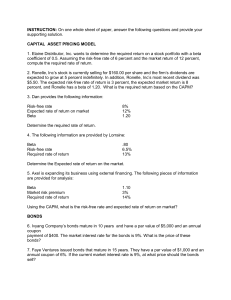

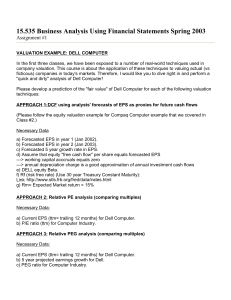

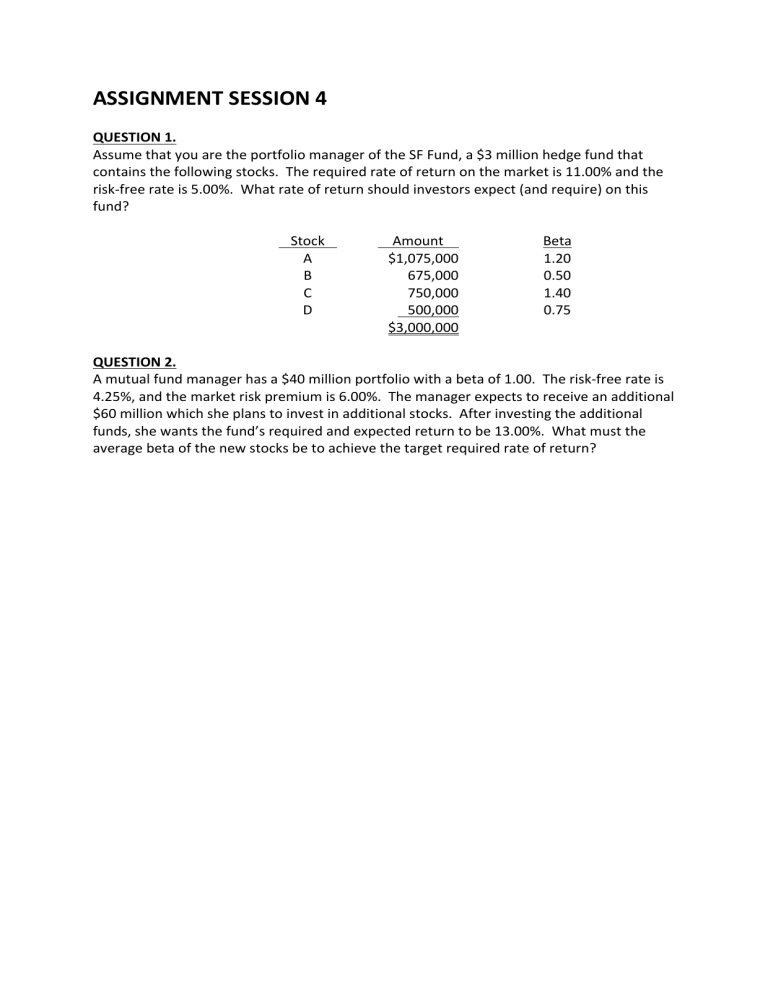

ASSIGNMENT SESSION 4 QUESTION 1. Assume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 5.00%. What rate of return should investors expect (and require) on this fund? Stock A B C D Amount $1,075,000 675,000 750,000 500,000 $3,000,000 Beta 1.20 0.50 1.40 0.75 QUESTION 2. A mutual fund manager has a $40 million portfolio with a beta of 1.00. The risk-free rate is 4.25%, and the market risk premium is 6.00%. The manager expects to receive an additional $60 million which she plans to invest in additional stocks. After investing the additional funds, she wants the fund’s required and expected return to be 13.00%. What must the average beta of the new stocks be to achieve the target required rate of return?