Page |1

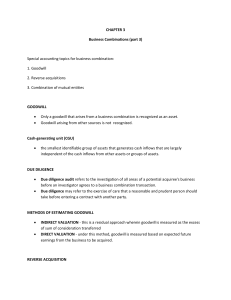

Chapter 1

Business Combinations (Part 1)

PROBLEM 1: TRUE OR FALSE

1. FALSE – “business” and “control”

2. FALSE – acquisition method

3. FALSE - acquirer

4. TRUE

5. FALSE – fair value or NCI’s proportionate share in the

acquiree’s net identifiable assets

6. TRUE

7. FALSE – recognized in profit or loss after reassessment

8. TRUE

9. FALSE – fair value less costs to sell

10. TRUE

Th

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

PROBLEM 2: TRUE OR FALSE

1. FALSE - ₱20

2. TRUE {100 + [(200 – 120) x 10%]} – (200 – 120) = 28

3. FALSE (100 + 10) – (200 – 120) = 30

4. FALSE 100 – (200 -120) = 20

5. TRUE 100 – (200 -120) = 20 (the liquidation costs are ignored

because these are post-combination expenses)

6. FALSE 100 – (200 + 5 intangible asset -120) = 15

7. TRUE 100 – (200 + 30 -120) = (10)

8. TRUE 100 – (200 -120 – 30 contingent liability) = 50

9. FALSE 100 – (200 -120 – 15 DTL*) = 35

*(200 CA for financial reporting – 150 tax base) = 50 TTD;

50 x 30% = 15 DTL

10. TRUE 100 – (200 -120) = 20 The trade secret processes are not

‘consideration transferred’ to Entity B’s former owners.

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Page |2

PROBLEM 3: FOR CLASSROOM DISCUSSION

1. D

2. D

3. Solution:

Consideration transferred

Non-controlling interest in the acquiree

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(2.37M – 20K goodwill – 700K liabilities)

Goodwill

1,800,000

1,800,000

(1,650,000)

150,000

4. Solution:

5. Solution:

Th

Consideration transferred

NCI

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired (4M –1.6M)

Goodwill

6. Solution:

2,000,000

600,000

2,600,000

(2,400,000)

200,000

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

Consideration transferred

NCI [(4M –1.6M) x 25%]

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired (4M –1.6M)

Goodwill

Consideration transferred (18,000 sh. x ₱100)

Non-controlling interest in the acquire

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired (3.8M –1.9M)

Gain on bargain purchase

2,000,000

540,000

2,540,000

(2,400,000)

140,000

1,800,000

1,800,000

(1,900,000)

(100,000)

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Page |3

The ₱36,000 stock issuance costs are deducted from share

premium. The ₱60,000 finder’s fees are expensed. The ₱280,000

liquidation costs are post-combination expenses. All of these do

not affect the computation of goodwill.

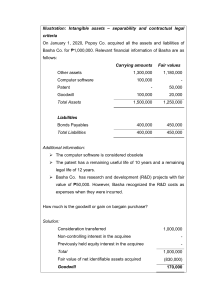

7. Solution:

Consideration transferred

Non-controlling interest in the acquire

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(4M + 100K patent + 160K R&D + 40K intangible asset on

operating lease w/ favorable terms –1.6M)

Goodwill

2,800,000

2,800,000

(2,700,000)

100,000

8. Solution:

(2,200,000)

150,000

(4M – 1.6M – 200K contingent liability)

Goodwill

9. Solution:

Th

Consideration transferred

Non-controlling interest in the acquiree

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

Carrying amt. - fin'l. reptg.

Assets

6,100,000

Liabilities

2,300,000

4,000,000

4,000,000

(3,770,000)

230,000

(6.1M + 60K DTA –2.3M – 90K DTL)

Goodwill

1,800,000

550,000

2,350,000

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

Consideration transferred

NCI (2.2M ‘see below’ x 25%)

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

Tax base

5,800,000

2,100,000

TTD (DTD)

300,000

(200,000)

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Page |4

Taxable temporary difference

Multiply by: Tax rate

Deferred tax liability

300,000

30%

90,000

Deductible temporary difference

Multiply by: Tax rate

Deferred tax asset

200,000

30%

60,000

10. Solution:

Consideration transferred (2.8M – 280K dividends on)

Non-controlling interest in the acquiree

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

2,520,000

2,520,000

(2,400,000)

120,000

(4M – 1.6M)

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

Goodwill

PROBLEM 4: EXERCISES

1. Solution:

Th

Consideration transferred

Non-controlling interest in the acquiree

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(1.7M – 50K goodwill – 390K liabilities)

Gain on bargain purchase

2. Solution:

Consideration transferred

NCI [(1.7M –.4M) x 20%]

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired (1.7M –.4M)

Goodwill

1,200,000

1,200,000

(1,260,000)

(60,000)

1,200,000

260,000

1,460,000

(1,300,000)

160,000

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Page |5

3. Solution:

Consideration transferred

NCI

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired (1.7M –.4M)

Goodwill

1,200,000

300,000

1,500,000

(1,300,000)

200,000

4. Solution:

Consideration transferred (10,000 sh. x ₱100)

Non-controlling interest in the acquire

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired (1.8M –.9M)

Goodwill

1,000,000

1,000,000

(900,000)

100,000

5. Solution:

6. Solution:

Th

(5M + 80K customer list –2.8M – 30K liability on operating

lease with unfavorable terms)

Goodwill

Consideration transferred

Non-controlling interest in the acquire

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(3.5M + 120K DTA – 1.9M – 100K contingent liability – 30K DTL)

Goodwill

1,500,000

800,000

2,300,000

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

Consideration transferred

Non-controlling interest in the acquire

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(2,250,000)

50,000

1,600,000

1,600,000

(1,590,000)

10,000

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Page |6

Carrying amt. - fin'l. reptg.

Assets

3,500,000

Liabilities

1,900,000

Contingent liability

100,000

Tax base

3,800,000

2,000,000

-

TTD (DTD)

(300,000)

100,000

(100,000)

Deductible temporary difference (DTD)

Multiply by: Tax rate

400,000

30%

Deferred tax asset

120,000

Taxable temporary difference (TTD)

Multiply by: Tax rate

100,000

30%

Deferred tax liability

30,000

Th

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

PROBLEM 5: MULTIPLE CHOICE - THEORY

1. C

2. C

3. B

4. C

5. D

6. B

7. D

8. D

9. A

10. D

11. C

12. D

13. B

14. D

15. C

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Page |7

PROBLEM 6: MULTIPLE CHOICE - COMPUTATIONAL

1. A Solution:

Consideration transferred

1M + (200K x PV of ordinary annuity of 1 @ 12%, n=5)

NCI (3.4M – 1.7M) x 20%

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired (3.4M– 1.7M)

Goodwill

1,720,955

340,000

2,060,955

(1,700,000)

360,955

2. C Solution:

Consideration transferred

NCI (1.2M ÷ 80%) x 20%

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(3.3M – 150K costs to sell – 1.7M)

Goodwill

1,200,000

300,000

1,500,000

(1,450,000)

50,000

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

3. C Solution:

Consideration transferred (2,000 sh. x ₱500)

NCI

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(2.8M – 1.6M)

Th

Gain on bargain purchase

4. A Solution:

Consideration transferred

NCI

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(5.9M + 90K int. asset on optg. lease – 3.5M – 10K cont. liab.)

Goodwill

1,000,000

1,000,000

(1,200,000)

(200,000)

2,600,000

2,600,000

(2,480,000)

120,000

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Page |8

5. B Solution:

Consideration transferred

NCI

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

(2.860M – 20K recorded goodwill + 60K R&D + 99K DTA

– .480M – 78K DTL)

Gain on bargain purchase

Previous

Carrying

amounts

(TB for

taxation)

10,000

400,000

480,000

2,000,000

400,000

Taxable temporary difference (200K + 60K)

Multiply by: Tax rate

Th

Deferred tax liability

Deductible temporary difference (120K + 130K + 80K)

Multiply by: Tax rate

Deferred tax asset

(2,441,000)

(41,000)

TTD (DTD)

(120,000)

(130,000)

200,000

60,000

(80,000)

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

Cash

Receivables – net

Inventory

Land

R&D

Payables

Fair

values

(CA for

financial

reporting)

10,000

280,000

350,000

2,200,000

60,000

480,000

2,400,000

2,400,000

260,000

30%

78,000

330,000

30%

99,000

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Page |9

PROBLEM 7: MULTIPLE CHOICE – PFRS for SMEs

1. C

2. B

Solution:

Consideration transferred

NCI in the acquiree

Previously held equity interest in the acquiree

Total

Fair value of net identifiable assets acquired

Goodwill

1,000,000

200,000

1,200,000

(800,000)

400,000

3. D

Solution:

Purchase cost

Acquisition-related costs

Total

1,000,000

100,000

1,100,000

Interest in net identifiable assets acquired

(600,000)

500,000

Goodwill

4. A

Th

5. C

re is

s

s

o

sh u tud

Co are rce y

ur d v wa

se ia s

H

er

(800K x 75%)

This study source was downloaded by 100000795765419 from CourseHero.com on 08-31-2021

Powered by TCPDF (www.tcpdf.org)