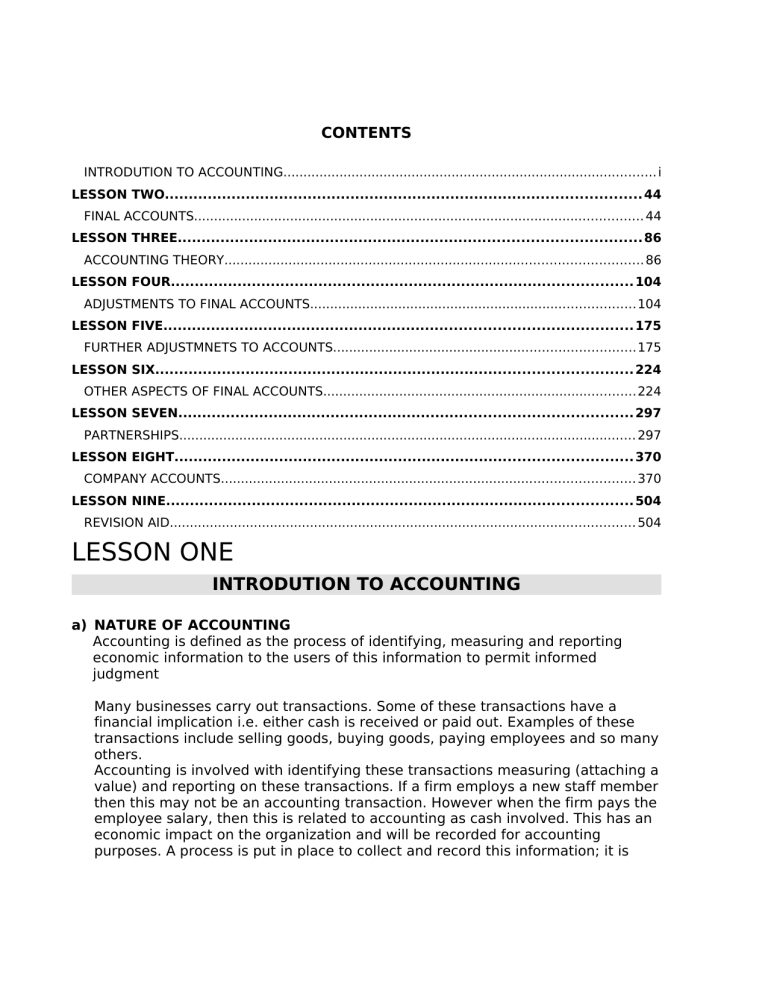

CONTENTS INTRODUTION TO ACCOUNTING............................................................................................. i LESSON TWO.................................................................................................... 44 FINAL ACCOUNTS................................................................................................................ 44 LESSON THREE................................................................................................. 86 ACCOUNTING THEORY........................................................................................................ 86 LESSON FOUR................................................................................................. 104 ADJUSTMENTS TO FINAL ACCOUNTS.................................................................................104 LESSON FIVE.................................................................................................. 175 FURTHER ADJUSTMNETS TO ACCOUNTS...........................................................................175 LESSON SIX.................................................................................................... 224 OTHER ASPECTS OF FINAL ACCOUNTS..............................................................................224 LESSON SEVEN............................................................................................... 297 PARTNERSHIPS.................................................................................................................. 297 LESSON EIGHT................................................................................................ 370 COMPANY ACCOUNTS....................................................................................................... 370 LESSON NINE.................................................................................................. 504 REVISION AID.................................................................................................................... 504 LESSON ONE INTRODUTION TO ACCOUNTING a) NATURE OF ACCOUNTING Accounting is defined as the process of identifying, measuring and reporting economic information to the users of this information to permit informed judgment Many businesses carry out transactions. Some of these transactions have a financial implication i.e. either cash is received or paid out. Examples of these transactions include selling goods, buying goods, paying employees and so many others. Accounting is involved with identifying these transactions measuring (attaching a value) and reporting on these transactions. If a firm employs a new staff member then this may not be an accounting transaction. However when the firm pays the employee salary, then this is related to accounting as cash involved. This has an economic impact on the organization and will be recorded for accounting purposes. A process is put in place to collect and record this information; it is Course Description ii then classified and summarized so that it can be reported to the interested parties. b) USERS OF ACCOUNTING INFORMATION Accounting information is produced in form of financial statement. These financial statements provide information about an entity financial position, performance and changes in financial position. Financial position of a firm is what the resources the business has and how much belongs to the owners and others. The financial performance reflects how the business has performed, whether it has made profits or losses. Changes in financial positions determine whether the resources have increased or reduced. The users of accounting information have an interest in the existence of the firm. Therefore the information contained in the financial statements will affect the decision making process. i. ii. The following are the users of accounting information: Owners: They have invested in the business and examples of such owners include sole traders, partners (partnerships) and shareholders (company). They would like to have information on the financial performance, financial position and changes in financial position. This information will enable them to assess how the managers of the business are performing whether the business is profitable or not and whether to make drawings or put in additional capital. Customers Customers rely on the business for goods and services. They would like to know how the business is performing and its financial position. This information would enable them to assess whether they can rely on the firm for future supplies. iii Course Description Suppliers They supply goods or services to the firm. The supplies are either for cash or credit. The suppliers would like to have information on the financial performance and position so as to assess whether the business would be able to pay up for the goods and services provided as and when the payments falls due. iii. iv. Managers The managers are involved in the day-to-day activities of the business. They would like to have information on the financial position, performance and changes in financial position so as to determine whether the business is operating as per the plans. In case the plan is not achieved then the managers come up with appropriate measures (controls) to ensure that the set plans are met. The Lenders They have provided loans and others sources of capital to the business. Such lenders include banks and other financial institutions. They would like to have information on the financial performance and position of the business to assess whether the business is profitable enough to pay the interest on loans and whether it has enough resources to pay back the principal amount when it is due. v. The Government and its agencies The Government is interested in the financial performance of the business to be able to assess the tax to be collected in the case there are any profits made by the business. The other government agencies are interested with the financial position and performance of the business to be able to come with National Statistics. This statistics measure the average performance of the economy. vi. The Financial Analyst and Advisors Financial analyst and advisors interpret the financial information. Examples include stockbrokers who advise investors on shares to buy in the stock market and other professional consultants like accountants. They are interested with the financial position and performance of the firm so that they can advise their clients on how much is the value their investment i.e. whether it is profitable or not and what is the value. Others advisors would include the press who will then pass the information to other relevant users. vii. The Employees They work for the business/entity. They would like to have information on the financial position and performance so as to make decisions on their terms of employment. This information would be important as they can use it to negotiate for better terms including salaries, training and other benefits. They can also use it to assess whether the firm is financially sound and therefore their jobs are secure. viii. The Public Institutions and other welfare associations and groups represent the public. They are interested with the financial performance of the firm. This Course Description iv information will be important for them to assess how socially responsible is the firm. This responsibility is in form the employment opportunities the firm offers, charitable activities and the effect of firm’s activities on the environment. c) THE ACCOUNTING EQUATION A business owns properties. These properties are called assets. The assets are the business resources that enable it to trade and carry out trading. They are financed or funded by the owners of the business who put in funds. These funds, including assets that the owner may put is called capital. Other persons who are not owners of the firm may also finance assets. Funds from these sources are called liabilities. The total assets must be equal to the total funding i.e. both from owners and nonowners. This is expressed inform of accounting equation which is stated as follows: ASSETS = LIABILITIES + CAPITAL Each item in this equation is briefly explained below. Assets: An asset is a resource controlled by a business entity/firm as a result of past events for which economic benefits are expected to flow to the firm. An example is if a business sells goods on credit then it has an asset called a debtor. The past event is the sale on credit and the resource is a debtor. This debtor is expected to pay so that economic benefits will flow towards the firm i.e. in form of cash once the customers pays. Assets are classified into two main types: i) Non current assets (formerly called fixed assets). ii) Current assets. Non current assets are acquired by the business to assist in earning revenues and not for resale. They are normally expected to be in business for a period of more than one year. Major examples include: Land and buildings Plant and machinery Fixtures, furniture, fittings and equipment Motor vehicles Current assets are not expected to last for more than one year. They are in most cases directly related to the trading activities of the firm. Examples include: Stock of goods – for purpose of selling. Trade debtors/accounts receivables – owe the business amounts as a resort of trading. v Course Description Other debtors – owe the firm amounts other than for trading. Cash at bank. Cash in hand. Liabilities: These are obligations of a business as a result of past events settlement of which is expected to result to an economic outflow of amounts from the firm. An example is when a business buys goods on credit, then the firm has a liability called creditor. The past event is the credit purchase and the liability being the creditor the firm will pay cash to the creditor and therefore there is an out flow of cash from the business. Liabilities are also classified into two main classes. i) ii) Non-current liabilities (or long term liabilities) Current liabilities. Non-current liabilities are expected to last or be paid after one year. This includes long-term loans from banks or other financial institutions. Current liabilities last for a period of less than one year and therefore will be paid within one year. Major examples: Trade creditors/ or accounts payable – owed amounts as a result of business buying goods on credit. Other creditors - owed amounts for services supplied to the firm other than goods. Bank overdraft - amounts advanced by the bank for a short-term period. Capital: This is the residual amount on the owner’s interest in the firm after deducting liabilities from the assets. The Accounting equation can be expressed in a simple report called the Balance Sheet. The basic format is as follows: Name Balance sheet as at 31.12. Sh Capital Non Current Liabilities Loan Current liabilities Overdraft xx Creditors xx Capital and Liabilities Sh Sh Non Current Assets Land & Buildings Plant & Machinery xx Fixtures, furniture & fittings Motor vehicles Sh xx xx xx xx xx xx xx Current Assets Stocks Debtor’s Cash at bank xx xx xx Course Description vi Cash in hand xx xx xx Total assets xx vii Course Description The above format of the balance sheet is the horizontal format however currently the practice is to present the Balance Sheet using the vertical format which is shown below. Name Balance sheet as at 31.12. Non Current Assets Land & Buildings Plant & Machinery Fixtures, furniture & fittings Motors vehicles Sh Sh xx xx xx xx xx Current Assets Stocks/inventories Debtors/ trade receivables Cash at bank Cash in hand Current Liabilities Bank Overdraft xx Creditors/trade payables Net Current Assets Net assets Sh xx xx xx xx xx Capital Non Current Liabilities Loan (from bank or other sources) (xx) xx xx xx xx xx Please pay attention to the format. The Non Current assets are listed in order of permanence as shown i.e. from Land and Buildings to motor vehicles. The Current Assets are listed in order of liquidity i.e. which asset is far from being converted into cash. Example ,stock is not yet sold, (i.e. not yet realised yet) then when it is sold we either get cash or a debtor (if sold on credit). When the debtor pays then the debtor may pay by cheque (cash has to be banked) or cash. The Current Liabilities are listed in order of payment i.e. which is due for payment first. Bank overdraft is payable on demand by the bank, then followed by creditors. Note that in the vertical format, current liabilities are deducted from current assets to give net current assets. This is added to Non Current assets, which give us net assets. Net assets should be the same as the total of Capital and Non Current Liabilities. Course Description viii Example 1.1 B Kelly has a business that has been trading for some time. You are given the following information as at 31.12.2002 £ Buildings 11,000 Furniture & Fittings 5,500 Motor Vehicles 5,800 Stocks 8,500 Debtor 5,600 Cash a bank 1,500 Cash in hand 400 Creditors 2,500 Capital 30,800 Loan 5,000 You are required to prepare a Balance Sheet as at 31 December 2001 B Kelly Balance Sheet as at 31 December 2001 Non Current Assets Buildings Furniture & Fittings Motor Vehicles Current Liabilities Stock Debtors Cash at bank Cash in hand Creditors Net Current Assets Net Assets Capital Non-Current Liabilities Loan £ £ £ 11,000 5,500 5,800 22,300 8,500 5,600 1,500 400 16,000 (2,500) 13,500 35,800 30,800 5,000 35,800 Example 1.2 L Stokes sets up a new business. Before he actually sells anything he has bought motor vehicles of ₤3,000, premises of ₤7,000, stock of goods ₤2,000. He still owes ₤800 in respect of them. He had borrowed ₤4,000 from D Evans. After the events just described and before trading starts, he had ₤300 cash in hand and ₤600 cash at bank. ix Course Description You are required to calculate the amount of his capital. Solution: Assets: ₤ Motor Vehicle Premises Stock Cash at bank Cash in hand Liabilities: Creditors Loan - D Evans ₤ 3,000 7,000 2,000 600 300 12,900 800 4,000 Capital (4,800) 8,100 8,100 Remember the Accounting equation: Assets = Liabilities + Capital. To get capital we rearrange the equation as follows: Capital = Assets - Liabilities Total Assets = ₤12,900 Total Liabilities = ₤4,800 Capital = ₤ 12,900 - 4,800 = ₤ 8,100 Example 1.3 C Kings has the following items in his balance sheet as on 30 June 2002. Capital £41,800, Creditors £3,200, Fixtures £7,000, Motor Vehicles £8,400, Stock of goods £9,900, Debtors £6,500, Cash at bank £12,900 and Cash in hand £240. During a. b. c. the first week of July 2002: He bought extra stock of goods £1,540 on credit. One of the debtors paid him £560 in cash. He bought extra fixture by cheque £2,000. You are to draw up a balance sheet as on 7 July 2002 after the above transactions have been completed. Course Description x First we need to look at the effect of the above transactions on the assets and liabilities of C Kings. For (a) Buying extra stock increases the level of stock by £1,540 and because this is bought on credit the creditors increase by £1,540 also. (b) Amount received from the debtor means that the level of debtors reduces and cash increases by £560. (c) Extra fixtures bought by cheque, will increase the fixtures and reduce the cash at bank by £2,000. This can be summarized as follows: Capital Creditors Fixtures Motor Vehicles Stock Debtors Cash at bank Cash in hand Opening Balances £ 41,800 3,200 7,000 8,400 9,900 6,560 12,900 240 Increase/(Decrease) 1,540 2,000 1,540 (560) (2000) 560 Closing Balances £ 41,800 4,740 9,000 8,400 11,440 6,000 10,900 800 Given these closing balances then the balance sheet can be drawn as follows: C Kings Balance sheet as at 7 July 2002. Non Current Assets Fixtures Motor Vehicles Current Assets Stock Debtors Cash at bank Cash at hand Current Liabilities Creditors Net Current Assets Net Assets Capital £ £ 9,000 8,400 17,400 11,440 6,000 10,900 800 29,140 (4,740) 24,400 41,800 41,800 xi Course Description From the illustration remember that any change in the items of the balance sheet will have a double effect on the accounting equation has a double effect and therefore the equation will always balance. Course Description xii Example 1.4 D Moody has the following assets and liabilities as on 31 April 2002: £ Creditors 15,800 Equipment 46,000 Motor Vehicle 25,160 Stock 24,600 Debtors 23,080 Cash at bank 29,120 Cash in hand 160 During the first week of May 2002 Moody: a. Bought extra equipment on credit for £5,520. b. Bought extra stock by cheque £2,280. c. Paid creditors by cheque £3,160. d. Debtors paid £3,360 by cheque and £240 by cash. e. Moody put in extra £1,000 cash as capital. Required: a. Determine the capital as at 1st May 2002. b. Draw up a balance sheet after the above transactions have been completed. Solution: (i) Using the accounting equation of Assets = Liabilities + Capital, then assets and liabilities can be listed as follows. Assets £ Liabilities £ Equipment 46,000 Creditors 15,800 Motor Vehicle 25,160 Stock 24,600 Debtors 23,080 Cash at bank 29,120 Cash in hand 160 148,120 Capital = Assets – Liabilities = £148,120 - £15,800 = £132,320 (ii) To draw up the balance sheet, we consider the effect of the above transactions on the relevant balances: a. Buying extra equipment means that the equipment balance will increase by £5,520 and the creditors will also increase by the same amount. b. Buying extra stock by cheque means that the level of stock goes up by £2,280 and the balance at bank reduces by the same. c. Paying creditors by cheque reduces the balance on the creditors account and also reduce the amount at the bank. d. Debtor paying the firm reduces the debtors balance by £3,600 and increases the cash at bank and cash in hand by £3,360 and £240 respectively. xiii Course Description e. Additional cash of £1,000 increases the cash in hand balance by £1,000 and the capital balances. Course Description xiv This is also summarized as follows: Opening Adjustment Closing Balance Increase/Decrease Balance Assets/Liabilities £ £ £ Equipment 46,000 +5,520 51,520 Motor Vehicle 25,160 25,160 Stock 24,600 +2,280 26,880 Debtors 23,080 -3,600 19,480 Cash at bank 29,120 (-2,280 – 3,160 + 3,360) 27,040 Cash in hand 160 (+240 + 1000) 1,400 Creditors 15,800 (+5,520 – 3,160) 18,160 Capital 132,320 +1,000 133,320 The balance sheet will therefore be prepared as follows: D Moody Balance sheet as at 7 May 2002 Non Current Assets Equipment Motor vehicle £ Current Assets Stock Debtors Cash at bank Cash in hand £ 51,520 25,160 76,680 26,880 19,480 27,040 1,400 74,800 Current Liabilities Creditors Net Current Assets Net Assets (18,160) 56,640 133,320 Capital 133,320 Double Entry Aspects The Accounting equation forms the basis of double entry and therefore it should always be maintained. Any change in assets, liabilities or capital will have a double effect such that assets will always be equal to liabilities plus capital. If the owners put in additional capital then this will increase the cash at bank and the capital amount therefore the equation is still maintained. Name Debit Date Detail Folio Amount Credit Date Detail Folio Amount xv Course Description In this account the date will show the opening period of the asset ,liability or capital i.e. the balance brought forward. It will also show the date when a transaction took place (i.e. either an asset was bought or liability incurred). The detail column (also called the particulars column) shows the nature of the transaction and reference to the corresponding account. The Folio Column for purposes of detailed recording shows the reference number of the corresponding account. The amount column shows the amount of the asset, liability or capital. The left side of the account is called the debit side and the right side is called the credit side. All assets are shown or recorded on the debit side while all the liabilities and capital are recorded on the credit side. Each type of asset or liability must have its own account whereby all transactions affecting them are recorded in this account. Therefore there should be an account for Premises, Plant and Machinery, Stock, Debtors, Creditors etc. Under the accounting equation if all assets are represented by liabilities and capital therefore all debits should be the same as credits. For the double entry to be reflected in the accounts, every debit entry must have a corresponding credit entry. The transactions affecting these accounts are posted in the account as debit entry and credit entry to complete the double entry. When we make a debit entry we are either: i. Increasing the value of an asset. ii. Reducing the value of a liability. iii. Reducing the value of capital. When we make a credit entry we are either: i. Reducing the value of an asset. ii. Increasing the value of a liability. iii. Increasing the value of capital. Example 1.5 H Jumps has the following assets and liabilities as on 30 November 2002: Creditors £39,500; Equipment £115,000; Motor vehicle £62,900; Stock £61,500; Debtors £57,700;Cash at bank £72,800 and Cash in hand £400. Compute the balance on the capital account as at 30 November 2002. During the first week of December 2002, Jump: a. Bought extra equipment on credit for £13,800. b. Bought extra stock by cheque £5,700. c. Paid creditors by cheque £7,900. Course Description xvi d. Received from debtors £8,400 by cheque and £600 by cash. e. Put in an extra £2,500 cash as capital. You are to draw up a balance sheet as on 7 December 2002 after the above transactions have been completed. xvii Course Description Answer: Capital = Assets – Liabilities Assets £ Liabilitie s 115,000 Creditor s 62,900 61,500 57,700 72,800 400 371,300 Equipment Motor vehicle Stock Debtors Cash at bank Cash in hand £ 39,50 0 Capital = £371,300 - £39,500 = £330,800 Creditors A/C a/c 2002 £B Motor Vehicles 2002 £ 2002 £ 2002 £ Bank 7900 c/d 62,900 1.12 Bal c/d 31,600 1.12 Bal b/d 39,500 1.12 Bal b/d 62,900 1.12 Bal 62,900 62,900 39,500 2002 £ 1.12 Bal b\d Creditors 2002 £ 1.12 Bal b\d Bank 39,500 Equipment a/c 2002 115,000 13,800 7.12 Bal c\d 128,800 128,800 Stock a/c 2002 61,500 5700 7.12 Bal c\d 67,200 £ 128,800 £ 67,200 67,200 Course Description xviii Debtors a/c 2002 2002 £ 1.12 Bal b\d 57,700 Bank Cash 570 7.12 Bal c\d 57,700 Bank Debtors Bal 2002 £ 7.12 Bal b\d 5,700 7,900 67,600 81,200 Cash in hand a/c 2002 £ b\d 600 2500 7.12 Bal c\d 3500 3500 3500 Capital 2002 2002 £ 7.12 Bal b\d 8,400 600 48,700 57,700 Cash at Bank a/c 2002 £ 72,800 Stock Creditors 8,400 7.12 Bal c\d 81,200 2002 £ 1.12 Bal b\d 2002 £ 1.12 400 Debtors Capital £ £ 1.12 Bal b\d 333300 Cash 128,800 330800 2500 128,800 Creditors Of Equipment 2002 £ 13800 Equipment 13,800 13800 13,800 H Jump Balance sheet as at 7 December 2002 Non Current Assets £ £ £ xix Course Description Equipment Motor vehicles 128,800 62,900 191,700 Current Assets Stock Debtors Cash at Bank Cash in Hand Current Liabilities Creditors of equipment Creditors Net Current Assets Net Assets Capital 61,200 48,700 67,600 3,500 187,000 13,800 31,000 (45,400) 141,000 333,300 333,300 Course Description xx Example 1.6 Write up the asset, capital and liability accounts in the books of M Crash to record the following transactions: 2002 June 1 Started business with £50,000 in the bank. “ 2 Bought motor van paying by cheque £12,000. “ 5 Bought Fixtures £4,000 on credit from Office Masters Ltd. “ 8 Bought a van on credit from Motor Cars Ltd £8,000. “ 12 Took £1,000 out of the bank and put it into the cash till. “ 15 Bought Fixtures paying by cash £600. “ 19 Paid Motor Cars Ltd by cheque £8000. “ 21 A loan of £10,000 cash is received from J Marcus. “ 25 Paid £8,000 of the cash in hand into the bank account. “ 30 Bought more Fixtures paying by cheque £3,000. Capital a/c Cash at bank a/c 2002 £ 2002 30/6 Bal c/f 50,000 1/6 Van 12,000 £ Bank 50,000 2002 1/6 12/6 £ Capital Cash 2002 £ 50,000 2/6 8,000 12/6Cash 1,000 19/6Motor ltd 8,000 50,000 50,000 30/6 Fixtures 3,000 30/6 Bal c/f 34,000 58,000 58,000 2002 2/6 12,000 8/6 8,000 Motor Van £ Bank Super M 30/6 20,000 20000 2002 5/6 4,000 15/6 600 30/6 3000 £ Bal c/f 20000 Fixtures £ 2002 young £ Cash Bank Bal c/f 7,600 xxi Course Description 7,600 2002 19/6 8000 7,600 Motor Car Ltd – Creditors £ 2002 Bank 8/6 Van 8000 2002 30/6 2002 12/6 1,000 21/6 J. Marcus 2002 30/6 £ 8000 8000 Office Masters Ltd - Creditor £ 2002 B\f 8/6 Fixtures 4000 4000 Cash in hand £ 2002 Cash 15/6 600 25/6 Bank 10000 30/6 Bal c/f 11000 J. Marcus - Loaner £ 2002 c\f 21/6 Cash 10000 £ 4000 4000 £ Cash 800 2400 11000 £ 10000 Note that the difference between the debit side and the credit side is the balancing figure. Most assets will have a balance on the credit side and most liabilities and capital accounts will have a balance on the debit side. A simple balance sheet from these balances will be as follows: M Crash Balance Sheet as at 30th June 2002 £ Non Current Assets Fixtures Motor vehicles Current Assets Cash at bank Cash in hand Current Liabilities Creditors – others Net Current Assets £ 7,600 20,000 27,600 34,000 2,400 36,400 (4,000) 32,400 Course Description Net Assets Capital Non Current Liabilities Loan – J Jarvis xxii 60,000 50,000 10,000 60,000 Let us now consider other transactions that take place in a business and the accounting entries to be made. Accounting for sales, purchases, incomes and expenses. Sales: This is the sell of goods that were bought by a firm (the goods must have been bought with the purpose of resale). Sales are divided into cash sales and credit sales. When a cash sale is made, the following entries are to be made. i. Debit cash either at bank or in hand. ii. Credit sales account. For a credit sale: i. Debit debtors/ Accounts receivable account. ii. Credit sales account. A new account for sales is opened and credited with cash or credit sales. Purchases: Buying of goods meant for resale. Purchases can also be for cash or on credit. For cash purchases: i. Debit purchases. ii. Credit cash at bank/cash in hand For credit purchases, we: i. Debit purchases. ii. Credit creditors for goods. A new account is also opened for purchases where both cash and credit purchases are posted. NOTE: NO ENTRY IS MADE INTO THE STOCKS ACCOUNT. Incomes: A firm may have other incomes apart from that generated from trading (sales). Such incomes include: Rent Bank interest Discounts received. When the firm receives cash, from these incomes, the following entries are made: Debit cash in hand/at bank. Credit income account. Each type of income should have its own account e.g. rent income, interest income. xxiii Course Description Incomes increase the value of capital and that is the reason posted on the credit side of their respective accounts. why they are Expenses: These are amounts paid out for services rendered other than those paid for purchases. Examples include: • Postage and stationery • Salaries and wages • Telephone bills • Motor vehicle running expenses. • Bank charges. When a firm pays for an expense, we: i. Debit the expense account. ii. Credit cash at bank/in hand. Each expense should also have its own account where the corresponding entry will be posted. Expenses decrease the value of capital and thus the posting is made on the debit side of their accounts. The following diagram is a simple summary of the entries made for incomes and expenses. Course Description xxiv Debit cash book/bank/in hand INCOME Credit INCOMES/EXPENSES Debit Expense A/C EXPENCE Credit cash book /bank/in hand Returns Inwards and Returns Outwards. Returns Inwards: These are goods that have been returned by customers due to various reasons e.g. i. They may be defective/damaged, ii. Being of the wrong type . iii. Excess goods being delivered. Goods returned may relate to cash sales or credit sales. For the goods returned in relation to cash sales and cash is refunded to the customer the following entries are made: i. Debit returns – inwards ii. Credit cashbook. For goods returned that relate to credit sales; no cash has been given to customer, the following entry is to be made. i. Debit returns inwards. ii. Credit debtors. Returns Outwards: These are goods returned to suppliers/creditors. They may be for cash purchases or for credit purchases. For cash purchases a cash refund given to the firm by the supplier, i. Debit the cashbook (cash at bank/hand). ii. Credit returns outwards. For credit purchases and no refund has been made: i. Debit creditors. ii. Credit returns outwards. xxv Course Description Diagrammatically shown as follows: Debit returns inwards. Cash Credit cashbook. Debit returns inwards Inwards Credit Credit debtors Debit cash Returns Cash Outwards Credit returns outwards Debit creditors Credit Credit returns outwards Now lets us take one example that includes most of the above transactions. Example 1.8 You are to enter the following transactions, completing the double entry in the books for the month of May 2002. 2002 May 1 Started business with £2,000 in the bank. “ 2 Purchased goods £175 on credit from M Rooks. “ 3 Bought furniture and fittings £150 paying by cheque. “ 5 Sold goods for cash £275. “ 6 Bought goods on credit £114 from P Scot. “ 10 Paid rent by cash £15. “ 12 Bought stationery £27, paying in cash. “ 18 Goods returned to M Rooks £23. “ 21 Let off part of the premises receiving rent by cheque £5. “ 23 Sold goods on credit to U Foot for £77. “ 24 Bought a motor van paying by cheque £300. “ 30 Paid the month’s wages by cash £117. “ 31 The proprietor took cash for himself £44. Example 2002 £ 1/5 2,000 21/5 Bank a/c 2002 £ Capital 3/5Furn& 150 24/5 300 Rent 31/5 fitting Motor Bal vehicle c/f Course Description xxvi 5 1,555 2,005 31/5 2,000 Bal c/f 2,005 Capital a/c 1/5 Bank 2,000 Purchases a/c 2002 £ Rooks 2002 £ 2/5M 175 6/5 114 P 2002 £ 18/5 23 31/5 152 Scot 31/5 289 289 Returns Bal Bal c/f 289 Creditor – M Rooks a/c 2002 £ in 2/5 175 c/f Purchases 175 175 Furniture & Fittings a/c 2002 £ 2002 £ 3/5 Bank 150 31/5 Bal c/f 150 Sales a/c 2002 £ 2002 £ 31/5 Bal c/f Cash 352 5/5 275 150 150 23/5 U. Foot 77 352 352 Cash in hand a/c 2002 £ 2002 £ 5/5 Sales 275 10/5 Rent £ 15 2002 P Scot a/c £ 2002 xxvii Course Description 12/5 Stationery 27 6/5Purchases 31/5 Bal c/f 114 114 30/5 Wages 31/5 Bal c/f 117 116 275 275 114 114 Expenses – Rent a/c 2002 11/5 Bal c/f 27 £ 2002 15 10/5 Cash Expenses – Stationery a/c £ 2002 15 £ 12/5 Cash 27 2002 £ 31/5Bal c/f 27 27 Course Description Returns – Out a/c 2002 £ 2002 £ £ 31/5 Bal c/f 23 18/5 M Rooks Bank 5 Debtors – U Foot a/c 2002 £ 2002 £ 23/5 Sales 77 31/5 Bal c/f 300 Expenses – Wages a/c a/c 2002 £ 2002 £ £ 30/5 Cash 117 31/5 Bal c/f c/f 44 xxviii Income – Rent a/c £ 2002 2002 23 77 21/5 Bal c/f 5 31/5 Motor vehicle a/c 2002 £ 2002 £ 24/5 Bank 300 31/5 Bal c/f Drawings 2002 117 £ 31/5 Cash 44 200 31/5 Bal Accounting for drawings, discounts allowed and discounts received. Drawings The owner makes drawings from the firm in various ways: i) Cash or bank withdrawals When the owner withdraws money from the business we debit drawings and credit cashbook (cash in hand or cash at bank). ii) Taking goods for own use and When the owner takes out some of the goods for his own use, we debit drawings and credit purchases. iii) Personal expenses, paid by the business Here we debit the drawings and credit expense account Taking some of the other assets from the business e.g. motor vehicles or using part of the premises. Sometimes the owner may take over some of the assets of the business e.g. vehicle or converting business premises into living quarters or not paying into the business xxix Course Description cash collected personally from the customers. When this happens we debit drawings and credit the relevant asset e.g. motor vehicles, premises or some building or even debtors. Course Description xxx Discounts Discounts received. A discount received is an allowance by the creditors to the firm to encourage the firm to pay the amount dues within the agreed time. It is an amount deducted from the invoice price. When a discount is given by the supplier then we debit creditor’s account and credit discounts received e.g. A. Ltd sells some goods on credit to B Ltd. ₤1,000 under the terms of sale, B Ltd, will receive a discount of 5% if they pay the amount due within one month. B decides to take up the offer and pays the amount within the given time. B will record the transaction as follows. Debit: Creditor – A Ltd Credit: Discounts Received Creditor A. Ltd a/c Purchases a/c 2002 £ 2002 2002 £ Bank 950 1,000 Discount received 50 1000 £ Purchases Discounts Received a/c 200 £ 2002 £ Bal c/f 50 A Ltd Ltd 950 2002 1,000 £ A Ltd 1000 £ 2002 Bank a/c £ 2002 50 A Discounts Allowed These are the allowances made by a firm on the amounts receivable from the customers to encourage prompt payment. The amounts deducted from the sales invoice. In the previous example when A Ltd issued the discount and was taken up by B the entries will be: i. Debit - discount allowed ii. Credit - debtors - B Ltd. 2002 Sales Debtors B Ltd a/c £ 2002 1,000 Bank £ 950 2002 £ Discount Debtor 1,000 1,000 1,000 Sales a/c 2002 £ 50 xxxi 2002 Debtor Course Description Discount allowed a/c £ 2002 50 Bal c/f £ 50 2002 Debtor Bank a/c £ 950 TRIAL BALANCE The trial balance is a simple report that shows the list of account balances classified as per the debits and credits. The purpose of the trial balance is to show the accuracy of the double entries made and to facilitate the preparation of final accounts i.e. the trading, profit & loss account and a balance sheet. The debits of the trial balance should be the same as the credits, if not then there is an error in one or more of the accounts. The trial balance in example 1.8 would be extracted as follows: Name Trial balance as at 31 May 2002 Debit Credit £ £ Rent – income 5 Debtor – U Foot 7 Motor vehicle 300 Bank 1555 Purchases 289 Wages 117 Capital 2000 Creditor – M 152 Rooks Furniture & 150 Fittings Sales 352 Cash in hand 72 Creditor – P Scot 114 Expenses – Rent 15 Expenses – 27 Stationery Returns Outwards 23 Drawings 44 . 2464 2464 From the trial balance please note that assets and expenses are on the debit side. Capital, liabilities and incomes are normally listed on the credit side. The next example is a detailed one that shows extracting of trial balance once all the postings have been made in the relevant accounts. Example 1.9 Write up the following transactions in the books of S Pink: Course Description 2003 March “ “ “ “ “ “ “ “ “ “ “ “ “ “ “ 1 2 3 4 5 7 11 14 17 20 22 27 28 29 30 31 xxxii Started business with cash £1,000. Bought goods on credit from A Cliks £296. Paid rent by cash £28. Paid £1,000 of the cash of the firm into a bank account. Sold goods on credit to J Simpson £54. Bought stationery £15 paying by cheque. Cash sales £49. Goods returned by us to A Cliks £17. Sold goods on credit to P Lutz £29. Paid for repairs to the building by cash £18. J Simpson returned goods to us £14. Paid A Cliks by cheque £279. Cash purchases £125. Bought a motor vehicle paying by cheque £395. Paid motor expenses in cash £15. Bought fixtures £120 on credit from R west. Solutions Capital a/c Cash in hand a/c 2003 £ 2003 £ 2003 £ £ 31/3 Bal c/d 1,500 1/3 Cash 1,500 1/3 Capital 28 11/3 Sales 1,000 2003 1,500 49 3/3 Rent 4/3 20/3 Bank Repairs 18 28/3 Purchases 125 30/3 exp. Motor 15 31/3 Bal c/d 363 1,549 1,549 Purchases a/c 2003 £ 2003 £ 2/3 A Hanson 296 31/3 Bal c/d 421 28/3 Cash 125 Creditors – A Cliks ac 2003 £ 2003 £ 421 Purchases 296 421 14/3 Returns out 17 2/3 xxxiii Course Description 27/3 Bank 279 296 296 Rent –Expenses a/c 2003 £ 3/3 15 £ 2003 Cash 28 £ 31/3 Bank a/c 2003 Bal c/d £ 28 2003 4/3 Cash 1,000 5/3 Stationery 27/3 A. Hanson 279 29/3 Motor van 395 31/3 Bal c/d 311 1,000 1,000 Debtor – J Simpson a/c Sales a/c 2003 £ 3/3 Sales JSimpson 54 £ 2003 54 £ 2003 22/3 Returns in 31/3 Bal c/d 14 ` £ 2002 31/3 40 Bal c/d 132 5/3 11/3 Sales 49 17/3 P Lutz 29 54 54 132 132 Course Description xxxiv Stationery a/c £ 2003 £ 15 31/3 Bal c/d 2003 7/3 Bank Returns outwards a/c 15 2003 £ 2003 £ 31/3 Cliks Bal c/d 17 14/3 A 17 P Lutz – Debtor a 2003 £ 2003 £ 17/3 Sales 29 21/3 Bal c/d c/d 18 Building repairs - expenses £ 2003 29 20/3 £ Cash 2003 18 31/3 Bal Returns - Inwards 2003 £ 2003 £ 22/3 J Simpson 14 31/3 Bal c/d 395 2003 14 £ 29/3 Bank R West – Creditor (others) 2003 31/3 Bal c/d 15 2003 31/3 A. Webster £ 2003 £ 120 31/3 Fixtures 120 Fixtures £ 2003 £ 120 31/3 Bal c/d Motor vehicle 2003 £ 395 31/3 Bal c/d Motor expenses 2003 120 £ 2003 30/3 Cash 15 £ 31/3 Bal c/d xxxv Course Description S PINKS TRIAL BALANCE AS AT 31 MARCH 2003 Debit (£) Capital Purchases Cash in hand Bank Rent expense Sales Fixtures Debtor – J Simpson Debtor – P Lutz Motor vehicle Creditors Motor expenses Returns inwards Creditors others – R West Stationery Returns outwards Building repairs Credit (£) 1500 421 363 311 28 132 120 40 29 395 15 14 120 15 18 1769 17 1769 Example 1.10 The following transactions took place during the month of May: 2003 May 1 Started firm with capital in cash of £250. “ 2 Bought goods on credit from the following persons: R Kelly £54; Pcombs £87; J Role £25; D Mobile £76; I. Sims £64. “ 4 Sold goods on credit to: C Blanes £43; B Long £62; F Skin £176. “ 6 Paid rent by cash £12. “ 9 C Blanes paid us his account by cheque £43. “ 10 F Skin paid us £150 by cheque. “ 12 We paid the following by cheque: J Role £25; R Kelley £54. “ 15 Paid carriage by cash £23. “ 18 Bought goods on credit from P Combs £43; Mobile £110. “ 21 Sold goods on credit to B Long £67. “ 31 Paid rent by cheque £18. Course Description xxxvi Answer 200 3 31/ 5 200 3 12/ 5 200 3 12/ 5 Bal c/d Creditor R Kelly £ 200 3 Bank 54 2/5 Purcha ses Creditor – J Role £ Bank 200 3 31/5 Bal c/d 200 3 4/5 21/ 5 Capital £ 200 3 250 1/5 Cash 25 2/5 Purcha ses Creditor I Sims £ 200 3 64 2/5 Purcha ses Debtor B Long £ 200 3 Sale 62 31/ Bal c/d s 5 Sale 67 s 129 £ 250 £ 54 £ 25 £ 64 £ 129 . 129 200 3 1/5 200 3 31/ 5 200 3 31/ 5 200 3 4/5 200 3 4/5 Cash in Hand £ 200 3 Capit 250 6/5 Rent al 15/ Carriag 5 e . 31/ Bal c/d 5 250 £ 12 23 21 5 25 0 Creditor P Combs £ 200 3 Bal c/d 130 2/5 Purcha ses . 18/5 Purcha ses 130 Creditor – D Mobile £ 200 3 Bal 186 2/5 Purcha c/d ses . 18/ Purcha 5 ses 186 Debtor C. Blares £ 200 3 Sales 43 4/5 Bank Debtor F Smith £ 200 3 Sales 176 10/ Bank 5 . 31/ Bal c/d 5 176 £ 87 4 3 13 0 £ 76 11 0 18 6 £ 43 £ 15 0 2 6 17 6 xxxvii Course Description 2/5 2/5 Purchases £ 200 3 R Kelly 54 31/ Bal 5 c/d P Combs 87 J Role 25 2/5 2/5 D Mobile L Sims 76 64 18/5 P Combs 43 18/5 D. Mobile 10 0 45 9 200 3 2/5 200 3 9/5 C Blanes H F Skin 10/5 19x 6 6/5 31/ 5 Cash Bank Bank £ 200 3 43 12/5 15 12/5 0 31/5 31/5 . 19 3 Rent £ 19x 6 12 31/ 5 1 8 3 0 £ 200 3 31/ 5 45 9 Bal c/f £ 4/5 4/5 C Blanes F Long F Skin 4/5 B Long 43 62 17 6 67 . 34 8 . 459 £ 2003 J Role 25 15/5 R Kelly Rent Bal c/d 54 Carriage Expenses £ 200 3 Cash 23 31/ Bal c/d 5 18 9 6 19 3 £ Bal c/d 30 . 30 Trial Balance as at 31/5/2003 Capital Sales £ 200 3 348 4/5 Debit - Credit 250 £ 23 Course Description Cash Creditor – R Kelly Creditor – P Combs Creditor – J Role Creditor – D Mobile Creditor – L. Simms Debtor – C. Blanes Purchases Sales Debtor- B. Long Debtor- F Skin Bank Carriage Rent xxxviii 215 - 130 - - 186 64 - 459 - 348 129 26 96 - 30 - 978 978 xxxix Course Description REINFORCEMENT QUESTIONS Question One Spark has been trading for a number of years as an electrical appliance retailer and repairer in premises which he rents at an annual rate of $1,500 payable in arrears. Balances appearing in his books at 1 January 19X1 were as follows: $ Capital account Motor van Fixtures and fittings Provision for depreciation on motor van (credit) Provisions for depreciation on fixtures& fittings (credit) Inventory at cost Receivables for credit sales: Brown Blue Stripe Cash at bank Cash in hand Payables for supplies: Live Negative Earth $ 1,808 1,200 806 720 250 366 160 40 20 220 672 5 143 80 73 296 45 100 Amount owing for electricity Local taxes paid in advance Although Sparks has three credit customers the majority of his sales and services are for cash, out of which he pays various expenses before banking the balance. The following transactions took place during the first Januar y $ Suppliers’ invoices: Live 468 Negative Earth 692 Capital introduced Bankings of cash (from cash sales) 908 Expenditure out of cash sales before banking: Withdrawals on account 130 Stationery 12 Travelling 6 Petrol and van repairs 19 four months of 19X1 Februar Marc April y h $ $ $ 570 87 500 940 390 103 187 602 64 - 766 1,031 120 14 10 22 160 26 11 37 150 21 13 26 Course Description xl Sundry expenses Postage Cleaner’s wages Goods invoiced to credit customers: Brown Blue Stripe Cheque payments (other than those to suppliers): Telephone Electricity Local taxes Motor van (1 February 19X1) Unbanked at the end of April 5 12 60 4 10 60 7 15 65 3 19 75 66 120 22 140 10 130 12 180 44 38 20 48 40 62 - 49 47 800 - 59 20 220 - 66 106 12 Spark pays for goods by cheque one month after receipt of invoice, and receives a settlement discount of 15% from each supplier. Credit customers also pay by cheque one month after receipt of invoice, and are given a settlement discount of 10% of the invoice price. Required: Write up the ledger accounts of Spark for the four months to 30 April 19X1, and extract a list of account balances after balancing off the accounts. Question Two Mary Balance Sheet as at 31 December 2000 Non Current Assets Premises £ Plant Current Assets: Stock Debtors Cash at bank Cash in hand Current liabilities: Creditors £ 25,000.0 0 12,000.0 0 37,000.0 0 11,000.0 0 10,000.0 0 5,000.00 3,000.00 29,000.0 0 (12,000.0 17,000.0 xli Course Description 0) Capital Non Current Liabilities: Loan from bank 0 54,000.0 0 34,000.0 0 20,000.0 0 54,000.00 During the year to 31 December 2001 the following total transactions occurred: a) Mary withdrew a total of £10,000.00 in cash b) Stock in trade was bought, all on credit, for £34,000.00 c) Sales were made totaling 60,000.00 of stock in trade which had cost £37,000.00. Of these sales £51,000.00 were on credit and £9,000.00 for cash. d) A total of £16,000.00 was drawn from the bank in cash to the cash till. e) Electricity for the year paid by cheque totaled £2,000.00 f) Rates for the year paid by cheque totaled £1,000.00 g) Wages for the year all paid cash totaled £10,000.00 h) Sundry expenses all paid in cash totaled £2,000.00 i) Creditors were paid a total of £36,000.00 all by cheque j) Debtors paid a total of £54,000.00 all in cheques. k) The bank charged interest on the loan deducting £3,000.00. Required: Prepare a revised balance sheet. (20 marks) Question Three a) Explain the nature of accounting and the accounting equation (8 marks) b) Calculate the profit for the year ended 31 December 2001 from the following information (12 marks) Non Current Assets Property Machinery 01.01.200 1 £ 20,000.00 6,000.00 31.12.200 1 £ 20,000.00 9,000.00 Course Description xlii 26,000.00 Current Assets: Debtors Cash Current Liabilities: Creditors Overdraft Net Current Liabilities Net Assets 29,000.00 8,000.00 4,000.00 1,000.00 5,000.00 1,500.00 9,500.00 5,000.00 6,000.00 3,000.00 9,000.00 11,000.00 (6,000.00) 12,000.00 (2,500.00) 20,000.00 26,500.00 Drawings during the year amounted to £4,500.00 Additional capital introduced by the owner £5,000.00 Question Four Brian Barmouth is a sole trader. At 30 June 2000 the following balances have been extracted from his books: Sales Purchases Office expenses Insurance Wages Rates Heating and Lighting Telephone Discounts allowed Opening stock Returns inwards Returns outwards £ 47,600. 00 22,850. 00 1,900.0 0 700.00 7,900.0 0 2,800.0 0 1,200.0 0 650.00 1,150.0 0 500.00 200.00 150.00 xliii Course Description Premises Plant and Machinery Motor Vehicles Debtors Bank balance Creditors Loan-long term loan Capital Drawings for the year Closing stock 40,000. 00 5,000.0 0 12,000. 00 12,500. 00 7,800.0 0 3,400.0 0 10,000. 00 60,000. 00 4,000.0 0 550.00 Required: Construct a trial balance, from the above list of balances. CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK Acknowledgement 44 LESSON TWO FINAL ACCOUNTS FINAL ACCOUNTS FOR SOLE TRADERS (a) TRADING ACCOUNT The trading account summarises the trading activities (sale and purchase of goods/stocks) of the business and tries to determine the gross profit for the relevant financial period. The gross profit is then taken up in the profit and loss account as part of the income. Format for the trading account: Name Trading Account for the year ended 31 Dec. ₤ ₤ ₤ Sales Less: Returns Inwards x (x) x Less: Cost of Sales Opening stock Purchases Add: Carriage Inwards x x x x Less: Returns Outwards Cost of stock available for sale Less: Closing stock Gross Profit x x x x (x) x Example: 2.1 From the following details draw up the trading account of Springs for the year ended 31 December 2002, which was his first year in business. ₤ Carriage inwards Returns outwards Returns inwards Sales Purchases Stock of goods: 31 December 19x7 6,700 4,950 8,900 387,420 333,330 74,890 Lesson One 45 Springs Trading Account for the year ended 31 Dec 2002 £ £ Sales Less: Returns Inwards 387,420 8,900 378,520 Less cost of sales Purchases Add: Carriage Inwards 333,330 6,700 340,030 4,950 335,080 74,890 260,190 Less: Returns outwards Less: Closing stock Gross Profit 118,330 Example 2.2 The following details for the year ended 31 March 2003 are available. Draw up the trading account of R Sings for that year. £ Stocks: 1 April 2002 Returns inwards Returns outwards Purchases Carriage inwards Sales Stocks: 31 March 2003 16,523 1,372 2,896 53,397 1,122 94,600 14323 Answer R Sings Trading Account for the year ended 31 Mar 19x8 ₤ ₤ ₤ 94,600 (1,372) 93,228 Sales Less: Returns Inwards Less: Cost of sales Opening Stock Purchases Add: Carriage Inwards 53,397 1,122 54,519 Less: Returns Outwards 2,896 Cost of goods available for sale 16,523 51,623 68,146 46 Introduction to Accounting Less: Closing stock (49,642) Gross Profit 18,504 43,586 (b) PROFIT AND LOSS ACCOUNT It shows the net profit or net loss that the business has made from all the activities during a financial period. The net profit (or loss) is determined by deducting all the expenses from all the incomes of the same financial period. In practice, the trading account is combined together with the net profit and loss account into one report so that the format is as shown below: Name Trading, Profit and Loss Account for the year ended 31/12/19xx £ £ £ x Sales Less: Returns Inwards x x Less: Cost of sales Opening stock Purchases Add: Carriage Inwards x x x x Less: Returns Outwards Cost of goods available for sale Less: Closing stock Gross Profit Discount received Rent received Interest received Other incomes x x x x (x) x x x x x x Less: Expenses Carriage Outwards Discounts allowed Postage & stationary Salaries & wages Rent paid Insurance & rates Bank charges Other expenses Net profit/ (loss) x x x x x x x x (x) x/(x) Lesson One 47 Example 2.3 From the following trial balance of P Boones draw up a trading and profit and loss account for the year ended 30 September 2002, and a balance sheet as at that date. Dr Cr £ £ Stock 1 October 19x8 23,680 Carriage outwards 2,000 Carriage inwards 3,100 Returns inwards 2,050 Returns outwards 3,220 Purchases 118,740 Sales 186,000 Salaries and wages 38,620 Rent 3,040 Insurance 780 Motor expenses 6,640 Office expenses 2,160 Lighting and heating expenses 1,660 General expenses 3,140 Premises 50,000 Motor vehicles 18,000 Fixtures and fittings 3,500 Debtors 38,960 Creditors 17,310 Cash at bank 4,820 Drawings 12,000 Capital 126,360 332,890 332,890 48 Introduction to Accounting Answer P Boones Trading, Profit and Loss Account as at 30 September 2003 £ £ £ 186,000 (2,050) 183,950 Sales Less: Returns Inwards Less: Cost of sales Opening stock Purchases Add: Carriage inwards 23,680 118,740 3,100 12,1840 Less: Returns Outwards Cost of goods available for sale Less: Closing stock Gross Profit 3,220 118,620 142,300 29,460 (11,2840) 71,110 Less Expenses Salaries & wages Carriage outwards Rent Insurance Motor expenses Office expenses Lighting & heating General expenses Net Profit 38,620 2,000 3,040 780 6,640 2,160 1,660 3,140 (58,040) 13,070 Lesson One 49 (c) BALANCE SHEET This is a simple report that shows the assets and liabilities of the business and the capital of the owner as at a certain point in time. The format is at shown below: Name Balance sheet as at 31/Dec/19xx £ £ £ Non Current Assets Land & Buildings Plant & Machinery Fixtures, Furniture & Fittings Motor vehicles x x x x x Current Assets Stock/inventories Debtors – trade Debtors – others Cash at bank Cash at hand x x x x x x Current Liabilities Bank overdraft Creditors – trade Creditors – others Net current assets Net Assets x x x (x) x x Capital Add: Net profit x x x Less: Drawings (x) x Non Current Liabilities Loan (s) x x The balance Sheet of P Boones in example 2.3 will be produced as follows: 50 Introduction to Accounting P Boones Balance Sheet as at 30 Sept 2002 £ £ Non Current Assets Premises Fixtures & fittings Motor vehicles 18,000 50,000 3,500 71,500 Current Assets Stock Debtors Cash at bank 29,460 38,960 4,820 73,240 Current Liabilities Creditors Net Current Assets Net Assets Capital Add: Net Profit Less: Drawings (17,310) 55,930 127,430 126,360 13,070 139,430 (12,000) 127,430 ` D) BOOKS OF PRIME ENTRY The diagram below shows the components of an accounting system for a firm that carries out trading activities from the source documents that record the evidence of transactions, where the documents are recorded and the postings to made. Lesson One 51 Source Final Documents Accounts Sales Invoice The Books of The Prime entry Ledger Balances Recorded Sales Journal List of the Sales Ledger THE Trading Account Purchas e Invoice Recorded Purchases Journal TRIAL Credit note Recorded The Return Inwards Journal Purchases Ledger Profit Loss Debit Loss Note Account Other Correspo Balance ndence BALANCE Recorded Receipt s Cheque s Petty & Return Outwards journal The cashbook & Recorded Petty cashbook General Ledger Recorded General Journal Balance Sheet A brief description of each component is explained below. SOURCE DOCUMENTS 52 Introduction to Accounting This shows the evidence transactions. They are collected, filed and posted in the books of prime entry. Example, if a firm sells goods on credit, then an invoice is raised. The source documents as shown in the above include: Lesson One 53 Sales invoice Purchases invoice Credit note Debit note Receipts, cheques and petty cash vouchers Other correspondences. (i) Sales Invoice The sales invoice is raised by the firm and sent to the debtor/customer when the firm makes a credit sale. The sales invoice contains the following: i. Name and address of the firm ii. Name and address of the buying firm iii. Date of making the sale – invoice date. iv. Invoice number v. Amount due (net of trade discount) vi. Description of goods sold vii. Terms of sale (ii) Purchases Invoice A purchase invoice is raised by the creditor and sent to the firm when the firm makes a credit purchase. It shows the following: i. Name and the address of the creditor/seller ii. Name and address of the firm iii. Date of the purchase (invoice date) iv. Invoice number v. Amount due vi. Description of goods sold vii. Terms of sale (iii) Credit note A credit note is raised by the firm and issued to the debtor when the debtor returns some goods back to the firm. It’s contents include: i. Name and address of the firm ii. Name and address of the debtor iii. Amount of credit iv. Credit note number v. Reason for credit e.g. if goods sent but of the wrong type. The purpose of the credit note is to inform the debtor or customer that the debtor’s account with the firm has been credited i.e. the amount due to the firm has been reduced or cancelled. The credit note may also be issued when the firm gives an allowance of the amounts due from the debtors. From the context we can assume that all credit notes are issued when goods are returned. (iv) Debit note This is raised by the creditor and issued to the firm when the firm returns some goods to the creditor. It includes the following items: i. Name and address of the firm ii. Name and address of the creditor 54 Introduction to Accounting iii. Amount of debit iv. Debit Note number v. Reason for the debit The purpose of the debit note is to inform the firm that the amount due to the creditor has been reduced or cancelled. The Firm Credit sales (sales invoice) The Debtor Returns inwards (credit note) Credit purchase (purchase invoice) The Firm Returns outwards (debit note) The Creditor (vi) Receipts A receipt is raised by the firm and issued to customers or debtors when they make payments in the form of cash or cheques. It shows: i. ii. iii. iv. The name and address of the firm The date of the receipt Amount received (cash or cheque or other means of payment) Receipt number. Cheques When a firm opens a current account with the bank, a chequebook containing cheques issued. The cheques allow the firm to make payments against the account with the bank. When a firm issues a cheque to its creditors for payments, it authorizes the bank to honour payments against the firm’s account with the bank. The cheque contains the following information: i. Name and account number of the firm (account holder) ii. The date of the cheque iii. Name of the payee (creditor) iv. Name of the firm’s bank v. Amount payable in words and figures vi. The cheque number vii. The authorized signature(s) Petty cash vouchers A petty cash voucher is raised by a cashier to seek authority for payments (payments of small value in the firm which require cash payments e.g. fuel, busfare, office snacks), which is approved by a senior manager and filed for record purpose. It shows: Lesson One 55 i. Date of payment ii. Amount paid iii. Reason for payment iv. Authorized signature(s): v. Person approving vi. Person receiving The person receiving the money must then return a document supporting how the money was utilized e.g. fuel receipt, bus ticket e.t.c. (vii) Other correspondence These include information received within or outside the firm that has a financial implication in the accounts. Examples are: i. Letters from the firm’s lawyers about a debtors balance. ii. Hire-purchase/credit sale or credit purchase agreements that relate to non-current assets. iii. Memorandum from a senior manager requiring changes to be made in the accounts. iv. Bank statement from the bank, e.g. bank charges. BOOKS OF PRIME ENTRY They record the source documents. Sales Journal It is also called a Sales Day Book. It records all the sales invoices issued by the firm during a particular financial period. The format is as follows (with simple records of invoice). SALES JOURNAL Date 19x8 1st March 3rd March 5th March Total Detail S. Spikes T. Binns L.Thompson Page 5 Folio Amount £ SL.10 SL.19 SL,8 200.00 350.00 150.00 700.00 The individual entries in the sales journal are posted to the debit side of the debtor’s accounts in the sales ledger and the total is posted on the credit side of the sales account in the general ledger. 56 Introduction to Accounting This is shown below: Sales Ledger 19x 8 1/3 S Spikes £ 19x 8 Sale 200 s General Ledger £ 19x 8 Sales Ledger 19x 8 3/3 19x 8 3/3 Sal es £ General Account 19x 8 5/3 Credit sales for period £ 700 General Ledger T Binus £ 19x 8 350 L Thompson £ 19x 8 Sal 150 es £ Example 2.4 You are to enter up the sales journal from the following details. Post the items to the relevant accounts in the sales ledger and then show the transfer to the sales account in the general ledger. 2003 Mar “ “ “ “ “ “ “ 1 3 6 10 17 19 27 31 Credit Credit Credit Credit Credit Credit Credit Credit sales sales sales sales sales sales sales sales to to to to to to to to J Gordon G Abrahams V White J Gordon F Williams U Richards V Wood L Simes £1,870 £1,660 £120 £550 £2,890 £660 £280 £780 Lesson One 57 Answer SALES JOURNAL Date (2003) 1/3 3/3 6/3 10/3 17/3 19/3 27/3 31/3 Page 10 Detail Folio J. Gordon G. Abrahams V. White J. Gordon F. Williams U. Richards V. Wood L. Simes Amount 1,870.00 1,660.00 120.00 550.00 2,890.00 660.00 280.00 780.00 8,810.00 Sales Ledger J Gordon £ 20 03 157 0 550 20 03 1/3 10/ 3 200 3 3/3 200 3 6/3 200 £ G Abrahams £ 200 3 Sal 1,6 es 60 Sal es £ U White £ 200 3 120 F Williams £ 200 20 03 19/ 3 £ £ 200 3 27/ 3 200 3 31/ 3 200 Sal es Sal es Sal es U Richards £ 20 03 660 £ V Wood £ 200 3 280 £ L Simes £ 200 3 750 Sales a/c £ 200 £ £ 58 Introduction to Accounting 3 17/ 3 3 Sal es 3 3 289 0 Cred it Sale s Purchases Journal Purchases journal is also called a purchases day-book. It records all the purchase invoices received by the firm during a particular financial period. It has the following format (including records of invoices). Date 19x6 1/5 2/5 PURCHASES JOURNAL Description/Detail C. Kelly L. Smailes Page 15 Amount Folio PL. 10 400 PL. 20 TOTAL 350 750 The individual entries in the purchases journal are posted to the credit side of the creditor’s accounts in the purchases ledger and the total is posted to the debit side of purchases account of the general ledger. This is shown below: 19x 6 19x 6 C Kelly £ 19x 6 1/5 Purchas es L Smailes £ 19x 6 2/5 Purchas es £ 40 0 19x 6 31/ 5 Purchases a/c £ 19x 6 Sundry 75 Credito 0 rs £ £ 25 0 Returns Inwards Journal It is also called the returns inwards day-book. It records all the credit notes raised by the firm and sent to customers during a particular financial period, it has the following format. Lesson One 59 RETURNS INWARDS JOURNAL Date 1 March 2 March 5 March Detail Folio S. Spikes C. Kelly T. Bills SL. 22 TOTAL Pg 10 Amount £20 SL. 18 SL. 9 £18 £15 £53 Individual entries in a return inwards journal are posted to the credit of the debtors accounts in the sales ledger and the total is posted to the debit side of the returninwards account of the general ledger. Sales Ledger General Ledger S. Spikes a/c £ 1/ 3 Returns In £ 20 C Kelly a/c £ 2/ 3 Returns In £ 18 31/ 3 Returns Inwards a/c £ Sundry 53 Debtors T. Bills a/c £ 5/ 3 Retur ns In £ £ 15 60 Introduction to Accounting Returns Outwards Journal It is also called the returns outwards daybook. It records all the debit notes received by the firm from the creditors during a particular financial period. It has the following format. RETURNS OUTWARDS JOURNAL DATE DETAILS FOLIO 2 May 3 May 4 May L. Thompson M. Hyatt T. Bills PL. 10 AMOUNT (£) PL. 15 14 12 PL. 7 TOTAL 19 35 Individual entries are posted on the debit side of the creditors account in the purchases ledger and on the total to credit side of the returns outwards account in the general ledger. Purchases Ledger Ledger L. Thompson a/c Outwards a/c ` £ 2/5 Returns out 14 sundry creditors General Returns £ £ 31/5 35 M. Hyatt a/c £ 3/5 Returns out 12 £ T. Bills a/c £ 4/5 Returns Out £ 19 £ Lesson One The following example 2.5 shows how the four journals are used. 61 62 Introduction to Accounting Example 2. (Frankwood adapted) You are to enter the following items in the books, post to personal accounts, and show transfers to the general ledger. 19x5 July 1 “ 3 5 “ “ “ “ “ “ “ 8 12 14 20 24 31 31 Credit purchases from: K Hill £3800; M Norman £500; N Senior £106. Credit sales to: E Rigby £510; E Phillips £246; F Thompson £356. Credit purchases from: R Morton £200; J Cook £180; D Edwards £410; C Davies £66. Credit sales to: A Green £307; H George £250; J Ferguson £185. Returns outwards to: M Norman £30; N Senior £16. Returns inwards from: E Phillips £18; F Thompson £22. Credit sales to: E Phillips £188; F Powell £310; E Lee £420. Credit purchases from: Ferguson £550; K Ennevor £900. Returns inwards from: E Phillips £27; E. Rigby £30. Returns outwards to: J Cook £13; C Davies £11. Study the solution provided: SALES JOURNAL DATE DETAIL AMOUNT (£) 3 July 3 July 3 July 8 July 8 July 8 July 20 July 20 July 20 July E. Rigby E. Phillips F. Thompson A. Green H. George J. Ferguson E. Phillips F. Powell E. Lee 510 246 356 307 250 185 188 310 420 TOTAL 2,772 Sales Ledger 19x 5 3/7 Sal es E Rigby £ 19x 5 51 3/7 0 £ Retur ns Inwar ds 30 19x 5 3/7 20/ 7 E Phillips £ 19x5 £ Sal es 246 14/7 Returns 18 Sal es 188 31/7 Retuns in 27 Lesson One 63 F. Thompson 19x 5 3/7 19x 5 8/7 19x 5 8/7 Sal es £ 19x 5 35 14/ 6 7 Sal es Green £ 19x 5 30 7 Sal es H George 19x 5 25 0 £ Retur ns in 19x 5 8/7 22 £ 19x 5 20/ 7 £ 19x 5 20/ 7 J. Ferguson £ 19x5 Sal es £ 185 F. Powell £ 19x5 Sal es 310 £ Sal es £ E Lee 19x5 £ 420 PURCHASES JOURNAL DATE 1 July 1 July 1 July 5 July 5 July 5 July 5 July 24 July 24 July DETAIL AMOUNT (£) K. Hill M. Norman N. Senior R. Mortan J. Cook D. Edwards C. Davies C. Ferguson K. Ennevor Total 380 500 106 200 180 410 66 550 900 3,292 Purchases Ledger N. Senior 64 Introduction to Accounting 1995 12/7 1995 £ Returns out 16 £ Returns out 30 £ Returns out 13 22 £ 1/7 500 Purchases £ 5/7 Purchases 180 C. Davies 1995 1995 31/7 Purchases J. Cook 1995 1995 31/7 1/7 M. Norman 1995 1995 30/7 £ £ Returns out 11 £ 5/7 Purchases 60 K. Hill 1995 1995 £ £ 1/7 Purchases 380 R. Morton 1995 1995 £ £ 5/7 Purchases 200 D. Edwards 1995 1995 £ £ 5/7 Purchases 410 C. Ferguson 1995 1995 £ £ 27/7 Purchases 550 1995 K. Ennevor 1995 Lesson One 65 £ £ 24/7 Purchases 900 RETURNS INWARDS JOURNAL DATE 14 July 14 July 31 July 31 July DETAILS E. Phillips F. Thompson E. Phillips E. Rigby AMOUNT 18 22 27 30 97 RETURNS OUTWARDS JOURNAL 12 12 31 31 July July July July M. Norman N. Senior J. Cook C. Davies 30 16 13 11 70 General Ledger Sales a/c 1995 1995 £ £ 31/7 Sundry debtors 2772 Purchases a/c 66 Introduction to Accounting 1995 1995 £ 31/7 Sundry creditors 3292 £ Returns Inwards a/c 1995 1995 £ £ 31/7 Sundry debtors 97 Returns Outwards a/c 1995 1995 £ £ 31/7 Sundry creditors 70 CASH BOOKS A cashbook records all the receipts (cash and cheques from customers and debtors or other sources of income) and all the payments (to creditors or suppliers and other expenses) for a particular financial period. The cashbook will also show us the cash at bank and cash in hand position of the firm. There are two types of cashbooks: i. ii. Cash in hand cashbook, which records the cash transactions in the firm or business. Cash at bank cashbook, which records the transactions at/with, the bank. The cashbook is the most important book of prime entry because it forms part of the general ledger and records the source documents (receipts and cheques). The cash at bank cashbook and cash in hand cashbook are combined together to get a two-column cashbook. The format is as follows: Two-column cashbook. CASH BOOK Date Details Bank Cash (£) Bank (£) Date Details (£) Cash (£) Lesson One 67 Additional columns for discounts allowed and discounts received can be included with the cash at bank columns to get a 3 – column cashbook. The format is as follows: Date Details Bank Cash Discount Cash Allowed (£) Bank (£) Date Details Discounts Received £) (£) The balance carried down (Bal c/d) for cash in hand and cash at bank will form part of the ledger balances and the discounts allowed and discounts received columns will be added and the totals posted to the respective discount accounts. The discount allowed total will be posted to the debit side of the discount allowed account in the general ledger and the total of the discount received will be posted to the credit side of the discount-received account of the general ledger. Cash at bank can have either a credit or debit balance. A debit balance means the firm has some cash at the bank and a credit balance means that the account at the bank is overdrawn. (the firm owes the bank some money). Example 2.7 Write up a two-column cashbook from the following details, and balance off as at the end of the month: 2003 May “ “ “ “ “ “ “ “ “ “ “ “ “ 1 2 3 4 5 7 9 11 15 16 19 22 26 30 Started business with capital in cash £1,000. Paid rent by cash £100. F Lake lent us £5,000, paid by cheque. We paid B McKenzie by cheque £650. Cash sales £980. N Miller paid us by cheque £620. We paid B Burton in cash £220. Cash sales paid direct into the bank £530. G Moores paid us in cash £650. We took £500 out of the cash till and paid it into the bank account. We repaid F Lake £1,000 by cheque. Cash sales paid direct into the bank £660. Paid motor expenses by cheque £120. Withdrew £1,000 cash from the bank for business use. 68 Introduction to Accounting “ 31 Paid wages in cash £970. Cash Book Capital F Lake (loan) Sales N Miller Sales G Moores Cash C Sales Bank C Capital F. Lake (Loan) Sales N Miller Sales G Moores Cash 1000 Bank Cash Bank 5000 980 620 530 650 Cash 1000 650 Cash C Sales Bank C 363 0 Cash Book Bank Rent 5000 B McKenzie 980 B Burton 620 Bank C 530 F Lake (loan) Motor Expenses 500 Cash C 660 Wages 1000 Balances c/d 7310 Cash 100 Bank 650 220 500 120 1000 100 970 1840 3630 4540 7310 Example 2.7(Frankwood adapted) A three-column cashbook is to be written up from the following details, balanced off, and the relevant discount accounts in the general ledger shown. 19x8 Mar 1 Balances brought forward: Cash £230; Bank £4,756. “ 2 The following paid their accounts by cheque, in each case deducting 5 percent Lesson One “ “ “ 4 6 “ “ 10 12 “ “ 15 18 “ “ “ 21 24 25 “ “ 29 31 8 69 discounts: R Burton £140; E Taylor £220; R Harris £800. Paid rent by cheque £120. J Cotton lent us £1,000 paying by cheque. We paid the following accounts by cheque in each case deducting a 2 ½ per cent cash discount: N Black £360; P Towers £480; C Rowse £300. Paid motor expenses in cash £44. H Hankins pays his account of £77, by cheque £74, deducting £3 cash discount. Paid wages in cash £160. The following paid their accounts by cheque, in each case deducting 5 per cent cash discount: C Winston £260; R Wilson & Son £340; H Winter £460. Cash withdrawn from the bank £350 for business use. Cash Drawings £120. Paid T Briers his account of £140, by cash £133, having deducted £7 cash discount. Bought fixtures paying by cheque £650. Received commission by cheque £88. 70 Introduction to Accounting Answer Disct Bank Bal b/d R Burton E Taylor R Harris J Cotton: loan H Hankins C Winston R Wison & Son H Winter Bank Commission Cash 230 7 11 15 3 13 17 23 350 89 580 Cash Book Bank Disct 4756 133 209 285 1000 Rent N Black P Towers C Rowse Motor expenses 74 Wages 247 Cash 323 Drawings 3/1 Sundry Debtors Bank 120 351 468 780 9 12 20 44 160 350 120 437 T Briers Fixtures 88 Balances c/d 7552 Discounts Received 3/1 Sundry Creditors Cash 7 133 48 123 580 650 4833 7552 48 Discounts Allowed 89 Petty Cash Book and the imprest system of Accounting. Petty Cash Book is a record of all the petty cash vouchers raised and kept by the cashier. The petty cash vouchers will show summary expenses paid by the cashier and this information is listed and classified in the petty cash book under the headings of the relevant expenses such as: Postage and stationery Traveling Cleaning expenses. The format is as shown: Petty Cash Book Receipts Date Detail Payments Expenses The Lesson One 71 Amount Postage Stationery Traveling Ledger The balance c/d of the petty cash book will signify the balance of cash in hand or form part of cash in hand. The totals of the expenses are posted to the debit side of the expense accounts. If a firm operates another cashbook in addition to the petty cash book, then the totals of the expenses will also be posted on the credit side of the cash in hand cashbook. The Imprest system This system of accounting operates on a simple principle that the cashier is refunded the exact amount spent on the expenses during a particular financial period. At the beginning of each period, a cash float is agreed upon and the cashier is given this amount to start with. Once the cashier makes payments for the period he will get a total of all the payments made against which he will claim a reimbursement of the same amount that will bring back the amount to the cash float at the beginning of the period. This is demonstrated as follows: £ Start with (float) Expenses paid Balance Reimbursement Cash float 1,000 (720) 280 720 1,000 Example 2.8 A cashier in a firm starts with £2,000 in the month of March (that is the cash float). I n the following week, the following payments are made: £ 1st March – bought stamps for 2nd March – paid bus fare for 2nd March – cleaning materials 3rd March – bought fuel 3rd March – cleaning wages 4th March – bought stamps 4th March – paid L. Thompson (creditor) 5th March – fuel costs On the 5th of March the cashier requested amount was reimbursed back. 80 120 240 150 300 200 400 150 for a refund of the cash spent and this 72 Introduction to Accounting Required: Prepare a detailed petty cash book showing the balance to be carried forward to the next period and the relevant expense accounts, as they would appear on the General Ledger. Lesson One 73 Answer Receipt s Date (£) 2000 1/3 1/3 2/3 2/3 3/3 3/3 4/3 4/3 5/3 1640 5/3 5/3 3640 2000 6/3 Detail Payment s Amount (£) Bal b/d Stamps Bus Fare Cleaning Materials Fuel Cleaning wages Stamps L Thompson Fuel Bal c/d Expenses Postag e (£) 80 120 240 Cleanin g (£) THE LEDGER Travel (£) (£) 80 120 240 150 300 150 300 200 400 150 1640 200 . 280 . 540 150 420 400 . 400 2000 3640 Bal b/d The General Journal It records information from other correspondence (information that is not recorded in the above books of prime entry). It explains the type of entries that will be made in the ledger accounts giving a reason for these entries. The type of transactions recorded here are: i. Writing off of assets from the accounts e.g. bad-debts. ii. Drawings for goods or other assets from the business by the owner, not cash drawings. iii. Purchase or sale of non-current assets on credit. The format is as shown: The General Journal GENERAL JOURNAL Date 1/3 Detail Account to be debited Account to be credited (Narrative) Debit Credit x x 74 Introduction to Accounting Example 2.9 You are to show the journal entries necessary to record the following items: • • • • • • • • • • 2003 May 1 Bought a motor vehicle on credit from Motors Ltd for £6,790. 2003 May 3 A debt of £34 owing from N Smart was written off as a bad debt. 2003 May 8 Furniture bought by us for £490 was returned to the supplier Wood Offices, as it was unsuitable. Full allowance will be given us. 2003 May 12 we are owed £150 by W Hayes. He is declared bankrupt and we received £39 in full settlement of the debt. 2003 May 14 we take £45 goods out of the business stock without paying for them. 2003 May 28 Some time ago we paid an insurance bill thinking that it was all in respect of the business. We now discover that £76 of the amount paid was in fact insurance of our private house. 2003 May 28 Bought Machinery £980 on credit from Xerox Machines Ltd. Lesson One 75 a. Answer GENERAL JOURNAL Date (19x5) 1/5 Detail Debit (£) Credit (£) Motor Vehicle 6,790 Motors Ltd 6,790 Motor vehicle bought on credit from Motors Ltd _________________________________________________________________________ 3/5 Bad debts 34 N Smart - Debtors 34 Amount due from N Smart written off as bad _________________________________________________________________________ 8/5 Wood offices 490 Furniture 490 Office Furniture returned to Wood offices _________________________________________________________________________ 12/5 Bad debts 111 W. Hayes 111 Amount owed now written off as bad debt. ________________________________________________________________________ 14/5 Drawing for goods 45 Purchases 45 Goods taken from the business for personal use. _________________________________________________________________________ 8/5 Drawings 76 Insurance Expenses 76 Insurance relating to private house now transferred to drawings _________________________________________________________________________ 28/5 Machinery 980 Xerox Machines 980 Machinery bought from Xerox Machines 76 Introduction to Accounting THE LEDGER The ledger is simply the accounts. The Ledger is classified into 3 main classes. 1. Sales Ledger, which has the accounts of all the debtors. 2. Purchases Ledger, which has the accounts of all the creditors. 3. The General Ledger. Has all the other accounts i.e. other assets, liability, incomes and expenses and capital. The ledger accounts can also be classified as follows: LEDGER ACCOUNTS IMPERSONAL ACCOUNTS PERSONAL ACCOUNS REAL ACCOUNTS DEBTORS (for goods) NORMAL a/cs CREDITORS (For goods) Other Non-current Liabilities assets Other Inventories/ Assets Stocks Income Expenses Capital Lesson One 77 REINFORCING QUESTIONS QUESTION ONE Mr J Ockey commenced trading as a wholesaler stationer on 1 May 2000 with a capital of £5,000.00 with which he opened a bank account for his business. During May the following transactions took place. May 1 Bought shop fittings and fixtures from store fitments Ltd for £2,000.00 May 2 Purchased goods on credit from Abel £650.00 May 4 Sold goods on credit to Bruce £700.00 May 9 Purchased goods on credit from Green £300.00 May 11 Sold goods on credit to Hill £580.00 May 13 Cash sales paid into bank account £200.00 May 16 Received cheque from Bruce in settlement of his account May 17 Purchased goods on credit from Kay £800.00 May 18 Sold goods on credit to Nailor £360.00 May 19 Sent Cheque to Abel in settlement of his account May 20 Paid rent by cheque £200.00 May 21 Paid delivery expenses by cheque £50.00 May 24 Received from Hill £200.00 on account May 30 Drew cheque for personal expenses £200.00 and assistant wages £320.00 May 31 Settled the account of Green. Required a) b) c) d) Record the transactions in the books of prime entry. Post the entries in the ledger accounts Balance the ledger accounts where necessary Extract a trial balance as at 31 May 2000. 78 Introduction to Accounting QUESTION TWO The following trial balance has been drawn up from the accounts of Endpages bookshop. Endpages Bookshop Trial balance as at 31 December 2002 Dr £ Sales Purchases Salaries and wages Office expenses Insurance Electricity Stationery Advertising Telephone Rates Discount allowed Discount received Rent received Returns inwards Returns outwards Stock at 01 Jan 2001 Premises Stock as at 31 Dec 2001 Fixtures and fittings Debtors and Creditors Cash in Hand Cash in bank Capital Drawings Stock as at 31 Dec 2001 Cr £ 151,500.00 103,500.00 18,700.00 2,500.00 1,100.00 600.00 2,400.00 3,500.00 800.00 3,000.00 100.00 200.00 2,000.00 1,500.00 3,500.00 46,000.00 80,000.00 41,000.00 5,000.00 4,800.00 200.00 7,500.00 12,000.00 11,000.00 14,000.00 ________ 328,700.00 41,000.00 328,700.00 Required Prepare a Trading and profit and loss account for the year ended 31 December 2002 and a balance sheet as at that date. (20 marks) Lesson One 79 QUESTION THREE The following is the trial balance of KSmooth as at 31 March 2002. Draw up a set of final accounts for the year ended 31 March 2002. Stock 1 April 2001 Sales Purchases Carriage inwards Carriage outwards Returns outwards Wages and salaries Rent and rates Communication expenses Commissions payable Insurance Sundry expenses Buildings Debtors Creditors Fixtures Cash at bank Cash in hand Drawings Capital Dr £ 1,816,000 Cr £ 9,234,000 6,918,500 42,000 157,000 64,000 1,024,000 301,500 62,400 21,600 40,500 31,800 2,000,000 1,432,000 816,000 285,000 297,000 11,500 762,000 5,088,800 152,028 152,028 80 Introduction to Accounting QUESTION FOUR Skates drew up the following trial balance as at 30 September 2002. You are to draft the trading and profit and loss account for the year to end 30 September 2002 and a balance sheet as at that date. Dr Cr £ £ Capital 3,095,500 Drawings 842,000 Cash at bank 311,500 Cash in hand 29,500 Debtors 1,230,000 Creditors 937,000 Stock 30 September 2,391,000 2001 410,000 Motor van 625,000 Office equipment 1,309,000 Sales 9,210,000 Purchases 55,000 Returns inwards 21,500 Carriage inwards 30,700 Returns outwards 30,900 Carriage outwards 163,000 Motor expenses 297,000 Rent 40,500 Telephone charges 1,281,000 Wages and salaries 49,200 Insurance 137,700 Office expenses Sundry expenses 28,400 17,153,200 17,153,200 CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK Lesson One 81 COMPREHENSIVE ASSIGNMENT No.1 TO BE SUBMITTED AFTER LESSON 2 To be carried out under examination conditions and sent to the Distance Learning Administrator for marking by the University. EXAMINATION PAPER. ANSWER ALL QUESTIONS TIME ALLOWED: THREE HOURS. QUESTION ONE The books of Mr T, a trader in tea showed the following balances as at 31 March 1998: Opening stock of tea Purchases – Tea Salaries paid Buildings Cash in hand Cash at bank Rent, rates and council taxes Insurance premium paid Miscellaneous receipts Sales Discounts allowed Bad debts Building repairs Miscellaneous expenses Advertisement Commission to sales manager Furniture and fittings Air conditioners Sundry debtors Sundry creditors Loan on mortgage Interest paid on the above Prepaid expenses Drawings Bills payable (Current liability) Bank charges Legal charges Motor vehicles Travelling and conveyance Capital Shs. 100,000 400,000 80,000 95,000 2,000 135,000 15,000 3,000 10,000 720,000 4,750 3,250 2,900 8,700 20,000 32,400 35,000 30,000 100,000 80,000 70,000 3,000 4,000 18,000 30,000 2,000 6,000 80,000 10,000 280,000 The following further information was obtained : 82 Introduction to Accounting 1. Closing stock was Shs.55,000. 2. Legal charges include Shs.5,000 for the cost of stamps and registration of a new building acquired during the year. 3. Purchases include 4000 kg tea valued at Shs.20,000, which was found totally spoilt. An insurance claim of Shs.15,000 has been accepted by the insurance company. 4. Travelling and conveyancing include proprietor’s personal travelling for which he is charged Shs.4, 800. 5. The sales manager is entitled to commission of 7.5% of the total sales. However any bad debts incurred during the year are deductible from such commission entitlements. 6. Debtors include: 7. Shs.10, 000 due from M & C0 (Creditors include Shs.18, 000 due to the same party). 8. Shs.5, 000 due from the sale of furniture. 9. Further bad debts of Shs.2, 000 10.Provision for bad debts is to be created at 2% of net amount outstanding from trade debtors. 11.Depreciation is chargeable as follows: Buildings 2.5% Furniture and Fittings 10% Air conditioners 15% Motor vehicles 20% 12.Miscellaneous receipts represent sales proceeds of furniture, whose written down value was Shs.12, 000. 13.Prepaid expenses include insurance premiums for the next year. Required: Prepare a trading, profit and loss account for the year ended 31 st March 1998 and a Balance Sheet as at that date. QUESTION TWO Hall Ltd., which makes up its accounts to 30 th June each year, has a fleet of motor lorries. Annual depreciation on motor lorries is calculated at a rate of 25% on the reducing balances, with a full year’s depreciation being made in the year of purchase, but no charge in the year of sale. An extract from the company’s balance sheet as on 30th June 1997 showed the following: Shs Motor Lorries at cost: Less provision for depreciation: Net book Value: 164,900 93,382 71,518 During the year ended 30th June 1998 purchases and sales of lorries were as follows: Purchases: 1997 July 30th Reg.No H11 Cost (Shs) 8,500 Lesson One 83 Oct 1st 1998 Sales: H12 Feb 25th June 24th H13 5,900 Purchased on: 1,592 10th July 1994 H4 Cost (Shs) 14th May 1993 H1 2,560 9th March 1996 H6 H7 9,000 H14 Reg.No Proceeds (Shs) 1997 July 30th 300 Oct 1st 1998 Mar 1st 4,600 June 25th 7,000 850 8,000 21st Sept 1996 3,648 2,700 Required: Write up the following accounts in the books of the company for the year ended 30th June 1998: a) The Motor lories account b) Motor lorries provision for depreciation account c) Motor lorries disposal account. QUESTION THREE The following trial balance was extracted form the books of Rodney, a sole trader, at 31st December 1997: Drawings/Capital Debtors/Creditors Purchases/Sales Rent and Rates Light and heat Salaries and wages Bad debts Provision for bad debts Stock in trade 31st Dec 1996 Insurance General Expenses Bank balances Motor van at cost/Provision for depreciation Proceeds on sale of van Motor expenses Freehold premises at cost Shs 2,148 7,689 62,10 1 880 246 8,268 247 Shs. 20,27 1 5,462 81,74 2 326 9,274 172 933 1,582 8,000 861 15,00 3,600 0 250 84 Introduction to Accounting 0 Rent received Provision for depreciation on buildings 750 5,000 117,4 01 117,4 01 The following matters are to be taken in to account: Stock in trade at 31st December 1997 was Shs.9,884 Rates paid in advance at 31st December 1997, Shs.40 Rent receivable due at 31st December 1997, Shs.250 Lighting and heating due at 31st December 1997, sh.85 Provision for doubtful debts to be increased to Shs.388 Included in the amount for insurance Shs.172, is an item for Shs82 for motor insurance and this amount should be transferred to motor expenses. 7. Depreciation has been and is to be charged on vans at an annual rate of 20% on cost. 8. Depreciate buildings Shs.500 9. On 1st January 1997 a van which had been purchased for Shs.1,000 on 1 st January 1994 was sold for Shs250. The only record of matter is the credit of Shs.250 to “Proceeds of sale on van” account. 1. 2. 3. 4. 5. 6. Required: A Trading Profit and Loss account for the year ended 31 st December 1997 and a Balance Sheet as at date using vertical format. QUESTION FOUR The Batley Print Shop rents a photocopying machine from a suppler for which it makes quarterly payments as follows: Three moths rental in advance; A further charge of 2 pence per copy made during the quarter just ended. The rental agreement began on 1st August 19X4, and the first six quarterly bills were as follows Bills and dates received 1 August 19X4 1 November 19X4 1 February 19X5 1 May 19X5 1 August 19X5 1 November 19X5 Required: Rental (Shs) 2,100 2,100 2,100 2,100 2,700 2,700 Cost of copies (shs)Total cost (Shs) 0 2,100 1,500 3,600 1,400 3,500 1,800 3,900 1,650 4,350 1,950 4,650 Lesson One 85 Given that Batley Printing shop ends its accounting year on 31 August, Calculate the charge for photocopying expenses for the year to 31 August, 19X5 and the amount of prepayments and / or accrued charges as at that date. Show the entries in the ledger of the Batley Printing Shop. QUESTION FIVE “The historical cost convention looks backwards but the going concern convention looks forwards.” Required: a) Explain clearly what is meant by: • • The historical cost convention The going concern convention. b) Does traditional financial accounting, using the historical cost convention, make the going concern convention unnecessary? Explain your answer fully. c) Which do you think a shareholder is likely to find more useful – a report on the past or an estimate of the future? Why? END OF COMPREHENSIVE ASSIGNMENT No.1 NOW SEND TO THE DISTANCE LEARNING CENTRE FOR MARKING Acknowledgement 86 LESSON THREE ACCOUNTING THEORY (a) International Accounting Standards and International Financial Reporting Standards. The foreword to accounting standards defines Accounting Standards as Authoritative statements of how particular types of transaction and other events should be reflected in financial statements. Accounting Standards are developed to achieve comparability of financial information between and among different organizations. International Accounting Standards (IAS’s) and International Financial Reporting Standards (IFRS) are meant to apply to most organizations in the world. IAS’s and IFRS’s are produced by the International Accounting Standards Board (IASB) whose objectives are: (a) To formulate and publish in the public interest accounting standards to be observed in the presentation of financial statements and to promote their worldwide acceptance; and (b) To work generally for the improvement and harmonization of regulations, accounting standards and procedures relating to the presentation of financial statements. The IASB is an affiliate of the International Federation of Accountants (IFAC) established in 1977 which co-ordinates the Accounting profession worldwide. Most accounting bodies of countries are members of IFAC. The IASC develops IAS’s through an international process that involves the worldwide accountancy profession, the preparers, users of financial statements and national standard setting bodies and other interested parties. The IASB sets up a steering committee to develop a statement of principles, an Exposure Draft and ultimately an Accounting Standards once a new topic is suggested. The process includes: − Identifying and reviewing of all the issues associated with the topic, − Studying national and regional accounting requirements and practice, consultation with the member bodies’ standard setting bodies and other interested groups, − Public Exposure of the draft Accounting Standard, − Evaluation by the steering committee and the board of the comments received on exposure drafts. Currently the IASB has developed about 40 IASs. Examples include: Lesson Two 87 − IAS 1 Presentation of Financial Statements − IAS 2 Inventories − IAS 16 Property plant and equipment. Previously new standards were called International Accounting Standards but from 2003 any new standards will be called International financial Reporting Standards. However in the current practice is to refer to all standards as International Financial Reporting Standard. In Kenya, Accountants used to prepare the financial statements in accordance with Kenya Accounting Standards (IASs), which were developed and published by ICPAK (Institute of Certified Public Accountants of Kenya). This were later dropped and International Accounting Standards adopted. Reasons why Accountants should observe International Accounting Standards: a) Use of IASs adds credibility to the financial statements as they can be compared with others globally. b) Facilitates communication within an enterprise that has foreign branches or subsidiaries due to harmonized reporting by the separate entities in the group. c) Adds value to the financial statements incase an entity is sourcing for foreign capital. d) Incase an entity wishes to be quoted on the Stock Exchange Market more so for companies. (c) Accounting Concepts Bases and Policies I) Concepts/conventions/principles Accounting Concepts are broad basic assumptions that underlie the periodic financial accounts of business enterprises. Examples of concepts include: i) The going concern concept: implies that the business will continue in operational existence for the foreseeable future, and that there is no intention to put the company into liquidation or to make drastic cutbacks to the scale of operations. Financial statements should be prepared under the going concern basis unless the entity is being (or is going to be) liquidated or if it has ceased (or is about to cease) trading. The directors of a company must also disclose any significant doubts about the company’s future if and when they arise. The main significance of the going concern concept is that the assets of the business should not be valued at their ‘break-up’ value, which is the amount that they would sell for it they were sold off piecemeal and the business were thus broken up. ii) The accruals concept (or matching concept): states that revenue and costs must be recognized as they are earned or incurred, not as money is received or 88 Final Accounts paid. They must be matched with one another so far as their relationship can be established or justifiably assumed, and dealt with in the profit and loss account of the period to which they relate. Assume that a firm makes a profit of £100 by matching the revenue (£200) earned from the sale of 20 units against the cost (£100) of acquiring them. If, however, the firm had only sold eighteen units, it would have been incorrect to charge profit and loss account with the cost of twenty units; there is still two units in stock. If the firm intends to sell them later, it is likely to make a profit on the sale. Therefore, only the purchase cost of eighteen units (£90) should be matched with the sales revenue, leaving a profit of £90. Lesson Two 89 The balance sheet would therefore look like this: £ Assets Stock (at cost, i.e. 2 x £5) Debtors (18 x £10) 10 180 190 Liabilities Creditors 100 90 Capital (profit for the period) 90 If, however the firm had decided to give up selling units, then the going concern concept would no longer apply and the value of the two units in the balance sheet would be a break-up valuation rather than cost. Similarly, if the two unsold units were now unlikely to be sold at more than their cost of £5 each (say, because of damage or a fall in demand) then they should be recorded on the balance sheet at their net realizable value (i.e. the likely eventual sales price less any expenses incurred to make them saleable, e.g. paint) rather than cost. This shows the application of the prudence concept. (See below). In this example, the concepts of going concern and matching are linked. Because the business is assumed to be a going concern it is possible to carry forward the cost of the unsold units as a charge against profits of the next period. Essentially, the accruals concept states that, in computing profit, revenue earned must be matched against the expenditure incurred in earning it. iii) The Prudence Concept: The prudence concept states that where alternative procedures, or alternative valuations, are possible, the one selected should be the one that gives the most cautious presentation of the business’s financial position or results. Therefore, revenue and profits are not anticipated but are recognized by inclusion in the profit and loss account only when realized in the form of either cash or of other assets the ultimate cash realization of which can be assessed with reasonable certainty: provision is made for all liabilities 90 Final Accounts (expenses and losses) whether the amount of these is known with certainty or is best estimate in the light of the information available. Assets and profits should not be overstated, but a balance must be achieved to prevent the material overstatement of liabilities or losses. The other aspect of the prudence concept is that where a loss is foreseen, it should be anticipated and taken into account immediately. If a business purchases stock for £1,200 but because of a sudden slump in the market only £900 is likely to be realized when the stock is sold the prudence concept dictates that the stock should be valued at £900. It is not enough to wait until the stock is sold, and then recognize the £300 loss; it must be recognized as soon as it is foreseen. A profit can be considered to be a realized profit when it is in the form of: • • Cash Another asset that has a reasonably certain cash value. This includes amounts owing from debtors, provided that there is a reasonable certainty that the debtors will eventually pay up what they owe. A company begins trading on 1 January 20X2 and sells goods worth £100,000 during the year to 31 December. At 31 December there are debts outstanding of £15,000. Of these, the company is now doubtful whether £6,000 will ever be paid. The company should make a provision for doubtful debts of £6,000. Sales for 20x5 will be shown in the profit and loss account at their full value of £100,000, but the provision for doubtful debts would be a charge of £6,000. Because there is some uncertainty that the sales will be realized in the form of cash, the prudence concept dictates that the £6,000 should not be included in the profit for the year. iv) The consistency concept: The consistency concept states that in preparing accounts consistency should be observed in two respects. a) Similar items within a single set of accounts should be given similar accounting treatment. b) The same treatment should be applied from one period to another in accounting for similar items. This enables valid comparisons to be made from one period to the next. v) The entity concept: The concept is that accountants regard a business as a separate entity, distinct from its owners or managers. The concept applies whether the business is a limited company (and so recognized in law as a separate entity) or a sole proprietorship or partnership (in which case the business is not separately recognized by the law. vi) The money measurement concept: The money measurement concept states that accounts will only deal with those items to which a monetary value can be attributed. For example, in the balance sheet of a business, monetary values can be attributed to such assets as machinery (e.g. the original cost of the machinery; Lesson Two 91 or the amount it would cost to replace the machinery) and stocks of goods (e.g. the original cost of goods, or, theoretically, the price at which the goods are likely to be sold). The monetary measurement concept introduces limitations to the subject matter of accounts. A business may have intangible assets such as the flair of a good manager or the loyalty of its workforce. These may be important enough to give it a clear superiority over an otherwise identical business, but because they cannot be evaluated in monetary terms they do not appear anywhere in the accounts. 92 Final Accounts vii) The separate valuation principle: The separate valuation principle states that, in determining the amount to be attributed to an asset or liability in the balance sheet, each component item of the asset or liability must be determined separately. These separate valuations must then be aggregated to arrive at the balance sheet figure. For example, if a company’s stock comprises 50 separate items, a valuation must (in theory) be arrived at for each item separately; the 50 figures must then be aggregated and the total is the stock figure which should appear in the balance sheet. viii) The materiality concept: An item is considered material if it’s omission or misstatement will affect the decision making process of the users. Materiality depends on the nature and size of the item. Only items material in amount or in their nature will affect the true and fair view given by a set of accounts. An error that is too trivial to affect anyone’s understanding of the accounts is referred to as immaterial. In preparing accounts it is important to assess what is material and what is not, so that time and money are not wasted in the pursuit of excessive detail. Determining whether or not an item is material is a very subjective exercise. There is no absolute measure of materiality. It is common to apply a convenient rule of thumb (for example to define material items as those with a value greater than 5% of the net profit disclosed by the accounts). But some items disclosed in accounts are regarded as particularly sensitive and even a very small misstatement of such an item would be regarded as a material error. An example in the accounts of a limited company might be the amount of remuneration paid to directors of the company. The assessment of an item as material or immaterial may affect its treatment in the accounts. For example, the profit and loss account of a business will show the expenses incurred by he business grouped under suitable captions (heating and lighting expenses, rent and rates expenses etc); but in the case of very small expenses it may be appropriate to lump them together under a caption such as ‘sundry expenses’, because a more detailed breakdown would be inappropriate for such immaterial amounts. Example: a) If a balance sheet shows fixed assets of £2 million and stocks of £30,000 an error of £20,000 in the depreciation calculations might not be regarded as material, whereas an error of £20,000 in the stock valuation probably would be. In other words, the total of which the erroneous item forms part must be considered. b) If a business has a bank loan of £50,000 balance and a £55,000 balance on bank deposit account, it might well be regarded as a material misstatement if these two amounts were displayed on the balance sheet as ‘cash at bank £5,000’. In other words, incorrect presentation may amount to material misstatement even if there is no monetary error. ix) The historical cost convention: A basic principle of accounting (some writers include it in the list of fundamental accounting concepts) is that resources are normally stated in accounts at historical cost, i.e. at the amount that the Lesson Two 93 business paid to acquire them. An important advantage of this procedure is that the objectivity of accounts is maximized: there is usually objective, documentary evidence to prove the amount paid to purchase an asset or pay an expense. Historical cost means transactions are recorded at the cost when they occurred. In general, accountants prefer to deal with costs, rather than with ‘values’. This is because valuations tend to be subjective and to vary according to what the valuation is for. For example, suppose that a company acquires a machine to manufacture its products. The machine has an expected useful life of four years. At the end of two years the company is preparing a balance sheet and has decided what monetary amount to attribute to the asset. x) Objectivity (neutrality):An accountant must show objectivity in his work. This means he should try to strip his answers of any personal opinion or prejudice and should be as precise and as detailed as the situation warrants. The result of this should be that any number of accountants will give the same answer independently of each other. Objectivity means that accountants must be free from bias. They must adopt a neutral stance when analysing accounting data. In practice objectivity is difficult. Two accountants faced with the same accounting data may come to different conclusions as to the correct treatment. It was to combat subjectivity that accounting standards were developed. xi) The realization concept: Realization: Revenue and profits are recognized when realized. The concept states that revenue and profits are not anticipated but are recognized by inclusion in the income statement only when realized in the form of either cash or of other assets the ultimate cash realization of which can be assessed with reasonable certainty. xii) Duality: Every transaction has two-fold effect in the accounts and is the basis of double entry bookkeeping. xiii) Substance over form: The principle that transactions and other events are accounted for and presented in accordance with their substance and economic reality and not merely their legal form e.g. a non current asset on Hire purchase although is not legally owned by the enterprise until it is fully paid for, it is reflected in the accounts as an asset and depreciation provided for in the normal accounting way. Example 3.1 It is generally agreed that sales revenue should only be ‘realized’ and so ‘recognized’ in the trading, profit and loss account when: a) The sale transaction is for a specific quantity of goods at a known price, so that the sales value of the transaction is known for certain. b) The sale transaction has been completed, or else it is certain that it will be completed (e.g. in the case of long-term contract work, when the job is well under way but not yet completed by the end of an accounting period). 94 Final Accounts c) The critical event in the sale transaction has occurred. The critical event is the event after which: i) It becomes virtually certain that cash will eventually be received from the customer. ii) Cash is actually received. Lesson Two 95 Usually, revenue is ‘recognized’ (a) When a cash sale is made. (b) The customer promises to pay on or before a specified future date, and the debt is legally enforceable. The prudence concept is applied here in the sense that revenue should not be anticipated, and included in the trading, profit and loss account, before it is reasonably certain to ‘happen’. Required Given that prudence is the main consideration, discuss under what circumstances, if any, revenue might be recognized at the following stages of a sale. (a) Goods have been acquired by the business, which it confidently expects to resell very quickly. (b) A customer places a firm order for goods. (c) Goods are delivered to the customer. (d) The customer is invoiced for goods. (e) The customer pays for the goods. (f) The customer’s cheque in payment for the goods has been cleared by the bank. Answer (a) A sale must never be recognized before a customer has even ordered the goods. There is no certainty about the value of the sale, nor when it will take place, even if it is virtually certain that goods will be sold. (b) A sale must never be recognized when the customer places an order. Even though the order will be for a specific quantity of goods at a specific price, it is not yet certain that the sale transaction will go through. The customer may cancel an order, the supplier might be unable to deliver the goods as ordered or it may be decided that the customer is not a good credit risk. (c) A sale will be recognized when delivery of the goods is made only when: i) The sale is for cash, and so the cash is received at the same time. ii) The sale is on credit and the customer accepts delivery (e.g. by signing a delivery note). (d) The critical event for a credit sale is usually the dispatch of an invoice to the customer. There is then a legally enforceable debt payable on specified terms, for a completed sale transaction. (e) The critical event for a cash sale is when delivery takes place and when cash is received, both take place at the same time. It would be too cautious or ‘prudent’ to await cash payment for a credit sale transaction before recognizing the sale, unless the customer is a high credit risk and there is a serious doubt about his ability or intention to pay. (f) It would again be over-cautious to wait for clearance of the customer’s cheques before recognizing sales revenue. Such a precaution would only be justified in cases where there is a very high risk of the bank refusing to honour the cheque. 96 Final Accounts II) Bases Bases are the methods that have been developed for expressing or applying fundamental accounting concepts to financial transactions and items. Examples include: − Depreciation of Non current Assets (e.g. by straight line or reducing balance method) − Treatment and amortization of intangible assets (patents and trade marks) − Stocks and work in progress (FIFO, LIFO and AVCO) III)Policies Accounting policies are the specific accounting bases judged by business enterprises to be the most appropriate to their circumstances and adopted by them for the purpose of preparing their financial accounts. Qualities of Useful Financial Information The four principal qualities of useful financial information are understandability, relevance, reliability and comparability. Understandability: an essential quality of the information provided in the financial statements is that it is readily understandable by users. For these reason users are assumed to have a reasonable knowledge of business and economic activities and accounting. Relevance: information has the quality of being relevant when it influences the economic decisions of users by helping them evaluate past, present or future events or confirming or correcting their past evaluations. The relevance of information is affected by its nature and materiality. Reliability: information is useful when it is free from material error and bias and can be depended upon by users to represent faithfully that which it purports to represent or could reasonably be expected to represent. To be reliable then the information should: a) Be represented faithfully, b) Be accounted for and presented in accordance with their substance and economic reality and not merely their legal form, c) Be neutral i.e. free from bias, d) Include some degree of caution especially where uncertainties surround some events and transactions (prudence), e) Be complete i.e. must be within the bounds of materiality and cost. An omission can cause information to be false. Comparability: users must be able to compare the financial statements of an enterprise through time in order to identify trends in its financial position and performance. Users must also be able to compare the financial statements of different accounting policies, changes in the various policies and the effect of these changes in the accounts. Compliance with accounting standards also helps achieve this comparability. The Accounting Profession in Kenya Lesson Two 97 The Accountants Act Cap 531 (1977) establishes the Institute of Certified Public Accountants of Kenya (ICPAK) and two boards, to be known as the Registration of Kenya Accountants Board (RAB) and Kenya Accountants and Secretaries National Examinations Board (IASNEB) 98 Final Accounts The following are the functions of ICPAK as outlined by the Act; a) To promote standards of professional competence and practice amongst members of the institute. b) To promote research into the subjects of accountancy and finance, and related matters, and the publication of books, periodicals, journals and articles in connexion therewith; c) To promote the international recognition of the institute; d) To advise the Examinations board on matters relating to examination standards and policies; e) To carry out any other functions prescribed for it under any of the provisions of the Act or under any other written law; and f) To do anything incidental or conducive to the performance of any of the preceding functions. A council known as the Council of the institute governs the Institute, which consists of the Chairman, nine members from the institute and one member appointed by the Minister of finance. The Registration of Accountants Board (RAB) functions include issuing out practicing certificates and registration of qualified persons as members of the institute. The Act also outlines the following as the functions of IASNEB: a) To prepare syllabuses for accountants’ and secretaries’ examinations, to make rules with respect to examinations, to arrange and conduct examinations and issue certificates to candidates who have satisfied examination requirements; b) To promote recognition of its examinations in foreign countries; and c) To do anything incidental or conducive to the performance of any preceding functions. Example 3.2 PILOT PAPER OCTOBER 1991 Briefly explain the meaning and the significance of the following: (i) Accounting concepts. (ii) Accounting bases. (iii)Accounting policies. (iv) Accounting standards. (Total: 20 Marks) (Covered adequately in the text). Lesson Two 99 Example 3.3 PILOT PAPER JULY 2000 (a) Define the following accounting concepts and for each explain their implication in the preparation of financial statements. (i) (ii) (iii) (iv) The Going concern concept Business entity concept Materiality Realization 4 4 4 4 marks marks marks marks (b) Two accounting concepts or conventions could clash or there could be inconsistency between them. Give two examples of such situations and explain how the inconsistency should be resolved. 4 marks Solution: (i) The Going Concern Concept The concept of going concern is that an entity will continue trading into the foreseeable future at a similar level as it does when the accounts are prepared. Going concern has implications for the value of the entities assets and the way the user may read the financial statements. If a business is to cease trading after the period of account the financial statements should be prepared on a break up basis as all liabilities will be due and assets will be valued at net realizable value. (ii)The Entity Concept The organization preparing accounts is a distinct and separate entity. Financial statements are prepared to reflect the activities of the entity. This concept prevents any confusion between the owner’s private finances and those of the entity, hence the option of drawings when a proprietor effectively reduces the capital of the entity. (iii) Materiality Materiality relates to significant amounts and items in the financial statements. A rough guide to what material amount is 5% of pre tax profits. However, this is only a guide. If say, cash in hand is offset against the overdraft balance this is a material misstatement. Materiality prevents time being wasted on items which do not impact on the results of the entity; it provides a focus on the significant items. (iv) Realization The realization concept involves recognizing amounts in the financial statements at the point at which they crystallize. Profit should not be reflected in the profit and loss account until it has been earned. The realization concept means that the profit in the financial statements should be reasonably stated. 100 Final Accounts (c) Clashes between accounting concepts Accruals and prudence The accruals concept requires future income (e.g. in relation to credit sales) to be accrued. The prudence concept dictates that caution should be exercised, so that if there is doubt about the subsequent receipt, no accrual should be made. Consistency and prudence If circumstances change, prudence may conflict with the consistency concept, which requires the same treatment year after year. In both situations, prudence must prevail. Example 3.5 DECEMBER 1994 QUESTION FIVE (a) Explain the nature of the Accounting Equation. (5 marks) (b) What are accounting standards and why are they important? (5 marks) (c) Describe the role of the Institute of Certified Public Accountants of Kenya. (5 marks) (d) In addition to the Kenya Accounting Standards, why is it important for an Accountant to make use of International Accounting Standards? (4 marks) (Total: 19 marks) (Covered adequately in the text) Lesson Two 101 REINFORCEMENT QUESTIONS Question One Explain, with examples, each of the following terms: Fundamental accounting concepts Accounting bases Accounting policies Question Two Accounting practice depends upon the guidance provided by a number of accounting concepts, some of which are to be found in IAS 1 and/or in the conceptional framework of the International Accounting Standards Committee. Required: (a) Define and explain the relevance of the following accounting concepts. (b) Neutrality Money measurement Accruals Substance over form Consistency (15 marks) Give two examples of situations in which there is a clash or inconsistency between two accounting concepts or conventions, and explain how the inconsistency should be resolved. (In answering this part of the question, you need not confine yourself to considering the concepts listed in part (a)) (5 marks) (20 marks) Question Three If the information in financial statements is to be useful, regard must be had to the following: Materiality Comparability Prudence Objectivity Relevance 102 Final Accounts Required Explain the meaning of each of these factors as they apply to financial accounting including in your explanations one example of the application of each of them. (Four marks for each of (a) to (e).) (20 marks) Lesson Two 103 Question Four a) b) Explain what is meant by materiality in relation to financial statements and state two factors affecting the assessment of materiality. (4 marks) Explain what makes information in financial statements relevant to users. (5 marks) c) 1. Two characteristics contributing to reliability are ‘neutrality’ and ‘prudence’. Explain the meaning of these two terms. 2. Explain how a possible conflict between them could arise and how that conflict should be resolved. (5 marks) d) One of the requirements of financial statements is that they should be free from material error. Suggest three safeguards, which may exist, inside or outside a company to ensure that the financial statements are free from material error. (6 marks) CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK Acknowledgement 104 LESSON FOUR ADJUSTMENTS TO FINAL ACCOUNTS a) ACCRUALS AND PREPAYMENTS Revenue and costs must be recognized as they are earned or incurred, not as money is received or paid. They must be matched with one another so far as their relationship can be established or justifiably assumed, and dealt with in the profit and loss account of the period to which they relate. Therefore all incomes and expenses that relate to a particular financial period will be matched together to determine the profit for the year. ACCRUALS Income: Accrued Income This is income that relates to the current year but cash has not yet been received. An accrued income should be reported in the profit & loss account and the same income will be shown in the balance sheet as a current asset. Example 4.1 A firm lets out part of its properties and receives rent of £2,000 per month, assuming that this is the first year of renting and rent is received in arrears (rent 4 January is received early Feb). The ledger accounts of the firm will be as follows: Cashbook Year 1 Feb (rent 4 Jan) Mar (rent 4 Feb) April (rent 4 Mar) May (rent 4 Apr) June (rent 4 May) July (rent 4 Jun) Aug (rent 4 July) Sept (rent 4 Aug) Oct (rent 4 Sept) Nov (rent 4 Oct) Dec (rent 4 Nov) £ 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 22,000 Lesson Three Year 1 31/12 P&L 24,000 105 Rent – Income £ Year 1 Jan C/B Feb C/B Mar C/B April C/B May C/B Jun C/B July C/B Aug C/B Sept C/B Oct C/B Nov C/B Dec Accrued c/f 24,000 £ 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 24,000 Although the cashbook is showing that rent received amounts £22,000, the full rental income of £24,000 will be reported in the Profit & Loss a/c as rent income and the accrued rent for Dec of £2,000 will be reported in the balance sheet as a current asset. Expenses: Accrued Expenses An accrued expense is an expense that is payable or due for payment but has not yet been paid during that period. An accrued expense should be charged in the P&L account and shown in the balance sheet as a current liability. Assume in the above example that the firm is meant to pay the rent, thus it becomes an expense with the facts still the same i.e. £2,000 payable in arrears. The ledger account will be as follows. Year 1 Cashbook £ Year 1 Feb (rent 4 Jan) Mar (rent 4 Feb) Apr (rent 4 Mar) May (rent 4 Apr) June (rent 4 May) July (rent 4 June) Aug (rent 4 July) Sept (rent 4 Aug) Oct (rent 4 Sept) Nov (rent 4 Oct) Dec (rent 4 Nov) £ 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 106 Accounting Theory Rent – Expenses Year 1 C/B Rent for Rent for Rent for Rent for Rent for Rent for Rent for Rent for Rent for Rent for Rent for 31/12 Bal c/d Jan Feb Mar Apr May June July Aug Sept Oct. Nov £ 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 Year 1 £ 2,000 2,000 2,000 2,000 31/12 P&L 24,000 24,000 24,000 The cashbook shows that the rent for the 11 months was paid for. However in the P&L a/c we should report rent for the full year of £24,000 and the £2,000, rent for Dec being the accrued expense will be shown in the balance sheet as a current liability. PREPAYMENTS Prepaid Income This is income that is not yet due but cash has been received for it. This happens where an income is payable in advance e.g. Rent payable 3 months in advance. A prepaid income should not be reported in the current financial period but should be carried forward and reported in the period it relates to. The accounting treatment will be to show it as a current liability. Example 4.2 A firm receives rent income of £5,000 per month payable quarterly in advance. Assuming that the firm’s rental income began in 1 st March and the financial year, end is on 31st Dec. The ledger accounts will be: 15,000 15,000 15,000 15,000 15,000 1.3 1.3 Cashbook 1.6 1.9 1.12 Lesson Three Year 1 1/3 Rent 1/6 Rent 1/9 Rent 1/12 Rent 107 £ Year 1 £ 15,000 15,000 15,000 15,000 Rent – Income Year 1 £ Year 1 £ 1/3 Cashbook 15,000 1/6 Cashbook 15,000 P&L (10 x 5,000) 50,000 1/9 Cashbook 15,000 31/12 Bal c/d 10,000 1/12 Cashbook 60,000 60,000 15,000 Rent for the 4 quarters of 12 months has been received as per the cashbook but because the end of the financial year is at 31 Dec, rent for 2 months is pre-paid. This £10,000 is not charged in the P&L but is carried forward as current liability in the balance sheet. Prepaid Expenses A prepaid expense is an expense that is not payable but cash has already been paid. A prepaid expense should not be charged in the P&L a/c but should be carried forward to the next financial period and should be shown in the balance sheet as a current asset. Example Assume as in the previous illustration, that all the facts are as stated except that rent is an expense. The ledger accounts is as follows: Year 1 £ Cashbook Year 1 1/3 Rent 1/6 Rent 1/9 Rent 1/12 Rent £ 15,000 15,000 15,000 15,000 Rent – Expenses Year 1 £ Year 1 £ 1/3 C/B (Mar, April, May) 15,000 1/6 C/B (June, July, Aug) 15,000 1/9 C/B (Sept, Oct, Nov) 15,000 P&L (10 x 5,000) 50,000 1/12 C/B (Dec, Jan, Feb) 15,000 31/12 Bal c/d (2 x 5,000) 10,000 60,000 60,000 108 Accounting Theory Rent of £10,000 for 2 months is carried forward to the next financial period and shown in the balance sheet as a current asset. Lesson Three 109 The following is the summary of treatment for Accruals and Prepayments: P&L B/Sheet Accrued - Report as Current Income Assets Income Prepaid -Not reported Current Liability Accruals/ Prepayments Accrued - Charge as Current an expense Liability Expense Prepaid - Not charged Current In P& L Assets Accrued Incomes and Expenses and Prepaid Incomes and Expenses are shown in the Balance Sheet as follows: Balance Sheet Extracts £ £ Current Assets Stock Debtors Accrued Incomes/Prepaid Expenses Cash at bank Cash in hand Current Liabilities Bank overdraft x Creditors x Prepaid Incomes/Accrued Expenses x X x x x x x x 110 Accounting Theory The accruals and expenses items may also be adjusted in the relevant income and expense accounts so that the correct amount of expense or income is reported in the profit and loss account for the year. Example 4.4 The financial year of H Seamers ended on 31 December 2002. Show the ledger accounts for the following items including the balance transferred to the necessary part of the final accounts, also the balances carried down to 2003: a) Motor expenses: Paid in 2002 £7,440; Owing at 31 December 2002 £2,800. b) Insurance: Paid in 2002 £42,000; Prepaid as at 31 December 2002 £3,500. c) Stationery: Paid during 2002 £18,000; Owing as at 31 December 2001 £25,000; Owing as at 31 December 2002 £49,000. d) Rates: Paid during 2002 £95,000; Prepaid as at 31 December 2001 £2,200; Prepaid as at 31December 2002 £2,900. e) Seamers sub-lets part of the premises. Receives £5,500 during the year ended 31 December 2002. Tenant owed Seamers £1,800 on 31 December 2001 and £2,100 on 31 December 2002 a) Motor Expenses £ 19X6 7,440 280 P/L a\c 7200 19x7 1/1 Bal b/d 19X6 Cashbook Bal c/d 31/12 b) £ 7220 7200 280 Insurance 19x6 £ Cashbook 19x7 1/1 c) 19x6 Cashbook £ 19x6 4,200 31/12 31/12 4,200 Bal b/d P&L a/c Bal c/d 3850 350 4200 350 === Stationery £ 19x6 18,000 1/1 Bal b/d £ 2,500 Lesson Three 111 31/12 Bal c/d 20,400 4,900 22,900 ==== P&L a/c 22,900 ==== 19x7 1/1Bal b/d 4,900 112 Accounting Theory d) Rates 19x6 1/1 Bal b/d Cashbook £ 19x6 2200 P&L 9500 31/12 Bal c/d 11,700 £ 8800 2900 11,700 19x7 1/1 Bal b/d e) 2900 Rent – Income 19x6 1/1 Bal b/d P&L £ 19x6 1800 Cashbook 5800 31/12 Bal c/d 7600 19x7 1/1 Bal b/d £ 5500 2100 7600 2100 b) BAD AND DOUBTFUL DEBTS Some debtors may not pay up their accounts for various reasons e.g. a debtor may go out of business. When a debtor is not able to pay up his/her account this becomes a bad debt. Therefore the business/firm should write it off from the accounts and thus it becomes an expense that should be charged in the profit & loss account. In practice a firm may also be unable to collect all the amounts due from debtors. This is because a section of the debtors will not honor their obligations. The problem posed by this situation is that it is difficult to identify the debtors who are unlikely to pay their accounts. Furthermore the amount that will not be collected may also be difficult to ascertain. These debts that the firm may not collect are called doubtful debts. A firm should therefore provide for such debts by charging the provision in the profit and loss account. Provision for doubtful debts maybe specific or general. Specific relate to a debtor whom we can identify and we are doubtful that he may pay the debt (if one of our debtor goes out of business). Accounting For Bad & Doubtful Debts. Bad debts When a debt becomes bad the following entries will be made: i. Debit bad debts account Credit debtors account with the amount owing. ii. Debit Profit and Loss Account. Lesson Three Credit bad – debts account to transfer the balance on the bad – debts account to the Profit and Loss Account. 113 114 Accounting Theory Doubtful Debts A provision for doubtful debts can either be for a specific or a general provision. A specific provision is where a debtor is known and chances of recovering the debt are low. The general provision is where a provision is made on the balance of the total debtors i.e. Debtors less Bad debts and specific provision. The accounting treatment of provision for doubtful debts depends on the year of trading and the entries will be as follows. If it is the 1 st year of trading (1st year of making provision): i. ii. Debit P&L a/c. Credit provision for doubtful debts (with total amount of the provision). In the subsequent periods, it will depend on whether if it is an increase or decrease required on the provision. If it is an increase: i. ii. Debit P&L a/c. Credit provision for doubtful debts (with increase only). If it is a decrease: i. Debit provision for doubtful debts. ii. Credit P&L a/c (with the decrease in provision only). Example Debtors Bad debts x Specific Provision General Provision (x) x (x) x (x) x A firm started trading in the year 1999, the balance on the debtor’s account was £400,000. Bad debts amounting to £40,000 were written off from this balance, there was a specific provision of £5,000 to be made to one of the debtors and a general provision of £5% was to be made on the balance of the debtors. The ledger accounts of 1999 were as follows: Debtors 1999 £ 1999 £ Bal B/d 400,000 Bad debts 40,000 22,750 Bal c/d 360,000 Provision for doubtful debts 1999 £ 31/12 Bal c/d 1999 £ 22,750 31/12 P&L Lesson Three 400,000 115 400,000 116 1999 Debtors Accounting Theory Bad debts £ 1999 40,000 31/12 £ P&L 40,000 £ Debtors Bad debts Specific Provision General Provision (5%) 400,000 (40,000) 360,000 (5,000) 355,000 (17,750) 337,250 Profit & Loss A/C (Extract) for the year ended 31/12/99 £ Expenses: Bad debts 40,000 Increase in provision for D/debts22,750 £ Balance Sheet (Extract) as at 31/12/99 £ £ Current Assets Stocks Debtors Provision for D/debts x 360,000 (22,750) 337,250 337,250 337,250 In the year 2,000, the debtors balance goes up to £500,000 from which bad debts of £50,000 needs to be written off there is no specific provision but the general provision is to be maintained at 5%. The ledger accounts will be as follows: Debtors Bad debts General Provision (5%) 500,000 (50,000) 450,000 22,500 427,500 Lesson Three 117 Debtors £ 2000 500,000 Bad Debts ______ Bal c\d 500,000 2000 Bal b\d £ 50,000 450,000 500,000 Provision for Doubtful Debts £ 2000 250 1\1 Bal b\d 22,500 22,750 2000 P\L Bal c\d £ 22,750 22,750 Bad Debts £ 2000 50,000 31\12 P& L 2000 Debtors £ 50,000 Profit And Loss Account (Extract) for year ended 31/12/2002. £ £ Incomes Decrease in provision for D/debts 250 Expenses Bad debts 50,000 Balance Sheet (Extract) as at 31/12/2002 £ £ Current Assets Debtors Provision for bad debts 450,000 (22,500) 427,500 In the year 2001 the debtors balance goes up to £600,000 from which bad debts of £50,000 need to be written off, there is no specific provision but the general provision is to be maintained at 5% the ledger accounts is as shown: £ Debtors Bad debts 600,000 (50,000) 550,000 General provision % (27,500) 522,500 118 Accounting Theory 2001 Bal b\ 600,000 £ Debtors 2001 Bad Debts £ 50,000 ______ Bal c\d 600,000 550,000 600,000 Provision for Doubtful Debts £ 2001 1\1 Bal b\d 27,500 P& L 22,500 2001 Bal c\d Bad Debts £ 2001 50,000 31\12 P& L 2001 Debtors £ 22,500 5,000 27,500 £ 50,000 Profit And Loss Account (Extract) for the year ended 31/12/2001 £ £ Expenses Bad debts Increase in provision 50,000 5,000 Balance Sheet (Extract) as at 31/12/2001 £ £ Current Assets Debtors Less: Provision for Doubtful Debts 550,000 (27,500) 522,500 Example 4.6 In a new business during the year ended 31 December 2002 the following debts are found to be bad, and are written off on the dates shown: 30 April 31 August 31 October H Gordon D Bellamy Ltd J Alderton £1,100 £640 £120 On 31 December 2002 the schedule of remaining debtors, amounting in total to £68,500, is examined, and it is decided to make a provision for doubtful debts of £2,200. Lesson Three You are required to show: a. The Bad Debts Account, and the Provision for Doubtful Debts Account. b. The charge to the Profit and Loss Account. c. The relevant extracts from the Balance Sheet as at 31 December 2002. 119 120 Accounting Theory £ Bad Debts Debtors 70,036 2002 £ 2002 £ Bad debts 1860 (1,860) Bad debts 68,500 1860 31/12 P\L Provision for D/Debt (2,200) 66,300 Provision for doubtful debts 2002 £ 2002 31/12 Bal c/d 2,200 31/12 £ P&L 2,200 Profit & Loss Account (Extract) £ £ Expenses Bad debts Increase in provision for Doubtful debts 1,860 2,200 Balance Sheet (Extract) £ £ Current Assets Debtor Less: Provision for D/Debts 8,500 (2,200) 6,300 Example 4.2 A business started trading on 1 January 2001. During the two years ended 31 December 2001 and 2002 the following debts were written off to the Bad Debts Account on the dates stated: 31 30 28 31 30 August 2001 September 2001 February 2002 August 2002 November 2002 W Best S Avon L J Friend N Kelly A Oliver £850 £1,400 £1,800 £600 £2,500 On 31 December 2001 there had been a total of debtors remaining of £405,000. It was decided to make a provision for doubtful debts of £5,500. On 31 December 2002 there had been a total of debtors remaining of £473,000. It was decided to make a provision for doubtful debts of £6,000. You are required to show: Lesson Three i. ii. 121 The Bad Debts Account and the Provision for Doubtful Debts Account for each of the two years. The relevant extracts from the Balance Sheet as at 31 December 2001 and 2002. Solutions Bad debts = Provision 2,250 405,000 (5,500) 399,500 Bad Debts £ 2001 850 1400 31\12 P&L 2250 2001 31\8 W.Best 30\9 S.Aron 2250 2250 Provision for D/Debts £ 2001 550 31\12 P&L 2001 31\12 Bal c\d 2001 1\1 £ £ 550 £ 2001 1\1 Bal b\d 600 31\12 P&L 600 Bal c\d £ 550 50 600 2001 28/2 J. Friend 31/8 N. Kelly 30/11 A. Oliver Bad Debts £ 2001 1,800 600 2,500 31/13 P&L 4,900 £ 4,900 4,900 122 Accounting Theory Profit & Loss Account (Extract) 19x6 £ £ Expenses Bad debts Provision for Doubtful Debts 2,250 5,000 19x7 Bad debts 4,900 Increase in provision for D/Debts 500 Balance Sheet as at 19x6 £ £ Current Assets Debtors Less provision 405,000 (5,500) 399,500 19x7 Debtors Less: provision 473,000 (6,000) 467,000 Provision for discounts allowable. In some cases a firm may create a provision for discounts allowable in addition to provision for doubtful debts. This happens where a firm anticipates that some of the debtors may take up cash discounts offered by the firm. The accounting treatment is similar to accounting for provision for doubtful debts. The provision should be made after creating a provision for doubtful debts (debtors figure less either general/specific provision for doubtful debts). Debtors Bad debts Specific provision x (x) x (x) x (x) x Provision for discount allowed (on balance) (x) x Lesson Three 123 Profit & Loss Account (Extract) £ £ Incomes Decrease in provision for D/Debts Decrease in provision for discounts allowed Expenses Bad debts Increase in provision for D/Debts Increase in provision for discounts allowed x x x x x Balance Sheet (Extract) Current Assets Debtors Less: provision for Doubtful Debts Less: provision for discounts allowed £ x (x) (x) £ x Bad Debts Recovered A firm may be able to recover a debt that was previously written off. The following entries will be made if this happens: i. Debit – Debtors Credit – credit bad debts recovered account – to restore the bad debt recoverable. N/B: This should be the amount to be recovered. ii. Debit – Cashbook Credit – Debtors with the cash received. iii. Debit – bad debts recovered account. Credit – P & L account with the same balance as bad debts account. Example: A firm recovers debts amounting to £10,000 that had been written off in the previous periods. In the same financial period the firm writes off bad debts amounting £30,000. The ledger accounts will be as follows: Bad debts £ £ Debtors 30,000 Bad Debt Recovered 10,000 P\L 20,000 30,000 30,000 Bad Debt Bad debts recovered £ 10,000 Debtors £ 10,000 124 Accounting Theory c) BANK RECONCILIATION STATMENTS The cashbook for cash at bank records all the transactions taking place at the bank i.e. the movements of the account held with the bank. The bank will send information relating to this account using a bank statement for the firm to compare. Ideally, the records as per the bank and the cashbook should be the same and therefore the balance carried down in the cashbook should be the same as the balance carried down by the bank in the bank statement. In practice however, this is not the case and the two (balance as per the bank and firm) are different. A bank reconciliation statement explains the difference between the balance at the bank as per the cashbook and balance at bank as per the bank statement. Causes of the differences: Items Appearing In The Cashbook And Not Reflected In The Bank Statement. Unpresented Cheques: Cheques issued by the firm for payment to the creditors or to other supplies but have not been presented to the firm’s bank for payment. Uncredited deposits/cheques: These are cheques received from customers and other sources for which the firm has banked but the bank has not yet availed the funds by crediting the firm’s account. Errors made in the cashbook These include: • Payments over/understated • Deposits over/understated • Deposits and payments misposted • Overcastting and undercasting the Bal c/d in the cashbook. ii) Items appearing in the bank statement and not reflected in the cashbook: Bank charges: These charges include service, commission or cheques. Interest charges on overdrafts. Direct Debits (standing orders) e.g. to pay Alico insurance. Dishonored cheques A cheque would be dishonored because: • Stale cheques • Post – dated cheques • Insufficient funds • Differences in amounts in words and figures. Direct credits Interest Income/Dividend incomes Lesson Three 125 Errors of The Bank Statement (Made By The Bank). Such errors include: • Overstating/understating. • Deposits • Withdrawals The Purposes of a bank reconciliation statement. 1. To update the cashbook with some of the items appearing in the bank statement e.g. bank charges, interest charges and dishonoured cheques and make adjustments for any errors reflected in the cashbook. 2. To detect and prevent errors or frauds relating to the cashbook. 3. To detect and prevent errors or frauds relating to the bank. Steps in preparing a bank reconciliation statement. 1. To update the cashbook with the items appearing in the bank statement and not appearing in the cashbook except for errors in the bank statement. Adjustments should also be made for errors in the cashbook. 2. Compare the debit side of the cashbook with the credit side of the bank statement to determine the uncredited deposits by the bank. 3. Compare the credit side of the cashbook with the debit side of the bank statement to determine the unpresented cheques. 4. Prepare the bank reconciliation statement which will show: a) Unpresented cheques b) Uncredited deposits c) Errors on the bank statement d) The updated cashbook balance. The format is as follows: (Format 1) Name: Bank Reconciliation Statement as at 31/12 £ Balance at bank as per cashbook (updated) Add: Un presented cheques Errors on Bank Statement (see note 1) £ x x x x x Less: Uncredited deposits x Errors on Bank Statement (see note 2) Balance at bank as per Balance Sheet x (x) x Note 1: These types of errors will have an effect of increasing the balance at bank e.g. an overstated deposit or an understated payment by the bank. Note 2: These types of errors will have an effect of decreasing the balance at bank e.g. an understated deposit or an overstated payment by the bank, or making an unknown payment. 126 Accounting Theory Format 2 Name: Bank Reconciliation Statement as at 31/12 £ Balance at bank as per bank statement Add: Uncredited deposits x Add errors on bank statement (note 2) £ x x x x Less: Unpresented cheques Errors on bank statement (note 1) Balance at bank as per cashbook (updated) x x (x) x === Example 4.8 Draw up a bank reconciliation statement, after writing the cashbook up to date, ascertaining the balance on the bank statement, from the following as on 31 March 2003: £ Cash at bank as per bank column of the cashbook (Dr) 38,960 Bankings made but not yet entered on bank statement 6,060 Bank charges on bank statement but not yet in cashbook 280 Un presented cheques C Clarke 1170 Standing order to ABC Ltd entered on bank statement, but not in cash book 550 Credit transfer from A Wood entered on bank statement, but not yet in cashbook 1,890 Solution 19X9 31/3 Bal b/d 38960 A Wood (credit transfer) Cashbook – Bank £ 19X9 Bank charges 280 ABC (standing order) 1890 31/3 Bal C/D 40,850 Bank Reconciliation as at 31/03/2003 £ 550 40,020 40,850 Lesson Three 127 £ £ Balance at bank as per cashbook Add: Unpresented cheques 40,020 1,170 41,190 (6,060) 35,130 ===== Less: Uncredited deposits Balance at bank as per Balance Sheet Example 4.9 The following are extracts from the cashbook and the bank statement of J Richards. You are required to: a) Write the cashbook up to date, and state the new balance as on 31 December 2002, and b) Draw up a bank reconciliation statement as on 31 December 2002. 2002 Dec 1 Dec 7 Dec 22 Dec 31 Dec 31 Dr Balance b/d J Map J Cream 115 K Wood M Barrett Cashbook £ 2002 Cr 1,740 Dec 8 A Dailey 88 Dec 15 R Mason 73 Dec 28 249 Dec 31 £ 349 33 G Small Balance c/d 178 1,831 2,328 2,328 Bank Statement 2002 Dec Dec Dec Dec Dec Dec Dec Dr £ 1 7 11 20 22 31 31 Balance b/d Cheque A Dailey 349 R Mason 33 Cheque Credit transfer: J Walters Bank charges Cr £ 88 Balance £ 1,740 1,828 1,479 1,446 73 54 22 1,519 1,573 1,551 Cashbook –Bank 2002 31/12 Bal b/d 31/12 J. Walters (C/T) 1,863 £ 2002 1,831 31/1 Bank charges 54 31/12 Bal C/D 1,885 1,885 £ 22 128 Accounting Theory Lesson Three 129 J. Richards Bank Reconciliation Statement as at 31/12/2002 £ £ Balance at bank as per cashbook – bank Add: Unpresented cheques – (G Small) 1,863 115 1,978 Less: Uncredited deposits K Wood M. Barret Balance at bank as per balance sheet OR: Balance at bank as per balance sheet Add: Uncredited deposits: K. Wood M. Barret Less: Unpresented cheques Balance at bank as per cashbook – bank 249 178 (427) 1,551 1,551 249 178 1,978 (115) 1,863 Exam Type Question: Nov 2001 Q4 QUESTION FOUR (a) Explain the term “bank reconciliation” and state the reasons for its preparation. (b) Ssemakula, a sole trader received his bank statement for the month of June 2001. At that date the bank balance was Sh. 706,500 whereas his cash book balance was Sh.2,366,500. His accountant investigated the matter and discovered the following discrepancies: 1. Bank charges of Sh.3, 000 had not been entered in the cashbook. 2. Cheques drawn by Ssemakula totaling Sh.22, 500 had not yet been presented to the bank. 3. He had not entered receipts of Sh.26, 500 in his cashbook. 4. The bank had not credited Mr Ssemakula with receipts of Sh.98, 500 paid into the bank on 30 June 2001. 5. Standing order payments amounting to Sh.62, 000 had not been entered into the cashbook. 6. In the cashbook Ssemakula had entered a payment of Sh.74, 900 as Sh.79, 400. 7. A cheque for Sh.15, 000 from a debtor had been returned by the bank marked “refer to drawer” but had not been written back into the cashbook. 8. Ssemakula had brought forward the opening cash balance of Sh.329, 250 as a debit balance instead of a credit balance. 9. An old cheque payment amounting to Sh.44, 000 had been written back in the cashbook but the bank had already honored it. 10.Some of Ssemakula’s customers had agreed to settle their debts by paying directly into his bank account. Unfortunately, the bank had 130 Accounting Theory credited some deposits amounting to Sh.832, 500 to another customer’s account. However acting on information from his customers Ssemakula had actually entered the expected receipts from the debtors in is cashbook. Required: i. A statement showing Ssemakula’s adjusted cashbook balance as at 30 June 2001. (9 marks) ii. A bank reconciliation statement as at 30 June 2001. (5marks) (Total: 20 marks) Solution a) Bank reconciliation is an attempt to explain the difference between the cash at bank balance as per the cashbook and the cash at bank balance as per the bank statement. Reasons for preparing a bank reconciliation statement are: 1. To update the cashbook with some of the relevant entries in the bank statement. 2. To detect and prevent errors or frauds that relate to the cashbook. 3. To detect and prevent any errors or frauds that relate to the bank. b) ADJUSTED CASHBOOK 2001 Sh. 2001 Bal b/d 3,000 Receipts omitted 2,366,500 Bank charges 26,500 Standing orders Sh. 62,000 cheques) Payment overstated 15,000 4,500 Debtors (dishonored Error on opening balance Balance C/F Cheque payment Balance C/D 2,397,500 2,397,500 SSEMAKULA Bank Reconciliation Statement as at 30 June 2001. Sh. Sh. 329,250 329,250 44,000 1,615,000 Lesson Three 131 Cash at bank as per the updated cashbook Add: Unpresented cheques Less: Uncredited cheques Error on bank statement Balance as per the bank statement 98,500 832,500 1,615,000 22,500 1,637,500 (931,000) 706,500 132 Accounting Theory Exam type Question: Nov 96 Q4 QUESTION FOUR (a) What is the purpose of preparing a bank reconciliation statement? (4marks) (b) The following is the bank statement of Kakamega Retail Traders for the month of October 1996: Date 1996 Particulars Debit Sh. Credit Sh. October 1 2 334,875 2 331,327 2 318,327 2 400,327 4 4 4 340,212 4 347,492 7 7 288,992 7 325,092 8 8 344,092 October 9 9 9 387,512 15 15 405,272 16 340,272 16 358,286 17 392,786 19 384,286 Balance b/d Cheque no. 63 31,000 Cheque no. 67 3,548 Cheque no. 65 13,000 Deposit 82,000 365,875 Cheque no. 69 Cheque no. 68 Cheque no. 64 Deposit 6,000 3,115 51,000 394,327 391,212 7,000 51,500 340,492 9,000 316,092 7,280 Cheque no. 70 Cheque no. 71 Deposit 36,100 Cheque no. 66 Deposit 28,000 Cheque no. 72 Cheque no. 73 Deposit 51,000 Cheque no. 74 Deposit 20,560 1,330 6,250 2,800 Cheque no. 75 65,000 Deposit 18,014 Deposit 34,500 Cheque no. 76 Balance Sh. 8,500 342,762 336,512 384,712 Lesson Three 19 427,036 21 21 412,120 21 21 401,620 21 410,620 23 394,380 23 457,380 26 455,880 26 26 527,130 28 491,630 28 481,230 28 454,230 28 431,730 28 444,755 31 31 472,055 133 Deposit 42,750 Cheque no. 79 Cheque no. 77 Cheque no. 78 Cheque no. 81 6,500 Deposit 9,000 2,410 12,506 424,626 4,000 408,120 Cheque no. 82 16,240 Deposit 63,000 Cheque no. 84 1,500 Dividends Deposit 8,750 62,500 Cheque no. 88 Standing order 464,630 35,500 10,400 (Insurance) Cheque no. 85 27,000 Cheque no. 87 22,500 Deposit 13,025 Service charge Deposit 750 28,050 444,005 The following is the bank column of the cashbook: Date Particulars Debit Date Particulars 1996 Sh. 1996 October 1 1 3 5 8 10 15 15 17 19 19 22 Balance b/d Deposited at Deposited at Deposited at Deposited at Deposited at Deposited at Deposited at Deposited at Deposited at Deposited at Deposited at bank bank bank bank bank bank bank bank bank bank bank 365,875 7,280 36,100 28,000 51,000 20,560 18,014 34,500 42,750 15,700 9,000 36,000 October 1 1 1 2 4 5 5 7 8 10 11 15 Credit Sh. Cheque Cheque Cheque Cheque Cheque Cheque Cheque Cheque Cheque Cheque Cheque Cheque no. no. no. no. no. no. no. no. no. no. no. no. 65 13,000 66 9,000 67 3,548 68 3,115 69 6,000 70 7,000 71 51,500 72 1,330 73 6,250 74 2,800 75 65,000 76 5,800 134 Accounting Theory 24 27 28 29 31 Deposited Deposited Deposited Deposited Deposited at at at at at bank bank bank bank bank 26,500 13,025 28,050 171,010 31,525 22 23 26 28 28 28 28 30 31 31 31 934,889 18 Cheque no. 77 12,506 19 Cheque no. 78 4,000 19 Cheque no. 79 2,410 19 Cheque no. 80 3,860 19 Cheque no. 81 6,500 Cheque no. 82 16,240 Cheque no. 815,000 Cheque no. 84 1,500 Cheque no. 85 27,000 Cheque no. 86 10,520 Cheque no. 87 22,500 Cheque no. 88 53,500 Cheque no. 89 2,500 Cheque no. 90 64,529 Cheque no. 91 15,500 Balance c/d 502,481 934,889 Notes: 1. The bank reconciliation on 30 September 1996 showed that one deposit was in transit and two cheques had not yet been presented to the bank. 2. Deposits of Sh.62, 500 and Sh.36, 000 had been entered in the cashbook as Sh.26, 500 and Sh.36, 000 and in the bank statement as Sh.62, 500 and Sh.63, 000, respectively. 3. A cheque from Mkulima for Sh.15, 700 was deposited on 18 October 1996 but was dishonored and the advice was received on 4 November 1996. 4. Counterfoils for cheques no. 76 and no. 88 showed they had been drawn for Sh.5, 800 and Sh.33, 500 respectively. Required: a) A correct cashbook balance. (8 marks) b) A bank reconciliation statement on 31 October 1996. (8 marks) (Total: 20 marks) Lesson Three 135 No 96 Q4 CASHBOOK (ADJUSTED) 1996 31.10 Bal b/d 10,400 Dividends Error on deposit 15,700 Error on cheque 88 Sh. 1996 502,481 8,750 36,000 18,000 565,231 Sh. Standing order (insurance) Service charge 750 Dishonored cheques (debtor) Bal c/d 538,381 565,231 Bank Reconciliation Statement as at 1 October 1996. (Previous period) Sh. Balance as per the cashbook Add: Unpresented cheques 63 64 Sh. 365,875 31,000 51,000 82,000 447,875 Less: Uncredited cheques Deposits Balance as per the bank statement (82,000) 365,875 Bank Reconciliation Statement as at 31 October 1996 Sh. Balance as per the correct cashbook Add: Unpresented cheques Cheque no. 80 Cheque no. 83 Cheque no. 86 Cheque no. 89 Cheque no. 90 Cheque no. 91 Error on bank statement Sh. 538,381 3,860 15,000 10,520 2,500 64,529 15,500 27,000 138,909 677,290 Less: Uncredited Cheques Deposits “ Error in bank statement Balance as per the bank statement 171,010 31,525 2,700 (205,235) 472,055 136 Accounting Theory d) CAPITAL AND REVENUE EXPENDITURE Capital Expenditure: This is the amount spent on the acquisition of a non-current asset or adding value to a non-current asset. Examples of expenses incurred in acquisition: i. Purchase price/cost of the asset. ii. Delivery/carriage inwards costs (e.g. shipping charges or import taxes). iii. Costs incurred to get the asset in use (e.g. assembly, testing) iv. Installation v. Demolition costs in order to construct a new building. vi. Architect fees for construction and supervision vii. Legal fees incurred in acquisition of a new asset (e.g. lease agreement) Examples of expenses incurred in adding value to an asset: i. Modify plant to increase its useful life. ii. Upgrading plant to improve quality of output. iii. Adopting or upgrading the production process to improve or reduce costs. Revenue Expenditure: There’s an amount spent by the firm in the normal trading process or to assist in earning revenues or income. Examples: i. Postage and stationery. ii. Carriage outwards (sales). iii. Repairs and maintenance. Example 4.10 For the business of K Spinns,a wholesaler, classify the following between ‘capital’ and ‘revenue’ expenditure: a) Purchase of an extra motor van. b) Cost of rebuilding warehouse wall, which had fallen down. c) Building extension to the warehouse. d) Painting extension to warehouse when it is first built. e) Repainting extension to warehouse three years later than that done in (d). f) Carriage costs on bricks for new warehouse extension. g) Carriage costs on purchases. h) Carriage costs on sales. i) Legal costs of collecting debts. j) Legal charges on acquiring new premises for office. k) Fire insurance premium. l) Costs of erecting new machine. Solution. a) Capital expenditure b) Revenue expenditure c) Capital expenditure d) Capital expenditure e) Revenue expenditure f) Capital expenditure g) Revenue expenditure h) Revenue expenditure i) Revenue expenditure j) Capital expenditure Lesson Three 137 k) Revenue expenditure l) Capital expenditure. e) DEPRECIATION It is the loss of value of a non-current asset throughout its period of use by the firm. IAS 16 on property, plant and equipment defines depreciation as the allocation of a depreciable amount of a non-current asset over its estimated useful life. Under the matching concept, all incomes or revenues and expenses for a particular period should be reported in the financial statements and because depreciation is an expense of the business therefore, it will be charged in the P&L A/C. Causes of Depreciation 1. Physical Factors a) Wear and tear: Some non-current assets depreciate or lose value due to use overtime e.g. machinery and motor vehicles. b) Rot/decay/rust:: This happens on assets that are not well maintained by the firm e.g. Some machines. 2. Economic Factors a) Inadequacy: Some assets lose value due to them becoming inadequate e.g. when a business grows or expands then some buildings may become inadequate due to space. Also some machines that are unable to manufacture a large number of goods. b) Obsolescence: Some assets become obsolete due to change in technology or different methods of production e.g. computers. 3. Time Factors Some assets have a legal fixed time e.g. properties on lease. 4. Depletion This occurs when some assets have a wasting character due to extraction of raw materials, minerals or oil. Such assets include mines, oil wells, and quarries. Methods of Calculating Depreciation These are the methods developed to assist in estimating the amount of depreciation to be charged in the P&L a/c as an expense. The methods chosen by a firm should be in accordance with the agreed accounting practice, accounting standards and suit the firm’s non-current assets. There are 2 main methods of estimating depreciation and 5 others that will apply in a firm’s situation. The main methods are: Straight-line method and Reducing Balance method. The other 5 methods include: i. ii. Sum of the digits methods – uses a formular. Revaluation method – applies to a non-current asset of low value. 138 iii. iv. v. Accounting Theory Machine-Hour method – depreciation is based on number of hours a machine is expected to operate (manufacturing process). Unit of output method – depreciation is based on the number of units a machine is expected to produce. Depletion of units – depreciation is based on number of units extracted from the asset. Lesson Three 139 Straight-Line Method This method ensures that a uniform amount of depreciation is charged in the P&L a/c for a particular asset and is based on the following formular: Depreciation for year £20,000 = Cost of asset – Residual Value = Estimated useful life £100,000 8 = £10,000 per year. Cost of Asset – Residual Value Estimated useful life of asset. Residual Value The amount the firm expects to sell the asset after the period of use in the firm, also called Sales Value / Scrap Value. Estimated Useful Life The period the asset is expected to be used in the firm. Example 4.1 A firm buys a machine for £100,000 which it expects to use in the firm for eight years. After the eight years the machine will be sold for £20,000. Under the straight-line method, the depreciation amount will be computed as follows: This means for this asset £10,000 will be charged in the P&L account as depreciation expense on the machine. The straight line method assumes that benefits accruing on use of a non-current asset are spread out evenly over the life of the asset e.g. buildings use straight-line method. Percentage rate based on cost as opposed to number of years can also be used to calculate the depreciation. Reducing Balance Method The firm determines a fixed percentage rate that is applied on the cost of the asset during the first period of use. The same rate is applied in the subsequent financial periods but the rate is applied on the reduced value of the asset. (Cost of asset – total depreciation provided to date). This method ensures that higher amount of depreciation are charged in the P&L account in the earlier periods of use and lower amounts in the latter periods of use as shown in the following example: Example 4.12 140 Accounting Theory Assume a firm buys machinery for £100,000 and provides depreciation on machines at 20% p.a. on reducing balance method. The depreciation charged to the P&L will be as follows for the next 3 years. Lesson Three 141 Year 1 £ Cost Depreciation 20% of 100,000 Balance to YR 2 80,000 (16,000) P&L YR 2 64,000 Year 3 Depreciation 20 % of 64,000 Balance to YR 4 P&L YR 1 80,000 Year 2 Depreciation 20% of 80,000 Balance to YR 3 100,000 (20,000) 64,000 (12,800) P&L YR 3 51,200 Reducing balance method (diminishing balance method) assumes that benefits accruing from the use of an asset are higher in the first periods of use and lower in the latter periods e.g. Fixtures, furniture and fitting. Plant and machinery. Motor vehicles. ACCOUNTING TREATMENT ON DEPRECIATION When non-current assets are depreciated, a new account for each type of asset is opened; this account is called a provision for depreciation whereby the following entries will be made: Debit – P&L a/c Credit – Provision for depreciation a/c With the amount of depreciation charged for the period. Example on straight-line method The entries will be as follows: Debit – P&L a/c with £10,000 Credit – Provision for depreciation. Machines a/c with £10,000 being depreciation provided for the machine. The ledger accounts will be as follows: Machinery £ £ Cashbook 100,000 31/12 Bal c/d P&L 10,000 Provision for Depreciation Machinery £ £ 100,000 31/12 Bal c/d 10,000 142 Accounting Theory The final accounts extracts will be shown as follows: (a) Profit And Loss Account (Extract) for the year ended Expenses £ Depreciation: Buildings x Plant and machinery Furniture, Fixtures and Fittings Motor vehicles £ 10,000 x x (b) Balance sheet (Extract) as at________ Non Current Assets Cost £ Land x Buildings x Plant and Machinery Furniture, Fixtures & fittings Motor vehicles x Total NBV (Net Book Value) Depreciation (£) £ (x) x x x x x (x) (x) (x) x x x x x Example 4.13 A company starts in business on 1 January 2002. You are to write up the motor cars account and the provision for depreciation account for the year ended 31 December 2002 from the information given below. Depreciation is at the rate of 20 per cent per annum. Using the basis of one month’s ownership needs one month’s depreciation. 2002 Bought two motor vans for £12,000 each on 1 January Bought one motor van for £14,000 on 1 July. Motorcars a/c 2002 1/1 Cashbook 1/7 Cashbook 38,000 £ 2002 24,000 14,000 31/12 38,000 £ Bal c/d 38,000 Calculation for depreciation 1/1 24,000 x 20 x 12 100 12 = £4,800 + 1/7( 14,000 x 20 x 6 100 12 = 1,400 ) Lesson Three 143 = £4,800 + 1,400 = £6,200 144 2002 Accounting Theory Provision- Depreciation for Motor cars A/c £ 2002 £ 31/12 Bal c/d 6,200 31/12 P&L 6,200 Profit And Loss Account (Extract) for the period. Expenses £ Depreciation: Motor vans 6200 £ Balance Sheet (Extract) as at 31/12/2002 Non-current Assets Motor vans Cost 38,000 Total Depreciation (6200) NBV 31,800 Example 4.14 A company starts in business on 1 January 1999, the financial year end being 31 December. You are to show: a. The plant account. b. The provision for depreciation account. c. The balance sheet extracts for each of the years 1999, 2000, 2001, 2002. The machinery bought was: 1999 1 January 2000 1 July 1 October 2002 1 April 1 2 1 1 plant plant plant plant costing costing costing costing £8,000 £5,000 each £6,000 £2,000 Depreciation is at the rate of 10 per cent per annum, using the straight-line method, plant being depreciated for each proportion of a year. Lesson Three 145 Plant a/c £ 199 8000 31/12 1999 1/1 Cashbook 2000 1/1 Bal b/d 1/7 Cashbook 1/10 Cashbook Bal c/d 2000 8000 10,000 6,000 24,000 2001 1/1 Bal b/d 24,000 2002 1/1 Bal b/d 1/4 Cashbook £ 8000 31/12 2001 24,000 Bal c/d 31/12 2002 24,000 2,000 31/12 26,000 24,000 24,000 Bal c/d Bal c/d 26,000 26,000 Calculation for Depreciation 1999 £8,000 x 10/100 x 12/12 £ = 800 2000 £10,000 x 10/100 x 6/12 = 500 £6,000 x 10/100 x 3/12 = 150 £8,000 x 10/100 x 12/12 = 800 1,450 2001 £24,000 x 10/100 x 12/12 = 2400 2002 £24,000 x 10/100 x 12/12 = 2400 £2,000 x 10/100 x 9/12 = 150 2,250 Accumulated Depreciation 800 2,250 4,650 7,200 146 1999 31/12 Bal c/d Accounting Theory Provision – Depreciation Machines £ 1999 £ 800 31/12 P&L 2000 £ 31/12 Bal c/d 2000 1/1 Bal b/d 2,250 P&L 2,250 2001 £ 31/12 Bal c/d £ 31/12 Bal c/d £ 800 1,450 2,250 2001 1/1 Bal b/d 4,650 P&L 4650 2002 800 £ 2,250 2,400 4650 2002 1/1 Bal b/d 7,200 P&L 7,200 £ 4,650 2,550 7,200 Balance Sheet (Extract) as at 31/12/99 – 31/12/02 Non Current Assets Cost Total Depreciation NBV 1999 Motor vans 8,000 (800) 7,200 1999 Motor vans 24,000 (2,250) 21,750 1999 Motor vans 24,000 (4,650) 19,350 1999 Motor vans 26,000 (7,200) 18,800 DISPOSALS OF ASSETS A firm may dispose off its non-current assets in the following 3 ways: i. Selling the asset. ii. Asset being written-off from damage/accident/theft. iii. Asset is scrapped/not used anymore. Lesson Three 147 When an asset is disposed and is no longer used by the firm, the appropriate entries should be made in the asset account and the total depreciation provided to date on the asset and the entries required will depend on the type of disposal. When the asset is sold, the following entries will be made: (a) Debit – asset disposal a/c Credit – asset a/c With the cost of the asset being disposed. (b) Debit – provision for depreciation of asset a/c. Credit – asset disposal a/c With the total depreciation provided to date on the asset. (c) Debit – cashbook. Credit – asset disposal a/c With the cash received on disposal. When an asset is written off as a result of damage/accident/theft. If it was insured and the insurance company accept liability but by the end of the period the insurance company has not yet paid. (a) Debit – asset disposal a/c Credit – asset a/c With the cost of the asset damaged. (b) Debit – provision for depreciation of asset a/c Credit – asset disposal a/c (c) Debit – insurance receivable a/c Credit – asset disposal a/c With the amount expected from the insurance. If the insurance pays before the end of the financial period, it will not be necessary to create an insurance debtor so the following entries will be made: Debit – cashbook. Credit – asset disposal a/c If the asset is not used anymore or scrapped by the firm, the appropriate entries will be made in the asset account and provision for depreciation a/c only. Debit – asset disposal a/c Credit – asset a/c With the cost of the asset no longer in use. Debit – provision for depreciation for asset Credit – asset disposal a/c With the total depreciation provided to date. 148 Accounting Theory The balance in the disposal a/c after the above entries will either be a debit balance or a credit balance. A credit balance represents a profit on disposal, which is reported in the profit and loss a/c together with other incomes. The entry will be: Debit – asset disposal a/c Credit – P&L a/c With the balance in the account. A debit balance in the asset disposal a/c is loss on disposal which is reported in the P&L a/c as an expense and therefore the entry will be. Example 4.15 A firm has a motor vehicle costing £1,000 total depreciation provided to date is £800. The firm decides to trade in the motor vehicle with a new one the value of the new one being £500. The supplier of the new vehicle agree with the firm that the old motor vehicle is worth £300, therefore the difference will be paid by cash. Bal b/d Disposals Cashbook Motor vehicle a/c £ £ 1,000 Motor vehicle disposal 300 200 Bal c/d 500 1,500 1,500 ===== ==== 1,000 Motor Vehicle Disposal a/c £ Motor vehicle P&L a/c £ 1,000 Provision for depreciation 100 Motor vehicle 1,100 1,100 JOURNAL ENTRIES 800 300 £ £ Debit – motor vehicles disposal 1,000 Credit – motor vehicles a/c (Motor vehicle being traded in now transferred to disposal a/c) Debit – Provision for depreciation – motor vehicles Credit – Motor vehicle disposal a/c (Total depreciation provided for motor vehicle) 1,000 800 800 Debit – Motor vehicle a/c Credit – Asset disposal a/c - Cashbook (New motor vehicle acquired by trade-in value of £300 and cheque payment of £200) 500 Debit – Asset disposal a/c 100 300 200 Lesson Three 149 Credit – P&L (Profit made on disposal) 100 In case of a loss, Debit – P&L a/c Credit – asset disposal a/c If the firm trades in an old asset for a new one, the following entries will be made in addition to the movements in the asset and depreciation a/c. Debit – asset a/c (value of the new asset) Credit – cashbook (cash paid as difference of new value i.e. trade in value of old asset) Asset disposal a/c (with trade-in value of old asset) Example 4.16 A company depreciates its plant at the rate of 20 per cent per annum, straight line method, for each month of ownership. From the following details draw up the plant account and the provision for depreciation account for each of the years 1999, 2000, 2001 and 2002. 1999 Bought plant costing £900 on 1 January. Bought plant costing £600 on 1 October. 2001 Bought plant costing £550 on 1 July. 2002 Sold plant which had been bought for £900 on 1 January 1999 for the sum of £275 on 30 September 2002. You are also required to draw up the plant disposal account and the extracts from the balance sheet as at the end of each year. Example 1999 1/1 Cashbook 1/10 Cashbook £ 900 600 1,500 2000 1/1 Bal b/d 1,500 £ 2001 1/1 Bal b/d 1/7 Cashbook 2,050 £ Plant a/c 1999 31/12 Bal c/d 2000 1,500 2001 1,500 550 31/12 2,050 2002 £ 1,500 1,500 £ 31/12 Bal c/d £ Bal c/d 2,050 2002 150 1/1 900 Accounting Theory Bal b/d 2,050 31/12 30/9 Disposal Bal c/d 1,150 2,050 2,050 Plant Provision for Depreciation a/c 1999 31/12 Bal c/d £ 1999 210 31/12 Bal c/d 2000 1/1 510 2000 31/12 P&L £ 210 Bal b/d P&L 210 300 510 2001 31/12 510 2001 1/1 865 Bal c/d Bal b/d P&L 865 2002 31/12 Disposals Bal c/d 675 1,230 510 355 865 2002 1/1 555 Bal b/d P&L 365 1,230 865 Calculation for Depreciation Date 1999 1/1 1/10 2000 1/1 300 2001 Cost Months Depreciation charge £ 900 600 12 3 20/100 x 900 x 12/12 20/100 x 600 x 3/12 = = 210 1,500 12 20/100 x 1,500 x 12/12 = 180 30 Lesson Three 1/1 300 1/2 151 1,500 12 550 6 20/100 x 1,500 x 12/12 20/100 x 550 x 6/12 = = 55 355 2002 30/9 31/12 31/12 900 550 600 2002 Plant a/c P&L 9 12 12 £ 900 50 950 20/100 x 900 x 9/12 20/100 x 550 x 12/12 20/100 x 600 x 12/12 = = = 365 135 110 120 Plant Disposal a/c 2002 £ 30/9 Provision for depreciation 675 30/9 Cashbook 275 950 Balance Sheet (Extract) Non Current Assets 1999 Plant Cost 1,500 Total Depreciation (210) 2000 Plant 1,500 (510) 990 2001 Plant 2,050 (865) 1,695 2002 Plant 1,150 (555) 595 NBV 1,290 CHANGE OF DEPRECIATION POLICY A firm may change its depreciation policy in several ways e.g. from straight line to reducing balance or vice versa, or it may increase/decrease the number of estimated useful years of an asset. A firm should always follow the depreciation policy adopted consistently and incase there is need to change the policy may be due to a new accounting standard or change in circumstances. This change should be disclosed in the financial statements. When there is change in the depreciation policy this may result in an increase or a decrease in the depreciation to be charged in the Profit and loss account .IAS 16 requires that depreciation should be based on the remaining net book value at the start of the period. Example 4.17 A firm buys a machine for £100,000 for which it expects to use for the next 10 years. The firm depreciates the machines on a straight-line basis on the years of the number of estimated useful years. In the 4 th year, the estimated useful life of the machine is now reduced to 8 years. year. Required: Show the charge in the provision for depreciation a/c and the balance carried down for year 4. Change for 10yr – 8 yr is same as change from 10% to 12.5% 152 Accounting Theory Lesson Three 153 Provision for Depreciation Year 1 31/12 Bal c/d 10,000 £ Year 1 10,000 Year 2 31/12 Year 2 1/1 20,000 Bal c/d 10,000 20,000 Year 3 1/1 30,000 Year 3 31/12 Bal c/d 10,000 £ 31/12 Bal b/d 31/12 Bal c/d Year 4 1/1 31/12 44,000 10,000 P&L 20,000 Bal b/d 31/12 30,000 Year 4 P&L 20,000 P&L 30,000 Bal b/d P&L 44,000 30,000 14,000 44,000 Workings: The net book value at the beginning of Year 4 is £ 70,000 (100,000- 30,000). And the remaining useful life is 5 (8 years- 3 years). The charge for year 4 for depreciation will be £ 70,000 = 14,000. 5 Assuming that in this example the life of the machine does not decrease but increases from 10 years to 13 years. Required: Show the provision of depreciation account in year 4 154 Accounting Theory Provision for Depreciation Year 1 31/12 £ Year 1 10,000 Bal c/d 10,000 Year 2 31/12 £ 31/12 Year 2 1/1 20,000 Bal c/d 10,000 P&L Bal b/d 10,000 P&L 20,000 Year 3 31/12 20,000 Year 3 Bal c/d 30,000 1/1 Bal b/d 20,000 _____ P&L 10,000 30,000 30,000 Year 4 Year 4 1/1 Bal b/d 30,000 31/12 7,000 Bal c/d 37,000 31/12 P&L 37,000 37,000 REVALUATION OF NON CURRENT ASSETS Some of the non-current assets in a firm tend to appreciate in value rather than depreciate e.g. land and buildings. IAS 16 on property, plant and equipment requires that such assets may be carried in the accounts at the revalued amounts (may be based on the their market price). Land is not depreciated, and therefore the adjustments required are minimal, but for buildings, changes should be made at the cost and depreciation reserve account is usually opened for the purpose of these adjustments. Example 4.18 A firm has the following assets as part of the non-current assets: Asset (a) (b) Land Buildings Cost Depreciation £1,000,000 £800,000 40,000 Lesson Three 155 Illustration 1 The firm decides to revalue these two assets to reflect their current market prices and these are revalued at: Land -£ 1,200,00 Buildings -£ 900,000 The following entries would be made (a) Debit – Land A/c – with revaluation gain - £ 200,000 Credit – Revaluation Reserve a/c with the same - £ 200,000 (Revaluation gain on the land ⇒ 1,200,000 – 1,000,000) (b) Debit – Building a/c with revaluation gain - £100,000 Credit – Revaluation Reserve a/c with the same - £100,000 (Revaluation gain on buildings ⇒ 900,000 – 800,000) (c) Debit – Provision for depreciation for buildings a/c with £ 40,000 Credit – Revaluation Reserve a/c with the same £ 40,000 Total credit depreciation charged to date on buildings now transferred to revaluation reserve a/c The ledger a/c will be as follows: Land a/c £ Bal B/D Revaluation reserve £ 1,000,000 __200,000 Bal C/D 1,2000,000 1,200,000 1,200,000 Buildings a/c £ Bal B/D 800,000 Revaluation reserve 100,000 £ Bal C/D 900,000 900,000 900,000 Revaluation Reserve a/c £ £ 156 Accounting Theory Bal C/D 340,000 Land 200,000 Buildings 100,000 Provision for depr. 340,000 40,000 340,000 Provision for depreciation (Buildings) £ £ Revaluation 40,000 Bal B/D 40,000 Bal c/d 45,000 P&L 45,000 85,000 85,000 The balances in the Land and Building a/c will be shown as cost in the Balance Sheet and the revaluation reserve a/c appears together with the capital as a revaluation reserve (especially used in company accounts. Land 1,200,000 – 1,000,000 = 200,000 Buildings 900,000 – 760,000 = 140,000 340,000 Any depreciation to be charged for the buildings should be based on the revalued amount (900,000) If we assume depreciation of 5% for buildings, we shall have £45,000 charged in the P & L and will also be the Bal c/d in the provision for depreciation a/c. Assume again that the firm decides to revalue its non-current assets or land and buildings downwards in year 3 to the following values: Land : £900,000 Buildings: £700,000 These amounts are to be reflected in the accounts for year 3. The Ledger accounts will be as follows: Land Year 3 £ 1/1 Bal B/D 1,200,000 Year 3 31/12 Revaluation £ 200,000 Lesson Three 157 P&L ________ 100,000 Bal C/D __900,000 1,200,000 1,200,000 Buildings Year 3 1/1 Bal B/D £ 900,000 _______ Year 3 £ 31/12 Revaluation 100,000 P&L 100,000 Bal C/D 700,000 900,000 900,000 Revaluation Reserve Year 3 £ Year 3 1/1/ Bal B/D £ 31/12 Land 200,000 340,000 31/12 Building 100,000 31/12 Prov. For depr. _40,000 _______ 340,000 340,000 Exam Type Question 4.19 (December 1995 ) Question 4 James Mbuvi started a taxi business in Nairobi March 1990 under the firm name Mbuvi Taxis. The firm had two vehicles KA and KB, which had been purchased forSh.560, 000, and Sh.720, 000 respectively earlier in the year. In February 1992 vehicle KB was involved in an accident and was written off. The insurance company paid the firm Sh.160, 000 for the vehicle. In the same year the firm purchased two vehicles, KC and KD for Sh.800, 000 each. In November 1993 vehicle KC was sold for Sh.716, 000. In January 1994 vehicle KE was purchased for Shs.840,000. In March 1994 another vehicle KF was purchased for Sh.960, 000. The firm’s policy is to depreciate vehicles at the rate of 25 per cent on cost on vehicles on hand at the end of the year irrespective of the date of purchase. 158 Accounting Theory Depreciation is not provided for vehicle disposed of during the year. The firm’s year ends on 31 December. Required: a) Calculate the amount of depreciation charged in the profit and loss account for each of the five years. (7 marks) b) Prepare the motor vehicle account (at cost). (8 marks) c) Calculate the profit and loss on disposal of each of the vehicles disposed of by the company. (5 marks) (Total: 20 marks) a Vehicle 1990 1991 1992 1993 KA 560,000 560,000 560,000 560,000 KB 720000 720,000 - - - KC - - 800,000 - - KD - - 800,000 800,000 800,000 KE - - - - 840,000 KF - - - - 960,000 Total cost 1,280,00 0 1,280,00 0 2,160,00 0 1,360,00 0 2,600,00 0 320,00 0 320,00 0 540,00 0 340,00 0 650,00 0 Depreciation at 25% Motor Vehicle 1990 1/3 Sh Cashbook 1,280,00 0 1991 1/1 1990 31/12 Sh Bal c/d 1,280,000 Bal c/d 1,280,000 1991 Bal b/d 1,280,00 0 31/12 1994 Lesson Three 159 1992 1/1 1992 bal b/d 1,280,00 0 1/2 Disposal Cashbook 1,600,00 0 31/12 Bal c/d 2,880,00 0 1993 1/1 720,000 2,160,000 2,880,000 1993 Bal b/d 2,160,00 0 1/11 Disposal ________ 31/12 Bal c/d 2,160,00 0 1994 800,000 1,360,000 2,160,000 1994 1/1 Bal b/d 1,360,00 0 1/1 Cashbook 840,000 1/3 Cashbook 960,000 3,160,00 31/12 Bal c/d 3,160,000 3,160,000 160 Accounting Theory Provision For Depreciation – M/V 1990 31/12 Sh Balc/d 320,000 1991 1990 31/12 Sh P&L 320,000 1/1 Bal b/d 320,000 31/12 P& L 320,000 1991 1992 31/12 Bal c/d 640,000 640,000 1992 640,000 1992 1/2 Disposal 360,000 1/1 Bal b/d 640,000 31/12 Bal c/d 820,000 3/12 P&L 540,000 1,180,00 0 1993 1,180,000 1993 1/11 Disposal 200,000 1/1 Bal b/d 820,000 31/12 Bal c/ 960,000 31/12 P&L 340,000 1,160,00 0 1994 1,1 60,000 1994 31/1 31/12 Bal c/d 1,610,00 0 1,610,00 0 Bal b/d 960,000 P&L 650,000 1,610,000 Note: KA is fully depreciated by 1994,so no depreciation is charged for that asset. Cost still remains until the asset is disposed. So depreciation ; = 25% x 2,600,000 = 650,000 Exam type Question Pentland Limited complies its financial statements for the year to 30 June each year. At 1 July 1999 the company’s balance sheet included the following figures: Lesson Three 161 l Accumulate d Net book Depreciatio n Value £000 £000 £000 Land 4,000 Nil 4,000 Buildings 2,200 800 1,400 Plant and machinery 1,600 600 1,000 600 200 400 Cost Motor vehicles Depreciation is charged at the following annual rates (all straight line): Land Nil Buildings 2% Plant and machinery Motor vehicles 15% 20% Appropriate depreciation charge is made in the year of purchase, sale or revaluation of an asset During the year ended 30 June 2000 the following transactions took place: 1. I January 2000 The company decided to adopt a policy of revaluing its buildings; and they were revalued to £3.4m. 2. 1 January 2000 Plant which has cost £300,000 was sold for £50,000. Accumulated depreciation on this plant at 30 June 1999 amounted to £230,000.New plant was purchased at a cost of £400,000. 3. 1 April 2000 A new motor vehicle was purchased for £30,000. part of the purchase price was settled by part exchanging another motor vehicle, which had cost £20,000, at an agreed value of £12,000. the balance of £18,000 was paid in cash. 4. The motor vehicle given in part-exchange had a net book value (cost less depreciation) at 30 June 1999 of £10,000 Required: Prepare ledger accounts to record these transactions in the records of Pentland Limited. (16 marks) 162 Accounting Theory Land 1999 1/7 £ 1999 Bal b/d 4,000 2000 1/1 £ 2000 Revaluation 1,200 30/6 Bal c/d 5,200 5,200 1999 1/7 Bal b/d 2000 1/1 Revaluation 2000 30/6 Bal C/D 30/6 1999 Buildings £ 1999 2,200 2000 1,200 30/6 3,400 £ Bal c/d 3,400 3,400 Revaluation Reserve £ 2000 1/1 Buildings 2,022 1/1 Provision for depr. 2,022 £ 1,200 822 2,022 Provision for Depreciation - Building £ 1999 £ 1/7 Bal b/d 800 1999 2000 1/1 5,200 Revaluation Bal c/d 2000 82 30/6 2 34 _ 85 6 Plant £ 1999 P&L 2,200 x ½ x 15 3,400 x ½ x 15 56_ 856 £ Lesson Three 1/7 163 Bal B/D 2000 1/1 1/7 1/4 1/4 2000 1/4 Disposal Bal c/d 1999 Bal b/d 2000 Disposal Cash book Motor Vehicle 300 1,700 2,000 2000 252.50 30/6 595.00 847.50 P&L Motor Vehicles £ 1999 600 12 18 630 1/4 30/6 Disposal Bal c/d 2000 Disposal Bal C/D Motor Vehicle Disposal £ 2000 20 1/4 Provision for depr. 5 1/4 Motor Vehicle 25 Plant 2000 13 1/4 307.5 30/6 320.50 £ 600 247.50 847.50 Provision for depreciation - Vehicle £ 1999 1/7 Bal b/d 1999 2000 1/1 Disposal Bal c/d Provision for Depreciation - Plant £ 1999 1/7 Bal b/d P&L 2000 1/4 30/6 2000 400 1/1 _____ 30/6 2,000 Cashbook 1999 2000 1/1 1,600 P&L Bal C/D Plant - Disposal £ 2000 300 1/1 Provision for £ 20 610 630 £ 13 12 25 £ 200 120.5 ______ 320.50 £ 252.50 164 Accounting Theory P&L depr. 2.50 Cash book 25 50___ 302.50 Property, Plant and Equipment Schedule (Formerly fixed asset movement schedule) The property, plant and equipment schedule is a summary report on the balances and transactions of the asset and provision for depreciation account as per the requirements of IAS 16 to be reported in the published accounts of companies. The format is as follows: Lesson Three Cost/ Valuation 165 Property, Plant and Equipment Schedule: Freehold Leasehold Property Plant and property (£) Bal as at 1/1/01 Additions Revaluations (gains) Reclassificati ons Disposals Bal as at 31/12/01 Depreciation/ Amortization Bal as at 1/1/10 Change for year Revaluation Eliminated on Disposal Bal as at 31/12/01 N.B. V as at 31/12/01 NBV as at 31/12/01 Fixture, Furniture Total Short lease (£) x Machiner y (£) And fittings (£) (£) x Long leases (£) x x x x xx xx xx - xx - xx - xx - xx xx - (xx) xx - - - (xx) (xx) (xx) (xx) (xx) (xx) xx xx xx xx xx xx xx - xx xx xx xx xx - xx xx xx xx (xx) - (xx) (xx) (xx) (xx) (xx) - (xx) (xx) (xx) (xx) (xx) xx xx (xx) xx (xx) xx (xx) xx (xx) xx xx xx xx xx xx xx Additional information is in this schedule called reclassifications where some of the non-current assets are transferred into a different class. (e.g.) some of the properties hold under long leases (over 50 years) will be transferred to the short leases classes when their term becomes less than 50 years. This is a reclassification from long lease to short lease and so is shown in the schedule at the value of transfer as a deduction in the long lease class and on addition in the short lease class Exam Type Questions May 2000 Question Three a) Briefly explain the nature and purpose of accounting for depreciation. 166 Accounting Theory b) The chief accountant of Jitegemea Ltd has encountered difficulties while accounting for fixed assets and the related depreciation in the company’s draft accounts for the year ended 30 April 2000. He has decided to seek your professional advice and presented the following balances of fixed assets as at 1 May 1999: Lesson Three Furniture Trucks Plant and machinery Land Buildings 167 Acquisition Accumulated Cost Sh. 900,000 3,525,000 7,387,500 2,775,000 2,925,000 Depreciation Sh. 300,000 1,470,000 4,462,500 292,500 Depreciatio n Rates % 12.5 25 10 Nil 2.5 The following additional information was also available: 1. It is the company’s policy to write off cost of the assets using above percentages on cost. 2. Depreciation is fully charged in the year of acquisition and none in the year of disposal. 3. A three year old machine acquired for sh.187,500 was sold for sh.15,750. 4. It has been decided to adjust and charge depreciation on buildings at 4%. 5. A used delivery truck purchased three years ago for sh.248,250 was traded in during the year at a value of sh.157,500 in part exchange of the new delivery truck costing sh.450,000. 6. Land, buildings and machinery were acquired for sh.1,350,000 from a company that went out of business. At the time of acquisition sh.90,000 was paid to have the assets revalued by a professionally qualified valuer. The revaluation indicated the following market values. Sh. Land 900,000 Buildings 600,000 Machinery 300,000 Required: A schedule of movement of fixed assets as requested by the Chief Accountant for inclusion in the company’s accounts for the year ended 30 April 2000. (10 marks) (Total: 15 marks) SOLUTION Depreciation is the loss of value of an asset (non-current) throughout the period of use by the firm. IAS 16 on property plant and equipment defines depreciation as allocation of a depreciable amount of a non-current asset throughout its useful life. Under the matching concept, all revenues should be matched with all the expenses that relate to a particular financial period and therefore because the firm to earn revenue or income uses the assets, then the loss of value should be marched with these revenues. A charge is made in the Profit and Loss account as a depreciation expense for the non-current asset. 168 Accounting Theory Property, Plant & Equipment Schedule: Cost/Valuation Land, Furniture Buildings And Machinery Sh. Sh. Bal as at 1/5/99 13,087,5 900,000 00 Additions 1,350,000 Revaluation 450,000 Disposals (187500) _____Bal as at 30/4/2000 14,700,000 900,000 Depreciation Bal as at 1/5/99 Charge for the year Eliminated on disposal Bal as at 30/4/2000 Motor Total Sh. 3,225,000 Sh. 17,512,500 450,000 (248,250) 3,726,750 1,800,000 450,000 (435,750) 19,326,750 4,755,000 1,066,500 (37,500) 300,000 112,500 -______ 1,470,000 931,687.5 (124,125) 6,525,000 2,110,687.5 (161,625) 5,784,000 412,500 8,474,062.5 8,332,500 8,916,000 600,000 487,500 2,277,562. 5 2,055,000 1,449,187. 5 NBV 1/5/99 NBV 30/4/2000 10,987,500 10852,687. 8 Workings: Depreciation on Furniture = 900,000 x 12.5% = 112,500 Motor vehicle Buildings = cost 3,525,000 Add 450,000 3,726,750 x 25% = 931,687.5 = (292,500 + 600,000) x 4% = 141,000 = 2,925,000 x 2.5% x 4 = 292,500 = 292,500 x 4% x 4 = 468,000 175,500 At 2.5% 4% Machinery: cost c/f + Additions – Disposals = Bal x 10% 73,787,500 + 300,000 – (187,500) = 7,500,000 x 10% = 750,000 Lesson Three 169 REINFORCING QUESTIONS QUESTION ONE Otter Limited operates a computerized accounting system for its sales and purchases ledgers. The control accounts for the month of September 1999 are in balance and incorporate the following totals: £ Sales ledger: Balances at 1 September 1999: Debit 386,430 190 Credit Sales Cash received Discounts allowed Sales returns inwards Credit balances at 30 September 1999 Purchases ledger: Balances at 1 September 1999: Credit 163,194 158,288 2,160 590 370 184,740 520 Debit Purchases Cash payments Discounts received Purchases returns outwards Debit balances at 30 September 1999 98,192 103,040 990 1,370 520 Although the control accounts agree with the underlying ledgers, a number of errors have been found, and there are also several adjustments to be made. These errors and adjustments are detailed below: 1. Four sales invoices totaling £1,386 have been omitted from the records. 2. A cash refund of £350 paid to a customer, A Smith, was mistakenly treated as a payment to a supplier, A Smith Limited. 3. A contra settlement offsetting a balance of £870 due to a supplier against the sales ledger account for the same company is to be made. 4. Bad debts totaling £1,360 are to be written off. 5. During the month, settlement was reached with a supplier over a disputed account. As a result, the supplier issued a credit note for £2,000 on 26 September. No entry has yet been made for this. 6. A purchases invoice for £1,395 was keyed in as £1,359. 7. A payment of £2,130 to a supplier, B Jones, was mistakenly entered to the account of R Jones. 170 Accounting Theory 8. A debit balance of £420 existed in the purchases ledger at the end of August 1999. The supplier concerned cannot now be traced and it has been decided to write off this balance. Required: Prepare the sales ledger and purchases ledger control accounts as they should appear after allowing, where necessary, for the errors and adjustments listed. QUESTION TWO April showers sells goods on credit to most of its customers. In order to control its debtor collection system, the company maintains a sales ledger control account. In preparing the accounts for the year to 31 October 20X3 the accountant discovers that the total of all the personal accounts in the sales ledger amounts to £12,802, whereas the balance on the sales ledger control account is £12,550. Upon investigating the matter, the following errors were discovered: 1. Sales for the week ending 27 March 20X3 amounting to £850 had been omitted from the control account. 2. A debtor’s account balance of £300 had not been included in the list of balances. 3. Cash received of £750 had been entered in a personal account as £570. 4. Discounts allowed totaling £100 had not been entered in the control account. 5. A personal account balance had been undercast by £200. 6. A contra item of £400 with the purchase ledger had not been entered in the control account. 7. A bad debt of £500 had not been entered in the control account. 8. Cash received of £250 had been debited to a personal account. 9. Discounts received of £50 had been debited to Bell’s sales ledger account. 10.Returns inwards valued at £200 had not been included in the control account. 11.Cash received of £80 had been credited to a personal account as £8. 12.A cheque for £300 received from a customer had been dishonored by the bank, but no adjustment had been made in the control account. Required: Prepare a corrected sales ledger control account, bringing down the amended balance as at 1 November 20X3. Prepare a statement showing the adjustments that are necessary to the list of personal account balances so that it reconciles with the amended sales ledger control account balance. QUESTION THREE George had completed his financial statements for the year ended 31 March 1999, which showed a profit of £81,208, when he realized that no bank reconciliation statement had been prepared at that date. Lesson Three 171 When checking the cashbook against the bank statement and carrying out other checks, he found the following: 1. A cheque for £1,000 had been entered in the cashbook but had not yet been presented. 2. Cheques from customers totaling £2,890 entered in the cashbook on 31 March 1999 were credited by the bank on 1 April 1999. 3. Bank charges of £320 appear in the bank statement on 30 March 1999 but have not been recoded by George. 4. A cheque for £12,900 drawn by George to pay for a new item of plant had been mistakenly entered in the cash book and the plant account as £2,900. Depreciation of £290 had been charged in the profit and loss account for this plant. 5. A cheque for £980 from a credit customer paid in on 26 March was dishonoured after 31 March and George decided that the debt would have to be written off as the customer was now untraceable. 6. A cheque for £2,400 in payment for some motor repairs had mistakenly been entered in the cash book as a debit and posted to the credit of motor vehicles account. Depreciation at 25% per annum (straight line) is charged on motor vehicles, with a full year’s charge calculated on the balance at the end of each year. 7. The total of the payments side of the cash book had been understated by £1,000. On further investigation it was found that the debit side of the purchases account had also been understated by £1,000. George had instructed his bank to credit the interest of £160 on the deposit account maintained for surplus business funds to the current account. This the bank had done on 28 March. George had made an entry on the payments side of the cashbook for this £160 and had posted it to the debit of interest payable account. George had mistakenly paid an account for £870 for repairs to his house with a cheque drawn on the business account. The entry in the cashbook had been debited to repairs to premises account. George had also mistakenly paid £540 to Paul, a trade supplier, to clear his account in the purchases ledger, using a cheque drawn on George’s personal bank account. No entries have yet been made for this transaction. The cashbook showed a debit balance of £4,890 before any correcting entries had been made. The balance in the bank statement is to be derived in your answer. Required: 1. Prepare an adjusted cash book showing the revised balance which should appear in George’s balance sheet at 31 March 1999. (6 marks) 2. Prepare a bank reconciliation statement as at 31 March 1999. (2 marks) 3. Draw up a statement for George showing the effect on his profit of the adjustments necessary to correct the errors found. (8 marks) 172 Accounting Theory 4. Prepare journal entries to correct items (9) and (10). Narratives are required. (4 marks) QUESTION FOUR 1. Name and explain four types of errors which are not disclosed by the trial balance. (8 marks) The trial balance of S Juma, a sole trader, did not balance on 30 April 1995. The difference was put in the suspense account. The final accounts which were then prepared showed a net profit of Sh. 64,000. During audit, the following errors were noted: • • • • • • • A loan from ABD Bank of Sh 10,000 was entered correctly in cash book but was not posted to the ledger. A cheque of Sh. 4,000 for rent was not entered in the books. Closing stock was overvalued by Sh 1,500. Discount allowed of Sh 500 was entered in the discount-received account. The opening stock was understated by Sh 3,200. Prepaid insurance of Sh 220 had been included in the profit and loss account. Goods destroyed by fire amounting to Sh 12,000 were written off in the profit and loss account. However, the insurance company has agreed to compensate the full amount. Required: 1. Journal entries to correct the errors. 2. Statement of corrected profit. 3. Suspense account. (8 marks) (2 marks) (2 marks) (Total: 20 marks) QUESTION FIVE The following Trial Balance was taken from the ledger of P Spike, a sole trader, on 31st December 2002: £ Capital Purchases Sales Salaries Opening stock Insurance Rent £ 40,000 26,154 36,246 4,814 4,307 820 965 Lesson Three Buildings Furniture Debtors Other expenses Creditors Commission 173 25,000 14,500 6,140 1,060 _____ 82,795 4,638 __946 82,795 Adjustments: 1. 2. 3. 4. 5. 6. 7. Salaries due, £350 Insurance was paid for one year up to 31st March 19-2. Rent received for January 19-2, £165. Commission accrued but not yet received, £120. Furniture to be depreciated by 10%. 5% of debtors are doubtful. Stock on 31st December 19-1 was valued at £5,008. Required: Prepare a 10 column worksheet. QUESTION SIX 1. Explain the purposes for which control accounts are prepared in a business organization. (3 marks) XML Ltd maintains control accounts in its business records. The balances and transactions relating to the company’s control accounts for the month of December 1994 are listed below: Balance at 1 December 1994: Sales ledger Purchases ledger Transactions during December 1994: Sales on credit Purchases on credit Returns inwards Returns outwards 6,185,0 00 52,500 16,500 4,285,0 00 8,452,0 00 5,687,5 00 203,50 0 284,00 (debit) (credit) (debit) (credit) 174 Accounting Theory Bills of exchange payable Bills of exchange receivable Cheques received from customers Cheques paid to suppliers Cash paid to suppliers Bill payable dishonoured Charges on bill payable dishounered Cash received from credit customers Bad debts written off Cash discounts allowed 0 930,00 0 615,00 0 7,985,0 00 4,732,0 00 88,500 400,00 0 10,000 Bill receivable dishonoured 153,00 0 64,500 302,00 0 88,500 Balances at 31 December 1994: Sales ledger Purchases ledger 44,000 (credit) 23,500 (debit) Required: Post the sales ledger and the purchases ledger control accounts for the month of December 1994 and derive the respective debit and credit closing balances on 31 December 1994. (17 marks) CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK Acknowledgement 175 LESSON FIVE FURTHER ADJUSTMNETS TO ACCOUNTS (a) CONTROL ACCOUNTS Control accounts are so called because they control a section of the ledgers. By control we mean that the total on the control accounts should be the same as the totals on the ledger accounts. There are two main types of control accounts: (i) Sales ledger control Account – also called total debtors. The balance on the sales ledger control account should be the same as the total of the balances in the sale ledger. (ii) Purchases Ledger Control Account – also called total creditors .The balance carried down (Bal c/d) on the purchases Ledger Control Account should be the same as the total of the balances in the purchases ledger. Example (Sales Ledger Control a/c) Sales Ledger Control A/c Sales 1400 CashBook Bal C/D 1400 700 700 1400 Sales = 200 + 300 + 400 + 500 Cashbook = 50 + 100 + 250 + 300 Balance c/d = 150 + 150 + 200 SALES LEDGER Debtor A a/c Sales 200 C/B Bal c/d 200 50 150 200 Debtor B a/c Sales 400 C/B Bal c/d 400 250 150 400 Debtor C a/c Sales 300 C/B Bal c/d 100 200 176 Adjustment to Final Accounts 300 300 Lesson Four 177 Debtor D a/c Sales 500 C/B Bal c/d 500 300 200 500 Example: Purchases Ledger Control a/c Purchases Ledger Control a/c C/B Bal c/d 1900 Purcha ses 700 2600 2600 2600 PURCHASES LEDGER Creditor A C/B Bal c/d 400 Purcha ses 200 600 600 600 Creditor B C/B Bal c/d 450 Purchas es 250 700 700 700 Creditor C C/B Bal c/d 350 Purchas es 150 500 500 500 Creditor D C/B Bal c/d 700 Purchas es 100 800 800 800 178 Adjustment to Final Accounts Purpose of Control Accounts 1. Provide for arithmetical check on the postings made in the individual accounts (either in the sales ledger or purchases ledger.) 2. To provide for a quick total of the balances to be shown in the trial balance as debtors and creditors. 3. To detect and prevent errors and frauds in the customers and suppliers account. 4. To facilitate delegation of duties among the debtors and creditors clerks. FORMAT OF A SALES LEDGER CONTROL Sales Ledger Control a/c 1. Balance b/d of the total debit balances from previous period 2. Total credit sales for the period (from the sales journal) 3. Refunds to customers (from cashbook) 4. Dishonored cheques (from cashbook) 5. Bad debts recovered (from general journal) 6. Total credit balances of the sales Ledger carried forward 1. Total credit balances of the sales ledger brought forward 2. Total cash received from credit customers/debtors (from cash book) 3. Total cheques received from credit customers/debtors (from cash book) 4. Total returns-inwards (returns-inwards journal) 5. Total cash discount allowed to customers (from cash book) 6. Bad debtors written-off (from general journal) 7. Cash received from bad debtors recovered (cash book) 8. Purchases Ledger contra 9. Allowances to customers (price reduction in excess to discounts allowed) 10.Total debit balance carried down to the next period – to be derived after posting all those transactions Refunds to Customers Sometimes a firm can refund some cash on the customers account. This takes place when there is a credit balance on the debtor’s a/c and the customer is not a creditor too. The entry will be: Dr. Debtor’s a/c Lesson Four 179 Cr. Cashbook Example: Debtor A £ £ 1000 Cashbook 950 100 Discounts 50 Returns 100 1100 1100 If the firm has not paid this amount owed to the customer, then it’s carried forward to the next period then is a credit balance in the customer’s a/c. Therefore, if a firm has several customer, this information will be shown in the control a/cs as total balance c/f (debit side). Sales (Refunds) C/B Contra against the purchases ledger balances: Some debtors may also be creditors in the same firm and therefore, if the amount due to them as creditors is less than what they owe as debtors, then the credit balance is transferred from their creditors a/c to their debtors a/c as a contra entry. Example: Debtor (A) Sales 2000 Contrapurchases Bal c/d 2000 1000 1000 1100 Creditor (A) Contra Debtor 1000 Purchases 1000 FORMAT OF A PURCHASES LEDGER CONTROL ACCOUNT Purchases Ledger Control A/C 1. Total debit balances from 1. Total credit balance brought purchases ledger brought forward (of purchases ledger forward from previous period from the previous period) 2. Total cash paid to creditors 2. Total credit purchases for the (from cash book) period (from purchases journal) 3. Total cheques paid to creditors 3. Refunds from suppliers (from cash book) (from cash book) 180 Adjustment to Final Accounts 4. Total cash discounts received (from cash book) 5. Allowances by suppliers 6. Sales ledger contra 7. Total returns outwards (from returns-outwards journal) 8. Total credit balance (to be derived after posting entries) 4. Total debit balances (of the purchases ledger carried forward) NOTES: The following notes should be taken into consideration: 1) Cash received from CASH SALES should NOT be included in sales ledger control a/c. 2) Only cash discounts (allowable & receivables) should be included. Trade discounts should NOT be included. 3) Provision for doubtful debts is NOT included in the sales ledger control a/c. i.e. increase or decrease in provisions for doubtful debts will not affect this account. 4) Cash purchases are NOT posted to the Purchases Ledger Control A/C. However in some cases it can be included especially where there are incomplete records (Topic to be covered later). 5) Interest due that is charged on over due customers’ account may also be shown on the debit side of the sales ledger control. However when trying to determine the turnover under incomplete records then it is wise to omit it. Example 5.1 You are required to prepare a purchases ledger control account from the following for the month of June. The balance of the account is to be taken as the amount of creditors as on 30 June. 2003 June 1 June 30 Purchases ledger balances Totals for June: Purchases journal Returns outwards journal Cheques paid to suppliers Discounts received from suppliers Purchases ledger balances £ 36,760 422,570 10,980 387,650 8,870 Solution 2003 Returns out Purchases Ledger Control A/C £ 2003 £ 10,980 Bal b/d (1/6) 36,760 ? Lesson Four 181 Bank Discounts received Bal c/d (30/6) 387,95 0 8,870 51,830 Purchases 459,33 0 422,570 459,330 Example 5.2 Prepare a sales ledger control account from the following: £ 2003 May 1 Debit balances Totals for May: Sales journal Cash and cheques received from debtors Discounts allowed Debit balances in the sales ledger set off against credit balances in the purchases ledger Debit balances Credit balances May 31 Solution 2003 1/5 Bal b/d Sales 31/5 Bal c/d Sales Ledger Control A/C £ 2003 £ 64,20 Cash book 103,70 0 0 128,0 Discounts 3,950 00 allowed Purchases 1,450 contra 500 31/5 Bal c/d 83,600 192,7 192,70 00 0 64,200 128,000 103,700 3,950 1,450 ? 500 182 Adjustment to Final Accounts Example 5.3 (Exam type question – November 1997 Question 2) (a) Explain the purposes for which control accounts are prepared. (3 marks) (b) The balances and transactions affecting the control accounts of Kopesha Ltd. for the month of November 1997 are listed below:Sh. Balances on 1 November 1997: Sales ledger Purchases ledger Transactions during November 1997: Purchases on credit Allowances from suppliers Receipts from customers by cheques Sale on credit Discount received Payments to creditors by cheques Contra settlements Bills of exchange receivable Allowances to customers Customers cheques dishonored Cash received from credit customers Refunds to customers for overpayments Discounts allowed Balances on 30 November 1997 Sales ledger Purchases ledger 9,123,00 0 211,000 4,490,00 0 88,000 (debit) (credit) (credit) (debit) 18,135,0 00 629,000 27,370,0 00 36,755,0 00 1,105,00 0 15,413,0 00 3,046,00 0 6,506,00 0 1,720,00 0 489,000 4,201,00 0 53,000 732,000 136,000 (credit) 67,000 (debit) Required: The sales ledger and purchases ledger control accounts for the month of November 1997 and show the respective debit and credit closing balances on 30 November 1997. (17 marks) (Total: 20 marks) Lesson Four 183 (a) i) Provide for arithmetical check on the postings made in the individual accounts (either in the sales ledger or purchases ledger.) ii) To provide for a quick total of the balances to be shown in the trial balance as debtors and creditors. iii) To detect and prevent errors and frauds in the customers and suppliers account. iv) To facilitate delegation of duties among the debtors and creditors clerks. 184 Adjustment to Final Accounts Kopesha Ltd 199 7 1/11 Bal b/d Sales Dishonored cheques Refunds to customers 30/1 1 199 7 1/11 Bal c/d Bal b/d Allowances from suppliers Discounts received Bank Contra settlement 30/1 1 Bal c/d Sales Ledger Control A/C Sh 199 7 9,123,00 1/11 Bal b/d 0 36,755,0 Bank 00 489,000 53,000 136,000 30/1 1 46,556,0 00 Contra Bills of exchange receivable Allowances Cash Discounts allowed Bal c/d Purchases Ledger Control A/C Sh 199 7 88,000 1/11 Bal b/d Purchases 629,000 1,105,00 0 15,413,0 00 3,046,00 0 2,411,00 30/1 Bal c/d 0 1 22,692,0 00 Sh 211,000 27,370,00 0 3,046,000 6,506,000 720,000 4,201,000 732,000 2,770,000 46,556,00 0 Sh 4,490,000 18,135,000 67,000 22,692,000 Example 5.4 (Exam Question – May 2000 Question 4) Poesha Limited keeps sales and purchases control accounts in the General Ledger. The transactions for the month ended 30 April 2000 were as follows: Sh Credit balances on 1 April 2000 -Sales ledger 154,000 -Purchases 569,000 ledger Debit balances on 1 April 2000 -Sales ledger 956,000 -Purchases 196,000 ledger Lesson Four 185 Credit balances on 30 April 2000 Debit balances on 30 April 2000 -Sales ledger Purchases ledger Credit purchases Credit sales Cheques received from debtors Cash received from debtors Cheque payments to creditors Cash payments to creditors Bad debts written off Discounts received Discounts allowed Contra entry to sales ledger from purchases ledger Refunds to debtors Returns outwards Returns inwards 178,000 189,000 2,450,000 4,563,000 3,140,000 1,367,000 1,994,000 352,000 68,000 104,000 169,000 234,000 62,000 138,000 231,000 Required: Sales ledger and purchases ledger control accounts for the month ended 30 April 2000. (20 marks) ERRORS ON ACCOUNTS There are two types of errors in accounts: • Errors that don’t affect the trial balance • Errors that affect the trial balance Errors that don’t affect the trial balance The trial balance produced from the accounts appears to be okay/correct, i.e the debits are the same as the credits. However, on taking a close check on the balances and transactions posted, errors may have been made and therefore the balances shown on the trial balance may be incorrect i.e. under/over stated. There are 6 main types of errors that don’t affect the trial balance and these are explained as follows: a) Error of omission Here, a transaction is completely omitted from the accounts and therefore the double entry is not made e.g. a sales invoice of £400 is not posted in the sales journal therefore no entry is made in the debtor’s account and the sales account i.e. both debit of £400 in debtor’s account and credit of £ 400 in the sales account. The effect of the error is understates both the debtors and the sales. To correct this error, the transaction is posted in the books by: Debiting debtors Crediting sales £400 £400 b) Error of Commission This error occurs when a transaction is posted to a wrong account but the account is of the same class. Example: a credit sale to T Thompson is posted to L Thompson’s 186 Adjustment to Final Accounts account for an amount of £ 200. Instead of a debit to T Thompson’s account it is made to L Thompson’s account and the corresponding credit in the sales account is correct. Although the debit entry is made into the wrong account, the two accounts are of the same class i.e. debtors. To correct this error a transfer is made from L Thompson’s account to T Thompson by: £ (i) (ii) Debit T Thompson a/c Credit L Thompson a/c 200 200 c) Error of principle In this type of error a transaction is posted not only to the wrong account but also of a different class e.g. Motor vehicle purchased for £ 400 is posted to the motor vehicle expenses a/c. (Instead of debiting motor vehicles, we debited motor vehicle expenses a/c and the credit entry in the cashbook is correct) The motor vehicles account is a non-current asset, and motor vehicles expenses a/c is an expense account. Therefore a capital expenditure has been posted as revenue expenditure. To correct this error a transfer is made from the motor expenses account to the motor vehicles a/c by: £ (i) Debit Motor vehicles a/c 400 (ii) Credit Motor expenses a/c 400 d) Complete reversal of entries A transaction is posted to the correct accounts but to the wrong sides of the accounts i.e. a debit is posted as a credit and a credit is posted as a debit. Example: cash drawn from the bank of £150 for business use is posted as a debit in the bank account and credit in cash in hand. To correct this error, two entries are made in the relevant accounts: (i) Correct the error (ii) Post the transaction correctly The entries will therefore be as follows: (i) Debit Cash in hand by £150 Credit bank by £150 To correct the error of £ 150 posted in the wrong sides of these account (ii) Debit cash by Credit bank by £150 £150 Lesson Four 187 To post the entries correctly e) Error of Original entry Here a transaction is posted to the correct accounts but the amount posted is not correct i.e. it is either under/over stated. In some cases, this is known as a transposition error e.g. cash received from a debtor of £980 is credited/posted to the customer’s account as £890. To correct this error, the amount understated or overstated is posted to these accounts to reflect the correct balance. In this case, we will: £ Debit cash book Credit debtors 90 90 f) Compensating Errors These are errors that tend to cancel out each other i.e. if the effect of one error is to understate the debits or credits then another error may take place to overstate the debits or credits by the same amount, hence canceling out each other. E.g. if the balance c/d of the purchases a/c is £3,980 but shown in the trial balance as £3,890 and another error carried to the trial balance of fixture amounting to £4,540 instead of £4,450: 188 Purchases Adjustment to Final Accounts £ 3,980 3,890 (90) £ Fixtures 4,450 (4,540) 90 This type of error is corrected by use of a suspense account. Example 5.5 Give the journal entries needed to record the corrections of the following. Narratives are required. a) b) c) d) e) Extra capital of £ 10,000 paid into the bank had been credited to Sales account. Goods taken for own use £ 700 had been debited to General Expenses. Private insurance £ 89 had been debited to Insurance account. A purchase of goods from C Kelly £ 857 had been entered in the books as £ 587. Cash banked £ 390 had been credited to the bank column and debited to the cash column in the cashbook. f) Cash drawings of £ 400 had been credited to the bank column of the cashbook. g) Returns inwards £ 168 from M McCarthy had been entered in error in J Charlton’s account. h) A sale of a motor van £ 1,000 had been credited to Motor Expenses. Lesson Four 189 Solution THE JOURNAL Debit 10,000 Sales Capital Additional capital passed into sales a/c now transferred to capital a/c Drawings General expenses Drawings debited in general expense now transferred to drawing a/c Drawings Insurance Private insurance transferred from insurance a/c to drawings a/c Purchases C Kelly Purchases and creditors amount to 857 initially entered as £587 Bank Cash Correct error in posting Bank Cash To post the cash banked correctly Bank Cash Cash drawings correctly started from bank to cash J Charlton M McCarthy Returns in from McCarthy entered in error in J Carlton now transferred to his a/c Motor expenses Motor disposal a/c To correct error in recording sales proceeds In expense account Credit 10,000 700 700 89 89 270 270 390 390 390 390 400 400 168 168 1000 1000 Example 5.6 (Exam type question – May 200 Question 2) The balance sheet of N Patel, a sole trader, as at 31 March 2000 was as follows: 190 Adjustment to Final Accounts Sh’000 Capital 1 April 1999 Profit for the year ended 31 March 2000 Deduct: drawings Creditors Bank overdraft 450 150 Sh’000 1,890 Land and buildings (at valuation) Machinery (at cost) 300 Deduct: depreciation 630 Stock at cost 270 Debtors 3,090 Sh’000 Sh’00 0 1,650 1,200 750 570 420 450 990 3,090 Further investigation reveals the following information: 1. The closing stock includes damaged goods which, although they had cost Sh. 10,000 have an estimated sale value of Sh.7, 500. 2. Debtors include Sh. 20,000 in respect of a customer who has gone bankrupt. A provision for doubtful debts of 2 ½% is also required on the balance of the debtors. 3. The machinery was acquired five years ago and is being depreciated to its scrap value on a straight-line basis over eight years. A more realistic estimate indicates that the life span will be 10 years. 4. Wages owing at 31 March 2000 amounted to Sh. 9,500 but this has not been reflected in the accounts. 5. Charges for the bank overdraft, amounting Sh 8,000 have not been reflected in the accounts. 6. In arriving at the profit for the period, a drawing of Sh 100,000 paid to Mr. Patel had been deducted as an expense. 7. Sh 20,000 rent owing to Mr. Patel for the letting of part of his business premises to external party had not been received and no entry had been made in the books in respect of this item. Required: a) Journal entries to correct errors and omissions. (10 marks) b) A statement of revised profit for the year ended 31 March 2000. (8 marks) c) A revised balance sheet as at 31 March 2000. (7 marks) (Total: 25 marks) Solution Lesson Four a) 191 THE JOURNAL Trading account Stock Being a reduction in stock for damaged goods Profit and loss(Bad debts) Debtors Debtors gone bankrupt written off Profit and loss) Provision for doubtful debts Being a provision for doubtful debts created at 20%. Provision for depreciation Profit and loss A change in estimated lifespan for machinery Profit and loss( wages ) Accrued expenses Wages owing omitted in the accounts Profit and loss (Bank overdraft charges) Bank overdraft Changes for overdraft not reflected in the accounts. Drawings Profit and loss Drawing to Mr. Patel deducted as an expense. Accrued income Profit and loss (rent income) Rent receivable owing not reflected in the accounts. Debit 2,500 Credit 2,500 20,000 20,000 10,000 10,000 150,000 150,000 9,500 9,500 8,000 8,000 100,000 100,000 20,000 20,000 192 Adjustment to Final Accounts b) STATEMENT OF ADJUSTED NET PROFIT Sh Net profit as per the account Add: Provision for depreciation 50,000 Drawings 100,000 Accrued income (rent) 20,000 Less: Stock reduction Bad debts Provision for doubtful debts Accrued expenses Bank charges Net profit (revised) Sh 450,000 170,000 620,000 2,500 20,000 10,000 9,500 8,000 (50,000) 570,000 REVISED BALANCE SHEET AS AT 31 MARCH 2000 Sh Sh Land and buildings 1,650,000 Machinery 1,200,000 (700,000) 2,850,000 700,000 Add: Current Assets Stock 567,500 Debtors 400,00 Less: Provision for doubtful (10,000) 390,000 debts Accrued rent income 20,000 977,500 Less Current liabilities Creditors 630,000 Accrued wage expense 9,500 Bank overdraft 278,000 (917,500) Capital Add Net Profit Less drawings Sh 1,650,000 500,000 2,150,000 60,000 2,210,000 1,890,000 570,000 2,460,000 (250,000) 2,210,000 Lesson Four 193 Errors That Affect The Trial Balance And The Suspense Account These types of errors are reflected on the trial balance because the debits will not be same as the credits. The debits may be more than the credits and vice versa. Examples include: 1. Transaction is posted on one side of the accounts i.e. only a debit entry or a credit entry. Example cash received from a debtor is debited to the cashbook and no other entry is made in the account, i.e. no credit entry on the debtor’s a/c. 2. A transaction is posted on one side of both the accounts i.e. two debits or two credits. Example a payment to a creditor of £ 300 is credited in the cashbook and also credited in the creditor’s accounts. 3. A transaction is posted correctly but different amounts i.e. debit is not the same as the credit. Example – cash received from a debtor of £ 450 is debited in the cashbook as £ 450 and credited as £ 540 in the debtor’s a/c. 4. Error on balances of accounts – i.e. understatement or overstatement of an account balance due to mathematical errors. 5. Balance on an account is shown on the wrong side of the account when opening the ledger accounts or when taken up to the trial balance. Example Bal c/d in the cash book for cash at bank of £ 2000 is shown as a credit i.e. an overdraft, instead of a debit in the trial balance. The balance may also be brought down as an overdraft instead of a debit balance in the trial balance. 6. A balance is omitted from the trial balance on the accounts in total. To correct the above errors, the appropriate or the adjusting entries are made through an account called a suspense account. The difference in the accounts is posted to this account and the entries to correct the accounts are posted here. The balance to be shown on the suspense accounts depends on which side the error is shown on the trial balance. If the debits > credits, then an amount is included on the credit side of the trial balance so that the debits = credits. This is a credit balance and will be taken to the suspense account on the credit side. Example: DR 240 240 Total Suspense CR 200 40 240 Suspense a/c £ Difference as per T/B £ 40 194 Adjustment to Final Accounts If the credits are more than the debits this is a debit balance and therefore we require an amount to be added to the total of the debits for the two side to be same. This debit balance is posted to the debit side of the suspense a/c. Total Suspense Difference as per T/B DR 260 40 300 CR 300 300 Suspense a/c £ 40 £ Posting the correct entries should eliminate the balance on the suspense account. In some cases, after checking for all errors that can affect the trial balance, the suspense a/c has a balance. This balance depends on whether it is a credit or debit and whether it is material or not for purposes of proper accounting treatment. The following is the recommended approach: Balance Debit Credit Material Show as an asset (eg) other debtors Show as a liability (eg) other creditors Not Material Charge in P& L as an expense Report as income in P&L Example 5.7 A bookkeeper extracted a trial balance on 31 December 2002 that failed to agree by £3,300, a shortage on the credit side of the trial balance. A suspense account was opened for the difference. In January 2003 the following errors made in 2003 were found: (i) (ii) (iii) (iv) (v) Sales daybook had been undercast by £1,000. Sales of £2,500 to J Church had been debited in error to J Chane account. Rent account had been undercast by £700. Discounts received account had been under cast by £3,000. The sale of a motor vehicle at book value had been credited in error to Sales account £3,600. You are required to: a) Show the journal entries necessary to correct the errors. b) Draw up the suspense account after the errors described have been corrected. c) If the net profit had previously been calculated at£79,000 for the year ended 31 December 2002, show the calculations of the corrected net profit Solution THE JOURNAL Lesson Four 195 Suspense Sales Sales under cast of £100 now corrected J Church J Chane Sale to J Church posted to J Chane corrected Rent Suspense Under cast in rent balance now corrected Suspense Discount received Under cast in discount received balance now corrected Sales a/c Disposal Sale of motor vehicle entered in sales a/c now corrected Sales Discount received Suspense a/c £ 1,000 Bal b/d 3,000 Rent 4,000 £ 1,000 £ ,1000 2,500 2,500 700 700 3,000 3,000 3,600 ,3600 £ 3,300 700 4,000 STATEMENT OF CORRECTED NET PROFIT £ £ Net profit as per 79,000 account Add: Sales 1,000 Discount received 3,000 4,000 Less: Rent 700 Sales 3,600 (4,300) Corrected net profit 78,700 Example 5.8 Chi Knitwear Ltd is an old fashioned firm with a handwritten set of books. A trial balance is extracted at the end of each month, and a profit and loss account and balance sheet are computed. This month, however, the trial balance did not balance, the credits exceeding debits by £1,536. 196 Adjustment to Final Accounts Your are asked to help and after inspection of the ledgers discover the following errors: (i) (ii) (iii) (iv) (v) (vi) (vii) A balance of £87 on a debtor’s account has been omitted from the schedule of debtors, the total of which was entered as debtors in the trial balance. A small piece of machinery purchased for £1,200 had been written off to repairs. The recipiets’ side of the cashbook had been under cast by £720. The total of one page of the sales daybook had been carried forward as £8,154, whereas the correct amount was £8,514. A credit note for £179 received from a supplier had been posted to the wrong side of his account. An electricity bill in the sum of £152, not yet accrued for, is discovered in a filing tray. Mr. Smith, whose past debts to the company had been the subject of a provision, at last paid £731 to clear his account. His personal account has been credited but the cheque has not yet passed through the cashbook. Solution Opening balance Sales - under record Suspense a/c £ 1,536. Debtors 00 360.00 Cashbook under cast Creditors error Creditors (correct) Cashbook: smiths debt paid 1,896.0 0 £ 87.00 720.00 179.00 179.00 731.00 1,896.00 i. Increase total for debtors by 87. ii. Add 1,200 to fixed assets and reduce repair costs by 1,200 therefore an increase in profits. iii. Increase sales by 360. iv. Reduce the creditors by 358. v. accruals by 152 and reduce profits by the same. vi. Increase the cash balance by 731. Lesson Four 197 Example 5.9 (Exam type question – May 2002 question 1). On 31 December 2001, an inexperienced bookkeeper working for Wanji, a sole trader extracted a trial balance. Due to errors committed by the bookkeeper, the trial balance failed to balance by Sh 369,400. He placed the difference in a suspense account as shown below: Wanji trial balance as at 31 December 2001 Sh Sh Fixed assets – cost 832,000 Stocks: 1 January 2001 148,000 31 December 98,800 2001 Trade debtors 76,000 Prepayments 10,000 Trade creditors 34,600 Bank overdraft 15,200 Accruals 16,000 Drawings 359,600 Capital 1,054,000 Sales 1,043,200 Provision for 166,400 depreciation Purchases 733,000 Operating expenses 126,000 Provision for doubtful 3,800 debts Discounts received 5,000 Discounts allowed 5,800 Suspense account ________ 369,400 2,548,400 2,548,400 Investigations carried out after preparing the above trial balance detected the following errors: 1. 2. 3. 4. 5. 6. The total of the sales daybook for December 2001 was overcast by Sh 25,700. On July 2001, the business purchased office equipment for Sh 40,000. These were debited to purchases account. Depreciation on the equipment is at the rate of 10% per annum on cost and based on the period (months) of usage in the year. A payment to a creditor by cheque of Sh. 8,500 was erroneously credited to the creditor’s account. A payment of Sh. 4,500 for telephone expenses was debited to telephone account as Sh 5,400. An amount of Sh 15,000 received from a debtor was not posted to the debtor’s account from the cashbook. Purchases daybook for October 2001 was under cast by Sh 28,000. 198 Adjustment to Final Accounts Assume the business had reported a net profit of Sh 85,800 before adjusting for the above errors. Required: (a) The adjusted trial balance and the correct balance of the suspense account. (6 marks) (b) Journal entries to correct the errors (Narrations not required) (6 marks) (c) Suspense account starting with the balance determined in the adjusted trial balance in (a) above. (4 marks) (d) The adjusted net profit for the year. (4 marks) Solution: Adjusted Trial Balance Fixed assets – cost Stock - 1 January 2001 Trade debtors Prepayments Trade creditors Bank overdraft Accruals Drawings Capital Sales Provision for depreciation Purchases Operating expenses Provision for doubtful debts Discounts received Discounts allowed Suspense account Sales Suspense Office equipment Purchases Provision for depreciation Profit and loss Sh 832,000 148,000 76,000 10,000 Sh 34,600 15,200 16,000 359,600 1,054,000 1,043,200 166,400 733,000 126,000 3,800 5,000 5,800 47,800 2,338,200 _______ 2,338,200 THE JOURNAL Dr 25,700 Cr 25,700 40,000 40,000 2,000 2,000 Lesson Four 199 Creditors Suspense Creditors Suspense 8,500 8,500 8,500 8,500 Suspense Telephone 900 900 Suspense Debtor 15,000 15,000 Suspense Discounts allowed 2,500 Suspense Discounts received 2,500 2,500 2,500 Purchases Suspense 2001 1 Jan Bal b/d Telephone Debtors Discount allowed Discount received Bal c/d 28,000 28,000 SUSPENSE ACCOUNT Sh 2001 47,800 1 Jan Sales 900 Creditors 15,000 Creditors 2,500 Purchases Sh 25,700 8,500 8,500 28,000 2,500 2,000 70,700 ______ 70,700 STATEMENT OF ADJUSTED NET PROFIT Sh Net profit as per the accounts Add Purchases Telephone expenses Discount allowed + received 40,000 Less Sales Depreciation Purchases Corrected Net Profit 25,700 2,000 28,000 Sh 85,800 900 5,000 c) STOCK VALUATION (IAS 2 INVENTORIES) 45,900 131,700 (55,700) 76,000 200 Adjustment to Final Accounts inventories in a firm includes: (a) Finished goods (assets held for sale) (b) Work in progress (assets still in production for purposes of sale) (c) Raw materials (to be used in production process). The cost of inventories should include all costs of purchase. (Purchase price and other taxes like import duties), costs of conversion (e.g. direct labour) and other costs incurred in bringing the inventories into their present location and condition (carriage inwards). Inventories or stock is a sensitive area, as it does not form part of the double entry. In most cases either carrying out stocktaking or checking the stock records that the firm is kept determines the value of stock at the end of the financial period. Stocktaking involves counting the number of units of finished goods, work in progress or raw materials available or in the stores/warehouse/saleroom. The value of stock to the final accounts is then derived by multiplying the cost per unit to the total number of units available. Example. A firm has three products A, B and C whose costs are shs.200, shs.300 and shs.400 each respectively. At the end of year 2002, stocktaking was carried out and the following units were available: Product A 200,000 units Product B 20,000 units Product C 30,000 units Lesson Four 201 Required: Compute the cost of stock to be included in the final accounts. Solution: (200,000 x 200) + (20,000 x300) + (30,000 x 400) = shs.58, 000,000 Cost Formular: The cost of the different units of stock that a firm has should be assigned to each unit as far as the business can be able to identify each item. For those units that the business cannot identify the specific cost due to the number of transactions and changes in the cost price, IAS 2 on inventories recommends the use of the following estimates: (i) First In First Out (FIFO) The business assumes that items of stocks that were purchased first are sold first and therefore, items left as part of closing stock were purchased recently. (ii) Weighted Average Cost (AVCO) Under this method, the cost of each item is determined from the weighted average of the cost of similar items at the beginning of the period and the cost of similar items purchased during the period. (iii) Last In First Out (LIFO) This method assumes that items of stock which were purchased last are sold first and therefore, the closing stock shows items that were bought first. Net Realizable Value (SP- Expenses) This is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. In some cases, the value of stock may decline where below the cost price (either actual or estimated under the different methods) and if the firm was to sell the stock, then it will fetch an amount below this cost. IAS 2 requires that closing stock should be stated at the lower of cost or net realizable value. Example: A firm has a closing stock of Sh 300,000 (cost) out of which stock valued Sh 20,000 is damaged. This stock can fetch the firm Sh 22,000 after repairs and packaging that will cost Sh 4,000. Required: What value will be attached on this damaged units and the total closing stock for the final accounts purposes. Sh Cost 20,000 Selling price 22,000 Repairs 4,000 NRV (22-4) 18,000 202 Adjustment to Final Accounts The NRV (22,000 – 4,000) is lower than the cost of Sh. 20,000 and therefore, this damaged unit will be shown as Sh 18,000. The balance of the stock of Sh 280,000 + 18,000 of the damaged stock will be included in the final accounts and shown together as Sh 298,000. Lesson Four 203 d) WORKSHEETS A work sheet is a simple report that shows the final accounts inclusive of the trial balance in column form. A work sheet has 8-10 columns and the simple headings are as follows: TRIAL BALANC E Dr Cr £ £ ADJUSTMEN T TRADING ACCOUNT Dr Cr £ £ Dr Cr £ £ PROFIT & LOSS ACCOUNT Dr Cr £ £ BALANCE SHEET Assets Liabilities + Capital £ £ Example 5.10 Mr Chai has been trading for some years as a wine merchant. The following list of balances has been extracted from his ledger as at 30 April 19X7, the end of his most recent financial year. £ Capital 83,887 Sales 259,870 Trade creditors 19,840 Returns out 13,407 Provision for bad debts 512 Discounts allowed 2,306 Discounts received 1,750 Purchases 135,680 Returns inwards 5,624 Carriage outwards 4,562 Drawings 18,440 Carriage inwards 11,830 Rent, rates and insurance 25,973 Heating and lighting 11,010 Postage, stationery and telephone 2,410 Advertising 5,980 Salaries and wages 38,521 Bad debts 2,008 Cash in hand 534 Cash at bank 4,440 Stock as at 1 May 19x6 15,654 Trade debtors 24,500 Fixtures and fittings – at cost 120,740 Provision for depreciation on fixtures and fittings – as at 30 April 19X7 63,020 Depreciation 12,074 The following additional information as at 30 April 19X7 is available: 204 Adjustment to Final Accounts (a) (b) (c) (d) (e) Stock at the close of business was valued at £17,750. Insurances have been prepaid by £1,120. Heating and lighting is accrued by £1,360. Rates have been prepaid by £5,435. The provision for bad debts is to be adjusted so that it is 3% of trade debtors. Required: MR CHAI Trial Balance WORKSHEET £ Dr Capital Sales Trade creditors Returns outwards Provision for B debts Discounts allowed Discounts received Purchases Returns Inwards Carriage outwards Drawings Carriage inwards Rent, rates & insurance Heating & lighting Postage, stationery and telephone Advertising Salaries and wages Bad debts Cash in hand Cash at bank Adjustments £ Cr 83,887 £ Dr Trading account £ £ Cr Dr Profit & loss Balance a/c sheet £ £ £ £ Cr Dr Cr Dr 259,87 0 19,840 259,8 70 13,407 13,40 7 19,8 40 512 223 735 2, 306 2,306 1,750 1,750 135,68 0 5,624 135,6 80 5,624 4,562 4,562 18,440 18,44 0 11,830 11,83 0 25,973 11,010 2,410 5,980 38,521 2,008 534 4,440 £ Cr 83,8 87 6,55 5 1,360 19,41 8 12,37 0 2,410 5,980 38,52 1 2,008 534 4,440 Lesson Four Stock at 1 May 19X6 Trade debtors Fixtures & fittings at cost Provision for depreciation Depreciation 15,654 15,65 4 24,500 24,50 0 120,7 40 120,74 0 63,020 63,0 20 12,074 442,28 6 Stocks 30.04.19X7 – asset Stocks 30.04.19X7 – Cost of Sales Insurance prepaid Heating and lighting accrued Rates prepaid Provision for bad debts 205 12,07 4 442,28 6 17,75 0 17,7 50 17,75 0 1,120 1,120 1,36 0 1,36 0 5,435 5,435 223 25,88 8 Gross profit (Balancing figure) 17,75 0 223 25,8 88 122,2 39 291,0 27 122,2 39 291,0 27 Net profit (Balancing figure) 24,11 7 123,9 89 123,9 89 24,1 17 192,9 192, 59 959 Prepare a worksheet for the year to 30 April 19X7 Solution This marks the end of the session on preparing final accounts with adjustments. In the next session we shall prepare the final accounts incorporating these adjustments. Some adjustments will affect the format of final accounts and therefore they will look as follows: 206 Adjustment to Final Accounts FORMAT OF FINAL ACCOUNTS WITH ADJUSTMENTS NAME TRADING, PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 DEC … £ £ £ Sales XX Less (XX) Returns inwards XX Less cost of sales Opening XX stock Purchases XX Add XX carriage in XX Less (XX XX Returns ) out XX Less (XX) (XX) closing stock Gross XX profit Discount XX received Other XX incomes (rent, interests, dividends) Profit on XX disposal of noncurrent assets Reduction XX in provision for doubtful debts Reduction XX in Lesson Four 207 provision for discount allowable Interest on overdue debtors balances XX XX Less Expenses Bad debts Depreciati on: (eg) Plant XX XX XX Motor vehicle Increase in provision for doubtful debts Increase in provision for discount allowable Loss on disposal of non current assets Loss of other assets (eg) stock Interest charged by creditors Other expenses: Rent Insurance Postage Interest XX XX XX XX XX XX XX XX XX (XX) 208 Adjustment to Final Accounts on loan etc NET PROFIT XX BALANCE SHEET AS AT 31 DEC……. Non current assets £ £ £ Land Buildings Plant and machinery Fixtures, furniture and fittings XX XX XX (XX) (XX) XX XX XX XX (XX) XX Motor vehicle XX (XX) XX XX Current assets Stock Debtors Less provision for doubtful debts XX XX (XX) XX Accrued income XX Prepaid expenses XX Cash at bank XX Cash in hand XX XX XX Lesson Four 209 Current liabilities Bank overdraft XX Trade creditors XX Prepaid income XX (XX) Net current assets Net assets X X XX Capital Add net profit XX X X XX (XX) Less drawings XX Non current liabilities Loan X X XX Non current liabilities Loan X X XX Non current liabilities Loan X X XX Non current liabilities Loan X X XX 210 Non current liabilities Adjustment to Final Accounts XX Loan Example 5.11 Given the question 5.10, the final accounts for the year ended 30 April 19X2 will be as follows: Mr Chai Trading and Profit and Loss Account for year ended 30 April 19X7 £ £ £ Sales 259,8 70 Less (5,62 Returns 4) inwards 254,2 46 Less cost of sales Opening 15,654 stock Purchas 135,680 es Add carriage in 147,510 Less (13,407) 134,103 Returns out Cost of 149,757 goods availabl e for sale Less (17,750) (132, closing 007) stock Gross 122,2 profit 39 Add: 1,750 Discoun t receive d 123,9 Lesson Four 211 89 Less Expens es Discoun t allowed Carriag e outward s Rent, rates and insuran ce Heating and lighting Postage , statione ry and telepho ne Advertis ing Salaries and Wages Bad debts Provisio n for bad debts Provisio n for depreci ation – fixtures and fitting Net profit Mr Chai Balance Sheet as at 30 April 19X7 2,306 4,562 19,418 12,370 2,410 5,980 38,521 2,008 223 12,074 99,87 2 24,11 7 212 Adjustment to Final Accounts Non current asset Fixtures and fittings Current assets Stock Debtors Less provision for doubtful debts Prepaym ents Cash at bank Cash in hand Current liabilitie s Creditors Accruals £ £ £ 120,7 40 (63,020) 57,720 17,750 24,50 0 (735) 23,765 6,555 4,440 5 34 53,044 19,84 0 1,360 (21,200) 31,844 89,564 83,887 24,117 Capital Add net profit 108,004 (18,440) Less drawings 89,564 Example 5.12 The following trial balance has been extracted from the ledger of Mr. Yousef, a sole trader. Mr. Yousef Trading and Profit and Loss Account for the year ended 31 May 19X6. £ Sales Purchases Carriage Drawings 82,350 5,144 7,800 £ 138,078 Lesson Four Rent, rates and insurance Postage and stationery Advertising Salaries and wages Bad debts Provision for bad debts Debtors Creditors Cash in hand Cash at bank Stock at at 1 June 19X5 Equipment At cost Accumulated depreciation Capital 213 6,622 3,001 1,330 26,420 877 130 12,120 6,471 177 1,002 11,927 58,000 ______ 216,770 19,000 53,091 216,770 The following additional information as at 31 May 19X6 is available: (a) Rent is accrued by £210. (b) Rates have been prepaid by £880. (c) £2,211 of carriage represents carriage inwards on purchases. (d) Equipment is to be depreciated at 15% per annum using the straight line method. (e) The provision for bad debts to be increased by£40. (f) Stock at the close of business has been valued at £13,551. Required: Prepare a trading and profit and loss account for the year ended 31 May 19X6 and a balance sheet as at that date. Solution: 214 Adjustment to Final Accounts Mr. Yousef Trading and Profit and Loss Account for the year ended 31 May 19X6. £ £ £ Sales 138,078 Less cost of sales Opening stock 11,927 Purchases 82,350 Carriage inwards 2,211 84,561 96,488 Less closing stock (13,551 (82,937 ) Gross profit 55,141 Less expenses Carriage outwards 2,933 Rent, rates and insurance 5,952 Postage and stationery 3,001 Advertising 1,330 Salaries and wages 26,420 Bad debts 877 Increase in provision for bad 40 debts Depreciation – equipment 8,700 (49,253 Net profit 5,888 Mr. Yousef Balance Sheet as at 31 May 19X6. Non Current assets Equipment Current Assets Stocks Debtors Less provision for doubtful debts Prepayments Cash in hand Cash at bank Current Liabilities Creditors Accruals Capital Add: Net Profit Less Drawings £ £ £ 58,000 (27,700) 30,300 13,551 12,120 (170) 11,950 880 177 1,002 27,560 6,471 210 6,681 20,879 51,179 53,091 5,888 58,979 (7,800) Lesson Four 215 51,179 216 Adjustment to Final Accounts Example 5.13 The following trial balance has been extracted from the ledger of Herbert Howell, a sole trader, as at 31 May 20X9, the end of his most recent financial year. Herbert Howell Trial Balance As At 31 May 20x9 Property at cost Equipment at cost Provision for depreciation (as at 1 June 20X8) Property Equipment Stock as at 1 June 20X8 Purchases Sales Discounts allowed Discounts received Wages and salaries Bad debts Loan interest Carriage out Other operating expenses Trade debtors Trade creditors Provision for bad debts Cash on hand Bank overdraft Drawings 13% loan Capital, as at 1 June 20X8 Dr £ 90,000 57,500 Cr £ 12,500 32,500 27,400 259,600 405,000 3,370 4,420 52,360 1,720 1,560 5,310 38,800 46,200 33,600 280 151 14,500 28,930 ______ 612,901 12,000 98,101 612,901 The following additional information as at 31 May 20X9 is available: (a) Stock as at the close of business was valued at £25,900. (b) Depreciation for the year ended 31 May 20X9 has yet to be provided as follows: Property 1% using the straight-line method Equipment - 15% using the straight-line method (c) Wages and salaries are accrued by £140. (d) Other operating expenses include certain expenses prepaid by £500. Other expenses included under this heading are accrued by £200. (e) The provision for bad debts is to be adjusted so that it is 0.5% of trade debtors as at 31 May 20X9. (f) Purchases include goods valued at £1,040, which were withdrawn by Mr Howell for his own personal use. Required: Lesson Four 217 Prepare Mr. Howell’s trading and profit and loss account for the year ended 31 May 20X9 and his balance sheet as at 31 May 20X9. (20 marks) Solution: £ Sales Less cost of sales Opening stock Purchases Less closing stock Gross profit Discounts received Decrease in provision for bad debts 27,400 258,560 285,960 (25,900) £ 405,000 (260,060) 144,940 4,420 ____49 149,409 Less expenses Depreciation: Property Equipment Discounts allowed Wages and salaries Bad debts Loan interest Carriage out Other operating expenses NET PROFIT 900 8,625 3,370 52,500 1,720 1,560 5,310 38,500 (112,485) 86,924 Herbert Howell Balance Sheet as at 31 May 2000 £ £ £ Non current Assets Property Equipment 90,000 57,500 147,50 0 (13,400) (41,125) 54,525 Current Assets Stock Debtor Less provision Prepayments Cash in hand Current liabilities Bank overdraft 25,900 46,200 (231) 14,500 45,969 500 151 72,520 76,600 16,375 92,975 218 Adjustment to Final Accounts Creditors Accruals 33,600 __340 (48,440) 24,080 117,055 98,101 36,924 135,025 (29,975) 105,055 Capital Add net profit Less drawings Non current liabilities Loan (13%) Workings: 1) Depreciation for: Property Equipment 12,000 117,055 1% X 90,000 15% X 57,500 = = 900 8,625 2) Provision for bad debts 0.5% X (46,200) =231 Decrease in provision for bad debts 280 – 231= 49 3) Wages and salaries Paid 52,360 Accruals 140 52,500 4) Other operating expenses Paid 8,800 Pre-paid (500) 8,300 Accruals 200 8,500 5) Purchases: Drawings: 259,600 – 1,040 28,930 + 1,040 = = 258,560 29,990 Lesson Four 219 REINFORCEMENT QUESTIONS QUESTION ONE David Dolgellau, a sole trader has prepared the following balance as at 31 March 2001 £ Sales Discount Received Rent Received Returns outwards Creditors Bank Overdraft Capital Purchases Salaries and Wages Office expenses Insurance premiums Electricity Stationery Advertising Telephone Business Rates Discounts allowed Returns Inwards Stocks as at 1 April 2000 Warehouse, shop and office Fixtures and fittings Debtors Cash in till Drawings 378,500.00 2,400.00 7,500.00 7,700.00 18,700.00 30,000.00 287,500.00 261,700.00 45,700.00 8,400.00 3,100.00 1,600.00 6,200.00 8,400.00 2,100.00 7,500.00 600.00 4,100.00 120,600.00 210,000.00 12,800.00 13,000.00 500.00 26,000.00 The following further information was obtained: • • • • • Closing stock was £ 102,500.00 Electricity charges accrued £ 700.00 Advertising expenses accrued £ 500.00 Insurance premiums paid in advance £ 900.00 Business rates prepaid £ 1,500.00 Required: Prepare a trial balance, trading, profit and loss account for the year ended 31 March 2001 and balance sheet as at that date. 220 Adjustment to Final Accounts QUESTION TWO Donald Brown, a sole trader, extracted the following trial balance on 31 December 20X0. TRIAL BALANCE AS AT 31 DECEMBER 20X0 Debit £ Capital at 1 January 20X0 Debtors Cash In Hand Creditors Fixtures and fittings at cost Discounts allowed Discounts received Stock at 1 January 20X0 Sales Purchases Motor Vehicles at cost Lightning and heating Motor expenses Rent General expenses Balance at bank Provision for depreciation Fixtures and fitting Motor vehicles Drawings Credit £ 26,094 42,737 1,411 35,404 42,200 1,304 1,175 18,460 491,620 387,936 45,730 6,184 2,862 8,841 7,413 19,861 _26,568 591,646 2,200 15,292 _______ 591,646 The following information as at 31 December is also available: a) £218 is owing for motor expenses. b) £680 has been prepaid for rent. c) Depreciation is to be provided of the year as follows: Motor vehicles: 20% on cost Fixtures and fittings: 10% reducing balance method d) Stock at the close of business was valued at £19,926. Required Prepare Donald Brown’s trading and profit and loss account for the year ended 31 December 20X0 and his balance sheet at that date. Lesson Four 221 QUESTION THREE The following trial balance has been extracted from the accounts of Brenda Bailey, a sole trader. Brenda Bailey Trial Balance As At 30 June 20x9 Dr £ Sales Purchases Carriage inwards Carriage outwards Wages and salaries Rent and rates Heat and light Stock at 1 July 20X8 Drawings Equipment at cost Motor vehicles at cost Provision for depreciation: Equipment Motor vehicles Debtors Creditors Bank Sundry expenses Cash Capital Cr £ 427,726 302,419 476 829 64,210 12,466 4,757 15,310 21,600 102,000 43,270 22,250 8,920 50,633 41,792 3,295 8,426 477 ______ 626,873 122,890 626,873 The following information as at 30 June 20X9 is also available. a) b) c) d) £350 is owing for heat and light. £620 has been prepaid for rent and rates. Depreciation is to be provided for the year as follows: Equipment - 10% on cost Motor vehicles - 20% on cost Stock at the close of business was valued at £16,480 Required Prepare Brenda Bailey’s trading and profit and loss account for the year ended 30June 20X9 and her balance sheet at that date. 222 Adjustment to Final Accounts QUESTION FOUR On 10 January 19X9, Frank Mercer received his monthly bank statement for December 19X9. The statement showed the following. MIDWEST BANK F Mercer: Statement of Account Date Particulars 19X8 Dec 1 Balance Dec 5 417864 Dec 5 Dividend Dec 5 Bank Giro Credit Dec 8 417866 Dec 10 417867 Dec 11 Sundry Credit Dec 14 Standing Order Dec 20 417865 Dec 20 Bank Giro Credit Dec 21 417868 Dec 21 416870 Dec 24 Bank charges Dec 27 Bank Giro Credit Dec 28 Direct Debit Dec 29 417873 Dec 29 Bank Giro Credit Dec 31 417871 Debits $ Credits $ 243 26 212 174 17 32 307 185 95 161 18 118 88 12 47 25 279 Balance $ 1,862 1,619 1,645 1,857 1,683 1,666 1,851 1,819 1,512 1,630 1,535 1,374 1,356 1,403 1,315 1,303 1,582 1,557 Lesson Four 223 His cashbook for the corresponding period was as follows. CASH BOOK 19x8 Dec 1 Dec 9 Balance b/d J Shannon M Lipton Dec Dec Dec Dec Dec G Hurst M Evans J Smith V Owen K Walters Dec 4 19 26 27 29 30 $ 19x8 1,862 Dec 1 212 Dec 2 185 Dec 5 118 47 279 98 134 Dec Dec Dec Dec Dec Dec Dec 6 10 14 16 20 21 22 Dec 31 _____ Cheque No Electricity P Simpson D Underhill A Young T Unwin B Oliver Rent M Peters L Philips W Hamilton Balance c/d $ 243 864 865 307 866 174 867 868 869 870 871 872 873 17 95 71 161 25 37 12 1,793 2,935 2,935 Required a) b) Bring the cash book balance of $1,793 up to date as at 31 December 19X8. (10 marks) Draw up a bank reconciliation statement as at 31 December 19X8 (5 marks) CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK Acknowledgement 224 LESSON SIX OTHER ASPECTS OF FINAL ACCOUNTS (a)INCOMPLETE RECORDS An incomplete record situation is whereby, the accounting system falls short of the double entry. This may be due to: − Lack of records at all; or − Insufficient records that will facilitate the preparation of final accounts. Reasons for incomplete records: a) Managers or owners may not have the skills or expertise in preparing and maintaining an accounting system (records and procedures). b) It may not be economical for the business to maintain accounting records due to the volume or/and nature of transactions (small scale businesses) c) Records are destroyed (e.g. through fire), stolen or misplaced. There are 4 main approaches in preparing final accounts where there are insufficient records. a) Estimating income from the net assets. b) Estimating income from the use of ratios. c) Use of a simple cashbook and bank statement. d) Use of control accounts. N/B: approach number c and d are normally used together. (a) Estimating Income from the Net Assets Where the available records are so deficient (i.e. it is impossible to compile a reasonable complete cash summary, the only method of estimating the profits or loss for the period, is to prepare statement of affairs showing the net worth of the business at the beginning and at the end of the period. The profit/loss is estimated by use of the following formulas: Profit or loss = Closing Capital – Opening Capital + Drawings – Additional Capital Or where there are no non current liabilities then this optional formula can be used Profit or loss = Closing Additional Net Asset - Opening Net Asset + Drawings Capital Lesson Five 225 Example: 6.1 A sole trader’s capital position is as follows: 31 December Motor vehicle: Cost Depreciation Stock Debtors Bank Cash Creditors Net assets 19X2 £ 19X3 £ 7,500 3,000 4,500 2,960 1,150 925 __263 9,798 2,860 6,938 7,500 4,500 3,000 3,450 2,060 2,125 ___54 10,689 3,340 7,349 He has estimated his drawings for 19X3 at £12,500. Estimate his net profit for the year. Solution: Net profit = Closing Net Asset Net Asset - Opening + Drawings Net assets - Additional = 7,349 – 6,938 + 12,500 = £12,911 (b) Use of Ratios There are 3 important ratios to be looked at: 1) Gross profit margin 2) Mark up 3) Stock turnover If a firm has a uniform Gross Profit for all the items sold then any information available on sales or purchases can be used to derive the total Gross Profit for the period and incase there is sufficient information on expenses, then the Net Profit can also be derived. The above ratios are computed as follows: 1) Gross Profit Margin = Gross Profit x 100 Sales (selling price) E.g. If the selling price of a unit is £100 and Gross Profit made per unit is £25, the Gross Profit Margin will be: = 25 x 100 100 226 Further Adjustments to Accounts = 25% Lesson Five 227 If a firm sells 1,000 units in a financial period, then the Gross Profit will be: = 25% (£100,000) = £25,000 2) Mark up = Gross Profit x 100 Cost of Sales (cost price per unit) In the above example, the mark up will be: = 25 x 100 75 = 33.33% N/B: 75 = 100 – 25 Cost = selling price – gross profit 3) Stock Turnover Measures the rate at which a firm uses its stocks to make sales or turnover. The formula is: Average stock = Cost of Sales Average Stocks expressed as number of times = Opening Stock + Closing Stock 2 Example: A firm has the following data for the period: Opening stock Purchases Closing stock £ 20,000 £300,000 £ 30,000 Required: The Stock Turnover Ratio. Average Stock = 30,000 + 20,000 2 = 25,000 Cost of sales = (20,000 + 300,000) – 30,000 = 290,000 Stock Turnover = 300,000 25,000 228 Further Adjustments to Accounts = 11.6 times Example 6.2 M Jones gives you the following information as at 30 June 2002 £ Stock 1 July 2001 6,000 Purchases 54,000 Jones’s mark-up is 50% on cost of goods sold. His average stock during the year was £12,000. Draw up a trading and profit and loss account for the year ended 30 June 2002. a) Calculate the closing stock as at 30 June 19X7. b) State the total amount of profit and loss expenditure Jones must not exceed if he is to maintain a net profit on sales of 10%. Solution a) Average Stock = Opening Stock + closing stock 2 12,000 = 6,000 + C 2 C = 24,000 – 6,000 = 18,000 Gross profit = 50% Cost of Sales = 42,000 Gross Profit = 50% 42,000 Gross Profit = 21,000. MEMORANDUM TRADING ACCOUNT Sales Less cost of sales Gross profit Expenses Net profit £ 63,000 (42,000) 21,000 (14,700) 6,300 Example 6.3 W White’s business has a rate of turnover of 7 times. Average stock is £12,600. Trade discount (i.e. margin allowed) is 33¼% off all selling prices. Expenses are 66 ¾% of gross profit. You are to calculate: (a) Cost of goods sold. Lesson Five (b) (c) (d) (e) Gross profit margin. Turnover. Total expenses. Net profit. 229 230 Further Adjustments to Accounts Solution: Profit schedule Turnover Cost of goods sold Gross profit Expenses Net profit £ 132,300 88,200 44,100 (29,400) 14,700 Turnover = Cost of Sales Average stock Margin = Gross Profit Sales 7 = Cost of Sales 12,600 Cost of Sales = 88,200 (c) Use of Cashbook and Bank Statement (in addition) Control Accounts. If there is sufficient information relating to cash payments and receipts, then a simple cashbook for both cash in hand and cash at bank can be prepared in confirmation of deposits and payments made from the bank statement. The information can then be posted to the relevant accounts e.g. any income received to the relevant income accounts, expenses to relevant expense accounts and assets and liabilities to relevant accounts. Information relating to amounts owed to suppliers/creditors and amounts due from debtors can be posted in summary to the control accounts. The preparation of the cashbook and control accounts will enable one to estimate any cash sales or credit sales and cash purchases or credit purchases. Steps in Preparing the Final Accounts 1) Prepare a statement of affairs at the beginning of the period (a list of all assets and liabilities) to determine the beginning capital. 2) Open and post the balances and transactions to these 3 relevant accounts (i.e. the cashbook (for both cash in hand and bank), sales ledger control account and purchases ledger control account. Any other account can be opened where necessary. 3) Make adjustments for any accruals or prepayments. 4) Extract a list of the balances. (Trial balance). 5) Prepare the final accounts. Example 6.4 Hobbs does not keep proper books of account. You ascertain that his bank payments and receipts during the year to 31 December 19X8 were as follows: Lesson Five 231 Reciepts Balance 1 Jan 19X8 Cheques for sales Cash banked Balance 31 Dec 19X8 Payments £ £ 572 Purchases 10,007 13,17 Expenses 9 14,00 Drawings 5 3,751 Delivery van 31,50 7 2,950 11,250 7,300 31,507 From a cash notebook you ascertain: £ 62 Cash in hand 1 January 19X8 Cash takings Purchases paid in cash Expenses paid in cash Cash in hand 31 December 19X8 Drawings by proprietor in cash 16,300 1,850 375 65 Unknown You discover that assets and liabilities were as follows: 1 Jan 19X8 Debtors Trade creditors Stock on hand £ 1,850 1,250 2,650 31 Dec 19X8 £ 2,070 1,420 2,990 Depreciation on the van is to be provided at the rate of 20% per annum. Statement of Affairs as at 1 January 19x8 £ CURRENT ASSETS Cash at bank Cash in hand Debtors Stock 572 62 1,850 2,650 5,134 CURRENT LIABILITIES Creditors Net Assets (1,250) 3,884 232 Further Adjustments to Accounts Capital 3,884 Balance b/d Sales Sales Ledger Control Account £ £ 1,850 Cash 16,300 Takings 29,69 Bank 13,179 9 ______ Bal c/d 2,070 31,54 31,549 9 Lesson Five 233 Purchases Ledger Control Account £ £ Cash purchases 1,850 Bal b/d 1,250 Bank 10,00 Purchases 12,027 7 13,27 13,277 7 Cash in Hand Account £ Balance b/d 62 Creditors Debtors/sales 16,30 Expenses 0 Bank Bal c/d _____ Drawings 16,36 2 • • £ 1,850 375 14,005 65 ___67 16,362 The capital invested at any point of time in a business by the owner is represented by the difference between the assets and liabilities at that time. The difference between the capital at the end and the capital at the beginning of the trading period represents the trading profit made during that period, unless there were withdrawals or investments of additional capital. Hobbs Trading and Profit and Loss Account for the year ending 31 December 19X8 £ £ Sales 29,699 Less cost of goods sold: Opening stock 2,650 Add purchases 12,027 14,677 Less closing stock (2,990) 11,687 GROSS PROFIT 18,012 Less Expenses: Expenses (375 + 2,950) 3,325 Depreciation 1,460 (4,785) NET PROFIT 13,227 234 Further Adjustments to Accounts Fixed Assets Delivery van Hobbs Balance Sheet as at 31 December 19X8 £ £ £ Cost Depreciation NBV 7,300 1,460 5,840 Current Assets Stock Debtors Cash Less current liabilities Creditors Bank overdraft 2,990 2,070 ___65 5,125 1,420 3,751 5,171 5,794 Financed by: Capital Add net profit Less drawings (11,250 + 67) 3,884 13,2 27 17,111 11,317 5,794 Example 6.5 (Exam Type Questions May 2001 Question 3) Kimeu commenced his business of making furniture on 1 April 2000. Due to his limited accounting knowledge he has not maintained proper books of account. You have been engaged to examine his records and prepare appropriate accounts there from. You perform an examination of the records and from interviews with Kimeu you ascertain the following information. 1. 2. 3. 4. 5. 6. At the commencement of business on 1 April 2000, he deposited Sh 1,200,000 into business bank account. On the same day he brought into the firm his pickup and estimated that it was worth Sh 660,000 and then that from 1 April 2000 it will have useful life of three years. To increase his working capital he borrowed Sh 400,000 at 15% interest per annum on 1 July 2000 from his sister but no interest has yet been paid. On 1 April 2000, Sally was employed as a clerk at a salary of Sh. 720,000 per annum. He had drawn Sh 18,000 per week from the business account for private use during the year. He purchased timber worth Sh 1,960,000 out of which Sh 158,000 worth of stock was retained in the workshop on 31 March 2001. He also spent Sh 960,000 on the purchase of some equipment at the commencement of the business which he estimates will last him five years. Electricity bills received up to 31 January 2001 were Sh 240,000. Bills for the remaining two months were estimated to be Sh 48,000. Motor vehicle expenses were Sh 182,000 while general expenses amounted to Sh 270,000 for the year. Lesson Five 7. 8. 9. 235 Insurance premium for the year to 30 June 2001 was Sh 160,000. All these expenses have been paid by cheque. Rates for the year to June 2001 were Sh 36,000 but these had not been paid. Sally sent out invoices to customers for Sh 6,178,000 but only Sh 5,080,000 had been received by 31 March 2001. Debt totaling to Sh 17,000 were abandoned during the year as bad. Other customers for jobs too small to invoice have paid Sh 726,000 in cash for work done of which Sh 560,000 was banked. Kimeu used Sh 75,000 of the difference to pay for his family’s foodstuff, bought Kenya Charity Sweepstake tickets worth 24,000 and Sally used the rest on general expenses except for Sh 30,100 which was left in the office on 31 March 2001. You agree with Kimeu that he will pay you Sh 55,000 for accountancy fee. Required: (a) Profit and loss account for the year ended 31 March 2001. marks) (b) Balance sheet as at 31 March 2001. marks) (10 (10 (Total: 20 marks) Solution: Capital Loan Debtors Cash Bal c/d Cash Sh 1,200,00 0 400,000 5,080,00 0 560,000 book – Bank Salary Drawings Timber Equipment Electricity Motor vehicle expenses General expenses Insurance ________ Bal c/d 7,240,00 0 Capital Sh Bank 1,860,00 Pick up 0 1,860,00 0 Debtors Sh Sh 120,000 936,000 1,960,000 960,000 240,000 182,000 270,000 160,000 1,812,000 7,240,000 Sh 1,200,000 660,000 1,860,000 Sh 236 Further Adjustments to Accounts Sales Sales 6,178,00 Bank 0 Bad debts ________ Bal c/d 6,178,00 0 Cash book - cash in hand Sh 726,000 Bank Drawings Drawings General Expenses ______ Bal c/d 726,000 5,080,000 17,000 1,081,000 6,178,000 Sh 5,080,000 17,000 1,081,000 36,900 30,100 726,000 Lesson Five 237 Loan interest = 400,000 x 15% x 9/12 Rates = 36,000 x 9/12 = Accruals = Electricity bills Rates = Agency fees = Loan interest = 48,000 27,000 55,000 = 45,000 175,000 27,000 Kimeu Profit and Loss Account For the year ended 31 March 2001 Sh Sh Sales (cash + credit) 6,904,000 Less expenses Timber used (1,960,000 – 1,802,000 158,000) Depreciation – motor vehicle 220,000 - Equipment 192,000 Loan interest 45,000 Salary 720,000 Electricity bills 288,000 Motor vehicle expenses 182,000 General expenses 306,900 Insurance premium 120,000 Rates 27,000 Bad debts 17,000 Accountancy fees 55,000 (3,974,900) Net profit 2,929,100 238 Further Adjustments to Accounts Non current Asset Equipment Motor vehicle Kimeu Balance Sheet as at 31 March 2001 Sh Sh 960,000 192,000 660,000 220,000 1,620,000 412,000 Current Assets Stock Debtors Insurance – prepayments Cash at bank Cash in hand Sh 768,000 440,000 1,208,000 158,000 108,000 40,000 181,200 30,000 3,121,100 Less current liabilities Accruals 175,000 Capital Add net profit 2,946,100 4,154,100 1,860,000 2,929,100 4,789,100 1,035,000 3,754,100 Less drawings Non current liability Loan 15% 400,000 4,154,100 Example 6.6 (Exam Type) June 1995 Question 2 Abi, a proprietor of a grocery and general store has not previously engaged an accountant. He informs you that this year his bankers have insisted on a proper set of accounts. Abi supplies you with his trading results for the year ended 30 June 1994 which are as follows: Payments for goods Payments for expenses Profits Sh 4,747,50 Takings 0 565,000 152,500 5,465,00 0 Sh 5,465,000 ________ 5,465,000 Abi instructs you to examine his records and prepare accounts. From your examination of the records and interview with your client, you ascertain the following information: 1. The takings are kept in a drawer under the counter; at the end of each day the cash is counted and recorded on a scrap of paper; at irregular intervals Mrs. Abi transcribes the figures into a notebook; a batch of slips of paper was inadvertently destroyed before the figures had been written into the notebook, Lesson Five 2. 239 but Mr. And Mrs. Abi carefully estimated their takings for that period, and the estimated figure is included in the total of Sh. 5,465,000. Mr. Abi involved himself in betting for 30 weeks of the year, spending Sh. 500 per week with cash taken from the drawer. His winnings totaled Sh. 29,500. 3. The following balances are ascertained as correct: 30 June 1994 1993 Sh Sh Cash in hand 43,500 22,500 Balance at bank 109,500 78,000 Sales debtors 245,500 229,000 Creditors for purchases of 121,500 139,500 stock Stock at cost 950,000 975,000 4. Debts totaling Sh. 178,000 were abandoned during the year as bad; the takings included Sh 12,500 recovered in respect of an old debt abandoned in the previous year. Mr. Abi rents the shop for living accommodation at Sh. 1,500 per week for 52 weeks in a year; the rent is included in expenses of Sh 565,000. The living accommodation comprises one-third of the building. The total expenses also include: 5. 6. • • • 7. 8. 9. 10. 11. 12. 13. Sh. 17,500 running expenses of Abi’s private car; Sh. 30,000 for exterior decoration of the whole premises; Sh. 80,000 for alterations to the premises to enlarge the storage accommodation. Mr. Abi takes Sh. 5,000 per week from the business for his wife’s personal expenses. This excludes the amount indicated in note 8. Mr. Abi draws Sh. 750 per week for cigarettes and beer. During the year, Mr. Abi bought a secondhand car (not for use in the business) from a friend; the price agreed was Sh. 175,000, but as the friend owed Mr. Abi Sh. 33,500 for goods supplied from the business, the difference was settled by cheque. An insurance policy for Mr. Abi’s life matured and realized Sh. 320,500. Mr. Abi cashed a cheque for Sh. 50,000 for a friend; the cheque was dishonored and the friend is repaying the Sh. 50,000 by installments. He had paid Sh. 20,000 by 30 June 1994. Other private payments by cheque totaled Sh. 48,000 plus a further sum of Sh. 55,000 for income tax. You are to provide Sh. 21,000 for accountancy fees. N.B. All receipts and payments of Mr. Abi are made through his business account. Required: 240 Further Adjustments to Accounts (a) Mr. Abi’s balance sheet for the business at 30 June 1993. (4 marks) (b) Mr. Abi’s profit and loss account for the year ended 30 June 1994. (12 marks) (c) Mr. Abi’s balance sheet for the business at 30 June 1994. (6 marks) (Total: 20 marks) Lesson Five 241 Solution: Abi Balance Sheet as at 30 June 1993 Current Assets Stock Debtors Cash at bank Cash in hand Current liabilities Creditors Sh 97,500 229,00 0 78,000 22,500 1,304,5 00 Sh (139,50 0) 1,165,0 00 1,165,0 00 Capital Balance b/d Sales ledger control a/c Insurance (drawings) Drawings Drawings Debtors 1,165,0 00 Cash at Bank Sh 78,000 Drawings – personal expense for wife 12,500 Drawings – cigarettes and beer 320,500 Expenses 50,000 Drawings – second hand car 20,000 Cash in hand 5,591,00 Drawings – friend 0 Creditors Dishonored cheque – drawings Drawings Income tax ________ Balance c/d 6,072,00 0 Cash in Hand Balance b/d Drawings – betting Bank Sh 22,500 12,500 6,500 Drawings Sh 15,000 Balance c/d 43,500 Sh 260,000 39,000 565,000 141,500 6,500 50,000 4,747,500 50,000 48,000 55,000 109,500 6,072,000 242 Further Adjustments to Accounts 58,500 Balance b/d Bad debts recovered Credit sales Bank Balance c/d Rent Motor running expenses Decoration Alterations Other expenses 58,500 Sales Ledger Control A/c Sh Sh 229,000 Bad debts 178,000 12,500 Bank 12,500 5,819,00 Drawings 33,500 0 Bank 5,591,000 ________ Balance c/d 245,500 6,060,50 6,060,500 0 Purchases Ledger Control A/c Sh Sh 4,747,50 Balance c/d 139,500 0 121,500 Credit 4,729,500 purchases 4,869,00 4,869,000 0 Total 78,000 17,500 Expenses Business 52,000 - 30,000 80,000 359,500 565,000 20,000 80,000 359,500 532,500 Private 26,000 17,500 10,000 _____ 53,500 Abi Trading Profit and Loss Account for the year ended 30 June 1994 £ £ Sales 5,819,000 Less cost of sales Opening stock 975,000 Purchases 4,729,500 57,040,500 Less closing stock 950,000 4,754,500 Gross profit 1,064,500 Less expenses Rent 52,000 Decoration 20,000 Alterations 80,000 Other expenses 359,500 Bad debts 165,500 Lesson Five 243 Accountancy fees Net profit Current Assets: Stock Debtors Cash at bank Cash in hand Current Liabilities Creditors Accruals Capital Add net profit Less drawings 21,000 (698,000) 366,500 Abi Balance Sheet as at 30 June 1994 Cost Depreciatio Book Value n £ £ £ 950,000 245,500 109,500 43,500 1,348,500 121,500 21,000 (142,500) 1,206,000 1,165,000 366,500 1,531,500 (325,500) 1,206,000 NON PROFIT MAKING ORGANIZATIONS (Club, Associations and Others) These are some form of organizations that are set up to promote or to cater for the welfare of the members involved and not to make a profit. These include clubs, (e.g. football clubs, sports clubs), welfare associations and any other societies (charitable institutions). Because these organizations are not trading, the types of accounts to prepare are different from the ones of trading organizations. Example: 1. 2. 3. Instead of a cashbook, the clubs will maintain a receipts and payments which has similar entries to those of a cashbook. Instead of profit and loss account, we have an income and expenditure account. Because the club is not formed by any one owner (has no owner), it is funded by members’ contributions, donations, income from investments to get an accumulated fund instead of capital. From the income and expenditure account, if the incomes are more than the expenditures for the period, then the club has a surplus and not a net profit. If the expenditure is more than incomes, then the club has a deficit and not a loss. The club may carry out some trading activities on a small scale to finance some of the clubs activities and incase a firm has a trading activity, then in addition to the income and expenditure account and the balance sheet, prepare a Bar Trading Account. 244 Further Adjustments to Accounts Format of the Final Accounts Name Income and Expenditure Account for the year ended 31 December …… Incomes £ £ Profit from trading activities XX Subscriptions XX Income from investments XX Donations XX Income from other activities [dinner dance, raffles, festivals] XX XX Expenditure Depreciation XX Salaries and wages XX Expenses on other activities [prizes] XX Loss from trading activities XX All other expenses XX SURPLUS/( DEFICIT ) (XX) XX/(XX) Lesson Five BALANCE SHEET Non current Assets Buildings Fixtures, fittings and equipment Motor vehicle 245 NAME AS AT 31 DECEMBER …… £ £ £ XX (XX) XX XX (XX) XX XX XX Investments Current Assets Stocks Debtors Prepayments and accrued income Cash at bank/hand (receipts + payments) (XX) (XX) XX XX XX XX XX XX XX XX Current liabilities Creditors Accrued expenses and prepaid income Bank overdraft XX XX XX (XX) Accumulated fund balance b/f Add/less surplus / deficit Other funds Life membership fund Building fund Education fund XX XX XX XX XX XX XX/(XX) XX XX Notes To The Above Format: 1. Subscriptions: These are the amounts received by the club from the members to renew their membership. It is often paid on an annual basis. • • • • It is income for the club and therefore reported in the income and expenditure account. Depending on the policy of a club, any subscriptions due but not received are shown as accrued income (debtors for subscriptions) in the balance sheet. Any amounts prepaid are shown as prepaid (creditors for subscriptions). Some clubs will not report subscriptions as income until it is received in form of cash. 2. Income from Investments: Some clubs invest excess cash in the bank (fixed deposit account), shares of limited companies, treasury bills and any other investment that may be available. 246 • • Further Adjustments to Accounts If the club is investing with no specific intention (i.e a general investment) then income from this investment should be reported in the income and expenditure account. If the investment is for a specific purpose and relates to a specific fund (e.g building fund) it will not be reported in the income and expenditure account but credited directly to the fund. 3. Other funds • These are funds set up for a specific purpose and not general. They will be shown together with the accumulated fund. • Any incomes relating to these funds, will be credited directly to the funds and any expenses will be taken off from these funds e.g. building fund, education fund. Life Membership Fund Some members may pay some amount to become life members of the club and if this happens, there may be a need to spread out this income over the expected life of the members in the club. Depending on the policy of a club, the following accounting treatment may be allowed: i. The full amount is reported in the Income and Expenditure account in the year it is received and therefore no balance is retained in the life membership account. ii. The amount is shown separately in the life membership fund with no transfer in the Income and Expenditure account and hence no balance in the life membership account. iii. To transfer some amounts from the life membership funds to the income and expenditure account over the expected life of membership to the club. Example 6.7 The following is the receipts and payments account of the Friendship Club for the year ended 31 December 19X1: £ £ Balance at bank 31 December 19X0 Entrance fees Subscriptions: 19X0 19X1 19X2 Bar Sales Sale of investments 102 Bar purchases 42 Wages 25 Rent 305 Heating and lighting 35 Postage and stationery 5,227 Insurance 750 General expenses Payments on 4,434 416 186 128 33 18 46 Lesson Five 247 account of new furniture Balance at bank, _____ 31 December 19X1 6,486 450 775 6,486 The following information is also supplied: (1) 31 December 19X0 Bar stock, at cost Creditors for bar purchases Rent due Heating and lighting expenses due Subscriptions due Insurance paid in advance 31 December 19X1 272 306 18 16 25 5 315 358 36 19 40 7 2) On 31 December 19X0, the club held investments which cost £500. During the year ended 31 December 19X1, these were sold for £750. 3) Furniture was valued at £300 on 31 December 19X0. On June 19X1, the club purchased additional furniture at a cost of £520. Depreciation of all furniture is to be provided for at the rate of 10% per annum. Required: (a) Prepare an income and expenditure account for the year ended 31 December 19X1. (b) Prepare a balance sheet at that date. Solution: Friendship Club Accumulated Fund As at 1.1.19X1 Assets £ Stock Subscriptions due Insurance prepaid Investments Furniture Balance at bank Liabilities Creditors £ 272 25 5 500 300 102 1,204 306 248 Further Adjustments to Accounts Rent due Heating and lighting expenses Accumulated fund Receipts and payments Balance c/d Balance b/d Income & expenditure Balance c/d Creditors £ 4,434 Balance b/f 358 Purchases 4,792 Subscriptions £ 25 Receipts & payments 345 35 Balance c/d 405 18 16 (340) 864 £ 306 4,486 4,792 £ 365 40 405 Lesson Five 249 Friendship Club Bar, Trading Account for the year ended 31 December 19X1 £ Sales £ 5,227 Less: Cost of Sales Opening stock Purchases 272 4,486 4,758 Less closing stock Gross profit to income & expenditure a/c (315) (4,443) 784 Friendship Club Income and Expenditure Account for the year ended 31 December 19X1 £ £ Profit from bar trading 784 Entrance fees 42 Subscriptions 345 Profit from sale of investments 250 1,421 Expenditure Wages 416 Rent 204 Heating and lighting 131 Postage and stationery 33 Insurance 16 General expenses 46 Depreciation – furniture 56 (902) Surplus 519 250 Further Adjustments to Accounts Friendship Club Balance Sheet as at 31 December 19X1 Non current Assets £ £ Furniture 820 (56) Current Assets Stock Subscriptions due Prepaid expense Cash at bank Current liabilities Creditors Prepaid subscriptions Accrued expenses Creditors fixtures Accumulated fund b/f Add surplus £ 764 315 40 7 775 1,137 398 35 55 70 (518) 619 1,383 864 519 1,383 Example 6.8 (Exam Type) November 2001 (a) State and briefly explain any three distinguishing features between (i) a receipts and payments account and (ii) an income and expenditure account. (6 marks) (b) The accountant of Mamba Sports Club has extracted the following information from the books of account for the year ended 31 March 2001. Lesson Five 251 Receipts Payments Sh Balance brought forward 288,000 Salaries and wages Subscriptions Year: 1999/2000 2000/2001 2001/2002 Sh New equipment 254,000 565,000 249,000 Repairs and maintenance 124,000 2,050,000 Office expenses 415,000 194,000 Printing and stationery 168,000 Dinner dance 723,000 Purchase of beverages 497,000 Beverage sales 657,000 Dinner dance expenses 315,000 Investments income 400,000 Refund of subscriptions 45,000 Sports prizes 25,000 Transport Investments _______ Balance carried forward 248,000 1,500,000 _405,000 4,561,000 4,561,000 31 March 2000 31 March 2001 Furniture and fittings (net) 240,000 - Equipment (net) 690,000 - Balances as at 252 Further Adjustments to Accounts Investment at cost 3,500,000 - 300,000 375,000 68,000 72,000 162,000 184,000 85,000 - Subscriptions in arrears Salaries accrued Stock of beverages Subscriptions in advance Additional information: 1. 2. 3. Subscriptions in arrears are written-off after twelve months. Depreciation is provided for on reducing balance method at 10% and 20% per annum on furniture and fittings and equipment respectively. Investments, which had cost Sh. 500,000, were sold on 30 March 2001 for Sh. 625,000. No entries have been made in the books in this respect. Required: (a) Income and expenditure account for the year ended 31 March 2001. (8 marks) (b) Balance sheet as at 31 March 2001. (6 marks) (Total: 20 marks) Solution: Mamba Sports Club Statement of Affairs Assets Sh Sh Furniture and fittings 240,000 Equipment 690,000 Receipts and payments 288,000 Investment at cost 3,500,000 Subscriptions in arrears 300,000 Stock of beverages 162,000 5,180,000 Liabilities Subscriptions accrued 85,000 Lesson Five Accrued salaries 253 68,000 (153,000) 5,027,000 254 Further Adjustments to Accounts Mamba Sports Club Trading Account for the year ended 31.3.2001 Sh Sales Less cost of sales Opening stock 162,000 Purchases 497,000 659,000 Less closing stock (184,000) Profit to income and expenditure 2001 Balance b/d Receipts and payments Income & expenditure Balance c/f Sh 300,000 45,000 2,465,000 194,000 3,004,000 Subscriptions 2001 Balance b/f Receipt and payment Income & expenditure Balance c/f Sh 657,000 (475,000) 182,000 £ 85,000 2,493,00 0 51,000 375,000 3,004,00 0 Mamba Sports Club Income and Expenditure Account for the year ended 31 March 2001 Incomes Profit from trading account Subscriptions Dinner dance Investment income Profit on sale of investments Sh 182,000 2,465,000 723,000 400,000 125,000 3,895,000 Lesson Five 255 Example 6.9 (Exam Type) DECEMBER 2000 QUESTION 3 The following trial balance was extracted from the books of Literary and Philosophical Society as at 30 September 2000: Sh Sh Balance at bank: current account 724,800 Accumulated fund 1 October 1999 5,771,200 Land and buildings, at cost 3,700,000 Debtors for subscription 62,000 Furniture and fittings 1,874,000 Provision for depreciation of furniture 284,000 & fittings Subscriptions 1,450,800 Lecturer’s fees 920,000 Lecturer’s travel and accommodation 358,000 expenses Donations 108,000 Camera and projector repairs 17,000 Projectors, cameras and audio 190,400 equipment Depreciation of equipment 54,400 Rates and water 277,000 Lighting and heating 367,200 Rental of rooms 495,000 Wages – Caretaker 880,000 - Restaurant 1,600,000 - Bar staff 800,000 Purchase of food 1,565,800 Stock – bar 1 October 1999 473,600 Bar receipts 4,032,000 Bar purchases 2,842,000 Restaurant receipts 3,642,000 Loan 1,600,000 Deposit account – bank 1,000,000 Interest payable and receivable 36,000 Creditors for bar and food ________ 178,400 17,651,800 17,651,800 Additional information: 1. The bar stock was valued at Sh. 642,800 as at 30 September 2000. 2. It is expected that, of the debtors for subscriptions, Sh. 43,600 will not be collectable. 3. The interest account is net. The loan is at a concessional rate of 4% while 10% has been earned on the deposit account. No changes have taken place all year in the principal sums involved. 4. An invoice for Sh. 43,000 of wine had been omitted from the records at the close of the year although the wine had been included in the bar stock valuation. 5. Depreciation for the year is to be provided as follows: Furniture and fittings Sh. 194,000 Projectors, cameras, etc. Sh. 19,000. 256 Further Adjustments to Accounts Required: (a) Bar and restaurant trading account for the year ended 30 September 2000 (6 marks) (b) An income and expenditure account for the year ended 30 September 2000 (8 marks) (c) A balance sheet as at 30 September 2000 (6 marks) (Total: 20 marks) Lesson Five 257 Solution: Literary and Philosophical Society Bar and Restaurant Trading Account for the year ended 30 September 2000 Sh Sales Less cost of sales Opening stock Add purchases Less closing stock Profit to the income and expenditure Sh 7,674,000 473,600 4,450,800 4,924,400 (642,800) (4,281,600) 3,392,400 Literary and Philosophical Society Income and Expenditure Account for the year ended 30 September 2000 Income Profit on trading account Interest on bank deposit account Subscriptions Donations Rental of rooms Expenditure Lecturer’s fees Depreciation on furniture and fitting Equipment Lecturer’s travel and accommodation exp. Camera repairs Rates and water Lighting and heating Caretakers wages Interest on loan Provision for subscription Surplus Sh Sh 992,400 100,000 1,450,000 108,000 495,000 3,146,200 920,000 194,000 19,000 358,000 17,000 277,000 867,200 880,000 64,000 43,600 (3,139,800) 6,400 258 Further Adjustments to Accounts Literary and Philosophical Society Balance Sheet as at 30 September 2000 Non current Assets Land and buildings Fixtures and fittings Equipment Current assets Stock Debtors of subscription Balance at bank – deposit a/c - Current a/c Current liabilities Creditors Accumulated fund b/f Add surplus Non current liabilities 4% loan Sh 3,700,000 1,874,000 190,400 5,764,400 Sh (478,000) (73,400) 551,400 Sh 3,700,000 1,396,000 117,000 5,213,000 642,800 18,400 1,000,000 724,800 2,386,000 (221,400) 2,164,600 7,377,600 5,771,200 ___6,400 5,777,600 1,600,000 7,377,600 (c ) Manufacturing Accounts Some firms may manufacture or produce goods rather than buy due to savings in operational costs. (i.e. it is cheaper to produce the goods rather than buy). Due to additional costs involved in the production process, additional information is reported in the final accounts. Therefore, in addition to a trading, profit and loss account, a new account called manufacturing account is shown before these others. The purpose of the manufacturing account is to report all the costs incurred in producing the goods. These costs are divided into 2 classes: 1) Direct costs (prime costs) 2) Indirect costs (overheads) Direct Costs/Prime Costs This is a cost that can be traced directly to a unit that has been produced. This include 1) Direct material 2) Direct labour (wages) 3) Direct expense Indirect costs/Production overheads These are all other costs incurred in the production of manufacturing of goods but cannot be traced directly to any particular unit. Example: 1) Rent for the factory 2) Salaries to supervisors and factory managers 3) Depreciation of plant and machinery used in production Lesson Five 259 The manufacturing account will show the factory cost of goods produced that will be shown in the trading account in place of purchases. 260 Further Adjustments to Accounts FORMAT Name Manufacturing Trading Profit and Loss Account for the year ended 31 December £ £ Raw Materials Opening stock of raw materials XX Purchases of raw materials XX Add carriage inwards XX XX Less returns outwards (XX) XX Cost of raw materials available for use XX Less closing stock of raw materials (XX) Raw materials consumed XX Direct labour (factory wages) XX Direct expenses XX Prime cost XX Factory overheads Salary to factory manager XX Depreciation on – Plant and machinery XX - Factory buildings XX Other expenses – Factory power XX Lighting and heating XX Water XX Cleaners wages XX XX Total cost of production XX Add: opening Work In Progress XX Less: closing Work In Progress (XX) XX Factory cost of production (cost of finished XX Note 1 goods) FACTORY PROFIT XX Finished goods at a transfer price XX Note 2 Sales Less returns inwards Less cost of sales Opening stock – finished goods Factory cost of production/transfer price Less closing stock of finished goods Gross profit Add factory profit Other incomes – discount received - Profit on disposal Less expenses Salaries and wages – administration & non production XX (XX) XX XX XX XX (XX) XX (XX) XX XX XX XX XX Lesson Five 261 Rent for administration building Depreciation - Delivery vans - Fixtures and distribution Other selling and distribution costs Net profit/(net loss) XX XX XX XX (XX) XX/(XX) For the balance sheet, the format is the same for all the assets and liabilities except for the current assets section whereby the stock at the end of the period should be shown for each type of stock as per this format: Current Assets Stock: raw materials Work in progress Finished goods £ XX XX XX £ XX Note 1: This represents the total costs of all the units produced during the period and therefore will be taken to the trading account as the goods are transferred to the selling department. Note 2: If the firm transfers the goods to the selling department at a price higher than the cost of production, then this generates a factory profit. The goods will be shown in the trading account at the transfer price and the factory profit is added to the Gross Profit of the period. Expenses can also be classified into: 1) Administration Expenses These are expenses incurred in running or managing the affairs of the firm and includes managers salaries (not factory managers), legal and accounting fees, depreciation of furniture and fixtures and equipment not used in production, finance cost e.g. loan interest. 2) Selling and Distribution These are expenses incurred to generate sales income e.g. • • • • • Salaries and commission to the sales manager and staff Carriage outwards (i.e. to deliver goods to the customers Depreciation on motor vehicles (used for the delivery purpose) Advertising Bad debts 262 Further Adjustments to Accounts Example 6.10 B spikes Trial Balance as on 31 December 2002 Stock of raw materials 1.1.2002 Stock of finished goods 1.1.2002 Work in progress 1.1.2002 Wages(direct £180,000: factory indirect£145,000) Royalties Carriage inwards (on raw materials) Purchases of raw materials Productive machinery (cost £280,000) Accounting machinery (cost £20,000) General factory expenses Lighting Factory power Administrative salaries Sales representatives’ salaries Commission on sales Rent Insurance General administration expenses Bank charges Discounts allowed Carriage outwards Sales Debtors and creditors Bank Cash Drawings Capital as at 1.1.2002 Dr 21,000 38,900 13,500 325,000 Cr 7,000 3,500 370,000 230,000 12,000 31,000 7,500 13,700 44,000 30,000 11,500 12,000 4,200 13,400 2,300 4,800 5,900 142,300 56,800 1,500 20,000 ______ 1,421,800 1000,000 125,000 29,680 1,421,800 Notes at 31.12.2002 1. 2. 3. Stock of raw materials £24,000, stock of finished goods £40,000, work in progress £15,000. Lighting, and rent and insurance are to be apportioned: factory 5/6ths, administration 1/6th. Depreciation on productive and accounting machinery at 10 per cent per annum on cost. Required: Prepare a manufacturing, Trading Profit and Loss Account for the year ended 31 December 2002. Lesson Five 263 Solution: B Spikes Manufacturing, Trading Profit and Loss Account for the year ended 31 December 2002 Raw Materials £ £ Opening Stock of raw materials 21,000 Purchases 370,000 Carriage inwards on raw materials 3,500 373,500 394,500 Less: closing stock of raw materials (24,000) Raw materials consumed 370,500 Direct wages 180,000 PRIME COST 550,500 Factory Overheads Wages 145,000 Royalties 7,000 Depreciation: productive machinery 28,000 General factory expenses 31,000 Lighting( 5/6 x 7,500) 6,250 Factory power 13,700 Rent(5/6 x 12,000) 10,000 Insurance( 5/6 x 4,200 ) 3,500 24,4,450 Total cost of production 794,950 Add: opening work in progress 13,500 808,450 Less: closing work in progress (15,000) Factory cost production per finished 793,450 goods Sales 1,000,000 Less cost of sales Opening stock of finished goods 38,900 Factory cost of production 793,450 832,350 Less closing stock of finished goods (40,000) 792,350 Gross profit 207,650 Expenses Accounting machinery – depreciation 2,000 Lighting (1/6 x 7,500) 1,250 Administrative salaries 44,000 Sales representatives salaries 30,000 Commission on sales 11,500 Rent ( 1/6 x 12,000) 2,000 Insurance (1/6 x 4200) 700 General administrative expenses 13,400 Bank charges 2,300 Discounts allowed 4,800 Carriage outwards 5,900 (117,850) Net profit 89,800 264 Further Adjustments to Accounts B Spikes Balance Sheet as at 31 December 2002 COST DEPRECIATION Non current Assets Productive machinery Accounting machinery Current Assets Stock: raw materials Finished goods Work in progress Debtors Cash at bank Cash in hand Current liabilities Creditors Capital Add net profit Less drawings £ 280,000 20,000 300,000 24,000 40,000 15,000 £ (78,000) (10,000) 88,000 NET BOOK VALUE £ 202,000 10,000 212,000 79,000 142,300 56,800 1,500 279,600 (125,000) 154,600 366,600 296,800 89,800 386,600 (20,000) 366,600 Lesson Five 265 Example 6.11 (Exam Type – June 1986 Question Two) Bibi Maridadi owns and manages a small manufacturing business. The following balances have been extracted from her books of account at 31 January 1986: Dr Sh Capital at 1 February 1985 Accounts payable Bank and cash balance Accounts receivable Drawings Administration expenses Advertising expenses Factory direct wages Factory indirect wages Factory power Furniture and fittings (all offices) Heat and light Plant and equipment Motor vehicle (used by salesmen) Plant hire Provision for bad debts Provision for depreciation 1 February 1985: − Furniture and fittings − Plant and equipment − Motor vehicle Raw material purchases Rent rates Sales Selling and distribution expenses Inventories at cost, 1 February 1985: − Raw materials − Work in progress − Finished goods Cr Sh 171,120 86,000 5,400 92,000 60,000 150,360 12,000 60,000 24,000 36,000 18,400 16,000 276,800 144,000 4,000 3,200 9,200 138,400 24,000 228,000 20,000 829,440 66,400 8,000 16,000 24,000 1,261,360 _______ 1,261,360 The following additional information is provided: (i) Accruals at 31 January 1986 were: Factory power Sh.1,600 Rent and rates Sh. 4,000 There was also prepayment of Sh. 800 for salesmen’s motor vehicle insurance. (ii) Inventories at 31 January 1986, were valued at cost as follows: Raw materials Work in progress Finished goods - Sh. 15,200 Sh. 30,400 Sh. 45,600 266 Further Adjustments to Accounts (iii) Depreciation is to be charged on plant and equipment, motor vehicle, furniture and fittings at the rates of 20%, 25% and 10% per annum respectively on cost. (iv) Expenditure on heat and light, and rent and rates is to be apportioned between the factory and office in the ratio of 9 to 1 and 3 to 2 respectively. (v) The provision for bad debts is to be made equal to 5% of accounts receivable at 31 January 1986. Required: Using the vertical method, prepare Bibi Maridadi’s manufacturing, trading and profit and loss account for the year ended 31 January 1986 and a balance sheet as at that date. (22 marks) Solution: Bibi Maridadi Manufacturing, Trading and Profit and Loss Account for the year ended 31 January 1986 Direct materials Sh Sh Opening stock of raw materials 8,000 Add: purchases of raw materials 228,000 236,000 Less: closing stock of raw materials (15,200) Raw materials consumed 220,800 Factory direct wages 60,000 PRIME COST 280,800 Factory overheads Factory indirect wages 24,000 Factory power 37,600 Plant hire 4,000 Heat and light 14,400 Rent and rates 14,400 Depreciation on plant 55,360 149,760 430,560 Add opening work in progress 16,000 446,560 Less closing work in progress (30,400) Factory cost of production 416,160 Sales 829,440 Less cost of sales Opening stock of finished goods 24,000 Add factory cost of production 416,160 440,160 Less closing stock of finished goods (45,600) 394,560 Gross profit 434,880 Less expenses Increase in provision for doubtful 1,400 debts Rent and rates 9,600 Heat and light 1,600 Depreciation: motor vehicle 36,000 Lesson Five 267 Furniture and fittings Selling and distribution expenses Administration expenses Advertising expenses Net profit 1,840 65,600 150,360 12,000 278,400 156,480 Bibi Maridadi Balance Sheet as at 31 January 1986 COST DEPRECIATION Non current Assets Plant and equipment Furniture and fittings Motor vehicle Current Assets Stock: Raw materials Work in progress Finished goods Debtors Less: provision for doubtful debts Prepayments Cash in hand and bank Current liabilities Creditors Accruals £ 276,800 18,400 144,000 439,200 £ (193,760) (11,040) (60,000) (264,800) 15,200 30,400 45,600 92,000 (4,600) 91,200 NET BOOK VALUE £ 83,040 7,360 84,000 174,400 87,400 800 5,400 184,800 86,000 5,600 Capital Add net profit Less drawings (91,600) 93,200 267,600 171,120 156,480 327,600 (60,000) 267,600 UNREALISED PROFITS ON CLOSING STOCK In most cases where business transfers finished goods at a profit to the selling department and the goods are reflected in the balance sheet at the transfer price, then the closing stock includes a profit that has not been earned or realised. If the mark up profit (the profit based on cost of production is always uniform, then any changes in the value of closing stock will result in a reduction or an increase in the unrealised profits. If there is an increase on unrealised profit on the closing stock, then this increase will be reduced from the gross profit from our profit and loss account and if there is a reduction in unrealised profits, then this reduction will be added to the gross profit in our profit and loss account. Any unrealised profit of closing stock should be deducted from the closing stock in the balance sheet. 268 Further Adjustments to Accounts The slight change in the format of the Profit and Loss Account and Balance Sheet will be as follows Lesson Five 269 Increase in unrealised profit in closing stock (UPCS) Profit and loss (extract) Account for year ended……….. £ Gross profit Add: factory profit Add: other expenses Less expenses Other expenses Increase in unrealised profit on closing stock Net profit X X £ X X X X (X) X Decrease in UPCS Profit and Loss Account (extract) for year ended ………… £ Gross profit Add: factory profit Add: other incomes Add: decrease in UPCS Less expenses Other expenses Net profit £ X X X X X (X) X Example: A firm always values its stock (finished goods) at a mark-up of 20% on cost of production. The opening stock of finished goods for the period was valued at Sh. 100,000. (The marked up cost) The closing stock at the end of the financial period was Sh.160,000. Opening Stock: 100,000 (marked up) = 120% (16,667) = (20%) 83,333 = 100% Closing Stock 160,000 (marked up) = 120% (26,667) = (20%) 133,333 = 100% Balance c/d UPCS Balance b/f 26,667 Profit and loss a/c 26,667 16,667 10,000 26,667 270 Further Adjustments to Accounts Profit and Loss (Extract) Less: Expenses: Sh Increase in unrealized profits on closing stock Sh 10,000 Balance Sheet (Extract) Current Assets Stock: Raw materials Work in progress Finished goods Less: UPCS Sh Sh X X 160,000 (26,667) 133,333 (d) DEPARTMENTAL ACCOUNTS Some organizations have various departments carrying out trade and therefore the profitability of each department needs to be established. For each department, trading, profit and loss account should be prepared. The final accounts will be very important for the management to assess the performance of each department. The expenses in relation to a specific department should be charged in the Profit and Loss account for that department. The accounts will be represented in columnar form and the format will be as follows: (Assume a firm has departments A and B). Name Trading Profit and Loss account for the year ended 31 December Sales Less cost of sales Opening stock Purchases Less closing stock Gross profit Other incomes Less expenses Salaries and wages Depreciation Other expenses Managers commission NET PROFIT Department A £ £ XX XX XX XX (XX) XX XX XX XX (XX) XX XX XX (XX) XX Department B £ £ XX XX XX XX (XX) XX XX XX XX (XX) XX XX XX (XX) XX Department C £ £ XX XX XX XX (XX) XX XX XX XX XX (XX) XX XX XX (XX) XX The balance sheet will reflect the position of the whole organization and therefore a departmental balance sheet is not required. Lesson Five 271 When departments in a firm are sharing resources, then the various expenses need to be apportioned between or among the different departments e.g. if the departments are sharing a building, then rent expense should be apportioned among the departments. The following guidelines can be followed in apportioning the expenses among the departments. Type of Expense 1) Rent, rates, heat, light, repairs to buildings, depreciation of buildings and insurance. Basis of apportionment Floor area occupied by each department. 2) Depreciation, insurance and maintenance of equipment Cost or net book value of the equipment in each department. 3) Salaries, canteen expenses, welfare and other expenses relating to employees. Number of employees in each department 4) Carriage inwards. Purchases in each department. 5) Advertising, depreciation and maintenance of delivery van. Value of sales in each department. 6) Increase in provision for doubtful debts, bad debts and discounts allowed. Sales or debtors in each department. Example 6.12 J Spratt is the proprietor of a shop selling books, periodicals, newspapers and children’s games and toys. For the purposes of his accounts, he wishes the business to be divided into two departments: Department A Department B Books, periodicals and newspapers Games, toys and fancy goods. The following balances have been extracted from his nominal ledger at 31 March 19X9: Dr Sales Department A Sales Department B Stocks Department A, 1 April 19X8 Stocks Department B, 1 April 19x8 Purchases Department A 250 200 11,800 Cr 15,000 10,000 272 Further Adjustments to Accounts Purchases Department B Wages of sales assistants Department A Wages of sales assistants Department B Newspaper delivery wages General office salaries Rates Fire insurance – buildings Lighting and air conditioning Repairs to premises Internal telephone 8,200 1,000 Cleaning Accountancy and audit charges General office expenses 30 120 60 25,000 750 150 750 130 50 120 25 25 25,000 Stocks at 31 March 19X9 were valued at: Department A £300 Department B £150 The proportion of the total floor area occupied by each department was: Department A one fifth Department B four-fifths Prepare J Spratt’s trading and profit and loss account for the year ended 31 March 19X9, apportioning the overhead expenses, where necessary, to show the Department profit or loss. The apportionment should be made by using the methods as shown: Area Rates, Fire insurance, Lighting and air conditioning, Repairs, Telephone, Cleaning: Turnover -General office salaries, Accountancy, General office expenses. Lesson Five 273 Solution: J Sprat Trading, Profit and Loss Account for the year ended 31 March 19X9 Sales Less cost of sales Opening stock Purchases Less closing stock Department A £ £ 15,000 250 11,800 12,500 (300) Gross profit Less expenses Wages Newspaper delivery wages General office salaries Rates Fire insurance – buildings Lighting and airconditioning Repairs to premises Internal telephone Cleaning Accountancy or audit charges General office expenses NET PROFIT (11,750 ) 3,250 Department B £ £ 10,000 200 8,200 8,400 (150) (8,250) 450 20,000 20,450 (450) 1,750 1,000 150 750 - 1,750 150 450 26 10 300 104 40 750 130 50 24 96 120 5 5 6 72 20 20 24 48 25 25 30 120 36 (1,784) 24 (1,426) 1,466 Workings: 1) General Office Salaries: Department C £ £ 25,000 A = 15,000 X 750 = 450 25,000 B = 10,000 X 750 = 300 25,000 2) Rates: A = 1/5 X 130 = 26 B = 4/5 X 130 = 104 3) Fire Insurance: A = 1/5 X 50 = 10 B = 4/5 X 50 = 40 4) Lighting: A = 1/5 X 120 = 24 B = 4/5 x 120 = 96 324 60 (20,000 ) 5,000 (3,210) 1,790 274 5) Repairs: Further Adjustments to Accounts A = 1/5 X 25 = 5 B = 4/5 X 25 = 20 etc. Lesson Five 275 Interdepartmental Trading A department may buy goods from another department in the same firm and therefore the departments trade with one another. Example, in 4.16 above, department A sells goods to Department B. (Department B is buying from department A). Interdepartmental sales and purchases should be excluded from the total sales and total purchases of the whole firm. If we assume that A sold goods to B amounting to £1,000 and this figure is included in sales of A and purchases of B, the trading account for the whole firm will be as follows (other items will remain the same): £ £ Sales 24,000 Less cost of sales Opening stock 450 Purchases 19,000 19,450 Less closing stock (450) (19,000) Gross profit 5,000 Managers Commission A commission based on the net profit made in each department may reward managers of each department. The commission is normally a percentage of the net profit but it may be a percentage on the net profit before or after charging the commission. 1) Percentage Before Charging Commission If we assume in example 4.16 that the managers in each department is paid a commission of 5%, before charging such commission, the commission will be as follows: Net profit before commission Managers commission @ 5% Net profit after commission Department A 1,466 Department B 324 Total 1,790 (73.3) (16.2) (89.5) 1,392.7 307.8 1,700.5 2) Percentage After Charging Commission Assume the commission is 5% of the net profit after charging such commission: Net profit before commission Managers commission @ 5% Net profit after commission Department A 1,466 Department B 324 Total 1,790 (69.8) (15.4) (85.2) 1,392.2 308.6 1,704.5 276 Further Adjustments to Accounts Note: If we use percentage for each commission assuming a 5% rate, the commission will be computed as follows: Net profit before commission Commission of 5% Net profit after commission Before charging commission 100 After charging commission __5 95 __5 100 105 REINFORCEMENT QUESTIONS QUESTION ONE Dare is a grocer who had not kept a full set of books. The following was a summary of his bank statement for the year ended 31 December 19X6: Amounts credited by bank £ 32,050 Balance at 1 January 19X6 Payments to trade creditors Rent and rates Fixtures Lighting and heating General expenses Loan interest Drawings Customers’ cheques dishonoured _____ Balance at 31 December 19X6 32,050 £ 892 27,380 475 100 210 800 120 900 180 993 32,050 You are given the following information: 1. Trading receipts consisted partly of cash and partly of cheques. During the year, Dare had paid, out of his takings, wages for part-time staff amounting to £2,914 and sundry expenditure of £140. He retained between £2 and £5 per week pocket money and maintained a balance of £20 in the till for change. The balance of his takings, together with cheques amounting to £250, which he had cashed out of his takings for the convenience of certain friends, was paid into the bank. Lesson Five 2. 3. 4. 5. 6. 277 Cheques drawn payable to trade creditors, but not presented at 1 January 19X6, amounted to £280 and at 31December 19X6 to £320. All dishonoured cheques were re-presented and honoured during the year. The loan interest was paid to a close friend, Bryant, who had lent Dare £4,000 some years ago at a nominal rate of interest of 3% per annum. The interest was duly paid half-yearly on 31st March and 30 September, and the loan was still outstanding at the end of the year. Discounts allowed by trade creditors amounted to £480 and those allowed to debtors were £520. Other balances at 1 January and 31 December 19X6 are given below: 1 January Stocks Trade debtors Accrued general expenses Rates paid in advance Fixtures valued at Trade creditors Creditors for heating and lighting 7. £ 4,500 2,800 240 40 2,800 1,800 80 31 December £ 5,800 3,200 (including a bad debt of £200 to be written off) 190 50 2,550 (including those purchased during the year) 2,200 70 There is a standard gross profit margin of 25% on sales. You are required to prepare: (a) a statement of Dare’s capital on 1 January 19X6; (b) a profit and loss account for the year ended 31 December 19X6; (c) a balance sheet as on that date. QUESTION TWO You have agreed to take over the role of bookkeeper for the AB Sports and Social Club. The summarized balance sheet on 31.12.94 as prepared by the previous bookkeeper contained the following items. All figures are in £s. Assets Heating oil for clubhouse Bar and café stocks New sports ware, for sale, at cost Used sports ware, for hire, at valuation Equipment for grounds person – cost 1,000 7,000 3,000 750 5,000 278 Further Adjustments to Accounts depreciation Subscriptions due Bank – current account - deposit account Claims Accumulated fund Creditors – bar and café stocks - Sports ware 3,500 1,500 200 1,000 10,000 23,150 1,000 300 Lesson Five 279 The bank account summary for the year to 31.12.95 contained the following items: Receipts: Subscriptions Bankings – bar and sale Sale of sports ware Hire of sports ware Interest on deposit account Payments Rent and repairs of clubhouse Heating oil Sports ware Grounds person Bar and café purchases Transfer to deposit account 11,000 20,000 5,000 3,000 800 6,000 4,000 4,500 10,000 9,000 6,000 You discover that the subscriptions due figure as at 31.12.94 was arrived at as follows: Subscriptions unpaid for 1993 Subscriptions unpaid for 1994 Subscriptions paid for 1995 10 230 40 Corresponding figures at 31.12.95 are: Subscriptions Subscriptions Subscriptions Subscriptions unpaid for 1993 unpaid for 1994 unpaid for 1995 paid for 1996 10 20 90 200 Subscriptions due for more than 12 months should be written off with effect from 1.1.95 Asset balances at 31.12.95 include: Heating oil for club house Bar and café stocks New sports ware, for sale, at cost Used sports ware, for hire, at valuation 700 5,000 4,000 1,000 Closing creditors at 31.12.95 are: For bar and café stocks For sports ware For heating oil for clubhouse 800 450 200 280 Further Adjustments to Accounts 2 /3 rds of the sportswear purchases made in 1995 had been added to stock of new sportswear in the figures given in the list of assets above, and 1/3 had been added directly to the stock of used sportswear for hire. Half of the resulting ‘new sportswear for sale at cost’ at 31.12.95, to transfer these older items into the stock of used sportswear, at a valuation of 25% of their original cost. No cash balances are held at 31.12.95. The equipment for the grounds person is to be depreciated at 10% per annum, on cost. Required: Prepare income and expenditure account and balance sheet for the AB Sports club for 1995, in a form suitable for circulation to members. The information given should be as complete and informative as possible within the limits of the information given to you. All workings must be submitted. (23 marks) QUESTION THREE Mr Cherono trades as a retailer of electric lamps and related products under the name of Chero Hardware. Most goods in which he trades are purchased from various suppliers in a finished form. In addition, a separate department of the firm manufactures various types of lampshades from purchased raw materials. When finished, the lampshades are transferred to the shop at an agreed transfer price for sale. No lampshades are sold other than through the shop. The firm’s Accounts Assistant presents you with the following trial balance at 30 June 1988: Sh Sh Capital account – Cherono 740,000 Drawings – Cherono 95,000 Long term loan (interest at 15% p.a) 240,000 Fixtures and fittings at cost 900,000 Accumulated depreciation at 1 July 350,000 1987 Motor vehicle at cost 208,000 Accumulated depreciation at 1 July 60,000 1987 Stock at 1 July 1987 (at cost): Raw materials for lampshades 40,000 Completed lampshades 20,000 Other goods 328,000 Trade debtors and creditors 122,000 Bank balance 98,000 Sales 4,100,000 Purchases – raw materials for 855,000 lampshades - other goods 2,400,000 Wages 254,000 Lesson Five Rent and rates Water and electricity Motor expenses Repairs Interest on loan Bank charges Insurance Sundry expenses 281 96,000 47,000 60,800 12,000 18,000 4,000 18,000 21,200 5,597,000 _______ 5,597,000 282 Further Adjustments to Accounts Additional Information: (i) Rent and rates include a prepayment of rates of Sh. 6,000. (ii) The insurance includes a premium for the period ending 31 October 1988. (iii)A trade debt of Sh. 14,000 is not expected to be realized. (iv) During the year a pick-up van, which was bought for Sh. 86,000, was sold for Sh. 30,000, and replaced with another pick-up van costing Sh. 152,000. Both transactions have been posted to the motor vehicle account. No disposal account has been opened. The straight-line rates of depreciation based on cost are 25% p.a. for motor vehicle and 10% p.a. for fixtures and fittings. A full year’s depreciation is charged in the year of acquisition and none in the year of disposal. (v) Accruals at 30 June 1988 were: Water and electricity Sh. 5,000 Sundry expenses Sh. 4,000 (vi) Stocks at 30 June 1988 were: Sh. Lampshades raw materials Lampshades (at transfer price) Other goods at cost (vii) 80,000 30,000 252,000 (a) The agreed transfer price for lampshades produced was Sh. 1,000,000. The workshop produced 50,000 lampshades during the year. (b) Wages include those of the lampshades making employee who has been paid Sh. 50,000 for the year. In addition, she is entitled to a commission on the annual profit of her department of 10% p.a. after charging such commission. Shop assistants’ wages were Sh. 108,000. (c) The apportionment of rent and rates; and water and electricity to the lampshades is 25% of the total. Required: (a) Prepare a manufacturing, trading and profit and loss accounts for the year ended 30 June 1988, disclosing clearly (i) the profit earned by the lampshadesmaking department and (ii) the gross profit earned by the shop. (b) Prepare a balance sheet as at 30 June 1988. QUESTION FOUR On 2 November 1983, the Treasurer of the Olympiad Athletics Club died. The financial year of the club, which had been formed to provide training facilities for both field and track event athletes, had ended two days previously on 31 October 1983. An extraordinary general meeting was convened for the purpose of appointing a new treasurer whose task it would be to prepare the annual accounts for that financial year. An enthusiastic club member, Guy Rowppe, was duly appointed but, having only an elementary knowledge of bookkeeping, soon found himself in difficulty. He sought your assistance, which you agreed to give. During your conversation he said, ‘The previous treasurer maintained a Cash and Bank account. I have Lesson Five 283 summarized the detailed entries into what I think you call a Receipts and Payments Account, and have rounded the figures to the nearest £1’. At this point he supplied you with a copy of the following document: 284 Further Adjustments to Accounts Olympiad Athletics Club Receipts and Payments Account for 12 months ended 31 October 1983 Not Receipts Not Payments e e No. No. Cash Bank Cash Bank £ £ £ £ Balance c/d 73 Balance b/d 105 Membership fees: (4) Insurance premiums paid to 580 brokers (1) Entrance 80 170 (7) Payments to suppliers of 5,270 sporting requisites (1) Annual subscriptions 215 4,465 (5) Wages of grounds 3,600 man (2) Life membership 530 (8) Postages and 692 telephones (3) Training ground fees 454 7,206 (9) Stationery 629 Insurance: World-wide Athletics Club 50 affiliation fee (4) Premiums 638 (10) Rates of training 846 ground (4) Commissions 53 Upkeep of training ground 1,200 (11 Interest received Transfers to bank 700 ) from investments 626 (12 Sale of office 370 (11) Purchase of 5,600 ) furniture investments (6) Sale of sporting 8,774 (11) Short term 3,000 requisites deposits Advertising revenue 603 Transfers from cash ____ __700 Balances c/d 122 2,563 £822 £24,1 £822 £24,1 35 35 Balances b/d 122 2,563 After you had perused the above account, Guy Rowppe explained the numbered items, as follows: (1) On admittance to membership of the club, new members pay an initial entrance fee together with their annual subscription. At 31 October 1982, annual subscriptions of £70 had been paid in advance and £180 was owing but unpaid; of this latter amount, £40 related to members who left during the current year and is now no longer recoverable. The figures at 31 October 1983 are £100 subscriptions in advance and £230 subscriptions in arrear. The policy of the club is to take credit for subscriptions when due and to write off irrecoverable amounts as they arise. Lesson Five 285 (2) As an alternative to paying annual subscriptions, members can at any time opt to pay a lump sum, which gives them membership for life without further payment. Amounts so received are held in suspense in a Life Membership Fund account and then credited to Income and Expenditure Account in equal instalments over 10 years; the first such transfer takes place in the year in which the lump sum is received. On 31 October 1982 the credit balance on the Life Membership Fund Account was £4,720, of which £850 credited was as income for year ended 31 October 1983. (3) The club has a permanent training ground. Non-members can use the facilities on payment of a fee. In order to guarantee a particular facility, advance booking is allowed. Advance booking fees received before 31 October 1983 in respect of 1984 total £470. The corresponding amount paid up to 31 October 1982 in advance of 1983 was £325. Members can use the facilities free of charge. (4) Club members can take out insurances through the club at advantageous rates. Initially, premiums are paid by members to the club. Subsequently, the club pays the premiums to an insurance broker and receives commission. At 31 October 1982, premiums received but not yet paid over to the broker amounted to £102 and commissions due but not yet received were £11. The corresponding amounts at 31 October 1983 are £160 and £13 respectively. (5) The grounds man is employed for the six months April to September only. He is then paid a retaining fee to secure his services for the following year. At 31 October 1982 the grounds man had been paid a retainer (£250) for 1983. Included in the Wages figure (£3,600) is the retainer (£300) for 1984. (6) Sporting requisites are sold only on cash terms. There are therefore no debtors for these items. (7) On 31 October 1982 sums owed to suppliers of sporting requisites totaled £163; the corresponding figure on 31 October 1983 was £202. (8) Stock of unsold sporting requisites on 31 October 1982 was £811 and on 31 October 1983, was £927. In arriving at this latter figure, the sum of £137, representing damaged and unsaleable stock at cost price, had been excluded. (9) Postage stamps unused at 31 October 1983 totalled £4. (10) Stock of stationery on 31 October 1982 and 1983 was £55 and £36 respectively. (11) Rates are payable to the District Council in two installments (in advance) each year. £360 had been paid on 1 October 1982, £390 on 1 April 1983 and £456 on 1 October 1983. (12) The club receives interest on investments bought a number of years ago at a cost of £7,400 (current valuation £7,550). At the end of October 1983, the club had acquired further investments which cost £5,600 (current valuation £5,600) and at the same time placed £3,000 in a short-term deposit account. (13) The written down value of the furniture which had been sold during the year was £350; it had originally cost £800. Other Matters: Initially, the training ground had been acquired freehold* from a farmer at an inclusive cost of £4,000. Subsequently, the club had some timber buildings erected 286 Further Adjustments to Accounts to provide various facilities for members. The total cost of these buildings was £35,000; depreciation is calculated at the rate of 10% per annum on a straight-line basis. At 31 October 1982, the provision for depreciation account had a balance of £9,400. At 31 October 1982, the furniture and equipment etc. was recorded in the club’s books as £7,900 (cost) against which there was a provision for depreciation of £4,150 (calculated on the same basis as for buildings). Apart from the disposal referred to in note (12) above there had been no other disposals or acquisitions during the year. Required: Prepare the club’s Income and Expenditure Account for year ended 31 October 1983 and the Balance sheet at that date. All workings must be shown. *Freehold land is land held in perpetuity. CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK Lesson Five 287 COMPREHENSIVE ASSIGNMENT No.2 TO BE SUBMITTED AFTER LESSON 6 To be carried out under examination conditions and sent to the Distance Learning Administrator for marking by the University. EXAMINATION PAPER. ANSWER ALL QUESTIONS TIME ALLOWED: THREE HOURS. QUESTION ONE The bank account of Fuller Ltd, prepared by the company’s book-keeper, was as shown below for the month of October 19-6: Bank Account 1919-6 6 Oct Oct 1 Balance c/d 91.40 2 Petty Cash 0623 36.15 13 3 McIntosh and Co 260.1 3 Freda’s Fashions 0623 141.1 1 14 7 3 Malcolm Brothers 112.8 6 Basford Ltd 0623 38.04 3 15 3 Cash sales 407.5 8 Hansler Agencies 0623 59.32 4 16 14 Rodney 361.0 9 Duncan’s storage 0623 106.7 Photographic 2 17 5 17 Puccini’s Cold Store 72.54 9 Aubrey plc 0623 18.10 Ltd 18 20 Eastern Divisional 10 Secretarial services 0623 28.42 Gas Board – rebate Ltd 19 (August direct 63.40 credit) 22 Grainger’s Garage 93.62 14 Trevor’s Auto 0623 11.75 repairs 20 29 Cash sales 235.3 15 Wages cash 0623 115.5 9 21 2 31 Balance c/d 221.5 16 Towers Hotel 0623 44.09 2 22 17 Bank charges - 12.36 (September) 20 Broxcliffe borough Council SO 504.2 2 21 Eastern Area Electricity Board DD 108.6 4 288 Further Adjustments to Accounts 24 ______ 1,919. 37 28 Eastern Divisional Gas Board Petty Cash 30 Wages cash 31 Salaries transfer Nov 1 Balance c/d DD 0623 23 0623 24 - 41.20 119.0 7 337.7 4 ______ 1,919. 37 221.5 2 In early November, the company’s bank sent a statement of account which is reproduced below: Lesson Five 289 Statement of Account with Lowland Bank plc Account: Fuller Ltd Current Account No 10501191 Date of issue: 1 November 19-6 19-6 Oct Description 1 BCE 2 CR 2 Debit Credit Balance £ £ £ 90.45 175.02 265.47 062310 111.34 154.13 3 062312 9.18 144.95 3 062309 15.41 129.54 3 CR 7 062313 780.48 36.15 910.02 873.87 10 ADJ 12.90 15 062315 38.04 848.73 16 062314 141.17 707.56 17 CR 20 SO 504.22 646.90 21 062317 106.75 540.15 21 DD 196.83 343.32 21 062320 11.75 331.57 22 141981 212.81 118.76 22 ADJ 10.00 108.76 22 062319 28.42 80.34 22 062320 11.75 68.59 443.56 886.77 1,151.12 290 Further Adjustments to Accounts 22 CR 24 ADJ 27 INT (loan a/c) 27 93.62 162.21 212.81 375.02 26.35 348.67 062321 115.52 233.15 28 062322 44.09 189.06 28 DD 108.64 80.42 30 CGS 9.14 71.28 31 ADJ Abbreviations: BCE = Balance Adjustment INT = Interest 11.75 SO = Standing Order DD = Direct Debit 83.03 CR = Credit ADJ = CGS = Charges Required: Prepare the company’s bank reconciliation statement as at 31 October 19-6. (Chartered Association of Certified Accountants) QUESTION TWO PAUL RUDYERD The following balances have been extracted from the accounting records of Paul Rudyerd, a wholesale fruiter, at the end of his financial year ended on 31 May 19X1. £ £ Purchases and sales 104,310 146,200 Stocks 3,010 Motor vehicles at cost 26,360 Provision for depreciation on motor vehicles as 12,960 at 1 June 19X0 Warehouse equipment at cost 20,000 Debtors and creditors 25,250 21,200 Bank 3,200 Motor vehicle expenses 11,960 Rent and rates 11,220 Advertising 2,500 Sundry expenses (including insurance and 3,470 electricity) Drawings 6,600 Capital as at 1 June 19X0 ______ 31,120 214,680 214,680 Lesson Five 291 Additional information and opinions are given as follows: (a) Stocks at 31 May 19X1 were valued at £2,600. This amount includes a consignment of rare fruit from abroad which cost £300, which would normally sell for approximately £660, but which is badly bruised and could be sold as juice pulp for £100. (b) Depreciation on motor vehicles is normally charged at an annual rate of 20%, using the reducing balance method. The motor vehicles at cost figure includes a new car purchased during the year for £9,600 for Rudyerd’s personal use which it is estimated will last four years with an estimated residual value of £4,000. (c) Expenses prepaid and accrued at 31 May 19X1 were estimated as follows: Prepayments Accruals £ £ Rates 230 Rent 160 Insurance 180 Electricity 200 (d) A bad debt of £250 is to be written off. A provision for doubtful debts of 1% of outstanding debtors should be created. (e) A recording error has resulted in a second-hand delivery van, purchased on 2 June 19X0 for £9,000, being treated as a motor vehicle expense. (f) No record has been made of fruit, estimated to have cost £520, withdrawn from the business by Rudyerd for his personal use. (g) No adjustment should be made, in preparing the answer to part (a) for the new warehouse equipment purchased during the year. Required: (a) Prepare a draft trading, profit and loss account for Paul Rudyerd’s wholesale fruit business for the year ended 31 May 19X1 and a draft balance sheet as at 31 May 19X1. (15 marks) (b) Briefly explain what accounting concepts and conventions would be important in considering the treatment of the new warehouse equipment. (4 marks) (c) Itemize the additional information that you would wish to know before you could make the appropriate adjustments to the above financial statements in respect of the new warehouse equipment. (3 marks) QUESTION THREE ABC LTD You have just been appointed as an accounting assistant to ABC Ltd. A week after your arrival the finance director is rushed into hospital; the auditors are about to arrive to prepare the accounts for the recently-ended financial year; you cannot find any working papers for the previous year’s accounts; and the other accounts staff are too busy to assist you in preparing for the auditor’s visit. The eight situations described below are detailed on a notepad left by the finance director and their treatment in the accounts needs to be considered by you. 292 Further Adjustments to Accounts (a) A supply of office stationery was purchased five months before the year-end at a cost of £1,000. At the year-end it is estimated there is about £250 worth left in stock. (b) An electronic typewriter was purchased during the year at a cost of £270. It is estimated to have a useful life of five years. (c) A batch of goods was produced to a customer’s special order. The goods cost £5,800 but have not been delivered as it transpires the customer is now bankrupt. A buyer for the goods has been found, who will pay £4,500 but modifications costing £1,200 will have to be made to the goods. (d) Three technical staff have spent the last six months exclusively on a new product design project; their salaries for this period amount to £22,000. At the year-end it is known that the design stage will take another month, to be followed by market research; after this the directors will decide whether the project should proceed to production and marketing. The company’s chief engineer is confident that sales of the new product will start in the next financial year and will last for at least four years. (e) A freehold property was purchased on the first day of the financial year at a cost of £650,000. The building is estimated to have a useful life of ten years when it is expected it will have to be demolished for redevelopment. It is estimated that the freehold land, at the time of purchase, was worth £500,000. (f) A specialist machine was purchased seven years ago for £200,000. It has been depreciated, using the straight-line method, at 10% per annum since then. To the beginning of the year under review £120,000 depreciation has been provided. The chief engineer has advised that the machine is worn out and would need to be rebuilt to last more than another two years. The directors have already decided the machine should not be rebuilt but scrapped one year after the end of the year under review. (g) The debtors’ ledger shows balances totalling £52,000 at the year-end. Two debts, totalling £2,000, are known to be bad. Another customer has gone into liquidation owing £3,000; it is expected he will be able to pay 60p of every £ owed to his creditors. The sales director recommends a general bad debt provision of 2% in respect of the remaining debtor balances. (h) The company has undertaken a heavy advertising campaign throughout the year under review to promote its corporate image and product range. The sales and managing directors feel that this campaign will benefit the company for at least a further six months after the year end. You determine that the campaign cost £150,000 and has been fully paid for before the year-end. Required: For each of the eight situations described above: (a) Describe what action should be taken in respect of: (i) The amount to be charged or credited to the year’s profit and loss account (if any); (ii) The value to be placed on the asset in the balance sheet at the year end (if any); (8 marks) (b) State what accounting assumptions, conventions or concepts could be involved and give reasons, where there is a conflict between two or more of them, why Lesson Five 293 you have chosen the action you propose. (9 marks) 294 Further Adjustments to Accounts QUESTION FOUR The following final balance was extracted from the books of J Yeats, a trader, at 31 December 19X9: Ksh Carriage inwards Capital account at 1 January 19X9 Motor vans Stock at 1 January 19X9 Balance at bank Purchases Sales Trade debtors Trade creditors Rent and rates Salaries General expenses Motor expenses Discounts allowed Discounts received Insurance Bad debts Provision for doubtful debts 1 Jan 19X9 Provision for depreciation on vans Drawings Disposal Returns inwards Ksh 6,310 500,000 200,000 164,000 116,860 1,593,690 2,224,000 290,000 157,600 56,080 350,400 44,720 25,600 40,400 37,600 17,600 30,400 8,000 60,000 50,000 7,140 2,993,200 6,000 _______ 2,993,200 The following matters should be taken into account: (a) After examination of the debtors account, it was decided to: Write off a bad debt of Ksh 12,000 Make a specific provision in the accounts for the following doubtful debts, Ksh 5,000 from Wordsworth Ksh 3,000 from Coleridge Make a general provision of 5% on the debtors. (b) Goods unsold at 31 December 19X9 had cost Ksh 201,600 but Yeats expected to sell them at Ksh 232,470. (c) Salaries accrued at 31 December 19X9 amounted to Ksh 32,000. (d) The rent of the premises is Ksh 40,000 a year, payable quarterly in arrears, but the instalment due on 31 December 19X9 was not paid until 15 January in the next year. (e) Insurance paid in advance at 31 December 19X9 amounted to Ksh 2,000. Lesson Five 295 (f) Depreciation is to be provided for on the motor truck at the rate of 20% per annum straight line on cost. (g) General expenses include Ksh 3,060 relating to the telephone account which is made up of: - Rent – three months in advance from 30 November 19X9 at Ksh. 420. - Calls – three months ended 30 November 19X9 at Ksh 2,640. (h) It has been agreed with Inland Revenue (Taxation Office) that 12.5% of the rent sand rates relate to private use. Prepare a trading and profit account for the year to 31 st December 19X9, and a balance sheet as at 31 December 19X9. QUESTION FIVE The balance sheet of Johnson’s shop at 1 October 19X7 was as follows: Non current assets Shop premises Ksh 45,000 Shop fittings Delivery van 12,000 4,000 Current assets Stock in trade Cash in hand 14,000 2,000 Ksh Ksh Capital as at 1 Oct Ksh 51,000 61,000 Current liabilities Trade creditors 16,000 Bank overdraft 77,000 12,000 14,000 26,000 77,000 The following is a summary of the transactions which took place during the year to 30 September 19X8: 1. Sales were made, all for cash, of Ksh 145,000. The stock in trade sold cost Ksh 83,000. 2. Stock in trade bought, all on credit for Ksh 78,000. 3. Cash of Ksh 113,000 was taken from the till (cash register) and paid into the bank. 4. The trade creditors were paid Ksh 73,000 by cheque. 5. Johnson borrowed Ksh 30,000 from Black, which was paid into the bank. The loan is for 5 years. 6. Wages of Kshs 17,000 were paid in cash. 7. Rates of Ksh 2,900 were paid by cheque. 8. Sundry expenses of Ksh 6,000 were paid in cash. 9. Electricity bills of Ksh. 1,600 were paid by cheque. 10. The owners of the business withdrew Ksh 9,000 in cash. At 30 September 19X8 you discover the following: 1. Interest Ksh 2,500 due to Black for the year was unpaid. 296 2. 3. 4. Further Adjustments to Accounts Shop fittings are to be depreciated at 10% per annum on the total at the yearend; the delivery van is to be depreciated at 20% per annum of the total at the year-end. The rates payment during the year included Ksh 1,000 in respect of the period 1/10/19X8 to 31/3/19X9. The electricity bill for the quarter to 30/09/19X8 for Ksh 500 was unpaid. Prepare a balance sheet as at 30 September 19X8 and a profit and loss account for the year to that date. END OF COMPREHENSIVE ASSIGNMENT No.2 NOW SEND TO THE DISTANCE LEARNING CENTRE FOR MARKING Acknowledgement 297 LESSON SEVEN PARTNERSHIPS A partnership is a relationship that subsists between two or more persons carrying on a business common with a view to making profit. Reasons for partnership 1) Additional capital incase a sole trader or one person is not able to raise sufficient capital. 2) Incase there is need for skills or expertise in certain areas of the business. 3) To involve more persons in the business especially for a family. Membership A partnership has minimum membership of two (2) maximum of fifty (50) except for professional firms (e.g.) lawyers, doctors, accountants etc. whose maximum membership is twenty (20) persons. Partnership deed Where two or more persons wish to form a partnership, then it is recommended that they agree on the terms upon which the partnership will be run and the relationship between each other. This is done in writing and signed off as agreed by all the partners and therefore it becomes a partnership deed or agreement. Contents of partnership agreement 1) Name(s) and address(s) of both the firm and the partners 2) Capital to be contributed by each partner 3) The profit sharing ratios that may be expressed as a fraction or as a percentage. 4) Salaries to be paid to any partners who will be involved in the active management of the business 5) Any interest to be charged on drawings made by the partners. 6) Interests to be given to the partners on their capital balances. 7) Procedures to be taken on the retirement or admission of a partner. Accounting for partnerships. The interest of the partners in the business is either long term or short-term. The long-term interest is the capital contributed by each partner and the balance is expected to remain fixed. It will only change when the partners agree or incase of any changes in the partnership like admission of or retirement of a partner. The short-term interest is reflected in form of a current account which is affected by the trading activities of the partnership (i.e.) the profits or losses and any drawings made by the partners. In most partnerships, both a capital and a current account are maintained and therefore the capital account becomes a fixed capital account. When there is no 298 Other Aspects of Final Accounts distinction between a capital account and a current account then any short- term changes are passed through the capital account therefore the capital account becomes a fluctuating capital account. Some of the transactions to be passed through the capital account and the current account are shown in the following formats. (Assume a firm of 3 partners A, B and C) Loss or revaluation Goodwill written off Bal c/d CAPITAL ACCOUNT A B C £ £ £ xx xx xx Bal b/d xx xx xx xx xx xx xx xx xx A £ xx B £ xx C £ xx Additional capital xx (c/book or asset) Gains on revaluation xx Goodwill xx xx Bal b/d xx xx xx xx xx xx xx xx xx xx xx CURRENT ACCOUNT B C A £ £ £ xx Bal b/d xx xx xx xx Interest on capitalxx A £ Bal b/d Interest on drawings Drawings Bal c/d xx xx xx xx xx - xx xx xx xx Salaries Share of profits Loan interest Bal c/d Bal b/d B £ xx xx xx - xx xx xx xx xx xx xx C £ xx xx xx xx xx xx xx Format For Final Accounts: Profit and Loss Account The profit and loss account is exactly as the one for the sole trader and in addition to the profit and loss account, a new section called the Appropriation account is included and this account shows how the partners share the Net Profit for the period. (In addition to other expenses in the profit and loss, an expense for interest on loan given by one of the partners is included and the credit entry is made on the partner’s current account.) The format for the Appropriation account is as follows: Lesson Six 299 £ Net Profit for the year Add: Interest on drawings. A B C xx xx xx £ xx xx xx Less: Interest on capital. A B C xx xx xx £ (xx) £ xx Less: Salaries A B C xx xx xx Balance of profit to be shared in percentage ratio A (ratio) xx B (ratio) xx C (ratio) xx (xx) xx (xx) Balance sheet The balance sheet also the same as that for a sole trader but the interest of each partner in the business should be shown separately and any loan given by a partner to the firm is also shown separately in the non-correct liability section therefore, the format will be as follows. £ £ £ xx xx xx xx xx Net assets. Capital: A B C Current account A B C (debit balance). Non-current liabilities 10% loan – B 10% loan – bank xx xx (xx) xx xx xx xx xx xx 300 Other Aspects of Final Accounts Example 7.1 Read the following and answer the questions below. A and B own a grocery shop. Their first financial year ended on 31 December 2002. The following balances were taken from the books on that date: Capital: Partnership salaries: Drawings: A- £60,000; A - £9,000; A - £12,000; B - £48,000. B - £6,000. B - £13,400. The firm’s net profit for the year was £32,840. Interest on capital is to be allowed at 10% per year. Profits and losses are to be shared equally. (a) From the information above prepared the firm’s appropriation account and the partners’ current accounts. SOLUTION A and B Profit and Loss Appropriation account for the year ended 31 Dec 2002 £ £ Net Profit for the year 32,840 Less: Interest on capital A B 6000 4800 (10,800) 22,040 Less: Salaries A 9000 B 6000 (15,000) Balance of profit to be shared in Profit Share Ratio 7,040 A ½ 3520 B ½ 3520 (7,040) Drawings A £ 12,86 0 Bal c/d 5,660 18,52 0 CURRENT ACCOUNT B £ 13,400 Interest on capital Salaries 920 Profit shared. 14,320 A £ 6,000 B £ 4,800 9,000 3,520 6,000 3,520 18,520 Bal b/d 14,32 0 5,660 920 Lesson Six 301 EXAMPLE 7.2 Draw up a profit and loss appropriation account for the year ended 31 December 19X7 and balance sheet extracts at the date, from the following: i. ii. iii. iv. v. vi. vii. viii. Net profits £30,350 Interest to be charged on capitals: W £2,000; P £1,500; H £900 Interest to be charged on drawings; W £240; P £180; H £130 Salaries to be credited: P £2,000; H £3,500. Profits to be shared: W 50%; P 30%; H20%. Current accounts: balances b/f W £1,860; P £946; H £717 Capital accounts: balances b/f W £40,000; P £30,000; H £18,000 Drawings: W £9,200; P £7,100; H £6,900. SOLUTIONS W,P and H Profit and Loss Appropriation Account for the year ended 31 December 2002 £ Net profit for the year Add: Interest on drawings W P H 240 180 130 Less: Interest on capital W P H 2,000 1,500 900 Less: Salaries P H Balance of profit to be shared W 50% Pl 30% H 20% W Interest on draw Drawings P £ 240 £ 10,500 6,300 4,200 550 30,900 (4,400) 26,500 (5,500) 21,000 (21,000) Current Account H £ 130 Bal b/d W £ 1,860 180 9,200 P £ H £ 717 946 6,900 7,100 Bal c/d 2,000 3,500 £ 30,350 Interest on capital Salaries 2,000 900 1,500 3,500 2,000 302 Other Aspects of Final Accounts Share of profits Bal c/d 4,920 14,360 4,200 6,300 2,287 3,466 10,74 6 9,317 Balance sheet (extract) as at 31 Dec 2002 £ Net Assets Capital W P H Current Accounts W Pl H 10,000 14,360 £ 10,74 6 9,317 £ xx 40,000 30,000 18,000 88,000 4,920 3,466 2,287 10,673 98,673 Example 7.3 The following list of balances as at 30 September 19X9 has been extracted from the books of Brick and Stone, trading partnership, sharing the balance of profits and losses in the proportions 3:2 respectively. £ Printing, stationery and postage 3,500 Sales 322,100 Stock in hand at 1 October 19X8 23,000 Purchases 208,200 Rent and rates 10,300 Staff salaries 36,100 Telephone charges 2,900 Motor vehicle running costs 5,620 Discounts allowable 950 Discount receivable 370 Sales returns 2,100 Purchases returns 6,100 Carriage inwards 1,700 Carriage outwards 2,400 Fixtures and fittings: at cost 26,000 Provision for depreciation 11,200 Motor vehicles: at cost 46,000 Provision for depreciation 25,000 Provision for doubtful debts 300 Drawings: Brick 24,000 Stone 11,000 Current account balances Lesson Six At 1 October 19X8: Brick Stone Capital account balances At 1 October 19X8: Brick Stone Debtors Creditors Balance at bank 303 3,600 2,400 credit credit 33,000 17,000 9,300 8,400 7,700 Additional information 1. £10,000 is to be transferred from Brick’s capital account to a newly opened Brick Loan Account on 1 July 19X9. 2. Interest at 10 per cent per annum on the loan is to be credited to Brick. 3. Stone is to be credited with a salary at the rate of £12,000 per annum from 1 April 19X9. 4. Stock in hand at 30 September 19X9 has been valued at cost at £32,000. 5. Telephone charges accrued due at 30 September 19X9 amounted to £400 and rent of £600 prepaid at that date. 6. During the year ended 30 September 19X9 Stone has taken goods costing £1,000 for his own use. 7. Depreciation is to be provided at the following annual rates on the straight line basis: Fixtures and fittings 10% Motor vehicles 20% Required: (a) Prepare a trading and profit loss account for the year ended 30 September 19X9. (b) Prepare a balance sheet as at 30 September 19X9 which should include summaries of the partners’ capital and current accounts for the year ended on that date. Note: In both (a) and (b) vertical forms of presentation should be used. SOLUTION Brick And Stone. Trial Balance As At 30 September 19x9 Debit £ Printing and stationery and postage 3,500 Sales Stock (1 October 19X8) 23,000 Purchases 208,200 Rent and rates Heat and light Staff salaries 36,100 Telephone charges 2,900 Motor vehicle running expenses 5,620 Credit £ 322,100 10,300 8,700 304 Discounts allowable Discounts receivable Sales returns Purchases returns Carriage inwards Carriage outwards Fixtures and fittings at cost Provision for depreciation Motor vehicles at cost Provision for depreciation Provision for doubtful debts Drawings: Brick Stone Other Aspects of Final Accounts 950 370 2,100 6,100 1,700 2,400 26,000 11,200 46,000 25,000 300 24,000 11,000 Lesson Six 305 Current accounts: Brick Stone Capital accounts: Brick Stone Debtors Creditors Balance at bank 3,600 2,400 33,000 17,000 9,300 8,400 7,700 429,470 429,470 TRADING AND PROFIT LOSS ACCOUNT FOR THE YEAR ENDED 30 SEPTEMBER 19X9 £ £ £ Sales 322,100 Less: Sales returns 2,100 320,000 less cost of sales Opening Stock 23,000 Purchases (adjustment) 207,200 Add: Carriage inwards 1,700 208,900 Less: Purchases returns (6,100) 202,800 225,800 Less: Closing Stock (32,000) (193,800) Gross profit 126,200 Discount receivable 370 Less Expenses Telephone charges (adjustment)) 3,300 Printing and stationery and postage 3,500 Rent and rages (adjustment) 9,700 Heat and light 8,700 Staff salaries 36,100 Motor vehicle running expense 5,620 Discount allowable 950 Carriage outwards 2,400 Depreciation on fixtures and fittings 2,600 Depreciation on motor vehicles 9,200 Interest on loan (adjustment) 250 (82,320) Net profit 44,250 Less: Salaries Stone (adjustment) (6,000) Balance of profit to be shared 38,250 Brick 3 5 22,950 Stone 2 5 15,300 (38,250 306 Other Aspects of Final Accounts Balance sheet as at 30 September 19X9 Non current Asset £ £ £ Fixtures and fittings 26,000 (13,800) 12,200 Motor vehicles 46,000 (34,200) 11,800 72,000 48,000 24,000 Current Asset Stock 32,000 Debtors 9,300 Less: Provision (300) 9,000 Payments 600 Cash at bank 7,700 49,300 Current Liabilities Creditors 8,400 Accruals 400 (8,800) 40,500 64,500 Capital Brick (adjustment) 23,000 Stone 17,000 Current: Brick adjustment 2,800 Stone 11,700 14,500 54,500 Non-Current Liabilities 10% loan – Brick 10,000 64,500 Current Account Drawings Brick £ 24,00 0 Bal c/d Stone £ 12,000 (adj) 11,700 Bal b/d Interest on loan Salaries. Brick £ 3,600 250 2,800 Share profits 26,80 0 26,800 Stone £ 2,400 22,950 26,800 6,000 15,30 0 23,70 0 Lesson Six 307 EXAMPLE 7.4 Mack and Spencer are in partnership sharing profits and losses equally. The following is the trial balance as at 30 June 2003. Dr. Cr. £ £ Buildings (cost £750,000) 500,000 Fixtures at cost 110,000 Provision for depreciation: Fixtures 33,000 Debtors 162,430 Creditors 111,500 Cash at bank 6,770 Stock at 30 June 19X8 419,790 Sales 1,236,500 Purchases 854,160 Carriage outwards 12,880 Discount allowed 1,150 Loan interest: King 40,000 Office expenses 24,160 Salaries and wages 189,170 Bad debts 5,030 Provision for bad debts 4,000 Loan from J King 400,000 Capitals: Mack 350,000 Spencer 290,000 Current accounts: Mack 13,060 Spencer 2,890 Drawings: Mack 64,000 Spencer 56,500 2,446,040 2,446,040 Required: Prepare a trading and profit and loss appropriation account for the year ended 30 June 19X9 and a balance sheet as at that date. a) b) c) d) e) f) g) Stock, 30 June 2003, £563,400 Expenses to be accrued: Office Expenses £960; Wages £2,000 Depreciate fixtures 10 per cent on reducing balance basis, buildings £10,000 Reduce provision for bad debts to £3,200. Partnership salary: £8,000 to Mack. Not yet entered Interest on drawings: Mack£1,800; Spencer £1,200. Interest on capital account balances at 10 per cent. 308 Other Aspects of Final Accounts Mack and Spencer Q 5.2 Trading and Profit Loss Account for the year ended 30 June 2003 £ £ £ Sales 1,236,500 Less cost of sales Opening Stock 419,790 Add: Purchases 854,160 1273,950 Less: Closing Stock (563,400) 710,550 Gross Profit 525,950 Reduction in provision for bad debts (400-300) 800 526,750 Less Expenses 10 Depreciation: Fixtures & Fittings (110,000-33,000 x 100 )7,700 Buildings 10,000 Carriage outwards 12,880 Discount allowed 1,150 Office expenses (24160 + 960) 25,120 Loan interest 40,000 Salaries and wages (18,9170 + 2000) 191,170 Bad debts 5,030 (293050) Net Profit for the period 233,700 Add: Interest on drawings: Mack 1,800 Spencer 1,200 3,000 236,700 Less: Salaries – Mack (8,000) 228,700 Less: interest on capital Mack 35,000 Spencer 29,500 (64,500) 164,200 Balance of profits Mack ½ 82,100 Spencer ½ 82,100 164,200 Mack – Current Account £ £ Drawings 64,000 balance b/d 13,060 Interest on drawings 1,800 salary 8,000 Interest on capital 35,000 Profit 82,100 bal c/d 72,360 138,160 138,160 Lesson Six 309 Spencer – Current Account £ Drawings 56,500 Interest on drawings 1200 Bal c/d £ bal b/d 2980 Interest on capital 29,500 Profit 82,100 56,880 114,580 114,580 Balance Sheet as at 30 June 19X9 Non Current Assets Buildings Fixtures £ Cost 750,000 110,000 860,000 Current Assets Stock Debtors (16,243 – 320) Cash at bank Current Liabilities Creditors Accruals (200 + 96) 56,3400 15,9230 6770 72,9400 111,500 2,960 Capital Accounts: Mack Spencer Current Accounts: Mack Spencer Loan from J. King £ £ Depreciation NBV (260,000) 490,000 (40,700) 69,300 (300,700) 559,300 (114,460) 61,4940 1,174,240 35,000 29,500 64,500 56,880 129,240 72,360 400,000 1,174,240 310 Other Aspects of Final Accounts Example 7.5 JUNE 1998 QUESTION 4 The balance sheet of the partnership of Kombo and Nzuki as at 31 March 1997 was as follows: Capital accounts: sh. sh Kombo 1,400,000 Nzuki 1,400,000 2,138,000 Current Accounts: Kombo 136,000 Nzuki (81,200) Current Liabilities: Creditors 501,600 Accruals 25,600 Suspense account 1,570,300 Shs. Sh. Fixed asset (at cost less depreciation 2,800,000 Premises 1,200,000 Equipment 520,000 Vehicles 418,000 54,800 Current Assets: Stock 894,200 527,200 debtors 475,900 Provision (46,400) 429,500 Prepayments 28,600 326,300 Bank and cash 281,000 3,708,300 3,708,300 After a lengthy check of all the entries, the following errors were identified 1. Discounts received, sh.26,400 had been debited to discounts allowed. 2. The sales account had been under cast by sh.200,000. 3. A credit sale of Sh.29,400 had been debited to a customer’s account as Sh.42,900. 4. A vehicle bought originally for sh.140,000 four years ago and depreciated at 20% by straight line method on an assumed residual value of Sh.20,000 had been sold at Sh.60,000 but no entries, other than in the bank account had been passed through the books. 5. An accrual of Sh.11,200 for electricity charges had completely been omitted. 6. A bad debt of Sh.31,200 had not been written off an provision for bad debts should have been maintained at 10% of debtors. 7. Kombo’s current account had been credited with a partnership salary of Sh.60,000 which should have been credited to Nzuki’s current account. 8. Kombo had withdrawn, for personal use, goods to the value of Sh.39,200. No entries had been made in the books. 9. The partners share of profits and losses as follows: Kombo 60% and Nzuki 40% Required: a) A statement of adjustments to show the correct net profit for the y (12 marks) Lesson Six b) 311 A suspense account showing how the balance is eliminated from the books. (2 marks) c) A corrected balance sheet as at 31 March 1997. (8 marks) 312 Other Aspects of Final Accounts SOLUTION The following journal can be included although not required in the question. DR i) DR: Suspense Account CR: Discount Allowed Account DR: Suspense Account CR: Discount receive Making the correct in the accounts ii) DR: Suspense Account CR: Sales Account Sales undercast now corrected iii) DR: Suspense Account CR: Debtors Account Being an overstatement of debtors account now corrected iv) DR: CR: DR: CR: DR: CR: DR: CR: v) DR: Profit and Loss Account CR: Accrue expenses Account vi) DR: CR: DR: CR: DR: CR: DR: CR: 39,200 CR 26,400 26,400 26,400 26,400 200,000 200,000 13,500 13,500 Asset Disposals Account 140,000 Asset Account 140,000 Provision for depreciation Account Asset Disposal Account Suspense Account 60,000 Asset Disposal Account 60,000 Asset Disposal Account 16,000 Profit and Loss Account 16,000 11,200 Profit and Loss Account Debtors Account Provision for doubtful debts Account Profit and Loss Account Kombo’s Current Account Nzuki’s Current Account Kombo’s Current Account Profit and Loss Account (Purchases) 11,200 31,200 31,200 3,280 3,280 60,000 60,000 39,200 Lesson Six (a) 313 Kombo and Nzuki Partnership Statement of Corrected Net Profit for the year Sh. Sh. Adjustments Discount allowed 26,400 Discount received 26,400 Sales undercasted 200,000 Profit on disposal of asset 16,000 Accrued electricity charges (11,200) Bad debts (31,200) Decrease in provision for bad debts 3,280 Drawings (goods) 39,200 Net adjustments to Net Profit 268,880 Bal b/d Nzuki Drawings Bal c/d Partners Current Account Kombo Nzuki Shs Shs. Bal b/d 81,200 Kombo 60,000 Net profit 39,200 adjustments 198,12 8 86,352 297,32 8 (b) Discount allowed Discount received Sales Debtors Motor vehicle disposal 167,55 2 Suspense Account Shs. 26,400 bal b/d 26,400 200,000 13,500 60,000 326,300 Kombo Shs. 136,00 0 - Nzuki Shs. - 161,32 8 60,000 107,55 2 297,32 8 167,55 2 Shs. 326,300 326,300 314 (c) Other Aspects of Final Accounts Kombo and Nzuki Balance Sheet as at 31 March 1997 Fixed Assets Shs. Shs. Premises Equipment Vehicles Current Assets Stocks Debtors (431,200 – 43,120) Prepayments Bank and Cash Current Liabilities Creditors 501,600 Accruals (25,600 + 11,200) Shs. 1,200,000 520,000 374,000 2,094,000 894,200 388,080 28,600 218,000 1,528,880 36,800 Capital Accounts Kombo Nzuki 1,400,000 1,400,000 Current Accounts Kombo Nzuki 198,128 86,352 (538,400) 3,084,480 990,480 2,800,000 284,480 3,084,480 NB This is a very good question on partnership as it combines both errors on the accounts and Partnerships. Please study it carefully and follow up the entries and adjustments. The next example is still on past paper and combines both incomplete records and partnerships. EXAMPLE 7.6 JUNE 1997 Question 1 Kefa and Mark are partners sharing profits and losses equally. They do not maintain proper books of accounts. The following information has been obtained from the available records on 31 March: 1996 1997 Sh. Sh. Balance at bank 94,800 169,680 Stock in trade 541,200 488,640 Trade debtors 612,000 ? Trade creditors ? 305,760 Furniture 360,000 Motor vehicles (book value) 1,920,000 Lesson Six 315 Total sales during the year ended 31 March 1997 amounted to Sh.3,849,120 while purchases, all on credit for the same period were Sh.2,952,480. On 31 March 1996 Kefa’s capital was Sh.200,000 less than that of Mark. The analysis of the cash book for the year ended 31 March 1997 shows the following: Receipts: Cash from credit sales Additional capital by Kefa Cash sales Payments: For purchases Salaries paid Rent paid (for 6 months to 30.9.96) Rates paid (for 6 months to 30.6.97) Electricity charges Advertising Motor vehicle expenses Sundry expenses Drawings Kefa Mark On 31 March 1997 liabilities were as follows: Sh. Electricity charges 12,480 Advertisement Sundry expenses 3,491,520 240,000 586,800 3,070,080 420,000 144,000 120,000 60,000 41,760 119,520 33,600 132,480 102,000 6,240 3,600 On 20 March 1997 the firm decided to dispose of two of its motor vehicles. One vehicle was sold on credit for Sh.640, 000 while the other was taken over by Kefa at a valuation of sh.250, 000. the combined book value of the two vehicles was Sh.660,000. the transaction has not been recorded in the books. Depreciation at the rate of 10 percent is to be provided on furniture and motor vehicles on hand at 31 March 1997. No depreciation is to be provided for the vehicles, which were disposed of. Required: a) Trading, profit and loss account for the year ended 31 March 1997. (10 marks) b) Balance sheet as at 31 March 1997. (8 marks) c) Partner’s capital accounts (4 marks) (Total: 20 marks) SOLUTION June 1997 Question 1 KEFA and MARK STATEMENT OF AFFAIRS AS AT 31 March 1997 Assets Sh. Sh. Bank 94,800 Stock 541,200 Debtors 612,000 316 Other Aspects of Final Accounts Furniture Motor vehicle Liabilities Creditors Net Assets Capital 360,000 1,920,000 3,528,000 (423,360) 3,104,640 Kefa Mark 1,452,320 1,652,320 3,104,640 Trading, Profit and loss account for the year ended 31 March 1997 Sh Sh. 3,849,120 Sales Less cost of sales Opening stock Purchases Less: Closing stock Gross profit Profit on disposal adjustment 541,200 2,952,480 488,640) (3,005,040) 844,080 230,000 1,074,080 Less Expenses Salaries Rent adjustment Rates Electricity Advertising Motor vehicle Sundry expense Depreciation – Furniture - Motor vehicle Net Loss should in PSR Kefa Mark 420,000 288,000 60,000 72,480 48,000 119,520 37,200 36,000 126,000 (66,560) (66,560) (1,207,200) (133,120) 133,120 Balance sheet as at 31 March 1997 Non-current Assets Furniture Motor vehicle Sh. 360,000 1,620,000 Current Assets Stock Debtors – Trade Adjustment - others vehicle Prepayments Bank Sh. (36,000) 1,260,000 (162,000) Sh. 324,000 (126,000) 1,134,000 1,458,000 488,640 382,800 640,000 60,000 169,680 1,741,120 Lesson Six 317 Current Liabilities Creditors Accruals Capital - Kefa Mark 305,760 166,320 (472,080) 1,269,040 2,727,040 1,243,280 1,483,760 2,727,040 318 Other Aspects of Final Accounts Kefa Shs. Drawings 132,480 Disposal Capital Account Mark Shs. Bal b/d 102,000 Cash 250,000 Kefa Shs. 1,452,3 20 mark Shs. 1,652,3 20 240,000 Loss shared Bal c/d 66,560 1,243,28 0 1,692,32 0 66,560 1,483,76 0 1,652,32 0 1,692,3 20 1,652,3 20 (c) GOODWILL AND REVALUATION OF ASSETS This is defined as the advantage, whatever it may be, a person gets by continuing to be entitled to represent to the outside would that he is carrying on a business which has been carried on for sometime previously. “Judge Warey in Hull V Frases” Goodwill is the element that arises from a business due to its reputation and therefore, enjoys benefits that a new business may not get. (e.g.) A new business may not make profits easily during the first year of trading. Factors that contribute to goodwill 1. Quality of products/Services 2. Good personnel 3. Marketing 4. Location 5. In accounting, goodwill is very important for ascertaining the element or the share of a partner’s effort to improve the business. The problem is normally to ascertain the value or cost of goodwill. There are two types of goodwill: 1. Non-Purchase goodwill Non- purchased goodwill is determined by using subjective estimates. There are various approaches to these. Goodwill maybe arrived at by taking the average profits for lets say three previous years of trading. Due to this subjective estimate, this type of goodwill is not maintained or shown in the accounts. 2. Purchased goodwill This is less subjective because it is the excess amount paid for a business above its net assets. This is less subjective because it is the excess amounts paid for a business above its net assets. Lesson Six 319 (e.g) If a business pays Sh.3.5 m to acquire the net assets (i.e. in these case the net assets will be total assets less total liabilities) of another business that is still trading on and the value of the net asset is 3 M, therefore the purchased goodwill may be shown in the accounts as an intangible asset. Purchased goodwill can be treated in the following three main ways: 1) Goodwill is written off from the accounts 2) Is carried at its value an amortized over a period of time 3) Carried at its value without being amortized. The practice is normally to carry it in the accounts together with the other assets (as an intangible asset) and amortize it over estimated period of time. 320 Other Aspects of Final Accounts In a partnership, there are normally three situations where goodwill is accounted for in the accounts: a) If there is a change in the profit sharing ratio. b) On admission of a new partner. c) On retirement of an old partner. d) Example (when there is a change in profit sharing ratio) When there is a change in the profit sharing ratio, then goodwill is introduced in the accounts by Dr. Goodwill account Cr. Partner’s capital account ( the credit is based on the old profit sharing ratio.) The goodwill may remain in the accounts and therefore no partner entries will be made. If the goodwill is to be written off from the accounts, this will be done by Debiting partner’s capital account (in the New profit sharing ratio) Crediting goodwill account Example: A and B have been trading as partners sharing profits and losses equally. They decided to change profit sharing ration to 3:2. The capital balances are: A: - Sh.1,000,000 B: - Sh.1,500,000 Goodwill has been agreed at Sh.500,00. Required: The partner’s capital balances assuming that: 1) Goodwill is to be retained in the accounts 2) Goodwill is to be written off form the accounts. Solution: 1) CAPITAL ACCOUNT B Bal b/d A A 1,000,0 00 B 1,500,0 00 250,000 250,000 Goodwill(OPSR) Bal c/d 2) Goodwill 12,500,0 00 12,500,0 00 1,750,0 00 1,750,0 00 CAPITAL ACCOUNT A B 300,000 Bal b/d A 1,000,000 B 1,500,00 Lesson Six 321 (NPRS) Bal c/d (NPSR) 950,000 12,500,00 0 200,000 1,550,00 0 1,750,00 0 0 Goodwill (OPSR) 250,000 12,500,00 0 250,000 1,750,00 0 REVALUATION OF ASSETS. The business may revalue some of the assets to reflect their fair values (e.g.) based on market price. The revaluation is normally done when a new partner is to be admitted or an old partner is retiring. Any revaluation gains or losses are passed through a new account (i.e) a Revaluation account and the balance on this account profit or low on revaluation is transferred to the partner’s capital accounts in the existing profit sharing ratio. Example: (A, B, and C are trading as partners sharing profits and losses in the ratio of 2:2:1. They have the following assets and liabilities at the book values and they wish to restate these values at market values and agreed values. Assets/Liabilities Buildings Fixtures, Fittings & furniture Motor vehicle Stock Debtors (50,000) Creditors Book value £ 2,000,000 900,000 1,200,000 700,000 450,000 Market price/Agreed value Gain) £ Loss 2,500,000 100,000 800,000 (100,000) 1,150,000 (50,000) 650,000 (50,000) 400,000 800,000 700,000 100,000 Required: Prepare Revaluation account and the partner’s capital account given the partner’s balances as A £3,000,000 B £2,500,000 C £1,500,000 REVALUATION ACCOUNT £ 100,000 50,000 50,000 50,000 140,000 Fixtures Motor vehicles Stock Debtors Capital A/C A 2 5 B 2 C 1 5 140,000 5 70,000 £ buildings Creditors 500,000 100,000 322 Other Aspects of Final Accounts 600,000 600,000 Goodwill A £ 000 Bal c/d 3,140 3,140 CAPITAL ACCOUNT C £ 000 Bal b/d 2,640 1,510 Revaluatio n 2,640 1,570 B £ 000 A £ 000 3,000 140 B £ 000 2,500 140 C £ 000 1,500 70 3,140 2,640 1,570 If there is a profit on revaluation, then the profit will be transferred to the partner’s capital account by: Dr. Revaluation Cr. Partner’s capital account in the profit share ratio If there is loss then Dr. Partner’s capital account Cr. Revaluation in the profit share ratio EXAMPLE 7.7 Alan, Bob and Charles are in partnership sharing profits and losses in the ratio 3:2:1 respectively. The balance sheet for the partnership as at 30 June 19X6 is as follows; Fixed Assets Premises Plant Vehicles Fixtures Current Assets Stock Debtors Cash £ 62,379 34,980 ___760 Capital Alan Bob Charles Current account Alan Bob £ 90,000 37,000 15,000 2,000 144,000 98,119 £242,11 9 85,000 65,000 35,000 185,000 3,714 (2,509) Lesson Six Charles Loan – Charles Current liabilities Creditors Bank overdraft 323 4,678 5,883 28,000 19,036 4,200 £242,11 9 Charles decides to retire from the business on 30 June 19X6, and Don is admitted as a partner on that date. The following matters are agreed: 324 Other Aspects of Final Accounts a) Certain assets were revalued; Premises £120,000 Plant £35,000 Stock £54,179 b) Provision is to be made for doubtful debts in the sum of £3,000. c) Goodwill is to be recorded in the books on the day Charles retires in the sum of £42,000. The partners in the new firm do not wish to maintain a goodwill account so that amount is to be written back against the new partners’ capital accounts. d) Alan and Bob are to share profits in the same ratio as before, and Don is to have the same share of profits as Bob. e) Charles is to take his car at its book value of £3,900 in part payment, and the balance of all he is owed by the firm in cash except £20,000 which he is willing to leave as a loan account. f) The partners in the new firm are to start on an equal footing so far as capital and current accounts are concerned. Don is to contribute cash to bring his capital and current accounts to the same amount as the original partner from the old firm who has the lower investment in the business. The original partner in the old firm who has the higher investment will draw out cash so that his capital and current account balances equal those of his new partners. Required; a) Account for the above transactions, including goodwill and retiring partners’ accounts. b) Draft a balance sheet for the partnership of Alan, Bob and Don as at 30 June 19X6. Solution: Goodwill written off Motor vehicle Cashbook Bal c/d Don Alan Bob £ £ £ 12,0 00 - 18,00 0 - 12,0 00 - - 21,00 0 67,00 0 106,0 00 67,0 00 79,0 00 Don Alan 67,0 00 79,0 00 Bob Charl es £ Capital Accounts Don Alan - Bal b/d 3,900 Goodwil l 38,10 Cash 0 book 42,00 0 Charl Bob Charl es £ £ £ £ - 85,00 0 21,00 0 - 65,0 00 14,0 00 - 35,00 0 7,000 106,0 00 79,0 00 42,00 0 79,0 00 79,0 00 Current Accounts Don Alan Bob - Charl Lesson Six Bal b/d Cash book Bal c/d 325 £ - £ - £ 2,50 9 9,02 3 3,09 1 3,09 1 es £ - Bal b/d 7,478 Revaluation a/c Cash book 3,091 12,11 4 3,09 1 5,60 0 es £ 4,678 £ - £ 3,714 £ - - 8,400 2,800 3,09 1 - 5,60 0 - 3,09 1 12,11 4 5,60 0 7,478 - 7,478 326 Plant Stock Debtors Profits shared: Alan Bob Charles Other Aspects of Final Accounts Revaluation Account £ £ 2,000 Premises 30,000 8,200 3,000 8,400 5,600 2,800 30,000 _____ 30,000 Cash book Bal b/d Don - capital account Current account £ 760 Charles – capital account 79,000 Loan 3,091 Current account Alan – capital account Current account Bal c/d £ 38,100 8,000 7,478 21,000 9,023 ****** Cash book £ Don - capital account Current account Bal b/d 79,000 Charles – capital account 3,091 Loan account Current account Alan – capital account Current account £ 4,200 38,100 8,000 7,478 21,000 9,023 Lesson Six 327 Alan, Bob and Don Partnership Balance Sheet as at 30 June 19X6 Fixed Assets Cost Depreciatio n Premises Plant Vehicles Fixtures 120,000 35,000 1,100 2,000 168,100 Current Assets Stock Debtors Cash 54,179 31,980 __760 86,919 Less Current Liabilities Creditors Bank overdraft 19,036 5,710 Capital accounts Alan Bob Don 67,000 67,000 67,000 Current Accounts Alan Bob Don Non current liabilities Loan – Charles NBV 3,091 3,091 3,091 (24,746) 62,173 230,273 201,000 9,273 210,273 20,000 230,273 NOTE: i. ii. iii. iv. Goodwill introduced shared among the partners in the old partnership in current profit sharing ratios. Same case applies for any gain or loss in the revaluation of assets. Goodwill written off in the new profit sharing ratios against the capital accounts only for the new partners. When there is no enough cash to be paid to the retiring partners, his balance remains in the business as a loan. (d)Admission of a new partner. When a new partner is admitted into the firm, this marks the end of the old partnership and the beginning of a new one. 328 Other Aspects of Final Accounts The new partner will have to bring in the capital that is due from him as per the agreement and also pay for a share of the goodwill. Goodwill is credited to the partner’s account(only the old) and is again written off by debiting the partner’s account(inclusive of the new one in the new Profit Sharing Ratio). If the admission is taking place part way through the financial period, then the new partner will be entitled to the profits or losses for the remaining part of the financial period. (i.e from the point of joining the partnership). Care should be taken when apportioning interest on capital, salaries and profits because of the changes Example: The following was the partnership trial balance as at 30 April 2001: Sh. Sh. Fixed capital accounts Rotich 750,000 Sinei 500,000 Current accounts Rotich 400,000 Sinei 300,000 Leasehold premises (purchased 1 May 2000) 2,250,000 Purchases 4,100,000 Motor vehicle (cost) 1,600,000 Balance at bank 820,000 Salaries (including partners’ drawings) 1,300,000 Stocks: 30 April 2000 1,200,000 Furniture and fittings (cost) 300,000 Debtors 225,000 Accountancy and audit fees 105,000 Wages 550,000 Rent, rates and electricity 310,000 General expenses (Sh.352,400 for the six months to 31 October 2000) 660,000 Cash introduced – Tonui 1,250,000 Sh. Sh. Sales (Sh.3,500,000 to 31 October 2000) 8,750,000 Accumulated depreciation: 1 May 2000 Motor vehicle 300,000 Furniture and fittings 100,000 Creditors 1,070,000 13,420,000 13,420,000 Additional information: 1. On I November 2000 Tonui was admitted as a partner and from that date profits and losses were to be shared on the ratio 2:2:1. For the purposes of this admission, the value of goodwill was agreed at Sh.3, 000,000. No account for goodwill was to be maintained in the books, adjusting entries for transactions between the partners being made in their current accounts. On that date, Tonui introduced Sh.1,250,000 more into the firm of which Sh.375,000 Lesson Six 2. 3. 4. 5. 6. 7. 8. 9. 329 comprised his fixed capital and the balance was credited to his current account. Interest on fixed capitals was still to be allowed at the rate of 10% per annum after Tonui’s admission. In addition, after Tonui’s admission, no interest was to be charged or allowed on current accounts. Any apportionment of gross profit was to be made on the basis of sales. Expenses, unless otherwise indicated were to be apportioned on a time basis. A charge was to be made fro depreciation on motor vehicle and furniture and fittings at 20% and 10% per annum respectively, calculated on cost. On 30 April, the stock was valued at Sh.1,275,000. Salaries included the following partners’ drawings: Rotich Sh.150,000, Sinei Sh.120,000 and Tonui Sh. 62,500 A difference in the books of Sh.48,000 had been written off at 30 April 2001 to general expenses, which was later found to be due to the following clerical errors: • Sales returns of Sh. 32,000 had been debited to sales returns but had not been posted to the account of the customer concerned; • The purchases journal had been undercast by Sh.80,000 Doubtful debts (for which full provision was required) amounted to Sh.30,000 and Sh.40,000 as at 31 October 2000 and 30 April 2001 respectively. On 30 April 2001, rates and rent paid in advance amounted to Sh.50,000 and a provision of Sh.15,000 for electricity consumed was required. Required: a) Trading and profit and loss account for the year ended 30 April 2001. (9 marks) b) Partners’ current accounts for the year ended 30 April 2001 (4 marks) c) Balance sheet as at 30 April 2001 (7 marks) (Total: 20 marks) Solution a) ROTICH, SINEI AND TONUI TRADING, P ROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 30 APRIL 2001 Sh. Sh. Sales 8,750,000 Less: cost of sales Opening stock 1,200,000 Purchases 4,180,000 5,380,000 Less: Closing stock (1,275,000) 4,105,000 Gross Profit 4,645,000 330 Other Aspects of Final Accounts Gross profit S TS × GP Expenses Dep. Motor Vehicle Furniture Salaries Accountancy fees 1.3.20003.10.2000 Sh Sh 1,858,00 0 1.11.200030.4.2001 Sh Sh 2,787,00 0 Sh 160,0 00 160,00 0 320,00 0 15,00 0 483,7 50 15,000 30,000 483,75 0 52500 967,50 0 105,00 0 275,00 0 137,50 0 359,60 0 550,00 0 275,00 0 612,00 0 52,50 0 275,0 00 137,5 00 362,4 00 Wages Rent, rates, electricity General expenses Prov. For depreciation 30,00 0 (1,506,1 50) 10,000 (1,393,3 50) 40,000 Net Profit 351,850 Sh 4,645,00 0 2,899,50 0 1,745,50 0 1,393,65 0 Less: Interest on capital Rotich 37,50 0 37,500 75,000 25,00 0 - 25,000 50,000 Sinei Tonui (62,500) Balance of profit shared Rotich 2 Sinei 1 3 3 2 5 2 5 18,750 289,350 192,9 00 96,45 0 (81,250) 18,750 1,312,40 0 524,96 0 717,86 0 524,96 0 621,41 0 (143,750 ) 1,601,75 0 Lesson Six Tonui - 331 1 - 5 (289,350 ) 262,48 0 (1,312,4 00) 262,48 0 (1,601,7 50 b) Goodwill w/o R Sh. 1,200,0 00 S Sh. 1,200,0 00 Capital A/C - - Current Account R Bal b/d Sh. T Sh. 600,00 0 375,00 0 Drawings 150,00 0 120,00 0 62,500 400,00 0 Cash book Goodwill (2:1) Interest on capital Profit share Bal c/d 1,842,8 60 3,192,8 60 c) 651,41 0 1,971,4 10 S Sh. 300,00 0 493,73 0 1,531,2 30 C Sh. - 1,250,00 0 2,000,0 00 1,000,0 00 75,000 50,000 18,750 717,86 0 621,41 0 262,480 3,192,8 60 1,971,4 10 1,531,23 0 Rotich, Sinei and Tonui Balance Sheet as at 30 April 2001 Non-Current Assets Leasehold premises Furniture and Fittings 170,000 Motor vehicle Sh 2,250,000 1,600,000 4,150,000 Sh. 300,000 Sh. 2,250,000 (130,000) (620,000 980,000 (750,000) 3,400,000 332 Other Aspects of Final Accounts Current Assets Stock Debtors Less Provision Prepayments Balance at bank Current Liability Creditors Accruals 1,275,000 193,000 (40,000) 1,070,000 15,000 153,000 50,000 820,000 2,298,000 (1,085,000) 1,213,000 4,613,000 Capital: Rotich Sinei Tonui Current Account: Rotich Sinei Tonui (d) 750,000 500,000 375,000 1,625,000 1,842,860 651,410 493,730 2,988,000 4,613,000 The adjusting entries on admission of a new partner should be made to the capital account (i.e) for any introduction of goodwill and revaluation of assets Some of the adjustments may also be made in the current accounts if adjustments are made in the capital account and the admission is partway through the financial period, then any interest to be charged on capital will be based on the adjusted capital balance. If the adjustments are made in the current account then there will be no change on the capital balance and therefore no change on the interest charged on the capital balances. (e) Retirement of a partner When a partner retires (i.e.) leaves the firm and the others partners are left to continue with the business then the retirement marks the end of one partnership and the start of a new one. The partner who is leaving should be paid all the amounts due to him. This include: 1) Capital balance This will be all the amounts the partner has invested in the firm. Some firms may not be able to refund the amount in full and therefore it may be transferred t o a loan account whereby interest will be paid on the balance. 2) Goodwill Because this partner contributed to the improvement (existence) of the partnership therefore it will be fair to pay him his share of the goodwill. Goodwill is introduced to the accounts in the old profit sharing ratio ((i.e.) credited to all the partner’s capital accounts in the old profit sharing ratio), then written off from the accounts by debiting the capital accounts of the remaining partners in the new profit share ratio. Lesson Six 333 2) Credit balance on the current account This amount due to the partner is paid directly from the cashbook or transferred to the capital account whereby the total cash payable is to be determined. The transfer is made by: Dr. Current account Cr. Capital account 4) Share of profits If the retirement takes place during the financial period, then the retiring partner is entitled to take profits made up to the point of retirement. Any interest of capital, salaries and balance of profit shared in profit share ratio will be credited to the partner’s current account. Therefore the profit and loss account will be split between the two periods and appointment of profits done and this will be based on the terms of the partnership in each period. EXAMPLE 7.9 May 2002 Question 3 Kyamba, Onyango and Wakil were partners in a manufacturing and retail business and shared profits and losses in the ratio 2:2:1 respectively Given below is the balance sheet Balance sheet as at 31 March Assets Non-current assets: Fixed assets Current assets: Stock Debtors Capital and liabilities: Capital accounts: Kyamba Onyango Wakil of the partnership as at 31 March 2001. 2001 Sh. Sh. 465,000 294,000 209,000 503,000 968,000 160,000 140,000 200,000 500,000 Current accounts: Kyamba Onyango Wakil 65,300 49,000 53,000 167,300 667,300 Current Liabilities: Bank overdraft Trade creditors 48,000 252,000 300,700 968,000 334 Other Aspects of Final Accounts Additional information: 1. On 1 April 2001, Wakil retired from the partnership and was to start a business as a sole trader while Kyamba and Onyango continued in partnership. 2. On retirement of Wakil, the manufacturing business was transferred to him while Kyamba and Onyango continued with the retail business The assets and liabilities transferred to Wakil were as follows: Net book value Transfer value Sh Sh. Fixed assets 260,000 306,000 Stocks 166,000 157,000 Debtors 172,000 165,000 Creditors 156,000 156,000 Wakil obtained a loan from a commercial bank and paid into the partnership the net amount due for him. 3. On retirement of Wakil form the partnership, goodwill was valued at Sh.200, 000 but was not to be maintained in the books of the partnership of Kyamba and Onyango. 4. After retirement of Wakil on 1 April 2001, Kyamba and Onyango agreed on the following terms and details of the new partnership. • • Kyamba and Onyango to introduce additional capital of Sh.48, 000 and Sh.68, 000 respectively. Each partner was entitled to interest on capital at 10% per annum with effect from 1 April 2001 and the balance of the profits be shared equally after allowing for annual salaries of Sh.72, 000 to Kyamba and Sh.60, 000 to Onyango. 5. The profit of the new partnership before interest on capitals and partners’ salaries was Sh.240,000 for the year ended 31 March 2002. 6. The profits made by the new partnership increased stocks by Sh.100,000, debtors by Sh.90,000 and bank balance by Sh.50,000. 7. Drawings by the partners in the year were Kyamba Sh.85,000 and Onyango Sh.70,000. Required: a) Profit and loss and appropriation account for the year ended 31 March 2002. (4 marks) b) Capital accounts for the year ended 31 March 2002 (4 marks) c) Current accounts for the year ended 31 March 2002. (4 marks) d) Balance sheet of the new partnership as at 31 March 2002. (8 marks) (Total: 20 marks) Lesson Six 335 SOLUTION a) Kyamba and Onyango Profit and loss appropriation account for the year ended 31.3.2002 Sh Net profit for the year Less: Interest on capital Kyamba Onyango Sh. 240,000 20,000 20,000 Less: Salaries Kyamba Onyango Balance of profits shared in PSR Kyamba ½ Onyango ½ (40,000) 200,000 72,000 60,000 34,000 34,000 b) (132,000) 68,000 (68,000) CAPITAL ACCOUNT (2) Goodwill in New PSR (4) Fixed Assets K 100,00 0 O 100,00 0 Stocks Debtors Bal c/d 200,00 0 W - Bal b/d 306,0 00 (1)Goodwill in old PSR 157,0 00 Cashbook 165,0 00 Profit on transfer in old PSR Creditors 200,00 0 K 160,0 00 O 140,0 00 W 200,0 00 80,00 0 80,00 0 40,00 0 - 48,00 0 68,00 0 12,00 0 12,00 0 156,0 00 Current account (3) 53,00 0 Cash book (**) 300,00 0 c) Capital 3000,0 00 628,0 00 6,000 300,0 00 300,0 00 173,0 00 628,0 00 CURRENT ACCOUNT K Sh - O Sh - W Sh 53,000 Bal b/d K Sh 65,300 O Sh W sh 53,00 336 Other Aspects of Final Accounts 49,00 0 Drawings 85,00 0 70,000 Interest on capital Salaries 20,000 0 - 20,00 0 72,000 60,00 0 Bal c/d 106,3 00 93,000 - 191,3 00 163,00 0 Share of profits 53,000 34,000 191,300 KYAMBA AND ONYANGO Balance Sheet as at 31 March 2002. Non-Current Assets Current Assets Stock Debtors 127,000 Bank 490,300 Liabilities Creditors (96,000) Capital: Kyamba Onyango Sh. Sh. 205,000 228,000 135,300 394,300 599,300 200,000 200,000 400,000 Current: Kyamba Onyango 106,300 93,000 b) 199,300 599,300 Bank Working capital Kyamba- capital Onyango – capital Increase 173,000 Bal b/d 48,700 48,000 Drawings 68,000 Kyamba 85,000 50,000 Onyango 10,000 _______ Bal c/d 135,300 339,000 339,000 Workings: Non Current Assets: 34,00 0 163,0 00 53,00 0 Lesson Six 337 Bal b/f Transfer Balance 465,000 260,000 205,000 Bal b/f Transfer Increase 294,000 (166,000) 100,000 228,000 Bal b/f Transfer Increase 209,000 (172,000) 90,000 127,000 Bal b/f Transfer 252,000 156,000 96,000 Stock: Debtors: Creditors: EXAMPLE 7.10 Upp and Downe are in partnership. The following trial balance has been extracted from their books of account as at 31 March 19 –2 after their trading and profit and loss account has been prepared, but before any consequent adjustments have been made to the partners’ respective capital accounts. Dr. Cr. Capital accounts (as at 1 April 19 – 1): £ £ Upp 60,000 Downe 40,000 Cash 6,600 Creditors 29,250 Debtors 201,000 Downe: goods withdrawn 400 Drawings: Upp (all at 31 December 19 – 1) 20,000 Downe (all at 30 September 19 – 1) 15,000 Fixed assets: at cost 200,000 Accumulated depreciation 90,000 Accrued interest on Upp’s Loan account 10,000 Loan account: Upp 50,000 Net profit for the year to 31 March 19 – 2) 179,750 Salary: Downe 12,000 Stocks 3,500 Upp: private expenses paid (on 31 March 19 – 2) 500 £459,000 459,000 Additional information 1. The partnership agreement contains the following provisions: 338 Other Aspects of Final Accounts a) Profits and losses are to be shared equally; b) Current accounts are not to be kept; c) The partners will be entitled to interest on their capital account balances as at 1 April in each year at a rate of 15% per annum; d) The partners will be charged interest on any cash drawings made during the year at a rate of interest of 10% per annum; e) Downe is to be allowed a salary of £16,000 per annum; f) A specific loan made by any partner is to bear interest at a rate of 20% per annum; g) Upon the retirement of a partner the partnership assets and liabilities ar to be revalued at their market value as at the date of retirement of the partner. 2. Upp decided to retire at 31 March 19 – 2. In accordance with the partnership agreement, the assets and liabilities were revalued as follows: £ Car (to be retained by UPP) 10,000 Remaining fixed assets taken over by the new partnership 50,000 Stocks 5,000 Debtors 180,000 Creditors 35,000 Goodwill 40,000 Legal and other expenses connected with the partnership change 4,750 3. Following Upp’s decision to retire, Downe invited Side to join him in partnership as fro 1 April 19 – 2. Side agreed to pay £75,000 into the new partnership as at that date as his capital contribution. Profits and losses are to be shared in the proportion Downe 75% and side 25%. Goodwill is not to be retained in the books of the partnership. 4. Upp agreed to leave half of the total amount owing to him on his retirement as a long run term loan in the new partnership, the other half being paid to him in cash. 5. It may be assumed that all of the transactions relating to the changes in the respective partnerships take place on 1 April 19 – 2. The legal and other expenses connected with the partnership changes were due for payment on 30 April 19 – 2. Required: Prepare: a. Upp and Downe’s profit and loss appropriation account for the year to 31 March 19 – 2. b. Upp, Downe and Side’s respective capital accounts sufficient to reflect all of the above transactions. and c. Downe and Side’s balance sheet as at 1 April 19 – 2 immediately after all of the above transactions have been settled. (Detailed working should be submitted with your answer). SOLUTION (a) Upp and Downe Lesson Six 339 Profit and loss appropriation account for the year ended 31 March 19-2 £ Net profit b/d Add interest on drawings Upp [3/12 x (10% x 20,000)] Downe [16/12 x (10% x 15,000)] £ £ 179,750 500 750 1,250 181,000 Less: Interest on capital Upp [15% x 60,000] Downe [15% x 40,000 Less: Salary – Downe Balance of profits shared in PSR Capital – Upp (1/2) - Downe (1/2) 9,000 6,000 (15,000) 166,000 (16,000) 150,000 75,000 75,000 150,000 _____- 340 Other Aspects of Final Accounts (b) Upp £ Capital Accounts Downe £ Balances b/d 500 750 Loan interest 12,000 15,000 Appropriation -salary 400 -interest on capital -residual profit Appropriation - interest on drawings Salary Drawings Private expenses/goods Car Revaluation (deficit) (W1) [see workings after (c)] Loan (balancing figure) Balance c/d Goodwill written back (W2) Balances c/d 20,00 0 500 10,00 0 20,00 0 103,0 00 _____154,0 00 Side £ 10,00 0 65,00 0 75,00 0 Upp £ 60,00 0 10,00 0 Downe £ 40,000 16,000 9,000 6,000 75,00 0 75,000 88,850 137,00 0 ______ 154,0 00 ______ 137,00 0 Downe £ 30,000 Balance b/d Side £ - Downe £ 88,850 58,850 Cash 75,00 0 75,00 0 ____- 20,000 88,850 (c) Balance Sheet as at 1 April 19-2 £ Non current assets Current assets Stocks 5,000 Debtors 180,000 Cash (W3) __5,100 190,100 £ 50,000 88,850 Lesson Six 341 Current liabilities Creditors [35,000 + 4,750] Working capital Net assets employed Financed by Capital Downe Side 39,750 150,350 200,350 58,850 65,000 123,850 Loan Upp (W4) _76,500 200,350 Workings W1 Revaluation Debtors Fixed assets (cost) Stocks Legal etc expenses Creditors £ 201,00 0 200,00 0 3,500 4,750 35,000 ______ 444,25 0 Balance b/d 40,000 _____ 40,000 Creditors Provision for depreciation Capital – Upp (car) Fixed assets Stocks Debtors Goodwill Balance c/d (deficit) Capital -Downe (1/2) -Upp (1/2) £ 29,250 90,000 10,000 50,000 5,000 180,00 0 40,000 40,000 444,25 0 20,000 20,000 40,000 W2 Goodwill Revaluation £ 40,000 _____ 40,000 £ Capital -Downe (75%) -Side (25%) 30,000 10,000 40,000 342 Other Aspects of Final Accounts W3 Cash Balance b/d Capital -Side Bal b/d £ 6,600 75,000 81,600 5,100 £ Loan -Upp [1/2 x 153,000] Balance c/d 76,500 5,100 81,600 W4 Loan - Upp Cash Balance c/d £ 76,500 76,500 Balance b/d Capital -Upp 153,00 0 Balance b/d £ 50,000 103,00 0 153,00 0 76,500 Lesson Six 343 REINFORCEMENT QUESTIONS QUESTION ONE 1. K. Kimeu and M. Maingi are in partnership as manufactures of Tick Toys, Kimeu being responsible for the factory and Maingi for the sales. All completed toys are transferred from the factory to sales department at agreed price. Profits are shared on the following basis: Factory Sales Department Kimeu 80% 40% Maingi 20% 60% The following trial balance has been extracted from the books at 31 March 1992: Sh. Freehold factory at cost Factory plant, at cost Provision for depreciation 1 April 1991 Delivery van, at cost Provision for depreciation 1 April 1991 Stocks at 1 April 1991 Raw materials Work-in-progress Toys completed (30,000 at Sh.40) Sales (45,500 toys) Purchases of raw materials Factory wages Sales department wages Expenses: Factory Sales Department Provision for doubtful debts 1 April 1991 Trade debtors and creditors Bank overdraft Capital accounts: Kimeu Maingi Drawings: Kimeu Maingi Sh. 1,053,750 843,750 151,250 401,250 86,250 100,700 85,000 1,200,000 2,775,500 716,250 375,500 150,750 301,750 250,500 450,000 40,000 150,000 176,200 1,400,000 1,425,000 150,000 125,000 6,204,200 6,204,200 344 Other Aspects of Final Accounts Additional information: i 38,000 toys at Sh.45 each were manufactured and transferred to Sales Department during the year. Tys in stock at the end of the year were to be valued at Sh. 45 each. Stock of raw materials was Sh.79.50 and work-inprogress was valued at prime cost of Sh.126, 250 at 31 March 1992. ii Accrued expenses outstanding at 31 March 1992: Factory Sales Department Sh. Sh. Expenses 52,250 27,000 Factory wages 7,000 iii Provision for depreciation is to be made as follows: - Factory plant 10% p.a. on cost - Delivery van 20% p.a. on cost iv The general provision for bad debts is to be maintained at 10% of the trade debtors. Required: Manufacturing, trading and profit and loss accounts for the year ended 31 March 1992 and a balance sheet as at that date. (20 marks) QUESTION TWO Amis, Lodge and Pym were in partnership sharing profits and losses in the ratio 5:3:2. The following trial balance has been extracted from their books of accounts as at 31 March 19-8: £ £ Bank interest received Capital accounts (as at 1 April 19-7): Amis 80,000 Lodge 15,000 Pym 5,000 Carriage inwards 4,000 Carriage outwards 12,000 Cash at bank 4,900 Current accounts: Amis 1,000 Lodge 500 Pym 400 Discount allowed 10,000 Discount received 4,530 Drawings: Amis 25,000 Lodge 22,000 Pym 15,000 Motor vehicles: 80,000 Accumulated depreciation (at 1 April 19-7) 20,000 Office expenses 30,400 Lesson Six 345 Plant and machinery: At cost 100,000 Accumulated depreciation (at 1 April 19-7) 36,000 Provision for bad and doubtful debts (at 1 April 19-7) 420 Purchases 225,000 Rent, rates, heat and light 8,800 Sales 404,500 Stock (at 1 April 19-7) 30,000 Trade creditors 16,500 Trade debtors 14,300 £583,300 £583,300 Additional information: 1. Stock at 31 arch 19-8 was valued at £35,000. 2. Depreciation on the fixed assets is to be charged as follows: a. Motor vehicles – 25% on the reduced balance b. Plant and machinery – 25% on the original cost. There were no purchases or sales of fixed assets during the year to 31 March 19-8. 3. The provision for bad and doubtful debts is to be maintained at a level equivalent to 5% of the total trade debtors as at 31 March 19-8. 4. An office expense of £405 was owing at 31 March 19-8, and some rent amounting to £1,5000 had been paid in advance as at that date. These items had not been included in the list of balances shown in the trial balance. 5. Interest on drawings and on the debit balance on each partner’s current account is to be charged as follows: £ Amis 1,000 Lodge 900 Pym 720 6. According to the partnership agreement, Pym is allowed a salary of £13,000 per annum. This amount was owing to Pym for the year to 31 March 19-8, and needs to be accounted for. 7. The partnership agreement also allows each partner interest on his capital account at a rate of 10% per annum. There were no movements on the respective partners’ capital accounts during the year to 31 March 19-8, and the interest had not been credited to them as at that date. Required: a) Prepare the Partners trading, profit and loss account for the year ended 31 March 19-8 b) The partners current accounts and a balance sheet as at 31 March 19-8 QUESTION THREE Amber and Beryl are in partnership sharing profits in the ratio 60:40 after charging annual salaries of £20,000 each. The regularly make up their accounts to 31 December each year. 346 Other Aspects of Final Accounts On July 1996 they admitted Coral as a partner and agreed profits shares from that date of 40% Amber, 40% Beryl and 20% Coral. The salaries credited to Amber and Beryl ceased from 1 July 1996. Lesson Six 347 The partnership trial balance at 31 December 1996 was as follows: £ Capital accounts as at 1.1.96: Amber Beryl Capital account Coral (see note (d) below) Current accounts as at 1.1.96 Amber Beryl Drawing accounts Amber Beryl Coral Loan account Amber Sales Purchases Stock 1.1.96 Wages and salaries of staff Sundry expenses Provision for doubtful debts at 1.1.96 Freehold land at cost (see not (e) below) Buildings: cost Aggregate depreciation 1.1.96 Plant, equipment and vehicles: cost Aggregate depreciation 1.1.96 Trade debtors and creditors Cash at bank £ 280,000 210,000 140,000 7,000 6,000 28,000 24,000 15,000 50,000 2,000,000 1,400,000 180,000 228,000 120,000 20,000 200,000 250,000 30,000 240,000 420,000 38,000 3,143,000 50,000 350,000 3,143,000 In preparing the partnership accounts the following further information is to be taken into account: a) Closing stock at 31 December 1996 was £200,000 b) Debts totaling £16,000 are to be written off and the provision for doubtful debts increased by £10,000. c) Provision is to be made for staff bonuses totaling £12,000. d) The balance of £140,000 on coral’s capital account consists of £100,000 introduced as capital and a further sum of £40,000 paid for a 20% share of the goodwill of the partnership. The appropriate adjustments to deal with the goodwill payment are to be made in the capital accounts of the partners concerned, and no goodwill account is to remain in the records. e) It was agreed that the freehold land should be revalued upwards on 30 June prior to the admission of Coral from £200,000 to £280,000. The revised value is to appear in the balance sheet at 31 December 1996. f) Amber’s loan carries interest at 10% per annum and was advanced dot the partnership some years ago. g) Provide depreciation on the straight-line basis on cost as follows: Buildings 2% 348 Other Aspects of Final Accounts Plant, equipment and vehicles h) Profits accrued evenly during the year. 10% Require: a) Prepare a trading account, profit and loss account and appropriation account for the year ended 31 December 1996 and a balance sheet as at that date. (17 marks) b) Prepare the partners’ capital accounts and current accounts for the year in columnar form. (7 marks) (Total: 24 marks) QUESTION FOUR Duke and Earl are in partnership operating a garage business named Aristocratic Autos. In addition to selling petrol and oil, the garage has a workshop where car repairs and maintenance are carried out and also a small showroom form which new and second hand cars are sold. For accounting purposes, each of these three activities is treated as a separate department. At 30th September 1986 balances extracted from the ledgers of Aristocratic Autos comprised: £ Cash sales: Workshop (repair charges) Petrol and oil Showroom (car sales) Credit sales: Workshop (repair charges) Petrol and oil Showroom (car sales) Stocks (at 1 October 1985): Workshop (repair materials) Petrol and oil Showroom (cars) Credit purchases: Workshop (repair materials) Petrol and oil Showroom (cars) Fixed assets (at 1 October 1985): *Freehold buildings: Workshop Petrol and oil Showroom Plant, equipment and vehicles: Workshop Petrol and oil 32,125 32,964 8,500 65,892 41,252 81,914 1,932 3,018 20,720 23,860 41,805 52,100 12,600 14,200 38,000 65,180 22,900 Lesson Six Showroom Provisions for depreciation (at 1 October 1985): Freehold buildings: Workshop Petrol and oil Showroom *Note ‘Freehold’ – held in perpetuity Plant, equipment and vehicles: Workshop Petrol and oil Showroom Fixed asset acquisitions during year (at cost): Plant and equipment: Workshop Petrol and oil Showroom Fixed asset disposal proceeds during the year (see note (3)): Plant and equipment: Workshop Salaries: Showroom Rates Electricity General expenses Wages: Direct: Workshop Petrol and oil Indirect: Workshop Showroom Creditors: Workshop Petrol and oil Showroom Bank/Cash: Workshop Petrol and oil Showroom Debtors: Workshop Petrol and oil Drawings: Duke Earl Current accounts (at 1 October 1985) (credit balances): 349 17,450 5,060 7,100 19,390 48,254 17,077 9,451 26,210 4,250 1,060 5,200 10,200 26,738 9,453 10,692 34,050 5,602 6,810 4,160 4,225 5,602 15,250 316 1,605 30,470 1,365 537 12,190 9,740 350 Other Aspects of Final Accounts Duke Earl Capital accounts: Duke Earl 9,750 10,477 50,000 40,000 Lesson Six 351 Notes at 30 September 1986 1) Stocks at 30 September 1986: Workshop 2,752 Petrol and oil 2,976 Showroom 25,310 2) Depreciation is calculated using the straight-line method (assuming no residual value) and is applied to the original cost of the asset at eh end of the financial year, using the following rates: % Freehold buildings 20 Plant, equipment and vehicles 20 The depreciation charges for the current year have not yet been posted to the accounts. The freehold buildings are temporary structures with a five year life. 3) No entries have yet been made to transfer the cost (£19,500) and accumulated depreciation (£15,633) of the workshop plant sold during the year. 4) Accruals at 30 September 19861 £ Wages: Direct: Workshop 113 Petrol and oil 83 Indirect: Workshop 214 Showroom 231 Electricity 517 General expenses 1,304 5) Prepayments at 30 September 1986 £ Rates 13,300 6) Rates and electricity are apportioned over departments on the basis of the original cost of freehold buildings at the end of the current financial year. 7) General expenses are apportioned over departments on the basis of turn over for the current year. 8) Duke and Earl are credited with interest on their respective capital account balances at the rate of 5% per annum. Required: Prepare, using separate columns for each department and the business as a whole; a) A departmental trading and profit and loss account for Aristocratic Autos for the year ended 30 September 1986. (20 marks) b) A departmental balance sheet for Aristocratic Autos as at 30 September 1986. (14 marks) (Total: 34 marks) 352 Other Aspects of Final Accounts Lesson Six 353 QUESTION FIVE Reg, Sam and Ted are in partnership, sharing profits and losses equally. Interest on capital and partnership salaries is not provided. The position of the business at th end of its financial year is: Capital accounts: Reg Sam Ted Current Accounts: Reg Sam Ted (debit) Creditors Balance Sheet 30 June 19-6 £ £ Buildings 9,000 8,000 8,000 Equipment Stock Debtors 25,00 Bank 0 £ £ 17,000 3,300 900 2,020 2,840 140 200 340 100 240 ___82 0 26,06 0 _____ 26,060 Reg died suddenly on 31 October 19-6. The partnership agreement provides that in the event of the death of a partner the sum to be paid to his estate will be the amount of his capital and current account balances at the last financial year-end adjusted by his share of profit or loss since that date together with his share of goodwill. A formula for calculation of goodwill is given, and its application produced a figure of £7,500. no goodwill account is to remain in the books after any change of the partnership constitution. The stock value at 31 October has been calculated and all other accounts balanced off, including provisions for depreciation, accrued expenses and prepaid expenses. This results in the following position at 31 October. £ buildings 17,000 Equipment (including additions of £400) Stock 1,100 Debtors 2,230 Bank balance 3,370 Creditors 980 3,480 There were no additions to, or reductions of, the capital accounts during the four months, but the following drawings have been made: 354 Other Aspects of Final Accounts Reg Sam Ted £2,000 £1,600 £1,800 Lesson Six • • • 355 It has also been agreed that the share of a deceased partner should be repaid in three equal installments, the first payment being made as on the day after the day of death. The surviving partners agree that Abe (son of Reg) should be admitted as a new partner with effect from 1 November, and it is agreed that he will bring into the business £4,000 as his capital together with a premium for his share of the goodwill (using the existing valuation). The new profit-sharing agreement is: Sam, two-fifths; Ted, tow-fifths; and Abe one-fifth. Show the partnership Balance Sheet as at 1 November 19-6, on the assumption that the above transactions have been completed by that date. CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK 356 Other Aspects of Final Accounts COMPREHENSIVE ASSIGNMENT No.3 TO BE SUBMITTED AFTER LESSON 7 To be carried out under examination conditions and sent to the Distance Learning Administrator for marking by the College. EXAMINATION PAPER. THREE HOURS. TIME ALLOWED: ANSWER ALL QUESTIONS QUESTION ONE The Dohray Amateur Musical Society has a treasurer who is responsible for receipts and payments, which he records in cash and bankbooks. Periodically, these books are handed over to the firm of certified accountants that employs you. One of your tasks is to prepare the final accounts of the Society. As a preliminary step, you have prepared the receipts and payments account (rounded to the nearest £1) for the year ended 31 May 1985. This is shown below, together with the explanatory notes which the treasurer has supplied to enable you to understand the nature o f some of the items. Dohray amateur Musical Society Receipts and Payments Account For the year ended 31 May 1985 Receipts Cash £ Payments Ban k £ Cash Bank £ £ £ £ £ £ Opening balances b/d Debtors: members Joining fees (note 1) Annual subscriptions (Note 2) 31 190 285 309 Creditors: trade Fixed assets (note 4) 160 Musical instruments Trophies 70 Creditors: trade 522 83 Lesson Six Annual concert (note 3) Takings Sales of goods (note 4) Musical instruments Prize moneys (note 7) Sponsorship grant (Note 5) Refreshment sales Raffle profits PAC grants (note 6) Revenue Capital 357 Purchase for resale 1,791 (Note 4) Sheet music 287 Annual concert (note 3) Hall booking fees 190 113 64 Closing balances c/d 3,091 490 Printing of publicity 300 Posters Hire professional Soloists Musicians 100 Adjudication fees 400 Musical Festivals (note 7) 2,91 Entrance fees 0 Hire of buses Honoraria (note 8) Secretary Treasurer R.M.F.C affiliation fee (Note 9) Rent of society’s premises (Note 10) Refreshment purchases Bank charges Sundry expenses Transfers to bank a/c Transfers from cash a/c 118 4,24 9 112 236 174 250 281 150 100 72 510 72 42 60 2,910 49 723 3,091 4,249 Explanatory notes supplied by the treasurer 1) On joining the Society, members pay a non-returnable fee of £10 (before 1 June 1982, the fee had been £). It has been found from experience that, on average, members remain in the Society for five years. On this basis, one 358 Other Aspects of Final Accounts fifth of each joining fee is credited to Income and Expenditure account each year. New members’ statistics are During the year Ended 31 May 1981 1982 1983 1984 1985 Number of new members No. 20 24 32 27 35 Joining fees in Suspense at 31 May 1984 £ 20 48 192 216 Nil £476 2) Annual subscriptions are due on 1 June each year. It is Society’s policy to credit these to income and expenditure account on an actual receipts basis, not an accruals basis. However, if subscriptions are received in advance, the amounts are credited to income and expenditure account for the year, which they are paid. 3) The Society’s major money raising event is its annual public concert. This is given in a large hall, which the Society hires. The society also hires professional musicians and soloists and has to pay the fees of the adjudicators (judges). 4) The society buys trophies (silver bowls and shield) to present to the winners of individual musical items at the annual concert. It also buys musical instruments some of which are for use by the members and others for resale to the members. Musical scores and sheets are also bought for resale to the members. 5) A local building company has given a grant to the Society for a period of three years in return for publicity. This sponsorship grant was received in full on 1 June 1984 and is being credited to income and expenditure account in equal installments in each o the three years to 31 May 1987. 6) The performing Arts Council (PAC) has awarded the Society an annual grant towards the running costs. In addition the PAC makes capital grants. The society’s policy is to hold capital grants in suspense and to release each year’s grant to income and expenditure account over a period of five years, from the year of grants onwards. At 31 May 1984 capital grants held in suspense were analyzed as follows: In respect of year Ended 31 May 1981 1982 1983 Capital grants Suspense £ 30 70 120 Lesson Six 359 1984 120 £340 7) Throughout the year, the Society competes at various musical festivals. Cash prizes won by individual members are retained by the Society and credited to income and expenditure account in order to reduce the cost of attending the festivals. 8) The offices of secretary and treasurer are unpaid but the society gives each of them an ex-gratia (honorary) cash award, termed an honorarium. 9) In order to participate in the musical festivals, the Society has to be affiliated to the Regional Musical Festival Community (RMFC). The annual fee, which has remained the same for a number of years, is paid on 1 March in each year. 10) The Society pays rent for its premises. The rental, which is inclusive of rates, heating, lighting, cleaning etc. is reviewed annually on 31 March. The payment shown in the receipts and payments account represents quarterly payments in advance, as follows: 1984 30 June 30 September 31 December Payment £ 120 120 120 120 1985 31 March 150 £510 The treasurer supplied further information as follows: 1) Creditors at 31 May 1984 £ Fixed assets Musical instruments Trophies Purchases for resale Sheet music Musical instruments 2) Subscriptions Payments in advance included in the actual receipts for the year 3) Stocks at 31 May Goods for resale Sheet music Musical instruments 1985 £ 79 119 23 14 45 20 39 30 31 70 13 40 52 94 360 Other Aspects of Final Accounts Refreshments not brought into account on the grounds that It is not material in amount 4) Fixed assets (at cost) at 31 May musical instrument Trophies 1,378 247 There were no fixed asset disposals during the year 5) Provision for depreciation at 31 May Musical instruments 704 Trophies 96 Depreciation is calculated on the cost of these assets at the end of the financial year. The straight-line method is employed using the following assumed asset lives. Musical instruments Trophies 5 years 10 years Required: Prepare for the Dohray Amateur Musical Society a) The Income and Expenditure account for year ended 31 May 1985, showing the surplus or deficit on each of the activities: and b) The Balance Sheet at that date. Note: WORKINGS are an integral part of the answer and must be shown. (34 marks) QUESTION TWO A client of the firm of accountants by which you are employed is interested in buying a road transport business from the widow of its deceased owner. The senior partner of the practice is investigating various aspects of the business and has delegated to you the task of discovering the amount of investment in vehicles at the end of each of the financial years ended 30 September 1980 to 1983 inclusive. The business had commenced operations on 1 October 1979. The only information available to you is the fact that the owner calculated depreciation at a rate of 20% per annum, using the Reduction Balance method, based on the balance at 30 September each year, and copies of certain ledger accounts which are reproduced below: 1981 30 Sept. Provision for depreciation of vehicles £ 1980 £ 1 Balance b/ 32,000 Oct. 1981 Balance c/d 57,600 30 Profit and 25,600 Sept. loss 57,600 £57,60 Lesson Six 361 0 £ 1982 30 Sept. Disposals Balance c/d 1983 30 Sept. Disposals Balance 1 Oct. 10,800 1982 Balance b/d 73,440 30 Sept. Profit and loss includes £10,000 (depreciation on 1982 acquisitions) ___ __ £84,24 0 £ £ 29,280 1 Oct. 79,328 1983 30 Sept. 1 Oct. Vehicles (vehicles Originally acquired On 1 October 1979) 26,640 _____ £84,24 0 _______ £108,6 08 1982 30 Sept. £ 57,600 Disposals £ 1982 30 Sept. 30,000 Balance b/d 73,440 Profit and loss (includes £20,000 Depreciation on 1983 acquisitions) 35,168 Balance b/d ______ £10860 8 79,328 £ Provision for Depreciation 10,800 Bank 16,000 Profit and loss 3,200 362 Other Aspects of Final Accounts ______ £30,00 0 ______ £30,00 0 £ 1983 30 Sept. Vehicles (vehicles Originally acquired On 1 October 1979) Profit and loss £ 1983 300 Sept. 60,000 Provision for Depreciation 29,280 Bank 42,000 11,280 ______ £71,28 0 ______ £71,28 0 Required: a) Calculate the cost of asset, vehicles, held by the business at 30 September in each of the years 1980 to 1983 inclusive (4 marks) b) Show the detailed composition of the charge for depreciation of the vehicles to profit and loss account at 30 September 1981, 1982 and 1983. (9 marks) All workings must be shown. (13 marks) QUESTION THREE The trial balance of Happy Bookkeeper Ltd, as produced by its bookkeeper includes the following items: Sales ledger control account £110,172 Purchase ledger control account Suspense account (debit balance) £78,266 £2,315 You have been given the following information: i. ii. The sales ledger debit balances total £111,111 and the credit balances total £1,234. The purchase ledger credit balances total £77,777 and the debit balances total £1,111. Lesson Six iii. iv. v. vi. vii. viii. ix. x. xi. 363 The sales ledger includes a debit balance of £700 for business X, and the purchase ledger includes a credit balance of £800 relating to the same business X. Only the net amount will eventually be paid. Included in the credit balance on the sales ledger is a balance of £600 in the name of H. Smith. This arose because a sales invoice for £600 had earlier been posted in error from the sales daybook to the debit of the account of M. Smith in the purchase ledger. An allowance of £300 against some damaged goods had been omitted from the appropriate account in the sales ledger. This allowance had been included in the control account. An invoice for £456 had been entered in the purchase daybook as £654. A cash receipt from a credit customer for £345 had been entered in the cashbook as £245. The purchase daybook had been overcast by £1,000. The bank balance of £1,200 had been included in the trial balance, in error, as an overdraft. The bookkeeper had been instructed to write off £500 from customer Y’s account as a bad debt, and to reduce the provision for doubtful debts by £700. By mistake, however, he had written off £700 from customer Y’s account and increased the provision for doubtful debts by £500. The debit balance on the insurance account in the nominal ledger of £3,456 had been included in the trial balance as £3,546. Required: Record corrections in the control and suspense accounts. Attempt to reconcile the sales ledger control account with the sales ledger balances, and the purchase ledger control account with the purchase ledger balances. What further action do you recommend? (25 marks) 364 Other Aspects of Final Accounts QUESTISON FOUR Ray Dyo, Harry UII and Val Vez are in partnership, trading under the name of Radtel Services, as radio and television suppliers and repairers, sharing profits and losses in the ratio one half, one third and one sixth, respectively. Val Vez works full-time in the business with responsibility for general administration for which she receives a partnership salary of £4,000 per annum. All partners receive interest on capital at 5% per annum and interest on any loans made to the firm, also at 5% per annum. It also had been agreed that Val Vez should receive not less than £4,000 per annum in addition to her salary. Any deficiency between this guaranteed figurer and her actual aggregate of interest on capital, plus residual profit (or less residual loss) less interest on drawings, is to be borne by Dyo and UII in the ratio in which they share profits and losses; such deficiency can be recouped by Dyo and UII at the earliest opportunity during the next two consecutive years provided that Val Vez does not receive less than the guaranteed minimum described above. During the year ended 30 September 1983, Dyo and UII had jointly contributed a deficiency of £1,500. Radtel Services rents two sets of premises - one, a workshop where repairs are carried out, the other, a shop from which radio and television sets are sold. The offices are situated above the shop and are accounted for as part of the shop. The workshop and shop are regarded as separate departments and managed, respectively, by Phughes and Sokkitt who are each remunerated by a basic salary plus a commission of one ninth of their departments’ profits after charging their commission. On 30 September 1984, the trial balance of the firm was: £ Stocks at 1 October 1993: Shop (radio and television sets) Workshop (spares, components etc.) Purchases: Radio and television sets Spares, components etc. Turnover: Sales of radio and television sets 19,750 8,470 155,43 0 72,100 232,60 0 127,00 0 Repair charges Wages and salaries (employees): Shop and offices Workshop Prepaid expenses (at 30 September 1984) Accrued expenses (at 30 September 1984) £ 54,640 18,210 640 3,160 Lesson Six Provision for doubtful debts at 1 October 1983 Rent and rates: Shop and offices Workshop Stationery, telephones, insurance: Shop and offices Workshop Heating and lighting: Shop and offices Workshop Debtors Creditors Bank Cash Other general expenses: Shop and offices Workshop Depreciation: Shop and offices (including vehicles) Workshop Shop fittings (cost) Workshop tools and equipment (cost) Vehicles (cost) Discount received: Shop Workshop Bank loan (repayable in 1988) Loan from Harry UII Capital Accounts: R. Dyo H. UII V. Vez Current Accounts (after drawings have been debited): R. Dyo H. UII V. Vez Loan interest: Bank loan Loan from H. UII Provision for depreciation: Shop fittings Workshop tools and equipment Vehicles 365 920 7,710 8,450 2,980 1,020 4,640 3,950 4,460 15,260 48,540 960 3,030 2,830 2,400 2,580 17,060 55,340 27,210 420 390 15,000 10,000 40,000 40,000 20,000 290 1,040 920 2,400 500 3,190 10,020 5,670 £525,5 90 £525,5 90 366 Other Aspects of Final Accounts The following matters are to be taken into account: 1) Manager’s commissions. 2) Partnership salary (Vez). 3) Interest on partners’ capital accounts (these have not altered during the year). 4) Interest on partners’ drawings; Dyo £70; UII £30; Vez £20. 5) Closing stocks: shop £31,080; workshop £10,220. 6) Provision for doubtful debts at 30 September 1984, £540. 7) Residual profits/Losses. N.B. Loan interest and the movement in the provision for bad debts are regarded as ‘shop’ items. Lesson Six 367 Required: a) Prepared columnar departmental trading and profit and loss accounts and a partnership appropriation account for he year ended 30 September 1984 and the partnership balance sheet at that date. (21 marks) b) Complete the posting of the partners’ current accounts for the year. (4 marks) (25 marks) QUESTSION FIVE Ernie is a building contractor, doing repair work for local householders. His wife keeps some accounting records but not on a double-entry basis. The assets and liabilities of the business at 30 June 1997 were as follows: £ Assets Plant and equipment: cost Depreciation to date Motor Van: cost Depreciation to date Stock of materials Debtors Rent of premises paid in advance to 30 September 1997 Insurance paid in advance to 31 December 1997 Bank balance Cash in hand Liabilities Creditors for supplies Telephone bill owing Electricity owing 12,600 5,800 9,000 6,500 14,160 9,490 750 700 1,860 230 3,460 210 180 His cash and bank transactions for the year from 1 July 1997 to 30 June 1998 are as follows: Receipts Opening balances Receipts from customers Loan received Proceeds of sale of vehicles Held at the beginning of year Cash paid into the Cash and Bank summary Cash Bank Payments £ £ 230 1,860 Suppliers 52,64 0 150,8 Rent of premises 80 10,00 Insurance (to 31.12.98) 0 Purchase of plant and equipment 3,000 Purchase of new vehicle 24,04 Telephone Cash £ Bank £ 83,99 0 3,600 1,600 8,400 12,80 0 860 368 Other Aspects of Final Accounts bank Cash withdrawn from bank Closing balance 0 48,26 0 Electricity 2,100 Wages of repair staff Miscellaneous expenses Drawings by Ernie Refund to customer Cash paid into bank Cash withdrawn from bank Closing balance 101,1 30 191,8 80 890 68,20 0 1,280 8,000 400 24,04 0 890 101,1 30 48,26 0 29,80 0 191,8 80 The following further information is available 1) Plant and equipment is to be depreciated at 25% per annum on the reducing balance with a full year’s charge in the year of purchase. 2) The new motor vehicle was purchased on 1 January 1998. Ernie’s depreciation policy is to charge depreciation at 25% per annum on the straight-line basis with a proportionate charge in the year of purchase but not in the year of sale. 3) The rent of the premises was increased by 20 % from 1 October 1997. 4) The loan of £10,000 was obtained from Ernie’s brother on 1 April 1998. It carries interest at 10% per annum, payable on 30 September and 31 March. 5) At 30 June 1998, Ernie owed the following amounts: £ Suppliers 4,090 Telephone 240 Electricity 220 Miscellaneous expenses 490 6) At 30 June 1998, amounts due from customers totaled £10,860. Of this amount, Ernie considered that debts totaling £1,280 were bad and should be written off. 7) Stock of materials at 30 June was £12,170 8) Ernie agreed to pay his wife £5000 for her assistance with his office work during the year. This amount was actually paid in August 1998. Required: Prepare Ernie’s trading profit and loss account for the year ended 30 June 1998 and a balance sheet as at that date. END OF COMPREHENSIVE ASSIGNMENT No.3 Lesson Six NOW SEND YOUR ANSWERS TO THE DISTANCE LEARNING CENTRE FOR MARKING 369 Acknowledgement 370 LESSON EIGHT COMPANY ACCOUNTS Introduction: COMPANY ACCOUNTS: Limited companies come into existence because of the growth in size of business and the need to have many investors in the business. Partnerships were not suitable for such businesses because the membership is limited to 20 persons. Types of companies There are 2 principle types of companies: Private companies These have the words limited at the end of the name. Being private, they cannot invite the members of the public to invest in their ownership. Public companies There much larger in size as compared to private companies. They have the words public limited company at the end of their name. They can invite the members of the public to invest in their ownership and the companies may be quoted on the stock exchange. Share capital of a company. The owner’s interest in a limited company consists of share capital. The share capital is divided into shares. The investor will then pay for and be issued with the shares and therefore, they become owners. Each share has a flat value called Par value/face value/nominal value. (e.g.) If a company decides to set up a share capital of Sh. 200,000, it may decide to issue: 200,000 shares of Sh. 1 each per value. 100,000 shares of Sh. 2 each per value. 400,000 shares of Sh. 50 each per value. There are 2 main types of share capital Preference share capital This is made up of preference shares and a preference share carries the right to a final dividend, which is expressed as a percentage of their par value. E.g. 10% preference shares. Preference shares do not carry a right to vote and therefore no control in the company. Ordinary Share capital These are the most common shares. They carry no right to a fixed dividend but are entitled to residual value of the business during winding up, and all profits after the claim on all of the preference dividend have been paid. The more the no. of ordinary share held, the higher the control. 371 Partnerships Share capital may also have the following meaning: Authorized share capital Also called, registered or nominal capital. Is the total of the share capital which the company is allowed to issue to shareholders. A company cannot issue more shares than the amount that is authorized. Issued share capital This is the total of the share capital actually issued to the shareholders. Called up share capital This is the amount the shareholders have been asked to pay where the amount of capital required is less than the issued share capital. (e.g.) If a firm issues ordinary shares of £1 each and request the shareholders to pay 60p. Assuming that the issued 100,000 shares, then the called up share capital will be: 60p × 100,000 = £60,000 Uncalled share capital This is part of the issued share capital for which the company has not requested for payment and therefore these amounts will be received in the future. In the above (e.g.) because the firm had not requested for 40p, therefore the uncalled capital is 40p × 100,000 = £40,000. Paid-up share capital This is the total of the share capital, which has been paid for by the shareholders. Illustration A limited has an authorized share capital of 200,000 shares of £1 each out of which only 150,000 share have been issued, Although the firm requested the shareholders to pay 80p per share, the shareholders were able to pay 50p per share. Required: Determine the: • Authorized share capital • Issued share capital • Called up share capital • Uncalled up share capital • Paid up share capital Authorized share capital 200,000 × £ = £200,000 Issued share capital 150,000 × £1 = £150,000 Called up share capital 150,000 × 80p = 120,000 Uncalled up share capital 150,000 ×20 p = £30,000 Paid up share capital 150,000 × 50p = £75,000 Lesson Seven 372 The principal distinctions between unlimited partnerships and limited companies are: Unlimited Partnerships Limited Companies No separate Legal Entity apart from its members Separate legal entity, which is not affect by changes in its membership. A company may contract, sue or be sued in it’s own name. If the company is limited by share, each shareholder is limited to the amount he has agreed to pay the company for share allotted. A limited company must have at least 2 members. The maximum number of shares is restricted to the company’s authorized share capital. Rights to management are delegated to directors who alone can act on behalf of and bind the company. Liability of each member for debts of the firm is unlimited. Number of partners limited to 20 except for professional firms. Every partner can normally take part in the management of the business. He can legally bind the firm by his action. Copy of accounts need not be filed with the Registrar of Companies Although a written Partnership deed is desirable it is not mandatory. A partnership is subject to the partnership Act which can be varied by mutual agreement. The partners contribute the capital by agreement. The amount need not be fixed. Copies of accounts must be registered with the Registrar of Companies A company is required to have a memorandum and articles of association which defines powers and duties of directors. A company is subject to the Companies Act the provisions of which cannot be varied. The authorized share capital is fixed by the memorandum of association. It can be altered by passing ordinary resolution or by the court. 373 A share in a partnership cannot be transferable except by the consent of all partners. A partnership is not obliged to keep statutory books of account and an audit is not compulsory. Partnerships In public companies shares are freely transferable. In private companies share transfer are subject to any restrictions imposed by the articles of association. A company is required to keep specialized accounting records and is subject to compulsory audit. Format Of Final Account The P & L of a company, is the same as that of a sole trader, but there are additional expenses that are unique to the company and therefore, they should be included in the P & L A/C. (e.g.) • Director’s fees salaries and other expenses • Audit fees • Amortization e.g. goodwill • Debenture interest In addition to the P & L A/C, just like a partnership has an appropriation A/C which shows the allocation of the net profit for the period. Therefore, the format will be as shown: Format for Company Accounts B Limited Trading, profit and loss and Appropriation Account for the year ended 31.12 £ £ £ Sales x Less Returns inwards (x) x Less Cost of Sales Opening Stock x Purchases x Add Carriage in x x Less purchase returns (x) x x Less Closing stock (x) (x) Gross Profit x Add incomes x Discount received x Profit on disposal (sale of Assets) x Income from investment (can also be shown x below) x Other incomes e.g. interest received from x bank x x Less Expenses x Lesson Seven 374 Other expenses Directors salaries/fees/---Audit fees Debenture Interest Amortization of good will Operating profit for the period Add investment income Profit before tax Taxation: Corporation tax Transfer to deferred tax Under or over provision Profit after tax Less: transfer to the general reserve Less: Dividends Preference dividend: Final proposed x x (x) x x x x x x x x x x x Interim paid Ordinary dividend: Interim paid Final proposed Retained profit for the year Retained profit b/f Retained profit c/d B Limited Balance sheet as at 31.12……… Non current Assets Land & Building Plant and Machinery Fixtures, Furniture & Fittings Motor vehicle Intangible Assets Goodwill Copyrights, patents £ £ £ x x x x x (x) (x) (x) (x) x x x x x x x x x (x) (x) x x x (Longterm) Investments (mkt value sh x) Current Assets Stock Debtors Less provision for bad debts Prepayments (Short term) Investments Cash at bank Cash in hand x x x x (x) x x x x x x (x) x (x) x (x) x x x 375 Current liabilities Bank overdraft Creditors Accruals Interest payable(debenture interest) Tax payable Dividends payable Partnerships x x x x x x (x) x x x (x) x Financed by Authorized share capital 100,000 ordinary shares of £1 each 100,000 preference shares of £1 each Issued and Fully paid 80,000 ordinary shares of £1 each 50,000 10% preference shares of £1 each Capital Reserves Share premium Revaluation Reserve Capital Redemption Reserve Revenue Reserves General Reserve Profit and loss A/C Deffered tax A/C Non Current Liabilities 10% debenture Other Long term Loans x x x x x x x x x x x x x x x x x Director’s salaries: Salaries, fees and other expenses in relation to the directors are expenses as far as company accounts are concerned. This is different from that of Partnerships & Sole traders which are shown as appropriations – expenses. Audit fees All companies are required to prepare the accounts which should be audited and therefore any fees paid in relation to audit and accountancy is an expense. Debenture interest Loans taken up by companies are called debentures. The interest paid on these loans are charged as an expenses and unpaid amount are shown as current liabilities in the business. The debenture is classified under non-current liability. Lesson Seven 376 Corporation tax Companies pay corporation tax on the profits they earn. This is shown in the accounts because a company is a separate legal entity unlike for sole traders and partnerships whose tax is shown as drawings. The tax is listed under those 3 items as shown in the appropriation (under/over provision for previous period, transfer to deferred tax corporation tax for the year). The under provision and corporation tax relate to direct liability to the government and therefore is a deduction from the net profit for the period . Transfer to deferred tax is to cater for future possible tax liability. Assume that a firm had estimated that the corporation tax for the year ended 31.12.99 is £150,000. In 2000, the liability is now agreed at £160,000, which the company pays and at the end of the year 2000, the company estimates that the tax liability is £140,000. Prepare a tax A/C and show the amount to be deducted as tax for the year (ignore deferred tax). (e.g.) Taxation Account Cashbook Bal c/d Under provision Corporation tax 160,000 140,000 300,000 Bal b/d 150,000 Appropriation 150,000 300,000 10,000 (160 -150) 140,000 DIVIDENDS Shareholders are also entitled to a share of profits made by the company and this is because the shareholders do not make drawings from the company. A company may pay dividends in 2 stages during the cause of the financial period: Interim dividends Is paid part way --- the financial period. (e.g.) after the 6 ----Final proposed Is paid after the year-end or after the completion to final accounts. If a company pays in these 2 stages then the dividend section of the P & L appropriation should disclose interim paid and final proposed. 377 Partnerships CAPITAL RESERVES Amounts reflected in Capital reserves cannot be paid out or distributed to shareholders. The three types of capital reserves are: Share Premium: A share premium arises when accompany issues shares at a price that is more than the par value. The share Premium may be applied in: • • • Paying un issued shares. Writing off preliminary expenses. Write off discounts on shares. Example: A Ltd wishes to raise capital by issuing 100,000 ordinary shares at £1 each (per value) and the issue price (selling price) is £1.5 each. The following are the entries to be made in the A/C. Dr Cashbook (100,000 × £1.5) 150,000 Cr Ordinary shares capital (100,000 × £1) 100,000 Cr Sahre Premium A/C (100,000 ×£0.5) 50,000 Issue of shares at a premium of £0.5 Revaluation Reserve: Any gain made on revaluation of non current Assets especially for Land and buildings. When company sills it’s property to realize the gain, the amount is transferred to the Profit and Loss Account. Capital Redemption Reserve: A reserve created after redemption or purchase of Preference shares without issuing new shares. The transfer is made from either the share premium or the profit and loss account. REVENUE RESERVES This can be distributed and includes the retained profits (P & L Accounts) and the General Reserves. Transfers are made from the Profits to the General reserves to provide for expansion or purchase of non current assets. The General Reserves can also be used to issue bonus Shares. DEBENTURE LOANS The term debenture is used when a limited company receives money on loan, and certificates called debenture certificates are issued to the lender. They are also called loan stock or loan capital. Debenture interest has to be paid whether profits are made or not. A debenture may either be redeemable of irredeemable. Redeemable is repayable at or by a particular date and irredeemable is payable when the company is officially terminated. BONUS SHARES Shares issued to existing shareholders free of charge. They are paid out from either the share premium, balance of retained profits of the General Reserves. A scrip issue is similar to bonus issue only that a scrip issue gives the shareholder the choice of receiving cash or stock dividends. In a bonus issue the shareholder has no choice but to take up the shares. Lesson Seven 378 Example A Ltd has 100,000 shares at £1 each to form an ordinary share capital of £100,000 and a balance on the share premium A/C of £50,000. It issues some bonus shares to existing shareholders at a rate of 1 share for every 5shares held. This amount is to be financed by the share premium. The entries will be as follows: Shares to be issued: 100,000 × 1 =20,000 5 Dr share premium A/C [20,000 × £1 ] 20,000 Cr ordinary share capital 20,000 A bonus issue of 20,000 shares Balance sheet (extract) Ordinary shares of £1 Capital Reserves Share premium 120,000 30,000 Rights Issue A right issue is an option on the part of the shareholder given by the company to existing shareholders at a price lower than the market price. It involves selling ordinary shares to existing shareholders of the company on a prorata basis. When the rights are issued the shareholders have 2 options available. Buy the new shares and exercise their rights Sell the rights in the market, Ignore the rights. A rights issue therefore gives the shareholder the right (but not an obligation) to buy the new shares issued by the company. Example: A Ltd has a share capital of £200,000 trade up of 100,000shares of £2 each. The balance on the share premium is £60,000. Additional capital is raised by way of a right issue. The term are: For every 5 shares held in the company, a shareholder can buy 2 shares at a price of £2.5 per share. Required: The journal entries to reflect the above transaction assuming that all the shareholders exercise their rights and the relevant balance sheet extract. Shares to be issued 100,000 × 2 =40,000 shares 5 Dr cash book [40,000 × £2.5 ] £100,000 Cr Ordinary share capital [40,000 × £2 ] £80,000 379 Cr Share Premium [40,000 × £0.5 ] Balance sheet (extract) 140,000 Ordinary shares @ £2 Capital Reserves Share premium 80,000 Partnerships £20,000 280,000 The following examples will illustrate the preparation of final Account for companies. Example 8.1 Just before you launch yourself into the question that follows remember that everything you have learnt about double entry bookkeeping and the presentation of year end accounts is valid in the context of companies, subject only to the points we have added in this session. The following is the trial balance of Transit Ltd at 31 March £ Issued share capital (ordinary shares of £1 each) 75,00 Leasehold properties, at cost 0 Motor vans, at cost (used for distribution) 2,500 Provision for depreciation on motor vans to 31 March 19X7 7,650 Administration expenses 10,00 Distribution expenses 0 Stock, 31 March 19X7 12,00 Purchases 0 Sales 138,7 Directors’ remuneration (administrative) 50 Rents receivable Investments at cost 25,00 Investment income 0 7% Debentures Debenture interest 6,750 Bank interest Bank overdraft Debtors and creditors 1,050 Interim dividend paid 162 Profit and loss account, 31 March 19X7 31,00 0 1,260 311,1 22 19X8. £ 42,00 0 1,000 206,5 00 3,600 340 15,00 0 730 24,10 0 17,85 2 311,1 22 You ascertain the following: All the motor vans were purchased on 1 April 19X5. Depreciation has been, and is to be, provided at the rate of 20% per annum on cost from the date of purchase to the Lesson Seven 380 date of sale. On 31 March 19X8 one van, which had cost £900, was sold for £550, as part settlement of the price of £800 of a new van, but no entries with regard to these transactions were made in the books. The estimated corporation tax liability for the year to 31 March 19X8 is £12,700. It is proposed to pay a final dividend of 10% for the year to 31 March 19X8. Stock at the lower of cost or net realizable value on 31 March 19X8 is £16,700. Required: Prepare, without taking into account the relevant statutory provisions: • • A profit and loss account for the year ended 31 March 19X8: A balance sheet at that date. (22 marks) 381 Partnerships Solution: Transit Ltd Profit and Loss /C for the year ended 31.3.19X8 £ Gross profit Profit on disposal of van Rent Receivable A Less: Expenses Depreciation on motor vans Administration expenses Distribution expenses Debenture interest Bank interest Trading profit for the year Add investment income Profit before tax Taxation Profit after tax Less: Dividends Interim paid Final proposed Retained profit for the year Retained profit b/f Retained profit c/d 500 32,65 0 10,00 0 1,050 162 1,260 4,200 £ 72,45 0 190 3,600 76,24 0 (44,3 62) 31,87 8 340 32,21 8 (12,7 00) 19,51 8 (5,46 0) 14,05 8 17,85 2 31,91 0 Lesson Seven 382 Transit Ltd Balance sheet as at 31.3.19X8 Non-Current Assets Leasehold properties Motor vans £ £ £ 75,000 2,400 77,400 (960) 960 75,000 1,440 76,440 6,750 83,190 Investments Current Assets Stock Debtors 16,700 31,000 47,700 Current liabilities Bank overdraft Creditors Tax payable Proposed dividends 980 24,100 12,700 4,200 Financed by: Authorized issued and fully paid 42000 ordinary share of £1 Revenue Reserves Profit and Loss A/C c/f 31,910 73,910 15,000 88,910 Workings Sales 206,500 Less: Cost of sales Opening stock 12,000 Purchases 138,750 150,750 Less Closing stock (16,700) (134,050) Gross profit 72,450 Motor vehicle Bal b/f 2,500 Disposal Disposal 550 5,720 88,910 42,000 Non-Current liabilities 7% Debentures Motor Vehicle – Depreciation Disposal 540 Bal b/d Bal c/d 960 P & L 1,500 (41,980 ) 1,000 500 1,500 900 383 Partnerships Cashbook Disposal P&L 250 Bal c/d 3,300 2,400 3,300 Motor vehicle Disposal 900 Motor Vehicle 550 190 Depreciation 540 1090 1090 Example 8.2 The Following Trial Balance Was Extracted From The Books Of Collins Ltd At 31 December 19X5 £ £ Share capital authorized and issued: 80,000 ordinary shares of £1 each Freehold premises at cost Motor vans Balance 1 January 19X5 at cost Additions less sale proceeds Provisions for depreciation of motor vans to 31 December 19X4 Stock in trade 31 December 19X4 Balance at bank Provision for doubtful debts 31 December 19X4 Trade debtors and creditors Directors’ remuneration Wages and salaries Motor and delivery expenses Rates Purchases Sales Legal expenses General expenses Profit and loss account: balance at 31 December 19X4 59,00 0 80,00 0 15,00 0 650 6,750 13,93 0 6,615 12,39 5 4,000 13,12 7 3,258 700 108,4 40 644 5,846 275 11,38 0 142,7 70 2,430 243,6 05 243,6 05 You are given the following information.: i. Stock in trade, 31 December 19X5, £14,600. ii. Rates paid in advance, 31 December 19X5, £140. iii. Debts of £1,075 to be written off and the provision to be increased to £350. iv. On 1 January 19X5, a motor van which had cost £680, was sold for £125. Lesson Seven 384 v. Depreciation provided for this van up to 31 December 19X4 was £475. vi. Provide for depreciation of motor vans (including additions) at 20% of cost. vii. The balance on legal expenses account included £380 in connection with the purchase of one of the freehold properties. viii. The directors have decided to recommend a dividend of 5%. Required: With particular emphasis on presentation, prepare a trading and profit and loss account for the year 19X5, and a balance sheet at 31 December 19X5, ignoring taxation. (24 marks) 385 Partnerships Solution: Trading and profit and loss account for the year ended 31 December 19X5 £ Sales Opening stock Purchases Less: Closing stock Cost of goods sold Directors’ remuneration Wages and salaries Motor and delivery expenses Rates (700 - 140) Legal expenses (644 - 380) General expenses Bad debts Loss on disposal Depreciation Net profit Proposed dividend Retained profit brought forward Retained profit carried forward Balance sheet at 31 December 19X5 13,93 0 108,4 40 122,3 70 14,60 0 4,000 13,12 7 3,258 560 264 5,846 1,150 80 3,019 £ 142,7 70 107,7 70 35,00 0 31,30 4 3,696 4,000 (304) 2,430 2,126 Lesson Seven 386 Non-Current Assets Freehold properties Motor vans £ £ £ 59,380 15,095 74,475 ---(9,294) (9,294) 59,380 5,801 65,181 Current Assets Stock Debtors and prepayments, less provision for doubtful debts Cash at bank 14,600 11,110 6,615 32,325 Current liabilities Creditors Proposed dividends 11,380 4,000 15,380 16,945 82,126 Share capital Ordinary shares of £1 each Profit and loss account 80,000 2,126 82,126 Workings Bad debts £ Debtors 1,075 Balance c/f 350 £ Balance b/f 275 Profit and loss account 1,150 1,425 1,425 Motor vans £ £ Balance b/f 15,000 Additions 775 Disposals 680 Balance c/f 15,095 15,775 15,775 Disposals 475 Balance c/f 9,294 9,769 Provision for depreciation £ Balance b/f 6,750 Profit and loss account 3,019 9,769 £ 387 Partnerships Disposals £ Motor vans 680 680 £ Provision for depreciation 475 Proceeds 125 Loss on capital 80 680 Example 8.3 Owik-Freez p.l.c. is a company which provides refrigerated storage facilities to local farmers. Services offered include the collection of produce, the use of rapid freezing equipment, storage of the frozen produce and transport from frozen storage in refrigerated vehicles to any point within the country. Orders for these services are secured by the company’s sales staff. The company’s revenue consists of charges for transport and freezing, and of storage rentals. Customers may hire storage space either on a long-term contract basis at advantageous charges (payable in advance) or on a casual basis (invoiced monthly). A considerable amount of electricity from the public supply is used by the company in the freezing and storage operations. In the event of a sudden failure in this supply, the company is able to generate its own emergency supplies from standby generators kept for this purpose. An insurance policy has been taken out to protect the company against the claims which would arise should any of the frozen produce deteriorate as the result of power or equipment failure. At the end of the company’s financial year ended 30 September 1982, the assistant accountant extracted the following balances from the ledgers. Lesson Seven Assets Account Land and buildings (at cost) Plant (at cost) Vehicle (at cost) Provision for depreciation (at 1 October 1981): Land and buildings Plant Vehicles Stock of consumable stores (at 30 September 1982) Debtor – for rentals for charges Bank Cash Liability Accounts Trade Creditors 7% Debentures 2004/2012 Ordinary Share Capital (see note 7) General reserve Unappropriated profit (at 1 October 1981) Share Premium Revenue Accounts Storage rentals – long term contracts Casual Freezing charges Transport charges Expense Accounts Wages, salaries and related expenses Rates Electricity Transport costs Repairs Consumable stores Postages, stationery, telephones Insurance premium Debenture interest Sundries 388 £ 390,000 271,900 82,600 39,600 144,800 27,050 23,449 18,204 2,332 30,710 1,103 7,390 80,000 200,000 25,000 108,284 15,000 302,090 85,063 112,810 90,107 128,004 79,112 76,860 43,271 30,319 29,800 15,604 7,800 5,600 9,176 8,650 Other Accounts Suspense (credit balance) Notes at 30 September 1982: At the beginning of the 1981-82 financial year, the company had sold refrigeration plant (which had originally cost £26,000 and on which £20,800 had been provided as depreciation to date of disposal) for £4,000. The only accounting entries relative 389 Partnerships to this disposal which have been made so far, are a debit to Bank and a credit to Suspense of the amount of the sale proceeds. In April 1982, the compressor unit in No.7 storage unit failed and as a consequence the contents deteriorated to such an extent that they had to be disposed of by incineration. Compensation of £1,350 was paid to the farmer by Owik – Freez by cheque and debited to Suspense. The insurance company has admitted liability under the policy but no further ledger entries have as yet been made. During the 1981-82 financial year, the company replaced one of its refrigerated vehicles, which has originally cost £16,400 and on which £13,120 had been provided as depreciation to date of disposal. A trade-in (part exchange) allowance of £6,000 was granted in respect to this vehicle. A replacement vehicle was acquired at a list price of £27,000. The entries relating to the disposal of the old vehicle have not yet been made, except that the trade-in allowance has been debited to Vehicles and credited to Suspense. The balance of the price of the new vehicle has been paid by cheque and debited to Vehicles account. It is the company’s policy to provide for depreciation on a straight line basis calculated on the cost of fixed assets held at the end of each financial year and assuming no residual value. Annual depreciation rates are: % Building 2 Plant 10 Vehicles 25 The ‘Buildings’ content of the item Land and Buildings included in asset account balances is £120,000. Adjustments, not yet posted to the accounts, should be made for the following items: £ Storage rentals received in advance 25,631 Insurance premium prepaid 600 Wages and Salaried accrued 1,920 Rates prepaid 28,820 Electricity accrued 5,757 Consumable stores include £4131 and Repairs include £9972 relating to vehicles. The authorized and issued capital of the company consists of 400000 Ordinary Shares of £0.50 per share. The directors have recommended a dividend for the year of £0.12 per share. Required: Prepare, for internal circulation purposes, a Profit and Loss account for Qwik-Freez p.l.c.for the year ended 30 September 1982 and a Balance Sheet at that date. All workings must be shown. (31 marks) Open the Suspense account and post the entries needed to eliminate the opening credit balance. (2 marks) Lesson Seven 390 (33 marks) Solution: Qwik-Freez (East Anglia) p.l.c. Profit and Loss Account for the year ended 30 September 1982 Workings: £ Revenue Storage rentals – long term (302,090 – 25631) casual Freezing charges Transport charges Less: Expenses Wages, Salaries etc. (128,004 + 1,920) Rates (79,112 – 28,820) Electricity (76,860 – 5,757) Transport costs (43,271 + 4,131 + 9,972) Repairs (30,319 – 9,972) Consumable stores (29,800 – 4,131) Postages, stationery, telephones Insurance premiums (7,800 - 600) 1,2 *Depreciation Debenture Interest Sundries £ 276,459 85,063 112,810 90,107 564,439 129,92 4 50,292 82,617 57,374 20,347 25,669 15,604 7,200 43,540 5,600 9,176 5 Profit (less loss) on disposal of fixed assets Net Profit For The Year Retained profit brought forward Distributed profit Less: Ordinary dividends proposed Retained profit carried forward 447,343 117,096 1,520 118,616 108,284 226,900 48,000 178,900 Workings: Fixed Assets: Balance 1 October 1981 (veh 82,600 – (6,000 + 21,000)) Acquisitions (21,000 – 6,000) Disposals Balance 30 September 1982 Land Building £ s 270,0 £ 00 120,00 0 270,0 00 120,00 0 Plant £ 271,90 0 (26,00 0) 245,90 0 Vehicl e £ 55,600 Total £ 717,50 0 27000 (16,40 0) 66,200 27,000 (42,40 0) 702,10 0 391 Depreciation -rate Partnerships £ - 2% £ 2,400 10 25 £ £ -current year charge 24,59 16,5 0 50 Alternatively the depreciation charge for vehicles (£16,550) transport cost, thereby increasing that figure to £73,924. £ 43,54 0 can be classified as a Lesson Seven Provision for Depreciation: Balance 1 October 1981 Disposals Current year charge 392 - 39,600 - 2,400 - 42,000 Balance 30 September 1982 Written down values at 30 September 1982 144,8 00 (20,8 00) 24,59 0 148,5 90 27,05 0 (13,1 20) 16,55 0 30,48 0 211,4 50 (33,9 20) 43,54 0 221,0 70 £ £ £ £ £ 270,0 00 78,000 97,31 0 35,72 0 481,0 30 4,000 6,000 10,00 0 5,200 3,280 Proceeds from disposals Less: Written down values of disposals (26,000 – 20,800) (16,400 – 13,120) Profit/(Loss) on disposals Qwik-Freez (East Anglisa) p.l.c Balance Sheet as at 30 September 1982 Workings: 8,480 £(1,2 00) 2,720 1,520 393 Fixed Assets Land and Buildings Plant Vehicles 1,3,4 Current Assets Stocks Debtors - for rentals - for charges - for insured losses Prepaid expenses (600 + 28,820) Bank Cash Less: Current Liabilities Creditors Accrued expenses (1920 + 5757) Advance receipts Proposed dividends Working Capital Net Assets employed Financed by: Share Capital, authorized, issued and fully paid, 400000 Ordinary shares of £0.50 per share 16 Reserves Share Premium General Reserve Profit and Loss account Shareholders’ funds Long-term loan 7% Debentures 2004/2012 Cost £ 390,000 245,900 66,200 Depreciation £ 42,000 148,590 30,480 Net £ 348,000 97,310 35,720 702,100 221,070 Partnerships Lesson Seven 394 Suspense £ £ Fixed Asset Disposals: ` Plant 4000 Balance b/d 8650 Vehicle 6000 Debtors (insured loss) 1350 10000 10000 Example 8.4 Mwanga and Sons Ltd is a small manufacturing firm owned by members of the family. The following trial balance was extracted from the books of the company as at 31 March 1993: Freehold property, at cost (land Sh. 75,000) Plant, at cost Depreciation Motor vehicle, at cost Depreciation – motor vehicle Fittings and fixtures, at cost Depreciation – fittings and fixtures 20,000 Ordinary shares of Sh. 10 each authorized, issued and fully paid Share premium General reserve Interim dividend paid Cash at bank and in hand Accounts receivable and payable 15% Debentures Discount received Profit and loss account 1 April 1992 Purchases of raw materials Sales of finished goods Inventories 1 April 1992: Raw materials Work in progress Finished goods Provision for doubtful debts Bad debts Rates and insurance Wages Factory power Light and water Plant maintenance Salaries Returns of raw material Sales returns Advertising Transport expenses (Sales department) Bank charges General expenses Sh. 125,00 0 130,00 0 Sh. 62,000 30,500 53,000 11,790 38,600 200,00 0 50,000 120,00 0 16,000 33,570 130,54 0 942,38 0 57,430 100,00 0 3,640 103,87 0 1,254, 760 33,060 57,660 107,86 0 6,400 4,890 9,430 108,37 0 22,560 16,280 10,970 90,000 3,240 395 Partnerships 1,360 8,580 24,320 3,040 36,1 60 2,003, 630 2,003, 630 Lesson Seven 396 Additional information: • • • • Depreciation is to be provided for the year using the reducing balance method and applying rates of 15% on plant, 25% on motor vehicle and 10% on fittings and fixtures. Building is to be depreciated at the rate of 4% using the straight-line method. (Assume the whole building is used for manufacturing purposes). Provision for doubtful debts is to be adjusted to a figure equal to 10% of accounts receivable. Light and water, insurance and general expenses are to be apportioned in the ratio 4:1 between factory and administrative overheads. Electricity and wateer accrued was Insurance prepaid was Rates prepaid were Sh. 860 270 780 Inventories were valued at: Raw materials Work in progress Finished goods • • 139,630 82,450 124,320 Debenture interest has not yet been paid. The directors require provision for a final dividend which will bring the dividend for the year up to Sh. 2 per share. Required: Prepare in vertical form a Manufacturing, Trading and Profit and Loss Account for the year ended 31 March 1983 and a Balance Sheet as at that date. (25 marks) 397 Partnerships MWANGA AND SONS LTD Manufacturing Account for the year ended 31 March 1993 Raw materials: Opening stocks 33,060 Purchases 942,380 Less Returns In. (3,240) 939,140 972,140 Less Closing stocks (139,630) Prime Costs 832,570 Factory Overheads: Plant depreciation 10,200 Rates and insurance 2,000 Factory power 6,704 Light and water 22,560 Plant maintenance 13,712 General expenses 10,970 28,928 95,074 Opening W.I.P. 927,644 Less: Closing W.I.P. 57,660 Goods manufactured (82,450) (24,790) 902,854 Trading, Profit And Loss Account For The Year Ended 31 March 1993 Shs Shs Sales 1,254,760 Less: Closing stocks (1,360) 1,253,400 Opening stock 107,860 Goods manufactured 902,854 1,010,714 Less: Closing stocks (124,320) 886,394 367,006 Discount received 3,640 370,646 Debenture interest 15,000 Provision for bad debts 6,654 Depreciation - Motor vehicle 5,625 - Fittings and fixtures 2,681 Dividend - Interim 16,000 - Fianl 24,000 40,000 Retained Profit for the year 49,150 Retained Profit brought forward 103,870 Retained Profit carried forward 153,870 Lesson Seven 398 Balance Sheet As At 31 March 1993 Fixed Assets Freehold property Plant Motor vehicle Fittings and fixtures Current Assets Stocks - Raw materials - work in progress - finished goods Debtors, less provisions Cash at bank and in hand Prepaid expenses Current Liabilities Creditors Accruals Dividend proposed Net current assets Financed by: Authorized, and issued share capital: 20,000 Ordinary shares each Sh. 10 Reserves: Share Premium General Reserve Profit and Loss account Cost £ 125,000 130,000 53,000 38,600 346,600 Depreciat ion £ 2,000 72,200 36,125 14,471 124,796 Net £ 123,000 57,800 16,875 24,129 221,804 139,630 82,450 124,320 346,400 117,486 33,570 1,050 498,506 57,430 15,860 24,000 97,290 401,216 623,020 200,000 50,000 120,000 153,000 323,020 523,020 100,000 623,020 15% debentures Workings: B/d Rate And Insurance 9,430 Prepaid Prepaid Profit and Loss Account Factory 9,430 270 780 1,676 6,704 9,430 399 Partnerships Issuance Of Shares Issue and Forfeiture of shares: The sale of shares by 2 PLC to members of the public can be categorized as follows: Sale of Sale at a Sale at per Lump sum Sale 2. Lump sum Sale 3. Lump sum Sale 4. Lump sum Sale 1. When shares are sold in exchange for lump sum cash payment and this is at per value, the entries to be made are: DEBIT: Cashbook CREDIT: Share Capital When shares are sold in exchange for lump sum cash payment and this is at a premium, the entries to be made are: DEBIT: Cashbook CREDIT: Share Capital CREDIT: Share Premium Sale of shares which are to be paid for in installments are normally dealt with as follows: The number of installments may vary from 2 – 4. Each installment is collected through a comprehensive set of processed(called a stage). The 4 possible stages are: Application stage For each stage, an account is opened. Allotment stage This account must close at the end of 1st Call stage the stage. (The application stage & 2nd Call stage allotment stage may be dealt with in a single account called the application/ Application Stage In this stage, the company invites members of the public to send in applications for share they (the public) are interested in purchasing. The application firms must be accompanied by the 1 st installment money when the public respond to the company’s offer. When the company requests members of the public to send in application forms & application money it will make the following entries in its books: Lesson Seven 400 DEBIT: Application A/C CREDIT: Share Capital When the public responds by sending funds, the company will then DEBIT: Cashbook CREDIT: Application A/C There may be an over or under subscription. If there is an under subscription, DEBIT: Cashbook CREDIT: Application With If there is an over-subscription, then the excess applications may either be rejected outright and the applicants’ money refunded, or applications awarded on a pro-rata basis. (i.e. a lower number of shares allotted compared to the number applied for) If outright rejection, the company will: DEBIT: Application With refunded CREDIT: Cashbook money If pro-rata issue, the company will: DEBIT: Application With amount required to CREDIT: Allotment close the application A/C. This marks the end of the application stage. Allotment Stage In this stage, the company selects the applicants and informs them of their allotment. It also requests them to bring in a second installment. As it requests for the second installment the entries to be made are: DEBIT: Allotment A/C. CREDIT: Share Capital. When the public respond by sending in the second installment money, the company, will in its books: DEBIT: Cashbook. CREDIT: Allotment. Generally only the correct amount of money is collected at this stage. Since the account has closed by this stage, the stage is deemed to be over. 1st Call Stage Here the company requests for the third installment from the public. As the company does this, it will: DEBIT: 1st Call A/C . CREDIT: Share Capital. When the public respond by bringing in the installment money, the company, will in its books: DEBIT: Cashbook CREDIT: 1st Call A/C. It is possible that some of the allotees do not pay their 1 st installment money on time. When this is so, DEBIT: Cashbook – with money received DEBIT: Calls in Arrears – with money not received CREDIT: 1st Call A/C – with total. This marks the end of the Call stage. 2nd Call Stage 401 Partnerships this is very similar to the 1st Call whereby the company requests for the second (and last) call money; as it does so, it will: DEBIT: 2nd Call A/C CREDIT: Share Capital When the public respond by sending in the second call money, then the company will: DEBIT: Cashbook CREDIT: 2nd Call A/C It is possible that some of the allotees do not pay up their 2 nd Call money. When this is so: DEBIT: Cashbook – with money collected. DEBIT: Calls in arrears with money not received CREDIT: 2nd Call A/C. THIS MARKS THE END OF THE NORMAL ISSUE OF SHARES PROCEDURES. When a debtor for share money (calls – in –arrears) does not pay up his dues, his shares will be cancelled and any money he previously gave the company forfeited (i.e. not refunded to him). This is known as Share Forfeiture. The entries to be made when shares are forfeited are: DEBIT: Share Capital CREDIT: Calls in Arrears CREDIT: Share forfeiture. Forfeited shares may be resold as follows: At per value At a premium At a discount If resold at per: DEBIT: Cashbook. CREDIT: Share Capital. If resold at a premium: DEBIT: Cashbook CREDIT: Share Capital. CREDIT: Share premium When shares are sold at a discount, a condition will have to apply. The share sale will be expressly illegal unless: Amounts collected from previous allotee plus an amount collected from current allotee equals or is greater than the par value. If the condition is fulfilled and shares are sold at a discount, then DEBIT: Cashbook – with money received. DEBIT: Share forfeited – with deficit. CREDIT: Share Capital with par value. Last entry in this exercise is to transfer any balance on the share forfeiture A/C to Share Premium A/C as follows: DEBIT: Share forfeiture . CREDIT: Share Premium. Lesson Seven 402 Example 8.5 MAY 1999 QUESTION FOUR Give a brief definition of memorandum of association and certificate of incorporation. (5 marks) Radhi Tea Company Limited has an authorized share capital of Sh. 10,000,000 ordinary shares of Sh.10 each. The shares were issued at par as follows: Payable Payable Payable Payable on on on on application allotment first call second call Sh.1.00 Sh.3.00 Sh.4.00 Sh.2.00 Applications were received for 1,630,000 shares. It was decide to refund applicants monies on 130,000 shares and to allot all the shares on the basis of two for every three applied for. The excess application monies received from the successful applicants is not to be refunded but is to be applied to reduce the amount payable on allotment. The calls were made and paid in full with the exception of one member of one member holding 5,000 shares who paid neither the first nor the second call and another member who did not pay the second call on 1,000 shares. After requisite action by the directors the shares were forfeited. They were later reissued at a price of Sh.8 per share. Required: The necessary ledger accounts to record these transactions (15 marks) (Total: 20 marks) Solution: Memorandum of association explains the relationship between the company and the outside world. It shows the object of the company, the name, address, the authorized share capital, its location (its registered office) and the date of incorporation. Articles of association state the rules under which the company will operate e.g. the number of directors, the structure, and meetings. It explains the relationship between the different directors and shareholders. Certificate of incorporation is a document issued to the company when it is registered by the registrar of companies. Radhi Tea Co. Application A/C Cashbook OSC Allotment Sh. 130,000 1,000,000 500,000 1,630,000 Sh. Cashbook 1,630,000 1,630,000 403 Partnerships Sh. OSC Allotment Allotment A/C Sh. 3,000,000 Application Cashbook 3,000,000 500,000 2,500,000 3,000,000 1st Call OSC Sh. Sh. 4,000,000 Calls in arrears 20,000 Cashbook 3,980,000 4,000,000 4,000,000 Lesson Seven 404 2nd Call OSC Bal c/d Sh. Sh. 1,990,00 Calls in arrears 2,000 Cashbook 1,988,000 1,990,000 1,990,000 Share Premium Sh. Sh. 1,630,000 Share forfeiture 1,630,000 Ordinary Share Capital Sh. Sh. Share forfeiture A/C 50,000 Application 1,000,000 Allotment 3,000,000 1st Call 4,000,000 nd 2 Call 1,990,000 Bal c/d 10,000,000 Share forfeiture 10,050,000 10,050,000 60,000 Share Forfeiture A/C Sh. Sh. Calls in arrears 22,000 OSC 50,000 OSC 60,000 Cashbook 48,000 Share Premium 16,000 98,000 98,000 1st Call 2nd Call Calls in Arrears Sh. ` Sh. 20,000 2,000 Share forfeiture 22,000 22,000 22,000 FINANCIAL STATEMENT ANALYSIS (RATIO ANALYSIS) Financial statements include a profit and loss A/C (income statement) that tells us the performance of a company throughout the financial period. It also includes a balance sheet that shows the financial position or status of a company and lastly a cash flow statement which shows changes in cash position of the entity, We analyse financial statements by the use of accounting ratios. There are 5 classes of ratios: • Liquidity • Leverage/Gearing ratios • Activity Ratios • Profitability 405 • Partnerships Equity / Investor ratios. Lesson Seven 406 LIQUIDITY RATIOS. These measure the firm’s ability to meet its short term maturing obligations. Leverage/Gearing Ratios – These measure the extent to which a firm has been financed by non-owner supplied funds. Activity Ratios – These measure the efficiency with which the firm is using various assets to generate sales revenue or how active has the firm been. Profitability Ratios – These measure the efficiency with which the firm uses various funds to generate profits or returns. They also measure the management’s ability to control the various expenses in the firm. Equity Ratios/Investor Ratios – They measure the relative value of the firm and returns expected by the owners of the firm. They also try to look at the overall performance of the firm and going concern of the firm. The following question will be used to illustrate the above classes of ratios ABC ltd Profit and Loss A/C for the year ended 31.12.1992 Sh Sh Sales 850,000 Less: Cost of Sales Opening stock 99,500 Purchases 559,500 659,000 Less: Closing stocks (149,000) (510,000) Gross profit 340,000 Less expenses Selling and distribution 30,000 Depreciation 10,000 Administration expenses 135,000 (175,000) Earnings before interest & taxes 165,000 Interest (15,000) Earnings before tax 150,000 Tax @ 50% 75,000 Less ordinary dividend 75,000 (0.75 per share) Retained profit for the year (15,000) 60,000 ABC Balance Sheet as at 31 December 1992 Non Current Sh. Assets 250,00 Land and 0 Buildings 80,000 Plant & 330,00 Machinery 0 75,000 Current Assets (4,000) 149,00 Inventory 0 Debtors Issued share capital (20000 share of Sh, 10) Reserve Retained profit Long term Current liabilities. Sh. 200000 90000 60000 100000 130000 580,000 407 Less provision Cash Partnerships 71,000 30,000 580,00 0 Additional Note Cash purchases amount to 14,250. Required: Compute the relevant ratios. LIQUDITY RATIOS Current Ratio = Current Assets Current Liabilities Current Ratio = 250,000 = 1.92 : 1 130,000 The higher the ratio then the more liquid the firm is. Quick Ratio/Acid Test Ratio = Current Assets - Inventories Current Liabilities = 250,000 – 149,000 = 101,000 130,000 130,000 = 0.78 : 1 this is a more refined ration that tries to recognize the fact that stakes may not be easily converted into cash. The higher the ratio, the better for the firm as it means an improved liquidity position. Cash Ratio = Cash + Marketable Securities Current Liabilities = 30,000 = 0.23 : 1 130,000 = 0.23 : 1 This ratio assumes that stakes may not be converted into cash easily and the debtors may not pay up their accounts on time. The higher the ratio, the better for the firm as the Liquidity position is improved. Net Working Capital Ratio. = Net Working Capital Net Assets Lesson Seven 408 Net Working Capital =CA –CL = 250,000-130,000=120,000 Net Working Capital = 120,000 = 0.27 : 1 450,000 = 0.27 : 1 The higher the ratio the better for the firm and therefore the improved Liquidity position. GEARING RATIOS These measure the financial risk of a firm (the probability that a firm will not be able to pay up its debts). The more debts a business has (non owner supplied funds) the higher the financial risk. Debt Ratio = Total Liabilities Total Assets This ratio measures the proportion of total assets financed by non owner supplied funds. The higher the ratio, the higher the financial risk . = 230,000 = 0.4 580,000 40% is supplied by non owners Debt Equity Ratio = Total Liabilities Networth (share holders funds) = 230,000 = 0.66 350,000 40% is supplied by non-owners This ratio measures how much has been financed by the non-owner supplied funds in relation to the amount financed by the owners i.e. for every shilling invested in the business by the owners how much has been financed by the non-owner supplied funds. For ABC Ltd, for every 1 shilling contributed in the business by the owner, the creditor have put in 67 cents. The higher the financial risk. Long Term Debt Ratio = Non Current Liabilities Net Assets = 100,000 = 0.2 450,000 This measures the proportion of the total net assets financed by the non-owner supplied funds. 409 Partnerships The higher the ratio, then the higher the financial risk. ACTIVITY RATIO Stock Turnover = Cost of Sales Average Stocks where Average Stocks = Opening Stock + Closing Stock 2 = 510,000 = 4.1 124,250 = 4.1 times This is the number of times stock has been converted to sales in a financial year. The higher the ratio the more active the firm is. An alternative formula is = Sales Closing Stock Debtors Turnover = Credit Sales Average Debtors Where Average Debtors = Opening debtors + Closing debtors 2 Assume the opening debtors was 89,000 and all sales are on credit Debtor Turnover = 850,000 = 10.625 80,000 The higher the ratio, the more active the firm has been (we had debtors over 10 times to generate the sales) Note Average Collection Period = 360 Debtors Turnover = 360 = 34 days 10.625 This measure the number of days it takes for debtors to pay up. The lesser the period, the better for the firm as it improves the liquidity position. Creditors Turnover = Credit Purchases Average Creditors = 545,250 Lesson Seven 410 130,000 = 42 times The ratio tries to measure how many times we have creditors during a financial period. The lesser the ratio the better. Non Current Assets Turnover (Fixed Assets Turnover) = Sales Average Fixed Assets A.F.A = 340,000 + 330,000 = 670,000 = 335,000 2 2 = 850,000 = 2.54 times 335,000 The ratio measures the efficiency with which the firm is using its fixed/ Non Current Assets to generate sales. The higher the ratio the more active the firm. Total Assets Turnover = Sales Total Assets = 850,000 580,000 = 1,046 times Measures the efficiency with which the firm is using its total assets to generate sales. PROFITABILITY RATIOS Profitability in Relation to Sales Gross Profit Margin = Gross Profit = 165,000 = 19% Sales 850,000 The higher the margin, the more profitable the firm is. Net Profit Margin = Net Profit after tax = 75,000 = 9% Sales 850,000 The higher the margin, the more profitable the firm is. Margin affected by: Operating expenses for the period. Profitability in Relation to investment 411 Partnerships Return On Investment = Net Profit after tax Total Assets = 75,000 = 13% 580,000 Shows how efficient the firm has been in using the total assets to generate returns in the business. Return On Capital Employed = Net Profit after tax Net Assets = 750,000 = 17% 450,000 How efficient the firm has been in using the net assets to generate returns in the business. Return On Equity = Earnings after tax Networth = 75,000 850,000 = 21% Efficiency of the firm in using the owner’s capital to generate returns. NOTE The higher the ratio the more efficient is the firm. EQUITY RATIOS Earnings Per Share (Eps) EPS = Earnings attributable to ordinary shareholders No. of ordinary shares outstanding. = 75,000 20,000 = 3.75 This is the return expected by an investor for every share held in the firm. Earnings Yield = Earnings Per Share Market price per share Assume that the market price for the ABC’S shares is Sh20/Share. Lesson Seven 412 = 3.75 × 100% 20 = 19% This is the return amount expected by a shareholder for every shilling invested in the business. Dividend Per Share = Total Dividend (ordinary shareholders) Ordinary shares outstanding. = 15,000 20,000 = 0.75 cts per share This is the amount expected by an investor for every share held in the firm. NOTE The higher the amounts, the better for the firm. LIMITATIONS ON USE OF RATIOS • It is difficult to categorise firms in the various industries due to diversification. This makes inter-company comparison difficult. • It is difficult to compare one company with others in case of monopolist firms. • Different, firms use different accounting policies and methods e.g. on depreciation, provisions and other estimates so this makes comparison of companies difficult. • Ratios are compiled at a point in time and may be affected by short term changes. Therefore ratios are used for short term planning. • Ratios are computed from historical data and therefore are not good indicators of the future. DEFINITIONS TREND ANALYSIS – Comparing or assessing a company’s performance over time. CROSS SECTIONAL ANALYSIS – Comparing two or more companies in the same industry. Example 8.6 (ACCA DEC 98) Beta Ltd is reviewing the financial statements of two companies, Zeta Ltd and Omega Ltd. The companies trade as wholesalers, selling electrical goods to retailers on credit. Their most recent financial statements appear below. PROFIT AND LOSS ACCOUNTS FOR THE YEAR ENDED 31 MARCH 20X8 Zeta Limited Omega Limited 413 Partnerships £’000 Sales Cost of sales Opening stock Purchases Less: closing stock 200 3,200 3,400 400 Profit before tax Taxation Net profit for the period £’000 £’000 6,000 800 4,800 5,600 800 3,000 1,000 Gross profit Expenses Distribution costs Administrative expenses Interest paid £’000 4,000 200 290 10 4,800 1,200 150 250 400 500 500 120 380 800 400 90 310 Lesson Seven 414 Balance Sheets As At 31 March 20x8 Zeta Limited £’000 Fixed assets Tangible assets Warehouse and office 1,200 buildings 600 Equipment and vehicles Omega Limited £’000 £’000 £’000 5,000 1,000 1,800 6,000 Current assets Stock Debtor – trade - sundry Cash at bank 400 800 150 1,350 800 900 80 100 1,180 Current liabilities Creditors – trade - sundry Overdraft Taxation (800) (80) (200) (120) (800) (100) (90) Long-term loan (interest 10% pa) Share capital Revaluation reserve Profit and loss account 150 1,950 1,950 1,000 950 1,950 890 6,890 (4,000) 2,890 1,600 500 790 2,890 Required: a) Calculate for each company a total of eight ratios which will assist in measuring the three aspects of profitability, liquidity and management of the elements of working capital. Show all workings. (8 marks) b) Based on the ratios you have calculated in (a), compare the two companies as regards their profitability, liquidity and working capital management. (8 marks) c) Omega Ltd is much more highly geared than Zera Ltd. What are the implications of this for the two companies? (4 marks) (20 marks) Solution: 415 Partnerships PROFITABILITY Gross profit margin Gross profit × 100% Sales Net profit margin Net profit × 100% Sales Return on capital employed Profit before interest and tax Capital employed Return on shareholders’ capital Profit before tax Share capital and reserves Asset turnover Sales Capital employed LIQUIDITY Current ratio Current assets Current liabilities 1000 × 100% = 25% 4000 1200 × 100% = 20% 6000 500 × 100% = 12.5% 4000 400 × 100% = 6.7% 6000 510 = 26.2% 1950 500 = 25.6% 1950 4000 = 2.1 times 1950 800 = 11.6% 6890 400 = 13.8% 2890 6000 = 0.9 times 6890 1880 = 1.9:1 990 Quick ratio Current assets – stock Current liabilities 1350 = 1.1:1 1200 Gearing Long – term loans Capital 950 = 0.8:1 1200 Interest cover Profit before interest and tax Interest charges nil = nil 1950 1080 = 1.1:1 990 4000 = 58% 6890 800 = 2 times 400 510 = 51 times 10 WORKING CAPITAL MANAGEMENT Debtors days Trade debtors × 365 days Sales Creditor days Trade creditors × 365 days Purchases 800 × 365 = 73 days 4000 900 × 365 = 55 days 6000 800 × 365 = 61 days Lesson Seven 416 Note. We have used average stock here. When you have the information use it. Profitability Zeta has a higher gross margin than Omega. This may indicate a differing pricing policy. Omega’s net margin is lower than Zeta’s. Omega’s expenses are therefore proportionally higher. It should be noted that Omega’s bottom line profit is reduced significantly by the interest charge. Return on Omega’s capital is around half of Zeta’s. Omega has a higher fixed asset base due in part to a revaluation. It may be that a revaluation of Zeta’s assets will partially close the gap. Liquidity Omega has nearly twice as many current assets as current liabilities. Although both companies’ quick ratios are much closer, Zeta’s liquidity does appear to be an issue especially as there is no cash at hand. It would be wise to examine projected cashflows to see how readily Zeta’s profits will improve this situation. As Zeta has no long-term loans they may be able to borrow in order to improve liquidity. Working capital management Zeta is turning stock over more quickly than Omega. This is beneficial in a market which can be subject to obsolescence. Zeta’s creditor and debtor days are a cause for concern. Debtors should be collected within 60 days if not sooner. 60 day collection would improve cash flow by over £140,000 reducing the debtors balance to £658,000(60/73 × £800,000). Creditors should be paid at least as quickly as Omega pays theirs. Zeta risks damaging the goodwill it has with its suppliers. Paying creditors within 60 days would have an adverse effect on cash flow of over £270,000. The creditors balance would be £527,000 (60/91 × £800,000). Omega is highly geared whereas Zeta has no long-term loans. Omega’s gearing means that should profits fall they may not be in a position to pay the loan interest. Zeta’s capital is entirely share capital and so a fixed return is not required. Omega’s loan appears to be fixed rate. This means that in times of falling interest rates Omega will have higher interest costs than say, Zeta, if Zeta borrowed the same amount. The converse is true in times of rising interest rates. 417 Partnerships REINFORCEMENT QUESTIONS QUESTION ONE The chief accountant of AZ Limited has extracted the following trial balance as at 31 October 1999. Sh. Sh. Authorized and issued capital 400000 Share premium 00 8% debenture stock 5000 Profit and loss stock 00 Motor vehicles at cost 165000 100000 Provision for depreciation on motor vehicle 00 00 Plant and machinery at cost 55000 Provision for depreciation on plant and 258000 00 machinery 00 Land buildings at cost 34000 Stock in hand 1 November 1998 – Finished 300000 00 goods 00 – Raw materials 42000 63000 – Work-in-progress 0 00 38000 0 Trade debtors 56000 Office furniture and equipment at cost 0 Provision for depreciation on office furniture and equipment Sh. Sh. Trade creditors 736000 Purchase of raw materials 0 Sales of finished goods 89000 18500 Direct wages 0 0 Direct expenses 10000 Factory expenses 00 Indirect materials 950000 Factory insurance 0 285500 Sales room expenses 00 Administration expenses 135000 Office salaries and wages 0 Vehicles running expenses 395000 Bad debts written-off 290000 Balance at bank – overdrawn 350000 150000 485000 620000 840000 656000 640000 11750 00 966100 966100 00 00 Lesson Seven 418 Notes: Closing stock includes – Finished goods – Raw materials – Work-in-progress Accrued salaries The directors recommended a dividend of 10% on the issued share capital and a transfer of Sh. 2000000 to a general reserve. Debenture interest has not been paid Depreciation is provided on straight-line method at 10% and 25% per annum on furniture and equipment, plant and machinery and motor vehicles respectively. The overdraft interest of Sh. 725000 was communicated to the company by the bank on 5 November 1999 and therefore it has not been posted in the cash book. Required: Manufacturing, trading, profit and loss account for the year ended 31 October 1999. (12 marks) Balance sheet as at 31 October 1999. (8 marks) (Total: 20 marks) QUESTION TWO The Chief Accountant of KK Ltd has extracted the following trial balance as at 31 October 1998. Sh,’00 Sh,’00 Authorized and issued capital (shares of Sh. 20 0’ 0’ each fully paid) 30,000 Share premium 350 10% premium 3,500 General reserve 2,000 Profit and loss account 1 November 1997 2,850 Motor vehicles at cost 3,500 Provision for depreciation 265 Freehold property 44,50 Trade debtors 0 Trade creditor 1,375 460 Purchases and sales 127,45 Stock in hand 1 November 1997 95,650 0 Furniture and fittings at cost 3,478 Provision for depreciation 1,540 Goodwill 138 Rent receivable 500 Salaries and wages 385 General expenses 2,285 Vehicles running expenses 358 Bad debts 2,470 Telephone and postage 124 Water and electricity 568 419 Rates and insurance Cash at bank Partnerships 269 289 10,492 167,39 8 167,39 8 Notes: 1. Credit sales amounting to Sh.165,000 were made on 31 October 1998 but no entries were made in the books. 2. Returns outwards amounting to Sh.128,000 were dispatched on 31 October 1998 but no entries were made in the books. 3. Closing stock was valued at Sh.4,398,000. 4. Accrued salaries and telephone bills amounted to Sh.134,000 and Sh.55,000 respectively. 5. Rent for the month of October 1998 amounting to Sh.35,000 had not been received from the tenant. 6. Provision for depreciation on furniture and fittings and the motor vehicles are 10% and 20% on cost respectively. 7. Provision for bad and doubtful debts of 5% on trade debtors should be made. 8. Corporation tax should be provided at 35% of the net profit before tax. 9. The directors propose a dividend of 15% on issued share capital and a transfer of Sh.2,500,000 to the general reserve. 10.The debenture interest has not yet been paid. Required: 1. Trading, profit and loss account for the year ended 31 October 1998. (13 marks) 2. Balance sheet as at 31 October 1998. (7 marks) (Total: 20 marks) QUESTION THREE ACCA PILOT PAPER The balance sheet of Grand Limited, a wholesaler, at 31 December 1995 and 1996 were as follows: 31 December 1995 1996 Lesson Seven Tangible fixed assets Cost of valuation Aggregate depreciation Current assets Stock Debtors Cash Current liabilities Trade creditors Corporation tax Proposed dividend Net current assets Loans (due for repayment 1999) Called up share capital Share premium Revaluation reserve Profit and loss account 420 £000 126,300 (50,000) £000 76,300 12,000 10,500 1,400 23,900 £000 £000 162,4 00 (64,0 00) 98,40 0 15,00 0 14,00 0 2,000 31,00 0 6,800 3,400 4,000 14,200 9,700 86,000 (60,00 0) 26,000 6,000 1,000 19,000 26,000 The stock at 31 December 1994 was £10,000,000. 9,400 5,000 6,000 20,40 0 10,60 0 109,0 00 (60,0 00) 49,00 0 10,00 0 3,000 8,000 28,00 0 49,00 0 421 Partnerships The summarized profit and loss accounts for the company for the years ended 31 December 1995 and 1996 were: Sales Cost of sales Gross profit Expenses Net profit before tax Year ended 31 December 1995 1996 £000 £000 64,000 108,000 40,000 75,600 24,000 32,400 10,000 12,400 14,000 20,000 Required: a) Calculate the following accounting ratios for both years: • The gross profit percentage • The current ratio and the quick ratio (or acid test) • Debtors’ collection period in days • Trade creditors’ payment period in days (based on purchases figures which are to be calculated) • Gearing ratio. b) Show you full workings. (10 marks) c) Explain what you can deduce from the ratios as at 31 December 1996 and from comparing them with those for 1995. (5 marks) d) State two points which could cause the movement in the gross profit percentages between the two years and explain how they could bring the change about. (2 marks) e) State the extent to which you agree or disagree with the following and give brief reasons for your answers. f) The current ratio and the quick ratio help to assess whether a company is able to meet its debts as they fall due. Therefore the higher these ratios are the better placed the company is. g) A high gearing ratio is advantageous to shareholders, because they benefit from the income produced by investing the money borrowed. (3 marks) (20 marks) QUESTION FOUR On 1 February 19X1 the directors of Alpha Ltd issued 50,000 ordinary shares of £1 each at 120p per share, payable as to 50p on application (including the premium), 40p on allotment and the balance on 1 May 19X1. The lists were closed on 10 February 19X1, by which date applications for 70,000 shares had been received. Of the cash received, £4,000 was returned and £6,000 was applied to the amount due on allotment, the balance of which was paid on 16 February 19X1. All shareholders paid the call due on 1 May 19X1, with the exception of one allotee of 500 shares. These shares were forfeited on 29 September 19X1 and reissued as fully paid at 80p per share on November 19X1. Lesson Seven You are required to write up the necessary accounts, excluding those relating to cash, to record these transactions. CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK 422 423 Partnerships COMPREHENSIVE ASSIGNMENT No.4 TO BE SUBMITTED AFTER LESSON 8 To be carried out under examination conditions and sent to the Distance Learning Administrator for marking by the University. EXAMINATION PAPER. ANSWER ALL QUESTIONS TIME ALLOWED: THREE HOURS. QUESTION ONE Pesa Nyingi had a retail business and employed an assistant at a weekly wage of Shs.5,000.00. On 2 January 2002, this assistant did not report for work and it was found that he had left, taking with him the balance in the till. It had been Pesa Nyingi’s practise to bank each Monday morning the balance in the till resulting from the previous week’s transactions. No float was maintained. The only records kept, apart from the bank statement, were details of sales on credit and unpaid invoices for goods. You ascertain the following balances on 1 January 2001. Stock 688,000.00 Creditors 988,000.00 Bank 276,000.00 Debtors 344,000.00 Cash 228,000.00 Accrued expenses 100,000.00 Fixtures and Fittings 1,000,000.00 You also ascertain the following: An analysis of the bank statement for the year ended 31 December 2001 showed the following Receipts 180,000.00 Banking from debtors cheques 4,116,000.00 Cash 4,296,000.00 Payments Creditors for goods Rent and expenses 3,748,000.00 232,000.00 3,980,000.00 Before banking the amounts, Pesa Nyingi paid the assistant and took Shs. 4,000.00 for himself every week. Expenses Paid out of the till could be assumed to average Shs. 8,000.00 per week excluding wages. Stock at the end of the period was valued at Shs.360,000.00. The debtors summary showed that credit sales for the period amounted to Shs. 13,960,000. An amount of Shs. 336,000.00 was still outstanding. Lesson Seven 424 Creditors for goods have always been paid by cheque. Unpaid invoices on 31 December 2001 amounted to Shs. 1,120,000.00. Creditors for expenses were Shs. 800,000.00. Although creditors were agreed at Shs. 1,120,000.00, goods had been returned against a cash receipt of Shs. 48,000.00. The receipt has not been recorded There was a fixed margin of gross profit of 20% on selling price. The insurance company has agreed to admit a claim for the amount of the theft. A depreciation charge of 20% is to be charged on the value outstanding on the fixtures and fittings at the end of the year. A cheque from one of the debtors of Shs. 10,000.00 was dishonored but this fact has not yet been reflected in the bank statement. Assume a 50 week year Required: a) Prepare workings showing your calculation of the amount of the theft. (8 marks) b) Prepare a trading, profit and loss account for the year ended 31 December 2001 and a balance sheet as at that date. 17 marks) QUESTION TWO Jambo Dealers Ltd maintains a Sales Ledger and a Purchases Ledger. The monthly accounts of the company for May 2002 are being prepared and the following information is available. Sales Ledger balances as at 1 May 2002 Purchases Ledger balances as at 1 May 2002 Sales Ledger balances as at 31 May 2002 Purchases Ledger balances as at 31 May 2002 Credit Sales Credit Purchases Cash and cheques received Sales Ledger Purchases Ledger Cash and cheques received Sales Ledger Purchases Ledger Credit notes issued (for returns inwards) Debit notes received (returns outwards) Dishonoured cheques Discounts allowed Discounts received Bad debts written off in December 2001 but now recovered Debit 1,672,000. 00 28,000.00 ? 36,500.00 Credit 114,600.00 747,000.00 67,000.00 ? 18,938,000. 00 670,000.00 1,549,700.0 0 13,000.00 47,000.00 632,000.00 119,800.00 24,000.00 32,000.00 43,000.00 33,800.00 14,200.00 It has been decided to set off a debt due from a customer, A Mutiso, of Shs. 30,000.00 against a debt due to him of Shs. 120,000 in the creditors ledger. The company has decided to create a provision for doubtful debts of 2.5% of the total debtors on 31 May. 425 Partnerships Required: a) Prepare the sales ledger control account and the purchases ledger control account for May 2002 in the books of Jambo Dealers Ltd. (14 marks) b) Produce an extract of the balance sheet as at 31 May 2002 of Jambo Dealers Ltd relating to the company’s trade debtors and trade creditors. (3 marks) c) Briefly explain the purpose of control accounts. (3 marks) QUESTION THREE The following are the summarized trading, profit and loss accounts for the year ended 30 April 2000, 2001, 2002 and balance sheet as at 30 April 1999, 2000, 2001 2002 for James Mwendapole, a sole trader. Trading, Profit and Loss Accounts for the year ended 31 May Sales Cost of sales Gross Profit Expenses (including loan interest) Net Profit 2000 Sh’000’ 1,000.00 (600.00) 2001 Sh’000’ 1,200.00 (720.00) 400.00 (200.00) 480.00 (300.00) 200.00 180.00 2002 Sh’000’ 1,400.0 0 (980.00 ) 420.00 (280.00 ) 140.00 Balance Sheets as at 31 May Non Current Assets 1999 Sh’000’ 380.00 2000 Sh’000’ 480.00 2001 Sh’000’ 680.00 2002 Sh’000’ 900.00 Current Assets Stocks Debtors Balance at bank Total Current Assets 140.00 100.00 900.00 330.00 160.00 180.00 130.00 470.00 200.00 400.00 390.00 990.00 290.00 520.00 160.00 970.00 Current Liabilities Creditors Loan (received on 31 May 2001) Total Current Liabilities (40.00) (40.00) (80.00) (80.00) (120.00) (500.00) (620.00) (180.00) (500.00) (680.00) Net Current Assets 290.00 670.00 390.00 870.00 370.00 1,050.00 290.00 1,190.00 Lesson Seven 426 Net Assets Capital Opening Capital Add Net Profit 510.00 160.00 670.00 670.00 200.00 870.00 870.00 180.00 1,050.00 1,050.00 140.00 1,190.00 Additional information: James MwendaPole, a man of modest tastes, is the beneficiary of a small income from his grandfather and therefore has taken no drawings from his retail business. Interest of 10% per annum has been paid on the loan from 1 June 2001. It is estimated that Shs. 120,000.00 would have been paid per year for the services rendered to the business by James MwendaPole. All sales are on 30 days credit basis. James MwendaPole is able to invest in a bank deposit account giving interest at the rate of 8% per year. Required: 1. Calculate for each of the years ended 31 May 2000, 2001, 2001, the following financial ratios. • Return on capital employed • Quick ratio • Stock turnover • Net Profit Margin (8 marks) 2. Use two financial ratios (not referred in (a) above) to draw attention to two aspects to the business which would appear to give cause for concern. (6 marks) 3. Advise James MwendaPole whether, on financial grounds, he should continue trading and whether it was a sound decision to borrow the loan. (6 marks) QUESTION FOUR Bingwa and Shabiki are in partnership as manufacturers of high quality wheelbarrows, Bingwa being responsible for the factory and Shabiki being responsible for sales. Completed wheelbarrows are transferred from the factory to the warehouse at agreed prises. Bingwa and Shabiki are credited with one third of the manufacturing profit and 10% of the trading gross profit respectively and the balance of the firm’s profit being shared equally. All wheelbarrows are sold at Sh. 680.00 each. No interest is credited or charged on capital accounts or drawings. The following trial balance was extracted on 31 March 2002. 427 Partnerships Sh. Capital Accounts Bingwa Shabiki Drawings Bingwa Shabiki Freehold factory (including land Sh. 300,000.00) Factory Plant at cost Delivery Van at cost Provision for depreciation Freehold Factory Factory Plant Delivery Van Stocks on 1 February 2001 Raw materials Work in progress Wheelbarrows (1220 at Shs. 440) Sales Return inwards Purchases of raw materials PAYE Factory wages Office wages Expenses Factory Office Provision for unrealized stock (in warehouse) Provision for doubtful debts Debtors and creditors Bank 96,000.0 0 87,400.0 0 708,800. 00 326,400. 00 82,000.0 0 42,000.0 0 40,200.0 0 536,800. 00 Sh. 482,000. 00 507,000. 00 307,040. 00 110,160. 00 38,400.0 0 1,237,60 0.00 13,600.0 0 291,600. 00 8,800.00 165,400. 00 48,000.0 0 126,800. 00 143,400. 00 48,800.0 0 19,200.0 0 109,200. 00 57,200.0 0 217,600. 00 2,926,00 0.00 Additional information: 2,926,00 0.00 Lesson Seven 428 a) 1540 wheelbarrows at Sh. 480 each were transferred to the warehouse during the year. b) Wheelbarrows in stock being balance of the current year’s production, were valued at agreed price of Sh. 480 each. c) The stock of raw materials was Sh. 34,000.00 and work in progress is valued at Sh. 53,600.00 d) Accrued expenses on 31 March 2002 amounted to 62,400 (including office(Sh. 32,800.00) and prepaid rates Sh,3,200.00 (including office Shs. 1,200.00 )). e) Provision for depreciation is to be made as follows: Factory buildings 2% p.a. Factory Plant 10% p.a. Motor vehicles 25% p.a. The general provision for doubtful debts is to maintain at 10% of the trade debtors. Required: Manufacturing, trading and profit and Loss Accounts for the year ended 31 March 2002 and a balance sheet as at that date. (20 marks) QUESTION FIVE State and explain the qualities of useful financial information. (10 marks) To what extent do International Accounting Standards help achieve these qualities. (5 marks) (25 marks) END OF COMPREHENSIVE ASSIGNMENT No.4 NOW SEND YOUR ANSWERS TO THE DISTANCE LEARNING CENTRE FOR MARKING 429 Partnerships PUBLIC SECTOR ACCOUNTING OBJECTIVES At the end of this lesson you should be able to meet these objectives: • State the accounting concepts, bases and policies of relevance to government accounting. • Prepare analyse and interpret financial statements of government units. • Public sector accounting; the development of accounting standards and their applicability to the public sector. • Fund accounting and its relationship to entity theory • Income measurement and valuation in the public sector. • Prepare the accounts of state corporations and similar organisations. CONTENTS • Public Sector Accounting • Fund Accounting Acknowledgement 430 PUBLIC SECTOR ACCOUNTING Public sector accounting is necessary because of the central rule it plays both politically and in economic terms. The public sector is composed of the following: • Central Government • Local government • Parastatals • Charitable organisations All public sector organisations have one characteristic, namely they derive their specific power from Parliament, and as a result they are represented in Parliament. The accountability of public sector to Parliament takes a variety of forms. For example, under central government, the department heads are directly accountable to Parliament for the activities of their organisation, such as the PS of a given ministry is accountable to Parliament through what is known as Parliamentary Accounts Committee for the proper management of his ministry. The Parastatals are accountable through their ministries, while local authorities are partially accountable to Parliament, and to some extent, to the local electorate. Typically a local authority can set out policies necessary for the improvement of services to the local population, and will look for funds either directly or from Parliament. The accountability to Parliament will then set the basis for objectives for different organisations. For the central government, the objectives are directly set by Parliament, while the parastatals (e.g. KPLC) will have general objectives set by Parliament, but specific operational objectives are to be set by the Board of Directors appointed by the minister to oversee the operations of the Parastatal. The following are objectives of Public Sector Accounting: • To provide financial information useful for the determination and predicting of the cash inflows, the balances and financial requirements to meet the short term needs of the organisation, i.e. the accounting information should be able to provide adequate information regarding the tax base as the main source of income to the organisation. • To provide financial information useful for determination and predicting the economic condition of the organisation. • To provide information useful for determining and evaluating the performance of the organisation in terms of legal, contractual and statutory requirements, i.e. the financial statements should be able to indicate whether the transactions of the organisation have been carried out legally and in accordance with statutory requirements and contractual terms. • To provide financial information necessary for the preparation of the budget-planning and to predict the impact of the acquisition and allocation of resources to the organisation. • To provide information necessary for evaluating the managerial performance of the organisation. The users of public sector accounts can be summarised as follows: • • Parliament – for control purposes Government departments – to evaluate performance. 431 • • • Company Accounts Tax payers – to confirm how tax has been used Voters – to decide whether to elect a parliament back and evaluate government performance. Investors and persons giving grants – such as donors. FUND ACCOUNTING A fund is defined as a distinct accounting entity with a self balancing set of accounts which has objectives set out to be met. In commercial accounting, a fund may be equated to a specific division of the company; that division being charged with specific responsibilities or given specific objectives, such as would be the case for a production department. In government accounting the emphasis is based on the fund as a part of an entity contributing to the overall objectives of the organisation. For this reason, a fund account will be set to receive cash inflows, record expenditures, show assets, as well as liabilities. An example would be a library fund A/C. An organisation may be composed of various fund entities, each fund will have its own books of account as if it was completely independent from the whole organisation. ACCOUNTING THEORY Accounting theory refers to the financial reporting that may be adopted by the organisation. It is necessary to note that fund accounting is the representation of the entity accounting theory as used in commercial accounting. This means a fund will be considered a distinctive unit separate from the people related to it. The financial statements prepared for each fund will be for use of those who are interested in the fund. The parallel in commercial accounting is that a company is a separate entity from shareholders, directors, debtors and creditors. The financial statements of the company are prepared to be used by such people. In public sector accounting, the main accounting concepts used are that of stewardship and accountability. Under the stewardship accounting concept, the steward is charged with the responsibility of making sure that the assets of an organisation are not misappropriated. Under accountability, the head of department is accountable for his actions regarding the management of the organisation as whole. FINANCIAL ACCOUNTING TECHNIQUES Public sector organisations may adopt different accounting techniques; the most important listed are below: 1) Budgetary accounting 2) Cash Accounting 3) Accruals Accounting 4) Commitment Accounting (encumbrances) 5) Fund Accounting 1) Budgetary Accounting Refers to the preparation of operating accounts in form of budgets. A budget is a management plan that has been transformed into figures necessary to evaluate the achievement of the organisations’ objectives. Under budgetary accounting, the concept is based on the forecasted cash flows, and operations must be limited to the budget estimates. The organisation cannot overspend above budget restrictions without Parliamentary approval. Budgetary accounting therefore, aims at achieving the following: Lesson Eight 432 (a) Ensure efficiency of managers. (b) Communicate the objectives of the organisation to the employees (c) Provide controls (d) Provide a yardstick for measuring performance of employees. 2) Cash Accounting Under this system only cash inflows and outflows are recognised and recorded. The system does not recognise any revenue or expenditure that has not been received or paid. (i.e. accrued) 3) Accrual Accounting The accruals concept states that revenues and costs are recognised as they are earned and incurred. Most of the organisations in the private sector prefer this method. However, under public sector accounting, both cash and accrual accounting can be used by different entities or kinds of organisations; e.g. if a part of an organisation is charged with the responsibility of running activities on the same basis as commercial organisations, such an entity may adopt accrual accounting irrespective of the accounting techniques adopted by the main organisation. 4) Commitment Accounting This accounting system recognises transactions when the organisation is committed to them. It means the transaction is not recognised when cash is paid or received, nor when an invoice is received or issued, but at an early stage where orders are received and placed. This accounting method is meant to ensure that government units do not overspend because transactions will only be entered into after checking committed balances. 5) Special funds Some specific departments of a governmental organisation may adopt special fund accounting according to the set objectives they have to meet. The following are some common special funds to governmental organisations: (a) Trust funds: These are those funds where the government receives money in the capacity of a trustee. They are also referred to as Agency funds, or Fiduciary funds. Examples of such funds include NSSF and NHIF. The governmental organisation does not have absolute title to the assets held; there are statutory restrictions upon their use. (b) Sinking funds: These are funds created to account for the accumulation of resources for retiring term bonds at their maturity. Thus their main purpose is the repayment of public debts. Such funds are set up through the approval by the Parliament, and some appropriation may be made from these funds. The amounts appropriated are invested to earn interest; when public debt matures, the sinking fund is used to redeem this debt. (c) Working capital funds/Revolving funds: They are also known as internal service funds and enterprise funds. They are used to account for services provided to other departments (internal departments – internal service funds, external services = Enterprise funds) for a fee – usually cost- 433 Company Accounts reimbursement basis. They are set up through the approval of Parliament to have the necessary resources for achieving their specific objectives. (d) Capital Project Funds: This provides resources for the completion of some specific capital projects. The main sources of financing such funds include proceeds from treasury bonds, grants, and transfers from other ministries and funds. This category excludes any capital projects under trust funds or revolving funds. (e) Specific Revenue funds or special funds: Funds of this class are created and operated to account for revenue designated by law for specific purpose. An example of this would be library services. (f) General funds: These are funds established to account for resources devoted to financing the general services which the governmental units perform for its citizens. These include general administration, protection of life and property etc. Note: In government accounting, sources of income can be divided into 2, namely 1) Recurrent expenditure income; 2) Development expenditure income. Recurrent expenditure income can be equated to operating income in financial accounting. Development expenditure income can be equated to capital income in commercial accounting. CONSOLIDATED FUND All Revenues for the government are recorded into a fund known as a consolidated fund. The consolidated fund account is kept by the treasury under the ministry of finance, and all revenues and grants received by the Government are paid into this account. No money can be withdrawn from this account without approval of Parliament, i.e. Parliament is the sole signatory to this account. This is necessary to ensure that all government incomes are used to carry out activities of public interest; and interests are represented in such decision making through the MPs. It is also important to note that each governmental unit may be in a position to raise funds from its local activities (e.g. Ministry of Education – Fees from students, Ministry of Health – Hospital fees). Money realised in this manner is called Appropriations-In-Aid (A-I-A). Each governmental unit is expected to make a budget of its estimated Appropriation-In-Aid and submit the budget to Parliament through the relevant ministry. Appropriations-In-Aid is supposed to be retained by the government unit that generated it. It will be added to the appropriation (allocation by Parliament) to cover the expenditure of the governmental unit. The following books of accounts are kept by each department (governmental unit) to record the transactions of the organisation: 1. Cash Book The cash book is that book in which all receipts and payments are recorded. Each accounting unit will maintain a cash book. There are different types of receipts and payments in different ministries, and the general point is that all receipts whether in cash or cheque will be recorded in the cash book. Illustration The following cash transactions (cash) took place for a government unit for the month of January 19X8 Sh. 02/01/119X8 Opening balance: Cash Bank 4,000 25,000 Lesson Eight 434 02/01/19X8 Received cheque in respect of trading license 62,500 03/01/19X8 Paid Peter and Sons (cheque for goods supplied) 05/01/19X8 Cash received in respect of fees 05/01/19X8 Paid telephone charges (cheque) 06/01/19X8 Paid AB Ltd by cheque 06/01/19X8 Paid cash to James Burton 08/01/19X8 Received cheque for Licenses 09/01/19X8 Paid wages in cash 10/01/19X8 Kept a cash balance 10,000 and banked rest together 20,000 2,500 8,700 52,000 2,800 210,000 5,000 with all cheques in hand. Required: Prepare a cash book for the governmental unit. Solution CASHBOOK Jan 19X8 2 Jan 2 Jan 8 Jan 10 Jan Balance b/d Trade Licenses Licenses Cash CASH Shs. 4,000 62,500 210,00 0 BANK Shs. 25,000 261,20 0 10 Jan Balance c/d 11 Jan Balance b/d 279,00 0 10,000 4,500 290,70 0 - Jan 19X8 3 Jan 5 Jan 6 Jan 6 Jan 9 Jan 10 Jan 10 Jan 11Jan CASH Shs. Peter & Sons Telephone chg. AB Ltd James Burton Wages Bank Balance c/d Balance b/d 2,800 5,000 261,20 0 10,000 279,00 0 - BANK Shs. 20,000 8,700 52,000 -__ 290,700 4,500 Note: In the illustration, the government unit has a debit balance in the bank – meaning they have an overdrawn account with the bank. For control purposes and using the cash accounting technique, such a situation is not allowed. The accounting officer should only release government cheques when there is at least an equivalent amount in the bank, otherwise such cheques may be dishonoured. 2. Vote book In commercial accounting, ledgers are a set of accounts; entries being recorded in such accounts. Under public sector accounting, ledgers are substituted with an equivalent called the vote book. In this book, various accounts are opened. These accounts relate to various expenditure heads and sources of revenue. In the vote book, the vote number of any particular department or ministry is used. This is an equivalent to a folio number under commercial accounting. The common head numbers include: 110 – Travelling and accommodation 120 – Postal and telegram expenses 435 Company Accounts 121 – Telephone expenses 130 – Official entertainment 174 – Stationery etc. These vote heads are necessary to speed up the processing and posting of various expenditures. Note: The vote book accounts are not to be balanced off as would be in the case of commercial accounting (personal or real accounts) but is a statement to indicate the total amount committed together with the payments that have been made against a given vote. It is presented generally in the form of a T- Account with commitments indicated on the left hand side, and actual payments and balances on the right thereof, i.e. Commitments Payment Balance ILLUSTRATION Vote head – Ministry of Public Works A I E (Authority to incur expenditure) No. 225 – 35. A I E (Authority to incur expenditure) K£5,000 (or Ksh100,000) Transactions (Dec 19X6) 1 Dec Ordered for iron sheets and cement from Ton & Co. for Sh.25,000; L.P.O. No. 5213 6 Dec Paid Sh.3,000 for lorry hire to transport cement; PV No. 357 Transactions (Jan 19X7) 10 Jan Paid Ton & Co. Sh.15, 000 being part payment for goods ordered through LPO No. 5213; PV No. 358. 15 Jan Purchased goods from AB & Co. for Sh.5,000 (timber); PV No. 359 20 Jan Issued LPO No. 5214 to Patel & Sons for windows and doors for Sh.20,000. 25 Jan Part payment to Patel & Sons Sh.7,000; PV No. 360. Lesson Eight 436 Solution Commitment Date 19X 6 1 Dec 19X 7 20th Payment Ref Tom & Co. Patel & Co. LPO 5213 LPO 5214 Estimated Cost Shs. 25,000 20,000 Date 19X6 PV No. Amoun t Balance Shs. 6th Dec 19X7 357 3,000 Shs. 100,000 97,000 10th Jan 15th Jan 25th Jan 358 359 360 15,000 5,000 7,000 82,000 77,000 70,000 On 25th January the balance on the vote book will indicate Sh.70,000 with a commitment of Sh.23,000. (Tom = 10,000; Patel = 13,000) Any other commitment must take into account the only expendable amount in the vote is Sh.70,000 – 23,000 = Sh47,000. Annual Accounts Every governmental unit will prepare financial statements to account for the money allocated to them. The financial statements differ according to the nature of the activities undertaken by the governmental unit. However, the following types of accounts are common among government units: 1) 2) 3) 4) 5) 6) 7) Income and expenditure accounts; Statement of assets and liabilities, General Accounts of Vote (GAV) The exchequer account Paymaster General Account (PMG) Appropriation account Revenue Account The techniques involved in preparation of the account shall be given by means of the following worked examples: 1) Income & Expenditure A/C This is similar to income and expenditure accounts for non-profit making organisations. It is however prepared by governmental units, which provide commercial services e.g. a staff canteen or students welfare canteen (at governmental colleges). Illustration The following account balances were extracted form the books of a pension fund for the year ended 30 th June 19X7: Payments to members Members’ contributions Payment for management expenses Interest on investment by fund Fund Account Cash balance (PMG) Investment A/C Dr (Shs) 500,000 Cr(Shs) 800,000 150,000 400,000 1,800,000 350,000 2,000,000 ________ 437 Company Accounts 3,000,000 3,000,000 Requitred: Prepare an income and expenditure account for the year ended 30 th June 19X7 and a balance sheet as at that date. Note: The fund is the amount set aside to meet the specific objectives of the governmental unit. It is equal to the capital in a business in commercial accounting. Solution Income and Expenditure account for the year ended 30 th June 19X7 Sh.‘000 Sh.‘000 INCOME 800 Members’ contribution 400 Interest income from investments 1,200 Payments to members 500 Expenses of management 150 (650) Surplus 550 Balance Sheet as at 30 June 19X7 Sh.‘000 ASSETS Investment A/C Cash balance Sh.‘000 2,000 _350 2,350 Fund Account B/F Add Surplus 1,800 550 2,350 2,350 2) General Account of Vote (GAV) During a budget speech, the Minister for Finance will give detailed appropriations (allocations) of funds to different governmental units. Through an appropriation bill, The Parliament will approve different estimates to individual governmental units. The amount approved to each governmental unit by Parliament is then recorded into a particular account known as “General Account of Vote” (GAV). This account therefore records funds allocated to various governmental units. All incomes of the government are received and recorded into an account called the “Exchequer account”. The total amount available in the exchequer represents the consolidated fund, i.e. the consolidated fund operates an account called exchequer. Illustration The approved estimates and actual details of the Ministry of Culture and Social Services for the year 19X6/19X7 were as follows: Gross estimated expenditure Estimated Appropriation-In-Aid Drawings from exchequer Gross Expenditure Actual appropriations in aid Required: Prepare a) K£640,000 K£ 40,000 K£530,000 K£480,000 K£30,000 i) The General Account of Vote Lesson Eight ii) iii) b) 438 The exchequer account Paymaster General Account A statement of assets and liabilities as at 30-6-19X7 SOLUTION Note: (i) The exchequer account records the amount accrued by the consolidated fund to a particular government unit (ii) The GAV account will record amounts approved by Parliament to a particular governmental unit. However, the consolidated fund will issue different amounts for a given period of time to a particular government unit subject to the maximum, which was approved by Parliament. E.g. Parliament may approve K£600,000 for a particular governmental unit, but due to various reasons, the consolidated fund may issue a different amount to the unit, but not exceeding K£600,000. (iii) The Paymaster General Account (PMG) is the cash account operated by the individual governmental units. It records amounts so far withdrawn from the exchequer. All money approved for a governmental unit is intended to meet a specific purpose. This means each governmental unit will maintain an expenditure account, in which shall be recorded debits for various expenses incurred. The corresponding credit is in the PMG account (cash account). The expenditure account will then be closed to GAV. The difference between the amount approved by Parliament and total expenditure will then represent a fund balance, that should be surrendered back to the treasury at year end if not used. GENERAL ACCOUNT OF VOTE 30 June 480,000 30 June 190,000 19X7 19X7 1 July 19X7 vote 640,000 _______ K£ K£ Expenditure 1 July 19X6 Exchequer 640,000 Balance c/d 30 June 19X7 Appropriation in Aid 30,000 670,000 670,000 EXCHEQUER ACCOUNT K£ K£ General Account for 30 June 19X7 PMG A/C 530,000 30 June 19X7 Balance c/f 110,000 640,000 640,000 PAYMASTER GENERAL ACCOUNT K£ 30 June 19X7 Exchequer 530,000 30 June 19X7 Appropriation In Aid 30,000 560,000 30 June 480,000 19X7 PMG 30 June 480,000 30 June 80,000 19X7 19X7 K£ Expenditure Balance c/d 560,000 EXPENDITURE ACCOUNT A/C 30 June 19X7 General Account of Vote 480,000 439 Company Accounts Notes: 1) Appropriation-In-Aid (AIA) is the amount to be generated by the governmental unit from its internal activities. It is subtracted from the gross estimate (gross vote) to arrive at net estimate of (net vote) which is approved by Parliament to be released from the consolidated fund. An A-I-A account may be maintained, Where: When A-I-A is received from own operations: Dr PMG Account Cr A-I-A Account At the year end: Dr A-I-A Account Cr GAV Account 2) At the beginning of each year, each governmental unit has an estimated Appropriation-In-Aid which will guide them on the total amount expected to be generated internally. Thus the sum of net estimates approved and actual appropriation in aid will constitute the total funds allocated to each governmental unit. This sum constitutes the credit side of the GAV account. STATEMENT OF ASSETS AND LIABILITIES AS AT 30-6-19X7 K£ K£ ASSETS 110,000 ______ Exchequer (Amount not yet 80,000 190,000 drawn) Paymaster General (PMG) FUNDED BY General Account of Vote 190,000 Thus funds allocated have been adequately accounted for and the balance of K£190,000 will be surrendered back to the Treasury. In this case, the government unit will surrender the Sh80,000 from the PMG, while the exchequer will surrender Sh 110,000 on behalf of the ministry. Illustration: The following information relates to a governmental unit for the fiscal year 19X6/19X7. Gross estimates: K£720,000 Appropriation-In-Aid estimated: K£90,000 Drawings from the exchequer K£450,000 Actual gross expenditure K£520000 Actual appropriation-in-aid K£120,000 Required: a) Prepare the following accounts: i) General Account of vote (GAV) ii) Exchequer A/C iii) PMG A/C b) Statement of assets and liabilities as at 30 June 19X7. Solution: For clear accounting procedure it is necessary to distinguish between the proportion of gross estimate that will be generated internally and that proportion that is expected from the treasury after Parliamentary approval. Lesson Eight 440 GENERAL ACCOUNT OF VOTE K£ K£ 30 June 19X7 Excess in A-I-A 1 July 19X6 Exchequer A/C 30,000 630,000 30 June 19X7 Expenditure 30 June 19X7 A-I-A 52,000 120,000 30 June 19X7 Balance c/d 20,000 ______ 750,000 750,000 NOTE: TO SIMPLIFY ACCOUNTING ENTRIES, THE A-I-A IS RECORDED IN THE GAV AT THE END OF THE FISCAL YEAR. THIS WILL ENABLE US TO DETERMINE WHETHER THERE WAS A SHORTFALL (DEFICIENCY) IN A-I-A FROM THE EXPECTED AMOUNT, OR THERE WAS A SURPLUS. EXCESS APPROPRIATION-IN-AID 30 June 30,000 19X7 Balance K£ c/d 30 June 30,000 19X7 GAV K£ A/C EXCHEQUER ACCOUNT 1 July 19X6 vote630,000 ______ K£ K£ General Account of 30 June 19X7 PMG 450,000 30 June 19X7 Balance c/d 180,000 630,000 630,000 PMG ACCOUNT K£ K£ 30 June 19X7 Exchequer A/C 30 June 19X7 Exchequer A/C 450,000 520,000 30 June 19X7 A-I-A 30 June 19X7 Balance 120,000 50,000 570,000 570,000 APPROPRIATION IN AID ACCOUNT 30 June 120,000 19X7 K£ GAV 30 June 120,000 K£ PMG 19X7 Note: amounts to be surrendered back to the exchequer will be £230,000. The governmental unit is also expected to remit any A-I-A to the consolidated fund – This is more apparent in a statement of appropriation. (also known as appropriation A/C). STATEMENT OF ASSETS AND LIABILITIES AS AT 30th June 19X7 Assets Exchequer A/C Paymaster General (PMG) Funded by Excess in AIA K£ 180,000 50,000 K£ ______ 230,000 30,000 ______ 441 Company Accounts General Account of Vote 200,000 230,000 APPROPRIATION ACCOUNTS These may be drawn in two different ways (one being a slight variation from the other). An example of an appropriation account would be as follows: APPROPRITATION ACCOUNT FOR THE YEAR ENDED 30TH JUNE 19X4 (K£) Details Approved estimate Personal emoluments: - original estimate - supplementary estimate House allowance Passage and Leave Travelling expenses: - original estimate - supplementary estimate Electricity & Water Purchase of plant & mach. Gross Appropriation Appropriation-In-Aid Net Appropriation 80,000 8,000 22,000 (2,000) Actual Expendit ure 88,000 15,000 5,000 90,000 13,000 4,500 20,000 6,000 50,000 23,000 6,500 40,000 184,000 (15,000) 169,000 177,000 (12,000) 165,000 Amount underspent Amount overspent 2,000 2,000 500 10,000 3,000 500 _____ 12,500 5,500 Note: 1) Net estimate exceeds actual expenditure by K£4,000. This indicates that there was no over expenditure for the governmental unit as a whole. However, there are some over-expenditures on individual items; but since these are not significant, no explanations are required by the accounting officer. 2) The gross estimates and gross actual expenditures are recorded before taking into account the effect of AI-A. In this case gross expenditure estimate exceeds the gross actual expenditure by K£7,000. But in order to determine the surplus to be returned to the treasury or over-expenditure, we must take into account the effects of either surplus AIA or deficiency of AIA. In this case, there is a shortage in AIA of K£3,000. The deficiency must be netted off from the surplus of “approved estimates and actual expenditure”: Surplus of estimates over actual expenditure K£7,000 Less deficiency in A-I-A (3,000) Expendable balance K£4,000 Therefore there is no net over-expenditure by the ministry. Illustration The approved estimates and actual expenditure details of the Ministry of Agriculture for the year 19X7/19X8 were as follows: CODE 000 050 Details Personal emoluments House Allowance Approved estimates K£ 123280 19,550 Actual Expenditure K£ 97,520 14,260 Lesson Eight 080 100 110 120 190 196 230 620 442 Passage and Leave Travelling and accommodation Transport and maintenance Postal and Telecom expenses Miscellaneous charges Training expenses Purchase of equipment AIA (Realised income) 41,040 1,334 16,100 4,600 17,480 5,980 21,000 1,000 667 1,656 13,593 3,312 16,882 4,738 39,800 5,560 The ministry made fair equal withdrawals from the exchequer in July 19X7, October 19X7, January 19X8 and May 19X8. In total, the ministry had drawn K£200,000 by the year-end. Required: a) The general account of vote b) The exchequer account c) The PMG account d) Statement of assets and liabilities as at 30th June 19X8. SOLUTION It would help if an appropriation account is drawn up. In this illustration it is drawn in a slightly varied version: CODE Details 000 050 080 100 110 120 190 196 230 Personal emoluments House Allowance Passage and Leave Travelling and accommodation Transport and maintenance Postal and Telecom expenses Miscellaneous charges Training expenses Purchase of equipment Gross Appropriation A-I-A Net Appropriation 620 Approved Estimates K£ 123280 19,550 41,040 1,334 16,100 4,600 17,480 5,980 21,000 Actual Expenditure K£ 97,520 14,260 667 1,656 13,593 3,312 16,882 4,738 39,800 Over/Under Expenditure K£ 25,760 5,290 40,373 (322) 2,507 1,258 598 1,242 (18,800) 250,364 (1,000) 249,364 192,428 (5,560) 186,868 57,936 4,560 62,496 GAV ACCOUNT K£ 30 June 19X8 Excess A – I – A A/C 4,500 30 June 19X8 Expenditure A/c 192,428 30 June 19X8 Balance c/d 57,936 254,924 30 June 4,560 19X8 Balance 1 July 19X7 249,364 30 June 19X8 5,560 K£ Exchequer A/c A – I – A A/C _______ 254,924 Excess Appropriation in Aid Account K£ K£ c/d 30 June 19X8 GAV A/C 4,560 443 1 July 249,364 Company Accounts Exchequer Account K£ K£ GAV A/C 30 June 19X8 Expenditure 200,000 30 June 19X8 Balance c/d 49,364 249,364 249,364 19X7 PMG Account 30 June 19X8 200,000 30 June 19X8 5,560 K£ Exchequer (Total) 30 June 192,428 A – I – A A/C 30 June 13,132 205,560 K£ (Total) 19X8 PMG 19X8 Balance c/d 205,560 Expenditure 30 June 192,428 19X8 K£ PMG 30 June 192,428 19X8 GAV K£ A/C Appropriation-In-aid Account 30 June 5,560 19X8 K£ GAV 30 June 5,560 19X8 K£ PMG STATEMENT OF ASSETS AND LIABILITIES AS AT 30 JUNE 19X8 K£ K£ ASSETS 49,364 _____ Exchequer A/C 13,132 62,496 Paymaster General A/C FUNDED BY General Account of Vote Excess appropriation-in-aid 57,936 4,560 ______ 62,496 REVENUE ACCOUNTS A revenue account records only the estimated revenue and actual revenue from each particular revenue source for the governmental unit. The difference between the two, if significant must be explained by the accounting officer. Alternatively the significant difference between the two can be used to correct future estimations by the governmental unit. It could also represent new factors emerging during the year which were not taken into account during the previous budget. ILLUSTRATION From the following data, prepare a statement of revenue for the year ended 30 th June 19X7. Renting building and equipment Estimated RevenueActual Receipts K£850,000 K£870,000 Lesson Eight 444 Fee for trading licenses Fees for import/export licenses Other receipts K£430,000 K£470,000 K£235,000 K£400,000 K£480,000 K£210,000 The following additional details are available: (i) Balance on hand on 30th June 19X6 K£247,000 (ii) Balance on hand on 30th June 19X7 K£160,000 REVENUE A/C FOR THE YEAR ENDED 30TH JUNE 19X7 Details Estimat e£ Balance b/d (30-June19X6) Rent for building/machinery Fees for trading licenses Fees for import/export Others 850 430 470 235 Actual £ 247 870 400 480 210 Details Payment to Treasury Balance c/f (30.6.19X7) 1,985 1,960 2,207 £ 2,047 160 2,207 Note: There are no serious differences between estimate and actual receipts, hence no explanation is required by the accounting officer. Illustration: The following are extracts from the trial balance for revenue head No. 180 – 240, Airport revenue collection for the year ended 30th June 19X8: Code Details Dr(£) Cr (£) 630 Renting building and equipment 807,456 631 Rent from land 3,796,205 651 Aviation landing fee 3,542,221 652 Airport passenger tax 3,991,029 670 Other airport receipts 798,144 Payment of revenue to exchequer 13,288,687 The following additional details are made available: i) ii) Balance in hand at 30th June 19X7 £2,568,242. Estimated receipts for the year: CODE AMOUNT 630 £1,000,000 631 £2,500,000 651 £3,000,000 652 £3,600,000 670 £1,100,000 Required: a) A statement of revenue for the year ended 30 th June 19X6 b) Give appropriate footnotes for material differences between estimates and the actual receipts. Solution REVENUE ACCOUNT FOR THE YEAR ENDED 30TH JUNE 19X8 Details Balance 19X7) Estimate £ b/d (30-June1,000,000 Actual £ Details 2,568,242 807,456 Payment to Treasury K£ 13,288,68 7 445 Renting building/machinery Rent for land Aviation landing fees Airport passenger tax Other airport receipts Company Accounts 2,500,000 3,000,000 3,600,000 1,100,000 3,796,205 3,542,221 3,991,029 798,144 11,200,00 0 12,935,05 5 15,503,29 7 Balance c/f 30.6.19X8 2,214,610 160 _________ 15,503,29 7 Note: There may have been a significant increase in the volume of business at the airport. It is possible that a new airline (previously not operational to Kenya) has decided to make Kenya one of its destinations/stopovers. It is also possible that some land and buildings have been sold, thus leading to a fall in rental income. GENERAL AND SPECIAL FUNDS ACCOUNTS In carrying out its functions to meet both economic and political needs of the country, the government sets out various funds that are charged with specific governmental units, ministries or departments that will oversee the operations of the fund. Note: A fund is an entity with self-balancing books to meet specified objectives. For proper accounting, different funds are named in accordance with the activities they are supposed to undertake. For example, the general fund of a governmental unit is the entity that accounts for all resources and assets used for financing the general administration of the unit. The general administration of the unit is for traditional services provided to the people, such as security, health, education and eradication of poverty. In some cases, the government may set aside funds to meet special duties or activities which are different from ordinary traditional services being offered to the people. This means whenever a tax or other revenue source is authorised by Parliament to be used for a specified purpose, then a governmental unit avails itself of that source, and may create what is known as a Special Revenue Fund. The purpose of a special revenue fund is to show that the revenue from such sources was used for a specific purpose only; and the governmental unit will then operate what is known as a special fund account to record the resources and liabilities for such an entity. The general fund and special funds are commonly known as revenue funds of a governmental unit. Thus, where there is no specification, the revenue fund of a governmental unit may refer either to the general fund or the special fund. It is important to note that the general fund as well as special revenue fund only record current assets and current liabilities of the governmental unit. Long term assets as well as long term liabilities for governmental units are covered under different funds e.g. property funds. The difference between current assets and current liabilities of a general or special fund constitute what is known as “fund equity”. Fund equity would thus be an equivalent of net working capital in commercial accounting. However from the governmental accounting point of view, fund equity represents the fund balance that has not been directly used or committed. The fund equity can further be divided into two parts: i) Fund balance ii) Reserves The reserves part of a fund equity represents funds that have been committed but the liability not yet incurred. For example, where a contract has been entered into, and the contractor has been issued with an LPO, but he has not yet supplied or provided the service; the amount committed to the LPO will be represented in form of a reserve to indicate that it is fund balance which cannot be distributed/utilised. The other distributable amounts are listed under fund balance. Lesson Eight 446 BUDGETARY ACCOUNTING All funds set up by the government to meet different objectives will have a budget as a source of control with regard to estimated revenue as well as estimated expenditure (appropriations). In order to record transactions of a governmental unit, the following general ledger control accounts are recommended: i) ii) iii) Estimated revenue A/C Appropriation A/C Encumbrances A/C These three accounts are general ledger control accounts which must be supported by the relevant subsidiary accounts as illustrated below: Illustration The expected revenue source of a particular governmental unit were as shown below: REVENUE LEDGER Taxes Licenses and permits Intergovernmental revenues Charges for services rendered Fines and forfeitures Miscellaneous revenues Total Expected Revenue £882,500 £125,500 £200,000 £90,000 £32,500 £19,500 £1,350,000 The Expected revenue would be recorded in the general ledger control accounts as £1,350,000; being the sum of individual expected revenue. The journal entry to record this transaction is: Estimated Revenue Fund balance To record approved governmental unit Dr £ 1,350,000 Cr £ 1,350,000 revenue to a Subsidiary ledgers will however record details of individual sources of revenue. Note: Estimated revenues are potential assets for the non-governmental organisation and are comparable to debtors in commercial accounting; hence the debit entry in the estimated revenue control account. On the other hand, appropriations are potential liabilities and are recorded through credit entries in the appropriations control A/C. Estimated revenues represent what the government unit expects from various sources. At the end of year, the actual revenue realised may be different from the estimated revenue. The revenue realised is recorded through the following entries: Debit Cash Credit Revenue A/c (This also acts as a control A/C) The revenue account is then closed to estimated revenue account to indicate whether estimated revenue exceeds actual revenue or vice versa. EXPENDITURE ACCOUNT 447 Company Accounts This account records actual liability incurred as opposed to the appropriation account which records estimated or potential liability. The corresponding credit is in the individual liability accounts, e.g. Expenditure Account £ payable Appropriations 74,000 payable Wages 60,000 Postage 14,000 74,000 £ A/C 74,000 The total expenditures incurred will then be compared with appropriations (or estimated expenditure). For this reason, the expenditure account is closed to appropriations A/C. Wages Payable £ Cash 60,000 Expenditure 60,000 £ A/C Postage payable £ Cash 14,000 Expenditure 14,000 £ A/C Encumbrances Encumbrances record the commitments that have been entered into but services are yet to be received. The purpose of recording the commitments is to ensure that the budgeted appropriations are not exceeded. In this way, accounting officers may guard against over expenditure. E.g. assume that approved estimates for a governmental unit was Sh1,000,000, and so far during the year Sh800,000 had already been incurred. Also assume that LPOs amounting to Sh120,000 have been committed to vote books. This therefore means that out of the Sh1,000,000, only Sh80,000 is available either to be retained to the treasury or to be expended by the governmental unit. The commitments are recorded in: i) Encumbrances accounts; ii) Fund balance reserved for encumbrances A/C In the above example, the encumbrances of Sh120,000 will be recorded as follows: Encumbrance Fund 120,000 balance Sh reserved... Sh Fund balance reserved for encumbrance Sh Encumbrance 120,000 After the expenditure has been incurred (commitments have been fulfilled). The above entries are reserved. At the same time, the expenditure is fully recorded. Assume the encumbrance of Sh120,000 was in respect of pool chlorine for training governmental unit forces; and the supplier has already fulfilled the commitment and has been paid: Encumbrance A/C Lesson Eight Fund 120,000 balance Encumbrance 120,000 Pool 120,000 448 Sh reserved... Fund 120,000 balance Sh reserved… Fund balance reserved for encumbrance Sh Sh Encumbrance 120,000 Expenditure A/C £ Chlorine Appropriations 120,000 £ Pool Chlorine A/C Sh Cash 120,000 Sh Expenditure 120,000 Sometimes there is an overlap between the end of the accounting period and when the commitments are fulfilled. Assume that the governmental unit accounting period ends on 30 th June every year, and a commitment entered into during the month of April for Sh250,000 have been partially services to the tune of Sh210,000 at the end of the accounting period to 30 th June 19X7. From the point when commitment was entered into, the following entries shall be made: 449 Company Accounts Encumbrance A/C d ,000 balance __ Sh reserved... Fund 210,000 Fund 40,000 250,000 balance Sh reserved… balance 250,000 This account is not to be balanced but closed to fund A/C Encumbrance 210,000 Balance 40,000 Fund balance reserved for encumbrance Sh Sh Encumbrance 250,000 c/d ______ 250,000 250,000 Balance b/d 40,000 The fund balance reserve for encumbrances will then appear in the statement of assets and liabilities at the end of the period. COMPREHENSIVE ILLUSTRATION The city of Westcycle fiscal period ends on 30 th June. The trial balance of the general fund as on 1 July 19X7 was as follows: Dr £ Cr £ Cash Balance 12,600 Savings A/C 66,800 Property tax receivable 480,000 Accounts payable 7,300 Wages payable 4,450 Fund balance 548,250 560,000 560,000 The operations for the year ended 30th June 19X8 are summarised as follows: i) Estimated revenues: £2,400,000; Appropriations: £2,350,000 ii) Revenues from property taxes levy: £1,925,500 iii) Cash received from property taxes: £2,005,600; and other revenues: £485,700 iv) Expenditures encumbered and evidenced by purchase orders: £1,760,000 v) Liquidation of encumbrances and vouchers prepared for purchase order billings: £1,755,000. vi) Expenditure for payroll £602,000 vii) Cash disbursed for vouchers: £1,740,000 Cash for payment of wages: £598,000 Cash transferred to savings A/C: £150,000. Required: a) Open the ordinary ‘T’ accounts for the accounts appearing in the trial balance and enter the balances as at 1 July 19X7. b) Open ‘T’ accounts for: Fund balance reserves for encumbrances : Estimated revenues : Revenues : Appropriations Lesson Eight c) d) e) f) 450 : Expenditure : Encumbrances Prepare journal entries to post the foregoing summarised operations. Post the entries recorded in (c) above into the accounts. Record appropriate entries to dwell the accounts as at 30 th June 19X8. Prepare a balance sheet as at 30th June 19X8. Cash £ Balance b/d 12,600 Property tax 2,005,600 Other revenue 485,700 _ _______ 2,503,900 £ Accounts payable 174,000 Wages 598,000 Savings 150,000 Balance c/d 15,900 2,503,900 Savings Sh Balance b/d 66,800 Cash 150,000 216,800 Sh Balance c/d 216,800 216,800 Fund Balances Sh Appropriations 2,350,000 Encumbrance 5,000 Appropriation 7,000 Balance c/d 597,450 2,959,450 Sh Balance b/d 548,250 Estimated revenue 2,400,000 Estimated revenue 11,200 ________ 2,959,450 Balance 597,450 b/d Fund Balance reserved for encumbrances Sh Sh Encumbrances Encumbrances 1,755,000 1,760,000 Balance c/d ________ 5,000 1,760,000 1,760,000 Balance b/d 451 Company Accounts 5,000 Estimated revenue Sh Fund balance 2,400,000 Fund balance 11,200 2,411,200 Sh Revenue 2,411,200 ________ 2,411,200 Property taxes Balance 405,500 Sh Balance b/d 480,600 Revenue A/C 1,925,500 2,406,100 b/d Sh Cash 2,005,600 Balance c/d 400,500 2,406,100 Wages payable Sh Cash 598,000 Balance 8,450 Sh b/d Balance 4,450 c/d Expenditure 602.000 606,450 Balance 8,450 606,450 b/d Accounts payable Sh Sh b/d Balance 7,300 Expenditure 1,755,000 Cash 1,740,000 Balance 22,300 c/d 1,762,300 1,762,300 Balance b/d 22,300 Encumbrances Fund reserved Sh … Fund reserved Sh … Lesson Eight 1,760,000 452 1,755,000 Fund ________ 5,000 1,760,000 balance 1,760,000 Appropriations Expenditure 2,357,000 Sh A/C Fund 2,350,000 ________ Fund 7,000 2,357,000 Sh balance balance 2,357,000 Revenue A/C Sh Estimated 2,411,200 Property revenue 1,925,500 Other 485,700 2,411,200 Sh tax revenue 2,411,200 Expenditure A/C Wages 602,000 Accounts 1,755,000 Sh payable Sh Appropriations payable 2,357,000 2,357,000 2,357,000 Other revenue Revenue 485,700 Sh account Cash 485,700 Sh 453 Company Accounts The Journal Dr (Sh) Estimated Revenue A/C Fund Balance A/C Fund Balance A/c Appropriations A/C 2,400,000 Property Taxes receivable A/C Revenue A/C Cash Property taxes receivable A/C 1,925,500 2,400,000 2,350,000 2,350,000 1,925,500 2,005,600 2,005,600 Cash 485,700 Other Revenue A/C Other revenue A/c Revenue A/C 485,700 Encumbrances Fund balance reserved for encumbrances Fund balance reserved for encumbrances Encumbrances Fund balance Encumbrances Expenditure A/C Wages Payable 485,700 485,700 1,760,000 1,760,000 1,755,000 1,755,000 5,000 5,000 602,000 602,000 Wages payable Accounts payable Savings bank A/C Cash 598,000 1,740,000 150,000 Expenditure A/C Accounts payable Revenue A/C Estimated Revenue A/C Estimated Revenue Fund Balance 1,755,000 Appropriations A/C Expenditure Fund Balance Appropriations 2,357,000 2,488,000 1,755,000 2,411,200 2,411,200 11,200 11,200 2,357,000 7,000 7,000 Balance Sheet as at 30th June 10X8 Assets Liabilities Sh Sh Cash Wages payable 15,900 8,450 Savings A/C Accounts payable 216,800 Property taxes receivable 22,300 400,500 Fund Balance _______ 597,450 Reserve for encumbrances 5,000 633,200 633,200 Illustration The following data relates to the city of Kababwe: Cr (Sh) Lesson Eight 454 Trial Balance As At 1 – 7 – 19x7 Cash Savings A/C Property taxes receivable Investment in government Treasury Bills Accounts payable Wages payable Fund Balances Dr (Shs) Cr (Shs) 242,500 250,000 185,000 350,000 162,600 30,000 834,900 1,027,500 ________ 1,027,500 The transactions completed during the year for the general fund are summarised and recorded as follows for the year ended 30 – June – 19X8. JOURNAL a) Estimated Revenue A/c Appropriations Fund Balance b) Property Taxes receivable Revenue c) Cash Property taxes receivable A/C Other revenue d) Expenditure Wages payable Encumbrances Fund balance reserved for encumbrances Fund balance reserved for encumbrances Encumbrances Expenditure Accounts payable Accounts payable Wages payable Cash Sh 9,100,000 Sh 9,070,000 30,000 9,105,000 6,470,000 2,635,000 3,280,000 3,280,000 5,800,000 5,800,000 5,785,000 5,785,000 5,785,000 5,785,000 5,800,000 3,270,000 9,100,000 38,000 Estimated Revenue Fund balances 9,070,000 Appropriations 9,065,000 5,000 Expenditure Fund Balance 15,000 Fund balance 15,000 Encumbrances Required: a) Open appropriate accounts, post entries therein, and balance them at the year end b) Draw a trial balance as at 30.6.19X8 c) Prepare a statement of assets and liabilities. SOLUTION Cash A/C Sh Balance b/d 242,500 Property taxes 6,470,000 Other revenue 2,635,000 9,347,500 Sh Accounts payable 5,800,000 Wages payable 3,270,000 Balance c/d 277,500 9,347,500 455 Company Accounts Property tax receivable Sh. Balance b/d 185,000 Revenue 6,500,000 6,685,000 Sh. Cash 6,470,000 Balance c/d 215,000 6,685,000 Wages payable Sh. Cash 3,270,000 Balance 40,000 c/d Sh. b/d Balance 4,450 Expenditure 602.000 3,310,000 3,310,000 Revenue A/C Sh. Estimated revenue 9,135,000 ________ Sh. Property tax 6,500,000 Cash other revenue 2,635,000 9,135,000 9,135,000 Encumbrances Sh. Sh. Fund reserved … 5,800,000 ________ Fund reserved … 5,785,000 Fund balance 15,000 5,800,000 5,800,000 Fund reserved for encumbrances Sh. Encumbrances 5,785,000 Balance c/d 15,000 5,800,000 Sh. Encumbrances 5,800,000 ________ 5,800,000 Savings A/C Sh. Balance b/d 250,000 Sh. Balance c/d 250,000 Treasury Bills A/C Sh. b/d Balance 350,000 Balance 350,000 Accounts payable Sh. Cash 5,800,000 Balance c/d Sh. Balance b/d 162,600 Expenditure Sh. c/d Lesson Eight 456 5,785,000 147,600 5,947,600 5,947,600 Fund Balances Sh. Appropriations 9,070,000 Encumbrance 5,000 Appropriation 7,000 Balance c/d 889,450 9,974,900 Sh. Balance b/d 834,900 Estimated revenue 9,100,000 Estimated revenue 35,000 Appropriations 5,000 9,974,900 Expenditure A/C Sh. Wages payable 3,280,000 Accounts payable 5,785,000 9,065,000 Sh. Appropriations 9,065,000 9,065,000 Appropriations Sh. Expenditure A/C 9,065,000 Fund balance 5,000 9,070,000 Sh. Fund balance 9,070,000 ________ 9,070,000 Estimated revenue A/C Sh. Fund balance 9,100,000 Fund balance 35,000 9,135,000 Sh. Revenue 9,135,000 ________ 9,135,000 Trial Balance As At 30 – 6 – 19x8 Dr Cash Savings A/C Treasury Bills Property taxes receivable Accounts payable Wages payable Fund balance reserved for encumbrances Fund balance Cr 277,500 250,000 350,000 215,000 ________ 1,092,500 147,600 40,000 15,000 889,900 1,092,500 Balance Sheet as at 30 – 6 – 19X8 ASSETS Cash Shs. Shs. Shs. 277,500 457 Company Accounts Savings A/C Treasury Bills Property taxes receivable 250,000 350,000 215,000 1,092,500 LIABILITIES Wages payable Accounts payable 40,000 147,600 (187,600) 904,900 FUND EQUITY Unreserved fund balance Fund balance reserved for encumbrances 889,900 15,000 904,900 Illustration: The city’s general fund trial balance as at 1 June 19X7 is as follows: Dr £ 225,000 80,000 122,500 100,000 Cash Savings A/C Property taxes receivable Investment in treasury bills Accounts payable Wages payable Fund balance 527,500 Cr £ 52,700 19,200 455,600 527,500 The following data summarises operations for the current fiscal year that ends operations on 30 – 6 – 19X8: £ a) Estimated: Revenues 2,180,000 : Appropriations 2,115,000 b) Revenue from property tax levy 1,450,000 Cash received from property taxes 1,460,000 Other revenues received 760,000 c) Expenditure on payroll 1,150,000 Expenditure encumbered and evidenced by LPOs 1,210,000 Liquidation of encumbrance vouchers for order billings 1,050,000 d) Cash disbursed: for vouchers 1,065,000 : for payment of wages 1,155,800 : for savings A/C 40,000 Cash A/C £ Balance b/d 225,000 Property taxes 1,460,000 Other revenue 760,000 ________ 2,445,000 £ Accounts payable 1,065,000 Wages payable 1,155,800 Savings A/C 40,000 Balance c/d 184,200 2,445,000 Savings A/C £ Balance b/d 80,000 Cash 40,000 £ Balance c/d 120,000 Lesson Eight 458 120,000 120,000 Property tax receivable £ Balance b/d 122,500 Revenue 1,450,000 1,572,500 £ Cash 1,460,000 Balance c/d 112,500 1,572,500 Accounts payable £ Cash 1,065,000 Balance c/d 37,700 1,102,700 £ Balance b/d 52,700 Expenditure 1,050,000 1,102,700 Wages payable £ Cash 1,155,800 Balance c/d 13,400 1,169,200 £ Balance b/d 19,200 Expenditure 1,150,000 1,169,200 Estimated revenue A/C £ Fund balance 2,180,000 Fund balance 30,000 2,210,000 £ Revenue A/C 2,210,000 ________ 2,210,000 Revenue A/C £ Estimated revenue 2,210,000 2,210,000 £ Property tax 1,450,000 Cash (other revenue) 760,000 2,210,000 Appropriations £ Expenditure A/C 2,200,000 ________ 2,200,000 £ Fund balance 2,115,000 Fund balance 85,000 2,200,000 459 Company Accounts Encumbrances £ Fund reserved … 1,210,000 ________ £ Fund reserved … 1,050,000 Fund balance 160,000 1,210,000 1,210,000 Fund Balances £ Appropriations 2,115,000 Appropriations 85,000 Encumbrance 160,000 Balance c/d 305,600 2,665,600 £ Balance b/d 455,600 Estimated revenue 2,180,000 Estimated revenue 30,000 ________ 2,665,600 Expenditure A/C £ Wages payable 1,150,000 Accounts payable 1,050,000 2,200,000 £ Appropriations 2,200,000 2,200,000 Fund reserved for encumbrances £ Encumbrances 1,050,000 Balance c/d 160,000 1,210,000 BALANCE SHEET AS AT 30 – 6 – 19X8 Assets £ Cash Savings A/C Treasury bills Property Taxes receivable £ Encumbrances 1,210,000 ________ 1,210,000 £ 184,200 120,000 100,000 112,500 516,700 LIABILITIES Accounts payable Wages payable 37,700 13,400 (51,100) 465,600 Financed by Unreserved fund B/F Fund balance reserved for encumbrances SPECIAL FUNDS 305,600 160,000 465,600 Lesson Eight 460 Special fund accounts are created by governmental units to account for the revenues and expenditures of specialised governmental unit operations, which are outside the traditional services offered by the government. Once a particular activity is identified, a special fund account is created to ensure that revenues allocated to this account are properly received and accounted for; and that expenditure from this fund must be incurred in respect of activities associated with the special fund. Once identified, the special operation necessitating creation of special fund will be treated exactly in the same way as general fund accounting, i.e. estimated revenue, revenue, appropriations and expenditure will be recorded in the same way as was done with the general fund. This also applies to encumbrances. Common examples of activities that require creation of special funds are: 1) Construction and maintenance of streets, roads and bridges 2) Libraries 3) Grants received either from foreign countries or specific government bodies that are geared towards specified operations. Note: Grant accounting requires a slightly different approach in the sense that the grantor would require the grantee to use the grants for a specified purpose; and in order to attain this objective, grant accounting is on the basis of reimbursement. This means that grant revenue will only be recognised as having been received after actual expenditure has been incurred. It is only then the grantor will release the grant revenue. However, for any given period it is possible for the grantee to account for any grant receivable by creating an account known as deferred revenue. The deferred revenue account is a liability account showing that there is a potential revenue which will only be recognised upon meeting certain conditions. Relevant entries are as follows: Assume that Town X was given a grant of Sh.50,000,000 for construction of streets in a particular region of the town. Upon receiving this information, the governmental unit will record the transaction as follows: Dr Grant receivable 50,000,000 Cr Deferred Revenue A/C 50,000,000 The basis of this entry is that the recognised accounting principles under special funds/general funds in the “modified accrual basis of accounting”. Under this principle, both revenues and expenditures are only recognised when the possibility of their realisation is certain. Grants will normally be released under specified conditions are being met; and under modified accrual basis of accounting such revenues cannot be recognised until the conditions required have bee fulfilled. In the above example, assume that 3 months later, Town X has identified the contractor and given out contracts to construct streets in the required region to the tune of Sh.30,000,000. When this is done, then the specified conditions have been met and the grant receivable revenue is recognised. The following entries are then made: 1. 2. Dr Deferred Revenue Cr Revenue Account 30,000,000 Dr Expenditure Cr Accounts payable 30,000,000 30,000,000 30,000,000 The second entry is required to enter the liability incurred when the contract is entered into while the first entry is now to recognise part of the grant revenue as receivable revenues under the modified accrual basis. However, where the contract has been entered into but the work is not yet performed, the encumbrance entries will be recorded instead of (2) above. The concept of modified acrrual basis of accounting is used in many other governmental units funds that will require the revenue to be recognised when there is uncertainty regarding their realisation. 461 Company Accounts One such fund is the capital projects fund. The capital projects fund is a fund created to cater/account for revenues and resources that are associated with capital projects of a governmental unit. The capital projects fund is an equivalent to capital budgeting/ financing under commercial accounting. General funds and special funds are not normally used to finance capital projects. Major sources of financing capital projects of a governmental unit are as follows: (1) Long-term debt (2) Governmental treasury bonds (3) Grants from other governmental units or foreign governments. (4) Transfer from other funds within the government. (5) Gifts (from individuals or organisations) that are specified to be used in particular projects. Once the sources of funds have been identified and set aside, a special account called the capital project fund account will be created to ensure proper utilisation of resources. The capital project fund will then operate on the basis of modified accrual principles of accounting, whereby related revenues and expenditures are recognised when there is a certainty of their occurrence. Assume that a governmental unit gets authority to issue long-term bonds to finance a particular capital project. Once authority is granted, the concerned governmental unit will only record the request’s acceptance, but the revenue arising thereon will only be recognised when bonds are issued and sold to the public. Under capital project funds, contracts will be entered into, and there may be a time lapse from when the contract is granted and when services are received. Such activities will be recorded as encumbrances in respect of the particular capital project. Actual expenditure incurred will be recorded against account payable. At the conclusion of the capital project comparison will have to be carried to between: 1) Sources of funds identified to finance the project; 2) Total expenditure – including the encumbrance incurred. The difference between (1) and (2) represents the excess/deficit of funds arising from a particular project; and is transferred to the governmental unit’s fund balance in the year in which the project was completed, e.g. suppose a particular capital project was to last 5 years, the financial statements for the interim period (1 – 4) will not include the balance in the capital project fund account. The surplus/deficit will be transferred to fund account at the end of year 5. Such transfers are known as equity transfers. FUND ACCOUNTING The accounts of a government unit are partitioned into segments called funds, and separate financial statements are prepared for each fund. A fund accounting system is a collection of distinct entities or funds in which each fund reflects financial aspects of a particular segment of the organisation’s activities. Separate funds are used to aggregate activities by functions because of the diverse nature of the services offered and because it is necessary to comply with legal provisions regarding activities of the government unit. Although funds are separate entities, the structure of funds is such that a single transaction may occasion entries in the accounts of several funds. Definition A fund is defined as a distinct accounting entity with a self-balancing set of accounts recording cash and other financial resources together with all related liabilities and residual equities or balances and charges therein. In other words, a fund is a segregated collection of both assets and equity accounts, together with related revenue and expenditure accounts that describe a particular aspect of the organisation. Each fund is established to account for specific activities or objectives in accordance with applicable regulations and Lesson Eight 462 restrictions. Since each fund represents a distinct reporting entity, separate financial statements are prepared for each fund, in addition combined financial statements may also be prepared. Types of funds The types of funds recommended for use by central and local governments are classified in three categories: (i) Government funds; (ii) Proprietary funds; and (iii) Fiduciary funds. In the first group, governmental funds, are: 1. General Funds General funds are funds established to account for resources devoted to financing the general services which the governmental unit performs for its citizens. These include general administration, protection of life and property, sanitation and similar broad services. The general fund is sometimes described as the one use to account for all financial transactions not properly accounted for in another fund. Some activities, such as governmentally supported liberties, are often of sufficient importance and magnitude to have a special fund; when this is not true they become a function and responsibility of the general fund. 2. Special Revenue, or Special, Funds Funds of this class are created and operated to account for revenue designated by law for a particular purpose. For the specific purpose of function to which it is devoted, a special revenue fund is much in the nature of a general fund. Some of the governmental services for which special funds are frequently established are education, libraries, streets and bridges, welfare, etc. 3. Capital Projects Funds The receipt and disbursements of all financial resources to be used for the acquisition of capital facilities other than those financed by special assessment funds, proprietary funds and trust funds is accounted for by capital projects funds. 4. Debt Service Funds (Sinking funds) A debt service fund is created to account for the resources devoted to the payment of interest and principal on long-term general obligation debt other than that payable from special assessments and that serviced by governmental enterprises. 5. Special Assessment Funds Special assessment funds are designed to account for the construction, or purchase through contract, of public improvements-streets, sidewalks and sewer systems, for example – which are financed in whole or in part by special levies against property owners adjudged to receive benefits from the improvements materially in excess of benefits received by the general body of taxpayers, and for the maintenance and upkeep of such assets. The following two fund types are referred to as proprietary funds: 6. Internal Service Funds (Working capital/Revolving funds) 463 Company Accounts Internal service funds are established by governmental units as a means of providing services to other funds or departments of the same unit, or to other governmental units, on a cost-reimbursement. 7. Enterprise Funds Internal service funds are established to provide services for governmental customers, but enterprise funds are operated to provide electric, water, gas, or other services to the general public. Except for ownership, they bear a close resemblance to investor-owned utility or other service enterprises. Enterprise funds are also used to account for activities for which the governmental body desires periodic computation of revenues earned, costs incurred, or net income. The third category of funds recommended for use by state and local governmental units is fiduciary funds. 8. Fiduciary Funds (Trust/Agency funds) E.g. NSSF, NHIF Fiduciary funds are used to account for transactions related to assets held by a governmental unit as a trustee or agent. In most cases the governmental unit does not have absolute title to the assets held; and in the remainder, they are owned with specific restrictions upon their use. In addition to the eight generally recognised types of funds, governmental units employ two self-balancing groups of accounts which are accounting entities, but which are not fiscal entities and therefore, are not funds. These groups are called the “general fixed assets group” and the “general long-term debt group”. General fixed assets are those not used exclusively by any one fund, and general long-term debt is that long-term debt which is presently a liability of the municipality as a whole and not of individual funds. Although funds are employed extensively and effectively to promote the use of governmental resources for their intended purposes, the practice can be carried to extremes. In the opinion of many, accounting and reporting are facilitated through use of the minimum number of funds consistent with legal and operating requirements. Integration of budgetary Accounts A second distinctive characteristic of governmental accounting resulting from the need to demonstrate compliance with laws governing the sources of revenues available to governmental units, and laws governing the utilisation of those revenues, is the formal recording of the legally approved budget in the accounts of funds operated on annual basis. Briefly, Budgetary accounts are opened as of the beginning of each fiscal year and closed as of the end of each fiscal year; therefore they have no balances at year-end. During the year, however the budgetary accounts of a fund are integrated with its proprietary accounts. Proprietary accounts, in the governmental sense, include accounts similar to the real and nominal groups found in accounting for profit-seeking entities – that is, asset, liability, net worth, revenue, and expense (or expenditure) accounts. The Basis of Accounting Lesson Eight 464 Use of the accrual basis of accounting is considered appropriate for proprietary funds, non-expendable trust funds, and pension trust funds of governmental units. Accrual accounting means: - 1. That revenues should be recorded in the period in which the service is given, although payment is received in a prior or subsequent period, and 2. That expenses should be recorded in the period in which the benefit is received, although payment is made in a prior or subsequent period. In business enterprise accounting, the accrual basis is employed to obtain a matching of costs against the revenue flowing from those costs, thereby producing a more useful income statement. In governmental entities, however, even for those funds which do attempt to determine net income, only certain trust funds have major interest in the largest possible amount of gain. Internal service and enterprise funds are operated primarily for service; they make use of revenue and expense accounts to promote efficiency of operations and to guard against impairment of ability to render the services desired. For these reasons, operating statements of proprietary funds, non-expendable trust funds, and pension trust funds are called statements of revenue and expenses, rather than income statements. Funds of other types (general funds, special revenue funds, capital projects funds, debt service funds, special assessments funds, and expendable trust funds) are not concerned with income determination. These funds are concerned with matching expenditure of legal appropriations, or legal authorisations, with revenues available to finance expenditures. Accordingly, the “governmental” funds and expendable trust funds should use the “modified accrual” basis. The modified accrual basis is defined as: Revenues should be recognised in the accounting period in which they become available and measurable. Expenditures should be recognised in the accounting period in which the fund liability is incurred, if measurable, except for unmatured interest on general long-term debt and on special assessment indebtness secured by interest-bearing special assessment levies, which should be recognised when due. The modified accrual basis is accepted by the American Institute of Certified Public Accountants as being consistent with generally accepted accounting principles. The AICPA recognises that it is not practicable to account on an accrual basis for revenues generated on a self assessed basis such as income taxes, gross receipts taxes, and sales taxes. For such taxes, determination of the amount of revenue collectible is ordinarily made at the time of the collection, thus placing the fund partially on the cash basis. Number of Funds Government units should establish and maintain those funds required by law and sound financial administration. Only the minimum number of funds consistent with legal and operating requirements should be established, since unnecessary funds result in inflexibility, undue complexity, and inefficient financial administration. Accounting for Fixed Assets and Long-term Liabilities 465 Company Accounts A clear distinction should be made between; (A) Fund fixed assets and general fixed assets; and (B) Fund long-term liabilities and general long-term debt (i) Fixed assets related to specific proprietary funds or Trust Funds should be accounted for through those funds. All other fixed assets of a governmental unit should be accounted for through the General Fixed Assets Accounts Group. (ii) Long-term liabilities of proprietary funds, special assessment funds, and Trust Funds should be accounted for through those funds. All other unmatured general long-term liabilities of the governmental unit should be accounted for through the General long-term debt account group. Valuation of Fixed Assets Fixed assets should be accounted for at cost or, if the cost is not practicably determinable, at estimated cost. Donated fixed assets should be recorded at their estimated fair value at the time received. Depreciation of Fixed Assets (a) Depreciation of general fixed assets should be recorded in the accounts of governmental funds. Depreciation of General Fixed Assets may be recorded in cost accounting systems or calculated for cost finding analysis; and accumulated depreciation may be recorded in the General Fixed Assets Account Group. (b) Depreciation of fixed assets accounted for in a proprietary fund should be recorded in the accounts of that fund. Depreciation is also recognised in those Trust Funds where expenses, net income and/or capital maintenance are measured. Accrual Basis in Governmental Accounting The modified accrual or accrual basis of accounting as appropriate, should be utilised in measuring financial position and operating results. (a) Governmental fund revenues and expenditures should be recognised on the modified accrual basis. Revenues should be recognised in the accounting period in which they become available and measurable. Expenditures should be recognised in the accounting period in which the fund liability is incurred, if measurable, except for unmatured interest on general long-term debt and on special assessment indebtness secured by interest-bearing special assessment levies, which should be recognised when due. (b) Proprietary fund revenues and expenses should be recognised on the accrual basis. Revenues should be recognised in the accounting period in which they are earned and become immeasurable; expenses should be recognised in the period incurred, if measurable. Lesson Eight 466 (c) Fiduciary fund revenues and expenses or expenditures (as appropriate) should be recognised on the basis consistent with funds accounting measurement objective. Non expendable Trust and Pension Trust Funds should be accounted for on the accrual basis; Expendable Trust Funds should be accounted for on the modified accrual basis. Agency Fund assets and liabilities should be accounted for on the modified accrual basis. (d) Transfer should be recognised in the accounting period in which the interfund receivable and payable arise. Budget and Budgetary Controls Budgets are key elements of legislative control over government units. The executive branch of a government unit proposes the budget, the legislative branch reviews, modifies and enacts the budgets and finally the executive branch implements the budget. The two basic classifications of budgets for governmental units are the same as for commercial enterprises; (i) Annual budgets – which include the estimated revenues and Appropriations for a specific fiscal year end; (ii) Capital budgets – which are used to control the expenditures for construction projects or other planned asset acquisitions. The operations of the two proprietary funds (i.e. enterprise and internal service) are similar to those of business enterprises. Consequently, annual budgets are used by these funds as a managerial planning and control rather than a legislative control tool. Thus, annual budgets of enterprise funds and internal service funds are NOT Recorded in ledger accounts by these funds. PUBLIC SECTOR ACCOUNTING The Consolidated fund This is the main fund operated by the government. The Exchequer and Audit Act states that all government revenue excluding income which a ministry is allowed to keep a cover part of its own expenses (i.e. Appropriation-In- Aid) must be put into this fund, and no money may be withdrawn form this fund without the authority of parliament. Each year, the Parliament votes on the appropriations bill, which sets out: a) The estimated total revenue of the government for the coming fiscal year (1 st July – 30th June) and; b) The amount of money which each ministry expects to be allocated for its needs in that fiscal year. 467 Company Accounts Thus the Appropriation Act for 1986/1987 Parliament authorised a gross sum f K£95,002,150 for the Ministry of Health in respect of recurrent expenditure. This was described in the 1986/87 estimates of recurrent expenditure as follows: K£ Gross vote 95,002,150 Appropriations-In-Aid Net Vote (2,280,250) K£ 92,721,900 The above description means that the Ministry was authorised to spend K£92,721,900 being supplied form the consolidated fund, and the remainder coming from the ministry’s own Appropriations-In-Aid. Examples of Appropriations-In-Aid within Ministry of Health would include Hospital Boarding fees, X-ray fees, Lab fees etc. Consolidated Fund Services Certain government expenditure does not have to be voted every year by Parliament because Parliament has already given its approval for the specific items concerned in the past. These items are known as consolidated fund services, and include salaries and allowances of the Judiciary, subscriptions to international organisations, such as OAU, UN etc., payment of pension to civil servants, payments of national debt, etc. Sources of Government Revenue Government revenue falls into two categories a) Recurrent b) Development The main source of revenue are taxes, government borrowings (both domestic and foreign) and grants. An example of revenue estimates for the year 1986/87 is: Recurrent Revenue Estimates (K£ Millions) Customs and excise duty Income tax Sales tax 298.5 370.0 /Value Added Tax Export duty and other taxes 437.0 107.4 Lesson Eight 468 Miscellaneous (15 categories) 160.9 1,373.8 The development revenue estimates were 64.5 1,438.3 The annual estimates of expenditure for the fiscal year 1986/1987 were: Recurrent expenditure 1,420.8 Development expenditure 292.6 1,713.4 There is a shortfall of K£275.1m expected for the 1986/87 fiscal year. The gap is normally closed by borrowing either from abroad or from the domestic market. Domestic borrowings usually take the form of Treasury Bills. Government Expenditure As with revenue, expenditure falls into two categories (i) (ii) Recurrent expenditure Development expenditure Recurrent Expenditure This is expenditure on the day to day business of the government. In commercial accounting, it could be called revenue expenditure. Recurrent expenditure may be referred to as maintenance expenditure as it covers items concerning the maintenance and operation of existing government services e.g. salaries to government officers, electricity, water, telephone etc. Development Expenditure This is expenditure concerning new projects e.g. construction of hospitals, roads, bridges etc. Recording Government expenditure and revenues: (1) Government accounting is “cash-based” i.e. limits itself to transactions which have been entered in the cash book. Thus government accounting has no personal accounts for debtors/creditors, nor does it have 469 Company Accounts accruals/prepayments. The only debtor-creditor relationship arises in transactions between the government and the ministries, but not third parties. (2) Government Accounting does not make any distinction between fixed assets and a day-to-day expense. Both are treated as expenditure in the period in which they are paid (properly classified as either recurrent or development expenditure) and hence there are no fixed asset accounts. (3) Since there are no fixed asset accounts, there is no such thing as depreciation in governmental accounting. The effect of passing fixed assets through the usual expenditure accounts is to write them off in the year of purchase. The reason for this treatment of fixed assets is that the government is not aiming at realising profits or quantifying losses, and hence does not need to divide the benefits of capital expenditure over the financial years, nor to assess the loss of value in that asset in a given year. There is also the difficulty of trying to value assets such as Nairobi-Mombasa Road etc. Accounting for and individual ministry In accordance with the normal rules of double entry book-keeping cash received is debited to the cash account (PMG) and the revenue account is credited. Thus in the books of Ministry X, the receipt of Ksh5,000 will be recorded as: Pay Master General A/C (Cash) Revenue 5,000 A/C Exchequer 5,000 Revenue Pay 5,000 Master General The paymaster General is the cash account of all ministries. Since all revenue (apart from Appropriation-InAid) must be transferred immediately to the consolidated fund, funds received will be paid over immediately Lesson Eight 470 to the Treasury which administers the consolidated fund on behalf of the government. The Account within which the Treasury administers the consolidated fund is called the Exchequer Account. Exchequer A/C Pay 5,000 Master General At the end of each financial year, each ministry which has collected funds on behalf of the government makes out a “statement of revenue”. Expenditure A ministry operates within the strict limits of the vote allocated to it by Parliament. The Accounting system is merely used to reveal whether the ministry is keeping within the limits of voted expenditure or not. The ministry has no authority to spend over parliamentary allocations, and the authority to spend is only for the duration of the financial year. If a ministry underspends in a financial year, or if there are any excess receipts, it may not retain the available funds, but must surrender them to the exchequer to be reincorporated into the consolidated fund and eventually re-distributed to the ministries as determined by Parliament. If the ministry overspends, the only body empowered to ratify this overspending is Parliament. In the subsequent financial year the matter is presented in Parliament in the form of “excess vote” and Parliament decides whether to approve the excess vote or to recover it from the officers responsible for exceeding the vote. The Pay Master General (PMG) The PMG is an office rather than an officer, and no person bears the title “Pay-Master General”. The functions of the PMG are carried out by a section of the treasury. The PMG is subordinate to the treasury and has the following functions: (which are regulated by the Minister of Finance) 1) It is the principal paying agent for the government and banker of all government departments as regards voted expenditures and payments on consolidated fund services. 2) It arranges with the treasury at regular intervals (usually twice a month) for funds to be withdrawn from the exchequer and put to the credit of the PMG’s account in the Central Bank of Kenya; 3) It allows authorised signatures from these ministries to draw cheques on this account; 4) It keeps a record of the above transaction and sends statements on a monthly basis to the accounting officers (i.e. the Permanent Secretaries) of each accounting unit together with supporting vouchers; 5) It receiver monthly reconciliations of these statements from accounting officers; 6) It supplies the treasury with the following: 471 Company Accounts a) A monthly statements and balance sheet b) Annual statements and balance sheet. It should be noted that the PMG is just a single account kept at the Central Bank of Kenya and administered by the PMG’s office in the treasury. All ministries are authorised to draw on this single PMG account. The PMG’s office is able to analyse the different payments and receipts to allocate to various ministries, and to send them monthly statements. Cash book There are significant differences between commercial accounting and government accounting as regards operation of the cash book. These are: (1) Restricted analysis – The government cash book makes an analysis between “cash” and “bank” only, i.e. there is no further analysis into categories/classes of expenditure. (2) The usage of the cash column – Cheques received are considered cash until they are banked. The book-keeping entry is: Debit Cash (Cash column of cash book) Credit Revenue (or Appropriation- In-Aid) When a cheque is banked, Debit Bank Column Credit Cash Column A dishonoured cheque can be recorded as: Debit Cash Column Credit Bank Column Three cash books are maintained: (i) (ii) (iii) Current revenue and expenditure cash book. Development revenue and expenditure cash book Deposits cash book. Lesson Eight 472 Vote books: The cash book and vote book from the bank-bone of the accounting system. The vote book is essentially a book of prime entry, and does not form part of the double entry system. The totals of the vote book are transferred to the ledger: Debit Expenditure item (as per vote book) Credit Cash book Year-end Accounts: By 31 October each year, 4 months after the end of the financial year, each ministry must present its final accounts to the Auditor General. These consist of (a) Statements of Revenue (b) Appropriation Accounts (c) Final Accounts – These refer to the various funds administered by different ministries and require an income and expenditure A/C as well as a statement of assets and liabilities for each fund. Illustration 1: Prepare a statement of revenue for the year ended 30.6.97 for Ministry of Domestic Affairs: Exchange Control fees (Code 740) – Estimated receipts - Actual receipts Insurance premiums (Code 750) K£300,000 K£3,460,968 - Estimated receipts - Actual receipts K£130,000 K£174,000 Other income (Code 679) - Estimated receipts K£20,000 - Actual receipts K£10,334 Extra exchequer income (Code 999) – Estimated receipts - Actual receipts Payments to exchequer K£1,055,000 K£6,843,238 K£8,68,422 473 Balance due to exchequer (1 July 96) Company Accounts K£249,529 Public Sector Accounting: Theory This part of the lesson has been built up using the question and answer approach. QUESTION ONE Discuss the role and functions of the Treasury and its relationship with other Government department, in planning and controlling government expenditure. Solution The role and functions of the treasury include: (1) Advising on the setting of objectives for economic policy. (2) Coordinating government expenditure towards the achievement of economic policy. (3) Ensuring the execution of Policies in the most economic fashion by Government Departments. (4) The overall supervision of national finance. (5) Involvement in the process of settlement of levels of national expenditure and the raising of revenue. (6) Controlling Government borrowing. (7) Management of pensions (8) Administration of contingency funds e.g. disbursements, distaden funds etc. (9) Payments forward – chief cashier to the government debts, incomes expenditures etc. Links with other Government Departments (1) Involvement in scrutinizing of annual estimates (2) Consultation on possible revisions of estimates. (3) Ensuring adequate financial controls exists within departments including adequate staffing and accounting procedures. (4) Involvement jointly in preparation of annual budget. Further points for Discussion (1) Importance of Treasury control during periods of economic stringency. (2) Financial specialisation and expertise needed in dealing with estimates and financial control. (3) Criticism of Treasury - Too much Treasury Control and interference stifling departmental initiative. - Staffing by career civil servants and injection of specialists from outside often resented. Lesson Eight - 474 Too narrow a view taken by Treasury is often over-cautious. QUESTION TWO Discuss the role of the Controller and Auditor General. Solution The Controller and Auditor General is an officer of Parliament (not a civil servant) who has two main functions:(1) As controller, he acts as Paymaster, controlling receipts and payments of public money through various accounts. (2) As External Auditor, he audits the various departmental accounts reporting on the Appropriation Account, etc. to the parliament, which refers them to the Public Accounts Committee. This is a Select Committee whose duty is to consider the report and issues arising from it. From Audit point of view, his work covers the following: Financial and Regularity Audit (a) Financial: - to ensure that accounting and financial control systems operate correctly so that all financial transactions are both properly authorised and properly accounted for. (b) Regularity: - to ensure that expenditure is incurred on approved matters and is legal. (c) Value for money audit: - an examination based on economy and efficiency to curb extravagance expenditure and maximise receipts. The Public Accounts Committee also tends to concentrate on this question. (d) Effectiveness of audit: - An examination to assess whether programmes undertaken to meet established policy objectives have achieved those objectives. QUESTION THREE Explain the main functions of an annual Budget for a public sector organisation with which you are familiar. Solution A budget may be defined as a financial and quantitative statement prepared prior to a definite period of time of the policy to be perused during that time for the purposes of attaining a given objective. A statement of the organisation’s intention against which its achievement can be measured. 475 Company Accounts Main function of an annual budget of local authority: 1. To assist in fixing the general rate, local authority is required to levy a rate sufficient to cover the needs of the year. 2. To assist Policy making - to help members to making decisions on the provision of services. 3. To assist control – or Income and expenditure. 4. To authorise expenditure – authority to incur the expenditure or collect the income. 5. To provide a standard against which to judge performance. QUESTION FOUR The independence of Internal Audit in a public sector organisation is considered to be essential to its effectiveness. Explain what is meant by independence in this context and give examples of circumstances which might impair independence. Solution As the internal auditor is appointed within the organisation he cannot be completely independent of the organisation but he must be sufficiently independent to allow him to carry out his duties in a manner which allows his professional judgement and recommendations to be effective and impartial. In order to operate effectively, the internal auditor should: 1) 2) 3) 4) Be independent of all staff whose operations are under review. Not be involved in routine financial systems. Have direct access to all department heads, chief executive and the management board. Have full rights of access to records, assets and personnel and receive such information and explanation as are necessary for the performance of their duties. The chief internal auditor should have the right to report under his own name on any aspect of the financial work including that of finance department. Impairment of Independence Lesson Eight 476 (a) Having an interest in business which is involved in any way with the audit. (b) Having been previously involved e.g. as accountant in the operations; or (c) Personal relationship e.g. a spouse or other relative of persons being audited. QUESTION FIVE Discuss the main reasons for the growth in public expenditure. Solution 1) Increase in range and volume of state activity – inflation. 2) The effect of economic ideas and political theories – use of public expenditure by state as a weapon of economic control. 3) The effects of wars and social crises. 4) With the development of the state has tended to come an increased expectation by the public of more state activities: - Roads, transport, energy, water and sewerage services. 5) The introduction and maintenance of the Welfare State. 6) External involvement such as membership of OAU etc. 7) Internal involvement in industry and commerce including nationalisation and control of socially significant industries and commerce and support for industries incurring heavy research and development costs, particularly new technology industries. QUESTION SIX (a) Explain the role and objectives of internal audit in a public sector organisation. (b) What factors influence the size and organisation of an internal audit section in a Public Sector organisation. Solution The role and objectives of internal audit may vary between different parts of the Public Sector, depending on attitudes, statutory requirements, size etc. Definition of internal audit – Statement of internal audit practice. “An independent appraisal function within an organisation for the review of activities as a service to all levels of management. It is a control which measures, evaluates and reports upon the effectiveness of internal controls, financial and otherwise as a contribution to the effective use of resources within an organisation. It is the responsibility of internal audit to review, appraise and report upon the following matters: 477 Company Accounts a) The soundness, adequacy and application of internal controls – internal controls can be said to comprise the whole system of controls established by management in order to 1) 2) 3) 4) Safeguard its assets Ensure reliability of records Promote operational efficiency and Monitor adherence to policies and directives. b) The extent to which the organisation’s assets and interests are accounted for and safeguarded from losses of all kinds from: Factors: 1) Fraud and other offences and 2) Waste, extravagance and inefficient administration, poor value for money and other causes. In recent years, increasing emphasis has been put on audits role in connection with avoidance of waste and obtain value for money. 3) The suitability and reliability of financial and other management data developed within the organisation. Detailed procedures should exist for initiating, authorising, carrying through and recording transactions. These procedures will allow the principles of internal check and will be kept under review by internal auditor. Factors: 1) 2) 3) 4) 5) Type of organisation The size The scope and objectives of internal audit Managerial attitude to internal audit The adequacy of internal control system QUESTION SEVEN Outline the differences between the financial objectives of: 1) Public Corporation i.e. state owned corporations, nationalised industries, and 2) Limited companies Solution Financial objectives of commercial concerns: - To maximise the value of the firms to its owners Lesson Eight - 478 Determined by management team More financial than theoretical objective Management is concerned with firms and share valuation as an indication of the level of reward to shareholders group. Management concentrate on the theoretical objectives – reporting on firm and share valuation helps management in decision making and policy formation process. Public Corporations Financial objectives are specified by government rather than determined by management. Such objectives are difficult to specify in value terms as: - There is usually no observable market value of claims on, or right to participate in the entity. It is difficult to identify the ownership group, whose value should be maximised. Financial objectives are usually specified in ‘non-value’ financial terms such as target, sometimes better described as financial constraints. Main difference in objectives of Commercial/Public Corporations: 1. The freedom of the entity’s management determine the firm objectives. 2. The nature of objectives set – value or accounting measures. Financial management should be integrated with the firm and designed to assist in meeting the firm’s objectives. Difference is due to considerable differences in the operation of firm. - Technology Type of market QUESTION EIGHT Outline the role played in Government accounting by: (a) The Public Accounts Committee (b) The controller and auditor general (c) The government Ministries Accounting Officers. 479 Company Accounts Solution Accounting has been described as a process whereby transactions of an operating entity are documented, classified and recorded for the purposes of accumulating and providing financial information essential to the conduct of designated activities. Government accounting is an essential element of the financial management function of government. In the main government accounting is directed towards satisfying the accountability and management requirements of officials responsible for the conduct of government activities and operations. It is therefore concerned with the proper recording of all receipts of government, with the maintenance of records that reflect the propriety of transactions and give evidence of accountability for assets and other resources available for use and with the classification of data in a way that provides useful information for control and effective and efficient management of government programme operations. Amongst the features of government accounting, are the specific roles played by the Public Accounts committee, the Controller and Auditor-General and the Ministries Accounting Officers to which we turn. a) The Public Accounts Committee - A standing committee of a few selected members of Parliament. - Charged with reviewing financial matters of government. - This is in line with the constitutional requirement that all financial matters in government are subject to consideration, approval and review by the legislature. - The deliberations and recommendations of the Public Accounts Committee are based on the report on funds and accounts by the Auditor-General. - The proceedings at the meeting are recorded verbatim, the Auditor-General’s staff and those of accounting unit responsible for the deliberations reacting to the points raised in the report. - Matters deliberated upon include serious ones concerning losses on a large scale, cases of thefts and Misappropriation, failure to observe regulations and ensure propriety of expenditure, cases of waste and other administrative inefficiencies which have led to wastage of funds and failure to obtain value for money. - These serious matters require proper explanation on the part of the Accounting Officer and the reaction of the Public Accounts Committee in recommending surcharge of the principle of personal accountability of government officers handling public funds. - The Public Accounts Committee’s recommendations are then debated in Parliament which often insists that the government takes necessary corrective action which often is done. - The role played by the Public Accounts Committee ensures that the government be made accountable for financial matters to the legislature. It is a control measure ensuring that public funds are protected and used only for purposes intended by Parliament. It curbs any tendency by public officers to be lax Lesson Eight 480 and wasteful in their handling and management of public funds. It ensures that proper accounting methods and procedures and controls are instituted to safeguard public funds. b) The Controller and Auditor General is appointed by the President and reports to Parliament. - He functions independently of executive council. - He controls issues of funds from exchequer that is funds voted for use by Parliament and intended for by spending units to be withdrawn from the exchequer, must be sanctioned for by the controller who satisfies himself that there are adequate funds and that they will be used for the purpose intended by Parliament. - He carries out both statutory and non statutory audit. The more serious audit queries known reference sheets are compiled in an audit report which is presented to Parliament for reviewing the government’s financial management. - The institution of the office of the Controller and Auditor-General plays a very effective role in the management of public funds. - The Controller and Auditor-General plays the role of a watchdog and the fact that he reports to Parliament ensures that spending units are not lax in handling public funds. - His independence in performance of his duties ensures that he is not subjected to undue influence by the executive. He carries out his duties without fear or favour, he expresses his opinion, qualifies his report and on the whole the powers conferred upon him by the exchequer and Audit Act, ensures the accountability of the executive to the legislature. Without any doubt, the role of the Controller and Auditor-General is very essential in ensuring proper financial management. - Although the role may be that of making of the report to Parliament, his officers carry out continuous audit inspection on the records of accounting units of the government, this minimises incidents of fraud, thefts and other misappropriations. - The recent creation of the Auditor-General for statutory boards underscores the importance the government attaches to the auditing function, it is indispensable. - The voted funds or the grants given by Parliament for use by the accounting officer should be properly handled to ensure regularity and propriety of expenditure. - The accounting officer is appointed by the Permanent Secretary Treasury personally and under the principle of personal accountability. c) 481 Company Accounts - The letter of appointment spells out his duties and functions, emphasising the fact he is answerable to the Public Accounts Committee on serious matters raised by the controller and Auditor-General. - His responsibilities in management of public funds, safeguarding public property and running his accounting unit must be carried out with diligence, dedication, with due regard for efficiency and effectiveness. - Amongst his duties are to organise his accounting unit to ensure that functions are carried out properly, to ensure that public property are safeguarded, to ensure that staff under him have the necessary technical skills for the proper performance of their duties, to plan and budget for the financial requirements of his unit as directed by Treasury, to instil cost-consciousness in the at all levels of management, to answer audit queries, to sign the appropriation accounts and so on. The accounting officer - The salient point of the role of the Accounting Officer is that he is personally held responsible for any undue happenings affecting public funds in his control. For example, should he differ with the Minister, his political head, on how to spend certain funds he has to obey the Minister’s directives but should write to Treasury, giving details of the dispute. This will absolve him of blame should a query arise. - Public servants handling public funds should be held wholly responsible. As head of his accounting unit, this requirement ensures that funds are not handled with laxity, that services are provided efficiently and effectively, that evidence is produced on how the funds were spent and last but not least, the taxpayers have got value for money with regard to the taxes they pay. QUESTION NINE In relation to fund accounting, explain what is meant by the following special funds and explain fully how they are operated. a) Revolving funds b) Trust funds c) Sinking funds One basic feature amongst others, of government accounting, is the concept of fund entities, which has its origin in the fact that financial powers of the executive are subject to the control of the legislature. There is for example, a constitutional requirement that government receipts from revenue and borrowing should be accumulated into a general fund (consolidated fund) for use of the government as a whole, and any withdrawals from fund be subjected to sanction by the legislature. Lesson Eight 482 Provision has also been made for separate treatment of monies received by the government in a trustee capacity. These are known as trust funds from which withdrawals are made in accordance with specific statutory provisions. Funds may also be established by law from the proceeds of earmarked taxes, with provisions for using such receipts to attain specified programme objectives – either with or without prior grant of authority from the legislature. Additionally, in some cases a contingency fund may be created to enable advances to be made for meeting necessary and unforeseen expenditures, subject to subsequent authorisation by the legislature. Funds are also established by legislative action which grants authority to spend for specified purposes and objectives. Such funds are legal entities. Like the National Social Security Fund and the National Hospital Insurance Fund, they have their own resources which include property, receivables, investments and other accountable assets. Any liabilities are set off against the assets to determine the network of the fund. Such a fund therefore is an independent accounting entity. An example of a trust fund is the Widows and Children’s Pension Fund to which all married Civil Servants must contribute a certain amount of their monthly salaries and on retirement or leaving the service, refunds are made. Revolving Funds are also entities set up by legislative action to provide agencies with resources for the attainment of specified objectives. Government enterprises are usually set up in this manner. The initial appropriation is made out of the consolidated fund. The receipts generated in such funds are automatically used by the agency in accordance with the law that set up the fund. Annual legislative appropriations are not therefore required for the operation of such funds. However, the original financing required to the financing of a programme increase or an incurred deficit would be appropriated out of the central funds of the government. Similarly, any surplus that may result from the operations carried out under such authority should be deposited in the central fund as receipts of the government. Sinking Funds are also entities set up by legislative action with the purpose of eventual liquidation or extinction of public debt. This requires annual appropriations into the fund thus building up the fund as maturation of the debt approaches, until the principal sum is repaid. There is necessity of investing the appropriations on a special account as the Sinking Fund is built up. Debt requiring such fund is known as Funded Debt. There is less use of these Funds these days as they entail tying down funds which would have been used elsewhere. QUESTION TEN One of the principle differences between non-profit and commercial organisations is that they have different reasons for their existence. Consequently, non-profit making organisations follow some accounting principles which differ from accounting principles followed by commercial organisations. You are asked to state which are the principles followed by non-profit making organisations and why you think they are more appropriate than corresponding principles applicable to commercial organisations. Solution 483 Company Accounts Types of non-profit making organisations are the Central Government. Local Authorities, Trade associations, welfare clubs, religious organisations, and so on, whose motive of existence is not profit but to advance the welfare of the members or some other. Take the example of the government accounting system (which includes Local Government accounting). The accounts are maintained on a receipts and payments basis. Actual receipts of revenues and actual expenditures incurred are the basis of the financial statements. These statements are produces by each accounting unit, not by the government as a whole. Each unit is charged with the task of providing a service, a function during a financial year, of a current or development nature. Since authority to raise revenue and spend public funds is vested in the legislature, the accounting unit merely has to satisfy accountability requirements while assuming that services were actually rendered. Any shortfalls in revenue collections or amounts owed to or by the accounting unit are not debtors or creditors per se but are a mere reflection on the performance of the unit. Its financial position at the end of the year is known as a statement of assets and liabilities vis a vis other units or balances held on hand (its assets) and any unused funds (its liabilities). Revenues to be collected by way of taxes, fees and charges, rates borrowing etc. are estimated for, and also how those revenues will be expended are also estimated for. It would be difficult to single out individual taxpayers as debtors or some unpaid bill at the end of the year as a creditor, since the functions of the state do not stop, but are continuous. The reason for having a financial year is to emphasize the constitutional requirement that Parliament is supreme in finance matters and the government must receive annual authority (by way of the Appropriation Act) to raise and expend public funds). In this case, it would appear that the receipts and payments basis of accounting is appropriate. The other non-profit accounting system is the income and expenditure system of accounting. Welfare clubs, Members clubs and religious organisations and trade associations rely mainly on member’s contributions and necessarily some members will default payment of their dues or the members may sometimes pay in advance. This is a clear case of creditors and debtors or accruals. A surplus or deficit may be reflect and a balance sheet drawn. This income and expenditure accounting system would appear to be appropriate for such organisations in view of the fact that their area and scope of activities is limited, its assets are identifiable, and liabilities can be ascertained. Although we have outlined the differences in approach between accounting in commercial and non commercial organisations, the dividing line is not straight and clear. It should be remembered that public sector accounting includes government commercial enterprises with a profit motive. More over, accounting by non-profit organisations is increasingly adopting practices similar to those employed in private industry. Such an operation involves setting up a “business type” financial system in which the relationship of receipts and expenditures and the financial results obtained continuously are highlighted for the attention of agency management and legislative review. QUESTION ELEVEN Lesson Eight 484 (a) “Without the profit motive there is an inevitable lack of budget motive”. Do you agree? (b) Explain the administrative and accounting controls used to achieve the budgeted level of expenditure by the Government Ministries. Solution (a) Planning and control are two important management functions and accounting in the present day conceptions lays emphasis on these two functions. In this sense, accounting is described as management accounting, which is any form of accounting which enables a business to be conducted more efficiently. This emphasis on accounting for efficiency, is in every area where accounting must be used, whether in an organisation with the profit motive or in nonprofit motive organisations like the government. Budgetary control refers to the use of budgets to control the activities of an organisation. Take the case of the government, the idea of budgetary control is in fact extensively used. Finance being such a scarce resource, no government can afford not to budget. Basically, the annual budget consists estimates of revenue and expenditure and each accounting unit or cost centre has to show its operational costs being limits beyond which no expenditure should be incurred without Treasury or Parliamentary approval. The government budget as whole should not be exceeded without parliamentary approval. All the estimates are broken up into minor budgets for ministries and/or departments. Vote control is in essence budgetary control and this is carried on without profit motive. Therefore, we can emphasize that the profit motive is not necessary for the use of budgetary control. (b) Budgeted levels of expenditure normally represent ceilings over and above which spending units of government must not go, without approval either by Parliament or Treasury. It is both legally and administratively binding for the government to present expenditure estimates to Parliament. The expenditure estimates are both of recurrent and development nature and pertain to one financial year. Sitting as a committee of supply, parliament approves the estimates by way of the appropriation bill which is signed by the President to become an act. QUESTIONTWELVE 485 Company Accounts (a) Compare and contrast the role of an accountant in a governmental accounting with that of an accountant in commercial accounting. (b) Explain and illustrate the distinction extraordinary items and exceptional items. Solution In order to clearly understand the role an accountant plays in both government and commercial accounting, we need to make a brief comparison and contrast between the two accounting systems. Unlike private businesses, government activities are not governed by the profit motive. Private firms essentially are concerned with profits made, for such purposes as return on investment and expansion in a selected field of activity. In contrast, functions are undertaken by government in multiple fields of activity, for a variety of broader purposes such as service to the public, maintaining the financial stability of the nation, promoting trade and commerce, stimulating private action of national importance and accelerating the development of the economy and social welfare. Government activities encounter many kinds of problems that are of greater complexity. Costs of performance are of significant interest to management, but they are of importance primarily as a measure of operational efficiency and the degree to which planned programme results are achieved with funds made available. The above description highlights the environment in which an accountant works, both in private commercial sector and government. In all government activities, accounting has to place emphasis on three aspects: a) Control of the acts of public bodies and officers in their raising and expending of public funds. b) Provide information that will assist in the economic planning of government functions and activities. c) Provide information to parliament and the public relating to the activities of government operations in whatever form. The last aspect is in fact a statutory requirement that the accounting officers should produce financial statements in the form of revenue accounts, fund accounts, appropriation accounts in order to satisfy the accountability requirements. However, it has been argued that the role of the accountant in the government accounting system has been more or less that of a bookkeeper, having no central role of management decision-making. That view is slowly changing. The accountant is, owing to more sophisticate nature of his work, now more appreciated, considered as an expert, one of the management team. He is required to provide information that will assist in the economic planning of government functions and activities. The role of the accountant in the commercial sector is of no less importance. Apart from the purpose for which financial statements are usually required, for example, under the Companies Act, or some other legislations, for assessments of taxation on profits or to support loans from banks or similar financial institutions, accounting in the present day conception lays particular emphasis on its use of two of the important management functions of planning and control. In this sense it is described as “Management Accounting” which may be very briefly referred to as any form of accounting which enables a business to be conducted more efficiently. These two management functions of planning and control are used in both government and commercial sector accounting. Accounting therefore serves the same purpose for all Lesson Eight 486 undertakings, both private and public. The accountant in all cases has to classify, record, summarise the many transactions and events usually in terms of money or money’s worth. The most important difference in the role of the accountant in government and commercial accounting is that profit is not the end product in government. But they use the same techniques and overall achievements of efficiency and effectiveness. Example 1 (a) In accounting for Central Government and Local Government units, a fund called Capital Project Fund is usually created. What is the purpose of this fund? (5 marks) (b) The City Council of Matopeni authorises the construction of a new city hall on 1 January 1991. This hall is expected to cost sh.100,000,000. Financing for the project is to beSh50,000,000 from 6½ per cent serial bond issue, Sh.40,000,000 from a Government Grant, and Sh.10,000,000 from the general fund (GF). Transactions and events during 1991 are as follows: (i) The city transfers Sh.10,000,000 from the GF to the City Hall Capital Project Fund (a CPF created for the construction). (ii) Planning and architect’s fees are paid in the amount of Sh.4,000,000. (iii) The contract is awarded to the lowest bidder for Sh.95,000,000. (iv) The bonds are sold for Sh.50,200,000. (v) The amount of the premium is transferred to the debt service fund. (vi) The construction is certified to be 50 percent compete and a bill for Sh.47,500,000 is received from the contractor. (vii) Contracts payable, less a 10 percent retained percentage, is paid. (viii) The books are closed and financial statements are prepared. Required: (i) (ii) Journal entries to record the above transactions. (10 marks) Financial statement of the capital project fund for the year 1991.(5 marks) (20 marks) Solution (a) Capital project fund (CPF) The purpose of capital project fund is to provide resources for the completion of some specific capital project. The main sources of financing include the proceeds of bond issues, grants and transfers from other funds. A separate capital project fund is created for each major project. 487 Company Accounts (b) (i) JOURNAL ENTRIES NO. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. PARTICULARS Transfers to city call CPF General Fund Cash A/C (Being the transfer to city hall CPF) Capital project fund (CPF): Cash account General Fund (GF) A/C (Being the receipt of funds from G.F) CPF Planning and architect’s fees A/C Cash A/C (Being the payment of planning and architect’s fees) CPF Encumbrances Reserve for encumbrances (Being the recording of encumbrances for the amount of contract) CPF Cash account Bonds account Premium on bonds etc. Being the proceeds from the issue of bonds) Premiums on bonds A/C Cash A/C (Being the transfer of premium bonds to City Hall debt service fund) F Dr (Sh ‘000’) 10,000 10,000 10,000 10,000 4,000 4,000 95,000 95,000 50,200 50,000 200 200 200 Reserve for encumbrances A/C Encumbrances A/C (Being the transfer of half of the amount encumbered) 47,500 Contract expenditures A/C Contract payable A/C Contract payable – retention A/C (Being the expenditure on the City Hall contraction recorded) 42,500 Contract payable A/C Cash A/C (Being the partial payment to the contractor) 42,750 CPF – Adjusting entry due from government grant Revenue A/C (Being the accrued revenue from the government grant.) CPF (Closing Entries) Revenue A/C Cr (Sh ‘000’) 47,500 42,750 4,750 42,750 40,000 40,000 40,000 Lesson Eight General Fund A/C Proceeds from issue Expenditures Encumbrances Fund balance (To close the books at the end of 1994) 488 10,000 50,000 46,750 47,500 5,750 (ii) CITY COUNCIL OF MATOPENI A statement of Revenue and Expenditure and charges in the Fund Balance for the year ended 31st December 1991. (Sh ‘000’) Project authorisation 100,000 Sources of Financial Funds Revenue from government grant 40,000 Transfers: Proceeds from fund issue 50,000 Transfers from general fund 10,000 100,000 Use of Financial Resources Expenditures 51,500 Excess of Revenue and Transfers over expenditure 48,500 Less: Increase in encumbrances 47,500 Fund Balances as at 31st December 1994 CITY OF MATOPENI City Hall Capital Project Fund 1,000 489 Company Accounts Balance Sheet as at December 31, 1991 (Sh ‘000’) Assets Cash 13,250 Due from government grant 40,000 53,250 Liabilities: Contracts payable – retention money 4,750 Fund equity: Reserve for encumbrance Fund balance 47,500 1,000 48,500 53,250 Example 2 The Ministry of Trade and Commerce had the following estimated revenues to collect during the financial year ended 30 June 1993. Sh. Hotel and Restaurant licences Cattle traders licences 900,000 1,000,000 Licences under Trade Licensing Act 765,000 Liquor licenses 500,000 Professional licences 75,000 Licenses for registration of Insurance Companies320,000 During the year and prior to any issue of licences, it was found necessary to suspend the issue of liquor licences and professional licences. The Receiver of Revenue further found out that more people were interested in scrap metal business. The Treasury authorised the Receiver of Revenue to open a new head for scrap metal licences with an estimated collection of Sh.955,000. Lesson Eight 490 At the close of the financial year, the Receiver of Revenue had collected the following amounts: Sh. Hotel and Restaurant licences 1,131,250 Cattle traders licences 2,261,250 Licences under Trade Licensing Act Liquor licences Professional licenses Registration of insurance companies Scrap metal licences 705,000 255,000 1,117,500 The Receiver of Revenue had provided the following additional information: (i) (ii) The ministry had a balance of Sh.33,750 at the beginning of the financial year. An amount of Sh.335,000 in respect of scrap metal licences was still in the hands of agents as at 30 June 1993. (iii) A sum of Sh.8,750 was due to the Exchequer at the end of the year. Required (a) A Statement of Assets and Liabilities for the year ended 30 June 1993 Ministry Of Trade and Commerce Statement of Assets and Liabilities as at 30 June 1992 Assets Cash balance Receivable from agents Sh. 5,503,750 335,000 (5 marks) 491 Company Accounts 5,838,750 Fund Balance and Liabilities Fund balance (brought forward) Fund balance (current year) (W – 1) 33,750 5,796,250 Payable to the exchequer 8,750 5,838,750 (b) STATEMENT OF REVENUE For the year ended 30 June 1993 Head Estimates Actual Over (under) Estimated Sh. Sh. Sh. 011 – Hotel & Restaurants900,000 1,131,250 (231,250) 012 – Cattle traders licences1,000,000 2,261,250 (1,261,250) 765,000 705,500 60,000 500,000 - 500,000 021 – Professional licences 75,000 - 75,000 255,000 65,000 1,117,500 (162,500) 5,470,000 (955,000) 013 – Licences under Trade Licensing Act 014 – Liquor Licences 022 – Registration of Insurance Companies 320,000 031 – Scrap metal licences 955,000 4,515,000 Balance b/f from previous year 33,750 Amount payable to the exchequer 5,503,750 Amount transferred to exchequer (Bal. Fig) 5,495,000 Lesson Eight 492 Amount due to exchequer 8,750 (W – 1) Fund Balance Current year: Amount transferred to exchequer 5,495,000 Add: Amount receivable from agents 335,000 5,830,000 Less: Balance b/f from previous year 33,750 5,796,250 (c) Footnotes: 1. Introduction of a new source of revenue i.e. scrap metal licences. 2. Withdrawal of two revenue sources i.e. liquor licences and professional licences. 3. Reasons for material variations in actual receipts. 4. Details about revenue with collector’s agents. Example 3 The following data were taken from the accounting records of the Town of Ole Meka General Fund after the accounts had been closed for the fiscal year ended 30 September 1991. Balances Fiscal Year 1991 Changes Balances 1 October 1990 Debit Sh. Sh. Sh. Sh. 180,000 955,000 880,000 225,000 20,000 809,000 781,000 48,000 6,000 9,000 (7,000) Assets Cash Taxes Receivable Estimated uncollected tax(4,000) Credit 30 Sept. 1991 196,000 296,000 Liabilities, Reserves & Funds Balances: Vouchers payable 44,000 880,000 889,000 53,000 493 Company Accounts Due to intra governmental Service fund 2,000 7,000 10,000 5,000 Due to Debt Service Fund10,000 60,000 10,000 50,000 Reserve for encumbrances40,000 40,000 47,000 47,000 Fund balance 100,000 20,000 61,000 141,000 19,000 2,777,000 2,777,000 296,000 The following additional data is available: (i) The budget for fiscal year 1991 provided for estimated revenues of Sh.1,000,000 and appropriations of Sh.965,000. (ii) Expenditure totalling sh.895,000 in addition to those chargeable against Reserve for Encumbrances, were made. (iii) The actual expenditure chargeable against Reserve for Encumbrances was Sh.37,000. Required: Show journal entries to record the above transactions in the books of Town of Ole Meka General Fund. (20 marks) Lesson Eight 494 Solution TOWN OF OLE MEKA GENERAL FUND ----Journal Entries S. No (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) Cash Revenue (Being revenue received) Expenditure Encumbrances Bank (Being the record of payment made) Tax receivable Fund Balance (Being the record of the increase in tax receivable) Dr Sh. 995,000 995,000 858,000 22,000 880,000 28,000 28,000 Fund Balance Incollectable taxes 3,000 Fund Balance Vouchers (Being increase of vouchers payable) Fund Balance Intra: government (Being the record of the net increase) 9,000 3,000 9,000 3,000 3,000 Fund Balance Debt Servicing Fund (Being the record of net appropriation to debt service fund). 40,000 Encumbrances Fund Fund Encumbrances (Being the record of net changes in encumbrances) 15,000 Revenue Expenditure (Being the record of expenditure incurred against the revenue). Revenue Fund (Being the transfer of net revenue to the Fund A/C). 40,000 15,000 44,000 44,000 858,000 858,000 97,000 97,000 FINANCIAL STATEMENT Town of Ole Meka Assets Sh. Cash Cr Sh. 225,000 495 Company Accounts Tax received 48,000 Estimated uncollected tax ( 7,000) 296,000 Fund Balances Sh. Sh. Uncollected Tax 3,000 Balance b/f 100,000 Voucher 9,000 Tax receivable 28,000 Intra 3,000 Reserve for Encumbrances 15,000 Debt fund 40,000 Reserve 97,000 Encumbrances 44,000 ______ Balance c/d 141,000 240,000 240,000 Lesson Eight 496 REINFORCEMENT QUESTIONS QUESTION ONE The Approved Estimates and Actual Expenditure details of the Ministry of Uchumi na Ufanisi for the year 197/8 were as follows: Approved Actual Estimates Expenditure £ £ 123,280 97,520 19,550 14,260 4,140 667 16,100 13,593 110 – Travelling and Accommodation 1,334 1,656 120 – Postal and Telecommunication Expenses 4,600 3,312 17,480 16,882 5,980 4,738 21,000 39,800 1,000 5,560 000 – Personal Emoluments 050 – House Allowances 080 – Passages and Leave 100 – Transport Maintenance 190 – Miscellaneous Charges 196 – Training Expenses 230 – Purchase of Equipment 620 – Appropriations-In-Aid (Realised) The Ministry made four (4) equal withdrawals from Exchequer in July 19-7, October 19-7, January 19-8 and May 19-8. In total the Ministry had withdrawn £200,000 by the end of the year. Required: (a) (i) (ii) The General Account of Vote (G.A.V) The Exchequer Account. 497 Company Accounts (iii) The Paymaster-General (PMG) Account. (b) A statement of assets and liabilities as at 30 June, 19-8. (20 marks) QUESTION TWO (a) Distinguish between Commitment Accounting and Fund Accounting in relation to Public Sector Accounting. (8 marks) (b) The Appropriation Account of the Government of the Republic of Kenya for 1992/1993 presented to Parliament in January 1994 included the following accounts for the Provincial Hospitals managed by the Ministry of Health. Estimated 1992/1993 Gross Current Expenditure/Income Other direct costs Capital Expenditure 26,770,000 Net Expenditure Income Expenditure 25,401,000 880,000 24,521,000 357,000 - 357,000 1,012,000 ____- 1,012,000 880,000 25,890,000 Lesson Eight 498 Actual 1992/93 Gross Net Expenditure Income Expenditure Current Expenditure/Income 26,593,1465 920,951 25,672,194 334,692 - 334,692 1,082,683 ______- 1,012,000 920,951 27,089,569 Other direct costs Capital Expenditure 28,010,520 These accounts were audited by the Controller and Auditor General who issued a clean certificate of findings. Required Discuss the usefulness of these published accounts from the point of view of: (i) (ii) (iii) (iv) A A A A Member of Parliament. taxpayer. patient of one of the hospitals. creditor to one of the hospitals. (3 (3 (3 (3 marks) marks) marks) marks) (Total: 20 marks) CHECK YOUR ANSWERS WITH THOSE GIVEN IN LESSON 9 OF THE STUDY PACK 499 Company Accounts COMPREHENSIVE ASSIGNMENT NO.4 TO BE SUBMITED AFTER LESSON 8 To Be Carried Out Under Examination Condition and Sent to the Distance Learning Administraton for Marking by the University TIME ALLOWED: THREE HOURS ANSWER ALL QUESTION QUESTION ONE (JUNE 2000 Q2) You have been provided with the following summarised accounts of Golden Times Ltd. For the year ended 31 March 2000: Balance sheet as at 31 March 2000 Fixed assets: Freehold property (Net book value) Plant and machinery (Net book value) Motor vehicles (Net book value) Furniture and fittings (Net book value) Sh. Current Assets: Stocks Debtors Investments Sh. Sh. 480,000 800,000 200,000 200,000 1,680,000 1,000,000 400,000 120,000 1,500,000 Current liabilities: Trade creditors Bank overdraft Corporation tax Dividends payable 238,400 878,400 176,000 107,200 (1,400,000 ) Financed by: Authorised share capital – 800,000 Sh.1 ordinary shares Issued and fully paid: 400,000 Sh.1 Ordinary shares Capital reserve Revenue reserve Loan capital: 400,000 10% Sh.1 Debentures 400,000 200,000 800,000 Profit and loss account for the year ended 31 March 2000 Sh. Sales (credit) 120,000 1,800,000 400,000 1,800,000 4,000,000 Profit after charging all expenses except interest on debentures Less: debenture interest Profit before tax Corporation tax Less: ordinary dividend proposed Retained profit transferred to revenue reserve 440,000 40,000 400,000 176,000 224,000 107,200 116,800 The following additional information was available: 1. 2. 3. The purchases for the year were Sh.2,160,000 while the cost of sales was Sh.3,000,000. The market price for Golden Times Ltd. Ordinary shares as at 31 March 2000 was Sh.5 The company estimates the current value of its freehold property at Sh.1,100,000. Required: (a) Compute the following ratios for Golden Times Ltd.: (i) Return on capital employees ( 1 mark) Lesson Eight (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x) (b) 500 The profit margin ( 2 marks) The turnover of capital ( 1 mark) Current ratio; ( 1 mark) Liquid ratio; ( 2 marks) Number of days accounts receivable are outstanding; ( 1 mark) Property ratio; ( 2 marks) Stock turnover ratio; ( 1 mark) Dividend yield ratio; ( 1 mark) Price earnings ratio. ( 2 marks) Comment on Golden Times Ltd. Liquidity stating the reference points to which relevant ratios can be compared. (6 marks) (Total: 20 marks) QUESTION TWO (MAY 2002 Q4) (a) (b) Briefly explain the objectives and scope of IAS 7 (Cash Flow Statements). (6 marks) The following are extracts from the financial statements of Wewe Ltd. As at 31 March: 2002 Sh.’000’ Fixed assets: Goodwill Freehold land and building Plant and machinery (NBV) Investment at cost Current assets: Stocks Accounts receivable Investments Cash at hand and bank Current liabilities Bank overdraft Accounts payable Proposed dividends Taxation Net current assets 15% debentures Capital and reserves: Authorised, issued and paid Sh.10 Ordinary shares Share premium Revaluation reserve Retained profit Sh.’000 ’ 2001 Sh.’000’ Sh.’000’ 2,800 16,800 5,860 3,600 29,060 2,900 12,000 6,350 3,750 25,000 10,050 6,140 1,710 200 18,100 8,700 7,800 840 430 17,770 (2,390) (5,850) (450) (820) (9,510) (6,540) (5,250) (380) (600) (12,770) 8,590 37,650 (7,500) 30,150 5,000 30,000 (9,000) 21,000 18,000 1,500 4,500 6,150 30,150 15,000 750 5,250 21,000 The profit and loss appropriation account for the year ended 31 March 2002 is given below: Sh.’000’ Net profit before tax Less: Corporation tax Profit after tax Dividends: Interim (paid) Proposed (paid) 150 450 Sh.’000’ 2,400 900 1,500 600 900 501 Company Accounts The following additional information is provided: 1. Profit for the year is arrived at after charging: SH.’000’ Depreciation on plant and machinery Goodwill amortisation 2. 3. 1,150 420 During the year, plant with a net book value of Sh.750,000 was sold for Sh.1,470,000. The plant had originally cost Sh.3,000,000. The investments portfolio was reduced by selling one block of shares at a profit of sh.160,000. Required: Cash flow statement in accordance with IAS 7. (14 marks) (Total: 20 marks) QUESTION THREE (DEC 2002 Q5) (a) Explain briefly the meaning of the terms listed below in relation to Government accounting: (i) (ii) (iii) (iv) (b) The Exchequer account The General account of Vote The Paymaster General Appropriations in Aid. ( ( ( ( 3 3 3 3 marks) marks) marks) marks) The approved estimates and actual expenditure details for the Ministry of Planning and Development for the year 2001/2002 were as follows: Personal emoluments House allowances Passage and leave Traveling and accommodation Transport and maintenance Postage and telephone expenses Miscellaneous charges Training expenses Purchase of equipment Appropriations in Aid Sh. 14,793,600 2,346,000 4,024,800 160,080 1,932,000 552,000 2,097,600 717,600 2,520,000 120,000 Sh. 11,702,400 1,711,200 80,040 198,720 1,631,160 397,440 2,025,840 568,560 4,776,000 667,200 The ministry made four equal withdrawals from the exchequer in July 2001, October 2001, January 2002 and May 2002. In total, the ministry had withdrawn Sh.24,000,000 by the year end. Required: (i) The General Account of Vote. ( 2 marks) (ii) The Exchequer Account ( 1 mark) (iii) The Paymaster General Account. ( 2 marks) (iv) Statement of assets and liabilities as at 30 June 2002. ( 3 marks) (Total: 20 marks) Lesson Eight (a) Explain briefly the meaning of the terms listed below in relation to Government accounting: (v) (vi) (vii) (viii) (b) 502 The Exchequer account The General account of Vote The Paymaster General Appropriations in Aid. ( ( ( ( 3 3 3 3 marks) marks) marks) marks) The approved estimates and actual expenditure details for the Ministry of Planning and Development for the year 2001/2002 were as follows: Personal emoluments House allowances Passage and leave Traveling and accommodation Transport and maintenance Postage and telephone expenses Miscellaneous charges Training expenses Purchase of equipment Appropriations in Aid Sh. 14,793,600 2,346,000 4,024,800 160,080 1,932,000 552,000 2,097,600 717,600 2,520,000 120,000 Sh. 11,702,400 1,711,200 80,040 198,720 1,631,160 397,440 2,025,840 568,560 4,776,000 667,200 The ministry made four equal withdrawals from the exchequer in July 2001, October 2001, January 2002 and May 2002. In total, the ministry had withdrawn Sh.24,000,000 by the year end. Required: (v) The General Account of Vote. ( 2 marks) (vi) The Exchequer Account ( 1 mark) (vii) The Paymaster General Account. ( 2 marks) (viii) Statement of assets and liabilities as at 30 June 2002. ( 3 marks) (Total: 20 marks) QUESTION FOUR (JUNE 2001 Q5) Write brief notes on the following: (a) (b) (c) (d) Controller and Auditor General Sinking fund Trust fund Revolving fund (5 marks) (5 marks) ( 5 marks) ( 5 marks) (Total: 20 marks) QUESTION FIVE (DEC 2001 Q5) (a) (b) In the context of accounting and financial reporting for the public sector define the term “fund” (3 marks) Write explanatory note son the specific funds falling under each of the categories listed below: (i) (ii) (iii) (c) Governmental funds; Proprietary funds; Fiduciary funds. ( 2 marks) ( 2 marks) ( 2 marks) For each of the three categories listed in (b) above, explain how the accounting practice adopted for each is guide by: (i) Accruals basis of accounting; ( 3 marks) 503 (ii) Company Accounts Budgets and budgetary control. ( 3 marks) (Total: 15 marks) END OF COMPREHENSIVE ASSIGNMENT No.4 NOW SEND YOUR ANSWERS TO THE DISTANCE LEARNING CENTRE FOR MARKING Lesson Eight 504 LESSON NINE REVISION AID INDEX KASNEB SYLLABUS MODEL ANSWERS TO REINFORCING QUESTIONS LESSON 1 LESSON 2 LESSON 3 LESSON 4 LESSON 5 LESSON 6 LESSON 7 LESSON 8 MOCK EXAMINATION 505 Company Accounts SOLUTIONS TO REINFORCEMENT QUESTIONS Question 1 Check the balances on your ledger accounts with the trial balance as shown below: DR CR £ £ Cash at bank 1,703 Cash in hand 12 Drawings 560 Postage and stationery 129 Traveling expenses 104 Cleaning expenses 260 Sundry expenses 19 Telephone 214 Electricity 190 Motor vas 2,000 Rates 320 Fixtures ad fittings 806 Capital 2,308 Purchases 3,163 Discounts received 419 Credit sales 830 Cash sales 4,764 Discount allowed 81 Provision for depreciation: 700 Motor van 250 Fixtures ad fittings Stock at 1 January 20X1 366 Loan - Frey 250 Debtors – Brown 12 Blue 150 Stripe 48 Creditors – Live 602 Negative _____ 64 10,207 10,207 Workings Cash at bank Opening balances Bankings of cash (908 + 940 + 766 + 1,031) Capital introduced £ 672 3,643 500 Lesson Eight 506 Received from customers (160 + 66 + 22 + 10 + 40 + 120 + 140 + 150 + 20 + 44 + 38 + 20) x 90% 729 5,546 Less cheque payments (telephone, electricity, rates and van) Payments to suppliers (143 + 468 + 570 + 390 + 80 + 87 + 103 + 73 + 692 + 187) (2,374) 1,703 Cash at Bank £ £ Bal b/d Sales (bal) 5 Bank 4,764 Drawings Stationery Travel Petrol ad van Sundry Postage Cleaner Bal c/d 4,769 3,645 560 73 40 104 19 56 260 _12 4,769 Question 2 Mary Carter Balance Sheet as at 31.12.2001 Non current assets Freehold premises Plant £ Current assets Stock Debtors Cash at Bank Cash in hand Current liabilities Creditors £ 8,000 7,000 1,000 6,000 22,000 (10,000) Capital [34,000 + 5,000 – 10,000] 20,000 49,000 Workings 11,000 + 34,000 – 37,000 10,000 + 51,000 – 54,000 12,000 49,000 29,000 Non current liabilities Loan from bank Stock: Debtors: £ 25,000 12,000 37,000 = 8,000 = 7,000 507 Company Accounts Cash at bank: 5,000 – 16,000 – 2,000 – 1,000 – 36,000 + 54,000 – 3,000 = 1,000 Cash hand: 3,000 – 10,000 + 9,000 + 16,000 – 10,000 – 2,000 = 6,000 Capital Bal b/f Add profit Less drawings Profit: Sales Cost of sales Electricity Rates Wages Sundry expenses Bank interest Net profit 34,000 _5,000 39,000 (10,000) 29,000 60,000 (37,000) (2,000) (1,000) (10,000) (2,000) (3,000) 5,000 Creditors = 12,000 + 34,000 – 36,000 = 10,000 Question 3 Apparent from the text Profit is determined by redrafting the second section of the balance sheet. Remember that net assets will be the same as capital. Capital b/f + additional Add net profit (missing figure) Less drawings Capital c/f 25,000 6,000 31,000 (4,500) 26,500 Profit may be also computed as follows: Net profit = closing capital (net assets) – opening capital + drawings – additional capital = 26,500 – 20,000 + 4,500 – 5,000 = £6,000 Lesson Eight 508 Question 4 Brian Barmouth Trial balance as at 30 June 2000 £ Sales Purchases Office expenses Insurance Wages Rates Heating and lighting Telephone Discounts allowed Opening stock Return inwards Returns outwards Premiums Plant and machinery Motor vehicle Debtors Bank balance Creditors Loan – long term loan Capital Drawings for the year £ 47,600 22,850 1,900 700 7,900 2,800 1,200 650 1,150 500 200 150 40,000 50,000 12,000 12,500 7,800 __4,000 121,150 3,400 10,000 60,000 ______ 121,150 NB: The closing stock does not appear in the trial balance. 509 Company Accounts LESSON 2 Question 1 (a) 1-May 13-May 16-May 24-May (b) 4 – May 11 – May 18 - May (c) 2 – May 9 – May 17 - May Capital Sales Bruce hill £ 5,000 200 700 200 1-May 19-May 20-May 21-May 30-May 30-May 31-May _____ 31-May 6,100 Store fitments Abel Rent Delivery exp Drawings Wages Green Balance c/d £ 2,000 650 200 50 200 320 300 2,380 6,100 SALES DAYBOOK £ 700 580 360 1,640 Bruce Hill Nailor PURCHASES DAYBOOK £ 650 300 800 1,750 Abel Green Kaye Check the account balances with the balances shown on the trial balance. (d) Cash Sales Purchases Debtors Creditors Capital Fixtures and fittings Rent Delivery expenses Drawings Wages Dr £ 2,380 Cr £ 1,840 1,750 740 800 5,000 2,000 200 50 200 _320 7,640 ____ 7,640 Lesson Eight 510 Question 2 End Papers Trading, Profit & Loss Account for the year ended 31.12.02 £ £ £ Sales 15,500 Less returns inwards (1,500) 150,000 Cost of sales Opening stock 46,000 Purchases 103,500 Less returns outwards (3,500) 100,000 146,000 Less closing stock (41,000) (105,000) Gross profit 45,000 Discount received 200 Rent received 2,000 47,200 Expenses Salaries and wages 18,700 Office expenses 2,500 Insurance 1,100 Electricity 600 Stationery 2,400 Advertising 3,500 Telephone 800 Rates 3,000 Discount allowed __100 (32,700) Net profit 14,500 End Papers Balance Sheet as at 31 December 2002 Non current assets £ Premises Fixtures and fittings Current assets Stocks Debtors Cash in hand Current liabilities Bank overdraft Creditors Capital Add net profit Less drawings £ £ 80,000 5,000 85,000 41,000 4,800 200 46,000 12,000 7,500 (19,500) 26,500 111,500 111,000 14,500 125,500 (14,000) 111,500 511 Company Accounts Question 3 K Smooth Trading, Profit and Loss Account for the year ended 31.3.2002 £ Sales Less: Cost of sales Opening stock Purchases Add carriage inwards Less returns outwards Less closing stock £ 1,816,000 6,918,500 42,000 6,960,500 (64,000) 6,896,500 8,712,500 (2,239,000) Less expenses Wages and salaries Carriage outwards Rent and rates Communication expenses Commission payable Insurance Sundry expenses Net profit Current liabilities Creditors Capital Add net profit Less drawings (6,473,500) 2,760,500 1,024,000 157,000 301,500 62,400 21,600 40,500 31,800 K Smooth Balance Sheet as at 31 December 2002 Non current assets £ £ Buildings Fixtures Current assets Stocks Debtors Bank Cash £ 9,234,000 (1,638,800) 1,121,700 £ 2,000,000 285,000 2,285,000 2,239,000 1,432,000 297,000 11,500 3,979,500 (816,000) 3,163,500 5,448,500 5,088,800 1,121,700 6,210,500 762,000 5,448,500 Lesson Eight 512 Question 4 Skates Trading, Profit and Loss Account for the year ended 31 September 2002 £ £ £ Sales 13,090,000 Less: returns outwards __(55,000) 13,035,000 Cost of sales: Opening stock 2,391,000 Purchases 9,210,000 Add carriage inwards ___21,500 9,231,500 Less returns outwards __(30,700) 9,200,800 11,591,800 Less closing stock (2,747,500) (8,844,300) 4,190,700 Less expenses Wages and salaries 1,282,000 Carriage outwards 30,900 Motor expenses 163,000 Rent and rates 297,000 Telephone 40,500 Insurance 49,200 Office expenses 137,700 Sundries 28,400 (2,027,700) Net profit _2,163,000 Skates Balance Sheet as at 30September 2002 Non current assets £ Office equipment Motor van Current assets Stocks Debtors Bank Cash Current liabilities Creditors Capital Add net profit Less drawings £ £ 625,000 410,000 1,035,000 2,747,500 1,239,000 311,500 __29,500 4,318,500 (937,000) 3,381,500 4,416,500 3,095,500 2,163,000 5,258,500 (842,000) 4,416,500 LESSON 3 513 Company Accounts Question 1Adequately covered in the text. Question 2 Also covered adequately in the text. Question 3 Materiality Information is material if its omission or misstatement could influence users’ decisions taken on the basis of the financial statements. The materiality of the omission or misstatement depends on the size and nature of the item in question judged in the particular circumstances of the case. Only items material in amount or in nature will affect the true and fair view given by a set of accounts. Example: If a business has a bank loan of £50,000 and a £55,000 balance on bank deposit account, it might well be regarded as a material misstatement if these two amounts were displayed on the balance sheet as ‘cash at bank £5,000’. In other words, incorrect presentation may amount to material misstatement even if there is no monetary error. Comparability Users must be able to compare the financial statements of an enterprise over time to identify trends and with other enterprise’s statements to evaluate their relative financial position, performance and changes in financial position. It is therefore necessary for similar events and states of affairs to be represented in a similar manner. Compliance with accounting standards helps to achieve comparability by ensuring that different entities account for similar transactions and events in a similar way. Example: Depreciation policy must be consistent from one period to the next, unless it becomes inappropriate. Prudence The prudence concept states that where alternative procedures, or alternative valuations, are possible, the one selected should be the one which gives the most cautious presentation of the business’s financial position or results. IAS 1 describes the prudence concept as being that ‘revenue and profits are not anticipated, but are recognized by inclusion in the profit and loss account only when realized in the form either of cash or of other assets, the ultimate cash realization of which can be assessed with reasonable certainty; provision is made for all known…….expenses and losses whether the amount of these is known with certainty or is a best estimate in the light of the information available.’ Example: If there is any doubt as to the recoverability of debts outstanding at the year-end, a provision should be made so that the amount in question is not included in the profit for the year. Objectivity: This means that accountants must be free from bias. They must adopt a neutral stance when analyzing accounting data. This means that they should try to strip their answers of any personal opinion or prejudice and should be as precise and as detailed as the situation warrants. The result of this should be that any number of accountants will give the same answer independently of each other. Lesson Eight 514 Example: Internally generated good will should not be capitalized in the balance sheet, as its value cannot be determined objectively. Relevance The Statement of Principles for Financial Reporting states that to be useful, information must be relevant to the decision-making needs of users. Information is relevant when it has the ability to influence the decisions of users by helping them to evaluate past, present or future events or to confirm or correct their past evaluations. Example: Suppliers and other creditors would like to have information that enables them to determine if to lend to the firm or supply on credit. Question 4 Information is material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements. Factors affecting materiality are: • The size of the item; • The nature of the item. To be useful, information must be relevant to the decision-making needs of users. Information is relevant when it influences the economic decisions of users by helping them evaluate past, present or future events or confirming, or correcting their past evaluations. Neutrality means that the information in financial statements should be free from deliberate or systematic bias. Prudence means that a degree of caution is needed in making estimates about certain items. The potential conflict between the two is that neutrality requires freedom from bias while the exercise of prudence is a potentially biased concept since judgment is required. In resolving the conflict, a balance should be found that neither overstates nor understates assets, gains, liabilities and losses. Safeguards to ensure that a company’s financial statements are free from material error: The fact that the financial statements have been audited by an independent professional; The existence of sound internal controls within the company; The existence of an internal audit function within the company. 515 Company Accounts LESSON FOUR Question 1 David Douglleu Trading and Profit and Loss Account for the year ended 31 March 2001 £ £ £ Sales 378,500 Less returns (4,100) inwards 374,400 Less cost of sales Opening stock 120,600 Purchases 261,700 Less returns out (7,700) 254,000 374,600 Less closing stock 102,500 272,100 Gross profit 102,300 Add Discount received 2,400 Rent received 7,500 112,200 Less expenses Salaries and 45,700 wages Office expenses 8,400 Insurance 2,200 premiums Electricity 2,300 Stationery 6,200 Advertising 8,900 Telephone 2,100 Business rates 6,000 Discounts allowed 600 (82,400) Net profit 29,800 Lesson Eight 516 Balance Sheet as at 31 March 2001 Non current assets £ Warehouse shop and office Fixtures and fittings Current assets Stocks Debtors Prepayments Cash in hand Current liabilities Creditors Accrued expenses Bank overdraft Capital Add Net Profit Less drawings £ £ 210,000 12,800 222,800 102,500 13,000 2,400 500 118,400 18,700 1,200 30,000 (49,900) 68,500 291,300 287,500 29,800 317,300 (26,000) 291,300 Question 2 Donald Brown Trading and Profit and Loss Account fro the year ended 31 December 20X0 £ £ Sales 491,620 Less cost of sales Opening stock 18,460 Purchases 387,936 406,396 Closing stock 19,926 386,470 Gross profit 105,150 Discounts received 1,175 106,325 Less expenses: Discounts allowed 1,304 Lighting and heating 6,184 Motor expenses 3,080 Rent 8,161 General expenses 7,413 Depreciation (w) 13,146 39,288 Net profit 67,037 Working: Depreciation charge: 517 Company Accounts Motor vehicles: £45,730 x 20% = £9,146 Fixtures and fittings: 10% x £(42,200 – 2,200) = £4,000 Total: £4,000 + £9,146 = £13,146 Donald Brown Balance Sheet as at 31 December 20X0 Cost Depreciation Non current £ £ asset s Fixtures and 42,200 6,200 fittings Motor vehicles 45,730 24,438 87,930 30,638 Current assets Stock 19,926 Debtors 42,737 Prepayments 680 Cash in hand 1,411 64,754 Current liabili ties Creditors 35,404 Accruals 218 Bank overdraft 19,861 55,483 Net current assets Net assets Financed by Capital Net Profit for year Less drawings Net £ 36,000 21,292 57,292 9,271 66,563 26,094 67,037 93,131 26,568 66,563 Lesson Eight 518 Question 3 Brenda Bailey Trading and Profit and Loss Account for the year ended 30 June 20X9 £ £ Sales 427,726 Opening stock 15,310 Purchases 302,419 Carriage inwards 476 318,205 Less closing stock 16,480 Cost of sales 301,725 Gross profit 126,001 Carriage outwards 829 Wages and salaries 64,210 Rent and rates (12,466 – 11846 620) Heat and light (4,757 + 5,107 350) Depreciation – 10,200 equipment Motor 8,654 vehicles Sundry expenses 8,426 109,272 Net profit for the year 16,729 Brenda Bailey Balance Sheet as at 30 June 20X9 Cost Depreciation Non current assets Equipment Motor vehicles Current assets Stock Debtors Prepayments Cash Current liabilities Bank overdraft Creditors Accruals Net current assets Capital Balance at 1 July 20X8 Add Profit for year £ 102,000 43,270 145,270 £ Net book value £ 32,450 17,574 50,024 69,550 25,696 95,246 16,480 50,633 620 __477 68,210 3,295 41,792 350 45,437 22,773 118,019 122,890 16,729 519 Company Accounts 139,619 21,600 118,019 Less drawings Balance at 30 June 20X9 Question 4 Frank Mercer 20X8 Dec 31 Balance b/f Dec 31 Dividend Cash book £ 20X8 1,793 Dec 31 Bank charges 26 Dec 31 Standing order Dec 31 Direct debit ____ Balance c/d 1,819 Bank reconciliation as at 31 December 20X8 £ Balance per bank statement Add unrecorded lodgments: V Owen K Walters £ 1,557 98 134 232 Less unpresented cheques: B Oliver (869) L Philips (872) Balance per cash book (corrected) 71 37 (108) 1,681 £ 18 32 88 1,681 1,819 Lesson Eight 520 LESSON FIVE Question 1 Bal b/d Sales (163,194 + 1,386) Cash refund Sales Ledger Control A/C £ 386,430 Bal b/d 164,580 Cash received 350 Discounts allowed Returns inwards Contra Bad debts written off ______ Balance c/d 551,730 Bal b/d Cash paid (103,040 – 350) Discounts received Returns outwards (1,370 + 2,000) Contra Balance c/d £ 190 158,288 2,160 590 870 1,360 388,272 551,730 Sales Ledger Control A/C £ 520 Bal b/d 102,690 Purchases (98,192 + 36) 990 Bad debts 3,370 870 175,048 Balance c/d 283,488 £ 184,740 98,228 2,160 ___100 283,488 Question 2 (a) Uncorrected balance b/f Sales omitted (a) Bank – cheque dishonored (1) Balance b/d Sales Ledger Control A/C £ 12,550 Discounts omitted (d) 850 Contra entry omitted (f) 300 Bad debt omitted (g) Returns inwards omitted (j) _____ Amended balance c/d 13,700 12,500 £ 100 400 500 200 12,500 13,700 Note: Items (b), (c), (e), (h), (i) and (k) are matters affecting the personal accounts of customers. They have no effect on the control account. 521 Company Accounts (b) Statement Of Adjustments To List Of Personal Account Balances £ £ Original total of list of balances 12,802 Add: debit balance omitted (b) 300 debit balance understated (e) 200 500 13,302 Less: transposition error (c ): understatement 180 of cash received cash debited instead of credited (2 x 500 £250) (h) discounts received wrongly debited to 50 Bell (i) Understatement of cash received (i) _72 __802 12,500 Question 3 (a) Balance Correction of error interest Balance George – Cash book £ 4,890 Bank charges (3) 320 Plant (4) £ 320 10,000 11,890 Cheque dishonored Correction of error in entering cheque (6) _____ Error in addition (7) 17,100 (b) Bank reconciliation Balance per bank statement Less lodgments not credited (2) Add: dishonored cheque Add: outstanding cheque (1) Balance per cash book - overdrawn £ 12,800 2,890 9,910 980 1,000 11,890 980 4,800 1,000 17,100 Lesson Eight 522 Statement of effect on profit Profit per draft accounts Bank charges (3) Depreciation (4) Bad debt (5) Motor expenses (6) Additional depreciation (6) Purchases understated (7) Interest adjustment (8) Repairs to premises (9) £ 81,208 £ 320 1,000 980 2,100 600 1,000 320 __870 82,398 _6,300 76,098 ____ 6,300 (d) Journal George – drawings Repairs to premises Repairs to George’s house mistakenly charged as a business expense *Paul – accounts payable ledger account George – drawings £ 870 £ 870 540 540 Business account paid by personal cheque *Note: a debit to accounts payable ledger control account is also acceptable for this entry. Question 4 Four errors not disclosed by the Trial Balance: Error of Omission: This is where a transaction is completely omitted from the records i.e. not posted at all. Error of Commission: A transaction is posted in the wrong account but of the same class e.g. a credit sale posted in a wrong debtors account (e.g. to debtor 1 instead of debtor 2) Error of Principle: A transaction is not only posted to the wrong account but also the class e.g. an expense of plant repair posted to the plant account (an asset). Error of Original Entry: A transaction is posted to the correct accounts but the amount is incorrect e.g. a credit sale of £250 is posted to the debtor and sales account as £520. (Refer to the text for further details) 523 Company Accounts (b) (i) Suspense ABD Bank – loan DR (Sh) 10,000 CR (Sh) 10,000 Cashbook P& L – Rent received 4,000 P& L –Trading account Closing stock 1,500 4,000 1,500 P& L – discount allowed P&L – discount received P& L – Trading a/c opening stock Suspense Prepayments (prepaid insurance)) P& L Insurance receivable P& L - income 500 500 3,200 3,200 220 220 12,000 12,000 (ii) Statement of Corrected net profit (Sh) Net profit Add: Rent received Discount received Prepaid insurance Insurance receivable 4,000 500 220 12,000 Less: closing stock overvalued Discount allowed Opening stock Adjusted net profit (iii) ABD Loan Suspense A/c Sh 10,000 Balance b/d _____ Opening stock 10,000 1,500 500 3,200 (Sh) 64,000 16,720 80,720 (5,200) 75,520 Sh 6,800 3,200 10,000 Lesson Eight 524 Question 5 UNTS Pre-Adjusted Trial Balance Dr Cr £ l ases £ 40,00 0 WORKSHEET Adjustmen Adjusted ts Trial Balance Dr Cr Dr Cr £ £ 26,15 4 £ 26,15 4 36,24 6 es ng nce ncome ngs ure rs 4,814 4,307 350 25,00 0 14,50 0 6,140 1,060 82,79 5 4,638 946 82,79 5 es due d nce ec’d in ebts g stock ofit n ers 1 2 25,00 0 13,05 0 5,833 1,060 4,638 1,066 350 350 205 165 ed ission ciation 800 4,638 1,066 350 205 205 165 165 120 120 1,45 0 307 1,450 1,450 307 307 83,26 5 5 4,063 43,12 0 7 2,59 7 3 2,59 7 4 £ 40,00 0 615 25,00 0 13,05 0 5,833 1,060 120 Liab. 36,24 6 800 1,45 0 307 Asset s £ 5,164 4,307 615 165 £ Balance sheet 26,15 4 5,164 4,307 205 965 £ 36,24 6 820 ses ors ission £ 40,00 0 T&P&L Account Dr Cr 120 83,26 5 6 5,008 5,008 43,12 0 8 49,21 6 9 49,21 6 10 Question 6 Purpose of Control Accounts i. To provide for arithmetic check on the postings made in the individual account i.e. either the sales ledger or the purchases ledger. ii. To provide a quick total of the debtors and creditors balances to be shown in the trial balance. 525 Company Accounts iii. To detect and prevent errors and frauds on the debtor and creditors account. iv. To facilitate delegation of duties especially where the debtors and creditors are many. Lesson Eight Bal b/d Sales Bills received dishonored Charges payable Bal c/d Bal b/d Returns outwards Bills payable Bank Cash Balance c/d Sales Sh 6,185,000 8,452,000 88,500 526 Ledger Control A/C Bal b/d Returns inwards Bank 10,000 Cash Bad debt Discounts allowed 44,000 Bal c/d 14,779,000 Purchases ledger control a/c Sh 16,500 Bal b/d 284,000 Purchases 930,000 Bills payable dishonored 473,200 88,500 _4,196,500 Balance c/d 10,396,000 Sh 52,500 203,500 7,985,000 153,000 64,500 302,000 5,404,000 14,779,00 0 Sh 4,285,000 5,687,500 400,000 ___23,500 10,396,00 0 527 Company Accounts LESSON SIX Question 1 (a) Dare Statement of Capital as at 1 January 1996 Assets £ Stocks Debtors Rates prepaid Fixtures Liabilities Bank overdraft (add unpresented cheques) Accrued expenses Creditors Loan Accrued interest [4,000 x 3% x 3 /12] Heating and lighting £ 4,500 2,800 40 2,500 10,140 1,172 240 1,800 4,000 30 80 (7,322) 2,818 (b) Dare Profit and loss account for the year ended 31 December 1996 £ £ Gross profit 9,000 Discounts received 480 9,480 Less expenses Rent and rates 465 Fixtures and fittings 350 (depreciation) Lighting and heating 200 General expenses 450 Loan interest 120 Wages 2,914 Sundry expenses 140 Discounts allowed 520 Bad debt 200 (5,659) Net profit 3,821 Lesson Eight 528 (c) Dare Balance Sheet as at 31 December 19X6 Non current assets £ Fixtures and fittings Current assets Stocks Debtors Prepayments Bank (less unpresented cheques) Cash Current liabilities Creditors Accruals Capital Net profit Less drawings Non current liabilities Loan – 3% 2,200 _290 £ £ 2,550 5,800 3,000 50 673 __20 9,543 (2,490) 7,053 9,603 2,818 3,821 6,639 (1,036) 5,603 4,000 9,603 Question 2 AB Sport and Social Club Income and Expenditure Account for the year ended 31 December 20X5 £ £ Income Subscriptions (W1) 10,690 Bar and café profit (W2) 9,200 Sale of sportswear (W3) 1,400 Hire of sportswear (W5) 1,700 Deposit account interest 800 23,790 Expenditure Rent of clubhouse 6,000 Groundsperson 10,000 Heating oil (W6) 4,500 Depreciation 5,000 x 10% 500 (21,000) Surplus of income over expenditure for 2,790 the year 529 Company Accounts AB Sport and Social Club Balance Sheet as at 31 December 20X5 £ Non current assets Equipment for grounds person: cost Depreciation (3,500 + 500) £ 5,000 (4,000) 1,000 Current assets Heating oil Bar and café stocks Sports equipment for sale (4,000 – 2,000) Sports equipment for hire (1,000 + 500) Subscriptions in arrears Bank deposit account Bank current account 700 5,000 2,000 1,500 90 16,000 1,300 26,590 Current liabilities Creditors for bar and café purchases Creditors for sportswear Creditors for heating oil Subscriptions in advance 800 450 200 _200 1,650 Net current assets Net assets Accumulated fund b/f Surplus for the year Accumulated fund c/f 24,940 25,940 23,150 2,790 25,940 Workings: Subscriptions Arrears b/f 1.1.X5 (10 + 230) Subscription income for year (bal fig) Advance c/f 31.12X5 SUBSCRIPTIONS £ £ 240 Advance b/f 40 1.1.X5 10,690 Cash received 11,000 __200 Arrears c/f ___90 31.12.X5 11,130 11,130 Note: The write off of the 20X3 arrears (£10) is dealt with in the above working. Bar and café profit £ Sales Cost of sales Opening stock Purchases* £ 20,000 7,000 8,800 15,800 (5,000) Closing stock 10,800 Profit 9,200 *Note: Purchases are 9,000 + 800 – 1,000 = £8,800 Lesson Eight 530 Sale of sportswear £ Sales Opening stock Purchases (W4) £ 5,000 3,000 3,100 6,100 (4,000) Closing stock Closing stock Gross Profit Sportswear written down Net profit (2,100) 2,900 (1,500) 1,400 Purchases of sportswear £ 4,500 450 (300) 4,650 For hire 1/3: £1,550 Bank Add closing creditors Less opening creditors For sale 2/3: £3,100 Hire of sportswear £ Receipts Costs* Opening stock Purchases (W4) £ 3,000 750 1,550 2,300 (1,000) Closing stock (1,300) 1,700 Profit *Note: While there is a case for treating the sportswear for hire as non current assets, in club accounts it is more usual to treat such items as stock in trade. Heating Oil Opening stock Purchases (4,000 + 200) Less closing stock Expense for year £ 1,00 0 4,20 0 5,20 0 (700 ) 4,50 0 531 Company Accounts Question 3 Mr Cherono Manufacturing Profit and loss Account for the year ended 30 June 1988 Raw materials Opening stock 40,0000 Purchases 855,000 895,000 Less closing stock (80,000) Raw materials consumed 815,000 Wages _50,000 865,000 Factory overheads Wages 96,000 Rent and rates 22,500 Water and electricity 13,000 131,500 Cost of goods completed 996,500 Factory profit ___3,500 Transfer price 1,000,000 Sales Less cost of sales Opening stock Purchases and cost of goods produced Less closing stock Gross profit Profit on disposal of motor vehicle Factory profit Less expenses Interest on loan Depreciation – fixtures and fittings Motor vehicles Wages Rent and rates Water and electricity Motor expenses Bad debt Repairs Bank charges Insurance Sundry expenses Commission to lampshade employee Less UPCS Net profit 4,100,000 348,000 3,400,000 3,748,000 (282,000) (3,466,000) 634,000 4,000 3,500 641,500 36,000 90,000 38,000 108,000 67,500 39,000 60,800 14,000 12,000 4,000 13,500 25,200 318 __120 (508,438) 133,062 Lesson Eight Cherono Balance Sheet as at 30 June 1998 Non current assets Fixtures and fittings Motor vehicles Current assets Stock: Raw materials Lampshades Less UPCS Other goods Debtors Prepayments Bank balance Current liabilities Creditors Accruals Capital Add net profit Less drawings Add loan 532 Cost 900,000 152,000 1,052,000 80,000 30,000 (120) 252,000 107,000 27,318 Depreciatio n (440,000) (38,000) (478,000) NBV 460,000 114,000 574,000 361,880 108,000 10,500 _98,000 578,380 (134,318) 444,062 1,018,062 740,000 133,062 873,062 (95,000) 778,062 _240,000 1,018,062 533 Company Accounts Question 4 Olympiad Athletics Club Income and Expenditure Account for year ended 31 October 1983 £ £ Income Annual subscriptions (4,680 + 70 + 230 – 4,740 (140 + 100)) Entrance fees 250 Life membership fees credited (850 + 53) 903 5,893 Training ground fees (7,660 – 470 + 325) 7,515 Sales of sporting requisites 8,774 Investment interest received 626 Insurance commissions received (53 – 11 55 + 13) Advertising revenue 603 Profit on sale of furniture (370 – 350) 20 Total income 23,486 Expenditure: Cost of sporting requisites sold (5,270 + 202 – 163 = 5,309 (purchases) 5,309 + 811 – 1,064 = 5,056) 5,056 Damaged stock etc 137 Wages of grounds man (250 + 3,600 – 3,550 300) Postages (692 – 4) 688 Stationery (55 + 629 – 36) 648 Rates (300 + 846 – 380) 766 Subscriptions in arrear written off 40 World-wide Athletics Club affiliation fee 50 Training ground upkeep 1,200 Depreciation: buildings 3,500 Furniture, equipment etc (10% x (7,900 – 800) __710 Total expenditure 16,345 Surplus of income over expenditure £7,141 Lesson Eight 534 Olympiad Athletics Club Balance Sheet as at 31 October 1983 Non current assets Land Buildings Furniture, equipment, etc £ Cost 4,000 35,000 7,100 46,100 Investments Investments at cost (7,400 + 5,600) (current valuation £13,150) Current assets Stocks – sporting requisites - stationery - stamps Debtors – subscriptions - insurance commissions Prepayments (300 + 380) Bank – deposit account - current account Cash Current Liabilities Creditors – prepaid subscriptions - Prepaid training - Ground fees - Premiums - Sporting requisites £ Depreciati on 12,900 4,410 17,310 £ Net 4,000 22,100 2,690 28,790 13,000 927 36 4 230 13 680 3,000 2,563 122 7,575 100 470 160 202 932 Working capital Net assets employed Financed by: Accumulated fund: as at 31 October 1982 Add: Surplus of income over expenditure for the year As at 31 October 1983 Life membership fund (4,720 + 530 – (850 + 53) 6,643 48,433 36,945 7,141 44,086 4,347 £48,433 535 Company Accounts Accumulated fund b/f Assets: Land Buildings Furniture Investment Stocks Debtors Prepayments cash Liabilities Creditors: Subscriptions Training Premiums Sporting requisites Bank overdraft Membership fund 4,000 25,600 3,750 7,400 866 191 550 ___73 42,430 70 325 102 163 105 4,720 (5,485) 36,945 Lesson Eight 536 LESSON 7 Question 1 Kimeu & Mwangi Manufacturing,Trading Profit and Loss account for the year to 31.3.x 2 Shs Shs Raw materials Opening stock 100,700 Purchases 716,250 816,950 Less stock of raw materials (79,500) Raw materials consumed 737,450 Factory wages 382,500 Prime cost 1,119,950 Add opening w/p 85,000 Less closing w/p (126,250) (41,250) 1,078,700 Factory overheads Depreciation on plant 84,375 Factory expenses 354,000 438,375 Factory cost of completed goods 1,517,075 Add factory profit ( missing figure) 192,925 Transfer price given in the question (par) 1,710,000 (38,000 x 45) Sales Cost of sales Opening stock of finished goods Transfer price Less closing stock of finished goods 2,775,500 1,200,000 1,710,000 2,910,000 (10,125,000 ) 878,000 192,925 1,070,925 Add factory profit Expenses Depreciation on delivery van Sales department wages Selling department expenses Increase for provision for bad debts Provision for unrealized profits Net profit Share of factory profits K M Share of remaining profit K M (1,897,500) 80,250 150,750 277,500 5,000 112,500 154,340 38,585 100,800 151,200 (626,000) 444,925 (192,925) 252,000 252,000 537 Company Accounts Workings for closing stock of completed units Completed units b/f Units manufactured Less units sold Closing stock Drawings Bal c/d K 15,00 0 105,1 40 255,1 40 30,000 38,000 (45,500) 22,500 x 45 = 10,125,000 M 125,00 0 54,785 Share of factory profit Balance of profit 189,78 5 Kimeu & Maingi Balance Sheet as at 31 March 1992 Non current assets Property, plant and equipment Freehold factory Factory plant ( 843,750 – 151,250 – 84,375 = 608,125) Delivery van ( 401,250 – 80,250 – 86,250 = 234,750) K 154,34 0 100,80 0 255,14 0 M 38,585 51,200 189,785 Shs Shs 1,053,750 608,125 234,750 1,896,625 Current Assets: Stock: Raw materials W.I.P Finished goods Debtors Current Liabilities Bank overdraft Trade creditors Accrued expenses and deferred income 79,500 126,250 900,000 405,000 1,510,750 (176,200) (150,000) (86,250) (412,450) Net current assets 1,098,300 2,994,925 1,400,000 1,425,000 2,825,000 Capitals: K M Current A/c: K M 105,140 64,785 169,925 2,994,925 The finished good is net of the unrealized profit on closing stock. Lesson Eight Question 2 Amis Lodge and Pym Trading, Profit and loss appropriation account for year ended 31 March 19-8 £ £ £ Sales 404,500 Less Opening stock 30,000 Purchases 225,000 Carriage inwards 4,000 229,000 Plant depreciation 259,000 Closing stock (35,000) Cost of sales (224,000) Gross profit 180,500 Discount received 4,530 Interest received ____750 185,780 Expenses Carriage outwards 12,000 Vehicle depreciation 15,000 [25% x (80,000 – 20,000)] Depreciation of plant 20,000 [20% x 100,000] Discounts allowed 10,000 Office expenses [30,000 + 405] 30,805 Rent, rates , heat and light 7,300 [8,800 – 1,500] Provision for bad debts increase [(5% x 14,300) – 420] 295 (95,400) Net profit for year 90,380 Interest charged on drawings etc Amis 1,000 Lodge 900 Pym 720 2,620 93,000 Less Salary – Pym 13,000 Interest on capital accounts Amis 8,000 Lodge 1,500 Pym 500 23,000 Residual profit 70,000 Less Share of residual profit Amis ( 5/10) 35,000 Lodge (3/10) 21,000 Pym (2/10) 14,000 70,000 (b) 538 539 Balances Drawings Appropn – interest Bal c/d Company Accounts A £ 1,00 0 25,0 00 1,00 0 16,0 00 43,0 00 L £ 500 22,00 0 900 _____ 23,40 0 Current Accounts P A £ £ 400 Appropn – salary 15,0 8,00 00 Interest 0 720 35,0 Residue 00 11,3 Bal c/d _____ 80 27,5 43,0 00 00 L £ 1,500 P £ 13,00 0 500 21,00 0 900 14,00 0 ____- 23,40 0 27,50 0 Question 3 Amber, Beryl and Coral Trading, Profit and Loss Account for the year to 31 December 1996 £’000 £’000 Sales 2,000 Cost of sales Opening stock 180 Purchases 1,400 1,580 Closing stock (200) 1,380 Gross profit 620 Expenses Wages and salaries (228 240 + 12) Sundry expenses 120 Bad and doubtful debts 26 Depreciation: Building 5 Plant and 24 equipment Interest on loan – Amber __5 420 Net profit 200 Assume profit is earned proportionately throughout the year Profit and Loss Appropriation Account 1/1X6 to 30.6.X6 Salaries Share of profit: £80,000 (60:40) 1.7.X6 to 31.12.X6 £100,000 (40:40:20) Amber £’000 Beryl £’000 Coral £’000 10 10 20 48 32 80 40 98 40 82 20 20 Total £’000 100 200 Lesson Eight 540 Amber, Beryl and Coral Balance Sheet as at 31 December 1996 Cost or Aggregate valuation depreciatio n Non current assets Land at valuation 280 Nil Buildings 250 35 Plant, equipment and 240 74 vehicles 770 109 Current assets Stock 200 Debtors (420 – 16) 404 Less: provision for doubtful 30 debts 374 Cash at bank 38 612 Current liabilities Trade creditor 350 Bonus 12 362 Net current assets Long term loan – Amber Net book value 280 215 166 661 250 911 50 861 Represented by: Capital accounts: Amber Beryl Coral 368 242 100 Current accounts: Amber Beryl Coral 82 64 _5 710 151 861 Proprietor funds A £’00 0 Goodwill Balances c/f B £’00 0 80 368 80 242 448 322 CAPITAL ACCOUNTS C A £’00 £’000 0 Balances b/f 280 40 Cash 100 Goodwill 120 (W1) Revaluation 48 140 448 Balances b/f 368 B £’000 C £’000 210 140 80 32 322 242 140 100 541 Company Accounts Lesson Eight Drawings Balances c/f A £’00 0 28 82 B £’00 0 24 64 __ __ 110 88 542 CURRENT ACCOUNTS C A £’00 £’000 0 15 Balances b/f 7 5 Profit for 98 year __ Loan _5 interest 20 110 B £’000 C £’000 6 82 20 __ __ 88 20 Question 4 The solution provided has the workings shown beside the accounts to make the comparison easier. Remember to adhere to previous partnerships and departmental formats. (a) Aristocratic Autos Trading and Profit and Loss Account for year ended 30 September 1986 Working Worksho Petrol/oil Showroo Total s p m £ £ £ £ Sales and charges: 32,125 32,964 8,500 Cash 73,589 65,892 41,252 81,914 Credit 189,05 8 98,017 74,216 90,414 Total turnover 262,64 7 (2) (1) (3) (4) (5) (6) (7) 1,932 23,860 3,018 41,805 Less materials: 20,720 Opening stock 52,100 Purchases 25,792 44,823 72,820 (2,752) (2,976) 23,040 41,847 47,510 Usage 34,163 57,203 5,685 47,532 ____- Direct wages 47,510 Cost of sales 40,814 26,684 42,904 Gross profit 1,333 - 42,147 26,684 - Profit on sale of plant 42,904 7,024 2,613 1,939 4,477 16,898 32,951 9,196 2,945 2,185 3,389 8,324 16,843 9,841 4,391 10,200 7,880 5,846 4,130 11,302 43,749 (845) (25,310) Closing stock Less Indirect wages Salaries Rates Electricity General expenses Depreciation Total Net profit/loss for 25,670 117,76 5 143,43 5 (31,038 ) 112,39 7 39,848 152,24 5 110,40 2 1,333 111,73 5 11,415 10,200 13,438 9,970 11,996 36,524 93,543 18,192 543 Company Accounts year Less appropriations Interest on capitals Duke (5% x £50,0000 Earl (5% x £40,000) Residual profit* Duke Earl (2,500) (2,000) 13,692 (6,846) (6,846) *The equal division stipulated by the Partnership Act applies in the absence of agreement to the contrary. Lesson Eight 544 Aristocratic Autos Balance Sheet as at 30 September 1986 Working Worksho Petrol/oil Showroo s p m £ £ £ (8) (8) (4) (9) 5,020 24,891 4,260 4,859 29,911 9,119 2,752 1,365 2,586 316 7,019 2,976 537 2,915 1,605 8,033 4,225 915 5,140 1,879 31,790 5,602 564 6,166 1,867 10,986 Total £ Non current assets at written down value: 11,010 Freehold buildings 5,357 Plant, equipment and vehicles 16,367 Current assets: 25,310 Stocks - Debtors 7,799 Prepayments 30,470 Bank and cash 63,579 Current liabilities: 15,250 Creditors 983 Accruals 16,233 47,346 Working capital 63,713 Net assets employed 20,290 35,107 55,397 31,038 1,902 13,300 32,391 78,631 25,077 2,462 27,539 51,092 106,48 9 Financed by Capital accounts Duke 50,000 Earl 40,000 90,000 Current accounts: Duke 6,906 Earl 9,853 (10) (10) 16,489 106,48 9 Working s (1) Plant disposal: Cost Accumulated depreciation Written down value Proceeds Profit on sale Worksh op £ Petrol/oil £ showroo m £ 19,500 (15,633 ) 3,867 5,200 1,333 Total £ 545 34,050 113 34,163 6,810 214 7,024 5,199 (2,586) Company Accounts 5,602 83 5,685 ______- - 4,160 231 4,391 5,860 (2,915) 15,679 (7,799) 2,613 2,945 7,880 1,838 101 1,939 2,072 113 2,185 5,543 303 5,846 3,990 487 4,477 3,021 368 3,389 3,681 449 4,130 2,520 14,378 16,898 2,840 5,484 8,324 7,600 3,702 11,302 Worksh op £ Petrol/oil £ Showroo m £ 12,600 _____12,600 14,200 _____14,200 38,000 _____38,000 5,060 2,520 7,580 5,020 65,180 7,100 2,840 9,940 19,390 7,600 26,990 4,260 11,010 22,900 17,450 (2) Direct wages: Per list Accrual Total (3) Indirect wages: Per list Accrual (4) Rates (apportioned on basis of freehold buildings at (8) below: Per list Prepayment Total (5) Electricity apportioned on same basis as (4) above: Per list Accruals Total (6) General expenses (apportioned on basis of turnover: Per list Accruals Total (7) Depreciation: Charge for year per (8) below: Freehold buildings Plant, equipment etc Total (8) Freehold buildings (cost): At 1 October 1985 Additions during year Disposals during year At 30 September 1986 Provision for depreciation on freehold buildings: At 1 October 1985 Disposals during year Charge for year At 30 September 1986 Written down value at 30 September 1986 Plant, equipment etc. (cost): At 1 October 1985 39,652 ___196 39,848 10,970 445 11,415 26,738 (13,300 ) 13,438 9,453 517 9,970 10,692 1,304 11,996 12,960 23,564 36,524 64,800 _____64,800 31,550 12,960 44,510 20,290 105,53 0 Lesson Eight 26,210 (19,500) 71,890 1,060 Additions during year 31,790 _____- ____- Disposals during year 27,420 18,510 (19,500 ) 117,82 0 48,254 (15,633) 17,077 - 9,451 - 14,378 46,999 5,484 22,561 3,702 13,153 24,891 4,859 5,357 83 113 368 564 231 303 449 983 113 214 101 487 915 546 4,520 At 30 September 1986 Provision for depreciation on plant, equipment etc At 1 October 1985 Disposals during year Charge for year At 30 September 1986 Written down value At 30 September 1986 (9) Accruals (per workings above): (2) (3) (5) (6) 74,782 (15,633 ) 23,564 82,713 35,107 196 445 517 1,304 2,462 (10) Current accounts: Earl Duke Opening balance 9,750 Interest on capital 2,500 Residual profit 6,846 Drawings (12,190) Closing balance 6,906 10,477 2,000 6,846 (9,740) 9,583 Question 5 WORKINGS The first step is to derive the profit for the period:£ Closing Opening Assets minus external liabilities (17,000 + 3,480 + 1,100 + 2,230 + 3,370 – 980) Add back drawings (2,000 + 1,600 + 1,800) Less assets minus external liabilities (26,060 – 820) Profit for period (1st July to 31st October) 26,200 5,400 31,600 25,240 6,360 547 Company Accounts R £ - dwill w/o ng nces s of cd S £ 3,00 0 T £ 3,00 0 - 7,50 0 7,50 0 11,5 00 11,5 00 - - 10,5 00 10,5 00 Balance b/d Drawings Closing balance Exors of R (decd) CAPITAL ACCOUNTS A R S £ £ £ 1,5 Opening 9,000 8,00 00 balances 0 Goodwill 2,500 2,50 raised 0 4,0 Bank 00 Capital - Premium (1/5 x 7,500) 5,5 00 11,50 0 10,5 00 CURRENT ACCOUNTS A R £ £ - Balances b/d 140 - Appropriation 2,12 a/c 0 - (profit) R £ 2,00 0 - S £ 1,60 0 720 T £ 100 1,80 0 720 260 - - - 2,26 0 2,32 0 2,12 0 - 2,26 0 T £ 8,00 0 2,50 0 4,00 0 1,50 0 A £ - 4,00 0 1,50 0 10,5 00 5,50 0 - S £ 200 2,12 0 T £ 2,12 0 A £ - 2,32 0 2,12 0 - The Capital and Current Accounts are given as workings for the Balance sheet figures. LESSON 8 Question 1 (a) AZ Ltd Manufacturing , Trading Profit and Loss Account for the year ended 31 October 1999 Raw Materials Sh’000 Sh’000 Opening stock – Raw material 380 Purchases – Raw material 9,500 9,880 Less closing stock – Raw material (465) Cost of raw materials consumed 9,415 Add: direct wages 1,350 direct expenses _395 1,745 Prime Cost 11,160 Factory overheads Factory expenses 290 Indirect materials 350 Factory insurance 150 Depreciation – plant and 5,160 5,950 machinery Lesson Eight 548 17,110 Total cost of production Add opening W.I.P Less closing W.I.P – Finished goods Factory cost of production – finished goods Sales Less cost of sales Opening stock – finished goods Factory cost of production – finished goods Less closing stock – finished goods Gross profit Less expenses Sales room expenses Administration expenses Office salaries and wages Vehicle running expenses Bad debts w/o Overdraft interest Debenture interest Depreciation: furniture and equipment Motor vehicles Less dividend Net profit for the year Add retained profit b/d Less transfer to general reserve Retained profit c/d 560 17,670 (695) 16,975 28,550 420 16,975 17,395 (610) (16,785) 11,765 485 620 898 656 64 725 800 89 4,125 (8,462) 3,303 (4,000) (697) 5,500 4,803 (2,000) 2,803 549 Company Accounts AZ Ltd Balance Sheet as at 31 October 1999 Non current assets Land & Buildings Plant and machinery Furniture and equipment Motor vehicles Sh’000 30,000 25,800 890 16,500 73,190 Current Assets Stock – Finished goods Raw materials WIP Current Liabilities Bank overdraft Creditors Accruals Debenture interest Dividends accrued Financed by: Authorized and issued capital Capital reserve Share premium Revenue reserve General reserve Retained profit Non current liability 8% debenture Sh’000 (11,460) (274) (7,525) 19,259 Sh’000 30,000 14,340 616 8,975 53,931 610 465 695 7,360 9,130 1,175 1,000 783 800 4,000 (7,758) 1,372 55,303 40,000 500 2,000 2,803 45,303 10,000 55,303 STA Balance Sheet as at 1 November 19-6 Lesson Eight 550 £ Buildings Equipment Current assets Stock Debtors Bank Current liabilities Creditors 1,100 2,230 4,950 8,280 (980) Capital: Sam Ted Abe Current accounts: Sam Ted Abe Estate of Reg. £ 17,000 3,480 20,480 7,300 27,780 7,500 7,500 4,000 19,000 720 220 __- 940 19,940 7,840 27,780 551 Company Accounts KK Ltd Balance Sheet as at 31 October 1998 Shs ‘000’ Shs ‘000’ Shs ‘000’ Non Current Assets Freehold property Furniture and fittings Motor vehicles 44,500 1,540 3,500 49,540 (292) (965) (1,257) Goodwill Current Assets Stock Debtors Less provision for doubtful debts Rent receivable Cash at bank Current Liabilities Creditors Accrued expenses Debenture interest Tax payable Proposed dividends 500 4,398 1,540 (77) 332 189 350 8,960 4,500 1,463 35 10,492 16,388 (14,331) Authorized and issued share capital 1,500,000 ordinary shares of Sh. 20 each fully paid 10% debenture 2,057 50,840 30,000 Capital reserves Share premium Revenue reserves General reserve Profit and loss account 44,500 1,248 2,535 48,283 350 4,500 12,490 16,990 47,340 3,500 50,840 Lesson Eight 552 Question 3 (a) 1995 1996 Gross profit percentage Gross profit Sales 24,000 64,000 Current ratio Current assets Current liabilities 23,900 = 1.68:1 14,200 31,000 = 1.52:1 20,400 Quick ratio Current assets less stock Current liabilities 23,900 – 12,000 = 0.84:1 14,200 31,000 – 15,000 = 0.78:1 20,400 10,500 x 365 = 60 days 64,000 14,000 x 365 = 47 days 108,000 6,800 x 365 = 59 days 42,000 9,400 x 365 = 44 days 78,600 60,000____ = 70% 60,000 + 26,000 60,000____ = 55% 60,000 + 49,000 Debtors collection period Debtors x 365 Sales Creditors payment period Trade creditors x 365 Purchases (W) Gearing ratio Loan capital Total capital Cost of sales Add: closing stock Deduct: opening stock Purchases 1995 £’000 40,000 12,000 52,000 10,000 42,000 = 37.5% 32,400 = 30% 108,000 1996 £’000 75,600 15,000 90,600 12,000 78,600 (b) • • • The gross profit margin has fallen when compared with last year, although in absolute terms, both profit and sales are higher. Possibly the firm has lowered the price of goods to increase sales, although there may be other explanations (see part (c) below). There has been a reduction in liquidity as evidenced by a fall in both the current and the quick ratios. However, this is no immediate cause for concern as the company appears to be paying its creditors more promptly than last year. The debtors’ collection period, already satisfactory, has decreased still further from 60 to 47 days. There is not enough information to say whether this is all due to good credit control, or whether some sales are being made on shorter credit terms or for cash. 553 • • Company Accounts The creditors payment period has shortened. Possibly the company has become more efficient at paying creditors, or perhaps it is purchasing goods on shorter credit terms. The gearing ratio has reduced but it is still too high. The reduction is mainly due to an increase in retained profits and in the revaluation reserve. High gearing involves greater risk for the shareholders. Any two of the following: • • • An error in counting closing stock An increase in prices from suppliers not passed on to customers Deliberate reduction in margin in an attempt to increase sales volume (d) The position is not quite as clear-cut as this statement would suggest. Liquidity is important, and a company ought to be able to pay its debts as they fall due. However, an excessively high current ratio means that resources are tied up in stock, debtors and cash instead of producing profits. Current assets should generally be kept as low as is compatible with efficient production and paying creditors as they fall due. There is some truth in this statement. High gearing means greater risk, but also, in good times, greater returns. It is important that the percentage return to shareholders is greater than the percentage rate of interest being paid on the borrowings. Question 4 19X1 11 Feb 11 Feb 19X1 29 Sep 1 Nov £ 4,000 Cash Share capital (50,000 @ 70p) Share premium (50,000 @ 20p) Application and allotment account 19X1 £ 10 Feb Cash 35,000 16 Feb Cash 10,000 ______ £49,000 £49,000 Ordinary Share capital account 19X1 500 11 Feb Application and allotment account (50,000 @ 70p) 1 May Call account 50,000 (50,000 @ 30p) £ Forfeited shares Balance carried down 1 Nov ______ £50,50 0 Forfeited shares reissued £ 35,000 15,000 ___500 £50,500 Ordinary Share Premium Account 19X1 £ Lesson Eight 554 11 Feb 1 Nov Bal c/d 10,250 £10,25 0 19X1 1 May Share capital Application and allotment account (50,000 @ 20p) Forfeited shares reissued account 1 Nov 19X1 1 Nov 1 Nov ___250 £10,250 £ 15,000 Call account 19X1 1 May Cash _____ 29 Sep ___150 14,850 Forfeited shares £15,00 0 19X1 29 Sep 10,000 £15,000 Forfeited Shares 19X1 29 Share capital (500 Sep @ £1) £ 500 Call account 150 Forfeited shares reissued 350 ____ £500 £500 Share capital Share premium £ 500 Forfeited Shares 19X1 1 Nov Cash 250 1 Nov £ 400 Forfeited shares £750 350 £750 LESSON 8(PUBLIC SECTOR) MINISTRY OF UCHUMI NA UFANISI General Account of Vote 19-8 £ 19-7 £ June 30 Cash (P.M.G.) A/C Expenditure 192,428 June 30 Excess A.I.A A/C 4,560 June 30 Balance c/d 22,036 July 1 Exchequer A/C 213,464 19-8 June 30 Appropriations in Aid A/C 5,560 219,024 219,024 555 Company Accounts Exchequer Account 19-7 £ 19-8 £ June 30 Cash (P.M.G.) A/C 200,000 June 30 Balance c/d 13,464 213,464 July 1 General Account of Vote 213,464 213,464 Paymaster-General (P.M.G.) Account 19-8 £ 19-8 £ June 30 General Account of vote 192,428 June 30 Balance c/d 13,132 June 30 Exchequer A/C 200,000 June 30 General Account of vote – A.I.A 5,560 205,560 205,560 Statement of Assets and Liabilities at 30th June 19-8 £ Liabilities £ Assets G.A.V 22,036 Excess Appropriation in Aid 4,560 26,596 Exchequer A/C 13,464 Paymaster – General A/C 13,132 26,596 Notes Total of approved estimates is obtained by adding up the approved estimates in respect of expenditure of different heads. Appropriation in Aid is not included. Total expenditure is obtained by adding up the actual expenditure of different heads. Appropriation-in-Aid (realised) is not included. ANSWER TWO Commitment Accounting and Fund Accounting in relation to Public Sector are distinguished as under: Commitment Accounting This accounting system recognises transactions when the organisation is committed to them. This means that the transaction is not recognised neither when cash is not paid or received, nor when an invoice is received or issued but at an earlier stage when orders are issued or received. Under this system, the organisation is recognising the issue of an order as a commitment to incur expenditure and accounts continuously record commitments. The main purpose of commitment accounting is the budgetary control rather than financial reporting. Fund Accounting This system refers to the method of accounting which reports in terms of funds rather than in terms of organisations. This indicates the extent to which different funds are utilized and the form and extent to which individual fund accounts are consolidated in the final accounts. For example, if ten funds are used but they are all consolidated into one operating statement and one balance sheet, then the results might be the same as accounts for a business. A Member of Parliament Lesson Eight 556 The interest of a Member of Parliament will be on fiscal compliance. This refers to the extent to which the organisation has complied with conditions laid down in the authority to spend. A Tax Payer The main interest of a taxpayer will be to evaluate the management and performance. This refers to the need to know whether the money was spent wisely. In other words, this refers to the measurement of efficiency of the Government as regards the expenditure incurred and resultant increase in level of output. A Patient of one of the Hospitals A patient’s interest is on the services provided in the Government Hospitals. He can find out whether the expenditure incurred on health reflects the improvement in delivery of services. A Creditor to one of the Hospitals The interest of a creditor will be on the financial viability. He should find out whether the state has enough ability to pay against the goods supplied to the hospitals.