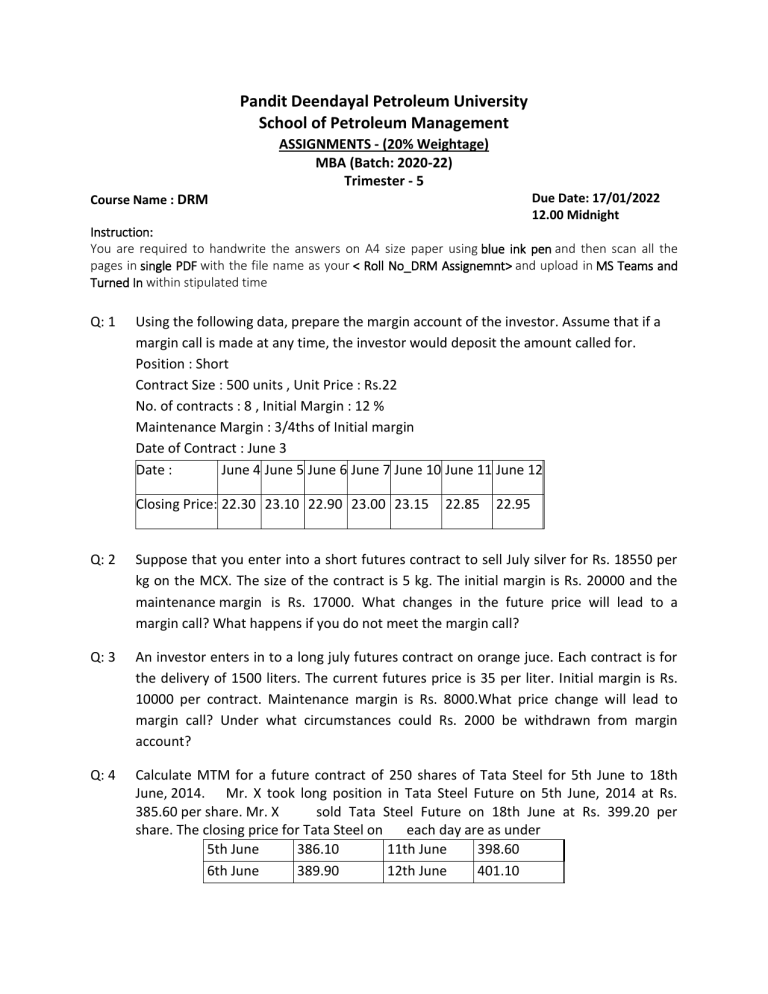

Pandit Deendayal Petroleum University School of Petroleum Management ASSIGNMENTS - (20% Weightage) MBA (Batch: 2020-22) Trimester - 5 Due Date: 17/01/2022 12.00 Midnight Course Name : DRM Instruction: You are required to handwrite the answers on A4 size paper using blue ink pen and then scan all the pages in single PDF with the file name as your < Roll No_DRM Assignemnt> and upload in MS Teams and Turned In within stipulated time Q: 1 Using the following data, prepare the margin account of the investor. Assume that if a margin call is made at any time, the investor would deposit the amount called for. Position : Short Contract Size : 500 units , Unit Price : Rs.22 No. of contracts : 8 , Initial Margin : 12 % Maintenance Margin : 3/4ths of Initial margin Date of Contract : June 3 Date : June 4 June 5 June 6 June 7 June 10 June 11 June 12 Closing Price: 22.30 23.10 22.90 23.00 23.15 22.85 22.95 Q: 2 Suppose that you enter into a short futures contract to sell July silver for Rs. 18550 per kg on the MCX. The size of the contract is 5 kg. The initial margin is Rs. 20000 and the maintenance margin is Rs. 17000. What changes in the future price will lead to a margin call? What happens if you do not meet the margin call? Q: 3 An investor enters in to a long july futures contract on orange juce. Each contract is for the delivery of 1500 liters. The current futures price is 35 per liter. Initial margin is Rs. 10000 per contract. Maintenance margin is Rs. 8000.What price change will lead to margin call? Under what circumstances could Rs. 2000 be withdrawn from margin account? Q: 4 Calculate MTM for a future contract of 250 shares of Tata Steel for 5th June to 18th June, 2014. Mr. X took long position in Tata Steel Future on 5th June, 2014 at Rs. 385.60 per share. Mr. X sold Tata Steel Future on 18th June at Rs. 399.20 per share. The closing price for Tata Steel on each day are as under 5th June 386.10 11th June 398.60 6th June 389.90 12th June 401.10 Q: 5 9th June 383.20 13th June 10th June 393.10 16th June 17th June 389.20 Explain the Term: Open Interest and Trading Volume. 376.10 381.60 Q: 6 Discuss the different types of orders. Q: 7 A stockbroker is holding 1,000 shares of Reliance Industries Limited (RIL) selling currently at Rs. 1,800. The futures contract expiring in one month is trading at Rs 1,808. Each future contract is for 100 shares of RIL. If the Stock broker can borrow/ invest at 12% per annum can he take advantage of the situation? Q: 8 Consider a 6 month forward contract on 100 shares with a price of Rs 1000 each. The risk free rate of interest semiannually compounded is 9 % per annum. The share is expected to yield a dividend of Rs.6 in 3 months from now. Determine the value of the forward contract. Q: 9 The current stock index is 3450 and its annualized dividend yield is 4%. A six month future is currently trading at Rs. 3585. The risk free rate is 10% .Verify whether there is any scope for a risk free arbitrage if 50% of stocks of the index pay dividend. Q: 10 Mr. Y sold GMR Infra 26th February, 2014 Future at Rs. 28.20 per share and wrote a put of Rs. 29 per share of same underlying for same expiry for premium of Rs. 1.60 per share. Calculate his net pay off if on expiry, spot price of GMR is Rs. 28.40 per share. Assume lot size of 7500 shares. Neglect transaction cost. Q: 11 The risk of spot prices on gold as measured from its standard deviation is placed at Rs. 120. Similarly, the price risk of the 3-month futures contract on gold is estimated to be Rs.150. the co-efficient correlation between the two is placed at 0.85 in order to hedge spot position what ratio of futures contract would be optimal? Q: 12 The standard deviation of monthly changes in the spot price of Sugar is 1.2. The standard deviation of monthly changes in the future price of sugar contract is 1.4. The correlation between the future price changes and the spot price changes is 0.7. It is now October 15. A sugar trader is committed to purchase 2 lakh Kgs of sugar on November 15. The trader wants to use the December future contract to hedge its risk. Each contract of sugar is for the delivery of 40000 kgs of sugar. What strategy the sugar trader should follow? Q: 13 Suppose that a call option involving 100 shares is selling for Rs.5.25 at maturity when the share price is Rs.64 and exercise price is Rs.60. Is arbitrageur can make any profit from the given scenario? Q: 14 Selan Exploration needs 1075 barrels of crude oil in the month of July whereas the current price of crude oil is Rs.3000 per barrel at the end of January month. July futures contract at MCX is trading at Rs.3200. The firm expects the price to go up further and beyond Rs.3200 in July. It has the option of buying the stock now or it can hedge through futures contract. Assume the size of futures contract is 100 barrels. a. If the cost of capital, insurance and storage is 15% continuously compounding, examine if it is beneficial for the firm to buy now? b. If the firm decides to hedge through futures, find out the effective price it would pay for crude oil if at the time of lifting the hedge (i) the spot and futures price are Rs.2900 and Rs2910 respectively and (ii) the spot and futures price are Rs.3300 and Rs.3315 respectively. Q: 15 What is options contract? How it differs from Futures? Q: 16 Explain the different pay off position in options. Q: 17 Explain the moneyness in options contract. Q: 18 Discuss the factor affecting the options prices. Q: 19 A stock price is currently $100. Over each of the next two six month periods it is expected to go up by 10% or down by 10%. The risk free rate is 8% per annum with continuous compounding. What is the value of one year European call option with a strike price of $100? Also draw a binomial tree. Q: 20 Calculate the price of a three month European put options on a non dividend paying stock with a strike price of 50$ when the current stock price is also $50, the risk free interest rate is 10% per annum and the volatility is 30% per annum. Use the BlackScholes option-pricing model. ***********************