ETFs Use Section 852(b)(6) for Tax Avoidance, Not Just Tax Deferral So Why Is This Loophole Still Open

advertisement

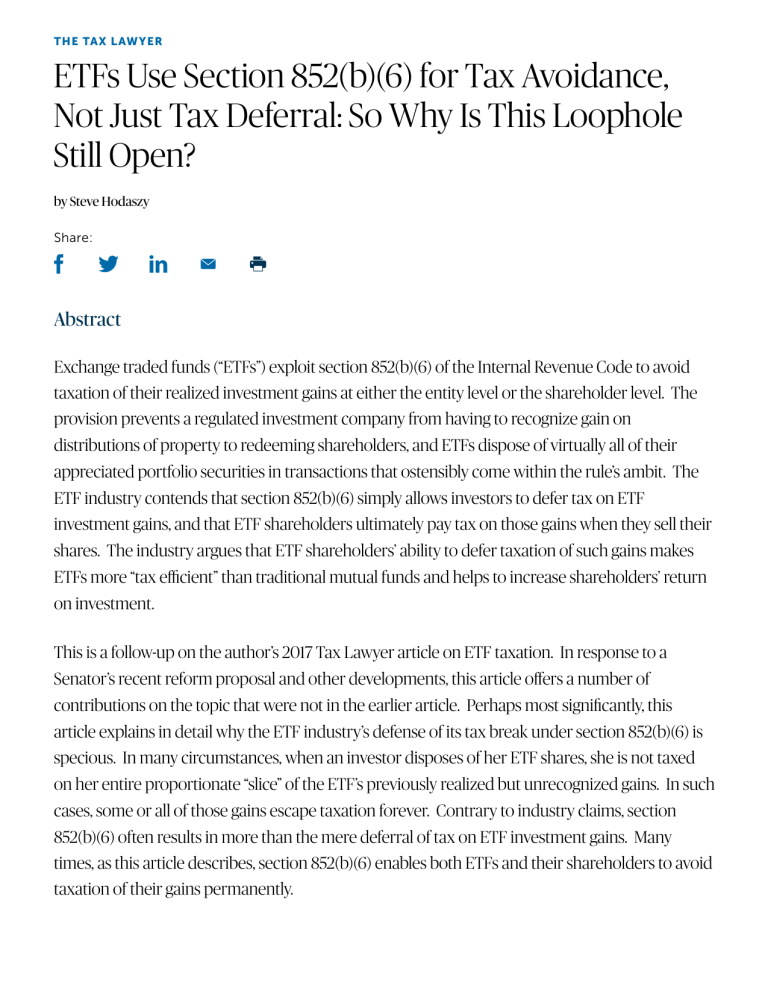

THE TAX L AWYER ETFs Use Section 852(b)(6) for Tax Avoidance, Not Just Tax Deferral: So Why Is This Loophole Still Open? by Steve Hodaszy Share: Abstract Exchange traded funds (“ETFs”) exploit section 852(b)(6) of the Internal Revenue Code to avoid taxation of their realized investment gains at either the entity level or the shareholder level. The provision prevents a regulated investment company from having to recognize gain on distributions of property to redeeming shareholders, and ETFs dispose of virtually all of their appreciated portfolio securities in transactions that ostensibly come within the rule’s ambit. The ETF industry contends that section 852(b)(6) simply allows investors to defer tax on ETF investment gains, and that ETF shareholders ultimately pay tax on those gains when they sell their shares. The industry argues that ETF shareholders’ ability to defer taxation of such gains makes ETFs more “tax efficient” than traditional mutual funds and helps to increase shareholders’ return on investment. This is a follow-up on the author’s 2017 Tax Lawyer article on ETF taxation. In response to a Senator’s recent reform proposal and other developments, this article offers a number of contributions on the topic that were not in the earlier article. Perhaps most significantly, this article explains in detail why the ETF industry’s defense of its tax break under section 852(b)(6) is specious. In many circumstances, when an investor disposes of her ETF shares, she is not taxed on her entire proportionate “slice” of the ETF’s previously realized but unrecognized gains. In such cases, some or all of those gains escape taxation forever. Contrary to industry claims, section 852(b)(6) often results in more than the mere deferral of tax on ETF investment gains. Many times, as this article describes, section 852(b)(6) enables both ETFs and their shareholders to avoid taxation of their gains permanently. The ETF tax break under section 852(b)(6) raises several serious policy concerns: First, it costs the Treasury tens of billions of dollars in forgone tax revenue each year. Second, by treating ETF shareholders more favorably than mutual fund shareholders, it creates inequitable disparities in how different taxpayers with substantively equivalent investments are taxed. Third, it exacerbates problems inherent in the U.S. income tax’s realization rule to contribute to income and wealth inequality. As high-net-worth investors have flocked from traditional mutual funds to ETFs to enjoy the “tax efficiency” that the ETF industry so proudly touts, those tax advantages have redounded increasingly to the affluent. Simply put, section 852(b)(6) provides an unwarranted tax windfall that enables already-wealthy ETF shareholders to amass further wealth more quickly through greater compounding of their investment gains. In September 2021, Senate Finance Committee Chairman Ron Wyden proposed a complete repeal of section 852(b)(6). Though tempting in its simplicity, that approach is ultimately flawed. Securities regulators consider section 852(b)(6) to be necessary to the functioning of a pricearbitrage mechanism that maintains an ETF’s share price at parity with the value of the ETF’s investment portfolio. Assuming that Congress does not want to render ETFs inviable as pooled investment vehicles, any reform to ETF taxation must also ensure that this arbitrage mechanism— and, thus, section 852(b)(6)’s nonrecognition rule—remains intact. The aims of this article are (1) to elucidate the concerns arising from ETFs’ exploitation of section 852(b)(6), (2) to urge policymakers finally to address those concerns, and (3) to offer workable solutions to the problem of ETF tax avoidance. American Bar Association | /content/aba-cms-dotorg/en/groups/taxation/publications/tax_lawyer_home/forthcoming_issue/hodaszy