MasterPresentation-1522955024782

advertisement

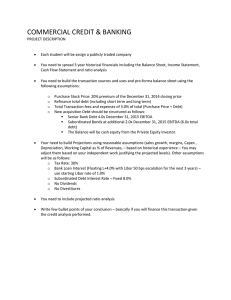

Corporate Finance 101 Table of Contents 01 02 03 04 Introduction Capital Markets Business Valuation Mergers & Acquisitions 05 06 07 Debt Financing Equity Financing Careers Introduction Investment Banking Investment Management Tim Vipond CEO Corporate Finance Institute Corporate Development & Strategy Corporate Finance Session objectives Capital Markets Business Valuation Mergers & Acquisitions • Understand the key aspects of investment banking (M&A advisory and underwriting) • Describe the difference between valuing a business using equity and enterprise value multiples • Understand the steps in the acquisition process, synergies, and transaction steps • Outline the corporate funding life cycle. • Outline how a business can be valued using discounted cash flow • Evaluate an appropriate financing structure for an acquisition Equity Financing • Outline the various types of equity finance • Understand the role of private equity funds Debt Financing • Describe different types of debt financing, outline the impact of leverage on returns, repayment options Capital Markets Who are the players in corporate finance? Public accounting firms Bonds or shares $ “Sell side” $ Contacts Contacts “Buy side” Fund Manager $ Corporates Banks Institutions Investors Capital What do capital markets do? Secondary markets Wants to sell Wants to buy Stock exchange/ OTC Fund Investment bank Manager Sales, trading and research Investment bank Sales, trading and research Fund Manager Investment banks help facilitate the trade in shares and bonds. The business life cycle LAUNCH $ GROWTH SHAKE -OUT MATURITY DECLINE Life cycle extension Sales Cash Profit Time (years) The corporate funding life-cycle Level of risk Debt funding Sales Business risk Launch Growth Maturity Decline Stage of the firm life cycle Corporate finance The term corporate finance typically covers two key areas: M&A advisory Underwriting Assisting in the negotiation and structuring of a merger/acquisition Raising capital through selling stocks or bonds to investors (e.g. IPO) Underwriting advisory services Planning Timing and demand Issue structure • Identify investor themes • Hot or cold issue market • Domestic or international • Investment rationale • Supported by positive news-flow • Institutional investor focus • Is IPO the • Investor appetite • Retail investor focus • best option • • Offer for sale • Size of float and lock-up issues Precedents and benchmark offerings • Intermediaries offer • Introduction • Preliminary view on investor demand • Investor experience Types of underwriting Types of underwriting commitment: Firm Commitment Best Efforts All-or-none The underwriter agrees to buy the entire issue and assume full financial responsibility for any unsold shares. Underwriter commits to selling as much of the issue as possible at the agreed-on offering price, but can return any unsold shares to the issuer without financial responsibility. If the entire issue cannot be sold at the offering price, the deal is called off and the issuing company receives nothing. Underwriting - the book building process Prospectus with price range Institutional investor commitment @ firm price Book of demand built Price is set to ensure clearing Allocation Underwriting - the road show The roadshow is an opportunity for management to convince investors of the strength of the business cases Areas that are critical include: Management structure, governance and quality Strategy, both tactical and long-term Funding requirements and purpose: Cash in versus cash out A thorough analysis of the industry/sector Key competitors Key risks Pricing the issue Key issues in pricing Price stability Buoyant after market Depth of investor base Access to market Pricing the issue After market price performance Under-pricing Under-pricing There are two costs associated with a flotation: Reduces the risk of equity overhang Ensures after market is buoyant, but There is a temptation for the advising bank to under-price the issue - why? Reduces the risk of equity overhang. Ensures after market is buoyant, but this fails to make the best possible returns for the current owners and could lead to profit-taking and hence volatility. The IPO pricing process IPO discount Indicative maximum Pricing range 10 to 15% Full value Indicative minimum • Relative valuation • Absolute valuation Business Valuation Session objective By the end of this session you will be able to: Describe the difference between valuing a business using equity and enterprise value multiples Outline how a business can be valued using discounted cash flow Tools and techniques for valuing a business Valuing a business for acquisition Public company comparatives Precedent transactions Discounted cash flow Equity multiples Stand-alone valuation Enterprise value multiples Synergies Enterprise value vs. equity value Market value of debt EV/EBIT EV/EBITDA EV/Sales Enterprise value Market value of equity (market capitalization) Price/Earnings Price/Book Price/Cash flow Unlocking the drivers of value We can use the DCF growing perpetuity formula to unlock the drivers of value: Business strategy Sales & marketing Cost structure Asset utilization Present value = Organic growth? Growth through acquisition? Free cash flow x (1 + growth) Cost of capital - growth Availability Risk Current capital Macro factors Organic growth? Growth through acquisition? Drivers of value and price in more detail Intrinsic Value • • • • • EBITDA, expected growth Capital requirements Capital structure Cost of capital Income tax position Synergies & Strategic Value • • • • • • • Economies of scale Diversification Eliminate competition Entry into new markets Mgmt & employees Income tax synergies Related costs, timing & risks Industry Life cycle Structural changes Competitive behaviour Barriers to exit/entry Price Company Market share and position Technology Competitive advantages Brand name Transaction Structure • • • • • • • Consideration Asset vs. Share Merger or joint venture IPO Break-up or spin-off Financial or M&A market conditions Regulation Price versus Value • • • • • • Deal costs Process, packaging and presentation Negotiating positions Knowledge and information Motivations Legal or other restrictions Discounted cash flow valuation overview Free cash flow FV x 1 (1+i)n $100 x 1 1.10 $100 x 1 1.102 $100 x 1 1.103 $100 x 1 1.104 $100 x 1 1.105 $300* x 1 1.105 186 PV 91 83 75 68 62 2015 2016 2017 2018 2019 Value of the firm = $565 million * Value of FCF beyond 2019 Terminal value Cost of capital Assets Net debt % net debt x Cost of debt = Contribution Market value of equity % equity x Cost of equity = Contribution Cost of capital Widget example $32bn 14% x 3.5% = 0.5% $193bn 86% x 9% = 7.7% $225bn 8.2% Mergers & Acquisitions Session objectives Outline the steps in the acquisition process Explain the difference between strategic versus financial buyers Identify hard and soft synergies Value financial synergies Outline transaction costs 10 step acquisition checklist 10 9 8 7 6 5 4 3 2 1 Acquisition Criteria Acquisition Strategy Acquisition Planning Searching for Target Valuing & Evaluating Due Diligence Negotiation Implementation Financing Purchase & Sales Contract Rival bidders The vast majority of acquisitions are competitive or potentially competitive. Companies normally have to pay a “premium”. Companies normally have to offer more than rival bidders To pay more than rival bidders, the company needs to be able to do more with the acquisition than the other bidders. Strategic versus financial buyers Strategic buyers Financial buyers Horizontal or vertical expansions Private equity Involves identifying and delivering operating synergies Leverage for maximum equity returns Hard synergies - cost synergies Soft synergies – revenue synergies Leverage and financial buyers ABC Co. XYZ Co. Net income = $10 Net income = $10 Return on equity = 20% Return on equity = 50% Debt $50 Assets Assets $100 $100 Equity $50 Debt $80 Equity $20 Analyzing acquisitions Involves identifying and delivering operating synergies Hard synergies cost synergies $1 of cost saving = $1 of profit Soft synergies revenue synergies $1 of revenue synergy $1 of profit cost savings from revenue enhancing activities economies of scale cross selling factory overhead reduction Geographic expansion corporate overhead reduction Acquisition valuation process 1. Value the target as stand-alone Enterprise value • • • • Sales growth EBIT margin Operating tax Movement in working capital • Capital expenditure 2. Value synergies • Sales (volume & price) • EBIT margin o Product mix o Overhead reductions • Operating tax o Tax efficiency o Tax losses • Working capital • Capital expenditure o Fully invested Best practice acquisition analysis 1 2 3 4 5 Financial synergies Transaction costs 6 Soft synergies Hard synergies Stand-alone enterprise value 7 Value created Net synergies Standalone value Consideration (price paid) Issues to consider when structuring a deal Contract Antitrust Transaction environment Market conditions Business plan Structuring environment Deal Accounting Securities Preferred finance Transaction character Corporate Law Tax Competing bidders Financing for mergers, buyouts, & acquisitions Senior debt Subordinated debt Equity Debt structuring Two basic types of loans Revolving Facilities (“Revolver”) • Typically used for general corporate purposes (“GCP”) including working capital financing and liquidity (commercial paper backup). • Multiple drawdown/repayment until the contracted maturity date. • Drawn / Undrawn. • Amount available may be subject to a sub-limit, such as a borrowing base on receivables and/or inventory. Non – Revolving Facilities (“Term Loan”) • Generally provided for a specific purpose such as an acquisition, capital expenditures, or a recapitalization. • After a drawdown(s) and (full or partial) repayment is made the credit/loan is not available to draw down again. • Drawn. Pricing debt Pricing is a function of risk where lenders focus on risk/return metrics when they decide to provide a loan. Loan pricing has several components Spreads (also called margin) – the margin added to a publicly quoted base rate of interest the “floating rate”) such as Prime, US Base Rate, LIBOR or Bankers Acceptances (eg. LIBOR+150bps) Rate (eg. LIBOR) + Fees – upfront, arrangement, underwriting, agency, ticking and standby (or commitment / undrawn) fees (eg. 50bps) Spread / Margin = Drawn pricing Debt repayment profiles $ Mezzanine finance – high yield debt Equal amortizing Balloon repayment Bullet repayment Bullet repayment 5 years Debt Financing Session objectives Describe different types of debt financing Outline the impact of leverage on returns Explain various debt repayment structuring options Assessing debt capacity Assessing debt capacity Balance sheet measures Cash flow measures Level of EBITDA Debt to equity Total debt / EBITDA Volatility and hence stability of EBITDA Complications include Senior debt / EBITDA cyclicality technology entry barriers Acquisition adjustment to assets goodwill Cash interest cover EBITDA-Capex interest cover Senior debt overview Revolver Term loan B Senior debt Term loan A Typically represents 50 percent of funding 2.0x to 3.0x EBITDA 2.0x interest coverage Term loan C Subordinated debt Equity Typically provided by Commercial banks Credit companies Insurance companies Senior debt capacity Structuring a transaction Revolving credit 1.0 x EBITDA but linked to current assets Term loans What can be amortized over five years based on detailed projections? A Held by bank investors Balloon term loan maturing after A B Held by non-bank institutional investors C, D As needed Sub debt multiple Total debt / EBITDA - senior debt / EBITDA Equity required Purchase price - total debt The role of subordinated debt Three to five years Senior debt Senior debt Equity IRR = 17% Equity Senior debt holders only provide so much This funding structure fails to deliver an adequate return. Leverage and returns Business projections EBIT Growth Current $m Year 1 $m Year 2 $m Year 3 $m Year 4 $m Year 5 $m 1.00 10% 1.10 10% 1.21 10% 1.33 10% 1.46 10% 1.61 10% Valuation analysis Enterprise value (8 x EBIT) Debt (4 x EBIT) Equity value Entry $m 8.00 4.00 4.00 Exit $m 12.88 4.00 8.88 Entry $m 2.60 1.40 4.00 Exit $m 5.77 3.11 8.88 Investment analysis % Private equity Management 65 35 100 IRR % 17% 17% Leverage and returns Business projections EBIT Growth Current $m Year 1 $m Year 2 $m Year 3 $m Year 4 $m Year 5 $m 1.00 10% 1.10 10% 1.21 10% 1.33 10% 1.46 10% 1.61 10% Valuation analysis Enterprise value (8 x EBIT) Debt (6 x EBIT) Equity value Entry $m 8.00 6.00 2.00 Exit $m 12.88 6.00 6.88 Entry $m 1.30 0.70 2.00 Exit $m 4.47 2.41 6.88 Investment analysis % Private equity Management 65 35 100 IRR % 28% 28% Leverage and return Senior debt Senior debt Equity Three to five years IRR = 28% Equity This amount of equity invested up front delivers an adequate return There is a funding gap to fill This is filled with the subordinated debt. How much subordinated debt? Subordinated debt holders will only supply so much debt. Total debt / EBITDA ~ 5 to 6 times xEBITDA / Cash interest ~ 2 times Equity funding ~ 30% to 35%. The appropriate financial structure has to be constructed within these constraints. Types of subordinated debt Increasing Increasing subordination return Subordinated debt Senior debt High yield bonds Mezz warrantless Increasing dilution Mezz warranted PIK notes Vendor notes Equity Subordinated debt is used to fill the funding gap. Mezzanine debt characteristics Mezzanine is non-traded debt, which is subordinated to senior debt. Bullet repaid Pays a cash and accrued return Can have equity warrants attached Debt with warrants Convertible loan stock Convertible preference shares Mezzanine returns Contractual return Warrants 3% to 10% of post exit value Accrued interest Cash pay interest Total return (IRR 14% to 20%) High yield bond characteristics High yield bonds are traded debt, which are subordinated to senior debt. Compared to mezzanine finance it typically… Has a cheaper all in funding cost Has greater covenant flexibility Involves a deeper pool of investors required to fund larger transactions. In return investors required: Call protection Registration which takes time to bring to market. Convertible preference shares Credit ratings and high yield debt Investment grade • Low risk • Low return • Low fees High yield • High risk • High return • High fees Moody’s S&P Fitch DBRS Aaa Aa1 Aa2 Aa3 A1 A2 A3 Baa1 Baa2 Baa3 AAA AA+ AA AAA+ A ABBB+ BBB BBB- AAA AA+ AA AAA+ A ABBB+ BBB BBB- AAA AA (high) AA AA (low) A (high) A A (low) BBB (high) BBB BBB (low) Ba1 Ba2 Ba3 B1 B2 B3 Caa1 Caa2 Caa3 - BB+ BB BBB+ B BCCC+ CCC CCCD BB+ BB BBB+ B BCCC+ CCC CCCD BB (high) BB BB (low) B (high) B B (low) CCC (high) CCC CCC (low) D Mezzanine versus high yield bonds Financial sponsors prefer mezzanine - why? Senior lenders also prefer mezzanine - why? Reliable availability vs. volatility of the high yield market Mezzanine investors interests are more aligned with the senior provider in a restructuring or in default Ease of execution vs. road show requirements Generally buy and hold investors Flexibility of mezzanine vs. restrictive non-call nature of high yield debt. Easily identified and contacted in the event of default More pre-disposed to restructuring than liquidation to achieve recoveries. Equity Financing Session objectives Outline the various types of equity finance Explain the role of private equity funds Design an appropriate exit strategy for a private equity firm Types of equity Senior debt Typically represents 30 to 40 percent of funding Private equity has 4 to 7 year exit strategy Subordinated debt Management Pref. shares CCPPO shares Ordinary shares Equity S/holder loans Private equity funds Subordinated debt holders Investment banks What are private equity funds? Private equity funds are pools of capital that invest in companies that represent an opportunity for a high rate of return. Private equity funds invest for limited time periods. Exit strategies include IPOs, selling to another private equity firm, etc. Private equity funds are typically split into two categories: Venture capital funds typically invest in early stage or expanding businesses that have limited access to other forms of financing Buyout of LBO funds typically invest in more mature businesses, usually taking a controlling interest and leveraging the equity investment with a substantial amount of external debt. Buyout funds tend to be significantly larger than venture capital funds. Exit considerations Is the structure appropriate? Is the business strategy appropriate? What IRR will be achieved? How soon does exit need to take place? Is the management team amenable to exit? What exit routes are available? Who are the potential acquirers? Typical exit routes for private equity Trade sale Total exit IBO Share repurchase Flotation Private placement Partial exit Corporate venturing Corporate restructuring Shareholder loans Shareholder loans are a means for private equity houses to invest sufficient equity into a buyout situation, whilst still allowing management a significant equity stake. Max debt $30m Enterprise value $50m Equity $20m Shareholder loan - PIK $16m Private equity $2m Management $2m Preference shares The ‘norm’ is for private equity to subscribe for preference shares which are: Terms Redeemable Attract a fixed dividend Have restricted voting rights. Preference shares are becoming less attractive as: Issues Change in tax credits on dividends Not tax deductible like interest Even if company has cash, payment may not be made if lack of distributable reserves. Equity ratchets actual versus projected performance repayment of debt or redemption of preference shares Often used to bridge expectation gap between investor and investee. Used to increase or decrease private equity or management's shareholding Corporate Finance Careers Career map Investment Banking Private Equity Equity Research Portfolio Management Sales & Trading Banks (‘Sell side’) Institutions (‘Buy side’) Research Commercial Banking Public Accounting Due Diligence Corporate Development Corporates Treasury Transaction Advisory Audit FP&A Roles at banks Banks (‘Sell side’) • Client facing / sales component • Capital Markets hire from schools • Retail hires at various points • Long hours • Competitive • Quick career progression Public Accounting Institutions (‘Buy side’) Corporates • Mix of client or inward focus • More internally focused • Internally focused • Hire from schools or from other accounting firms • Hire from banks • Hire grad schools students • Hire from banks, accounting firms, institutions and schools • Long hours • Hire across all entry points • Competitive • Less hours • Quick career progression • Competitiveness varies by company • Long / medium hours • Competitive • Clear career path • Career progression varies Prepping for a finance interview You’re telling a story about yourself that will lead the interviewer to visualize you working in their firm. Be clear on your story. Prep for your interview by identifying: • The people and firms that you’ve researched and/or spoken to. • The stocks you are following. • The specific classes you’ve taken which relate to the job you’re interviewing for. • Any related activities (case competitions, investment competitions, investment banking competitions, conferences). • Any related awards or prizes you’ve won. • The top 3 things that get you excited about this job. Top five finance interview questions Technical Questions Behavioral Questions Walk me through the three financial statements Why do you want to work at this company? How would you perform a valuation of a business? Describe a time you worked as a team / leadership / what’s one of your weaknesses? Explain the time value of money to me in simple terms. What makes you a good fit with our corporate culture? How would you build a financial model? Top five career hacks 1 • Basic Advice ▪ Join an investment club (at university, or outside) • Career Hack ▪ Start your own club ▪ Students: Ask the school to fund you ▪ Alumni: Use Meetup.com Top five career hacks 2 • Basic Advice ▪ Network with finance professionals, alumni, LinkedIn etc. • Career Hack ▪ Enroll in the CFA so you can attend CFA events and see CFA jobboard Top five career hacks 3 • Basic Advice ▪ Follow the markets – subscribe to Bloomberg, Google Finance, Seeking Alpha etc. • Career Hack ▪ Publish articles on SeekingAlpha.com ▪ Free or Paid articles Top five career hacks 4 • Basic Advice ▪ Participate in case competitions • Career Hack ▪ Students: Enter NIBCC ▪ Alumni: Attend ModelOff ▪ Free exercises or attend the World Championships Top five career hacks 5 • Basic Advice ▪ Take online financial modeling and courses • Career Hack ▪ Build a model for the company you want to work for ▪ Use the templates and knowledge from the online courses ▪ Meet with people from the company to discuss, or use it in an interview www.corporatefinanceinstitute.com