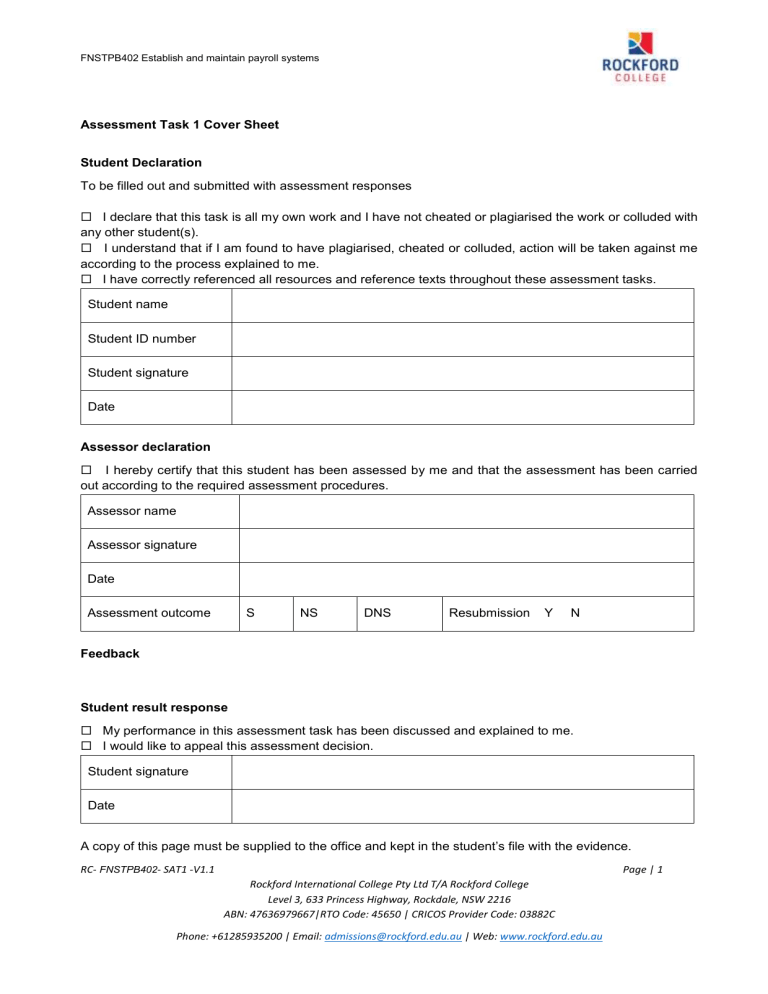

FNSTPB402 Establish and maintain payroll systems Assessment Task 1 Cover Sheet Student Declaration To be filled out and submitted with assessment responses I declare that this task is all my own work and I have not cheated or plagiarised the work or colluded with any other student(s). I understand that if I am found to have plagiarised, cheated or colluded, action will be taken against me according to the process explained to me. I have correctly referenced all resources and reference texts throughout these assessment tasks. Student name Student ID number Student signature Date Assessor declaration I hereby certify that this student has been assessed by me and that the assessment has been carried out according to the required assessment procedures. Assessor name Assessor signature Date Assessment outcome S NS DNS Resubmission Y N Feedback Student result response My performance in this assessment task has been discussed and explained to me. I would like to appeal this assessment decision. Student signature Date A copy of this page must be supplied to the office and kept in the student’s file with the evidence. RC- FNSTPB402- SAT1 -V1.1 Page | 1 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems Assessment Task 1: Written Questions Task summary This is an open book test, to be completed in the classroom. A time limit of 2 hours to answer the questions is provided. You need to answer all of the written questions correctly. Your answers must be word processed and sent to the assessor as an email attachment. Required Access to textbooks/other learning materials Computer and Microsoft Office Access to the internet Timing Your assessor will advise you of the due date of this assessment. Submit Answers to all questions Assessment criteria All questions must be answered correctly in order for you to be assessed as having completed the task satisfactorily. Re-submission opportunities You will be provided feedback on their performance by the Assessor. The feedback will indicate if you have satisfactorily addressed the requirements of each part of this task. If any parts of the task are not satisfactorily completed, the assessor will explain why, and provide you written feedback along with guidance on what you must undertake to demonstrate satisfactory performance. Re-assessment attempt(s) will be arranged at a later time and date. You have the right to appeal the outcome of assessment decisions if you feel that you have been dealt with unfairly, or have other appropriate grounds for an appeal. You are encouraged to consult with the assessor prior to attempting this task if you do not understand any part of this task or if you have any learning issues or needs that may hinder you when attempting any part of the assessment. RC- FNSTPB402- SAT1 -V1.1 Page | 2 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems Written answer question guidance The following written questions use a range of “instructional words” such as “identify” or “explain”, which tell you how you should answer the question. Use the definitions below to assist you to provide the type of response expected. Note that the following guidance is the minimum level of response required. Analyse – when a question asks you to analyse something, you should do so in in detail, and identify important points and key features. Generally, you are expected to write a response one or two paragraphs long. Compare – when a question asks you to compare something, you will need to show how two or more things are similar, ensuring that you also indicate the relevance of the consequences. Generally, you are expected to write a response one or two paragraphs long. Contrast – when a question asks you to contrast something, you will need to show how two or more things are different, ensuring you indicate the relevance or the consequences. Generally, you are expected to write a response one or two paragraphs long. Discuss – when a question asks you to discuss something, you are required to point out important issues or features, and express some form of critical judgement. Generally, you are expected to write a response one or two paragraphs long. Describe – when a question asks you to describe something, you should state the most noticeable qualities or features. Generally, you are expected to write a response two or three sentences long. Evaluate – when a question asks you to evaluate something, you should do so putting forward arguments for and against something. Generally, you are expected to write a response one or two paragraphs long. Examine – when a question asks you to examine something, this is similar to “analyse”, where you should provide a detailed response with key points and features and provide critical analysis. Generally, you are expected to write a response one or two paragraphs long. Explain – when a question asks you to explain something, you should make clear how or why something happened or the way it is. Generally, you are expected to write a response two or three sentences long. Identify – when a question asks you to identify something, this means that you are asked to briefly describe the required information. Generally, you are expected to write a response two or three sentences long. List – when a question asks you to list something, this means that you are asked to briefly state information in a list format. Outline – when a question asks you to outline something, this means giving only the main points, Generally, you are expected to write a response a few sentences long. Summarise – when a question asks you to summarise something, this means (like “outline”) only giving the main points. Generally, you are expected to write a response a few sentences long. RC- FNSTPB402- SAT1 -V1.1 Page | 3 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems RC- FNSTPB402- SAT1 -V1.1 Page | 4 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems Assessment Task 1 Instructions Provide answers to all of the questions below: 1. List a useful source of information for keeping up to date with Modern Award changes to ensure that your payroll is correctly maintained. The Fair Work Commission (FWC) is the Australian mechanical relations council made by the Fair Work Act 2009 as a major aspect of the Rudd Government's changes to modern relations in Australia. The main roles of FWC are: a. To screen certain 457 and 482 subclass visa plans. b. To promote agreeable, profitable and helpful work environment relations. c. To ensure consistence with Australian working environment laws. 2. Bee Enterprises has an enterprise agreement with staff. Assume that in the role of the new payroll officer, you are reviewing employee payments and discover that wage rates are now less than the current award rates, which changed recently. Explain if this is allowed under the Fair Work Act 2009 and give a reason for your answer. No, it is not allowed under the Fair Work Act because the base pay rate in the registered agreement can’t be less than the base pay rate in the award, but the award doesn’t apply if bee enterprise has registered workplace agreement 3. Outline the payroll category in MYOB that can be adjusted based on an employee’s award or agreement. Leave entitlements: It is like annual and personal leave, which employees accrue under the terms of the work agreements are tracked using entitlement categories (but paid out using wage categories). 4. Explain why is important for organisations to have confidentiality/privacy policies and procedures in place and what a payroll officer needs to be aware of when dealing with personal information? It is important for organization to have confidentiality policies and procedure in place for the following reasons: Failure to properly secure and protect confidential business information can lead to the loss of business/clients. Confidential information can be misused to commit illegal activity The disclosure of sensitive employee and management information can lead to a loss of employee trust, confidence and loyalty. A payroll officer needs to be aware of following when dealing with personal information: Using encryption technology, firewalls, and site monitoring to protect information. Managing the under 18 users as it is not intended for use by minor. Regularly updating the policies, processes and technology in order to make the data security safest as possible RC- FNSTPB402- SAT1 -V1.1 Page | 5 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems 5. Give at least two payroll actions that a payroll officer would need to get authorisation for. The two examples when a payroll officer need to get authorization for a payroll action are: When cheques are issued to employees rather than bank transfers then the payroll cheques should be approved, signed and distributed by a designated manager. When the payroll data are processed and confirming and the payments with actual work are in line then the payroll should be verified and authorized by the appropriate person. 6. Explain the term “structure of authority’ as used in organisations in relation to payroll functions within an organisation. Structure of authority is a system that outlines how certain activities are directed in order to achieve the goals of an organization which include rules, roles, and responsibilities. It defines the scope of acceptable behaviour within an organization, its lines of authority and accountability, and to some extent the organization's relationship with its external environment. More specifically, it shows the pattern or arrangement of jobs and groups of jobs within an organization and yet it is more than an organizational chart. 7. Outline two instances in which a payroll service provider does not need to register as a tax agent or BAS agent, as set out in the Payroll Service Providers Information Sheet issued by the Tax Practitioners Board according to the Tax Agent Services Act 2009. The two instances in which a payroll service provider does not need to register as a tax agent or BAS agent, as set out in the Payroll Service Providers Information Sheet issued by the Tax Practitioners Board according to the Tax Agent Services Act 2009 are: The services that are not provide for a fee or reward. It the provided services do not meet the definition of tax agent services such as (processing of payments, preparing bank reconciliations). 8. Assume that a client of yours is trying to decide whether to continue using their manual payroll system or to upgrade to a computerised system. To help them make the choice, explain the differences between manual and computerised payroll system, including at least two features and two advantages and disadvantages of each type of system. Differences Meaning Manual payroll system A manual payroll means that the use of human hands required to hire a team of professionals who will do every accounting and payroll task by hand It is very cheaper because it only uses either the oldfashioned books or use programs like excel. It is very slower compared to computerized payroll system All the calculation is performed manually Not possible to save a file and entries the transaction Cost Speed Calculation Backup Computerizes payroll system A computerized payroll system is comprised of a set of software programs. It is very expensive compared to manual payroll system. It is comparatively faster All the calculation are calculated by computer system Possible to save a file and entries the transaction RC- FNSTPB402- SAT1 -V1.1 Page | 6 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems speed It is very slower compared to computerized payroll system. It is comparatively faster manual payroll system. to 9. Explain why it is important for a payroll officer to understand the Fair Work Act 2009 and the National Employment Standards. It is important for a payroll officer to understand the Fair Work Ac 2009 and the National Employment standards for the following reasons: To guarantee all the finance exchanges are prepared proficiently. To develop ad hoc financial and operational reporting as needed resolve discrepancies in payroll. To provide maximum weekly hours and manage for flexible working arrangements. To arrange leaves, holidays, notice of termination, redundancy pay and fair work information statements 10. Under the Fair Work Act, how much annual leave is an employee entitled to. Under the Fair Work Act, Full-time and part-time employees get 4 weeks of leave annually, based on their work hours as well as shift workers may get up to 5 weeks of leave per year. https://www.fairwork.gov.au/leave/annual-leave 11. Explain the superannuation guarantee scheme, including employee eligibility for superannuation under the Superannuation Guarantee Act. Superannuation is a compulsory contribution made by placing a minimum percentage of the income to support the financial needs in retirement. Superannuation guarantee is paid if a worker is paid $450 or more wages before tax in a month. It must be paid four times a week and electronically reported in standard form, ensuring that all the super requirements are meet. If it not paid in time, then the employer has to pay the super charges. Employee eligibility for superannuation: Must be 18 and over and earn $450 per month. Must work for 30 hours in a week as full time, part time or casual 12. What allowances are there for employees with regard to voluntary contributions for superannuation? The allowance for employees with regards to voluntary contributions for superannuation are: Special duties or allowance like first aid certificate or safety officer. Providing expenses that can’t be claimed as a tax deduction like travel from home to work Providing work related expenses that may be claimed as tax deduction. (Travel between work sites). Reference: https://www.ato.gov.au/Business/PAYG-withholding/Payments-you-need-to-withholdfrom/Payments-to-employees/Allowances-and-reimbursements/ 13. What tax benefits does payment of voluntary superannuation provide? RC- FNSTPB402- SAT1 -V1.1 Page | 7 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems Salary sacrifice is an arrangement between you and your employer where a portion of your pre-tax salary is used to provide benefit of a similar value. Depending on your income and how much you can afford to contribution may be a good option Alternatively, you may work for an employer who reduce your salary for the purposes of calculating superannuation. Guarantee contribution, when you option to commence a salary sacrifice arrangement, effectively receiving fewer super entitlement. 14. Explain the circumstances in which an employer must pay a super guarantee charge. If an employer doesn’t meet the circumstances for super guarantee, then they are charged with penalty on them. The circumstances in which employer must pay a super guarantee charge are: SG shortfall amounts (including any choice liability calculated on your employee’s salary or wages Interest on those amounts (currently 10%) An administration fee of $20 per employee, per quarter. 15. According to the Corporations Act, how long should business records be retained? What happens if a business does not retain required records? Pay Extra Taxes If you don’t keep records of estimated tax payments or don’t keep receipts for planned deductions, you won’t be able to claim these items on a business tax return and will have to pay more tax than is owed. This is just one main consequence of failing to keep accurate records! Tax Adjustments After Audit If you get audited and don’t have paperwork to back up claims, the IRS may decide that you need to pay more taxes than you originally had to pay. There may also be costly penalties for the failure to file taxes appropriately. Audit Failures Failing an external or internal audit can lead to large fines or even the closure of your business. Criminal Penalties for Improper licensure Without copies of licenses, a person can face jail time for operating without the proper license. Inability To Protect Your Business from Theft Without the right paperwork to justify claims, you may not be able to sue someone for copyright infringement or patent infringement. Employee lawsuits If an employee claims you acted in an illegal manner – i.e., a wrongful termination or a refusal to pay worker’s compensation – you won’t have much recourse if there is no paperwork to prove that you complied with the applicable laws. Always keep copies of any interactions your employees have with your staff that may affect you in a legal manner later on. RC- FNSTPB402- SAT1 -V1.1 Page | 8 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems Deals Fall Through Losing or misplacing an important document can cause a major deal to fall through. Something as small as an old employee contract can hold up a transaction greatly reducing your chance for success. In order to prevent these negative consequences of failing to keep accurate records, it’s important to find a records storage system that works for your business. It should be a business requirement to have some kind of system in place in case you are audited. 16. Explain the purpose of workplace/occupational health and safety legislation. Give an example of a safe work practice for a payroll officer needs to implement. The purpose of the Work Health and Safety laws (WHS laws) is to protect health, safety and welfare of employees, any potentials of work hazard, volunteers and other persons who are contact with a work place This means that in most states and territories and at the Commonwealth level, WHS laws impose similar obligations. Examples of a safe work practice for a payroll officer need to implement are given below: Improperly adjusted workstations and chairs Frequent lifting Poor posture Awkward movements, especially if they are repetitive Using too much force, especially if it’s done frequently https://www.worksafe.vic.gov.au/occupational-health-and-safety-act-and-regulations 17. Explain workers’ compensation and give an example of an adjustment that may need to be made to a payroll system if an employee is entitled to worker’s compensation. Workers' compensation is a government-mandated system that pays monetary benefits to workers who become injured or disabled in the course of their employment. Workers' compensation is a type of insurance that offers employees compensation for injuries or disabilities sustained as a result of their employment. Workers’ compensation includes payments to employees to cover their: wages while they're not fit for work medical expenses and rehabilitation. 18. Explain why businesses have to pay payroll tax and identify thresholds and rates for businesses for the state or territory in which you are living. Business has to pay payroll tax because it is calculated on the amount of wages paid each month and payable in the state or territory of Australia where the services were performed. Tax year Threshold Tax rate 01/07/2021 to 30/06/2022 $1,200,000 4.85% 01/07/2020 to 30/06/2021 $1,200,000 4.85% RC- FNSTPB402- SAT1 -V1.1 Page | 9 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems 01/07/2019 to 30/06/2020 $900,000 5.45% The monthly threshold amounts are: Days in the month 28 30 31 Threshold $92,055 $98,630 $101,918 19. How long does the ATO require small businesses to keep records for? Give two examples of records that must be kept. The ATO require 5 years to keep records for small business. The two examples of records you should keep from the date you lodge your tax return are: payments you have received expenses related to payments you receive when you have acquired or disposed of an asset – such as shares or a rental property 20. Explain the importance of keeping payroll information confidential. The importance of keeping payroll information confidential are: To keep the employee information safe from identity theft. To prevent jealousy among employees. To prevent the business information. 21. Outline three areas that an organisation must address in regard to procedures around collection of personal information of employees to ensure it complies with the Australian Privacy principles. The three areas that’s an organisation must address in regard to procedures around collection of personal information of employees are: Notifiable data breaches scheme Credit reporting Tax file numbers 22. Outline the ATO requirements in relation to repayments of a higher education loan program (HELP). Repayments of HELP must be done when your income exceeds the minimum repayment threshold. This is even if you are still studying or undertaking an apprenticeship. Your compulsory repayment rate increases as your income increases. The more you earn, the higher your repayment. Your compulsory repayment is based on your income alone – not the income of your parents or spouse. Compulsory repayments are made through your tax return. You can also make voluntary repayments at any time to reduce your loan balance. 23. Explain the purpose of the Medicare levy and identify the rate at which it is levied. The main purpose of Medicare levy is to provide free care in public hospitals, and lower costs to buy prescription medicines. The Medicare levy helps fund some of the costs of Australia's public health system known as Medicare. RC- FNSTPB402- SAT1 -V1.1 Page | 10 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems The Medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. 24. Explain the purpose of modern awards within the national workplace relations system and give an example of a modern award. The purpose of modern awards within the national workplace relations system is to provide a fair and relevant minimum safety net of terms and conditions, taking into account: Relative living standards and the needs of the low paid The need to encourage collective bargaining The need to promote social inclusion through increased workforce participation The need to promote flexible modern work practices and the efficient and productive performance of work The need to provide additional remuneration for: Employees working overtime Employees working unsocial, irregular or unpredictable hours Employees working on weekends or public holidays Employees working shifts The principle of equal remuneration for work of equal or comparable value The likely impact of any exercise of modern award powers on business, including on productivity, employment costs and the regulatory burden The need to ensure a simple, easy to understand, stable and sustainable modern award system for Australia that avoids unnecessary overlap of modern awards, and The likely impact of any exercise of modern award powers on employment growth, inflation and the sustainability, performance and competitiveness of the national economy. An Example of modern award is Banking, Finance and Insurance Award 2020 25. Explain the purpose of enterprise bargaining and give an example of an enterprise agreement. Enterprise bargaining is the process of negotiation generally between the employer, employees and their bargaining representatives with the goal of making an enterprise agreement. The purpose of enterprise bargaining is as follow: To establishes a set of clear rules and obligations about how this process is to occur Improve workplace productivity through bargaining To increase efficiency and effectiveness of the business to the advantage of both the employer and the employee. Example of an enterprise agreement: Single Enterprise Agreement A single enterprise agreement can be created by two or more employers who share a single interest. To create a single enterprise agreement, all the employers wishing to join the agreement need to receive a determination from the Fair Work Commission that they are single interest employers. For example, this could be employers in related corporations or who are involved in a joint venture. These employers can come together to negotiate an agreement with their collective employees. RC- FNSTPB402- SAT1 -V1.1 Page | 11 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems 26. Explain whether an employment contract can provide for less than the legal minimum under the NES. An employment contract can’t provide for less than the legal minimum under the NES. They can’t exclude the NES. An employment contract must provide all 11 minimum entitlements of NES. These are: Maximum weekly hours Requests for flexible working arrangements Offers and requests to convert from casual to permanent employment Parental leave and related entitlements Annual leave Personal/carer's leave, compassionate leave and unpaid family and domestic violence leave Community service leave Long service leave Public holidays Notice of termination and redundancy pay Fair Work Information Statement and Casual Employment Information Statement 27. Under the Fair Work Act 2009, how much sick leave are employees entitled to. Under the Fair Work Act 2009, the yearly entitlement is based on an employee’s ordinary hours of work and is 10 days for full-time employees, and pro-rata for part-time employees. This can be calculated as 1/26 of an employee’s ordinary hours of work in a year. 28. Outline the four main items that must be recorded against an employee’s payroll record when they commence employment with a company to ensure they receive their correct salary and entitlements and their details are reported correctly to the ATO. General records Pay records Hours of work records Leave records 29. Explain the purpose of the Australian Bureau of Statistics (ABS) Act and briefly explain how statistics produced by the ABS can be used by a business. The ABS purpose is to inform Australia's important decisions by partnering and innovating to deliver relevant, trusted and objective data, statistics and insights. They impose the lowest load possible while meeting its obligations to provide Government and the community with a high quality official statistical service. Business providers are managed within an overall strategy referred to as Total Approach Management (TAM). This strategy aims to minimise the impact on providers while still achieving an acceptable level of compliance with ABS requests for information to ensure reliable statistical estimates are obtained. The Australian bureau of statistics (abs) has a wealth of information. This information can be used by businesses to improve their decisions and planning. Many businesses can use abs information to RC- FNSTPB402- SAT1 -V1.1 Page | 12 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems Decide when to start up or expand their business Locate potential customers Develop targeted marketing campaigns. Assess site location Improve your market strategy 30. List three entities who are entitled to an ABN Carrying on or starting an enterprise in Australia Making supplies connected with Australia's indirect tax zone A Corporations Act company. 31. Explain an employer’s obligation regarding PAYG withholding tax and outline when PAYG withholding amounts must be paid for small withholders (individual or business that withholds amounts under 25,000), for a medium withholder (individual or business that withholds amounts of $25,0001 to 1 million) and large withholders (individual or business that withholds amounts totalling more than $1 million). Small withholders: withholds $25,000 or less a year pays withholding amounts to us each quarter reports withholding on activity statements received each quarter can arrange to receive monthly activity statements by contacting our extended-hours business service. Medium withholders: withholds $25,001 to $1 million a year pays withholding amounts to us each month reports withholding on activity statements received each month. Large withholders: an individual or business that withheld amounts totalling more than $1 million in a previous financial year, or is part of a company group that has withheld more than $1 million in a previous financial year amounts withheld are paid, and sent electronically to us, twice a week date for payment depends upon the day withholding took place: 32. Who is responsible for paying fringe benefits tax, and what is the FBT Rate for the financial year ending March 2015 and the financial years ending 2016 and 2017? Employer is responsible for paying fringe benefits tax. The FBT Rate for the financial year ending March 2015 is 47% For financial years ending 2016 and 2017 is 49% 33. What is fringe benefit in tax terms and two examples of fringe benefits and two examples of items used for work that would not be classified as fringe benefits. RC- FNSTPB402- SAT1 -V1.1 Page | 13 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems In terms of tax fringe benefit is the services or additional benefit provided by the employer to employee or other associates. The two examples of fringe benefits are: Allowing employees to use a work car for private purpose. Providing entertainment to employee by offering free concert tickets. Examples of work that would not be classified as fringe benefits are: Benefits provided to volunteers and contractors. Employer contributions to comply super funds. 34. Give three examples of information that is reported on an Instalment Activity Statement (IAS)? Amounts of PAYG instalments, Amounts of PAYG withholding Amounts of ABN withholding. 35. In your own words, explain each principle of the TPB Code of Professional Conduct (Code) for all registered tax agents, BAS agents and tax (financial) advisers. Honesty and integrity You must act honestly and with integrity. You must comply with the taxation laws in the conduct of your personal affairs. If you: receive money or other property from or on behalf of a client, and hold the money or other property on trust you must account to your client for the money or other property. Independence You must act lawfully in the best interests of your client. You must have in place adequate arrangements for the management of conflicts of interest that may arise in relation to the activities that you undertake in the capacity of a registered BAS agent. Confidentiality Unless you have a legal duty to do so, you must not disclose any information relating to a client’s affairs to a third party without your client’s permission. Competence You must ensure that BAS services that you provide, or that is provided on your behalf, is provided competently. You must maintain knowledge and skills relevant to the BAS services that you provide. RC- FNSTPB402- SAT1 -V1.1 Page | 14 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems You must take reasonable care in ascertaining a client’s state of affairs, to the extent that ascertaining the state of those affairs is relevant to a statement you are making or a thing you are doing on behalf of a client. You must take reasonable care to ensure that taxation laws are applied correctly to the circumstances in relation to which you are providing advice to a client. Other responsibilities You must not knowingly obstruct the proper administration of the taxation laws. You must advise your client of the client’s rights and obligations under the taxation laws that are materially related to the BAS services you provide. You must maintain the professional indemnity insurance that the Board requires you to maintain. You must respond to requests and directions from the Board in a timely, responsible and reasonable manner. 36. What is an Early Termination Payment and when must it be made to be considered as an Early Termination Payment? An employment termination payment (ETP) is a lump sum payment received in consequence of the termination of employment. It can include: a payment for unused rostered days off or unused sick leave a payment in lieu of notices a gratuity or ‘golden handshake’ an amount of a genuine redundancy or early retirement scheme payment in excess of the tax-free component a payment because of termination due to an employee’s invalidity (other than compensation for personal injury) certain payments after the death of an employee It is considered to be as an Early Termination Payment if it is received no later than 12 months after the termination, unless it is a genuine redundancy or early retirement scheme payment 37. How are Early Termination Payment made outside the permitted period taxed? When Early Termination Payment period is exceeded then: a) it is included in your assessable income and taxed at your marginal tax rates b) A payment that is made more than 12 months after termination can still be an ETP in some circumstances. If you receive a termination payment more than 12 months after termination 38. Explain the concept of salary packaging and give two examples of common items that can be salary packaged. Salary Packaging is also known as Salary Sacrifice. It is the inclusion of employee benefits (also called fringe benefits) in an employee remuneration package in exchange for giving up part of monetary salary. If you work for an organisation that offers salary packaging, you can use some of your salary to pay for everyday expenses before income tax is calculated, meaning you pay less tax and have more RC- FNSTPB402- SAT1 -V1.1 Page | 15 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems money to spend. That’s because your salary packaging money is deducted first and then your tax is calculated on the remaining amount. Common items that can be salary packaged: Additional superannuation Aged care & disability costs for a loved one RC- FNSTPB402- SAT1 -V1.1 Page | 16 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems Assessment Task 1 Checklist Student’s name: Did the student provide a sufficient and clear answer that addresses the suggested answer for: Completed successfully Yes Comments No Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 Question 9 Question 10 Question 11 Question 12 Question 13 Question 14 Question 15 Question 16 Question 17 Question 18 Question 19 Question 20 Question 21 Question 22 Question 23 RC- FNSTPB402- SAT1 -V1.1 Page | 17 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au FNSTPB402 Establish and maintain payroll systems Student’s name: Did the student provide a sufficient and clear answer that addresses the suggested answer for: Completed successfully Yes Comments No Question 24 Question 25 Question 26 Question 27 Question 28 Question 29 Question 30 Question 31 Question 32 Question 33 Question 34 Question 35 Question 36 Question 37 Question 38 Question 39 Satisfactory Task Outcome: Not Satisfactory Assessor signature Assessor name Date RC- FNSTPB402- SAT1 -V1.1 Page | 18 Rockford International College Pty Ltd T/A Rockford College Level 3, 633 Princess Highway, Rockdale, NSW 2216 ABN: 47636979667|RTO Code: 45650 | CRICOS Provider Code: 03882C Phone: +61285935200 | Email: admissions@rockford.edu.au | Web: www.rockford.edu.au