Ch 9--Past IB Macroeconomic Questions

advertisement

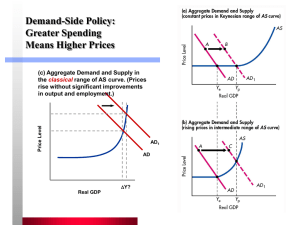

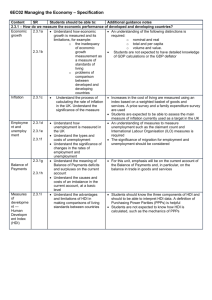

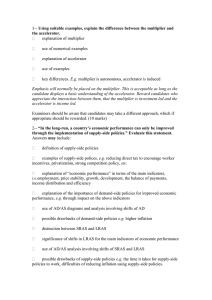

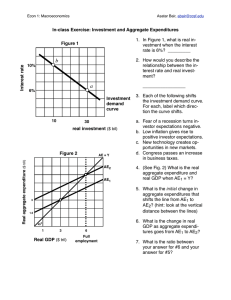

Past IB Macroeconomic Questions Question 1 examples, 60 minutes 1a--Explain how interest rates can be used to bring about an increase in economic activity. (10) 1b--Discuss the strengths and weaknesses of demand-side policies. (15) 2a-- Using one or more diagrams, explain the difference between the equilibrium level of national income and the full employment level of national income. (10) 2b-- Evaluate the policies a government may use to increase the full employment level of national income. (15) 3a—Explain the difference between progressive taxation and regressive taxation (10) 3b-- Evaluate the possible effects of a decrease in direct taxation on a country’s inflation rate, unemployment rate and balance of payments. (15) 4a-- Explain how the rate of inflation might be measured and the factors which might make accurate measurement difficult. (10) 4b-- Evaluate the extent to which an individual government can influence the rate of inflation in its economy. (15) 5a-- Explain how supply-side improvements to an economy may be achieved through the use of taxes and government spending. (10) 5b-- Evaluate the use of supply-side policies to reduce unemployment. (15) 6a-- Explain what the multiplier is and, using a numerical example, demonstrate how it can be calculated. (10) 6b-- Evaluate whether real Gross Domestic Product (GDP) can be increased by the use of demand-side policies. (15) Question 2 examples, 20 minutes 1-- Explain how an increase in government spending can lead to crowding out. 2-- Explain how a progressive tax system may be used to redistribute income. 3-- With the use of examples, explain the difference between a progressive tax and a regressive tax. 4-- Explain two ways a government can reduce its natural rate of unemployment. 5-- With reference to the concept of the multiplier, explain how the level of national income might be affected by a new government spending project worth $100 million. 6-- Using an appropriate diagram, explain how a government decision to decrease income tax rates could lead to a movement along the short-run Phillips curve. 7-- Using a diagram, and assuming a neo-classical aggregate demand/aggregate supply model, explain the short-term and long-term effects of a rise in aggregate demand when a country is at full employment. 8-- A government decides to increase its spending on new roads, recognizing that there will be a multiplier effect on national income. Using a numerical example, explain what may determine the size of the multiplier.