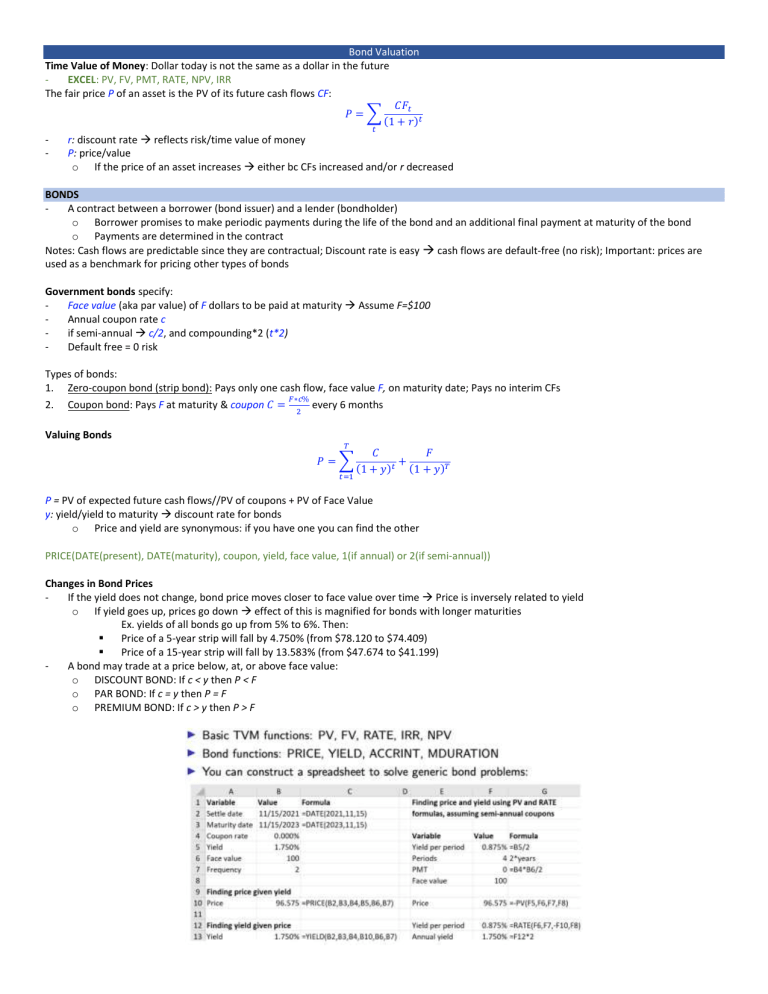

Bond Valuation Time Value of Money: Dollar today is not the same as a dollar in the future EXCEL: PV, FV, PMT, RATE, NPV, IRR The fair price P of an asset is the PV of its future cash flows CF: 𝐶𝐹𝑡 𝑃=∑ (1 + 𝑟)𝑡 𝑡 - r: discount rate reflects risk/time value of money P: price/value o If the price of an asset increases either bc CFs increased and/or r decreased BONDS A contract between a borrower (bond issuer) and a lender (bondholder) o Borrower promises to make periodic payments during the life of the bond and an additional final payment at maturity of the bond o Payments are determined in the contract Notes: Cash flows are predictable since they are contractual; Discount rate is easy cash flows are default-free (no risk); Important: prices are used as a benchmark for pricing other types of bonds Government bonds specify: Face value (aka par value) of F dollars to be paid at maturity Assume F=$100 Annual coupon rate c if semi-annual c/2, and compounding*2 (t*2) Default free = 0 risk Types of bonds: 1. Zero-coupon bond (strip bond): Pays only one cash flow, face value F, on maturity date; Pays no interim CFs 𝐹∗𝑐% 2. Coupon bond: Pays F at maturity & coupon 𝐶 = every 6 months 2 Valuing Bonds 𝑇 𝑃=∑ 𝑡=1 𝐶 𝐹 + (1 + 𝑦)𝑡 (1 + 𝑦)𝑇 P = PV of expected future cash flows//PV of coupons + PV of Face Value y: yield/yield to maturity discount rate for bonds o Price and yield are synonymous: if you have one you can find the other PRICE(DATE(present), DATE(maturity), coupon, yield, face value, 1(if annual) or 2(if semi-annual)) Changes in Bond Prices If the yield does not change, bond price moves closer to face value over time Price is inversely related to yield o If yield goes up, prices go down effect of this is magnified for bonds with longer maturities Ex. yields of all bonds go up from 5% to 6%. Then: Price of a 5-year strip will fall by 4.750% (from $78.120 to $74.409) Price of a 15-year strip will fall by 13.583% (from $47.674 to $41.199) A bond may trade at a price below, at, or above face value: o DISCOUNT BOND: If c < y then P < F o PAR BOND: If c = y then P = F o PREMIUM BOND: If c > y then P > F Spot Rates Pricing a bond by discounting each CF at its own discount rate (instead of 1) Time specific, they apply to a time, not a bond//yields are bond-specific and cannot be applied to other bonds Also called a zero-coupon rate appropriate rate to discount any risk-free CF that happens at time t: 𝐶 𝐶 𝐶+𝐹 𝑃 = 𝑃𝑉(𝐶𝐹𝑠) = + + ⋯+ (1 + 𝑟𝑇 )𝑇 1 + 𝑟1 (1 + 𝑟2 )2 Ex. Steps: 1. 2. 3. Use yield/price to find the yield/prices of bonds Bootstrap: use prices and yields to find the spot rates of each bond Use the spot rates to calculate other prices/yields of other risk-free bonds The Yield Curve The set of spot rates with different maturities (r1,r2,r3, etc.) make up the zero-coupon yield curve (also called spot yield curve) o There are other “types” of yield curves: coupon yield curve, corporate yield curve, etc. Information in the zero-coupon yield curve of is sufficient to price any risk-free bond o When news arrives, it affects investors’ expectations of inflation, demand for credit, economic growth, etc. o Bond prices change accordingly, as does the yield curve Normal/Upward Sloping - When bond maturity is higher, P is lower and Y is higher o When bond maturity higher, P higher, and Y higher: Intuition: market bad in short term so people want to get bonds back in long term, prices higher Inverted/Downward Sloping Straight: all spot rates the same so all yields for diff maturities are the same Arbitrage The practice of buying and selling equivalent goods or portfolios to take advantage of a price difference An arbitrage opportunity is a situation in which it is possible to make a profit without taking any risk or having any net cash outflows (free lunch) getting something for nothing with no risk Law of one price: in competitive markets, assets or portfolios with identical cash flows must have identical prices Arbitrage forces coupon and strip bond prices to be correct In well-functioning markets, arbitrage opps cannot exist for long (money lying on the street is quickly picked up); by exploiting an arbitrage situation, market participants push prices towards fair values All risk-free bonds are priced using one set of spot rates – otherwise there would be arbitrage More generally: it may be possible to value a complex asset by breaking it into individual pieces and valuing them separately When traded, assets have two prices o Ask price: the price at which you buy o Bid price: the price at which you sell In active (“liquid”) markets, ask and bid prices are typically close You can short-sell: sell an asset that you do not own 1. Borrow the asset from someone (typically through your broker) in exchange for a (usually small) fee 2. Sell the asset in the market for the current price 3. In the future, buy the asset back in the market and return it to the original owner Duration Duration of a bond: a measure of sensitivity of bond price to yield changes tells us by how many percent points price will change if yields change by 1% o Prices of bonds with higher duration are more sensitive to interest rate changes Ex. if yields go up by 0.5%, price of a bond with duration of 4 will fall by about 0.5%×4 = 2% If yields go down by 0.2%, price of a bond with duration of 15 will rise by about 0.2%×15 = 3% Longer-term bonds are more sensitive to yield changes the sooner you get your money back, the less changes in yields will affect you o Bonds with shorter maturities o Bonds with higher coupon rates o Bonds with higher yields Stock Valuation In addition to raising capital by issuing bonds, a firm can issue stock (aka equity) A stock is a claim that represents ownership in a firm Stockholders: o Collectively own the firm o Have the right to vote o Receive dividends 𝐹𝑎𝑖𝑟 (𝑜𝑟 ′𝑖𝑛𝑡𝑟𝑖𝑛𝑠𝑖𝑐 ′ ) 𝑝𝑟𝑖𝑐𝑒 = 𝑃𝑉 𝑜𝑓 𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑓𝑢𝑡𝑢𝑟𝑒 𝑐𝑎𝑠ℎ 𝑓𝑙𝑜𝑤𝑠 2 types of future cash flows: 1. Dividends 2. Free cash flows to the firm 2 discount rates: 1. Cost of equity: to discount cash flows to equityholders 2. WACC (weighted average cost of capital): to discount cash flows to both equityholders and debtholders Terminal value: the value of all cash flows after the forecast period Need an assumption about future (perpetual) cash flow growth rate perpetuity formula ∞ 𝑃𝑜 = ∑ 𝑡=1 𝐶𝐹𝑡 (1 + 𝑟)𝑡 If cash flows are constant: 𝑃𝑜 = If cash flows grow at a constant rate g per period: 𝑃𝑜 = 𝐶𝐹 𝑟 𝐶𝐹1 𝑟−𝑔 **last two formulas give PV of cash flows one period before the first cash flow happens! Discounted Cash Flow (DCF) Model 𝑃=∑ 𝑡 - 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒𝑡 (1 + 𝑟𝐸 )𝑡 CF each year is the div per share rE is the cost of equity, the rate of return equity investors expect (“require”) perpetuity 𝑃𝑉𝑡−1 = Then discount 𝑃𝑉𝑡−1 back to today 𝑃= 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑡 𝑟𝐸 − 𝑔 𝑃𝑉𝑡−1 (1 + 𝑟𝐸 )𝑡−1 Why dividend discount models don’t work well assume investors only value future cash dividends dividends are discretionary and have become less common over time, many companies don’t pay dividends doing a DCF using dividends is simplistic and likely wrong Equity valuation Equity value: 𝐸 = 𝑃 ∗ 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑠 𝐸=∑ 𝑡 𝑇𝑜𝑡𝑎𝑙 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠𝑡 (1 + 𝑟𝐸 )𝑡 Using rE denotes the expected return (future). Historical returns are called realized returns. Realized return: 𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑣𝑎𝑙𝑢𝑒 𝑃𝑟𝑖𝑐𝑒𝑡 + 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑡 − 𝑃𝑟𝑖𝑐𝑒𝑡−1 𝑃𝑟𝑖𝑐𝑒𝑡 − 𝑃𝑟𝑖𝑐𝑒𝑡−1 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑡 = = + 𝑠𝑡𝑎𝑟𝑡𝑖𝑛𝑔 𝑣𝑎𝑙𝑢𝑒 𝑃𝑟𝑖𝑐𝑒𝑡−1 𝑃𝑟𝑖𝑐𝑒𝑡−1 𝑃𝑟𝑖𝑐𝑒𝑡−1 Capital gain dividend yield Free Cash Flow Model Free cash flow (FCF): cash flow that is available for distribution to investors discount FCFs instead of dividends different from earnings: earnings do not tell us the amount of cash available to investors Revenues – costs = EBITDA – depreciation = EBIT – Taxes = Net Income + Depreciation = Operating cash flow – Capex – Increase in net working cap = Free cash flow (Revenue – Costs – Dep)×(1−TC) + Dep – Capex – Inc. in NWC Then find PV of all relevant free cash flows - Investors pay for future, not past cash flows o FCFF0 is in the past → not relevant to determine P But if we are given g we can use FCFF0 to get FCFF1, then discount FCFF at the given discount rate Firm valuation 𝑉=∑ 𝑡 V: firm value total value of debt and equity 𝐹𝐶𝐹𝐹𝑡 (1 + 𝑊𝐴𝐶𝐶)𝑡 𝐸 = 𝑉−𝐷 𝑃= 𝐸 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑠 Discounting per-share free cash flows to the firm at the cost of equity gives the fair per-share value of equity for a firm with no debt. Multiples Valuation Different multiples used for different companies/situations EV/EBITDA: the ratio of enterprise value (value of debt+equity) to EBITDA Price-earnings ratio: Price/Earnings Price-to-sales ratio: common for companies with negative earnings Sector-specific multiples o Price per user (social media) o Price per flowing barrel (oil) Valuation outcome is only as good as the multiple used Choose a comparison peer group with similar fundamentals Common to take average or median of multiples of the peer group Pros of multiples valuation: Easy to understand and apply Requires few (explicit) assumptions and forecasts Reflects current market conditions Cons of multiples valuation: Problematic if there are no truly comparable peers Assumes that the peer group is correctly valued by the market Make a number of (implicit) assumptions Some multiples depend on how much debt a firm has Risk and Return Assumptions: investors prefer investments with higher returns and lower risk, i.e., prefer more wealth to less and are risk averse o If A and B have the same risk, but A has higher expected return, prefer A o If A and B have the same expected return, but A has lower risk, prefer A Risk-return trade-off: returns on investments vary with risk o Investors expect (or “require”) a higher return to take more risk When deciding how to invest, investors care only about expected return and risk Goal is to combine assets into the best portfolio: each asset i has a weight wi Each asset has: o an expected return E(R); o a standard deviation of returns (also called volatility) σ measures how much “dispersion” exists around the mean investors prefer lower std. devs, all else equal variance: σ2 returns of each pair of assets i and j has a correlation 𝐶𝑜𝑣𝑎𝑟𝑖𝑎𝑛𝑐𝑒(𝑅𝑖 , 𝑅𝑗 ) 𝑃𝑖𝑗 = 𝜎𝑖 𝜎𝑗 Where -1 ≤ Pij ≤ 1 o measures how returns of i and j co-move over time Modern Portfolio Theory Answers: how should investors build the ‘best’ possible portfolios for themselves? Case 1: 2 Risky Assets Stocks A and B form portfolio P with weights wA and wB where wB= 1 - wa Expected return of portfolio P: 𝐸(𝑅𝑃 ) = 𝑤𝐴 𝐸(𝑅𝐴 ) + 𝑤𝐵 𝐸(𝑅𝐵 ) The standard deviation of portfolio P: 𝜎𝑃 = √𝑤𝐴2 𝜎𝐴2 + 𝑤𝐵2 𝜎𝐵2 + 2𝑤𝐴 𝑤𝐵 𝜎𝐴 𝜎𝐵 𝜌𝐴𝐵 To create this graph: show how the risk of the portfolio depends on correlation ρAB start with ρAB = 1: o For each set of weights, get E[RP] and σp, and plot point on graph wA =1 and wB =0 wA =0.9 and wB =0.1 … wA = 0 and wB = 1 Connect the dots Then do the same for ρAB = 0.5, ρAB = 0, ρAB = −0.5, etc. By forming a portfolio P, investors can reduce risk through diversification E[Rp] is a weighted average of E[RA] and E[RB] σP is less than a weight average of σA and σB when ρAB < 1 o stocks A and B do not move perfectly together so some risks are “averaged” out The benefit of diversification depends on ρ If ρ = 1, there is no diversification benefit (σP = wA σA + wB σB) If ρ = -1, all risk can be eliminated (with some weights, wA and wB, σP = 0) Investors hold only efficient portfolios portfolios with the highest expected return for a given level of risk Case 2: Many Risky Assets 2 risky assets + a ‘good’ risky asset 2 risky assets + a ‘bad’ risky asset Modern Portfolio Theory - As assets are added, the possible portfolios become better A ‘bad’ asset may be attractive if its correlation with other assets is low Efficient frontier: the set of portfolios that give the highest expected return for a given level of risk o All investors hold portfolios on the efficient frontier o The specific (efficient) portfolio an investor holds depends on how much risk they are willing to take (e.g., John prefers less risk, Jane prefers more) Case 3: Many Risky Assets and a Risk-Free Asset Suppose John and Jane have different risk preferences chose different efficient portfolios on the same efficient frontier They have the same efficient frontier because they have the same expectations about investment opportunities Assume: o All investors have the same (homogeneous) expectations about means and variances of risky assets and correlations o Investors can borrow or lend at RF Risk free asset has no risk, so σRF = 0 Standard deviation of a portfolio that combines asset A and a risk free asset: 2 2 𝜎𝑃 = √𝑤𝐴2 𝜎𝐴2 + 𝑤𝑅𝐹 𝜎𝑅𝐹 + 2𝑤𝐴 𝑤𝑅𝐹 𝜎𝐴 𝜎𝑅𝐹 𝜌𝐴𝑅𝐹 = 𝑤𝐴 𝜎𝐴 Any portfolio that includes RF and A falls on a straight line connecting RF and A If investors behave as we assumed: All investors hold the same optimal portfolio of risky assets, M The optimal portfolio for any investor is a combination of the risk-free asset RF and optimal risky portfolio M The exact combination depends on each investor’s risk preferences - o Between RF and M: wRF > 0 and wM > 0 (positive amounts in both RF and M) o Right of M: wRF < 0 and wM > 1 (borrow at RF, invest own+borrowed cash in M) M must contain all (market-cap weighted) risky assets: it is the market portfolio Caveats Some of the assumptions we made are reasonable Investors prefer more wealth, less risk There are no transaction costs; assets are infinitely divisible Investors can borrow / lend at RF Other assumptions? Investors are rational (maybe?) Investors only care about mean and variance of returns (returns follow a normal distribution) (probably not) Investors have the same expectations (probably not) Diversification By holding a well-diversified portfolio Investors can reduce risk without sacrificing expected return Some risks get “averaged out”: returns of a diversified portfolio are less likely to be very high or very low Some risk still remains Portfolio M is the most diversified portfolio (contains all risky assets) Investors are rational and understand that if they don’t hold M then they are not fully diversified and are taking on avoidable risks What types of risk can and cannot be diversified? Total risk (σ) = Market risk + Firm-specific risk ✓Firm-specific risk can be eliminated by diversifying Idiosyncratic Positive news from one firm cancels out negative news about another Do NOT expect higher return from taking on firm specific risk Market risk is what gives higher returns ✗Market risk cannot be eliminated by diversifying Market risk is what remains in portfolio M Beta/portfolio risk: This risk is part of the market no hiding from it Beta risk Systematic risk: A market shock affects all assets, but affects some more/less than others Rational investors invest in assets with higher market risk only if they get a higher expected return What does it mean for an asset i to have more market risk? Means that price movements of I are more sensitive to movements of the market M Price movements of i are measured by its period-by-period returns, Ri Market movements are measured by its period-by period returns, Rm Beta: the Measure of Market Risk Beta of any security i: - Measures how returns on asset i co-move with returns on M It is a measure of market risk Think of it as an ‘amplifier’ of (or sensitivity to) market returns It is typically measured using historical returns data Beta of the overall market is 1 (it co-moves one-to-one with itself) Assets with β > 1 have more market risk than the market Assets with β < 1 have less market risk than the market If beta of asset i is βi =2: Security i has twice as much market risk as M If the market goes up by 1%, security i is expected to go up by 2% If βi <0:Security i does well when the market does poorly think of it as an “insurance” asset Market Risk Premium Risk premium: higher return for more risk Market risk premium (beta): higher return for taking on ore market risk How should we measure market risk premium? An investor with β = 1 should get an expected return of E(RM) (recall βM = 1) An investor who has a portfolio without market risk (β = 0) should get RF So, the market risk premium (extra return per unit of beta) is: E(RM) – RF Other market risk premium attributes: Important since it affects estimates of how much extra return we should get Reflects risk tolerance of investors as a group Fluctuates over time Very hard to estimate Academics and practitioners use values between 4% and 6% Summary: If your portfolio has no market risk, your expected return should be RF If you do have market risk, you should also get an extra return of E (RM) − RF for each unit of β This extra return is the market risk premium Capital Asset Pricing Model CAPM: translates beta to a justifiable discount rate most important model of the relation between risk and return Standard model for estimating the cost of equity (rE) Portfolio beta is the weighted average beta of securities in the portfolio Use CAPM for valuations to estimate the cost of equity for any security WACC: Use WACC as discount rate to find firm value Use CAPM for Evaluating portfolio performance Portfolio should generate a return as the CAPM predicts (r is estimated rate of return) CAPM provides a benchmark for us to compare actual return to Diff between actual (“realized”) return on a portfolio and the expected return is called alpha - portfolio that generates more than CAPM predicts has a positive α portfolio that generates less than CAPM predicts has a negative α o Asset managers strive to generate α If a positive alpha opportunity arises, investors will trade on it and make it ‘disappear’ In competitive markets, expected α = 0 for all assets Use CAPM for Investment Strategies/Philosophies All securities / portfolios have expected alphas of zero o There are no under- or overvalued securities If you want to earn a higher return than the market, you have to take more risk o A portfolio’s return is determined by its beta o You cannot “beat the market” Investing is “simple” o Form a portfolio of M and RF based on your risk preferences o Stock-picking or paying professional investment managers high fees is not worthwhile Estimating Beta Use regression analysis Use realized returns (past) not expected returns (future) A security’s excess returns: Rit - RFt Market excess returns: RMt – RFt Regression estimate of beta equals: Multi-Factor Models CAPM fails to accurately predict returns on many assets, in particular Says all portfolios should fall on a straight line: the higher the value of β; the higher the expected return of portfolio o Never actually the case: portfolios are scattered – not on a straight line Small stocks: those with lower market value of equity – on average have done better than the CAPM predicts Value firms: those with high ratios of book equity to market equity – on average have done better than the CAPM predicts Winner stocks: those with high recent returns – on average have done better than the CAPM predicts Factors other than beta seem to affect expected returns: get a ‘better’ estimate of E(Ri) if we account not only for market risk but also for risk related to size and book equity to market ratio (B/M) Fama and French: Small stocks and value stocks earn higher returns because they are riskier Size and value characteristics capture non-diversifiable risks not captured by market risk We are not sure what these risks are, but they are correlated with size and value (book-to-market) characteristics add size and value risks (betas) to the CAPM: If an asset ‘moves like’ a small stock, it likely has high size risk si If an asset ‘moves like’ a value stock, it likely has high value risk hi Size factor risk premium is the difference in expected returns of ‘risky’ (small, S) stocks and ‘safe’ (big, B) stocks: Value factor risk premium is the difference in expected returns of ‘risky’ (high book-to-market, H) stocks and ‘safe’ (low book-to-market, L) stocks: Fama French 3 Factor Model: 3 types of risk: market, size, and value risks, measured by β, s, and h betas For each of these risks, you should get extra expected return: market, size, and value premiums Carhart 4-Factor Model - Added momentum risk: If an asset ‘moves like’ a winner, it likely has high momentum risk, m Momentum risk premium: difference in expected returns of ‘risky’ stocks (those that went up, U) and ‘safe’ stocks (those that went down, D): Multi-Factor Models Pros Work ‘better’: they explain some important CAPM errors such as those due to size, value, and momentum factors Explain historical returns better than the CAPM Are widely used by both academics and industry professionals Have the same logic as CAPM: E(Ri) is determined by how much risk you take and the compensation (premium) for that risk Cons Lack of theoretical motivation: What non-diversifiable risks do size and value capture? These models are still not perfect cost of equity is forward looking, in addition to market risk premium also need forward looking estimates of SMB, HML, etc (additional estimation error) Risk interpretation of some factors is debated Summary: Expected returns should equal the risk-free rate plus the return for taking on risks According to the 4-factor model, there are four sources of risk Each source of risk has a ‘reward’ (extra expected return, aka risk premium or price of risk) per unit of risk Performance of Fund Managers According to CAPM alpha, a manager who is invested in small value stocks may have a higher alpha thank someone invested in large growth stocks Better gauge of fund performance: Adjust for differences in all risks (not just market) by computing FF alpha Style Analysis Fund managers declare the investment “style” in the fund’s prospectus and often in the name of the fund, e.g., RBC US Small-Cap Value Equity Fund Suggests that the fund invests in US small-cap, value stocks Closet indexing is a strategy used to describe funds that claim to actively purchase investments but wind up with a portfolio not much different from the benchmark. Use the FF 3 factor model to check: Write model in terms of realized returns, and move RF to left side Use multiple regression to estimate coefficients: Steps to estimate FF 3-factor model (use same approach for other MFMs) 1. Collect returns on fund i you are interested in, Rit 2. Collect returns on the risk-free asset, RFt 3. Collect returns on the factors: RMt, SMBt, and HMLt 4. Estimate regression, get: Interpreting Regression Results - ETFs A security that trades directly on an exchange, like a stock, but represents ownership in a portfolio of securities (stocks, bonds, commodities, etc.) Track a market (e.g., the Canadian stock market), sector (e.g., banks), type of stock (e.g., high dividend), asset (sub-)class (e.g., government bonds) Some offer levered exposure (e.g., 2x) Managed by professionals, but portfolios are formed based on objective rules (e.g., no stock picking) Goal is not to beat a benchmark but match it - o Active ETFs are a recent breed that try to beat it (account for 0.2% of assets) Low fees Smart Beta (Factor Investing) A set of investment strategies that emphasizes the use of alternative index construction rules to traditional market capitalization-based indices Follows objective rules to capture known drivers of return, e.g., size, value, momentum, etc. → based on academic research The expression smart beta is new but the concepts behind it are not → benchmark driven factor investing Goal: improve returns, reduce risks and enhance diversification o Cannot necessarily accomplish all simultaneously Passive? Active? o Implementation is rules based, goal is to capture specific exposures o Deviates from market portfolio and alters the risk-return tradeoff, so some view as active o Alpha is zero, by definition, since the goal is to mimic returns of a benchmark Funds and fees: Active and Passive funds have same return as overall market Average active fun underperforms by the amount of the management fee avoid high fee funds o Investors shouldn’t buy actively managed funds with expense ratios above 50 basis points – A Random Walk Down Wall Street Possible for active funds to outperform, just not the norm. Also possible for an investor to choose funds that collectively outperform passive alternatives Performance Persistence Should performance persist in equilibrium in the long run?: in equilibrium, past performance of individual funds should not predict future performance o New money will flow to outperforming managers, harder to invest more money (decreasing returns to scale) o Academic evidence supports lack of performance persistence Past performance does not guarantee future results Fund style Managers declare investment style in prospectus or name of fund 1/3 of actively managed funds size and value/growth benchmark index do not match the funds actual style Managerial Activeness Managers get paid active management fees, so we expect them to be ‘active’ Activeness can relate to future fund performance Quantifying “activeness”: computed with respect to a benchmark portfolio or benchmark model o More active funds perform better in the future lower R2 significantly predicts better performance Active Share predicts fund performance: funds with the highest Active Share significantly outperform their benchmarks... funds with the lowest Active Share underperform their benchmarks. Funds which tend to do better in the future: o when managers have larger stakes in them o With higher Morningstar ratings o Smaller sized funds Actively managed funds have charged lower fees over years due to competition from low cost explicitly indexed funds o Funds flowing out of typical active funds, and flowing into ESG funds Fund performance very difficult to predict; an average active fund is bound to underperform after fees Options A derivative is a security whose value depends on the values of other, more basic, underlying variables, including Traded assets: stocks, bonds, gold, etc. Non-traded assets: temperature, amount of snow fall, etc. Others: Forwards, futures, swaps, others Why options are important Options markets are huge, especially in currencies, fixed income, and commodities Compensation packages include options Corporate managers can use options to hedge a variety of risks ‘Real’ options (e.g., options to wait, to abandon a project, etc.) can be valuable, and should be considered in decision making Traders/speculators include options in their portfolios o Trading of options by individual investors has been growing tremendously Traded om: The Montreal Options Exchange(CAN), CBOE (US): (Index Options, Equity Options, Options on ETFs, Currency options, Credit Options (US)) Terminology - - Spot price S is the current price of the underlying asset Strike (or exercise) price X is the price at which the underlying asset can be bought or sold in an option contract Time to expiration, T When you buy or sell the underlying as part of fulfilling the options contract, you exercise the option o We will study options that can be exercised only at expiration (they are confusingly called European, as opposed to American, which can be exercised at any time) C is the value (price) of a call option today P is the value (price) of a put option today Options Contract between option owner (buyer) and option writer (seller) o Option buyer has the right but not obligation to buy at X o Option writer has the obligation to sell at X if the option is exercised o Option buyer has a long position; option writer has a short position *terminology: at expiration, value of option = option’s payoff = option’s cash flow Call option: gives owner the right to buy an asset at a fixed price at some future date S > X: option is in-the-money: cash flow to buyer is positive o Make money if we buy asset today for X and sell it in the market for S o Option worth S - X S < X: option is out-the-money: cash flow to buyer would be negative o Lose money if we buy today for X and sell for S o Value = 0, do not exercise S = X: option is at-the-money: cash flow to buyer would be zero o No gain/loss if we buy today for X and sell for S o Value = 0, do not exercise Value of a call option is either 0 or S- X max(0, S-X) Put option: gives the owner the right to sell an asset at a fixed price at some future date S < X: option is in-the-money: cash flow to buyer is positive o Make money if we buy asset today in the market for S and sell it for X o Option worth X - S S > X: option is out-the-money: cash flow to buyer would be negative o Lose money if we buy today for S and sell for X o Value = 0, do not exercise S = X: option is at-the-money: cash flow to buyer would be zero o No gain/loss if we buy today for S and sell for X o Value = 0, do not exercise Nano Options Currently options are traded in bundles of 100 units - o If call priced at $20, you buy one, you will pay $2000 and own 100 units CBOE (Chicago Board of Options Exchange) introduced nanos: just 1 unit Value of Options Today Total option value is the sum of intrinsic value and time value: 1. Intrinsic Value: maximum of 0 and the value of option if exercised now Call options: max(0, S - X) Put options: max(0, X – S) 2. Time Value: the value arising from the time left to maturity Difference between the price of the option and its intrinsic value If we know C, we can figure out time value If S = 50, and a call option with X = 40 is worth C = 15, then: o Intrinsic value equals max(0, S - X) = 10 o Time value equals 15 – 10 = 5 Summary Put-Call Parity: the relationship between the price of a call option and the price of a put option (on the same underluing asset and with the same X and T) The relationship between prices of calls and puts: o No-arbitrage arguments o Idea is to have 2 portfolios that give the same future payoffs One portfolio with call, one with put o Law of one price: prices of 2 portfolios should be equal, otherwise arbitrage opportunity Payoffs from combining a stock and a put You own one share and want insurance in case the stock price falls below $30 You buy a put option with strike X = $30 and maturity T Payoffs from combining a call and a risk-free zero-coupon bond You can get same payoff by buying a call (strike X = $30, maturity = T) and a zero-coupon bond (face value = $30, maturity = T) Put-call parity At expiration (for a given X and T): Today: By no arbitrage, the prices today of these two strategies should be the same: Binomial Option Pricing Model Start with a single-period model and assume that on the option expiration date, the stock price can take only two possible values 1. Compute the payoffs of the option at expiration max(0, S −X) for calls, max(0, X −S) for puts 2. Find a portfolio that has the same payoffs as the option at expiration Use stocks and bonds to form this replicating portfolio We know the price of the stock and bond today Therefore, we can calculate the price of this portfolio today 3. Apply the law of one price Option price must equal the price of the replicating portfolio If not, investors can earn arbitrage profits We can generalize this approach and use it in a more complicated, more realistic model - Value of a call option equals the value of the replicating portfolio The option is really just a portfolio of a stock and a bond o Value of a stock is the PV of its expected CFs o Value of a bond is the PV of its expected CFs Put Options Cheat Sheet page What determines the value of an option? Stock Price S Positive news increases stock price from $50 to $55 Good for calls: C will go up Bad for puts: P will go down o If x = 50, RF = 3% and T = 1 Strike Price X If two options are identical except for the strike price o Call options: Higher X → lower C o Put options: Higher X → higher P If S= 50, RF =3%, and T=1 Volatility, σ If expected price movements are more volatile o Both calls and puts will have higher values If S= 50, X = 50, RF =3%, and T=1 Suppose that the current stock price of ABC is $50. If an investor has both a one-month call and a one-month put on ABC with strike of $50 in the portfolio, what is that investor likely betting on? Answer: The investor will benefit if stock goes up or goes down, so the investor is most likely betting on a big (positive or negative) jump in the stock price. To say it differently, the investor is betting on volatility. Summary Valuing options at expiration is easy, there is no time value Calls are worth max (0, S – X) Puts are worth max(0, X - S) Valuing options today is harder: need an assumption about how stock price evolves in the future Made an assumption that stock price is either SU or SD but this is unrealistic Black-Scholes Option Pricing Model More realistic binomial model Increase # of period between today and expiration date, decrease time btwn periods, more possible outcomes for S at expiration Black Scholes: Shrink amount of time btwn periods (to 0) Increase # of period to infinity (infinite # of stock prices at expiration) Value of a call option (on a non-dividend paying stock) Binomial Model vs. Black Scholes Model Close link btwn binomial and Black Scholes - Both form replicating portfolio & apply law of one price o Dollar amount to borrow to replicate the options payoffs: o o *B is negative for call options Dollar value of shares to buy to replicate the option’s payoffs N(d1) is δ: Delta both capture by how much option price changes when stock price changes Delta: Analogous to duration, delta gives local approximate changes in call option value when stock price changes