Fiscal Policy

advertisement

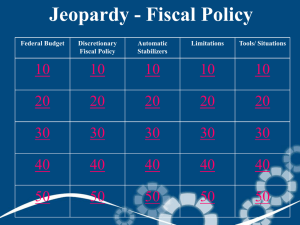

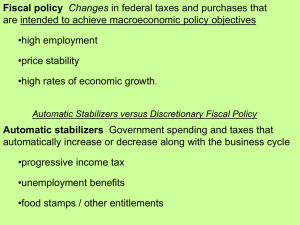

Fiscal Policy Purpose: to regulate fluctuations in the market economy -Carried out by the executive branch with oversight from the legislative branch. Discretionary policy- directed in response to economy Automatic or “built in” policy- a result of the tax system or Gov. spending without any legislative action. Discretionary: A. Expansionary Fiscal Policy- three options to combat recession (fig 11.1) 1. Increase Government Spending- amend the lack of investment in accordance with the multiplier 2. Reduce Taxes-Because of the MPS, the amount of tax cuts must be greater than Spending in order to have the same effect on AD 3. Combination of the two B. Contractionary Fiscal Policy-to combat demand-pull inflation- three options (fig. 11.2) 1. Decrease Government Spending-problem: prices tend to ratchet up when AD increases, but not the other way. So, reductions usually mean no further shifts, taming inflation. 2. Increased Taxes- Multiplier and MPS must be addressed 3. Combination of the two C. Deficits and Surpluses in the budget 1. Expansionary Policy Impact-increasing debt 2. Borrowing from the Public- competition for funds will drive up interest rates and counterbalance the effect of increased spending 3. Money creation-This can alleviate the competition for funds, but can potentially cause increase inflation 4. Contractionary Policy Impact-increasing surplus 5. Debt Retirement-paying off debt increases the amount of money in the market, increasing borrowing and spending, which can be counterproductive to the policy 6. “Impounding” funds-keeping funds “in reserve” is not as inflationary, but politically unpopular D. So, is Spending or Taxing the best policy? It depends on an individual’s view of the role and size of government at the time. Automatic or “built-in” Policy Changes in tax revenues in relation to performance of the GDP E. During Recession- the deficit automatically increases (or surplus decreases) F. During Inflation- The deficit automatically decreases (or surplus increases) T Gov & Tax Rev. surplus G deficit GDP 1 GDP 2 GDP 3 G. As GDP rises during prosperity, so due tax revenues and the implementation of the contractionary surplus “policy” H. The opposite is true for recessions I. Progressive taxation 1. The rate of change in taxes determines the slope of the tax curve and the “built-in” stability 2. Progressive tax- tax rate rises with GDP-most steep 3. Proportional tax- constant rate- less steep 4. Regressive tax- declining rate - least steep Determining and Evaluating Fiscal Policy J. Full Employment Budget (standardized budget)- the budget that would be reached at current tax levels and government spending if the economy reached potential GDP (full employment) K. Is the budget deficit a result of discretionary (expansionary?) policy or builtin? L. What if the tax rates were reduced? M. Recent U.S. Fiscal Policy (see table 11.1) Criticism of Fiscal Policy N. Timing- Are the corrections timely? 1. Recognition lag 2. Administrative lag 3. Operational lag O. Political considerations- Is the economy or politics being served? P. Local and State financing- provisions to balance budgets actually make situations worse. Q. Crowding-out- effect on interest rates-see loanable funds Graph R. Foreign impacts of AD-The net export effect- (see table 12.2, Page 226) Step 1-Expansionary policy raises interest rates due to the crowding-out effect Step 2-Higher interest rates attract foreign money to be exchanged into dollars Step 3-Higher demand for U.S. dollars raise the value Step 4-Higher valued dollars means more expensive U.S. goods for foreigners Step 5-More expensive U.S. goods means fewer purchases of them. The effect is the opposite for contractionary policy Debt and Deficit, revisited Who owns American debt? Debt as a percentage of GDP Debt compared to other countries Crowding Out-if the public investments lead to possible private gains, then the crowding out can be eliminated or at least reduced.