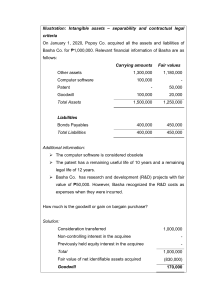

lOMoARcPSD|18674900 Chapter 2- Business Combinations (Part 2) Accountancy (University of the Philippines System) Studocu is not sponsored or endorsed by any college or university Downloaded by Abegail Dadia (abegaildadia4@gmail.com) lOMoARcPSD|18674900 Page |1 Chapter 2 Business Combinations (Part 2) PROBLEM 1: TRUE OR FALSE 1. FALSE – The transaction is a business combination effected through exchanges of equity interests. 2. TRUE 3. FALSE - ₱100, the total increase in share capital and share premium 4. FALSE – (₱100 consideration transferred, equal to total increase in share capital and share premium, minus ₱80 fair value of net assets) = ₱20 goodwill 5. TRUE 6. FALSE 7. TRUE – The 20% interest is most likely to have been classified as Investment in associate. Accordingly, the remeasurement gain of ₱10 (₱40 fair value - ₱30 carrying amount) is recognized in profit or loss. 8. TRUE – (100 CT + 60 NCI + 40 PHEI) – 180 = 20 goodwill 9. FALSE 10. TRUE PROBLEM 2: TRUE OR FALSE 1. FALSE – maximum of 12 months from acquisition date 2. TRUE 3. FALSE [100 – (170 – 70 provisional amt. + 60 fair value – 80)] = 20 4. TRUE 5. TRUE 6. TRUE 7. TRUE 8. TRUE 9. TRUE (100 + 20 fair value of contingent consideration) – (170 – 80) = 30 10. TRUE – Goodwill is not affected by fair value changes that are not measurement period adjustments. Downloaded by Abegail Dadia (abegaildadia4@gmail.com) lOMoARcPSD|18674900 Page |2 PROBLEM 3: FOR CLASSROOM DISCUSSION 1. Solution: Step 1 Consideration transferred (squeeze) Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (given) Goodwill (start) 4,200,000 4,200,000 (4,000,000) 200,000 Step 2 ₱4.2M consideration transferred ÷ ₱100 fair value per share = 42,000 shares issued 2. Solution: Consideration transferred Non-controlling interest in the acquiree (690K x 40%*) Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill 300,000 276,000 138,000 714,000 (690,000) 24,000 *100% - (20% + 40%) = 40% 3. Solution: Consideration transferred Non-controlling interest in the acquiree (1.8M x 100%) Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill Downloaded by Abegail Dadia (abegaildadia4@gmail.com) 1,800,000 1,800,000 (1,800,000) - lOMoARcPSD|18674900 Page |3 4. Solution: Provisional Consideration transferred NCI Previously held equity interest Total Fair value of net identifiable assets Goodwill (a) (1.980M Adjusted 2,000,000 2,000,000 (1,980,000) 20,000 2,000,000 2,000,000 (1,900,000)(a) 100,000 – 220K provisional amount + 140K fair value) The new information obtained on July 1, 20x2 is not a measurement period adjustment because it does not relate to facts and circumstances that have existed as at the acquisition date. This is accounted for as a post-combination event under PFRS 9. Apr. 1, 20x2 Apr. 1, 20x2 (b) Goodwill Machine Accumulated depreciation (b) Retained earnings 80,000 80,000 278 278 Depreciation based on: ➢ provisional amount: (220K ÷ 6) x 2/12 = 6,111 ➢ fair value: (140K ÷ 4) x 2/12 = 5,833 ➢ Decrease in accumulated depreciation: (6,111 – 5,833) = 278 5. Solution: Consideration transferred (800K – 30K – 50K) Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill Downloaded by Abegail Dadia (abegaildadia4@gmail.com) 720,000 720,000 (600,000) 120,000 lOMoARcPSD|18674900 Page |4 The reimbursement for the appraisal fees is an acquisitionrelated cost. This is expensed. The trade secret does not qualify as ‘consideration transferred’ because it is retained in the combined entity after the business combination. 6. Solution: Consideration transferred (2M – 200K ‘off-market’ value) Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (4M + 100K intangible asset on reacquired rt. – 150K franchise - 2.2M) Goodwill 1,800,000 1,800,000 (1,750,000) 50,000 Journal entries Jan. 1, 20x1 Identifiable assets acquired (4M + 100K – 150K) Goodwill Liabilities assumed Cash (2M – 200K) 3,950,000 50,000 2,200,000 1,800,000 to record the business combination Jan. 1, 20x1 Contract liability Cash Settlement gain 230,000 to record the effective settlement of preexisting relationship as a separate transaction from business combination transaction Downloaded by Abegail Dadia (abegaildadia4@gmail.com) 200,000 30,000 lOMoARcPSD|18674900 Page |5 7. Solutions: Requirement (a): Consideration transferred (10,000 sh. x ₱200) + 280K contingent consideration 2,280,000 2,280,000 (1,900,000) 380,000 Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill Requirement (b): Dec. 31, 20x1 Jan. 14, 20x2 No entry Share premium – contingent consideration Share capital (2,000 x ₱20 par) Share premium (squeeze) 280,000 40,000 240,000 to record the issuance of 2,000 additional shares Requirement (c): Dec. 31, 20x1 Share premium – contingent consideration Share premium 280,000 Downloaded by Abegail Dadia (abegaildadia4@gmail.com) 280,000 lOMoARcPSD|18674900 Page |6 PROBLEM 4: EXERCISES 1. Solutions: Requirement (a): ABC Co. 800,000 Share capital (₱20 par) Increase 176,000 Combined entity 976,000 176,000 ÷ 20 par = 8,800 shares Requirement (b): Consideration transferred (a) Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (b) Goodwill (a) Share capital Share premium Totals ABC Co. 800,000 300,000 1,100,000 Combined entity 976,000 1,092,000 2,068,000 Combined ABC Co. entity Identifiable assets 2,200,000 3,600,000 Liabilities 700,000 1,300,000 Fair value of net identifiable assets acquired 968,000 968,000 (800,000) 168,000 Increase 968,000 Increase (b) 1,400,000 600,000 800,000 Requirement (c): Retained earnings = 400,000 Downloaded by Abegail Dadia (abegaildadia4@gmail.com) lOMoARcPSD|18674900 Page |7 2. Solutions: Requirement (a): Consideration transferred (80,000 sh. x ₱8) Non-controlling interest in the acquiree (665,000 x 10%*) Previously held equity interest in the acquiree** Total Fair value of net identifiable assets acquired Goodwill 640,000 66,500 80,000 786,500 (665,000) 121,500 * (10,000 + 80,000) ÷ 100,000 = 90% controlling interest; (100% - 90%) = 10% NCI ** (10,000 sh. x ₱8) = 80,000 Requirement (b): 7/1/20x2 Investment in subsidiary (80,000 x 8) 640,000 Cash to record the newly acquired shares 640,000 FVPL financial assets [(8 – 5) x 10,000] 30,000 Unrealized gain – P/L to remeasure the previously held equity interest 30,000 Investment in subsidiary 80,000 FVPL financial assets to reclassify the previously held equity interest 80,000 Downloaded by Abegail Dadia (abegaildadia4@gmail.com) lOMoARcPSD|18674900 Page |8 3. Solution: Requirement (a): Provisional Consideration transferred NCI Previously held equity interest Total Fair value of net identifiable assets Goodwill (a) (2.6M 1,800,000 1,800,000 (1,700,000) 100,000 Adjusted 1,800,000 1,800,000 (1,600,000)(a) 200,000 – 300K provisional amount + 200K fair value - .9M) Requirement (b): Aug. 31, 20x2 Goodwill Trademark 100,000 Downloaded by Abegail Dadia (abegaildadia4@gmail.com) 100,000 lOMoARcPSD|18674900 Page |9 4. Solution: Requirement (a): Settlement loss (360K – 170K ‘at-market’ = 190 ‘off-market’) Carrying amount of related asset or liability recognized Adjusted settlement loss Jan. 1, 20x1 Settlement loss Cash 190,000 190,000 190,000 190,000 Requirement (b): Consideration transferred (2.2M – 190K ‘off-market’ value) Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired (3.6M – 1.8M) Goodwill 2,010,000 2,010,000 (1,800,000) 210,000 The ₱170,000 “at-market” value is subsumed in goodwill and not recognized as intangible asset because there is no reacquired right. 5. Solution: Requirement (a): Consideration transferred (10,000 sh. x ₱200) + ₱280K contingent consideration Non-controlling interest in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill Downloaded by Abegail Dadia (abegaildadia4@gmail.com) 2,280,000 2,280,000 (1,920,000) 360,000 lOMoARcPSD|18674900 P a g e | 10 Requirement (b): Dec. 31, 20x1 Jan. 14, 20x2 (a) Unrealized loss – P/L (a) Liability for contingent consideration 120,000 Liability for contingent consideration Cash 400,000 120,000 400,000 Carrying amount of contingent consideration - 12/31/20x1 280,000 Fair value – 12/31/20x1 400,000 Increase in fair value of liability (loss) (120,000) Requirement (c): Dec. 31, 20x1 Liability for contingent consideration Gain on extinguishment of liability – P/L 280,000 PROBLEM 5: MULTIPLE CHOICE - THEORY 1. B 2. C 3. A 4. B 5. D 6. D 7. A 8. B 9. D 10. D Downloaded by Abegail Dadia (abegaildadia4@gmail.com) 280,000 lOMoARcPSD|18674900 P a g e | 11 PROBLEM 6: MULTIPLE CHOICE - COMPUTATIONAL 1. D Solution: Consideration transferred (squeeze) NCI in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill (start) 2,000,000 2,000,000 (2,000,000) - (2,000,000 ÷ 20,000 shares) = 100 per share 2. C Solution: ➢ 2M consideration transferred – 400K increase in share premium = 1.6M increase in share capital; ➢ 1.6M ÷ 20,000 shares = 80 3. B Solution: Outstanding shares of Finger (₱40,000 ÷ ₱4 par) Ratio No. of shares issued by Point (10,000 sh. x 2) Consideration transferred (squeeze) NCI in the acquiree Previously held equity interest in the acquiree Total Fair value of net identifiable assets acquired Goodwill (start) 10,000 2:1 20,000 800,000 800,000 (800,000) - (800,000 consideration transferred ÷ 20,000 sh. issued by Point) = 40 Downloaded by Abegail Dadia (abegaildadia4@gmail.com) lOMoARcPSD|18674900 P a g e | 12 4. C Solutions: Consideration transferred (50,000 sh. x ₱7) Non-controlling interest in the acquiree (665,000 x 40%*) Previously held equity interest in the acquiree** Total Fair value of net identifiable assets acquired Goodwill 350,000 266,000 70,000 686,000 (665,000) 21,000 * (10,000 + 50,000) ÷ 100,000 = 60% controlling interest; (100% - 60%) = 40% NCI ** (10,000 sh. x ₱7) = 70,000 5. C Solution: Provisional Consideration transferred NCI Previously held equity interest Total Fair value of net identifiable assets Goodwill (Negative goodwill) (a) Adjusted 800,000 800,000 (900,000) (100,000) 800,000 800,000 (720,000)(a) 80,000 (1.2M – 200K provisional amt. + 20K fair value - .3M) Feb. 1, 20x2 Feb. 1, 20x2 Goodwill Retained earnings* Intangible asset Accumulated amortization Retained earnings 80,000 100,000 180,000 7,500 7,500 *This represents the reversal of the negative goodwill recognized in profit or loss in 20x1. **Amortization recognized in 20x1: (200,000 ÷ 10) x 6/12 = 10,000; Correct amortization in 20x1: (20,000 ÷ 4) x 6/12 = 2,500; Excess amortization expense in 20x1 = (10,000 – 2,500) = 7,500 Downloaded by Abegail Dadia (abegaildadia4@gmail.com)