voyager indemnity insurance company

advertisement

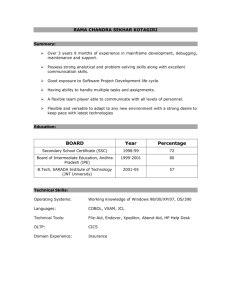

VOYAGER INDEMNITY INSURANCE COMPANY ($000) 2013 2014 2015 Total Assets 83,581 84,569 116,406 Total Liabilities 26,859 25,299 Policyholder Surplus 56,722 59,270 Loss & LAE Reserves 12,637 Reserves / NPE 11.1% 2yr Res Development 2yr Dev / Reserves RBC Ratio (%) ($000) 2013 2014 2015 Operating Cash Flows 12,853 24,658 36,198 42,921 Cash & Equivalents 17,436 11,020 18,420 73,485 Cash / Total Assets 20.9% 13.0% 15.8% 13,587 26,378 Affiliated Common Stck 12.8% 19.6% Affiliated CS / Surplus 0 0 0 0.0% 0.0% 0.0% -498 -2,188 65 Net Reins Recoverable 52,996 43,710 25,799 -3.9% -16.1% 0.2% Net Reins Rec / Surplus 93.4% 73.7% 35.1% 2,107.9 4,736.3 1,790.6 A / nr A / nr A / nr AMB / S&P Ratings Income/Loss Trends ($000) Combined Ratio Trends 40,000 120.0 35,000 100.0 30,000 80.0 25,000 20,000 60.0 15,000 40.0 10,000 5,000 20.0 0 2013 2014 2015 Net Underwriting Results Net Investment Result Net Income Dividends to Stockholders Premium Trends ($000) 0.0 2013 2014 Loss Ratio 2015 Expense Ratio Combined Ratio 2015 Investment Portfolio Cash & S/T Inv. 21% Preferred Stock 2% 200,000 150,000 100,000 50,000 Bonds 77% 0 2013 Gross Premiums Written 2014 2015 Net Premiums Written Net Premiums Earned Voyager Indemnity Insurance Company was incorporated in the State of Georgia in December 1981. The company was acquired by American Bankers Insurance Group in May 1993. Financial control has been under Assurant, Inc. (previously known as Fortis, Inc. prior to its 2004 spin-off from its European-based parent, Fortis) since August 1999. The company has been eligible to write surplus lines business in New York since July 9, 2013. As of December 31, 2015, Voyager was licensed in Georgia and operated on a nonadmitted basis in forty-eight states and Puerto Rico. ULTIMATE PARENT – Assurant, Inc. Corporate Profile Address: Assurant, Inc. One Chase Manhattan Plaza, 41st Floor New York, NY 10005 Website: www.assurant.com Ticker Symbol: NYSE - AIZ Highlights ($000) Total Assets Total Liabilities Shareholders' Equity Net Income Debt Debt / Equity 2015 Form 10-K: http://www.sec.gov/Archives/edgar/data/1267238/000 162828016011239/aiz1231201510k.htm Dividends Paid Dividends / Net Income 2014 31,562,466 26,381,159 5,181,307 470,907 2015 30,043,128 25,519,161 4,523,967 141,555 1,171,079 22.6% 1,171,382 25.9% 77,495 16.5% 94,168 66.5% Assurant, Inc. is a publicly traded holding company (NYSE: AIZ). AIZ provides specialized insurance products and related services in North America and internationally. The company operates in four segments: Assurant Solutions; Assurant Specialty Property; Assurant Health; Assurant Employee Benefits. AIZ was founded in 1969 and is based in New York, New York. Important Information Regarding Financial Summaries This financial summary contains information helpful to New York excess lines brokers in meeting their non-delegable duty to use “due care” in the selection of a financially secure excess line insurer. Definitions of the financial terms used in the summaries appear as pop-up boxes when hovering your mouse over the corresponding text. For additional guidance on assessing insurance company financial statements, please reference “ELANY COMPLIANCE ADVISOR: FUNDAMENTALS OF INSURANCE COMPANY FINANCIAL ANALYSIS”. The Excess Line Association of New York has compiled the insurance company financial information from the Annual Statutory Financial Statements. All ratios, charts, and graphs are based on the compiled information. We have made every effort to ensure all information transcribed for these pages is correct. However, the Excess Line Association of New York cannot attest to the accuracy of data provided by its sources, nor do we make any warranties, either expressed or implied, regarding the accuracy or completeness of information presented in this document. We assume no responsibility for loss or damage resulting from the use of this information.