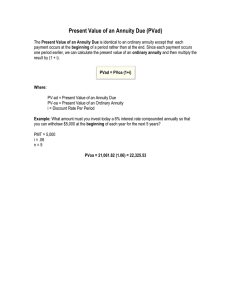

Lecture 2 Question of the Week Have you ever thought of buying a house or a car after your graduation? Are you wondering how much loan you have to borrow, whether you will be able to pay for the loan each month and which financial institutions or banks you should borrow the loan from? The concept we are going to learn this week will help answer the above questions. The question of this week concerns the last period of your life, your retirement. You are saving for retirement. You plan to retire when you reach 65 years old. To live comfortably during retirement, you plan to withdraw money from your savings account $48,000 each year. Suppose today is your 25th birthday, and you decide, starting today and continuing on every year up to your 64th birthday, that you will put the same amount into a savings account. If the interest rate is 2.4% per annum, compounded annually, how much must you set aside each year to make sure that you will have enough money in the account on your 65th birthday in order to be able to withdraw $48,000 per year when you retire and you expect to live until your are 90 years old (i.e., the first withdrawal is on your 65th birthday and the last withdrawal occurs on your 89th birthday)? By the end of the lecture, you would be able to answer this question. 0 Lecture 2 Time Value of Money and Loan Amortisation Learning Objectives • Explain how time value of money works and why it is important in Finance • Calculate the present value (PV) and future value (FV) of: ‒ ‒ ‒ ‒ A lump sum Annuity Uneven cash flow stream Perpetuity (only PV) • Differentiate between annuity due and ordinary annuity • Explain the difference between nominal, periodic, and effective interest rates ‒ Understand how to compare alternative investments with different compounding periods • Understand loan amortisation and able to calculate the relevant outputs (e.g. payments, principal outstanding). 1 AB1201: Financial Management Lecture 2: Time Value of Money and Loan Amortisation By: Chanika Charoenwong 2 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is time value of money? • Time value of money: Idea that money available today is worth more than the same amount in the future because you can invest the money, for example – Deposit the money in a bank to earn interest – Invest in stocks and bonds 3 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is time value of money? • Time value of money is important in finance. Its analysis is used in many ways such as Valuing stocks and bonds Planning retirement making corporate decisions regarding investing in new plant and equipment Setting up loan payment schedule 4 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Time Lines • Show the timing of cash flows. • Tick marks occur at the end of periods, so Time 0 is today, Time 1 is the end of the first period (year, month, etc.) or the beginning of the second period. 0 1 2 3 CF1 CF2 CF3 I% CF0 5 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Drawing Time Lines $100 lump sum due in 2 years 0 I% 1 2 100 Uneven cash flow stream 0 I% 1 2 100 200 3 50 6 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is the future value (FV) of an initial $100 after three years, if I/YR = 10%? • Finding the FV of a cash flow or series of cash flows is called compounding. • FV can be solved by using the step-by-step, financial calculator, and spreadsheet methods. 0 1 2 3 10% 100 FV = ? 7 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Solving for FV: The Step-by-Step and Formula Methods • After 1 year: – FV1 = PV(1 + I) = $100(1.10) = $110.00 • After 2 years: – FV2 = PV(1 + I)2 = $100(1.10)2 = $121.00 • After 3 years: – FV3 = PV(1 + I)3 = $100(1.10)3 = $133.10 • After N years (general case): FVN = PV(1 + I)N 8 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Solving for FV: The Calculator Method • Solves the general FV equation. • Requires four inputs into calculator, and will solve for the fifth. (Set to P/YR = 1 and END mode.) INPUTS OUTPUT 3 10 -100 0 N I/YR PV PMT FV 133.10 9 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is the present value (PV) of $133.10 due in three years, if I/YR = 10%? • Finding the PV of a cash flow or series of cash flows is called discounting (the reverse of compounding). 2 0 1 3 > Calculating FV of lump sum > 10% 133.10 • PV – how much is a stream of future cash flows worth today? PV = ? 10 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Solving for PV: The Formula Method • Solve the general FV equation for PV: – PV = FVN /(1 + I)N – PV = FV3 /(1 + I)3 = $133.10/(1.10)3 = $100 11 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Solving for PV: The Calculator Method • Exactly like solving for FV, except we have different input information and are solving for a different variable. INPUTS OUTPUT 3 10 N I/YR PV 0 133.10 PMT FV -100 12 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Lessons Learnt 1 • Time value of money: Idea that money available today is worth more than the same amount in the future because you can invest the money • Time value of money is important in finance. Its analysis is used to – value the stocks, bonds and capital budgeting projects – plan for retirements – set up loan payment schedules, etc. • Finding the FV of a cash flow or series of cash flows is called compounding. • Finding the PV of a cash flow or series of cash flows is called discounting (the reverse of compounding). 13 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is the difference between an Annuity – series of equal cash flows an at fixed intervals fordue? a specified ordinary annuity and annuity no. of periods Ordinary Annuity Ordinary Annuity: Cash flows occur at end of period 0 I% 1 2 3 PMT PMT PMT 1 2 3 PMT PMT Annuity Due Annuity Due: Cash flows occur at beginning of period 0 PMT I% 14 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Ordinary Annuity, Solving for FV: 3-Year Ordinary Annuity of $100 at 10% • $100 payments occur at the end of each period 15 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Ordinary Annuity, Solving for FV: 3-Year Ordinary Annuity of $100 at 10% • $100 payments occur at the end of each period, but there is no PV. PMT N 1 I 1 FV I INPUTS OUTPUT 100 3 1 0.10 1 FV 0.10 3 10 0 -100 N I/YR PV PMT FV 331 16 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Ordinary Annuity, Solving for PV: 3-year Ordinary Annuity of $100 at 10% • $100 payments still occur at the end of each period 17 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Ordinary Annuity, Solving for PV: 3-year Ordinary Annuity of $100 at 10% • $100 payments still occur at the end of each period, but now there is no FV. PMT PV I INPUTS OUTPUT 1 1 N 1 I 3 10 N I/YR 100 1 PV 1 0.10 1 0.10 3 PV 100 0 PMT FV -248.69 18 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion How will things change if we want to solve the FV and PV of a 3-year annuity due of $100 at 10%? Annuity Due, Solving for FV: 3-Year Annuity Due of $100 at 10% Ordinary Annuity 0 $100 10% $100 1 $100 2 $100 $100 $100 3 Annuity Due 19 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Annuity Due, Solving for FV: 3-Year Annuity Due of $100 at 10% • Now, $100 payments occur at the beginning of each period. • FVAdue= FVAord(1 + I) = $331(1.10) = $364.10 • Alternatively, set calculator to “BEGIN” mode and solve for the FV of the annuity: BEGIN INPUTS OUTPUT 3 10 0 -100 N I/YR PV PMT FV 364.10 20 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion How will things change if we want to solve the FV and PV of a 3-year annuity due of $100 at 10%? Annuity Due, Solving for PV: 3-Year Annuity Due of $100 at 10% Ordinary Annuity 0 $100 10% $100 1 $100 2 $100 $100 $100 3 Annuity Due 21 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Annuity Due, Solving for PV: 3-Year Annuity Due of $100 at 10% • Again, $100 payments occur at the beginning of each period. • PVAdue = PVAord(1 + I) = 248.69(1.10)=$273.55 • Alternatively, set calculator to “BEGIN” mode and solve for the PV of the annuity: BEGIN INPUTS OUTPUT 3 10 N I/YR PV 100 0 PMT FV -273.55 22 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is the PV of a perpetuity that pays $100 per year at 10%? • Perpetuity: An annuity that lasts forever PV = PMT/I = $100/0.1 = $1,000 23 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Lessons Learnt 2 • Ordinary annuity is the series of equal cash flows that occur at the end of the period • Annuity due is the series of equal cash flows that occur at the beginning of the period • FVdue = FVord(1+I) • PVdue = PVord(1+I) • Perpetuity is the annuity that lasts forever 24 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is the PV of this uneven CF stream? 0 1. 2. 3. 4. 10% 1 2 3 4 100 300 300 -50 530 590 598 Impossible to solve! 25 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is the PV of this uneven cash flow stream? 1st Method 0 1 10% 100 2 3 4 300 300 -50 90.91 247.93 225.39 -34.15 530.08 = PV 26 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion What is the PV of this uneven cash flow stream? 2nd Method • 2nd Method: Input cash flows in the calculator’s “CFLO” register: – CF0 = 0 – CF1 = 100 – CF2 = 300 – CF3 = 300 – CF4 = -50 • Press NPV button, enter I/YR = 10, press CPT button to get NPV = $530.087. (Here NPV = PV.) 27 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Will the FV of a lump sum be larger or smaller if compounded more often, holding the stated I% constant? 0 10% 1 2 3 100 133.10 Annually: FV3 = $100(1.10)3 = $133.10 0 100 5% 1 1 year 2 3 2 years 4 5 3 years 6 134.01 Semiannually: FV6 = $100(1.05)6 = $134.01 • LARGER, as the more frequently compounding occurs, interest is earned on interest more often. 28 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Classifications of Interest Rates • Nominal rate (INOM) – also called the quoted or stated rate. An annual rate that ignores compounding effects. – Stated in contracts. Periods must also be given, e.g. 8% quarterly compounding or 8% daily interest compounding • Periodic rate (IPER) – amount of interest charged each period, e.g. monthly or quarterly. - IPER = INOM/M, where M is the number of compounding periods per year. M = 4 for quarterly and M = 12 for monthly compounding 29 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Classifications of Interest Rates • Effective (or equivalent) annual rate (EAR = EFF%) – the annual rate of interest actually being earned, accounting for compounding. – EFF% for 10% semiannual investment EFF% = ( 1 + INOM/M )M – 1 = ( 1 + 0.10/2 )2 – 1 = 10.25% – Should be indifferent between receiving 10.25% annual interest and receiving 10% interest, compounded semiannually. 30 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Why is it important to consider effective rates of return? • Investments with different compounding intervals provide different effective returns. • To compare investments with different compounding intervals, you must look at their effective returns (EFF% or EAR). 31 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Why is it important to consider the effective rates of return? • See how the effective return varies between investments with the same nominal rate (10%), but different compounding intervals. – – – – EARANNUAL EARQUARTERLY EARMONTHLY EARDAILY (365) 10.00% 10.38% 10.47% 10.52% ?? 32 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion When is each rate used? • INOM - Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines. • IPER - Used in calculations and shown on time lines. If M = 1, INOM = IPER = EAR. • EAR - Used to compare returns on investments with different payments per year. 33 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Example: What is the FV of $100 after three years under 10% semiannual compounding? I NOM FVN PV1 M M N 23 0.10 FV3S $1001 2 6 FV3S $100(1.05) $134.01 Quarterly compounding? FV3Q $100(1.025) $134.49 12 34 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Example: What’s the FV of a 3-year $100 ordinary annuity, if the quoted interest rate is 10%, compounded semiannually? • Payments occur annually, but compounding occurs every six months. • Cannot use normal annuity valuation techniques. 0 5% 1 2 100 3 4 100 5 6 100 35 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Compound Each Cash Flow 0 5% 1 2 3 100 $100(1.05)4 4 5 100 $100(1.05)2 6 100 110.25 121.55 331.80 36 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Lessons Learnt 3 • FV of a lump sum will be larger if compounded more often, holding the stated I% constant because as the more frequently compounding occurs, interest is earned on interest more often. • Three types of interest rates—nominal rate, periodic rate and effective annual rate (EAR) • EAR is used to compare returns on investments with different payments per year. 37 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Loan Amortisation • Amortised loan: A loan that is repaid in equal payments over its life • Amortised loans are widely used for home mortgages, auto loans, business loans, retirement plans, etc. 38 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Example • You take out a $1,000 loan to buy a used car. The loan is to be repaid in three equal payments at the end of each of the next three years. Construct an amortisation schedule, with annual rate of 10%. 39 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion How much do you need to pay at the end of each of the next three years? 0 1 2 3 10% -PMT -PMT -PMT • PMT = 1000/3 = $333? • PMT = (1000*1.13)/3 = $443.67? • Somewhere in between: Ordinary annuity? $1000 – Three equal payments at the end of each of the next three years 40 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Step 1: Find the Required Annual Payment PMT PV I 1 1 N 1 I PMT 1000 0.10 1 1 3 1 0 . 10 • All input information is already given, just remember that the FV = 0 because the reason for amortising the loan and making payments is to retire the loan. INPUTS OUTPUT 3 10 -1000 N I/YR PV 0 PMT FV 402.11 41 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Step 2: Find the Interest Paid in Year 1 • The borrower will owe interest upon the initial balance at the end of the first year. Interest to be paid in the first year can be found by multiplying the beginning balance by the interest rate. INTt = Beg balt(I) INT1 = $1,000(0.10) = $100 42 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Step 3: Find the Principal Repaid in Year 1 • If a payment of $402.11 was made at the end of the first year and $100 was paid toward interest, the remaining value must represent the amount of principal repaid. PRIN = PMT – INT = $402.11 – $100 = $302.11 43 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Step 4: Find the Ending Balance after Year 1 • To find the balance at the end of the period, subtract the amount paid toward principal from the beginning balance. END BAL = BEG BAL – PRIN = $1,000 – $302.11 = $697.89 44 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Constructing an Amortisation Table: Repeat Steps 1–4 Until End of Loan • Interest paid declines with each payment as the balance declines. YEAR 1 2 3 TOTAL BEG BAL PMT $1,000 $ 402 698 402 366 402 – $1,206 INT $100 70 36 $206 PRIN $ 302 332 366 $1,000 END BAL $698 366 0 – 45 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Lessons Learnt 4 • Amortised loan: A loan that is repaid in equal payment over its life. – Amortisation schedule • Outstanding principal/loan = PV of all future payments 46 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Some Food for Thought • What determines the discount rate? • What if the cash flows are riskier? • Consider two banks: – Bank A = Very safe – Bank B = Not so safe, i.e. some chance that you will not get back your deposit – If both banks offered you the same interest rates, who would you bank with? – What would make you feel indifferent between the two banks? 47 What is time value of money? > FV of lump sum > PV of lump sum > LL1 > FV of ordinary annuity > PV of ordinary annuity > FV of annuity due > PV of annuity due > PV of perpetuity > LL2 > PV of uneven CF stream > Three types of interest rates > Why EAR? > When is each rate used? > LL3 > Loan amortisation > LL4 > Conclusion Where do we stand? • Future value of lump sum after N years: – FVN = PV(1 + I)N • Present value of lump sum due in N years: – PV = FVN /(1 + I)N • Future value of ordinary annuity: • • • • • FV PMT 1 I N 1 I Present value of ordinary annuity: PMT 1 PV 1 Annuity due I 1 I N Uneven cash flow streams Nominal rates, periodic rates, effective annual rates Loans amortisation - Amortised schedule 48 Lecture 2 Revisiting Question of the Week You are saving for retirement. You plan to retire when you reach 65 years old. To live comfortably during retirement, you plan to withdraw money from your savings account $48,000 each year. Suppose today is your 25th birthday, and you decide, starting today and continuing on every year up to your 64th birthday, that you will put the same amount into a savings account. If the interest rate is 2.4% per annum, compounded annually, how much must you set aside each year to make sure that you will have enough money in the account on your 65th birthday in order to be able to withdraw $48,000 per year when you retire and you expect to live until your are 90 years old (i.e., the first withdrawal is on your 65th birthday and the last withdrawal occurs on your 89th birthday)? 49 Lecture 2 Revisiting Questions of the Week 25th 0 | | | PMT …. 64th 65th 39 40 | | PMT | PMT … | | 89th 90th 64 65 | | | PMT -48k -48k ……… -48k Step 1: Finding the amount of money you need to have at 65 years old in order to withdraw 48k every year when you retire. Present value at t = 40 50 Lecture 2 Revisiting Questions of the Week 25th 64th 65th 89th 90th 0 39 40 64 65 | | | PMT …. | | PMT | PMT … | | | | | PMT -48k -48k ……… -48k 916,040 Step 2: Finding the amount of money you need to save each year, starting today (t=0), until you are 64 years old (t=39). PMT 51