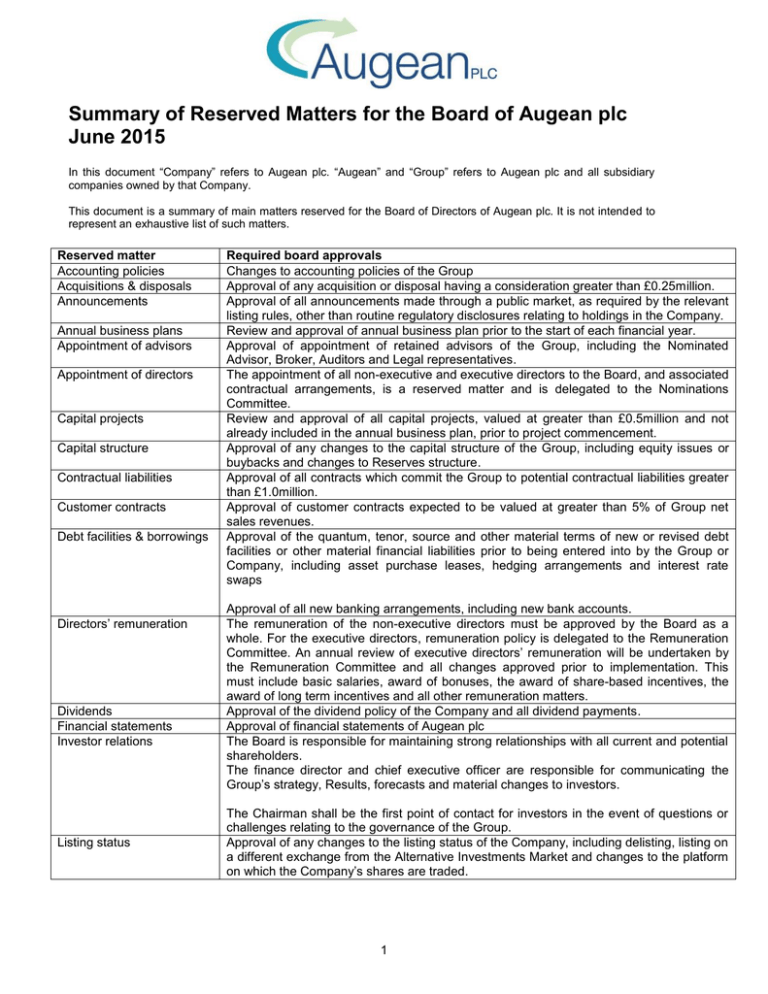

Summary of Reserved Matters for the Board of Augean plc June 2015

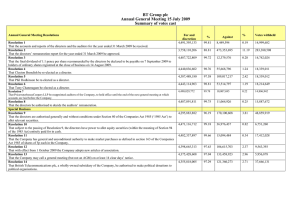

advertisement

Summary of Reserved Matters for the Board of Augean plc June 2015 In this document “Company” refers to Augean plc. “Augean” and “Group” refers to Augean plc and all subsidiary companies owned by that Company. This document is a summary of main matters reserved for the Board of Directors of Augean plc. It is not intended to represent an exhaustive list of such matters. Reserved matter Accounting policies Acquisitions & disposals Announcements Annual business plans Appointment of advisors Appointment of directors Capital projects Capital structure Contractual liabilities Customer contracts Debt facilities & borrowings Directors’ remuneration Dividends Financial statements Investor relations Listing status Required board approvals Changes to accounting policies of the Group Approval of any acquisition or disposal having a consideration greater than £0.25million. Approval of all announcements made through a public market, as required by the relevant listing rules, other than routine regulatory disclosures relating to holdings in the Company. Review and approval of annual business plan prior to the start of each financial year. Approval of appointment of retained advisors of the Group, including the Nominated Advisor, Broker, Auditors and Legal representatives. The appointment of all non-executive and executive directors to the Board, and associated contractual arrangements, is a reserved matter and is delegated to the Nominations Committee. Review and approval of all capital projects, valued at greater than £0.5million and not already included in the annual business plan, prior to project commencement. Approval of any changes to the capital structure of the Group, including equity issues or buybacks and changes to Reserves structure. Approval of all contracts which commit the Group to potential contractual liabilities greater than £1.0million. Approval of customer contracts expected to be valued at greater than 5% of Group net sales revenues. Approval of the quantum, tenor, source and other material terms of new or revised debt facilities or other material financial liabilities prior to being entered into by the Group or Company, including asset purchase leases, hedging arrangements and interest rate swaps Approval of all new banking arrangements, including new bank accounts. The remuneration of the non-executive directors must be approved by the Board as a whole. For the executive directors, remuneration policy is delegated to the Remuneration Committee. An annual review of executive directors’ remuneration will be undertaken by the Remuneration Committee and all changes approved prior to implementation. This must include basic salaries, award of bonuses, the award of share-based incentives, the award of long term incentives and all other remuneration matters. Approval of the dividend policy of the Company and all dividend payments. Approval of financial statements of Augean plc The Board is responsible for maintaining strong relationships with all current and potential shareholders. The finance director and chief executive officer are responsible for communicating the Group’s strategy, Results, forecasts and material changes to investors. The Chairman shall be the first point of contact for investors in the event of questions or challenges relating to the governance of the Group. Approval of any changes to the listing status of the Company, including delisting, listing on a different exchange from the Alternative Investments Market and changes to the platform on which the Company’s shares are traded. 1 Policies Related parties Strategy of the Group Review and approval of the following policies prior to publication and adoption by the Group and any subsequent changes thereto: i) Dealing in shares ii) Health and safety iii) Environmental iv) Anti-bribery v) Whistleblowing Approval of all contractual arrangements with Related Parties prior to signature. Annual review of Group strategy and any changes to strategic plans prior to implementation or communication to investors. 2