future.doc

advertisement

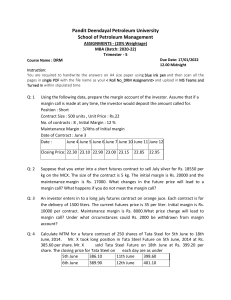

FUTURES HOMEWORK Use the designated WSJ 1. For wheat (KC): What is the (1) standard bushels per contract, (2) settlement price, (3) Lifetime low and (4) how many open interests are there? Define/explain (5) the settlement price and (6) open interests. (Include only Dec 2002 Contract) 2. a) Assuming a 10% margin, what would the investor put up in order to purchase 1 future contract in Treasury Notes(CBT) due in Dec 02? (Assume Settlement Price) b) If the price of the December contract changed to 98, what would happen to the investor's account (dollar gain (loss)) What profit (loss) in dollars, holding period return, and compounded annual return would that be to the purchaser if they had bought it at the price in “a” 30 days ago? c) How much did the Treasury Bill December contract change from the previous day? What would be this one day profit (loss) in dollars, holding period return, and compounded annual return would that be to the purchaser? Assume the 10% margin and the resulting initial margin dollars from “a”. (Refer to Future Prices in Wall Street) 3. On March 17 an investment banking house agreed to underwrite $1,000,000 of MGIC's 30 year 16% mortgage-backed bonds at 98 to yield 17.2%. The actual transfer will take place on March 31. The cash market price of a similar issue on March 17 was 98 5/8 (yielding 17%). On March 24, the cash market price of that issue was 98 1/4. a) If the investment banker decides to hedge its underwriting transaction on March 24, what does it think will happen to prices on mortgage backed bonds in the next week? b) How could it hedge in the GNMA futures market? c) What kind of hedge is this? d) If it traded a GNMA December contract at 91-04 on March 24 and it can only sell the MGIC bonds it buys on March 31 for 97 3/4, what must the December contract be priced at on March 31 to create a perfect hedge (ignore transactions costs)?

![Strategic Interaction between Hedge Funds and Prime Brokers [10pt]](http://s2.studylib.net/store/data/018352879_1-00a6c92a4ca320d43c8b07e84a978d7f-300x300.png)