Wealth Management Overview

Wealth Management Overview

What is Wealth Management?

Financial services provided to wealthy clients, mainly individuals and their families.

• More expansive than asset management

• Large scope of careers

• Large scope of securities researched, analyzed, and managed

• Entrepreneurial

Career Options

• Financial Advisor

• Client Associate

• Operations Associate

Types of Firms:

• National Wirehouse: o Examples: Merrill Lynch, Morgan Stanley, JP Morgan, Wells Fargo

• Independents (RIAs) o Example: LPL Financial, Acme Capital

• Banks o

Examples: Citizen’s Bank, Sovereign Bank, Rockland Trust

Investment management overview

Individuals, families Institutional investors

Wealth managers Internal managers

Internal asset allocators

Portfolio consultants

Fund of funds

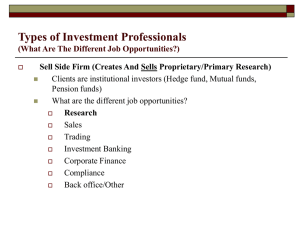

Sell side research

Independent research

Market research

Arrows indicate flow of capital

Mutual funds

Hedge funds

Index funds

External legal counsel

Hedge Funds Overview

What are hedge funds?

Investment partnerships managing relatively small pools of capital, specialized in investment style and/or asset class.

• (Relatively) unregulated o Flexible in ability to invest, but restricted in whose money we can manage

• Unique profit split and downside protection features: o 2 / 20 economics – performance oriented, volatility agnostic o Absolute performance, hurdles, high water marks

• Styles: specialized and concentrated o E.g. value, long/short, trading, special situations, global macro

• Small firms vs. big firms o Less silos - more independence o o o

Less politics/bureaucracy - more of your voice

Less splitting of the pie

No less job security

Career options

•

Research analyst o o

Reading: SEC filings, transcripts, product literature, news

Phone: Talking to management, competitors, customers o Traveling / meeting: Meeting management, site visits, shareholder meetings, conferences o Modeling: Excel, valuation, projections

• CFO / COO

• Trader

•

Legal counsel

• Marketing

Ancillary career options:

•

Sell-side research o CraigHallum, B. Riley, Needham, Northland, Sidoti, all the major banks…

• Independent research: o E.g. Telsey, Zelman, Hedgeye

•

Market research: o E.g. Gartner, Forrester, IDC

Job hunting / interviewing at hedge funds:

•

You will likely get a job through a reference

• Some hedge funds are continuously interviewing

• Resume – don’t fluff it up, keep it short, have someone in industry look it over o

Don’t use pre-canned cover letters/thank you letters. Email is fine. Keep it short.

o Attach a stock idea. One page. Bullet points.

•

Know your accounting and how to read financial statements.

•

Interviewers will look for the following in a entry-level analyst: o Integrity o o o o o o o o

Intellectual Curiosity

Loyalty

Accounting skills and familiarity with financial statements

If they can picture working with you everyday

Interest/passion for investing

Clear and concise spoken communication

Style fit

Why you picked that firm

Mutual Fund Overview

What are Mutual Funds?

Generally speaking, a mutual fund is a type of investment that invests in securities (typically stocks or bonds) led by a portfolio manager.

Two Types:

1. Active: Actively managing with the goal of beating their benchmark. Example:

Fidelity Investments

2. Passive: Index funds that match a particular index. Example: Vanguard

Career Options

• Investment Associate

• Junior Analyst

• Senior Analyst

• Portfolio Manager

• Operations Associate

• Information Technology

• Internal/External Wholesaler: Marketing/sales

Examples of Companies: Fidelity, Vanguard, Capital Research &

Management (American Funds), JP Morgan, Blackrock, PIMCO,

Franklin Templeton, Federated, Goldman Sachs, Eaton Vance,

Putnam