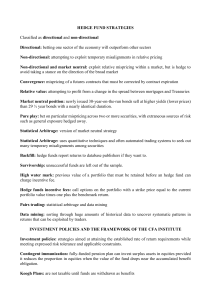

Market Sense and Nonsense How the Markets Really Work ( PDFDrive )

advertisement