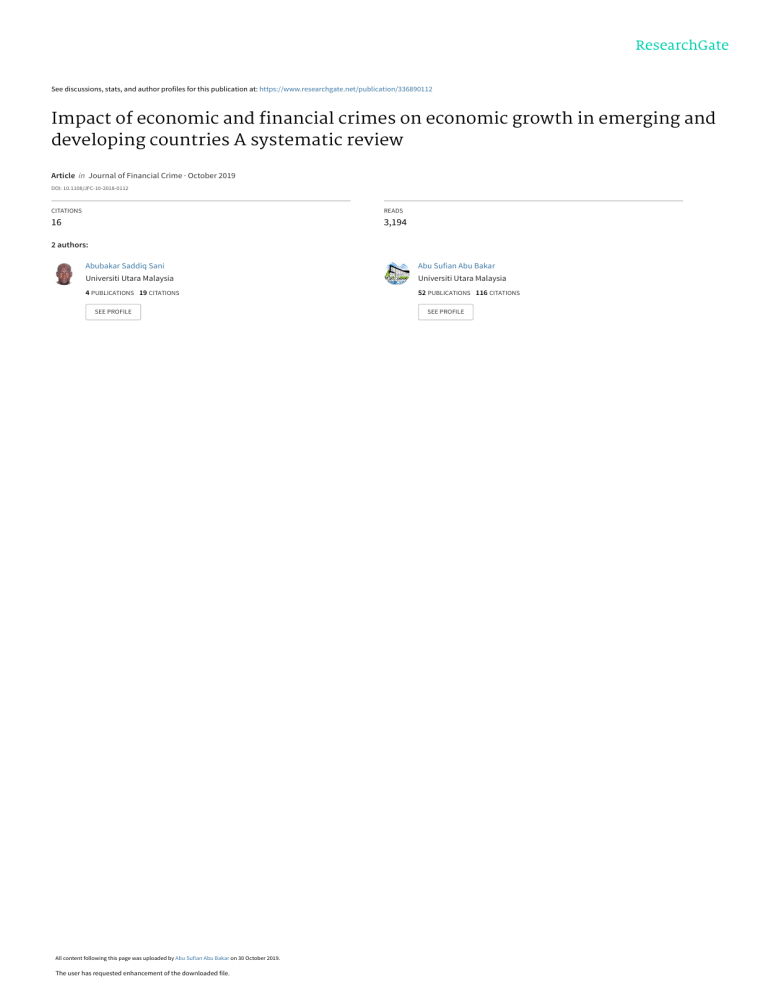

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/336890112 Impact of economic and financial crimes on economic growth in emerging and developing countries A systematic review Article in Journal of Financial Crime · October 2019 DOI: 10.1108/JFC-10-2018-0112 CITATIONS READS 16 3,194 2 authors: Abubakar Saddiq Sani Abu Sufian Abu Bakar Universiti Utara Malaysia Universiti Utara Malaysia 4 PUBLICATIONS 19 CITATIONS 52 PUBLICATIONS 116 CITATIONS SEE PROFILE All content following this page was uploaded by Abu Sufian Abu Bakar on 30 October 2019. The user has requested enhancement of the downloaded file. SEE PROFILE The current issue and full text archive of this journal is available on Emerald Insight at: www.emeraldinsight.com/1359-0790.htm JFC 26,3 910 Impact of economic and financial crimes on economic growth in emerging and developing countries A systematic review Sani Abubakar Saddiq Department of General Studies, Abubakar Tatari Ali Polytechnic, Bauchi, Nigeria, and Abu Sufian Abu Bakar School of Economics, Finance and Banking, Universiti Utara Malaysia, Sintok, Malaysia Abstract Purpose – The purpose of the study is to investigate the impact of economic and financial crimes on the economies of emerging and developing countries. Design/methodology/approach – Preferred Reporting Items for Systematic review and Meta-Analysis (PRISMA) guidelines and meta-analysis of economics research reporting guidelines were used to conduct a quantitative synthesis of empirical evidence on the impact of economic and financial crimes in developing and emerging countries. Findings – A total of 103 studies were searched, out of which 6 met the selection/eligibility criteria of this systematic review. The six selected studies indicated that economic and financial crimes have a negative impact in emerging and developing countries. Originality/value – To the best knowledge of the authors, no published systematic review of the impact of economic and financial crimes in developing countries has been conducted to date. Keywords Impact, Systematic review, Economic and financial crimes, Emerging and developing countries Paper type Literature review Journal of Financial Crime Vol. 26 No. 3, 2019 pp. 910-920 © Emerald Publishing Limited 1359-0790 DOI 10.1108/JFC-10-2018-0112 Background Past studies conducted reveal that economic and financial crimes have continued to increase despite tough policy measures put in place in both developed and developing countries. For instance, it was estimated that $1.5 trillion to $2 trillion (or around 2 per cent of global gross domestic product [GDP]) in bribes are paid annually in both developing and developed countries (Lagarde, 2016). It was estimated that illicit financial flows (IFFs) from developing and emerging economies stood at nearly US$1 trillion in 2014 (Global Financial Integrity, 2017). Developing countries are at high risk of incidences of economic and financial crimes. For example, the poor in developing countries pay as high as 6.4 to 12.6 per cent of their incomes in bribe (World Bank Group, 2017). In Nigeria, a survey conducted in 2017 reveals that 95 per cent of Nigerians indulge in bribery (National Bureau for Statistics, 2017). Similarly, research studies conducted by various scholars, institutions, authorities and organizations have consistently revealed negative impact of economic and financial crimes on economic growth and development across the globe. For example, it was found that developed countries did not have a monopoly on economic and financial crimes. Developing countries also had their share of such criminal activities, which constituted major obstacles to political and social stability and to economic progress (Aquino, 2005). Economic and financial crimes have been one of the most serious threats for the security and stability of nations, regions and the world. The crimes were growing at an alarming rate and were linked to the growing integration of the world economy (Bertrand, 2005). Economic and financial crimes such as corruption was declared public enemy number one in developing countries (Kim, 2013). Corruption in particular is considered a major challenge to twin goals of ending extreme poverty by 2030 and boosting shared prosperity for the poorest 40 per cent of people in developing countries. This means that corruption has negative impact on the poor and on economic growth (World Bank Group, 2017). The main problem associated with economic and financial crimes is the seemly unsolvable nature of these crimes. Various theoretical works were put forward to explain causes, types, characteristics and impact of economic and financial crimes. For example, an economic crime such as corruption is a product of individual and structural variables that interact to produce both positive and negative consequences; corruption, as a process, influences the optimal level of social welfare; this theory posits that if the level of corruption is high in country be it developed or underdeveloped, the level of its economic growth will be low (Nas et al., 1986). It was postulated that economic crime is an illegal act perpetrated by an individual or group of individuals purposively for financial gain (Chamlin and Kennedy, 1991) and (Freeman, 1996). These theories are of the assumption that offenders motive in committing economic crime can be observed. Similarly, Savelsberg (1987) and Baldry (1995) theorized that economic crimes are illegal acts that successfully offer the offenders economic returns (outcomes) while the victims incur economic cost. The outcomes could be financial or professional advantage, while the victims can be an individual, group of individuals or the society as a whole. When these theoretical works are applied to occurrences of economic and financial crimes in the world, this paper assumes that these criminal activities have profound negative impacts especially in developing countries. This systematic review is conducted to examine the following research questions: What are the impacts of economic and financial crimes such as corruption on economic growth of emerging and developing countries? What factors influence an individual or group of individuals to commit economic and financial crimes in emerging and developing countries? What are the policy measures put in place to tackle economic and financial crimes in emerging and developing countries? Vast majority of empirical analyses also reveals a negative relationship between economic crime such as corruption and economic growth in emerging and developing countries ranging from siphoning limited resources to worsening poverty (Waziri, 2010). Economic crime is defined as that group of offences frequently committed in conjunction with legitimate economic activities and largely by perpetrators who enjoy considerable amount of respect in the communities (Caric, 2005). However, to the best knowledge of authors of this a systematic review of the impact of economic and financial crimes on developing countries has not been conducted. This study conducted a systematic review of the impact of economic and financial crimes in developing countries such as East Asia and Pacific (EAP), Middle East, Africa, Latin America, Caribbean (LAC), East Europe and Central Asia. Methods To conduct a quantitative synthesis of empirical evidence on the impact of economic and financial crimes in developing and emerging countries, this systematic review will be conducted Impact of economic and financial crimes 911 JFC 26,3 912 according to the Preferred Reporting Items for Systematic review and Meta-Analysis (PRISMA) guidelines (Moher et al., 2009) as well as meta-analysis of economics research reporting (MRA) guidelines (Stanley et al., 2013). PRISMA is a term used to refer to combination of systematic review and meta-analysis. A systematic review is a review of a clearly formulated question that uses systematic and explicit methods to identify, select and critically appraise relevant research, and to collect and analyze data from the studies that are included in the review. Meta-analysis refers to the use of statistical techniques in a systematic review to integrate the results of included studies (Nas et al., 1986). MRA is the systematic review and quantitative synthesis of empirical economic evidence on a given hypothesis, phenomenon or effect. MRA is a type of meta-analysis that is explicitly designed to integrate econometric estimates, typically regression coefficients or transformations of regression coefficients (Stanley et al., 2013). Selection/inclusion criteria In this review only quantitative studies were selected for meta-analysis. The study adopted the following eligibility criteria. First, research studies had to focus on the impact of any type of economic and financial crimes in emerging and developing countries. Studies that focused on the impact of economic and financial crimes in developed countries were excluded. Second, research studies had to focus on non-violent economic and financial crimes such as corruption, money laundering, etc. Studies that focused on violent economic crimes such as armed robbery and drug trafficking were excluded. Finally, studies had to focus on policy measures that should be put in place in developing and emerging countries aimed at tackling economic and financial crimes. Studies that do not focus on policy measures aimed at tackling economic and financial crimes were excluded. Search strategy This systematic review conducted in-depth search in United Nations (UN) database, World Bank database, International Monetary Fund (IMF) database, Transparency International database, Human Rights Watch Reports, African Union (AU) Reports, Google Scholar, online papers, books, dissertations, theses and journal articles from 2000 to 2017. The study used four concepts as search strategy, namely: (1) economic crimes; (2) financial crimes; (3) developing countries; and (4) emerging countries. Results In this paper, 103 studies were searched in a thorough review of literature on economic and financial crimes in emerging and developing countries (Figure 1). Out of the 103, 74 studies were excluded as a result of duplications, 18 studies were not included because they did not fulfil the aim of this meta-analysis and 5 studies did not meet eligibility criteria. Only six studies were included in the meta-analysis. Study characteristics In this systematic review, included studies were published from 2007 through 2017. Data were obtained from the Economic Community of West African States (ECOWAS; Impact of economic and financial crimes Additional studies identified through other sources (n = 2) Studies identified through database searching (n = 101) 913 Studies after duplicates were removed (n = 29) Studies screened (n = 29) Studies excluded (n = 18) Studies assessed for eligibility (n = 11) Studies excluded with reasons (n = 5) - - No sampling design (n = 2) No sample size (n = 2) Studied both developed and developing countries (n = 1) Studies included in the meta-analysis (n = 6) Abu, 2015), Sierra Leone (Global Financial Integrity, 2017), Ghana (Ocansey, 2017), Nigeria (Ogbuagu et al., 2014), Malaysia (Sanusi et al., 2016) and 41 developing countries (Table I). Meta-analysis of the included studies In this systematic review, meta-analysis will be calculated using the Ellis (2010) formula. The formula is written as: P Nð r Þ P (1) N where Figure 1. PRISMA flow chart diagram describing selection of studies for systematic review and meta-analysis on the impact of economic and financial in emerging and developing countries Systematic sampling Sampling type N = 15 Sample size Corruption Country Journal article (continued) Quantitative Stratified sampling N=2 Corruption Nigeria Descriptive and Simple Correlation analysis Results: The study discovered from the simple correlation analysis that it is not absolute lack of funds that has caused infrastructural decay but outright mismanagement of funds (corruption) that is principally responsible for the level of infrastructural decay in Nigeria. It was recommended that there should be promotion and institutionalization of good governance, long-term infrastructural planning and public–private partnership in the provision of infrastructures Ogbuagu et al. (2014) Ocansey Journal Survey Random sampling N = 66 Economic and Ghana (2017) article financial crimes Results: Economic and financial crimes have plagued every corner of the economies of the world. These crimes affect all firms and the economies of nations. Economic and financial crime such as fraud is usually perpetrated when there is pressure from many situations, a high opportunity is perceived and there is low integrity. It was recommended that all institutions (anti-corruption agencies and companies) should establish forensic accounting unit to help strengthen internal controls and ensure thorough investigation to prevent, deter and detect financial and economic crimes Kanu Journal Qualitative and Stratified random sampling N = 340 Corruption Sierra Leone (2015) article quantitative Results: Corruption is one of the factors hindering the development of SMEs in Sierra Leone. The study shows that corruption has a significant negative association with growth, productivity and employment. Corruption as it affects SMEs in Sierra Leone is owing to the liability of size, short-term vision and perspective, restricted financial resources, failure to exercise a strong influence on government officials and institutions, capital structure and the inability to shun it. The study recommended that the national Government of Sierra Leone should take a giant step to curb corruption within the SME sector so that these enterprises can contribute meaningfully to the economic development of the country Quantitative Research design Economic Community of West African Countries (ECOWAAS) Results: ECOWAS countries are facing serious corruption problem. Corruption has a negative impact on saving in the region. Corruption is caused by low income levels in the region. Corruption can be reduced through increases in income, higher wages and establishment of efficient legal system and anti-grant agencies to facilitate the arrest and prosecution of offenders Thesis Abu (2015) Table I. Features of studies included in this systematic review Publication type 914 Author(s) and year Type of economic and financial crime studied JFC 26,3 Publication type Research design Sampling type Sample size Country Shabbir Journal Quantitative Random sampling N = 41 corruption 41 developing countries and article correlation Anwar (2007) Results: Corruption is found to be “a limp in the walk of human progress.” It is caused by economic and non-economic factors. It is recommended that governments of developing countries focus on the economic determinants of corruption, especially the policy of economic freedom (free-market economy) to control the perceived level of corruption. The policy of globalization must be supported because it has significantly contributed in reducing the level of public corruption. The government should also focus on distributive and social justice during the course of economic development. The policy of press liberalization must be fully supported to reduce the perceived level of corruption Sanusi Journal Quantitative Companies listed under the “Status of Cases N = 80 Money Malaysia et al. article Cross tabulation Investigated” section on the Bank Negara Malaysia laundering (2016) website from the years of 2006 to 2014 Results: Economic and financial crime such as money laundering has a serious negative impact on the economy of Malaysia, and it is largely caused by loopholes in the laws alongside with a lack of awareness of the relevant legal institutions in the battle against money laundering. Anti-Money Laundering and Terrorist Financing Act (AMLATFA) was enacted in 2001 to tackle the menace of money laundering in Malaysia Author(s) and year Type of economic and financial crime studied Impact of economic and financial crimes 915 Table I. JFC 26,3 916 N = sample size; r = effect size estimate expressed in the correlational metric; and p = p value or statistical significance of each study’s result. The following studies satisfied the inclusion criteria of this systematic review and are selected for simple meta-analysis: Study (Abu, 2015) N = 15, r = 0.79 and p = 0.0002 Study (Kanu, 2015) N = 340, r = -0.438 and p = 0.008 Study (Ocansey, 2017) N = 66, r = 0.77 and p< 0.05 Study (Ogbuagu et al., 2014) N = 2, r = 0.72 and p = 0.0007 Study (Sanusi et al., 2016) N = 80, r = 7.06 and p = 0.008 Study (Shabbir and Anwar, 2007) N = 41, r = 0.50 and p < 0.07 It should be noted that five studies have positive results (0.79, 0.77, 0.72, 7.06 and 0.50) and one has negative result (0.438). This means that five studies indicated positive effect while only one indicated negative effect. As the main aim of this systematic review is to calculate a weighted mean estimate of the effect size (outcome or result) of economic and financial crimes in emerging and developing countries each of the selected study’s r’s will be weighted by their respective sample sizes. Note that P values cannot be used to estimate common effect size; therefore, they will be ignored (Ellis, 2010). The weighted mean effect size of the above selected studies is thus calculated as follows: ð15 0:79Þ þ ð340 x 0:438Þ þ ð66 0:77Þ þ ð2 0:72Þ þ ð80 7:06Þ þ ð41 0:50Þ 15 þ 340 þ 66 þ 2 þ 80 þ 41 ¼ 11:85 – 148:92 þ 50:82 þ 1:28 þ 72:94 þ 20:5 15 þ 340 þ 66 þ 2 þ 80 þ 41 ¼ 8:47 544 ¼ 0:016 The result above indicates that the sample effect is positive in direction but small in size. Standard error In this study, standard error is to be used to measure or estimate standard deviation of sampling distribution associated with an estimation method. Standard error is calculated to estimate confidence interval of 95 per cent. This is an interval that shows the margin of error around a result or what is roughly estimated. Standard error formula: s SEx ¼ p (2) n where SEx = standard error of the mean; s = standard deviation of the mean; and n = number of observations of the sample. Impact of economic and financial crimes Standard error mean: X = 2, 15, 41, 66, 80 and 340 Total inputs (N) = (2, 15, 41, 66, 80, 340) Total inputs (N) = 6 To calculate mean: Mean ðXm Þ ¼ Mean ðXm Þ ¼ ðx1 þ x2 þ x3 . . . xn Þ N (3) 2 þ 15 þ 41 þ 66 þ 80 þ 340 6 Mean ðXm Þ ¼ 544 6 Mean ðXm Þ ¼ 90:67 To calculate standard deviation: p SD ¼ 1=ðN 1Þ* ðx1 xm Þ2 þ ðx2 xm Þ2 þ :: þ ðxn xm Þ2 ¼ p (4) 2 2 2 2 ð Þ 1= 6 1 ð2 90:67Þ þ ð15 90:67Þ þ ð41 90:67Þ þ ð66 90:67Þ 2 2 þð80 90:67Þ þ ð340 – 90:67Þ ÞÞ ¼ p ¼ 2 2 2 2 2 2 1=5 ð88:67Þ þ ð75:67Þ þ ð49:67Þ þ ð24:67Þ þ ð10:67Þ þ ð249:33Þ p 1=5 ð7; 862:3689Þ þ ð5; 725:9489Þ þ ð2; 467:1089Þ þ ð608:6089Þ þ ð139:8489Þ þð62; 165:4489ÞÞÞ ¼ p 1=5ðð78; 969:3334ÞÞ p ¼ ð15; 793:86668Þ ¼ 125:674 To calculate standard error: p ðNÞ p Standard Error ¼ 125:67365= ð6Þ Standard Error ¼ SD= Standard Error ¼ 125:6737=2:4495 Standard Error ¼ 51:3059 (5) 917 JFC 26,3 918 Study findings Table I presents the characteristics of the included studies. These include author(s) name, year of publication, types of study, research design, sampling type, sample size, type of economic and financial crime studied, country studied and the result of the study. The sample size ranges from 2 to 340. All the studies point to the fact economic and financial crime such as corruption have had a negative impact on all the facets of the economies of emerging and developing countries. However, based on the result of meta-analysis of the included studies (0.016 though small but positive), indicates that economic and financial crimes do not decrease economic growth. As these crimes increases, economic growth increases even though moderately in emerging and developing countries. The result of the standard deviation (125.674) and standard error (51.3059) at 95 per cent confidence interval shows that they are quite different but related to the mean (90.67). The standard error indicates the reliability of the mean. This means that the study’s mean effect is statistically significant due to large sample size (544). This is also an indication that the result or outcome is not by chance, that is there is a moderate positive relationship between economic growth and economic and financial crimes in emerging and developing countries. Discussion This systematic review is a further demonstration of the incidences of economic and financial crimes in emerging and developing countries. It shows that these crimes are high and on the increase in emerging and developing countries despite tough policy measures put in place by the various governments in these countries. Africa in particular has the highest incidences of economic and financial crimes included in this study (Abu, 2015; kanu, 2015; Ocansey, 2017), and (Ogbuagu et al., 2014). One study (Sanusi et al., 2016) revealed incidence of money laundering in Malaysia. According to the World Bank (World Bank Group, 2017), economic crime such as corruption is a major challenge to its twin goals of ending extreme poverty by 2030 and boosting shared prosperity for the poorest 40 per cent of people in developing countries. Similarly, according to this systematic review corruption is the major public problem in developing countries (Shabbir and Anwar, 2007). The meta-analysis conducted by this study revealed a moderate positive impact of economic and financial crimes in emerging and developing countries. This outcome is in contrast to the findings of the included studies. All the included studies recommended the use of economic, legal, social and political measures as well as partnership with international institutions in tackling the menace of economic and financial crimes in emerging and developing countries. Conclusion In conclusion, this study attempted to shed more light on the incidences of economic and financial crimes in emerging and developing countries. The meta-analysis conducted indicated a moderate positive impact of economic and financial crimes in emerging and developing countries. Despite this indication, adequate intervention should be designed by policymakers, private sector managers, international partners and researchers to reduce these crimes to the barest minimum. Further studies should be conducted to accurately determine the negative impact of economic and financial crimes in emerging and developing countries. References Abu, N. (2015), “The effects of corruption and political instability on savings: the case of economic community of West African states”, A Thesis Submitted to Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia. Unpublished. Aquino, V. (2005), Eleventh UN Congress on Crime Prevention and Criminal Justice Bangkok, Thailand, pp. 18-25. Baldry, T. (1995), The Regulation and Prevention of Economic Crime Internationally, J., Reuvid (Ed.), Kogan, London. Bertrand, J. (2005), Eleventh UN Congress on Crime Prevention and Criminal Justice Bangkok, Thailand, pp. 18-25. Caric, A. (2005), “The eleventh united nations congress on crime prevention and criminal justice, Bangkok (Thailand), 18.-25. April 2005”, Hrvatski Ljetopis za Kazneno Pravo i Praksu, Vol. 12 No. 2, pp. 899-924. Chamlin, M.B. and Kennedy, M.B. (1991), “The impact of the Wilson administration on economic crime rates”, Journal of Quantitative Criminology, Vol. 7 No. 4, pp. 357-372. Ellis, P.D. (2010), The Essential Guide to Effect Sizes: Statistical Power, Meta-Analysis, and the Interpretation of Research Results, Cambridge University Press. Freeman, R.B. (1996), “Why do so many young American men commit crimes and what9 might we do about it?”, Journal of Economic Perspectives, Vol. 10 No. 1, pp. 25-42. Global Financial Integrity (2017), “Illicit financial flows to and from developing countries: 2005-2014”, www.gfintegrity.org/report/illicit-financial-flows-to-and-from-developingavailable at: countries-2005-2014/ kanu, A.M. (2015), “The effect of corruption on small and medium enterprises: perspective from a developing country”, International Journal of Small Business and Entrepreneurship Research, Vol. 3 No. 3, pp. 12-27. Kim, J.Y. (2013), Corruption Is “Public Enemy Number One” in Developing Countries, The World Bank Group. Lagarde, C. (2016), “Addressing corruption–openly/christine lagarde”, Against Corruption: a collection of essays (Policy paper), available at: www.gov.uk/government/publications/against-corruptiona-collection-of-essays/against-corruption-a-collection-of-essays Moher, D., Liberati, A., Tetzlaff, J. and Altman, D.G. (2009), “Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement”, Annals of Internal Medicine, Vol. 151 No. 4, pp. 264-269. Nas, T.F., Price, A.C. and Weber, C.T. (1986), “A policy-oriented theory of corruption”, American Political Science Review, Vol. 80 No. 1, pp. 107-119. National Bureau for Statistics (2017), “Ninety five per cent (95%) of Nigerians indulge in bribery”, available at:www.premiumtimesng.com/news/headlines/240517-95-nigerians-indulge-bribery-nbs. html Ocansey, E.O.N.D. (2017), “Forensic accounting and the combating of economic and financial crimes in Ghana”, European Scientific Journal, Vol. 31 No. 13. Ogbuagu, U., Ubi, P. and Effiom, L. (2014), “Corruption and infrastructural decay: perceptible evidence from Nigeria”, Journal of Economics and Sustainable Development, Vol. 10 No. 5. Sanusi, Z.M., Adam, Y.C., Azman, N.S.M.N. and Mohamed, N. (2016), “Investigations and charges of money laundering cases under AMLATFA: enforcement of Malaysia central bank int”, Journal of Economics and Management, Vol. 10 No. S2, pp. 541-555. Savelsberg, J.J. (1987), “The making of criminal law norms in welfare states: economic crime in west Germany”, Law and Society Review, Vol. 21 No. 4, pp. 529-561. Impact of economic and financial crimes 919 Shabbir, G. and Anwar, M. (2007), “Determinants of corruption in developing countries”, The Pakistan Development Review, Vol. 46 No. 4II, pp. 751-764. Stanley, T.D., Doucouliagos, H., Giles, M., Heckemeyer, J.H., Johnston, R.J., Laroche, P. and Rosenberger, R.S. (2013), “Meta-analysis of economics research reporting guidelines”, Journal of Economic Surveys, Vol. 27 No. 2, pp. 390-394. Waziri, F. (2010), “Leadership and the challenges of good governance in Nigeria”, A paper delivered at the Professor Ambrose Alli annual lecture/Awards. World Bank Group (2017), Doing Business Report. A World Bank Group Flagship Report, available at: www.doingbusiness.org//media/WBG/DoingBusiness/ JFC 26,3 920 Corresponding author Sani Abubakar Saddiq can be contacted at: saddiqsaniabubakar@yahoo.com For instructions on how to order reprints of this article, please visit our website: www.emeraldgrouppublishing.com/licensing/reprints.htm Or contact us for further details: permissions@emeraldinsight.com View publication stats