Presentation

November 7, 2007

Forward Looking Statement

Statements in this presentation that are not reported financial results or other historical information are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. They include, for example, statements about our business outlook, assessment of market conditions, projected strategies, future plans, future sales, expectations about price levels for our major products and our major suppliers, predictions concerning inventory levels, capital spending and tax rates. These forward-looking statements are not guarantees of future performance. They are based on management’s expectations and assumptions that we believe are reasonable at the current time but involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements.

2

Management

• Cal Jenness

– Sr. Vice President & Chief Financial Officer

• Ken Saito

–

President, Oregon Cutting Systems Group

• Jake VanderZanden

–

President, ICS & Sr. VP, Business Development

3

Company Overview

Blount International

LTM Sales (mm): $639

LTM EBITDA (mm) $109

Margin 17. 1%

Outdoor Products Group

(“OPG”)

LTM Sales (mm): $476

LTM EBITDA (mm): $114

Margin 23.9%

• Oregon Cutting Systems – Saw chain, bar & accessories, outdoor equipment parts

• ICS – Concrete cutting saws & diamond chain for construction

Industrial Power & Equipment

Group (“IPEG”)

LTM Sales (mm): $ 164

LTM EBITDA (mm): $9.6

Margin 5.8%

• Forestry & Industrial Equipment –

Timber harvesting equipment

• Gear Products – Rotational bearings, gear components

LTM Revenues LTM EBITDA

___________________________

Note: Data reflects LTM period ended 9/30/07

4

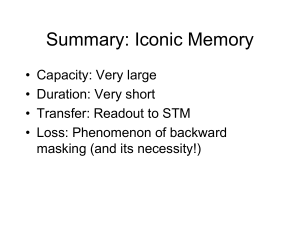

Operating Strength

• Leading Market Positions

– Global leader in chainsaw chain & guide bars (est. market shares >50%)

– First mover and sole position in Diamond Chain Technology™

• Attractive “Razor-Blade” Business Model of OPG Segment

– High margin recurring revenue stream

• Strong Growth Potential

– Earnings leverage with improved capital structure

– International expansion opportunities

– New Product & Business Development Group

– Low-cost producer positioned for further margin improvements (e.g. China)

• Channel Breadth, International Strength and Customer Relationships

– Strong long-term relationships with both OEM’s and distributor/dealer channels

• Experienced Management Team

5

Revenue & EBITDA Performance

• Consistent core OPG segment growth excluding Forestry

$600

$500

$475

$484

$441

$400 $372

$323

$300

$104 $106 $104

$200 $83

$72

$100

$0

2002 2003 2004 2005 2006

$504

$102

LTM

$200

$150

$100

$50

$0

___________________________

Note: Pro forma revenue excluding Forestry Division

6

Debt and Leverage

Total Debt and Leverage

425

350

275

200

$ in MM

650

575

7.9x

500

$628

12/31/02

$611

6.2x

12/31/03

Total Debt

$494

3.8x

12/31/04

$408

3.0x

12/31/05

3.0x

$351

3.3x

$355

9.0x

8.0x

7.0x

6.0x

5.0x

4.0x

3.0x

2.0x

1.0x

0.0x

12/31/06 09/30/07

Leverage

7

8

Company Overview

• Market leader in cutting attachments for chainsaws, mechanical harvesters, lawnmowers and related products.

• Wide array of customers ranging from professional loggers, timber harvesters, arborists and maintenance crews, to landscapers and homeowners around the world.

• Specialized in global, precision manufacturing of high volumes of small metal parts.

9

Drivers & Strengths

Business Drivers

• Residential & industrial construction

• Repair & remodeling

• Demand for pulp & paper

• Natural disasters

• Energy prices

• Disposable income

Competitive Strengths

• World-class distribution

• Long-term customer relationships

• Oregon® brand

• Market share

• Global manufacturing

• Total Quality focus

10

Chainsaw Market Growth

• Growing global market with near 14 million chainsaws sold annually

Units in MM

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

CAGR

11%

2001 2002

Gas

2003 2004

Electric

2005

___________________________

Note: Company Estimates

11

2006

Saw Chain Market Share

• Market leading position & brand

Oregon

Stihl

Chinese

Carlton

12

___________________________

Note: Company Estimates 2006

Revenue Mix

• Diversified revenue sources offer cyclical protection

OEMs

28%

Mass

Retailers

9%

Europe

40%

Dealers

8% by CHANNEL

Distribtrs

55%

Other

3%

Latin

America

9%

South

Asia

11% by GEOGRAPHY

North

America

37%

13

___________________________

Note: 2006 Oregon Cutting Systems Sales Revenue

Global Production

• Six world-wide production facilities, including China

14

15

Company Overview

• Strategic growth business, now an anchor Brand for Blount in construction space

• Concrete saws & proprietary diamond-segment concrete cutting chain

• Very high margin business; both razor & razor-blade model

• Strong sales revenue growth w/ 5-yr CAGR of 19%

• EBITDA > 30% of sales

16

Customer Proposition

• Product Advantages

–

–

–

–

Square Corner Cuts

Deep Cuts to 24”

Portability

Labor Savings

• Key Markets

–

–

–

–

–

General Construction

Fire & Rescue/Homeland Security

Landscape/Hardscape

Pipe/Excavation

Masonry

17

Growing Base Market

• 10+ years of pioneering creates a strong future replacement consumables market (ea. saw consumes avg. of 4-5 chains/yr)

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

Annual Saw Units Sold (ICS Brand)

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006

18

Future Opportunity

• Current 4% Share of Global

Diamond Tool Market Space

• Strong Intellectual Property

– Multiple patents, including new technology launched 2008

• New Products & Markets

– New Saw Platforms 2008

– Marketing Awareness & Applications

• New Business Development

Group; Bolt-On Acquisition Efforts

19