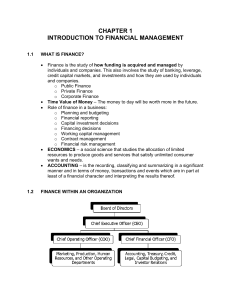

Chapter 1 Introduction to Financial Management Forms of Business Organization Stock Prices and Shareholder Value Intrinsic Values, Stock Prices, and Executive Compensation Important Business Trends Conflicts Between Managers, Stockholders, and Bondholders 1-1 Finance Within the Organization Board of Directors Chief Executive Officer (CEO) Chief Operating Officer (COO) Chief Financial Officer (CFO) Marketing, Production, Human Resources, and Other Operating Departments Accounting, Treasury, Credit, Legal, Capital Budgeting, and Investor Relations 1-2 Proprietorships and Partnerships Advantages Disadvantages Ease of formation Subject to few regulations No corporate income taxes Difficult to raise capital Unlimited liability Limited life 1-3 Corporation Advantages Disadvantages Unlimited life Easy transfer of ownership Limited liability Ease of raising capital Double taxation Cost of set-up and report filing 1-4 Income Statement ISM, Tbk 5 Income Statement ISM, Tbk 6 Determinants of Intrinsic Values and Stock Prices Managerial Actions, the Economic Environment, Taxes, and the Political Climate “True” Investor Returns “True” Risk “Perceived” Investor Returns Stock’s Intrinsic Value “Perceived” Risk Stock’s Market Price Market Equilibrium: Intrinsic Value = Stock Price 1-7 Corporate Valuation 8 Sales revenues − Operating costs and taxes − Required investments in operating capital Free cash flow (FCF) Value = FCF1 + (1 + WACC)1 FCF2 + (1 + WACC)2 = + ... FCF∞ (1 + WACC)∞ Weighted average cost of capital (WACC) Market interest rates Cost of debt Firm’s debt/equity mix Market risk aversion Cost of equity Firm’s business risk Stock Prices and Shareholder Value The primary financial goal of management is shareholder wealth maximization, which translates to maximizing stock price. Value of any asset is present value of cash flow stream to owners. Most significant decisions are evaluated in terms of their financial consequences. Stock prices change over time as conditions change and as investors obtain new information about a company’s prospects. 1-9 Stock Prices and Intrinsic Value In equilibrium, a stock’s price should equal its “true” or intrinsic value. Intrinsic value is a long-run concept. To the extent that investor perceptions are incorrect, a stock’s price in the short run may deviate from its intrinsic value. Ideally, managers should avoid actions that reduce intrinsic value, even if those decisions increase the stock price in the short run. 1-10 Some Important Business Trends Recent corporate scandals have reinforced the importance of business ethics, and have spurred additional regulations and corporate oversight. Increased globalization of business. The effects of ever-improving information technology have had a profound effect on all aspects of business finance. 1-11 Conflicts Between Managers and Stockholders Managers are naturally inclined to act in their own best interests (which are not always the same as the interest of stockholders). But the following factors affect managerial behavior: Managerial compensation packages Direct intervention by shareholders The threat of firing The threat of takeover 1-12 Conflicts Between Stockholders and Bondholders Stockholders are more likely to prefer riskier projects, because they receive more of the upside if the project succeeds. By contrast, bondholders receiving fixed payments are more interested in limiting risk. Bondholders are particularly concerned about the use of additional debt. Bondholders attempt to protect themselves by including covenants in bond agreements that limit the use of additional debt and constrain managers’ actions. 1-13