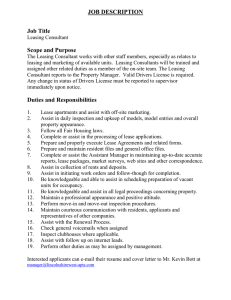

Car Leasing Plummeted During Pandemic, Could Take Years to Recover Low dealership stock, lack of affordable deals push more Americans to buy rather than lease their next car Leasing typically offers car buyers a more-affordable monthly payment compared with a financed vehicle purchase.PHOTO: LUKE SHARRETT/BLOOMBERG NEWS By Ryan Felton Follow Jan. 28, 2023 5:30 am ET Vehicle leasing—once a path for nearly one-third of American buyers to get behind the wheel of a new car—has faded since the pandemic. Now it is likely to be years before the U.S. lease market returns to normal, executives and analysts say. The leasing falloff is largely tied to the vehicle shortage that has plagued the car business for more than two years. Auto makers generally make more money selling cars outright, rather than leasing them, which typically involves a heavier subsidy from the manufacturer. With inventory constrained, car companies have significantly dialed back attractive lease deals that had been a staple of auto retailing. Auto makers are unlikely to revert to more-generous lease terms until vehicle availability rebounds closer to prepandemic levels, executives and analysts say. Even then, the relative dearth of people who leased cars in recent years will produce a lag effect, drying up what is normally a steady stream of customers returning to dealerships. It could take the better part of this decade for the lease market to normalize, some analysts say. “The cycle is definitely out of cycle,” said Jaycie Dane, general manager of sales operations for Toyota Motor Corp.’s Lexus division in North America. Leases accounted for 20%-25% of Lexus sales in recent months, compared with prepandemic highs of around 40%, she said. “It’ll be a rocky road for a few years.” The percentage of Americans leasing new vehicles dropped to the lowest levels since the financial downturn around 2009, averaging about 16% of overall retail sales in the second half of last year, according to research firm J.D. Power. That amount is roughly half of what it was before the Covid-19 pandemic. Leasing typically offers car buyers a more-affordable monthly payment compared with a financed vehicle purchase. For dealers, lease returns offer repeat business and help feed used-car inventory. Auto makers keep lease payments lower by subsidizing the transaction through their financing arms, which hold the car as an asset, essentially renting it to the customer for a period of three or four years. At the end of the term, those drivers can either buy the vehicle at a preset price or return it to dealers. In recent years, manufacturers haven’t had much motivation to use leasing to stimulate sales, because a computer-chip shortage and other supply-chain snarls have left dealership lots thinly stocked. The average lease payment rose to $567 in the third quarter of 2022, a 25% jump compared with the same period two years prior, according to data from creditreporting firm Experian. The gap between the monthly payment to lease versus finance a new car has shrunk, dealers and executives say. In November, for example, the average lease payment for a new Honda HR-V small SUV was $374, according to data from car-buying research site Edmunds, about $100 less than the cost to finance. “If you buy it or if you lease it, your prices are pretty similar,” said Ryan DeNooyer, general manager of Kalamazoo, Mich., dealership chain DeNooyer Automotive. About 20% of his customers leased vehicles in recent months, compared with 45% before the pandemic. The percentage of Americans leasing new vehicles dropped to the lowest levels since around 2009.PHOTO: ANDRES KUDACKI/ASSOCIATED PRESS U.S. vehicle inventories are slowly rebuilding. There were nearly 1.7 million vehicles on dealership lots or en route to stores at the end of 2022, up 49% from a year earlier, according to research firm Wards Intelligence. Still, that is roughly half of prepandemic levels. Auto makers aren’t likely to significantly sweeten lease terms until stocks are more fully rebuilt, said Peter Muriungi, chief executive at Chase Auto, which provides financing for Subaru Corp., Rivian Automotive Inc. and other car companies. “Manufacturers have no need for it,” he said. The decline of leasing underscores the market disruption that has played out in the car business since the onset of the pandemic. The inventory crunch and subsequent high prices have limited choice for consumers and changed the way Americans buy cars. This year, analysts expect higher interest rates and recessionary fears, along with improved inventories, to cool record-high prices. Some auto executives say leasing remains an important aspect of their sales strategies as a way to boost customer loyalty and replenish their dealers’ used-car inventory. GM finance chief Paul Jacobson recently said the company expects leasing to be a good option for electric-vehicle customers as the company prepares to launch several new EV models. Jeff Dyke, president of publicly traded auto retailer Sonic Automotive, figures his company’s lease portfolio will be smaller for the next couple of years, but expects auto manufacturers to eventually increase spending on lease promotions. “That ecosystem got broken during the pandemic,” Mr. Dyke said. “It’s an ecosystem that needs to come back.” Write to Ryan Felton at ryan.felton@wsj.com