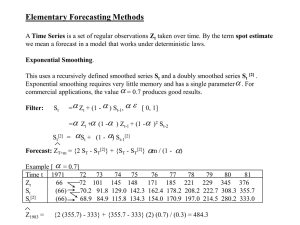

1 Textbook: pp. 165-202 Chapter 5: Forecasting 2 Learning Objectives After completing this chapter, students will be able to: • Understand and know when to use various families of forecasting models • Compare moving averages, exponential smoothing, and other time-series models • Calculate measures of forecast accuracy • Apply forecast models for random variations • Apply forecast models for trends and random variations • Manipulate data to account for seasonal variations • Apply forecast models for trends, seasonal variations, and random variations • Explain how to monitor and control forecasts 3 Introduction • Main purpose of forecasting Reduce uncertainty and make better estimates of what will happen in the future • Subjective methods Seat-of-the pants methods, intuition, experience • More formal quantitative and qualitative techniques 4 Forecasting Models 5 Qualitative Models (1 of 3) • Incorporate judgmental or subjective factors o Useful when subjective factors are important or accurate quantitative data is difficult to obtain • Common qualitative techniques 1. Delphi method 2. Jury of executive opinion 3. Sales force composite 4. Consumer market surveys 6 Qualitative Models (2 of 3) • Delphi Method o Iterative group process o Respondents provide input to decision makers o Repeated until consensus is reached • Jury of Executive Opinion o Collects opinions of a small group of high-level managers o May use statistical models for analysis 7 Qualitative Models (3 of 3) • Sales Force Composite o Allows individual salespersons estimates o Reviewed for reasonableness o Data is compiled at a district or national level • Consumer Market Survey o Information on purchasing plans solicited from customers or potential customers o Used in forecasting, product design, new product planning 8 Time-Series Models • • • • Predict the future based on the past Uses only historical data on one variable Extrapolations of past values of a series Ignores factors such as o Economy o Competition o Selling price 9 Components of a Time Series (1 of 3) • Sequence of values recorded at successive intervals of time • Four possible components o Trend (T) o Seasonal (S) o Cyclical (C) o Random (R) 10 Components of a Time Series (2 of 3) Scatter Diagram for Four Time Series of Quarterly Data: 11 Components of a Time Series (3 of 3) Scatter Diagram of a Time Series with Cyclical and Random Components: 12 Trend (T); Seasonal (S); Cyclical (C); Random (R) Time-Series Models Two basic forms: • Multiplicative Demand = T × S × C × R • Additive Demand = T + S + C + R • Combinations are possible 13 Measures of Forecast Accuracy (1 of 5) • Compare forecasted values with actual values o See how well one model works o To compare models Forecast error = Actual value − Forecast value • Measure of accuracy o Mean absolute deviation (MAD): forecast error MAD n 14 Measures of Forecast Accuracy (2 of 5) Computing the Mean Absolute Deviation (MAD). 15 Measures of Forecast Accuracy (3 of 5) Computing the Mean Absolute Deviation (MAD): • Forecast based on naïve model • No attempt to adjust for time series components forecast error MAD n 16 160 17.8 9 Measures of Forecast Accuracy (4 of 5) Computing the Mean Absolute Deviation (MAD): 17 Measures of Forecast Accuracy (5 of 5) Other common measures: o Mean squared error (MSE) MSE 2 (error) n o Mean absolute percent error (MAPE) error actual MAPE 100% n o Bias is the average error 18 Forecasting Random Variations • No other components are present • Averaging techniques smooth out forecasts o Moving averages o Weighted moving averages o Exponential smoothing 19 Moving Averages (1 of 2) • Used when demand is relatively steady over time o The next forecast is the average of the most recent n data values from the time series o Smooths out short-term irregularities in the data series Moving average forecast = Sum of demands in previous n periods n 20 Moving Averages (12 of 2) Mathematically: Yt Yt 1 ... Yt n 1 Ft 1 n where Ft+1 Yt n = forecast for time period t + 1 = actual value in time period t = number of periods to average 21 Wallace Garden Supply (1 of 4) • Wallace Garden Supply wants to forecast demand for its Storage Shed o Collected data for the past year o Use a three-month moving average (n = 3) 22 Wallace Garden Supply --- Shed Sales (2 of 4) 23 Weighted Moving Averages • Weighted moving averages use weights to put more emphasis on previous periods • Often used when a trend or other pattern is emerging Ft 1 (Weight in period i )(Actual value in period i ) (Weights) Mathematically w1Yt w 2Yt 1 ... w nYt n 1 Ft 1 w1 w 2 ... w n where wi = weight for the ith observation 24 Wallace Garden Supply (3 of 4) • Use a 3-month weighted moving average model to forecast demand Weighting scheme: 25 Wallace Garden Supply (4 of 4) Weighted Moving Average Forecast for Wallace Garden Supply: 26 Exponential Smoothing (1 of 2) Exponential smoothing: o A type of moving average o Easy to use o Requires little record keeping of data New forecast = Last period’s forecast + α(Last period’s actual demand − Last period’s forecast) α is a weight (or smoothing constant) with a value 0 ≤ α ≤ 1 27 Exponential Smoothing (2 of 2) Mathematically Ft 1 Ft (Yt Ft ) where Ft+1 Yt α Yt = new forecast (for time period t + 1) = pervious forecast (for time period t) = smoothing constant (0 ≤ α ≤ 1) = pervious period’s actual demand The idea is simple – the new estimate is the old estimate plus some fraction of the error in the last period! 28 Exponential Smoothing Example (1 of 2) • In January, February’s demand for a certain car model was predicted to be 142 • Actual February demand was 153 autos • Using a smoothing constant of α = 0.20, what is the forecast for March? New forecast (for March demand) If actual March demand = 136 New forecast (for April demand) = 142 + 0.2(153 − 142) = 144.2 or 144 autos = 144.2 + 0.2(136 − 144.2) = 142.6 or 143 autos 29 Exponential Smoothing Example (2 of 2) • Selecting the appropriate value for α is key to obtaining a good forecast • The objective is always to generate an accurate forecast • The general approach is to develop trial forecasts with different values of α and select the α that results in the lowest MAD 30 Port of Baltimore Example (1 of 2) Port of Baltimore Exponential Smoothing: • Forecasts for α = 0.10 and α = 0.50 31 Port of Baltimore Example (2 of 2) Absolute Deviations and MADs for the Port of Baltimore Example: 32 PROGRAMME 5.1A Using Software (1 of 7) Selecting the Forecasting Model in Wallace Garden Supply Problem: 33 PROGRAMME 5.1B Using Software (2 of 7) Initialising Excel QM Spreadsheet for Wallace Garden Supply Problem: 34 PROGRAMME 5.1C Using Software (3 of 7) Excel QM Output for Wallace Garden Supply Problem: 35 PROGRAMME 5.2A Using Software (4 of 7) Selecting Time-Series Analysis in QM for Windows in the Forecasting Module: 36 PROGRAMME 5.2B Using Software (5 of 7) Entering Data for Port of Baltimore Example in QM for Windows: 37 PROGRAMME 5.2C Using Software (6 of 7) Selecting the Model and Entering Data for Port of Baltimore Example in QM for Windows: 38 PROGRAMME 5.2D Using Software (7 of 7) Output for Port of Baltimore Example in QM for Windows: 39 Forecasting Models – Trend and Random Variations • Exponential smoothing does not respond to trends • A more complex model can be used • The basic approach o Develop an exponential smoothing forecast o Adjust it for the trend 40 Exponential Smoothing with Trend (1 of 2) • The equation for the trend correction uses a new smoothing constant β • Ft and Tt must be given or estimated • Three steps in developing FITt Step 1: Compute smoothed forecast Ft+1 Smoothed forecast = Previous forecast including trend + a(Last error) Ft 1 FITt (Yt FITt ) 41 Exponential Smoothing with Trend (2 of 2) Step 2: Update the trend (Tt +1) using Smoothed forecast = Previous forecast including trend + b(Error or excess in trend) Tt 1 Tt (Ft 1 FITt ) Step 3: Calculate the trend-adjusted exponential smoothing forecast (FITt +1) using Forecast including trend (FITt+1) = Smoothed forecast (Ft+1) + Smoothed trend (Tt+1) FITt 1 Ft 1 Tt 1 42 Selecting a Smoothing Constant • A high value of β makes the forecast more responsive to changes in trend • A low value of β gives less weight to the recent trend and tends to smooth out the trend • Values are often selected using a trial-and-error approach based on the value of the MAD for different values of β 43 Midwestern Manufacturing (1 of 6) • Demand for electrical generators from 2007 – 2013 o Midwest assumes F1 is perfect, T1 = 0, α = 0.3, β = 0.4 FIT1 = F1 +T1 = 74 + 0 = 74 Midwestern Manufacturing’s Demand: 44 Midwestern Manufacturing (2 of 6) For 2008 (time period 2) Step 1: Compute Ft+1 F2 = FIT1 + α(Y1 − FIT1) = 74 + 0.3(74 − 74) = 74 Step 2: Update the trend T2 = T1 + β(F2 − FIT1) = 0 + .4(74 − 74) = 0 45 Midwestern Manufacturing (3 of 6) Step 3: Calculate the trend-adjusted exponential smoothing forecast (Ft+1) using FIT2 = F2 + T2 = 74 + 0 = 74 46 Midwestern Manufacturing (4 of 6) For 2009 (time period 3) Step 1: F3 = FIT2 + α(Y2 − FIT2) = 74 + 0.3(79 − 74) = 75.5 Step 2: T3 = T2 + .4(F3 − FIT2) = 0 + .4(75.5 − 74) = 0.6 Step 3: FIT3 = F3 + T3 = 75.5 + 0.6 = 76.1 47 Midwestern Manufacturing (5 of 6) Midwestern Manufacturing Exponential Smoothing with Trend Forecasts: 48 PROGRAMME 5.3 Midwestern Manufacturing (6 of 6) Output from Excel QM in Excel 2016 for Trend-Adjusted Exponential Smoothing Example: 49 Trend Projections (1 of 2) • Fits a trend line to a series of historical data points • Projected into the future for medium- to long-range forecasts • Trend equations can be developed exponential or quadratic models based on • Linear model developed using regression analysis is simplest 50 Trend Projections (2 of 2) Mathematical formula: where Ŷ b0 b1 X Yˆ b0 b1 X = predicted value = intercept = slope of the line = time period (i.e., X = 1, 2, 3, …, n) 51 Midwestern Manufacturing (1 of 4) • Based on least squares regression, the forecast equation is Yˆ 56.71 10.54X • Year 2014 is coded as X = 8 (sales in 2014) = 56.71 + 10.54(8) = 141.03, or 141 generators • For X = 9 (sales in 2015) = 56.71 + 10.54(9) = 151.57, or 152 generators 52 PROGRAMME 5.4 Midwestern Manufacturing (2 of 4) Output from Excel QM in Excel 2016 for Trend Line Example: 53 PROGRAMME 5.5 Midwestern Manufacturing (3 of 4) Output from QM for Windows for Trend Line Example: 54 Midwestern Manufacturing (4 of 4) Generator Demand and Projections for Next Three Years Based on Trend Line: 55 Seasonal Variations • Recurring variations over time may indicate the need for seasonal adjustments in the trend line • A seasonal index indicates how a particular season compares with an average season o An index of 1 indicates an average season o An index > 1 indicates the season is higher than average o An index < 1 indicates a season lower than average 56 Seasonal Indices • Deseasonalised data is created by dividing each observation by the appropriate seasonal index • Once deseasonalised forecasts have been developed, values are multiplied by the seasonal indices • Computed in two ways o Overall average o Centered-moving-average approach 57 Seasonal Indices with No Trend (1 of 3) • Divide average value for each season by the average of all data o Telephone answering machines at Eichler Supplies o Sales data for the past two years for one model o Create a forecast that includes seasonality 58 Seasonal Indices with No Trend (2 of 3) Answering Machine Sales and Seasonal Indices: 59 Seasonal Indices with No Trend (3 of 3) Calculations for the seasonal indices: 60 Seasonal Indices with Trend (1 of 2) • Changes could be due to trend, seasonal, or random • Centered moving average (CMA) approach prevents trend being interpreted as seasonal • Turner Industries sales contain both trend and seasonal components 61 Seasonal Indices with Trend (2 of 2) Steps in CMA: 1. Compute the CMA for each observation (where possible) 2. Compute the seasonal ratio = Observation÷CMA for that observation 3. Average seasonal ratios to get seasonal indices 4. If seasonal indices do not add to the number of seasons, multiply each index by (Number of seasons)÷(Sum of indices) 62 Turner Industries (1 of 7) Quarterly Sales ($1,000,000s) for Turner Industries: 63 Turner Industries (2 of 7) Quarterly Sales ($1,000,000s) for Turner Industries: 64 Turner Industries (3 of 7) • To calculate the CMA for quarter 3 of year 1, compare the actual sales with an average quarter centred on that time period • Use 1.5 quarters before quarter 3 and 1.5 quarters after quarter 3 o Take quarters 2, 3, and 4 and one half of quarters 1, year 1 and quarter 1, year 2 0.5(108) + 125 + 150 + 141 + 0.5(116) CMA(q3, y1) = = 132.0 4 65 Turner Industries (4 of 7) Compare the actual sales in quarter 3 to the CMA to find the seasonal ratio: Sales in quarter 3 150 Seasonal ratio = = = 1.136 CMA 132.0 66 Turner Industries (5 of 7) Centered Moving Averages and Seasonal Ratios for Turner Industries: 67 Turner Industries (6 of 7) The two seasonal ratios for each quarter are averaged to get the seasonal index: Index for quarter 1 = I1 = (0.851 + 0.848)÷2 = 0.85 Index for quarter 2 = I2 = (0.965 + 0.960)÷2 = 0.96 Index for quarter 3 = I3 = (1.136 + 1.127)÷2 = 1.13 Index for quarter 4 = I4 = (1.051 + 1.063)÷2 = 1.06 68 Turner Industries (7 of 7) Scatterplot of Turner Industries Sales Data and Centered Moving Average: 69 Trend, Seasonal, and Random Variations • Decomposition – isolating linear trend and seasonal factors to develop more accurate forecasts Five steps to decomposition: 1. Compute seasonal indices using CMAs. 2. Deseasonalise the data by dividing each number by its seasonal index 3. Find the equation of a trend line using the deseasonalised data 4. Forecast for future periods using the trend line 5. Multiply the trend line forecast by the appropriate seasonal index 70 Deseasonalised Data for Turner Industries (1 of 4) 71 Deseasonalised Data (2 of 4) • Find a trend line using the deseasonalised data where X = time b1 = 2.34 b0 = 124.78 Ŷ =124.78 + 2.34X • Develop a forecast for quarter 1, year 4 (X = 13) using this trend and multiply the forecast by the appropriate seasonal index Ŷ = 124.78 + 2.34(13) = 155.2 (before seasonality adjustment) 72 Deseasonalised Data (3 of 4) Including the seasonal index: Ŷ ´I1 = 155.2´ 0.85 = 131.92 73 Deseasonalised Data (4 of 4) Scatterplot of Turner Industries Original Sales Data and Deseasonalised Data: 74 Turner Industries (1 of 2) Turner Industry Forecasts for Four Quarters of Year 4: 75 Turner Industries (2 of 2) Scatterplot of Turner Industries’ Original Sales Data and Deseasonalised Data with Unadjusted and Adjusted Forecasts: 76 PROGRAMME 5.6A Using Software (1 of 2) QM for Windows Input Screen for Turner Industries Example: 77 PROGRAMME 5.6B Using Software (2 of 2) QM for Windows Output Screen for Turner Industries Example: 78 Using Regression with Trend and Seasonal (1 of 5) • Multiple regression can be used to forecast both trend and seasonal components o One independent variable is time o Dummy independent variables are used to represent the seasons o An additive decomposition model Ŷ = a + b1 X1 + b2 X 2 + b3 X 3 + b4 X 4 where X1 X2 X3 X4 = time period = 1 if quarter 2, 0 otherwise = 1 if quarter 3, 0 otherwise = 1 if quarter 4, 0 otherwise 79 PROGRAMME 5.7A Using Regression with Trend and Seasonal (2 of 5) Excel QM Multiple Regression Initialisation Screen for Turner Industries: 80 PROGRAMME 5.7B Using Regression with Trend and Seasonal (3 of 5) Excel QM Multiple Regression Output Screen for Turner Industries: 81 Using Regression with Trend and Seasonal (4 of 5) • Regression equation Ŷ = 104.1 + 2.3X1 + 15.7X 2 + 38.7X 3 + 30.1X 4 • Forecasts for first two quarters next year Yˆ = 104.1 + 2.3(13) + 15.7(0) + 38.7(0) + 30.1(0) = 134 Yˆ = 104.1 + 2.3(14) + 15.7(1) + 38.7(0) + 30.1(0) = 152 82 Using Regression with Trend and Seasonal (5 of 5) • Different from the results using the multiplicative decomposition method • Use MAD or MSE to determine the best model! 83 Monitoring and Controlling Forecasts (1 of 3) • Tracking signal measures how well a forecast predicts actual values o Running sum of forecast errors (RSFE) divided by the MAD 84 Monitoring and Controlling Forecasts (2 of 3) • Positive tracking signals indicate demand is greater than forecast • Negative tracking signals indicate demand is less than forecast • A good forecast will have about as much positive error as negative error • Problems are indicated when the signal trips either the upper or lower predetermined limits • Choose reasonable values for the limits 85 Monitoring and Controlling Forecasts (3 of 3) Plot of Tracking Signals: 86 Kimball’s Bakery Example • Quarterly sales of croissants (in thousands) For Period 6: forecast error å MAD = n Tracking signal = = 85 = 14.2 6 RSFE 35 = = 2.5 MADs MAD 14.2 87 Adaptive Smoothing • Computer monitoring of tracking signals and selfadjustment if a limit is tripped • In exponential smoothing, the values of α and β are adjusted when the computer detects an excessive amount of variation 88 Homework --- Chapter 5 • End of chapter self-test 1-14 (pp. 243-244) Compile all answers into one document and submit at the beginning of the next lecture! On the top of the document, write your Pinyin-Name and Student ID. • Please read Chapter 6!