Commercial Real Estate Finance Basic financial terms

advertisement

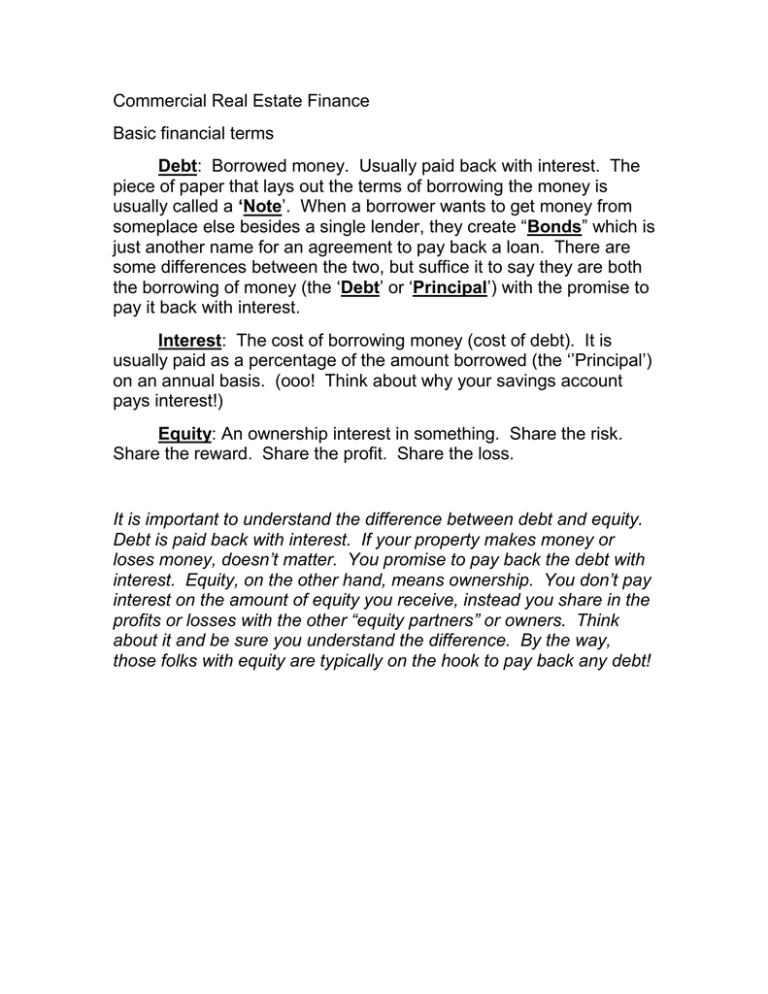

Commercial Real Estate Finance Basic financial terms Debt: Borrowed money. Usually paid back with interest. The piece of paper that lays out the terms of borrowing the money is usually called a ‘Note’. When a borrower wants to get money from someplace else besides a single lender, they create “Bonds” which is just another name for an agreement to pay back a loan. There are some differences between the two, but suffice it to say they are both the borrowing of money (the ‘Debt’ or ‘Principal’) with the promise to pay it back with interest. Interest: The cost of borrowing money (cost of debt). It is usually paid as a percentage of the amount borrowed (the ‘’Principal’) on an annual basis. (ooo! Think about why your savings account pays interest!) Equity: An ownership interest in something. Share the risk. Share the reward. Share the profit. Share the loss. It is important to understand the difference between debt and equity. Debt is paid back with interest. If your property makes money or loses money, doesn’t matter. You promise to pay back the debt with interest. Equity, on the other hand, means ownership. You don’t pay interest on the amount of equity you receive, instead you share in the profits or losses with the other “equity partners” or owners. Think about it and be sure you understand the difference. By the way, those folks with equity are typically on the hook to pay back any debt!