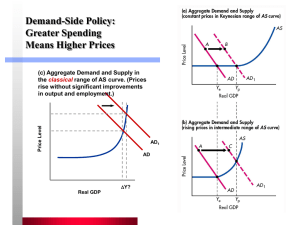

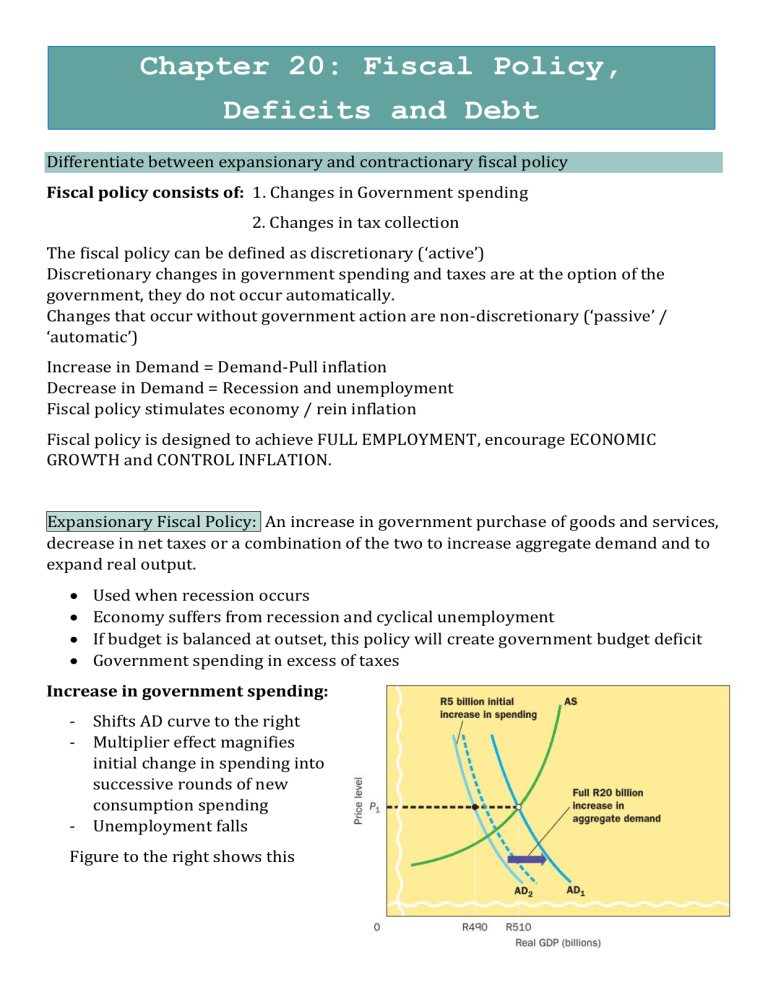

Chapter 20: Fiscal Policy, Deficits and Debt Differentiate between expansionary and contractionary fiscal policy Fiscal policy consists of: 1. Changes in Government spending 2. Changes in tax collection The fiscal policy can be defined as discretionary (‘active’) Discretionary changes in government spending and taxes are at the option of the government, they do not occur automatically. Changes that occur without government action are non-discretionary (‘passive’ / ‘automatic’) Increase in Demand = Demand-Pull inflation Decrease in Demand = Recession and unemployment Fiscal policy stimulates economy / rein inflation Fiscal policy is designed to achieve FULL EMPLOYMENT, encourage ECONOMIC GROWTH and CONTROL INFLATION. Expansionary Fiscal Policy: An increase in government purchase of goods and services, decrease in net taxes or a combination of the two to increase aggregate demand and to expand real output. Used when recession occurs Economy suffers from recession and cyclical unemployment If budget is balanced at outset, this policy will create government budget deficit Government spending in excess of taxes Increase in government spending: - Shifts AD curve to the right - Multiplier effect magnifies initial change in spending into successive rounds of new consumption spending - Unemployment falls Figure to the right shows this Tax reduction: - Reduction in taxes shifts AD curve to the left Increase in disposable income increases aggregate demand Multiplier effect causes successive rounds of increased consumption Part of tax reduction increases savings this shifts AD curve but not as far as government spending - The smaller the MPC, the greater tax cut is needed to shift the AD curve Combination of tax reduction and government spending - This will produce the desired initial decrease in spending - Will eventually increase AD - Increases GDP Contradictory Fiscal Policy: A decrease in government purchases of goods and services, an increase in net taxes, or some combination of the two to decrease aggregate demand which therefore controls inflation - When demand-pull inflation occurs, contractionary fiscal policy may help control it. - Government can decrease government spending, raise taxes or combination of the two. - In case of demand-pull inflation, fiscal policy should cause government budget surplus. - Tax revenues in excess of government spending. Decreased government spending - Reduced government spending shifts AD curve to the left to curb demand-pull inflation. - Multiplier effect causes AD curve to shift even further to the left - Thus, deflation will occur. - Economy is not as simple – increases in demand causes prices to rise but a decrease in demand doesn’t drop prices. - Stopping inflation is a matter of halting the rise of prices, not bringing it down. - Contractional fiscal policy stops continuous right shift of AD curve. Increased taxes - Tax increases reduces consumption spending - AD curve shifts to the left - Thus, multiplier effect shifts further left Combination of the two - Reduces AD and checks inflation Budget deficit: the amount by which the expenditures of the government exceed its revenues in a year Budget surplus: the amount by which government revenue exceeds its expenditures in a year Policy options: Government spending or taxes? Built-In Stability Government tax revenues change automatically over the course of a business cycle and in ways stabilize the economy. This built-in stability constitutes nondiscretionary budgetary policy and results from make-up of most tax systems. Net Tax revenues vary directly with GDP. Virtually any tax will yield more tax revenue as GDP rises. Built-in stabilizer: a mechanism that 1. increases government budget deficit (or reduces its surplus) during a recession, 2. increases government budget surplus (or reduces its deficit) during an expansion without any action by policy makers. e.g. the tax system Economic importance The economic importance of direct relationship between tax receipts and GDP becomes apparent when we consider 1. Taxes reduce spending and AD 2. Reductions in spending are desirable when economy is moving towards inflation 3. Increases in spending is desirable when economy is slumping Tax progressivity Built-in stability depends on responsiveness of tax revenues to changes in GDP The more progressive the tax system, the greater the built-in stability Built-in stabilizers can only diminish, not eliminate swings in real GDP -Line T represents the direct relationship between tax revenues and GDP. -The steepness of T depends on the tax system itself -If tax revenue changes sharply when GDP changes, T will be steep with vertical distances between T and G (the deficits and surpluses) will be large -If tax revenue hardly change when GDP changes; the slope will be gentle Most built in stability: higher the gradient Least built in stability: lower the gradient (flatter the line) Less built in stability (lower the line) = the largest generated cyclical deficits Progressive Tax: The average tax rate rises with GDP Average tax rate increases as taxpayer’s income increases Decreases with a decrease in taxpayer’s income Proportional Tax: Average tax rate remains constant as taxpayer’s income changes or when GDP rises. Regressive Tax: Average tax rate falls as GDP rises Tax whose average tax rate decreases as taxpayer’s income increases and increases when taxpayer’s income decreases. Evaluating Fiscal Policy In evaluating the status of the fiscal policy, we must adjust deficits and surpluses to eliminate automatic changes in tax revenues. Then compare the sizes of the adjusted budget deficits or surpluses to the levels of potential GDP. Standardised budget: AKA: Full-employment budget A comparison of government expenditures and tax collections that would occur if the economy operated at full employment (the full-employment budget) Standardised budget is used to adjust the actual budget deficits and surpluses to eliminate automatic changes in tax revenues. Standardized budget measures what budget deficit or surplus would be with existing tax rates and government spending levels if the economy has full employment level of GDP. Compares actual government spending with tax revenues that would have occurred if economy had achieved full-employment GDP. Cyclical deficit: a government budget deficit is caused by a recession and the consequent decline in tax revenues. -A recession occurs and GDP1 falls to GDP2 -Assume government takes no discretionary action so lines G and T stay the same. -Tax revenues automatically fall to R450 (point c) at GDP2 -While government spending remains at R500 (point b) -A R50 budget deficit (distance bc) arises -But this cyclical deficit is a by-product of the economy’s slide into recession - Real output declined from full employment (GDP3 to GDP4) and govt. response was reduced tax rates in year 4. -Represented by downward shift of T1 to T2 - Govt. spending in year 4 is R500 (point e) -The R25 tax revenue where e exceeds h is the standardised budget deficit that increased from 0 in year 3 (before tax cut) to a positive percentage (R25 x GDP3) This increase reveals that the fiscal policy is expansionary Problems, criticisms and complications Problems of timing Recognition lag: Time between beginning of recession and inflation and certain awareness that it is actually happening. Arises because of difficulty in predicting future. Administrative lag: Typically, a lag between time the need for action is realized and action is actually taken. Operational lag: A lag between the time fiscal action is taken and the time that action affects output, employment and price level. Political considerations - Fiscal policy is conducted in political arena. Politicians may rationalize actions and policies in their own self-interest. May use expansionary fiscal policy before election and contractionary after. Causing political business cycles. Political business cycles: tendency of parliament to destabilise the economy by reducing taxes and increasing government expenditures before elections and to raise taxes and lower expenditures after elections. Public debt Public debt: total amount owed by the government to the owners of government securities which is equal to the sum of past government budget deficits less government budget surpluses. Emerged mainly because of expansionary fiscal policy objectives. Primary burden of the debt = Interest charge accruing on bonds sold to finance debt. False concerns: - Large public debt won’t bankrupt the government because of Refinancing and Taxation. - Public debt is easily refinanced by selling new bonds. - Government can levy and collect taxes to finance debt Substantive issues: - Income distribution: distribution of ownership of government securities very uneven Incentives: Higher tax may dampen incentive to bear risk, innovate and risk Foreign owned public debt Crowding-out effect Practical Applications 1.1 Refer to the above diagram. The economy is at equilibrium at point A. What fiscal policy would be most appropriate to control demand-pull infla3on? A) decrease aggregate demand by increasing taxes B) increase aggregate demand by decreasing taxes C) decrease aggregate supply by increasing taxes D) increase aggregate demand by increasing government spending 1.2 Refer to the above diagram. The economy is at equilibrium at point B. What fiscal policy would increase real GDP? A) increase aggregate demand from AD2 to AD1 by decreasing taxes B) decrease aggregate demand from AD2 to AD3 by increasing government spending C) decrease aggregate demand from AD2 to AD3 by decreasing government spending D) increase aggregate demand from AD2 to AD3 by decreasing taxes 1.3 Refer to the above diagram. The economy is at equilibrium at point C. What fiscal policy would increase real GDP? A) increase aggregate demand from AD2 to AD1 by decreasing taxes B) decrease aggregate demand from AD2 to AD3 by increasing taxes C) increase aggregate demand from AD1 to AD2 by increasing government spending D) make no change because the economy is at or near its full-employment level of real output 1.4 Refer to the above diagram. An expansionary fiscal policy can best be represented by a: A) shift in the aggregate demand curve from AD2 to AD1. B) shift in the aggregate demand curve from AD3 to AD2. C) shift in the aggregate demand curve from AD1 to AD2. D) movement along the aggregate demand curve. 1.5 Refer to the above diagram. A contrac3onary fiscal policy can best be represented by a: A) shift in the aggregate demand curve from AD1 to AD2. B) shift in the aggregate demand curve from AD3 to AD2. C) shift in the aggregate demand curve from AD1 to AD3. D) movement along the aggregate demand curve 2.1) Refer to the above diagram. Which tax system has the most built-in stability? A) T4 B) T3 C) T2 D) T1Answer: D 2.2) Refer to the above diagram. Which tax system has the least built-in stability? A) T4 B) T3 C) T2 D) T1Answer: A 2.3) Refer to the above diagram. Which tax system will generate the largest cyclical deficits? A) T4 B) T3 C) T2 D) T1 Answer: D 3.1) If the full-employment GDP for the above economy is at L, the: A) actual budget will have a deficit. B) standardized budget will have a deficit. C) actual budget will have a surplus. D) standardized budget will have a surplus. Answer: D 3.2) With the expenditures programs and the tax system shown in the above diagram: A) the public budget will be expansionary at all GDP levels above K, and contrac3onary at all GDP levels below K. B) the public budget will be a destabilizing force at all levels of GDP. C) deficits will occur at income levels below K, and surpluses above K. D) deficits will occur at income levels below H, and surpluses above H. Answer: C 3.3) Refer to the above diagram. The degree of built-in stability in the above economy could be increased by: A) reducing government purchases so that the purchases line shifts downward but parallel to its present position. B) changing the tax system so that the tax line is shifted downward but parallel to its present position. C) changing the tax system so that the tax line has a greater slope. D) altering the government expenditures line so that it has a posi3ve slope. Answer: C 4)The following is budget informa3on for a hypothe3cal economy. All data are in billions of rand. 4.1 In which year is there a budget surplus? A) Year 1 B) Year 2 C) Year 3 D) Year 4 Answer: B 4.2 In which year is there a balanced budget? A) Year 1 B) Year 2 C) Year 3 D) Year 4 Answer: C 4.3 What is the public debt as a percentage of GDP in Year 5? A) 1.6 percent B) 2.7 percent C) 4.9 percent D) 6.7 percent Answer: B Calculate Public Debt: 4.4 What year is the budget deficit R250 billion? A) Year 2 B) Year 3 C) Year 4 D) Year 5 Answer: D 4.5 Assume that Year 1 is the first year for this economy and Year 5 is the current year. What is the public debt in this economy? A) R100 billion B) R150 billion C) R250 billion D) R300 billion Answer: D 5.1 Using the Id1 schedule, assume that the government needs to finance the public debt and this public borrowing increases the interest rate from 3% to 4%. How much crowding out of private investment will occur? A) R100 billion B) R200 billion C) R600 billion D) R700 billion Answer: A 5.2 Assume that the public debt is used to improve the capital stock of the economy and that, as a consequence, the investment-demand schedule changes from Id1 to Id2. At the same 3me, the interest rate rises from 3% to 4% as the government borrows money to finance the public debt. How much crowding out of private investment will occur in this case? A) R0 B) R100 billion C) R600 billion D) R700 billion Answer: A 5.3 The crowding-out effect means that: A) higher interest rates would decrease private investment spending. B) lower interest rates would increase private investment spending. C) lower interest rates would decrease private investment spending. D) higher interest rates would increase private investment spending. Answer: A