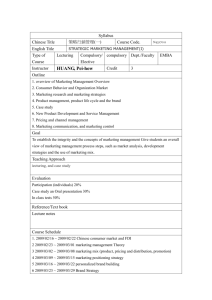

Session 12: New Products Innovation Product o Def: anything that can be offered to a market for attention, acquisition, or use that might satisfy a want/need. o From a marketing perspective, a product is “new” if customers perceive it as new Types of innovations o Measured by innovation continuum o o Examples The first iPhone was discontinuous, but then the rest of the releases were continuous Products that changed entertainment JVC video recorder (VCR) Followed by CD Player Followed by Nintendo Wii New Product Development Process 80% of new products fail or dramatically underperform, why? o Ask around for the reasons from lecture The process has many steps o Idea Generation o Two sources for ideas Internal External o Internal R&D departments This comes with high product development costs Often the source of technological products Also common source for breakthrough products o External Crowdsourcing Def: obtaining information by enlisting services of large group of people, paid or unpaid. Usually done through the internet Competitors Different ways to battle competitors o Reverse engineering Reproduction of another manufacturer’s product following examination of its composition o “Me too” or copycat products Outsourcing Def: using external parties for idea generation and strategy development to get new products into the market o Screening ideas Follow RWW Does it address a real need? Can we win? (Sustainable competitive advantage?) Is it worth doing? (Sufficient profit potential?) Concept Development and Testing o Expand ideas into more concrete/complete product concepts o Describes the features the product should have and their benefits o Test different concepts with target customers (eg. Through test questions) Marketing Strategy Development o Find the strategy to introduce it to the target market o Done through Identifying target market Estimate its size Determine how the product can be positioned Plan pricing, distribution, and promotion expenditures necessary for roll-out Business Analysis o In order to see if there’s a business case for the product, need to consider Projected sales, costs, profits Company’s objectives Company’s capabilities Technical/Product Development o Work with engineers to refine design and production process o Develop one or more prototypes o Evaluate prototypes with prospective customers Market Testing o Try out the completing marketing plan (4P’s) in a small geographic area that is similar to larger target market o This reduces uncertainty, but comes with tradeoffs Expensive Takes time Competition can see what you’re up to Commercialization o Must decide on timing o Must decide on where to introduce the product (eg. Single location vs. state vs. region vs. nationally etc.) o Must develop a market rollout plan Consumer Adoption and Diffusion Process Adoption o The process by which a consumer/business customer begins to buy and use a new product/service/idea Diffusion o Describes how the use of a product/service spreads throughout a population o AKA adoption rate Diffusion Process o Concerned with broader issue of how a product is communicated and adopted throughout a marketplace o o Customer profiles Innovators (enthusiasts) Risk-taking Young Higher social status Financial liquidity Early Adopters (visionaries) More judicious Opinion leaders Higher social status Well-educated Financial liquidity Early Majority (pragmatists) Follow early adopters Late Majority (conservatives) Average person Lower social status Unsure of innovation Laggards (skeptics) Advanced in age Lower in social status Fewer financial resources Resistant to change Factors affecting rate of adoption/diffusion process o Relative advantage When a product innovation is perceived as better than an existing product Positively correlated with an innovation’s adoption rate Examples of better things it offers Aesthetics Social benefits Immediacy of reward o Compatibility Positively correlated with an innovation’s adoption rate Overcome perception of incompatibility with heavy advertising o Complexity Inverse relationship with an innovation’s adoption rate Overcome perception of complexity through demonstrations, personal selling, and emphasis on easy use o Trialability Use a product on a limited basis before completely putting it onto the market Reduces risk Experience provides credible information o Observability/communicability When the product user can observe the positive effects of the new product Positive correlation b/w visibility and adoption rate o Total time for adoption can be reduced I.e. the parabola becomes narrower New products can also bring losses o Eg. Online grocery shopping means you can’t choose the freshest products o Ways to avoid these losses Make behaviorally compatible products (eg. Prius) Be patient Find believers (find people who prize the new product benefits) Session 13: Product Lifecycle Intro Product Lifecycle (PLC) o Def: refers to the way product categories evolve over time, from their “births” to their “deaths.” o Marketing strategies must change and evolve even as a product moves through the PLC Since products almost always die, companies must always introduce more products Lifecycle durations (as well as the durations of each stage) can vary There are four stages, and the graph can look like this o The Four Stages Introduction o Goals: get first-time buyers to try the product o Sales: increase at a steady but slow pace o Profits: usually negative or low o Price: Either high (to recover R&D costs) or low (to attract a large number of customers) o Marketing Communications: informing customers and creating awareness o Distribution: intensive personal selling to retailers and wholesalers o Nutri-Grain by Kellogg’s case study By introduction stage had 50% of the growing cereal bar market Growth o Goals: maximize market share o Sales: rapid increase (which in turn creates economies of scale) o Profits: increase, max out, and then plateau o Price: may need to reduce because of increased competition o Marketing Communications: heavy advertising (either brand or comparative ads) to counter competition o Distribution: Wide Maturity o Goals: maximize profits and defend market share o Sales: peak, plateau, and then often decline o Profits: decline o Price: usually lowers to maintain market share o Marketing communications: sales promotion o Distribution: Wide o Product: product lines are widened or expanded on o Nutri-Grain by Kellogg’s case study Sales were growing until around 2000, when category sales (and Kellogg’s share) Kellogg’s then expanded into other products o Strategies in the Maturity stage Modifying the product This could attract more users and/or inspire more usage How? o Add new features o Improve durability, reliability, etc. o Improve styling and attractiveness Increasing consumption of the current product How? o Look for ways to increase usage among present customers (eg. Sales) o Look for new users and market segments o Reposition the brand to appeal to a larger and/or fast-growing segment Decline o Goals: remain profitable and decide whether to keep or phase product o o o o out Sales: decline Profits: decline Price: may be lowered if the product is still profitable Marketing Communications: reduced to lower costs and maintain profitability Conclusion Products live and die Marketers need to be aware of the PLC and adjust their strategy accordingly Growth stage doesn’t last forever Companies must always develop new products to replace the dying ones. Session 14: Managing the Brand Customer Lifetime Value Definition o The value of the entire stream of purchases that a single customer would make over a lifetime of patronage Formula o Branding Definition o A name, term, sign, symbol, design, or some combination of these, that identifies the products/services of one or more sellers and differentiates those from their competitors Examples of what makes a brand o Brand name o URLs o Logos + Symbols o Characters o Slogans o Jingles Products vs. Brands o Products Do something Defined by their function and specs Expand choices Can be identical to other products o Brands Stand for something Defined by their associations and their emotional impact Simplify choices No two brands are identical Brand equity o Definition: set of brand assets and liabilities linked to the brand, its name and symbol, that add or subtract value to a product/service o Elements of brand equity Brand loyalty Name awareness Perceived quality Brand associations Other propriety assets o Measuring brand equity Many different ways of measuring it Can measure it at consumer and market level Consumer level example Willingness-to-pay for branded vs. generic products Different companies have different ways to measure it at market level On average, brands contribute to around 1/3 of a company’s total market value Memory o Memory is an associative network o Your brand will be linked with many other concepts Company (who makes the product) Country of origin (where it’s made) Spokesperson or endorser Sporting or cultural event Product Line Decisions Product line o Definition: a firm’s total product offering designed to satisfy a similar need for target consumers o Kellogg’s line of cereals is a good example All Bran Raisin Bran Etc. Product Mix o Definition: a firm’s entire range of products o Kellogg’s product mix is a good example, they sell Cereals Bars Crackers Etc. o Product mix dimensions Width: number of different product lines Length: number of different offerings within a product line Consistency: how closely related the various lines are How this works with Kellogg’s “House of Brands” vs. “Branded House” o Examples of the former General Mills (Wheeties, Cheerios, Total, etc.) P&G (Tide, Ivory Crest, etc.) o Examples of the latter IBM Mercedes Kellogg’s o Houses of Brands are everywhere o Branded House considerations Individual profit centers can affect, and be affected by, decisions made by other parts of the company They generally require a greater level of internal communication and information sharing in relation to brand equity o Branded House Benefits Money invested in parent brand not wasted even if product becomes obsolete Good brand image is transferrable – benefits all products Parent brand acts as solid foundation A strong parent brand reassures consumers in new/different product/service areas like e-commerce transactions or new financial instruments Line extensions o Definition: a new product that targets a new segment within a product category currently served by the parent brand o Examples Coke Zero Colgate Gel Brand Extensions o Definition: a new product within a product category not served by the parent brand o Examples Honda Motorcyles Cars Colgate Toothbrush Fighter Brands o See notes for details on what it is o Hazards Cannibalization Failure to bury the competition Financial losses Missing the mark with customers Management distraction Session 16: Managing Services Services vs. Products Service o Definition: an activity, benefit, or satisfaction offered for sale that is essentially intangible and does not result in the ownership of anything Service industry is large and growing o Makes up 65% of GDP growth o Most companies have a service component Domain of Services o You’re marketing experiences/things people can’t tough Eg. Going to a theme park, attending a concert o Primary product Enjoyment Knowledge Information Excitement Tradeoff of service o People desire high-quality service but low prices o Issues with starting a service business at certain levels Too high: customers won’t pay Too low: consumers will go elsewhere Characteristics of services o Core and Augmented services o Core services Benefits that a customer gets from the service o Augmented service Additional offerings that differentiate the firm o Example: Airlines Core service: travel Augmented services: in-flight entertainment, internet access Measuring Service Quality Critical incident technique o When companies collect and closely analyze very specific customer complaints to identify critical incidents/sources of dissatisfaction Gap analysis o Measuring the difference between customer expectation of service quality and perceived performance o Typically done using SERVQUAL surveys o These surveys are made up of 22 questions based on 5 factors Reliability Ability to perform the promised service Responsiveness Willingness to help customers and provide prompt service Assurance Knowledge and courtesy of employees and their ability to convey trust and confidence Tangibles Appearance of physical facilities, equipment, personnel, and communication materials Empathy The caring, individualized attention the firm provides to its customers o Perceptions + expectations are given a rating for certain dimensions From 1 (strongly disagree) to 7 (strongly agree) o Average expectation rating is then subtracted from the average perception rating o Conclusions you can draw High negative rating: changes needed on dimension High positive rating: changes not needed on dimension Improving Service Quality Service Failure and Recovery o When services fail, they must recover fast If it’s a process failure, they must apologize If it’s an outcome failure, they must compensate o Speed of recovery has a substantial impact on repurchases o A good idea is to empower employees to recover by themselves Eg. Mariott gives employees $2,500 to spend on immediate compensation o In some cases, a good recovery can be better than no failure HBR Article o 3 forces strongly influence how customers feel about a service encounter Sequence effects: how people recall experiences Duration effects: how people process time Rationalization effects: people want things to make sense (their tendency to want explanations for events) o How firms can optimize interactions with customers Principle 1: finish strong Principle 2: get the bad experiences out of the way early Principle 3: segment the pleasure, combine the pain Principle 4: build commitment through choice Principle 5: give people rituals and stick to them o See article notes for more details + examples Session 17: Pricing Definition + basic facts o Def: the value that customers give up or exchange to obtain a desired product o The one marketing mix element that can change quickly o Has a direct impact on firm’s bottom line o Plays a key role in creating customer value Pricing Methods Cost-based pricing o Two types of costs Fixed costs: don’t vary with production levels Variable costs: vary with production levels o Product driven rather than value driven approach o Cost plus pricing (markup pricing) Manufacturer determines all costs per unit and then adds desired profit per unit Markup on cost: cost is calculated by adding a markup on cost Price = total cost + (total cost*markup %) Markup on selling price: price is calculated by adding a markup on selling price Price = total cost / (1 – markup %) o Pros Simple to calculate Relatively risk free o Cons Difficult to estimate costs accurately Fails to consider non-monetary costs Value based pricing o Difference b/w it and cost based o Two main calculations Price to retailer = selling price * (1 – markup %) Target unit cost = price to retailer * (1 – profit %) o “Good Value” pricing Offering just the right combination of quality at a fair price Focus on introducing less expensive versions of products to meet the needs of frugal customers Eg. McDonald’s dollar menu o “Value Added” pricing Attached value added features to differentiate products and support higher prices Competition based pricing o Assumes customers base their judgments of a products value based on how competitors price similar products o Assessing competitor’s pricing strategies How does the firm’s offering compare in terms of customer value? How strong are the competitors, and what are their pricing strategies? Break even analysis o o Firms could also do this with the target profit goal included Pricing Strategies Price skimming o Def: refers to setting a high price for a new product in order to “skim” revenues, layer-by-layer, from those willing to pay a high price o The company will make fewer, but more profitable sales o Electronics often use this strategy o Conditions for success Highly desirable products, unique benefits, company focused on profit objectives Substantial number of customers with low price sensitivity Lower probability that competitors can enter the market quickly The reduced price must sufficiently increase sales o Calculations Profit margin = (price – unit variable cost) / price New sales level = original profit / new profit margin Penetration pricing o Def: refers to setting a low initial price in order to penetrate the market quickly o Can attract a large number of buyers quickly and win a large market share o Considerations Creates barriers to entry Gain market share early on Production + distribution costs must fall as sales volume increases Company needs to be able to maintain low price strategy position Skimming vs. Penetration o Skimming results in a slower acceptance of a new product but higher unit profits o Penetration results in greater initial sales volume but lower unit profits General pricing tactics for multiple products o Product line pricing (eg. Line extensions) o Price bundling (2+ products for a single price) Encourages sale of slow-moving items Encourages stock up Encourages trial of new brand Gives customers an incentive to purchase o Captive pricing (sell initial product at lower price, then charge higher prices for “accessories”) Eg. Gillette w/ blade prices after purchasing a razor o Leader pricing (sell one product at a loss to get customers through the door) The hope is that they’ll be encouraged to buy other products Deceptive Pricing Practices Overview of the types o Illegal practices Price-fixing (vertical and horizontal) Predatory pricing o Going-out-of-business sales o Bogus reference prices o Bait-and-switch tactic Horizontal price-fixing o When two or more competitors conspire to set prices Vertical price-fixing o When parties at different levels of a system of production & distribution act to fix a good’s market price Predatory pricing o The pricing of goods at such a level that competitors can’t compete and are forced to leave the market Going-out-of-business sales o Sales made to clear stock in anticipation of the business closing o Some businesses make these sales and then end up staying open Bogus reference prices o Companies sometimes give high fake reference prices to justify selling the product for more than it’s actually worth Bait-and-switch o Customers are “baited” by ads that show low-priced goods o When they arrive to the store they find those goods either “sold-out” or lower quality than expected o Retailers then try and “switch” them to similar products at higher prices Psychological Concerns in Pricing Psychological pricing o Considers psychology of prices Here price is used to say something about the product o When unable to judge quality, customers use price as a reference point for quality Eg. Who is the better lawyer? The $50/hour or the $500/hour Reference prices o Definition: the price that people expect/deem to be reasonable for a certain type of product o They are an important driver of consumer behavior o Several factors can influence reference prices Memory of past prices Frame of reference Prices of other products in the same shelf, catalog, or product line Presentation/format Order in which prices are learned Price placebo effects o Works similarly to other effects – by the power of suggestion o Paying more for a product increases product efficacy just because of higher expectations Short term sales vs. Long term retention o Managers must find a balance between the two o Consumers are more likely to purchase products they actually use o Also more likely to consume when they feel “out of pocket” Timing of payments by customers o Consumption closely tracks this timing o How could managers use this insight? Yield management Reduce consumption Smooth consumption o Price Bundling o Affects decisions to consume o Offering multiple product units for one single price decouples costs and benefits, resulting in lower consumption rates Stopping customers from fixating on price o You normally want to do this in mature, commoditized markets o Three main ways to do this Change your price structure Use it to clarify and call attention to the value your product delivers This encourages them to focus more on value than price For this to work, price should depend on what’s most distinctive about your offering rather than its composition To do this, pick a single thing to differentiate it (eg. Goodyear prices tires based on how many miles they’ll last) Stimulate curiosity by overpricing There’s a price range above which will make customers ask themselves “do I need this benefit?” instead of “what’s the cheapest option?” Eg. Starbucks’ premium pricing made people question the importance of a coffee break in their lives Equalize price points to crystallize personal relevance When you make all prices the same, it becomes more of a question of what customers like instead of price Session 18: Distribution The Value Delivery Network Definition o Comprised of the company, suppliers, distributors, and ultimately customers who “partner” with each other to improve the performance of the entire system in delivering customer value Producing + selling products requires relationships with two types of supply chain partners o Upstream partners: firms that supply raw materials, components, parts, and other elements necessary to create a good o Downstream partners: firms that link companies to customers See slide 15 for benefits to channel players Channel Design There are two options for who provides the functions in slide 15: manufacturers or intermediaries o If the former does it, costs increase o The latter is more efficient o o Deciding on channel breadth o Intensive distribution (eg. Wrigley’s) As many outlets as possible Price and convenience are a priority Selling support unnecessary Typical for convenience or commodity products o Selective distribution (eg. Sony) Multiple but limited outlets per region Some selling/support effort needed for customers Typical for “shopping” products o Exclusive distribution (eg. Rolex) Single outlet per region Substantial selling support required (service becomes a priority) Typical for “specialty” products Vertical integration o One firm consolidates all the different intermediaries (producer, wholesaler, retailer, etc.) under them o There are three types of vertical integration Corporate (eg. Zara) Administered (eg. Wal-Mart) Contractual (eg. McDonald’s) The Internet in the distribution channel Has triggered disintermediation as companies now question the value of the layers added in the distribution channel Resellers and intermediaries must adapt to survive Producers must seek additional direct channels to remain competitive, but this often results in channel conflict (eg. Theatre owners conflicting with producers that opt to use Netflix instead) Deciding on Channel Depth Indirect is better than direct when o One-stop shopping is important o After sale service is important o Resources are limited Direct is better than indirect when o Product is technical and info needs are high o Quality assurance matters o Transportation and storage are complex o Cross selling is important o You want to own your customers Conclusions Distribution can add value There is a trade-off between efficiency and “owning” your customer Channels can provide different opportunities depending on design and breadth Session 19: Online and Social Marketing Online and Social Marketing Internet usage is increasing o This is important for retailers o It also disrupts traditional markets o A lot of products/services are tailored around the idea that people should get what they want, when they want Social media usage is increasing too, but there is a knowledge and skills gap o A survey of 180 North American senior execs asked them about social media 90% understood its impact Only 32% monitored it, though 14% used it when measuring corporate performance 59% use it to interact w/ customers, 49% to advertise and 35% to research their customers 30% used it to research competitors, new products, etc. These low stats are despite the fact that 80% had a LinkedIn account and 68% had a Facebook account See slides for graphs detailing internet, social media, and smartphone usage stats Disruptions to Traditional Marketing Digital disruptions o Market Research o You can use social media to get consumer intelligence o Companies like radian6, Topsy, etc. allow you to get both consumer and competitor intelligence New Product Development examples o Starbucks crowdsourcing ideas o Kickstarter Targeting o You can microtarget thanks to the internet Customer interactions o Brands now directly interact with their customers o Fake reviews can be a problem, though, now that websites like Yelp are popular Brand Positioning o Cautionary Tale from United Airlines (ask about it) Content Generation o User generated/interactive campaign Pros High consumer involvement Novel Low financial costs Cons Less control Less persuasive Session 20: Advertising Decisions and Information Processing Promotion (Last of the 4 P’s) Promotion Mix o Definition: the specific blend of promotion tools the company uses to engage consumers, persuasively communicate customer value, and build customer relationships. o It is shaped by various efforts, such as Advertising Public relations Personal selling Sales promotion Advertising o Definition: paid for promotion of ideas, goods, and services by an identified sponsor Advertising Decisions Goal of Advertising o o It bridges between the boxes: so it informs, persuades, and reminds o This flow chart is known as the purchase decision process Examples of advertising objectives o Informative advertising Communicating customer value Explaining how a product works Informing the market of a price change Describing available services and support o Persuasive advertising Encouraging switching to a brand Persuading customers to purchase now Convincing customers to tell others about the brand Changing the customers’ perceptions of product value o Reminder advertising Maintaining customer relationships Prompting customers on where to buy the product Keeping the brand in customers’ minds during the off-season Reminding customers that the product may be needed in the future Advertising Budget approaches o Affordable approach “We can only afford to spend $x million” o Percentage-of-sales approach “We’ll spend 10% of our revenue on advertising” o Competitive-parity approach “We need to spend at least as much as our competitors, if not more” o Objective-and-task approach “We’ll spend what it takes to achieve our goal of 15% market share by year x” Advertising strategy o There are two types of decisions o Creative/message decisions Content (what do you say?) Evidence (why should they buy it?) FBI (features, benefits, image) Source of message (eg. A celebrity or ordinary person) Execution (how do you say it? what emotion do you convey?) o Media decisions Medium and vehicle Eg. Broadcast vs. print vs. web Schedule Reach (how many?) Frequency (how often?) How Consumers Process Messages Elaboration likelihood model o ELM argues that there are two processing routes through which we process persuasive information o Central processing route High involvement Effortful processing of information Appeals to cognitive side o Peripheral route Low involvement Heuristic processing of information Appeals to the affective side o Two factors determine which route we use/will promote attitude change Motivation Ability Central processing route o We process information through here when we are motivated and able to elaborate on it o Focuses people on the claims being made about the product/brand, and they tend to generate counterarguments and support arguments o When processing information through this route, arguments need to be solid o Attitudes formed along this route are stronger and more resistant to change, but aren’t always positive. Peripheral processing route o We process information through here when our motivation and ability to elaborate on it are low o People rely on peripheral cues present in communication, rather than arguments o Essentially anything other than the message itself, for example Celebrity endorsers Emotional appeals Attractive sources Number of arguments, rather than quality o Attitudes formed along this route are weakly held and rather temporary To be persuasive, marketers must provide consumers with information compatible to the route they will use to process it When to use each route o If people are likely to be in an effortful and highly-involved mode (CPR) Go with a complex message from a credible source Consider print medium – it takes time to absorb complex messages You can still use peripheral cues like attractive sources, but they aren’t as much of a priority o If people are likely to be in a heuristic, low involvement mode (PPR) Keep the message simple Use attractive sources or one that seems similar They won’t make an effort to process message claims, so try to tug on their emotions Summary o Understanding consumers’ cognitive and affective responses to persuasive appeals is critical to understanding attitudes and attitude changes o If you can anticipate how involved your consumers will be when processing information, you can predict the route they are likely to take when forming attitudes o This will allow you to craft a message that is most likely to persuade