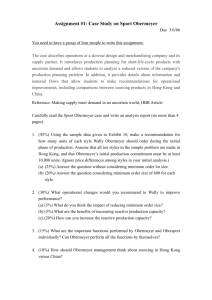

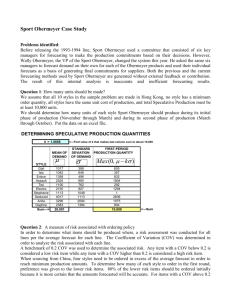

Sports Obermeyer Ltd. Case Report Submitted to: Dr. Rameez Khalid For the Course of Technology and Operations Management Summer Session 2014 INSTITUTE OF BUSINESS ADMINISTRATION, KARACHI August 12, 2014 Authored by: AHSAN JALAL (07863) NAJIULLAH HABIB (06659) YASEEN JAN ALLAWALA (07850) ZEESHAN JAWED (05042) Abstract The case report assignment provided in this course is meant for students to apply their theoretical knowledge of technology and operations management so that they can learn real world operation challenges. Our group decided to take Sports Obermeyer case due to following reasons: All members love sports so utmost the Sports Obermeyer case grasped the attention It gave us variety of challenges This case covers overall topics which covered in the academic course It gives an opportunity to think as marketer, planner, financer and at best an operations manager 1|Page Contents Abstract ......................................................................................................................................................... 1 Company Introduction .................................................................................................................................. 3 PROBLEM STATEMENT WITH SOLUTION ...................................................................................................... 3 PRODUCTION PLANNING PROBLEM ......................................................................................................... 3 INACCURATE FORECAST: ........................................................................................................................... 5 LONG MANUFACTURE LEAD TIME: ........................................................................................................... 6 Application in Pakistan Industry ................................................................................................................... 8 Annexure ....................................................................................................................................................... 9 2|Page Company Introduction Sport Obermeyer's origins traced back to 1947, when Klaus Obermeyer commenced instructing at the Aspen Ski School. During harsh winter Klaus found his students cold and miserable due to the impractical clothing. Klaus began to find durable, high-performance ski clothing and equipment for his students. In the early 1980s, he popularized the "ski brake," a simple device replacing cumbersome "run-away straps"; the brake kept skis that had fallen off skiers from plunging down the slopes. Over the years, Sport Obermeyer developed into a preeminent competitor in the U.S. skiwear market: estimated sales in 1992 were $32.8 million. The company held a commanding 45% share of the children's skiwear market and 11% share of the adult skiwear market. Product line: Obermeyer offered a broad line of fashion ski apparel, including parkas, vests, ski suits, shells, ski pants, sweaters, turtlenecks, and accessories. Parkas were considered the most critical design component of a collection; the other garments were fashioned to match the parkas' style and color. Obermeyer products were offered in five different "genders": men's, women's, boys', girls', and preschoolers'. The company segmented each "gender" market according to price, type of skier, and how "fashion-forward" the market was. PROBLEM STATEMENT WITH SOLUTION PRODUCTION PLANNING PROBLEM In this case, we found that one of the biggest challenges which company faces was to decide where to produce their products and in which quantity. This task becomes more challenging due to little or no sales forecast. The risk associated with this involves: 1. Over production which leads to selling of products at a discount that is even below the manufacturing cost 2. Stock Outs: high sale items stock out which result in the decline in customer trust in company The problems become critical due to difference in aspects of their production facilities. That is to say that the China and Hong Kong facilities provide parkas with many limiting factors. Even if production is decided the quantity for each production facility will remain a problem which can lead to over production or stock out. 3|Page ANALYSIS OF PRODUCTION PLANNING The analysis of problem contains a comparison of production facilities. First thing to consider in solution for production planning challenges is to compare production facilities. From Table 1 we see that China production facility outruns Hong Kong due low labor cost and transportation cost1. But we still cannot say that China is superior to Hong Kong due to uncertainty of sales2. On basis of COV<=.2 it is safe product. The result showed gave us Isis, Teri, Stephanie, Anita and Dephne as Risky products. Assuming 24% profit/piece while 8% loss/piece as given in exhibit, We calculated unit profit or loss on each product in table 3. In order to meet Wally commitment of 10000 units without proper forecast, we used normal distribution formula: 3 Since minimum order has been calculated, in first phase we decided to order all products from China than all order from Hong Kong. But by analysis, it was observed that all product from China will increase excess quantity which can be troublesome. While all product from Hong Kong will increase labor cost decreasing profit margins [Table 5, 6]. Therefore we placed risky item low quantity orders in Hong Kong to decrease excess quantities. While large orders from China as shown in table resulting in reduction of risk and labor cost. Style Min order China Hong Kong Gail Isis Entice Assault Teri Electra Stephanie Seduced Anita Daphne Total 605 357 832 1,804 292 1,294 2 2,836 1,075 903 10,000 0 0 0 1,804 0 1,294 0 2,836 605 600 832 0 600 0 600 0 1,075 903 5,215 0 5,934 Excess Qty 0 243 0 0 308 0 598 0 0 0 1,149 Excess Qty Risk $ 0 1,925 0 0 3,031 0 6,363 0 0 0 11,318 RECOMMENDATION Due to expected forecast error, there is a risk of over/out stocks, but to meet minimum number of forecasted quantity we have to imply all options. After Las Vegas show, Quantities greater than 1200 units should be produced in China facility as it clearly has an edge over Hong Kong due to labor and transportation cost. But in order to defy out stocking, we can order a lot from Hong 1 Please refer to Table 1 in Annexure. In order to assess the risk associated with each product line, a dimensionless number is used called coefficient of variance. Please refer to Table 2 in Annexure. 3 Normal Distribution : x= µ - z δ 2 4|Page Kong to release the pressure as lead time is lower at Hong Kong. In certain cases, Air transport can be utilized for faster delivery. INACCURATE FORECAST: One of the problems faced by Obermeyer is inaccurate forecasting. They are unable to accurately predict market response to its product lines in order to meet demand most efficiently. Since “Greater product variety and more intense competition have made accurate predictions increasingly difficult”. It needs to find a way to improve forecasting the demand in order to avoid stock-outs and at the same time, avoid excess merchandise in its warehouse for those products that retailers did not purchased. Considerable income is lost each year to Lost sales and Deep discounts because of the company's inability to predict best-sellers products. RECOMMENDATION As Exhibit 5 from the case study4 suggests, Demand Forecasts Improves with Increasing Information, Obermeyer usually receives 80% of the annual order volume the week after Las Vegas show, long after its products entered production. If only Obermeyer gets the response sooner, it can alter its forecast to match the demand for the upcoming season. Obermeyer can arrange an early meeting with some of its largest retailer customers to give them a sneak preview of the new annual line and to cash early orders. The data collected and gathered from early orders and from the results of the existing buying-committee can together then be used to improve demand forecasts just before the Trade show. To maximize the value of the market feedback, Obermeyer could also include small retailers from both urban and resort retailers. To deal with stock-outs, now that Obermeyer will be in a position to forecast more accurately the predictable items or “best-sellers”, it can devote most of its production to these items, thus limiting the production of unpredictable items and hence not resulting in excess merchandise of the items not bought by the retailers. To incorporate Lost Sales due to stock-outs, Obermeyer can ask its retailers to improve customer interaction by fulfilling customer requests for an unavailable item at a later time through mail, if possible. The lost sales data can further benefit Obermeyer in determining the true demand of its retailer which will allow Obermeyer to do a better job of estimating lost sales and forecasting demand. 4 Please see Exhibit 5 attached for reference 5|Page Early communication with its retailers can help Obermeyer pass the crucial information to its suppliers, allowing the information (material management) they need as soon as possible, production to begin earlier and the bullwhip effect to be greatly reduced. Further more, instead of using just a simple average of the individual forecasts made by the “buying-committee”, using a weighted average; with the weights reflecting past accuracy (calculated using MAPE or Mean Absolute Percent Error) to enhance the accuracy of demand forecasts. LONG MANUFACTURE LEAD TIME: Nearly two years of planning and production activity takes place prior to the actual sale of products to consumers. To make matters worse strict quota restrictions by the U.S government in certain product categories, results in individual companies rushing to get their products into the country before other firms had "used up" the available quota. To overcome the highly volatile demand, the Obermeyer has to bears huge transporation costs (air-shipping) to ensure timely delivery to retailers. RECOMMENDATION Decrease lead times for both raw materials and finished goods, thereby allowing more time to utilize existing capacity. Since the business strategy should emphasize dependability more than cost, lead times can be reduced using some or all the following methods. Chose suppliers of raw materials more on the basis of dependability rather than just cost Speed up orders through information sharing with suppliers Speed up shipments using faster (but more expensive) shippers. Establish some local (but more expensive) production capacity for “last minute” production. Other ways to reduce lead time includes: For the items with long lead times increase the amount of safety stock inventory for those items that are inexpensive and/or shared by many parkas (e.g. black fabric, lining and insulation fabrics). Simplify the Parkas design so that they can share as many components as possible. Increase production capacity by using more sub-contractors who can deliver at a faster rate to fill in gaps and employing more overtime in China. Exploring an alliance with swimwear manufacturers who can supply excess capacity when Obermeyer needs it and consume capacity when Obermeyer has excess capacity 6|Page Decrease minimum order quantities, thereby improving the ability to “fine tune” during reactive production. Minimum order quantities occur because there are long setup times when switching from the production of one style of parka to another, thereby making it uneconomical to have short runs. Obermeyer can decrease the minimum order quantities by providing incentives to its suppliers to have more flexible production lines. Increased flexibility can come from improved process design e.g. cellular production. Buy new technologically advanced equipment e.g. a flexible cutting machine and by completely automating the sewing operations. If implemented, these changes would drastically impact the supply chain, avoid income lost each year, improve the overall quality and cost of the Obermeyer product line and help the company’s ability to predict “future best-sellers”. FUTURE OF OBERMEYER Obermeyer incorporated the following changes in order to shorten lead times and cope up with Demand Uncertainty; Operational Changes Introduced computerized systems to reduce the time for order processing and computing raw material requirements Pre-positioned anticipated raw materials in a warehouse in the Far East. With material in hand Sport Obermeyer could begin manufacturing as soon as it received orders Began using air freight as delivery due dates approached Production Planning Changes Kept raw materials and production capacity undifferentiated as long as possible Booked production capacity well in advance without specifying exact styles until later (assumed risk of supplying raw materials to factories) Merged design and production departments to broaden strategy Encouraged designers to use same types of raw materials Recorded orders for out of stock products 7|Page The Company Sports Obermeyer will be able to continue its operations and business as soon as it increases its efficiency in its supply chain and planning process. It also will have to establish a distribution channel to reduce lead times and cost of inland transportation from Seattle to Denver. Some of its changes at the operational level include collecting and analyzing its past data and being vigilant of any situation as observed in case where stock outs are occurring. In all, the forecast needs to be as correct as possible. In long term future the Company will be better off developing its production base in China as that is where all the production of the majority of the world’s goods are coming from. The company in future will focus on sustainable building and use environmental friendly materials. The company can use solar panels at its factories to and use mountain supply water in the summer. The solar panel array will be energy saving and exhaust reducing strategies. Furthermore all factory lighting can be phased in to fluorescent lamps, furthering energy efficiency. Sports Obermeyer should continually look for better ways to improve efficiencies and to make sure to produce goods in environmentally friendly way. The company in future can move from solvent based dyes to water based dye alternatives.5 Application in Pakistan Industry Levi’s Pakistan has 240 SKUs.6 This was calculated when we researched about the new factory which started its operation almost 10 years back. Levis is a clothing brand with a product mix of 240 SKUs (3 colors x 20 styles x 4 sizes). Levis produces several variants, including 2-4 colors, of 4 different sizes, that make them hard to forecast the demand of each SKU. Levis has developed an alliance with its upstream and downstream because they are already holding keen interest in the development of their suppliers. Also Levis is selling its clothing line through its own franchises and retail shops, including the factory outlets. After the first few years they developed several issues with stocks left in there stores so they developed its factory outlets to sell at a discount in order to gain minimum profits from left over merchandise. It also streamlined its supply chain by introducing a customer feedback asking its customers which style they prefer so Levis will make exactly what their customers want. 5 See more at: http://www.obermeyer.com/stepping-lightly/production-and-manufacturing.html#sthash.6sns00JE.dpuf 6 http://levi.com.pk/pk/# 8|Page Annexure Table 1 Dec Var Exchange Rate Labor Cost Productivity Repairs min Order Qty Transportation Total CHINA HONG KONG Justification of Value Score Wt Score Score Wt Score 0.1 10 1 8 0.8 Exchange rate of HKD is 37% higher than RMB 0.35 10 1 6 0.6 Labor cost of China is 90 % lower than HongKong 0.25 8 0.8 10 1 Productivity of china is 40 % lower than that of HK 0.05 8 0.8 10 1 repairs of HK product is more than 50 % lower 0.1 5 0.5 5 0.5 Min Qty limits restriction 0.15 8 0.8 6 0.6 Transportaion Cost from china is 14% lower 1 49 4.9 45 4.5 Factor Table 2 Style Price Avg FC 2*Std Dev Gail 110 1017 388 Isis 99 1042 646 Entice 80 1358 496 Assault 90 2525 680 Teri 123 1100 762 Electra 173 2150 807 Stephanie 133 1113 1048 Seduced 73 4017 1113 Anita 93 3296 2094 Daphne 148 2382 697 Total ‐ 20000 ‐ COV Risk/ Safe 0.38 Safe 0.62 Risk 0.37 Safe 0.27 Safe 0.69 Risk 0.38 Safe 0.94 Risk 0.28 Safe 0.64 Risk 0.29 Safe ‐ ‐ Table 3 Style Price Profit Gail 110 26.4 Isis 99 23.76 Entice 80 19.2 Assault 90 21.6 Teri 123 29.52 Electra 173 41.52 Stephanie 133 31.92 Seduced 73 17.52 Anita 93 22.32 Daphne 148 35.52 Total ‐ 269.28 Loss 8.8 7.92 6.4 7.2 9.84 13.84 10.64 5.84 7.44 11.84 89.76 Diff 17.6 15.84 12.8 14.4 19.68 27.68 21.28 11.68 14.88 23.68 9|Page Table 4 K= 1.06 Style Price Avg FC Std Dev Min order Gail 110 1,017 388 605 Isis 99 1,042 646 357 Entice 80 1,358 496 832 Assault 90 2,525 680 1,804 Teri 123 1,100 762 292 Electra 173 2,150 807 1,294 Stephanie 133 1,113 1,048 1 Seduced 73 4,017 1,113 2,836 Anita 93 3,296 2,094 1,075 Daphne 148 2,382 1,394 903 Total ‐ 20,000 10,000 Table 5 Style Price Min order China Excess qty Gail Isis Entice Assault Teri Electra Stephanie Seduced Anita Daphne Total 110 99 80 90 123 173 133 73 93 148 ‐ 605 357 832 1,804 292 1,294 1 2,836 1,075 903 10,000 1200 1200 1200 1804 1200 1294 1200 2836 1200 1200 14,334 595 843 368 0 908 0 1,199 0 125 297 4,334 Style Price Min order Hong Kong Excess qty Gail Isis Entice Assault Teri Electra Stephanie Seduced Anita Daphne Total 110 99 80 90 123 173 133 73 93 148 ‐ 605 357 832 1,804 292 1,294 1 2,836 1,075 903 9,999 605 600 832 1804 600 1294 600 2836 1075 903 11,149 0 243 0 0 308 0 599 0 0 0 1,150 Risk on Excess Qty $ 5,232 6,678 2,356 2 8,937 0 12,753 0 930 3,511 40,399 Labor Cost USD 937 937 937 1,408 937 1,010 937 2,214 937 937 11,191 Table 6 Risk on Excess Qty $ 0 1,925 0 0 3,031 0 6,373 0 0 0 11,329 Labor cost USD 5,864 5,815 8,064 17,485 5,815 12,542 5,815 27,487 10,419 8,752 108,060 10 | P a g e Exhibit 5 11 | P a g e