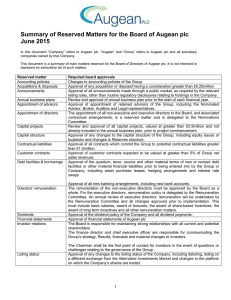

Corporate Annual Report For the year ended 31 December 2015 English 31-12-2015

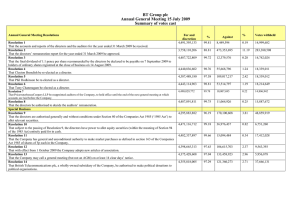

advertisement