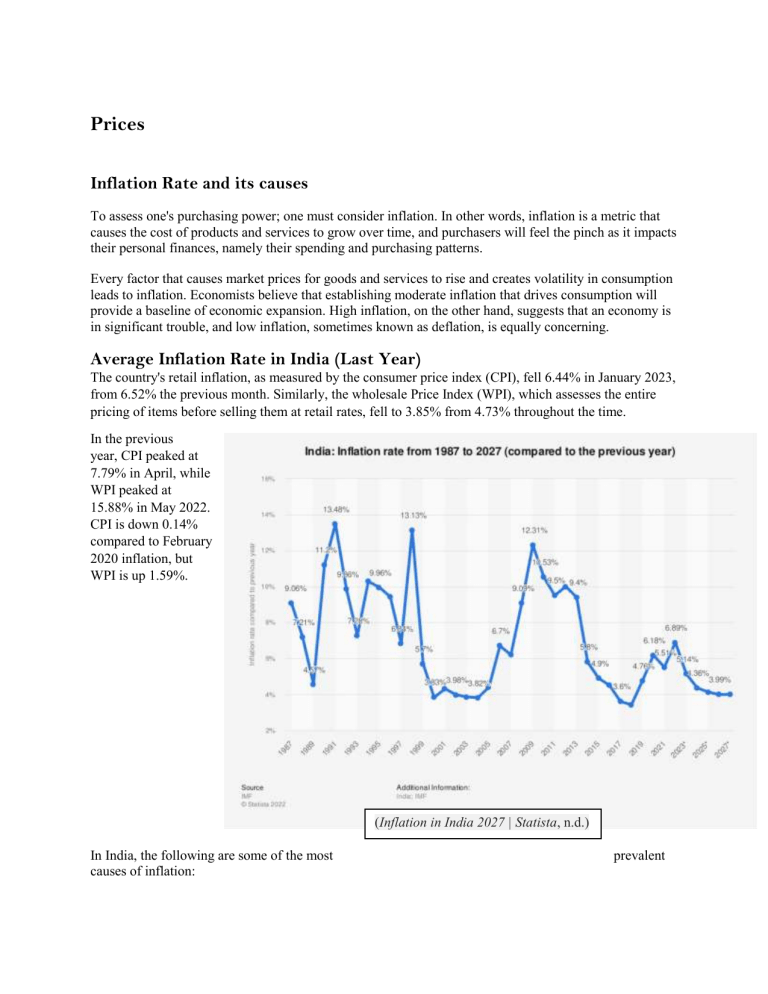

Prices Inflation Rate and its causes To assess one's purchasing power; one must consider inflation. In other words, inflation is a metric that causes the cost of products and services to grow over time, and purchasers will feel the pinch as it impacts their personal finances, namely their spending and purchasing patterns. Every factor that causes market prices for goods and services to rise and creates volatility in consumption leads to inflation. Economists believe that establishing moderate inflation that drives consumption will provide a baseline of economic expansion. High inflation, on the other hand, suggests that an economy is in significant trouble, and low inflation, sometimes known as deflation, is equally concerning. Average Inflation Rate in India (Last Year) The country's retail inflation, as measured by the consumer price index (CPI), fell 6.44% in January 2023, from 6.52% the previous month. Similarly, the wholesale Price Index (WPI), which assesses the entire pricing of items before selling them at retail rates, fell to 3.85% from 4.73% throughout the time. In the previous year, CPI peaked at 7.79% in April, while WPI peaked at 15.88% in May 2022. CPI is down 0.14% compared to February 2020 inflation, but WPI is up 1.59%. (Inflation in India 2027 | Statista, n.d.) In India, the following are some of the most causes of inflation: prevalent Demand-pull inflation: As the general demand for products and services in the economy rises, prices may rise as well. Factors such as strong economic development, increasing disposable income, or government expenditure can all cause demand-pull inflation. Cost-push inflation occurs when the costs of production rise and are passed on to consumers in the form of increased prices. These price increases can be attributed to growing raw material costs, salaries, or energy prices. Supply-side shocks: Unanticipated occurrences or disruptions in the supply of goods and services can cause inflation. Natural catastrophes, agricultural failures, and geopolitical conflicts all have an influence on the supply of key commodities like oil. Inflation can be exacerbated by structural issues in the Indian economy, such as poor infrastructure or supply chain bottlenecks. These variables might raise manufacturing and delivery expenses, resulting in increased pricing. Consumer Price Index CPI Every month, the Labour Bureau, an associated office of the Ministry of Labour and Employment, compiles the Consumer Price Index for Industrial Workers based on retail prices gathered from 317 marketplaces dispersed over 88 industrially important centers in the country. The index is produced for 88 centers and is issued on the final business day of the following month. This news release contains the index for the month of February 2023. The All-India CPI for February 2023 declined by 0.1 point and stood at 132.7 (one thirty two point seven) points. In terms of 1-month percentage change, it fell by 0.08 percent from the previous month. A decline of 0.08 percent was also noted during the same months a year earlier. The Food & Beverage group Inflation based on CPI-IW (Food and General) contributed the most downward pressure to the current index, accounting for 0.1 percentage point of the overall decrease. Cabbage, Cauliflower, Brinjal, Carrot, Onion, Potato, Peas, French-bean, Drumstick, Kundru, Grapes, Sunflower Oil, Soyabean Oil, Mustard Oil, Poultry/Chicken, Eggs-hen, and Fish Fresh, among other items, are to blame for the index drop. Nevertheless, Rice, Wheat, Wheat Atta, Buffalo Milk, Cow Milk, Pure Ghee, Garlic, Gourd, Lady's finger, Parwal, Cumin Seed/Jira, Apple, Banana, Mango, Country liquor, Foreign liquor, and Medication Allopathic, among others, kept the index from falling further. How India’s Inflation rate could be reduced Inflation in India may be reduced by using a mix of fiscal, monetary, and structural policy measures. Following are some techniques for controlling and lowering inflation in India: Monetary policy: The Reserve Bank of India (RBI) may manage the money supply and impact inflation by using monetary policy tools such as interest rates, reserve requirements, and open market operations. The RBI, for example, may make borrowing more costly by hiking interest rates, which can assist cut expenditure and manage inflation. Fiscal policy: To limit inflation, the Indian government can utilize fiscal policy measures such as altering government expenditure and taxation. The government can reduce aggregate demand and aid to control inflation by cutting government expenditure or raising taxes. Nonetheless, striking a balance between lowering inflation and preserving economic development is critical. Supply-side policies: The government can employ supply-side policies to boost the Indian economy's efficiency and competitiveness. These policies might include investing in infrastructure, boosting R&D, enhancing education and skill training, and reducing rules to encourage corporate growth. These policies can assist decrease cost-push inflation and encourage long-term growth by increasing the economy's productive capacity. Improving the agricultural sector: Food price changes account for a large amount of India's inflation. The government may assist stabilize food costs and minimize inflationary pressures by investing in the agriculture sector, boosting supply chain efficiency, and supporting new farming practices. Controlling currency rates: The RBI can regulate the value of the Indian rupee through foreign exchange interventions and other measures, which can impact import prices and overall inflation. A stable currency rate can assist minimize imported inflation and make the business climate more predictable. Inflation targeting: The RBI has implemented an inflation targeting framework, which entails establishing a precise inflation target and implementing monetary policy to attain that aim. In the long run, this method serves to anchor inflation expectations and supports price stability. Financial inclusion can assist reduce informal lending, slash borrowing costs, and encourage more efficient resource allocation in the economy, all of which contribute to reduced inflation. It is critical to understand that regulating inflation is a hard endeavor that needs a well-balanced and coordinated strategy. To address the root causes of inflation while sustaining economic growth and stability, policymakers must examine both short-term and long-term initiatives. References Pradhan, D. (2023, April 6). Inflation Rate In India: April 2023 Data. Forbes Advisor INDIA. https://www.forbes.com/advisor/in/personal-finance/inflation-rate-in-india/ Inflation in India 2027 | Statista. (n.d.). Statista. https://www.statista.com/statistics/271322/inflation-ratein-india/ Consumer Price Index for Industrial Workers (2016=100) – February, 2023. (n.d.). https://pib.gov.in/Pressreleaseshare.aspx?PRID=1912710 Explained: What are the factors leading to rise in inflation rate. (n.d.). OnManorama. https://www.onmanorama.com/news/india/2022/08/02/factors-inflation-rate.html