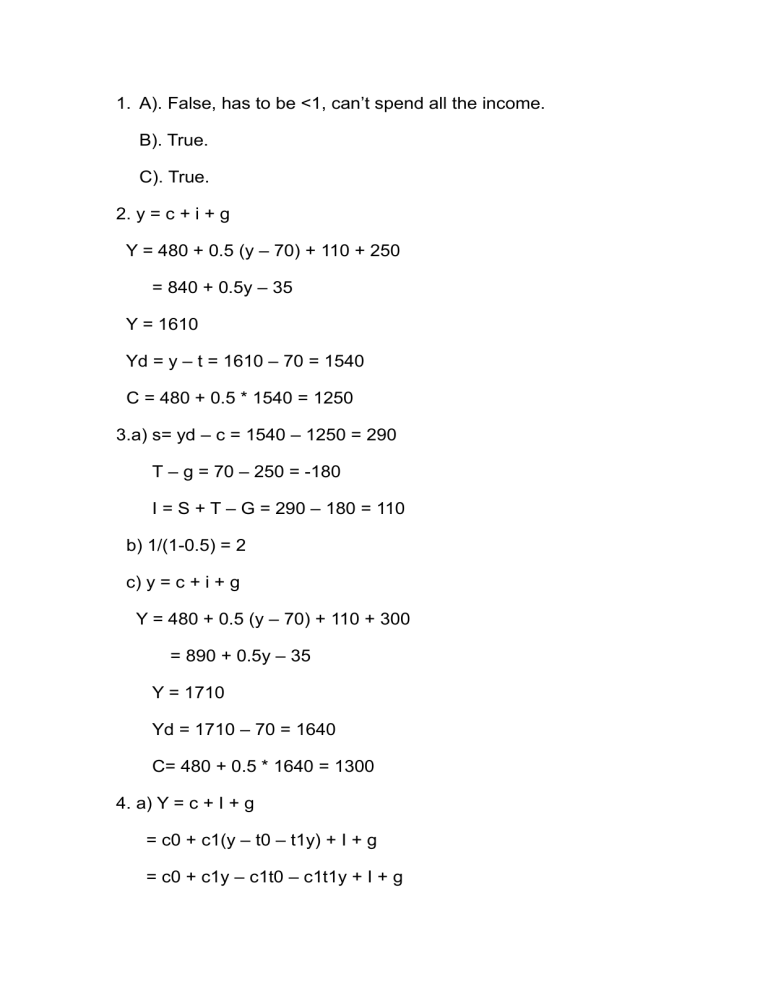

1. A). False, has to be <1, can’t spend all the income. B). True. C). True. 2. y = c + i + g Y = 480 + 0.5 (y – 70) + 110 + 250 = 840 + 0.5y – 35 Y = 1610 Yd = y – t = 1610 – 70 = 1540 C = 480 + 0.5 * 1540 = 1250 3.a) s= yd – c = 1540 – 1250 = 290 T – g = 70 – 250 = -180 I = S + T – G = 290 – 180 = 110 b) 1/(1-0.5) = 2 c) y = c + i + g Y = 480 + 0.5 (y – 70) + 110 + 300 = 890 + 0.5y – 35 Y = 1710 Yd = 1710 – 70 = 1640 C= 480 + 0.5 * 1640 = 1300 4. a) Y = c + I + g = c0 + c1(y – t0 – t1y) + I + g = c0 + c1y – c1t0 – c1t1y + I + g Y – c1y + c1t1y = c0 – c1t0 + I + g (1 – c1 – c1t1) Y = c0 – c1t0 + I + g Y = 1/ (1- c1(1 + t1)) * (c0 – c1t0 + I + g) b) 1/ (1- c1(1 + t1)) when t1 is positive, the multiplier is larger, the economy responds more to change in autonomous spending. c) change the output by varying the t1 and government spending. 1. a) 1/ (1 – c1) b) c1/ (1 – c1) c) (1 – c1)/ (1 – c1) = 1 government spending affects demand directly while taxes affect demand indirectly through consumption and the mpc is less than one. d) gdp increase by 1 unit. Not eco neutral. The model is not perfect. e) no effect. the balanced budget tax increase aborts the multiplier process initiated by the increase in government spending. 2. a) y = 1/ (1-c1 -b1) * (c0 – c1T – b0 + g) b) multiplier is 1/ (1-c1 -b1), b1 increases the multiplier increases b1 + c1 < 1 the numerator of multiplier should be positive. c) multiplier would be negative which indicates that as the autonomous value increase the output will decrease. People invest and consume over they earn. (e.g., Spend and invest more than $1 when income adds $1)? d) b0 increase, the output would also increase by the size of the multiplier, more than the change of b0, since after b0 increases the output increases and b1* Y would also increase. Therefore, investment will increase by more than b0. The economy would save more since that investment = saving in equilibrium situation.