Elementary Forecasting Methods

advertisement

Elementary Forecasting Methods

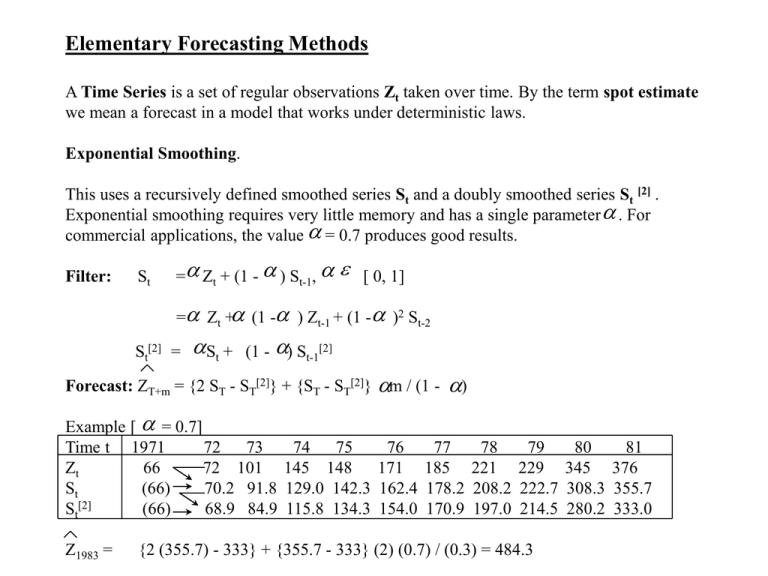

A Time Series is a set of regular observations Zt taken over time. By the term spot estimate

we mean a forecast in a model that works under deterministic laws.

Exponential Smoothing.

This uses a recursively defined smoothed series St and a doubly smoothed series St [2] .

Exponential smoothing requires very little memory and has a single parameter . For

commercial applications, the value = 0.7 produces good results.

Filter:

St

= Zt + (1 - ) St-1,

[ 0, 1]

= Zt + (1 - ) Zt-1 + (1 - )2 St-2

St[2] =

St +

(1 -

) St-1[2]

Forecast: ZT+m = {2 ST - ST[2]} + {ST - ST[2]} m / (1 Example [ = 0.7]

Time t 1971

72

73

Zt

66

72 101

St

(66)

70.2 91.8

St[2]

(66)

68.9 84.9

Z1983 =

74 75

145 148

129.0 142.3

115.8 134.3

76

171

162.4

154.0

)

77

185

178.2

170.9

78

221

208.2

197.0

79

229

222.7

214.5

{2 (355.7) - 333} + {355.7 - 333} (2) (0.7) / (0.3) = 484.3

80

81

345 376

308.3 355.7

280.2 333.0

Moving Average Model.

If the time series contains a seasonal component over n “seasons”, the Moving Average

model can be used to generate deseasonalised forecasts.

t n 1

Filter:

Mt

=

i t

Xi / n = Mt - 1 + { Zt - Zt - n } / n

t n 1

Mt[2]

=

Mt / n

i t

Forecast: ZT + k= { 2 (MT - MT[2]) } + { MT - MT[2] } 2 k / ( n - 1)

Example.

Time t 1988

1989

Sp Su Au Wi Sp Su Au

ZT

5 8

5 13

7 10

6

MT

- 7.75 8.25 8.75 9.00

MT[2]

- - 8.44

1990

1991

Wi Sp Su Au Wi Sp Su Au Wi

15 10 13 11 17 12 15 14 20

9.50 10.25 11.00 12.25 12.75 13.25 13.75 14.50 15.25

8.88 9.38 9.94 10.75 11.56 12.31 13.00 13.56 14.19

The deseasonalised forecast for Sp 1992, which is 4 periods beyond the last observation, is

ZT+4 = { 2 (15.25 - 14.19) } + { 15.25 - 14.19 } 2 (4) / 3 = 19.14

In simple multiplicative models we assume that the components are

Zt = T (trend) * S(seasonal factor) * R (residual term).

The following example demonstrates how to extricate these components from a series.

Time

t

Sp 1988

(1) Raw

(2) Four Month (3) Centered (4) Moving (5) Detrended (6) Deseasonalised (7) Residual

Data

Moving Total Moving Total Average

Data (1) / (4) Data (1)/(Seasonal) Series (6) / (4)

Zt =T*S*R

T*R

T

T

S*R

T*R

R

5

--

--

--

5.957

--

--

--

--

7.633

--

64

8.000

62.500

7.190

89.875

68

8.500

152.941

9.214

108.400

71

8.875

78.873

8.340

93.972

74

9.250

108.108

9.541

103.146

79

9.875

60.759

8.628

87.363

85

10.625

141.176

10.631

100.057

93

11.625

86.022

11.914

102.486

100

12.500

104.000

12.403

99.224

104

13.000

84.615

15.819

121.685

108

13.500

125.926

12.049

89.252

113

14.125

84.956

14.297

101.218

119

14.875

100.840

14.311

96.208

--

Su

8

31

Au

5

33

Wi

13

35

Sp 1989

7

Su

10

Au

6

36

38

41

Wi

15

44

Sp 1990

10

49

Su

13

Au

11

Wi

17

51

53

55

Sp 1991

12

58

Su

15

61

Au

14

Wi

20

---

---

---

20.133

--

---

---

---

14.175

--

--

The seasonal data is got by rearranging

column (5). The seasonal factors are then

reused in column (6)

Sp

1988

-1989 78.873

1990 86.022

Due to round-off errors in the arithmetic,

1991 84.956

it is necessary to readjust the means, so

Means 83.284

that they add up to 400 (instead of 396.905). Factors 83.933

The diagram illustrates the components

present in the data. In general when

analysing time series data, it is important

to remove these basic components before

proceeding with more detailed analysis.

Otherwise, these major components will

dwarf the more subtle component, and

will result in false readings.

The reduced forecasts are multiplied by

the appropriate trend and seasonal

components, at the end of the analysis.

Su

-108.108

104.000

100.840

104.316

105.129

Au

62.500

60.759

84.615

-69.291

69.831

Wi

152.941

141.176

125.926

-140.014

141.106

Raw Data

20

Trend

10

1988

1989

1990

1991

The forecasts that result from the models above, are referred to as “spot estimates”. This is

meant to convey the fact that sampling theory is not used in the analysis and so no

confidence intervals are possible. Spot estimates are unreliable and should only be used to

forecast a few time periods beyond the last observation in the time series.

Normal Linear Regression Model

In the model with one independent variable, we assume that the true relationship is

y = b0 + b1 x

and that our observations (x1, y1), (x2, y2), … , (xn, yn) is a random sample from the bivariate

parent distribution, so that

y= 0+ 1x+ ,

where -> N( 0, ).

If the sample statistics are calculated, as in the deterministic case, then 0, 1 and r are

unbiased estimates for the true values, b0, b1 and , where r and are the correlation

coefficients of the sample and parent distributions, respectively.

If

y=0+

1

x0 is the estimate for y given the value x0, then our estimate of 2 is

s2 = SSE / (n - 2) = ( yi - yi )2 / (n - 2)

and

VAR [ y] = s2 { 1 + 1/n + (x0 - x ) 2 / ( xi - x ) 2 }.

The standardised variable derived from y has a tn - 2 distribution, so confidence intervals for

the true value of y corresponding to x0 is

y0 + tn - 2 s

1 + 1/n + (x0 - x ) 2 / ( xi - x ) 2 .

Example. Consider our previous regression example:

y = 23 / 7 + 24 / 35 x

xi

0

1

2

3

4

5

yi

3

5

4

5

6

7

yi

3.286 3.971 4.657 5.343 6.029 6.714

2

(yi - yi ) 0.082 1.059 0.432 0.118 0.001 0.082

=>

( yi - yi )2 = 1.774, s2 = 0.4435,

(x - x )2 = 17,5,

x = 2.5,

i

Let

Then

f(x0) = t4, 0.9 s 1 + 1/n + (x0 - x )2 /

x0

0

1

2

3

f(x0)

2.282 2.104 2.009 2.009

y0 - f(x0) 1.004 1.867 2.648 3.334

y0 + f(x0) 5.568 6.075 6.666 7.352

The diagram shows the danger of extrapolation.

It is important in forecasting that the trend is

initially removed from the data so that the

slope of the regression line is kept as close to

zero as possible.

A description of the Box-Jenkins methodology

and Spectral Analysis, which are the preferred

techniques for forecasting commercial data, is

to be found in standard text books.

(6)

7.40

s

= 0.666,

t4, 0.95 = 2.776, t4, 0.95 (s) = 1.849

(xi - x )2 .

95% Confidence

4

2.104

3.925

8.133

Interval when x=6

5

6

2.282 2.526

4.432 4.874

8.996 9.926

8

Y

6

4

2

X

6