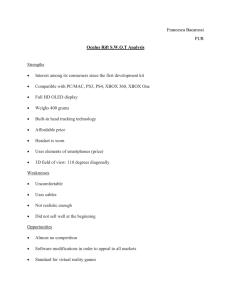

Virtual Reality Industry Report

advertisement